Analysis of Bitcoin Price Forecasting and Related Influencing Factors

Jiaxin Wang

a

School of Mathematical Sciences, University of Southampton, 58 Salisbury Road, Southampton, SO17 1BJ, U.K.

Keywords: Price Prediction, ARIMA Model, Macroeconomic Indicators, Market Sentiment, Volatility.

Abstract: This paper focuses on the factors affecting the price of Bitcoin and its predicted future price trends. As the

most iconic cryptocurrency, Bitcoin has received widespread attention from investors, policymakers, and

researchers due to its high volatility and potential ability to transform the financial system. Understanding the

determinants of Bitcoin's price is important for assessing its role in financial markets, improving risk

management capabilities, and developing effective investment strategies. This study examines a variety of

internal and external factors that may affect the price of bitcoin, including market supply and demand, investor

sentiment, macroeconomic indicators, regulatory policy changes, and technological advances. In terms of

price forecasting, this paper employs statistical and machine learning methods, focusing on the use of ARIMA

model, to model and analyse the long-term trend of Bitcoin. The study incorporates historical data to test the

effectiveness of the model. This study helps to deepen the understanding of Bitcoin's market behaviour,

provides reference for investors to optimise their asset allocation in the context of the evolving digital

economy, and provides theoretical support for financial stability analysis and regulatory policy formulation.

1 INTRODUCTION

Bitcoin was launched in 2008 by a developer under

the pseudonym Satoshi Nakamoto, followed by the

Bitcoin Genesis block in 2009, and is now the leading

cryptocurrency and has revolutionized the financial

sector (Yu et al, 2025). As a decentralized digital

currency, Bitcoin operates over a network without the

need for a central authority or intermediary, based on

blockchain technology that ensures the transparency,

security, and immutability of transactions. Since its

launch, Bitcoin has grown significantly in terms of

market capitalization and market acceptance,

attracting widespread attention from individual

investors, financial institutions, and regulators. The

total supply is limited to 21 million units, a scarcity

that has led it to be considered “digital gold”.

However, the volatility of the price of Bitcoin remains

an important area of research, raising widespread

concern about the drivers behind its price

fluctuations. Understanding these influences is

critical not only for investors looking to maximize

returns on their investments but also for policymakers

and financial analysts to understand the role and

impact of Bitcoin in the wider financial system. This

a

https://orcid.org/0009-0009-6425-3318

paper will explore the key factors that influence

bitcoin price dynamics, consolidate existing research

findings, and highlight the importance of

understanding bitcoin price volatility in the context of

financial market and economic stability.

Over the past decade, researchers have conducted

extensive studies on the factors influencing the price

of Bitcoin. Early research primarily focused on the

technical and structural characteristics of Bitcoin,

such as its limited supply, decentralized nature, and

mining difficulty. These intrinsic features laid the

foundation for Bitcoin’s unique behaviour in the

financial market (Chang and Liu, 2008).

Subsequent studies explored Bitcoin’s dual nature

as both a speculative asset and a financial hedging

instrument. Dirk et al. highlighted that Bitcoin’s price

is highly sensitive to market sentiment and

macroeconomic uncertainty, reflecting its speculative

characteristics as well as its potential role in risk

diversification (Dirk et al., 2018). However, market

fundamentals such as supply, and demand can only

partially explain the high volatility in Bitcoin’s price.

Acikgoz argued that speculative trading and market

speculation play a more significant role in driving

price fluctuations (Acikgoz, 2025). Macroeconomic

620

Wang, J.

Analysis of Bitcoin Price Forecasting and Related Influencing Factors.

DOI: 10.5220/0013834500004708

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 2nd International Conference on Innovations in Applied Mathematics, Physics, and Astronomy (IAMPA 2025), pages 620-625

ISBN: 978-989-758-774-0

Proceedings Copyright © 2025 by SCITEPRESS – Science and Technology Publications, Lda.

indicators have also emerged as key determinants of

Bitcoin’s price. Factors such as interest rates and

inflation influence investor behaviour and,

consequently, Bitcoin valuation. For instance,

Shahzad et al. found that Bitcoin tends to exhibit a

negative correlation with traditional financial assets

during periods of market stress, suggesting its

potential as a haven under specific conditions

(Shahzad et al., 2020). Beyond economic

fundamentals, behavioural and psychological factors

are increasingly recognised as important influences.

Klein stated that Bitcoin’s value is heavily shaped by

market narratives, media coverage, and investor

sentiment, often resulting in “boom-bust” cycles.

This behaviour is closely linked to investor

psychology and herd behaviour (Klein, 2017).

Supporting this view, Beckmann et al. demonstrated

that social media activity and online search trends are

strongly correlated with Bitcoin price movements,

underlining the critical role of public perception and

sentiment in shaping market dynamics (Beckmann et

al., 2024).

Finally, regulatory developments and government

policies represent another major area of influence.

Regulatory announcements-including restrictions on

cryptocurrency trading, tax policies, and central bank

interventions-have been shown to trigger sharp

fluctuations in Bitcoin prices. Lashkaripour found

that the Bitcoin market reacts strongly to regulatory

policy changes, with the direction and magnitude of

these reactions depending on the nature of the

measures implemented (Lashkaripour, 2024). A

prominent example is the Chinese government’s ban

on Initial Coin Offerings (ICOs) and cryptocurrency

trading in 2017, which resulted in a significant

decline in Bitcoin prices, highlighting the market’s

sensitivity to regulatory uncertainty (Okorie and Lin,

2020).

2 METHODOLOGY

2.1 Data Source

The data used in this study is from Kaggle, and the

dataset is owned by Zielak. It has a high usability

rating of 10.0 and has been downloaded over 172000

times, indicating its popularity and reliability among

data analysts and researchers. The dataset contains

detailed information on a total of 3,649 participants,

is provided in CSV format, and notably does not have

any missing values, which ensures the integrity and

completeness of the analysis. Additionally, the

dataset has been widely used in various machine

learning and statistical modeling tasks, making it a

suitable and credible source for this study.

2.2 Sample Selection

In order to understand the long-term trend of the

Bitcoin price, this paper will use a time series model

to analyse the price trend using time series data. The

steps include data collection, preprocessing, feature

engineering, model training and evaluation. The

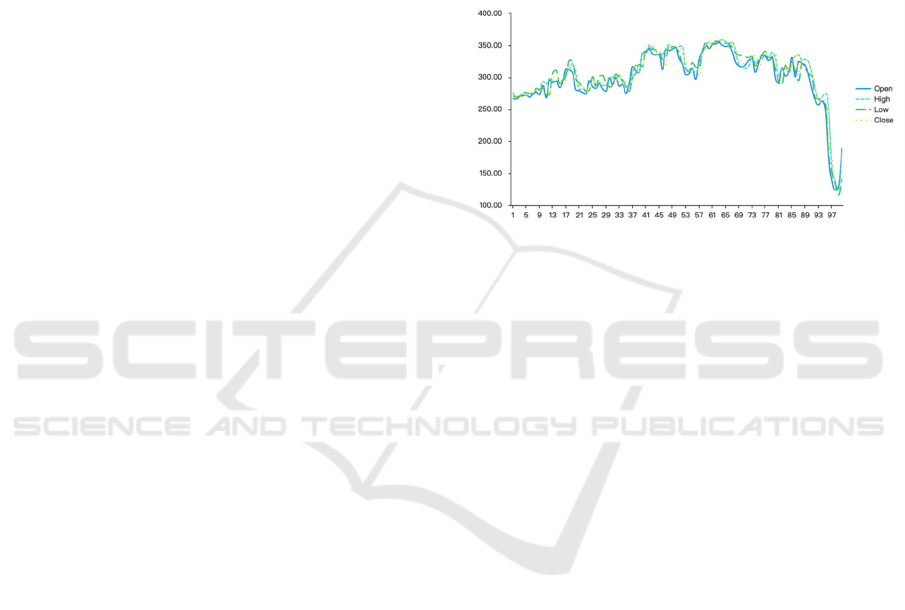

following figure shows the initial time series plot of

the data .

Figure 1: 2017-2023 Bitcoin Price Action (Picture credit:

Original)

This time series plot Figure 1 illustrates the trend of

Bitcoin prices from 2017 to 2023. Several prominent

surges and drops can be observed, corresponding to

key market events such as bull runs in late 2017 and

early 2021, as well as sharp declines during

regulatory crackdowns and macroeconomic

tightening. The pronounced volatility highlights the

need for robust time series models to account for non-

stationary behaviours.

2.3 Experimental Design

The core model used in this study is the

AutoRegressive Integrated Moving Average

(ARIMA) model, which is well-suited for univariate

time series forecasting (Zhang et al., 2003). The

general form of an ARIMA(p,d,q) model is:

𝑌

=𝑐𝜑

𝑌

𝑡1

⋯𝜑

𝑌

𝑡𝑝

𝜃

𝜀

𝑡1

⋯𝜃

𝜀

𝑡𝑞

𝜀𝑡 (1)

Where p is the autoregressive order, d is the degree of

differencing, and q is the moving average order. The

model selection was based on Autocorrelation

Function (ACF) and Partial Autocorrelation Function

(PACF) plots. The final selected model was ARIMA

(3,1,1), which demonstrated robust forecasting

performance in both the training and test sets.

Analysis of Bitcoin Price Forecasting and Related Influencing Factors

621

3 RESULTS AND DISCUSSION

3.1 Definition of the Variables

This table 1 provides a clear definition of the key

variables used in the analysis. 'Open', 'High', 'Low',

and 'Close' represent the opening, highest, lowest, and

closing prices of Bitcoin, respectively. These

variables are critical for constructing meaningful

features in time series modelling. Among them, the

closing price is selected as the main dependent

variable for prediction, as it best reflects the daily

summary value and is widely used in financial

forecasting.

Table 1: Name and Definition of the Variables

Name of Variables Definition of the Variables

Open Bitcoin Opening Price (US $)

Hi

g

h Bitcoin O

p

enin

g

Price

(

US $

)

Low Bitcoin Opening Price (US $)

Close Bitcoin O

p

enin

g

Price

(

US $

)

3.2 ADF Test Analyse

This table 2 presents the results of the Augmented

Dickey-Fuller (ADF) test applied to the closing price

series. The test statistic is -9.744 with a p-value of

0.000, which is lower than all critical values at the 1%,

5%, and 10% levels. This strongly rejects the null

hypothesis of a unit root, confirming that the first-

order differenced series is stationary and suitable for

ARIMA modelling.

Table 2: Close-ADF Check list

Difference

Order

t p

Critical Value

1% 5% 10%

1 -9.744 0.000 -3.499 -2.892 -2.583

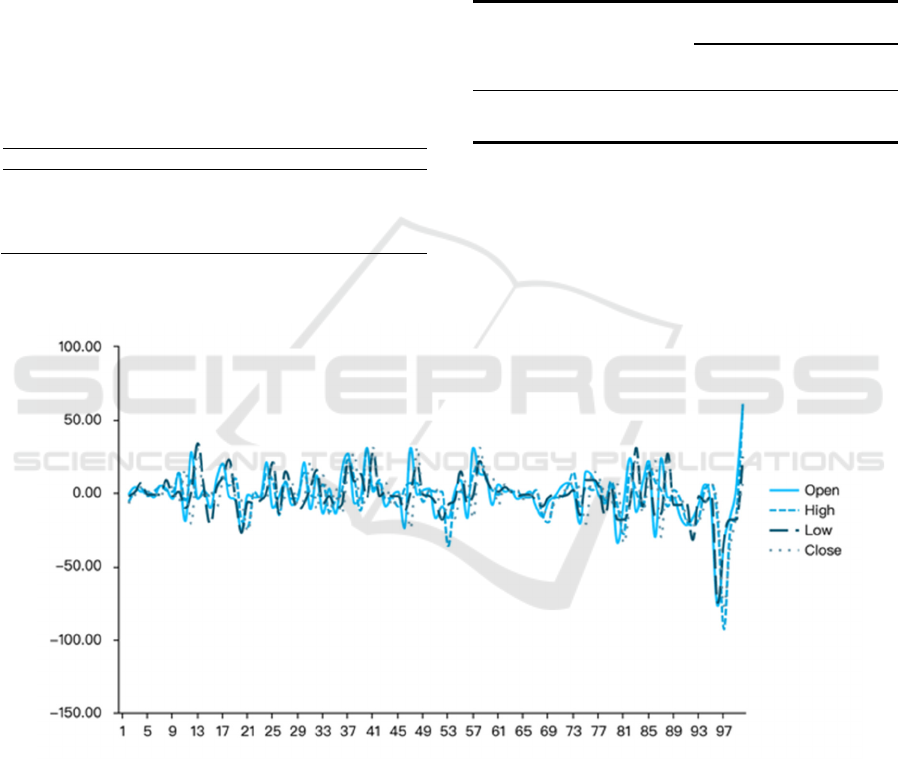

The figure 2 shows the transformed series after

applying first-order differencing. The resulting data

appear to fluctuate around a constant mean with

relatively stable variance, indicating that the non-

stationarity in the original series has been removed.

Figure 2: First order difference sequence diagram (Picture credit: Original).

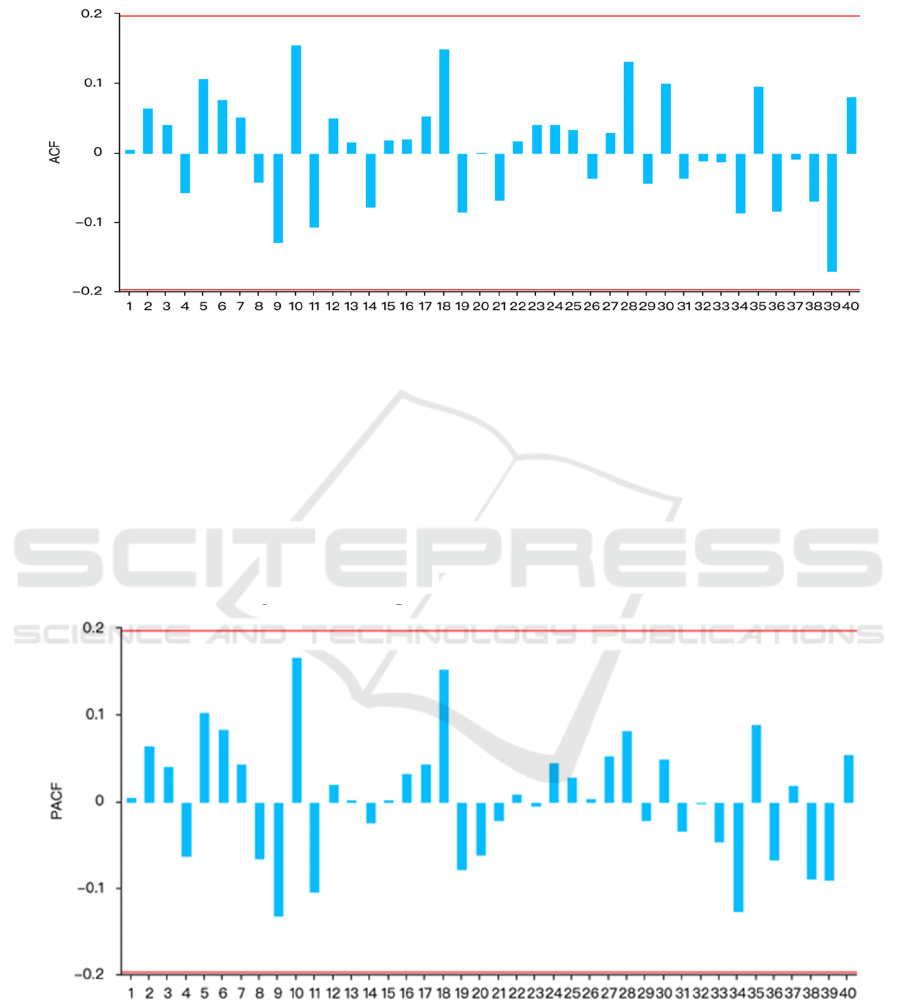

3.3 ACF and PACF Test

The Figure 3 ACF plot displays significant

correlations at lags 1 to 3, gradually tapering off. This

pattern suggests the presence of a moving average

(MA) component in the time series data, which plays

a vital role in modelling the random shock effects of

prior periods on current Bitcoin prices. Specifically,

the sustained correlation at early lags indicates that

recent past errors still carry predictive power for

future observations. In the context of Bitcoin price

movements, this result reflects the asset’s

susceptibility to short-term noise and external events,

such as sudden news, regulatory developments, or

investor reactions to macroeconomic announcements.

IAMPA 2025 - The International Conference on Innovations in Applied Mathematics, Physics, and Astronomy

622

These transient shocks-whether driven by a market

crash, positive sentiment on social media, or abrupt

liquidity movements-create residual effects that

persist for a few days before fading.

Figure 3: ACF plot (Picture credit: Original)

By identifying these lagged relationships, the MA

component in the ARIMA model helps smooth out

short-term volatility, enabling the model to better

estimate the underlying price trend. Given Bitcoin’s

well-documented sensitivity to speculation and high-

frequency trading, incorporating the MA(q) structure

allows for a more refined capture of these temporary

distortions. Therefore, the findings from the ACF plot

are not just statistically informative-they directly

support a more accurate forecasting approach for a

financial asset like Bitcoin, which is frequently

affected by episodic market behaviours. These

insights justify the inclusion of a single moving

average term (q = 1) in the ARIMA (3,1,1) model,

balancing responsiveness to shocks while avoiding

overfitting in a high-volatility environment.

Figure 4: PACF plot (Picture credit: Original)

The PACF plot shows significant spikes at lags 1 to 3

before cutting off, indicating the presence of a strong

autoregressive (AR) structure in the time series

(Figure 4). Each spike implies a direct relationship

between Bitcoin’s current closing price and its values

in the preceding days, independent of intermediate

lags. This autocorrelation pattern reveals that Bitcoin

prices exhibit temporal dependencies-meaning recent

price levels have a strong and direct influence on

subsequent prices. In financial terms, this behaviour

Analysis of Bitcoin Price Forecasting and Related Influencing Factors

623

is consistent with momentum trading, market

memory, and investor psychology-where previous

gains or losses tend to influence current market

behaviour due to trend-following strategies or fear-

of-missing-out (FOMO) phenomena.

By incorporating up to three AR terms (𝑝 = 3),

the model captures this serial dependence, allowing it

to learn from recent trends and apply them to future

predictions. This is particularly important in

cryptocurrency markets, where price inertia often

emerges from collective behaviour and delayed

reactions to news. For example, a bullish trend

initiated by positive regulatory news or institutional

adoption may persist over several days as more

participants join the market. Likewise, a sudden drop

may extend over multiple sessions due to panic

selling. The PACF structure helps capture this lagged

momentum. As a result, the choice of 𝑝 = 3 in the

ARIMA (3,1,1) model is not arbitrary-it reflects the

behavioural underpinnings of the Bitcoin market and

enhances the model’s ability to replicate its empirical

price dynamics. When used in tandem with

differencing (𝑑 = 1) and MA components, the AR

terms help stabilize forecasts while accounting for

intrinsic patterns in the data.

3.4 ARIMA Model

The ARIMA model results show that among the

autoregressive (AR) and moving average (MA)

terms, some parameters are statistically significant.

Specifically, the second autoregressive term (𝛼

) has

a coefficient of 0.937 with a p-value of 0.000,

indicating a strong positive and statistically

significant effect at the 1% level. This suggests that

past values, particularly those lagged by two periods,

have a substantial influence on the current price trend.

In contrast, the first autoregressive term (𝛼

) and the

third autoregressive term (𝛼

) are not statistically

significant (p-values of 0.816 and 0.632 respectively),

implying their limited explanatory power in the

model (Table 3).

For the moving average component, 𝛽

is

estimated at 0.945 with a p-value of 0.000,

demonstrating a significant positive impact. The high

significance of 𝛽

suggests that past forecast errors

are highly influential in shaping the current

observations, reflecting the market’s sensitivity to

unexpected shocks or noise. The model achieves an

Akaike Information Criterion (AIC) of 851.152 and a

Bayesian Information Criterion (BIC) of 866.783,

indicating a reasonably good model fit relative to

alternative specifications.

The strong significance of the second-order

autoregressive term (𝛼

) highlights the inertia and

memory effect in Bitcoin prices, where movements

from two periods ago exert a lasting impact on the

present. This characteristic aligns with the speculative

nature of cryptocurrency markets, where price trends

are often amplified over short time horizons due to

herd behaviour and momentum trading.

Similarly, the significant moving average term

(𝛽

) reflects the persistence of shocks in the market.

A large 𝛽

coefficient implies that deviations from

expected prices are not rapidly corrected but instead

influence future prices, underscoring the market’s

inefficiency and the role of sentiment-driven

volatility. This is consistent with the behaviour

observed in Bitcoin markets, where news events,

regulatory changes, and speculative trading can create

price distortions that last over multiple periods.

Table 3: ARIMA (3,1,1) model results

Term

Coefficient Standard error z p 95% CI

Constant term c 14.143 23.351 0.606 0.545 -31.624 ~ 59.910

AR

α1 0.063 0.271 0.232 0.816 -0.468 ~ 0.594

α2 0.937 0.222 4.225 0.000 0.502 ~ 1.372

α3 -0.054 0.112 -0.479 0.632 -0.273 ~ 0.166

MA

β

1 0.945 0.263 3.587 0.000 0.429 ~ 1.461

Remarks:AIC= 851.152

BIC= 866.783

IAMPA 2025 - The International Conference on Innovations in Applied Mathematics, Physics, and Astronomy

624

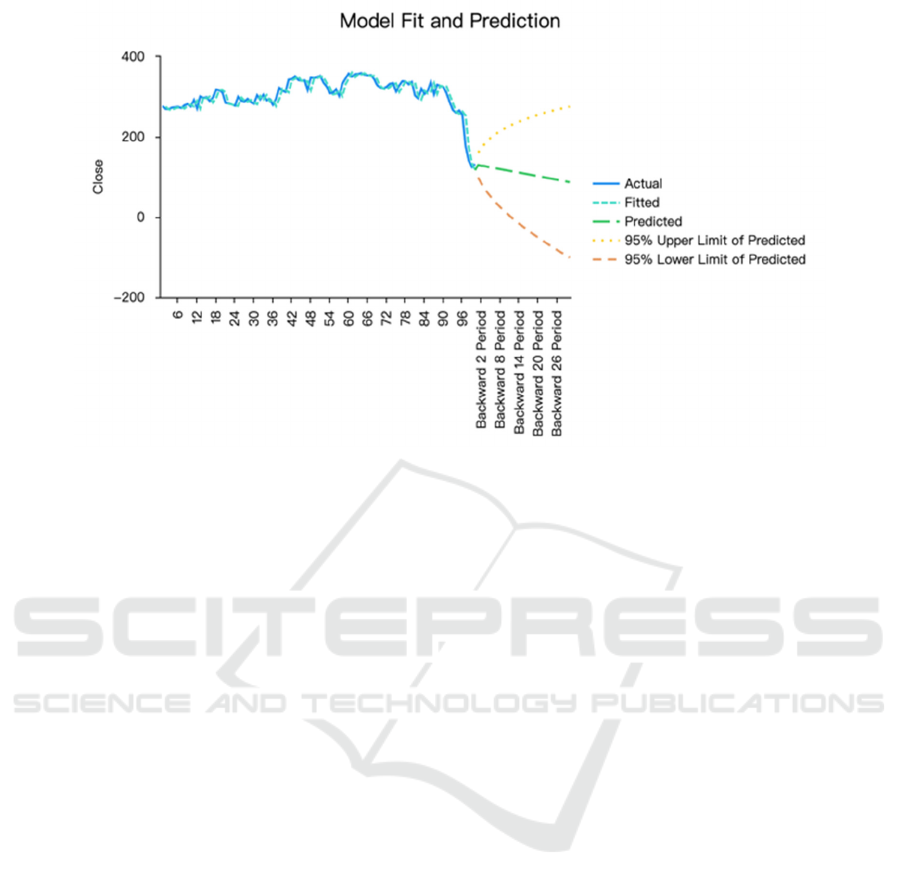

Figure 5: Model Fit and Prediction (Picture credit: Original).

This graph compares the fitted ARIMA model values

with actual observed Bitcoin prices (Figure 5). The

model tracks the historical trends well, especially

during the mid-term periods, although some deviation

occurs during extremely volatile price movements.

Nonetheless, the model provides a reliable foundation

for short-term forecasting.

4 CONCLUSION

Since the birth of Bitcoin in 2009, its price has

experienced drastic fluctuations, which makes

Bitcoin price forecasting and influencing factors a

popular topic in financial market research. Since the

Bitcoin market is affected by various factors such as

supply and demand, macroeconomic policies,

investor sentiment, etc., how to use a suitable time

series model to make effective forecasts is a question

worth exploring. ARIMA, as a classic time series

analysis method, can fit the price trend better after

data smoothing. Therefore, in this paper, the ARIMA

(3,1,1) model is used for Bitcoin price prediction and

its performance is evaluated. And the prediction was

made based on the historical data from 2017-2023.

The experimental results show that the model can

effectively capture the long-term trend of bitcoin

price and has high prediction accuracy in the short

term. Through model evaluation, this paper finds that

ARIMA (3,1,1) outperforms the linear regression

model in terms of mean square error (MSE) and root

mean square error (RMSE).

REFERENCES

Acikgoz, T. 2025. Gold and Bitcoin as hedgers and safe

havens: Perspective from nonlinear dynamics,

Resources Policy, 102, 105489.

Beckmann, J., Geldner, T. Wustenfeld, J. 2024. The

relevance of media sentiment for small- and large-scale

bitcoin investors, Journal of International Financial

Markets, Institutions and Money, 92, 1042-4431.

Chang, P.C., Liu, C H. 2008. A tsk type fuzzy rule based

system for stock price prediction. Expert Systems with

Applications, 34(1), 135-144.

Dirk, G., Thomas, D., Konstantin, K. 2018. Bitcoin, gold

and the US dollar-A replication and extension, Finance

Research Letters, Elsevier, 25, 103-110.

Klein, T. 2017. Dynamic correlation of precious metals and

flight-to-quality in developed markets, Finance

Research Letters, 23, 283-290.

Lashkaripour, M. 2024. Some stylized facts about bitcoin

halving. Finance Research Letters, 69, 106198.

Okorie, D., Lin, B. 2020. Did China’s ICO ban alter the

Bitcoin market? International Review of Economics &

Finance, 69, 977-993.

Shahzad, S., Bouri, E., Roubaud, D., Kristoufek, L. 2020.

Safe haven, hedge and diversification for G7 stock

markets: Gold versus bitcoin, Economic Modelling, 87,

212-224.

Yu, Y., Tong, Y., Qiu, X.Y. 2025. Analysis of Factors

Influencing Bitcoin Price Volatility. Finance and

Management, 5, 54-58.

Zhang, L., et al. 2003. Energy clearing price prediction and

confidence interval estimation with cascaded neural

networks. IEEE Transactions on Power Systems.

Analysis of Bitcoin Price Forecasting and Related Influencing Factors

625