The Puzzle of Stock Premium in Western Market and Its

Enlightenment to Chinese Market

Yuchuan Zhou

a

International College, Jiangxi University of Finance and Economics, 169 Shuanggang East Street, Nanchang, China

Keywords: Puzzle of Stock Premium, Behavioural Finance, Western and Chinese Market.

Abstract: The mystery of stock premium has been a curious issue for nearly a hundred years. This study discusses the

origin of the puzzle of stock premium, the progress of western research and Its Enlightenment to China's

capital market. The mystery of stock premium comes from Mehra and Prescott's research in 1985, which

refers to the phenomenon that the real return of stocks is much higher than the risk-free interest rate, which is

difficult to explain by the traditional CAPM model. Behavioural finance provides new explanations from the

perspective of psychological bias and emotion, such as prospect theory, disposition effect, over trading. This

paper analyses the causes of stock premium, including investor behaviour, market volatility, information

asymmetry and so on, and points out its enlightenment to China's capital market, such as controlling inflation,

reducing policy intervention, strengthening market supervision and information disclosure transparency.

These results provide a useful reference for improving the institutional design and policy making of China's

capital market, and promotes its healthy development.

1 INTRODUCTION

The puzzle of stock premium was an important point

put forward by Mehra and Prescott in 1985. By

analysing the stock market data of the US S&P 500

index from 1889 to 1978 (Zhou, 2013), they found

that the stock yield was about 7%, while the Treasury

bond yield, that is, the risk-free bond yield, was about

1% in the same period (Zhu & Zheng, 2013). The

stock yield and the risk-free bond yield form the

equity premium. However, under the traditional

financial model, the phenomenon of equity premium

cannot be explained, which leads to the view of "the

puzzle of stock premium".

In the western market, the research on the puzzle

of stock premium has experienced several stages of

development. Early studies mainly focused on the

classical capital asset pricing model (CAPM), trying

to explain the stock premium phenomenon by

improving the model assumptions. However, with the

in-depth study, scholars gradually realized that it was

difficult to fully explain the causes of stock premium

only by traditional models, and then introduced the

multi-dimensional theoretical framework of

behavioural finance, macroeconomic factors, market

a

https://orcid.org/0009-0009-2772-685X

friction and so on (Zheng & Xiao, 2013). For example,

Barberis et al. introduced the prospect theory into the

asset pricing model to explore the impact of investors'

bounded rationality on the stock premium (Barberis

et al., 2001).

With the continuous development of the global

financial market, China's capital market is also

gradually maturing, and China's influence on the

international stock market and economy is growing

(Shao, 2008). It is of great theoretical and practical

significance for China to study the mystery of stock

premium. This paper will first review the origin of the

puzzle of stock premium and its research progress in

the west, then analyse the causes of the puzzle of

stock premium, and finally put forward policy

suggestions and future research directions for the

development of China's capital market. Through the

in-depth study of the puzzle of stock premium, one

can not only better understand the relationship

between risk and return in the financial market, but

also provide a useful reference for improving the

institutional design and policy-making of China's

capital market, so as to promote the healthy

development of China's capital market and enhance

82

Zhou, Y.

The Puzzle of Stock Premium in Western Market and Its Enlightenment to Chinese Market.

DOI: 10.5220/0013833100004719

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 2nd International Conference on E-commerce and Modern Logistics (ICEML 2025), pages 82-86

ISBN: 978-989-758-775-7

Proceedings Copyright © 2025 by SCITEPRESS – Science and Technology Publications, Lda.

its position in the global financial system (Zhao & Hu,

1999).

2 BACKGROUNDS

2.1 Traditional Finance

Mehra and Prescott first put forward the puzzle of

stock premium in 1985, i.e., the real rate of return of

stocks is much higher than the risk-free interest rate

(Mehra & Prescott, 1985). Traditional finance uses

capital asset pricing model (CAPM) to explain the

phenomenon of stock premium. The CAPM model

was proposed by Sharpe in 1964. It believes that the

expected return of assets is proportional to its

systematic risk (β value). However, CAPM model

assumes that the market is completely efficient and

investors are rational, which is quite different from

the behaviour of investors in the actual market

(Sharpe 1964). It is difficult to explain this

phenomenon with a reasonable risk aversion

coefficient. Mehra and Prescott pointed out that to

explain the stock premium, investors' risk aversion

coefficient needs to be as high as 30 to 40, which is

in contradiction with the risk aversion coefficient of

about 1 observed in reality. Some typical results are

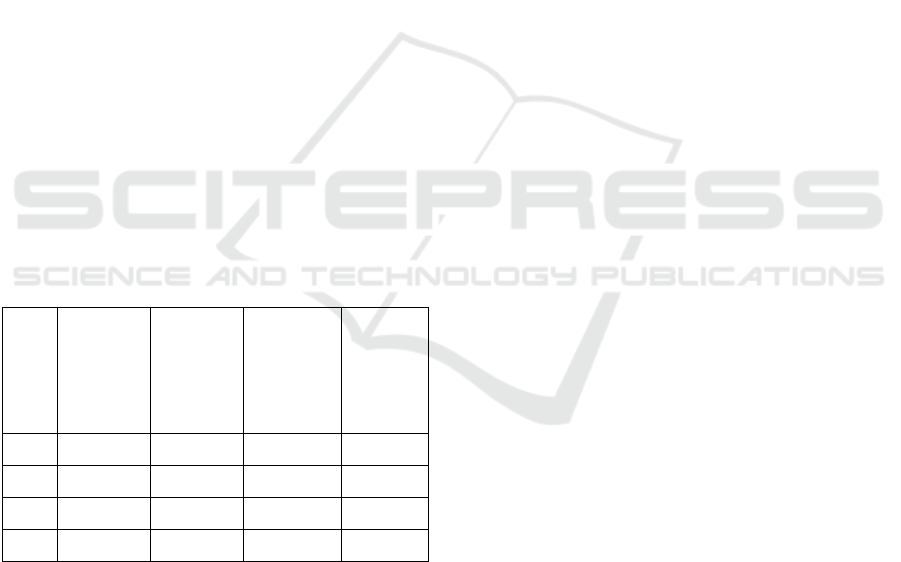

shown in Table 1.

Table 1: Comparison between CAPM model prediction and

actual rate of return.

β Risk free

interest

rate

Market

rate of

return

CAPM

forecast

rate of

return

Actual

rate of

return

0.5 2% 8% 5% 6.5%

1.0 2% 8% 8% 9.2%

1.5 2% 8% 11% 12.8%

2.0 2% 8% 14% 15.5%

Data source: risk free interest rate: fed economic data (Fred).

Market return: S&P 500 index historical data (CRSP).

Actual rate of return: Based on historical stock portfolio

(CRSP)

2.2 Behavioural Finance

The rise of behavioural finance provides a new

perspective to explain the mystery of stock premium.

Behavioural finance believes that the behaviour of

investors is affected by psychological bias and

emotion, which leads to the market is not always

effective. The explanation mainly focuses on the

psychological bias of investors. The disappointment

aversion theory explains investors' behaviour of

reducing holdings due to the volatility of stock returns

by introducing the disappointment aversion

coefficient and reference level; Barberis and Huang

pointed out in 2007 that incorporating loss aversion

and a narrow framework into the traditional utility

function can generate. Higher stock premiums and

lower risk-free interest rates at the same time, even

when consumption growth is stable and the

correlation with the stock market is weak (Barberis,

et al., 2001). Based on the prospect theory, the short-

term loss aversion theory points out that investors

magnify short-term loss perception due to frequent

portfolio evaluation, which requires a higher stock

premium to compensate for psychological costs

(Benartzi, 1995). These theories reveal the

phenomenon of stock premium that cannot be

explained by traditional finance from the perspective

of behaviour.

2.3 Empirical Analysis

Prospect theory, proposed by Kahneman and Tversky,

emphasizes that investors' perception of loss and

return is nonlinear, and their sensitivity to loss is

higher than that of return. Barberis, Huang and Santos

applied the prospect theory to the asset pricing model

in 2001, assuming that investors' sensitivity to loss is

higher than income, and the degree of risk aversion

will change with the change of investment results

(Barberis et al., 2001). This framework can explain

the historical data of stock premium.

Utility function is used to describe the risk

preference of investors in behavioural finance. The

traditional utility function assumes that investors are

risk neutral, while behavioural finance introduces the

concept of loss aversion and modifies the form of

utility function (Mehra & Prescott, 1985).

3 REASONS

3.1 Disposal Effect

The disposition effect was first proposed by Shefrin

and Statman in 1985, pointing out that investors tend

to sell profitable stocks too early and hold loss stocks

too long (Shefrin & Statman, 1985). The existence of

disposal effect shows that investors are affected by

psychological bias in the decision-making process,

especially the aversion to losses and the premature

realization of profits.

The Puzzle of Stock Premium in Western Market and Its Enlightenment to Chinese Market

83

Odean analysed the trading data of individual

investors in 1998 and found that the probability of

investors selling profitable stocks was significantly

higher than that of selling loss stocks (as shown in

Figure 1). This finding supports the existence of

disposition effect and shows that investors are

significantly affected by psychological bias in the

decision-making process (Odean, 1998). Feng and

Seasholes found that Chinese investors also showed

significant disposition effect through the study of

Chinese stock market in 2005. Their research also

found that experienced investors are less affected by

the disposal effect than novice investors, indicating

that investors can reduce the impact of psychological

bias through learning and experience (Feng &

Seasholes, 2005).

Over trading refers to the phenomenon that

investors buy and sell stocks frequently, resulting in

increased transaction costs and decreased net return.

This behaviour is usually driven by overconfidence

and over optimism. Barber and Odean found in 2000

that the annualized rate of return of over traded

investors was significantly lower than the market

average. Their research also shows that male

investors are more likely to show overconfidence than

female investors, leading to higher trading frequency

(Barber & Odean, 2000).

Attention driven trading means that investors tend

to buy stocks that attract their attention, and these

stocks may not have good fundamentals. This

behaviour is usually driven by media reports,

advertisements or other external information sources.

Hirshleifer et al. Found in 2011 that media reports

increased the trading volume and volatility of stocks.

Seen from Table 2, their research shows that when

faced with a large amount of information, investors

may rely on simple clues (such as stock names or

recent performance) to make decisions (Hirshleifer et

al, 2011).

Emotion driven trading means that investors'

decisions are affected by emotional fluctuations,

resulting in excessive buying when market sentiment

is high and excessive selling when market sentiment

is low. Such behaviour is usually driven by

psychological factors such as market sentiment and

herding. Baker and Wurgler found in 2006 that

market sentiment has an impact on stock returns.

Their research shows that investors may be overly

optimistic when the mood is high, and may be overly

pessimistic when the mood is low (Baker & Wurgler,

2006). Inadequate diversification of investment

portfolio means that investors fail to fully diversify

investment risks, resulting in unnecessary risks. This

behaviour is usually driven by psychological factors

such as local preference and industry concentration.

French and Poterba found in 1991 that investors

generally have local preferences, leading to the lack

of internationalization of the portfolio. Their research

shows that investors may underestimate some risks,

resulting in insufficient diversification of the

portfolio (French & Poterba, 1991).

Figure 1: Stock type (Photo/Picture credit: Original).

Table 2: This caption has one line so it is centered.

Male Female

Annual average

transaction frequency

80% 50%

3.2 Market

Market volatility refers to the volatility of stock prices,

which is usually measured by standard deviation.

High market volatility may lead investors to demand

higher risk premium. Campbell and Shiller found in

1988 that there was a significant correlation between

market volatility and stock premium. Their research

shows that high market volatility may lead investors

to demand higher returns to compensate for risks

(Campbell & Shiller, 1988).

Information asymmetry refers to the fact that

different participants in the market have different

amounts of information, which leads to investors'

inaccurate risk assessment of stocks, thus requiring

higher returns. Grossman and Stiglitz pointed out in

1980 that information asymmetry is one of the

important reasons for market failure. Their research

shows that information asymmetry may cause the

market price to deviate from its true value (Grossman

& Stiglitz, 1980).

4 ENLIGHTENMENTS TO

CHINA

Hyperinflation will severely hit the national debt

market and the stock market. Holders of government

60%

40%

Profitable stock

Loss stock

ICEML 2025 - International Conference on E-commerce and Modern Logistics

84

bonds may sell government bonds in the event of

inflation, leading to a decline in the price of

government bonds. At the same time, inflation may

lead to the bubble of the stock market and eventually

lead to the bursting of the economic bubble, as shown

by the bursting of the economic bubble in Japan in the

1980s (Zhao & Hu, 1999). In order to promote the

healthy development of the capital market, one must

strictly control the inflation rate and ensure the

stability of the national debt and stock markets.

The time-varying parameters and statistics show

that there are limitations in the application of

consumption-based asset pricing model in China's

stock market. China's stock market is often referred

to as a "policy market". For example, the increase in

stamp duty on May 30th, 2007 led to a sharp decline

in the stock market. Such policy intervention has

increased market instability and intensified

speculation. In order to improve this situation, the

management should reduce direct intervention,

strengthen market supervision, crack down on

manipulation, improve the regulatory system,

improve the transparency of information disclosure,

and increase the punishment for violations. Through

these measures, China's stock market will gradually

mature, making the model introduced from abroad

more practical (Song, 2008).

The calculation of stock premium depends on

historical data, which may not accurately predict the

future market performance. In addition, the risk-free

interest rate (e.g., treasury bond interest rate) used to

calculate the stock premium also has risks, and the

difference of treasury bond interest rate in different

periods may affect the calculation results. Due to the

particularity of the Chinese market, the Chinese stock

market has existed for a short time, and the policy

intervention is frequent, and the investor structure is

different.

5 CONCLUSIONS

Since Mehra and Prescott proposed the mystery of

stock premium in 1985, it has aroused extensive and

in-depth discussion in the field of western financial

research. The CAPM model of traditional finance is

limited by the assumptions of its fully efficient

market and rational investors, and it is difficult to

reasonably explain the phenomenon that the real rate

of return of stocks is much higher than the risk-free

interest rate. The rise of behavioural finance provides

a new perspective for solving the mystery of stock

premium from the perspective of psychological bias,

such as disappointment aversion theory, prospect

theory, loss aversion and so on, which enables us to

have a deeper understanding of investor behaviour

and market phenomenon.

From the perspective of the causes of stock

premium, investors themselves have a variety of

irrational behaviours, such as disposal effect,

excessive trading, attention driven trading, emotion

driven trading and insufficient portfolio dispersion.

These behaviours are not only affected by

psychological factors, but also significantly affect the

return on investment in the market. At the same time,

the volatility and information asymmetry at the

market level make investors face higher risks and

demand higher returns, which together contribute to

the phenomenon of stock premium.

For China's capital market, the study of the puzzle

of stock premium has important theoretical and

practical significance. Theoretically, it helps us

understand the complex relationship between risk and

return in financial markets; In practice, it provides a

reference for the system design and policy making of

the capital market. On the one hand, controlling the

inflation rate is the key to stabilizing the national debt

and stock market, and the damage of hyperinflation to

the financial market should not be underestimated.

On the other hand, the policy management should

reduce direct intervention in the market, avoid

increasing market instability and speculation, and

instead strengthen market supervision, improve the

regulatory system, improve the transparency of

information disclosure, and severely crack down on

market manipulation and other violations, so as to

promote the maturity and healthy development of

China's stock market, so that international advanced

financial models can better play a role in the Chinese

market.

However, there are some limitations in the study

of the puzzle of stock premium. On the one hand, its

calculation relies on historical data, which makes it

difficult to accurately predict the future market trend,

and the selection of risk-free interest rates and term

differences will affect the calculation results. On the

other hand, the Chinese market has its particularity,

such as short development time, frequent policy

intervention, unique investor structure, etc., which

makes it necessary to be cautious when learning from

western research results. Future research should focus

on how to combine the characteristics of the Chinese

market and the development technology of artificial

intelligence, build a more practical theoretical model,

and deeply analyse the phenomenon of stock

premium, so as to provide more powerful theoretical

support for the long-term development of China's

capital market. This study will help to explore the

The Puzzle of Stock Premium in Western Market and Its Enlightenment to Chinese Market

85

causes of the mystery of stock premium and provide

a better reference for the development of China's

stock market.

REFERENCES

Baker, M., Wurgler, J., 2006. Investor sentiment and the

cross-section of stock returns. Journal of Finance,

61(4), 1645-1680.

Barber, B. M., Odean, T., 2000. Trading is hazardous to

your wealth: The common stock investment

performance of individual investors. Journal of

Finance, 55(2), 773-806.

Barberis, N., Huang, M., Santos, T., 2001. Prospect Theory

and Asset Prices. The Quarterly Journal of Economics,

1162.

Benartzi, T., 1995. Myopic Loss Aversion and the Equity

Premium Puzzle. The Quarterly Journal of Economics,

2(1), 73-92.

Campbell, J. Y., Shiller, R. J., 1988. Stock prices, earnings,

and expected dividends. Journal of Finance, 43(3),

661-676.

Feng, L., Seasholes, M. S., 2005. Do investor sophistication

and trading experience eliminate behavioral biases in

financial markets. Review of Finance, 9(3), 305-351.

French, K. R., Poterba, J. M., 1991. Investor diversification

and international equity markets. American Economic

Review, 81(2), 222-226.

Grossman, S. J., Stiglitz, J. E., 1980. On the impossibility

of informationally efficient markets. American

Economic Review, 70(3), 393-408.

Hirshleifer, D., Lim, S. S., Teoh, S. H., 2011. Limited

investor attention and stock market misreactions to

accounting information. Review of Asset Pricing

Studies, 1(1), 35-73.

Mehra, R., Prescott, E. C., 1985. The equity premium: A

puzzle. Journal of Monetary Economics, 15(2), 145-

161.

Odean, T., 1998. Are investors reluctant to realize their

losses. Journal of Finance, 53(5), 1775-1798.

Shao L., 2008.An empirical analysis of the puzzle of equity

premium in China. Qingdao University.

Sharpe, W. F., 1964. Capital asset prices: A theory of

market equilibrium under conditions of risk. Journal of

Finance, 19(3), 425-442.

Shefrin, H., Statman, M., 1985. The disposition to sell

winners too early and ride losers too long: Theory and

evidence. Journal of Finance, 40(3), 777-790.

Song, N., 2008. An analysis of the puzzle of equity

premium in China's stock market. Huazhong University

of science and technology.

Zhao, L., Hu, Y., 1999. The puzzle of western stock

premium and the steady development of China's capital

market. Journal of Qingdao Ocean University, 1, 67-

71+50.

Zheng, X., Xiao, Y., 2013. Review of equity risk premium

theory Based on C-CAPM model. Journal of Guizhou

University of Finance and Economics, 6, 42-47.

Zhou, H., 2013 The puzzle of equity premium in China: An

analytical perspective of behavioural finance. Liaoning

University.

Zhu, K., Zheng, S., 2013. Prospect theory and an

explanation of stock premium -- An Empirical Analysis

Based on China's securities market. Journal of

Southwest Agricultural University (Social Science

Edition), 11(11), 22-26.

ICEML 2025 - International Conference on E-commerce and Modern Logistics

86