Analysis of the Influence of Psychological Factors on Personal

Financial Investment

Jing Yang

Institute of Music, Changchun Normal University, Yuanda Street, Changchun, China

Keywords: Behavioural Finance, Psychological Account, Risk Perception.

Abstract: With the continuous development of the economy, individuals pay more and more attention to financial

investment, so the results of investment with different attitudes are also very different. Traditional finance

believes that investment should be rational, but the conclusion of behavioural finance is not. This article

studies the present from several main factors of behavioural finance, e.g., the kinds of mentality do investors

have when investing and methods can be studied to minimize such impacts to maximize profits. In the end,

this study did not eliminate the impact of psychological factors on investment and financial management.

Instead, by focusing on the two aspects of psychological accounts and risk perception, it was found that risk

perception has a close positive correlation with investment decision-making, and emphasized that the

sensitivity of individuals to risk perception in the process of investment decision-making is very high. The

important thing is not to be overconfident or blindly follow the trend. This study analyses the psychological

activities and changes in mentality experienced by investors before making investment decisions, and

concludes that such psychological activities will have a significant impact on investors.

1 INTRODUCTION

The conditions that affect decision-making are often

caused by personal cognition, psychological factors

and behavioural restrictions (Bashar, 2023).

Traditional finance believes that investors with

rational behaviour should conduct risk assessment

before investing, and investment behaviour should be

rational, while behavioural finance believes that

psychological accounts will affect investors' follow-

up decision-making, which is irrational (Almansour

& Arabyat, 2017), which is a kind of behavioural

deviation. The most basic reason why the author

studies behavioural finance is that traditional finance

has certain limitations in explaining investors'

financial decisions and cannot give a more

authoritative explanation. Behavioural finance not

only does not deny any financial theory, but also adds

psychological knowledge (Bashar, 2023), in order to

It is enough to explain some irrational investment

behaviours and financial decisions that traditional

finance cannot explain. Some typical suggested

characteristics of investment risks are listed in Table

1 (Lvo vlaev et al., 2009).

Investment is often to obtain higher returns, so as

to improve personal living standards and satisfy the

public's pursuit of high quality of life and enjoyment.

With the desire for these interests, individuals always

cannot absolutely rationally stop loss or take profit in

time according to the current situation when investing.

For example, stock investment, firstly, based on

speculation, people buy stocks at higher prices, but

sell them at lower prices because of lack of

confidence, which causes certain losses (Bashar,

2023). Secondly, due to overconfident bias but lack

of sufficient financial knowledge, they are used to

new things and when old things are connected,

representative bias may cause significant losses for

buyers to buy stocks with too high prices. Most

investors tend to prefer a more stable and stable risk

tendency when investing, and hold a high-risk

avoidance attitude (Wildavsky & Dake, 1990). It is

precisely because of the perception of low risk by

market participants that they are inclined to grazing,

which also has an adverse impact on their decision-

making (Madaan & Singh, 2019). The collapse of the

Saudi stock market in 2006 was also mainly attributed

to the irrational behaviour of investors.

Although investors' profits and losses will have

a significant impact due to behavioural financial bias,

this article is based on this phenomenon. Through

research on the investment market, stocks, sinking

Yang, J.

Analysis of the Influence of Psychological Factors on Personal Financial Investment.

DOI: 10.5220/0013832600004719

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 2nd International Conference on E-commerce and Modern Logistics (ICEML 2025), pages 57-60

ISBN: 978-989-758-775-7

Proceedings Copyright © 2025 by SCITEPRESS – Science and Technology Publications, Lda.

57

costs, purchase commodity utility, etc., it hopes to

find a way to reduce the impact of psychological

factors in the process of financial investment, so that

investors can better Business planning and decision-

making. This article still explores the relationship

between sunk costs and psychological accounts in the

category of behavioural finance, and the intermediary

role of risk perception in the Saudi stock market in the

impact of behavioural financial factors on personal

financial investment decision-making. However,

there is no relevant research on risk perception as an

intermediary in the Saudi stock market (Bashar,

2023). Although the impact of psychological

accounts on individuals is not small, this impact will

gradually decrease over time. That's why investors

often buy expensive goods that far exceed their

psychological expectations (Bashar, 2023). Hence

this research which kind of psychological activity did

the buyer experience when he bought these high-

priced goods. Through the study of these

psychological account investment problems, one is

inspired by the correct direction and field of

investment in the future.

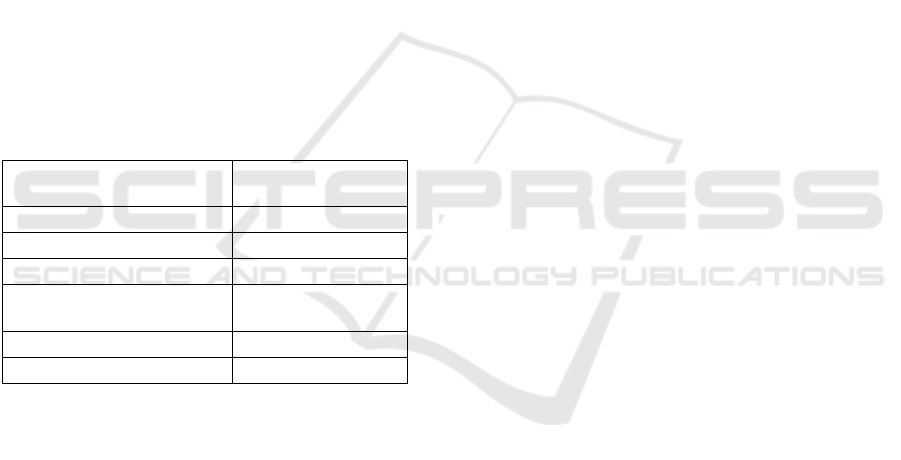

Table 1: Suggested Characteristics of Investment Risk.

Characteristic Category Percentage of Time

Mentioned First

Stock market volatilit

y

35%

Economic uncertaint

y

22%

Saved amount (exposure) 11%

Characteristics of the

investment company

11%

Salar

y

/

j

ob uncertaint

y

7%

Others 15%

2 DESCRIPTIONS OF

BEHAVIORAL FINANCE

Because it involves psychological factors, it should

be studied from the scope of behavioural finance.

Traditional finance believes that investment should

be completely rational, so scholars do not consider it

from here. After studying behavioural finance, it is

concluded that personal cognitive bias and emotional

reaction will affect the final investment decision-

making. A wide range of behavioural financial factors

include bias, risk perception and personality

characteristics, etc.

The bias of behavioural finance has a significant

impact on investors' profits and losses (Parveen et al.,

2020). For example, overreacting, investors always

overestimate the importance of new information.

Being too confident in their decision-making will

give them a prejudice of overconfidence, resulting in

excessively high economic costs and large losses.

They will also overreact to negative news and

underweight the possibility of rare events, which will

eventually lead to inefficient investment or make bad

investment decisions (Grable et al., 2020; Kim et al.,

2022). In terms of emotional response, people's greed

and fear dominate. Investors often have "floating

losses are not losses" or are unwilling to give up in

time when there is a little profit. Driven by this greed,

investors' excessive investment may lead to huge

losses, or irrational selling when the market panics

will also lead to assets. Fall.

Speaking of crowd psychology, for most investors,

they do not have enough financial knowledge to

support their rational investment. They often blindly

follow the trend, which is very unfavourable to both

the stock market and the cryptocurrency market. It is

easy to form a stock market bubble or a herd effect.

The collapse of the Saudi stock market in 2006 was

mainly due to investors' irrational investment and

blind follow-up.

3 RISK PERCEPTION

Risk perception is a very important intermediate

variable to understand how a person's subjective

evaluation of risk affects his final investment decision.

Through the study of risk perception, one can fully

understand how risk perception and investment

decision-making and behavioural factors interact, and

finally shape investment decision-making, helping

researchers to comprehensively understand the whole

process of investment decision-making (Adil et al.,

2022). Some typical results are listed in Table 2.

First of all, when it comes to risk, different

investors must have different preferences for risk.

However, due to the high attention to the degree of

risk, the risk perception has gradually increased and

the frequency of transactions has also increased,

resulting in less investment in the stock market

(Ahmed et al., 2022), so there will be different types

of investors with different attitudes towards risk. The

first risk-averse investor tends to invest in low-risk

and more stable assets, such as bonds and time

deposits. The second is risk-neutral investors. They

will want to seek balance. They may choose the

combination of stocks and bonds, that is, portfolio

investment. They do not put eggs in the same basket,

spread risks, and make full use of the

complementarity between different assets in order to

ICEML 2025 - International Conference on E-commerce and Modern Logistics

58

improve the overall investment effect. Such

investment will also bring Come to a relatively stable

income. The third type of risk-preference investors,

who are willing to take high risks in order to obtain

higher returns, may invest in cryptocurrencies or

venture capital (Ballis & Verousis, 2022). However,

one thing is that although they are willing to bear the

losses that may be brought about by high risks, most

of them may not have sufficient financial knowledge

to support their rational investment. At this time,

investors will blindly follow the trend due to the

psychology of following the crowd, and in the end,

they will not achieve the expected high benefits.

Some other results are also listed by (Michael &

Joseph, 2020).

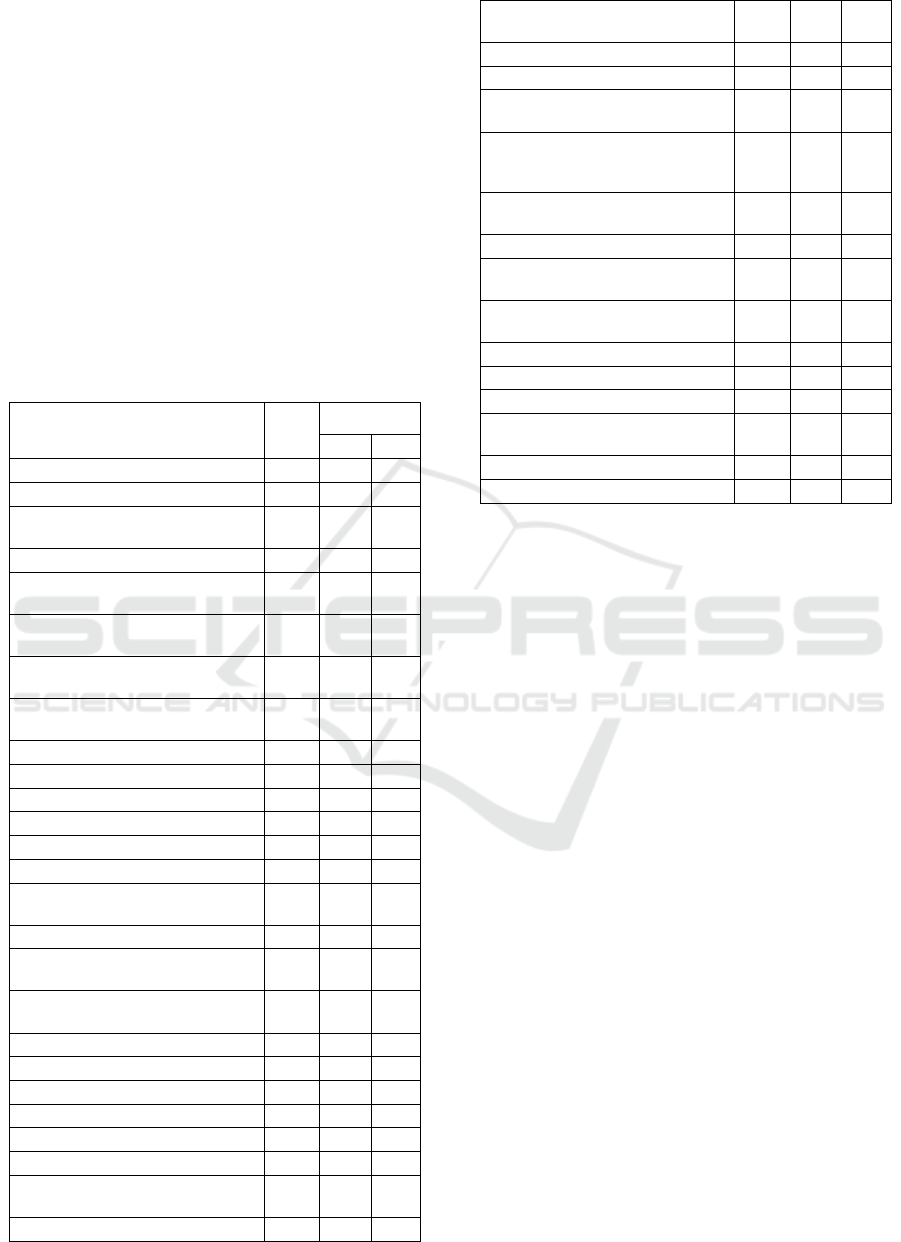

Table 2: Suggested Characteristics of Investment Risk.

Risk Factor

Mean t-test (df = 55)

t

p

Possibility for very large loss in relation5.70

—

—

to the amount of money invested. (1.49)

Feeling of loss of control over the

course

5.20 2.05 .0456

of the investment. (1.31)

The possibility that your investmen

t

does

5.20 2.58 .0127

not increase in value so that you do no

t

reach your target retirement income.

(1.49)

The possibility that your investmen

t

may

5.16 2.04 .0459

still not be enough to provide a prope

r

style of living after retirement.

(1.63)

Lack of trust in the financial adviser. 5.13 2.27 .0274

1.36

Lack of knowledge about particula

r

5.07 2.73 .0084

investments. (1.23)

Likelihood that cost of life (prices) will 5.04 2.62 .0115

go extremely high due to high (1.32)

inflation, which will make you savings

unable to cover your life needs.

Lack of confidence in the future 4.95 3.03 .0037

p

erformance of the economy and/or the

stock market.

(1.33)

Lack of trust in the product provider. 4.93

(1.54)

2.59 .0121

The fear that you might be making a 4.86 3.20 .0023

wrong decision. (1.46)

Lack of trust in the particular company 4.66 4.07 .0002

in which you are investing. (1.48)

The unsuitability of particular types of 4.64 4.53 .0000

investments. (1.43)

Lack of trust in the particular industry. 4.64

(1.38)

4.61 .0000

The worry and anxiety that may be 4.63 3.65 .0006

caused if the value of your investmen

t

decreases.

(1.36)

Equity or fairness of the ris

k

-

b

enefit 4.39 5.62 .0000

distributions. (1.04)

Concern as to whether you will lose

state

4.30 5.34 .0000

benefits to which you would otherwise

b

e entitled if you did not save for you

r

retirement.

(1.52)

Unfamiliarity with a type of investment. 4.29

(1.52)

8.09 .0000

The fact that investing for a pension is 4.21 5.73 .0000

complex process and something you are

not used to doing.

(1.66)

The liquidity of your investment. 4.04

(1.39)

5.89 .0000

General uncertainty about investmen

t

3.95 6.29 .0000

p

roducts in general. (1.65)

The fear that you may not be able to 3.88 5.81 .0000

meet the saving commitment of ε2000 a

year.

(1.70)

Lack of confidence in the workings of 3.79 7.45 .0000

the financial markets. (1.36)

4 MENTAL ACCOUNTING

There are five types of psychological accounts, which

correspond to different financial decisions, and they

influence and constrain each other. However, it is

precisely because the distribution of these funds is too

meticulous that the limitations of psychological

accounts may lead to the distortion of the first risk

preference, which may lead to irrational investments,

such as including unexpected income in the

investment account for high-risk investment and

ignoring the comprehensiveness of investment

decision-making. The second point leads to

misjudgement of capital flow. Investors may make

wrong judgments about capital flow, which will

affect investment decision-making and capital

allocation.

Then studying the formation of psychological

accounts makes researchers understand that there is

no way to eliminate the impact of psychological

accounts on investors. The first is that cognitive

differences lead people to tend to distribute funds

according to source, purpose and feelings, which is

unconscious. Another thing is that social and cultural

background and education level will affect a person's

view of money, which is implicitly formed and

basically cannot be changed.

Analysis of the Influence of Psychological Factors on Personal Financial Investment

59

5 LIMITATIONS AND

PROSPECTS

Since there is no law to avoid the impact of these

psychological factors, one can find ways to reduce

these effects. First of all, emotional management

training can be carried out, so that investors can

maintain a stable mentality and reduce unnecessary

losses caused by emotional fluctuations. The second

is to learn more relevant financial knowledge. With a

certain financial knowledge reserve, investors can

have a certain confidence when investing instead of

blind confidence or blindly following the crowd

(Ahmad, 2022). Finally, build the awareness of long-

term investment to help investors build patience to

avoid increasing costs due to frequent transactions

(Ababio et al., 2020).

6 CONCLUSIONS

In summary, there are many and complex

psychological factors affecting personal financial

investment, and may even cause irreparable huge

losses, but this impact is inevitable. This research can

only reduce its impact through various methods.

Personal cognitive and psychological changes are

often the fundamental prerequisites that affect a

person's investment decision-making. From the

perspective of behavioural finance, there are many

factors that affect investment decision-making. In

general, it is difficult for a person to be rational when

making investment decisions, often because they do

not have enough relevant financial knowledge. There

is a keen sense of risk, which leads to blindly

following the crowd due to overconfidence and so on.

The formation of psychological accounts has both

advantages and disadvantages. The advantage is that

the detailed distribution allows investors to better

plan their property, but it also makes investors have

great limitations when investing and cannot consider

problems comprehensively, and the investment

results are not satisfactory. Therefore, since there is

no law to avoid psychological factors when investing,

you might as well face the difficulties and consider

comprehensive issues as much as possible according

to the research results when investing, so as to avoid

emotional ups and downs that investment decisions

are greatly affected by psychological factors and

cause irreparable losses.

REFERENCES

Almansour, B. Y., Arabyat, Y. A., 2017. Investment

decision making among Gulf investors: Behavioural

finance perspective. International Journal of

Management Studies, 24(1), 41-71.

Ahmed, S. U., Ahmed, S. P., Abdullah, M., Karmaker, U.,

2022. Do socio-political factors affect investment

performance. Cogent Economics & Finance, 10(1).

Adil, M., Singh, Y., Ansari, M. S., 2022. How financial

literacy moderate the association between behaviour

biases and investment decision? Asian Journal of

Accounting Research, 7(1), 17–30.

Ahmad, M., 2022. The role of cognitive heuristic-driven

biases in investment management activities and market

efficiency: A research synthesis. International Journal

of Emerging Markets, 178.

Ababio, K. A., 2020. Behavioural portfolio selection and

optimisation: Equities versus cryptocurrencies. Journal

of African Business, 21(2), 145–20.

Bashar, Y. A., 2023. Behavioural finance factors and

investment decisions: A mediating role of risk

perception. General & Applied Economics, 17.

Ballis, A., Verousis, T., 2022. Behavioural finance and

cryptocurrencies. Review of Behavioral Finance, 14(4),

545–562.

Grable, J. E., Jo, S. H., Kruger, M., 2020. Risk tolerance

and household financial behavior: A test of the

reflection effect. IIMB Management Review, 32(4),

402-412.

Kim, J. J., Dong, H., Choi, J., Chang, S. R., 2022. Sentiment

change and negative herding: Evidence from

microblogging and news. Journal of Business

Research, 142, 364-376.

Lvo Vlaev, Nick, C., Neil S., 2009. Dimensionality of Risk

Perception: Factors Affecting Consumer

Understanding and Evaluation of Financial Risk, 11.

Madaan, G., Singh, S., 2019. An analysis of behavioral

biases in investment decision-making. International

Journal of Financial Research, 10(4), 55-67.

Michael, S., Joseph, A., 2020. Risk Perception: Reflections

on 40 Years of Research.

Parveen, S., Satti, Z. W., Subhan, Q. A., Janil, S., 2020.

Exploring market overreaction, investors’ sentiments

and investment decisions in an emerging stock market.

Borsa Istanbul Review, 20(3),224-235.

Wildavsky, A., Dake, K., 1990. Theories of risk perception:

Who fears what and why. Daedalus, 199(4), 41-60

ICEML 2025 - International Conference on E-commerce and Modern Logistics

60