Practical Research on the Inclusion of Data Assets of Data-Driven

Intelligent Enterprises in Financial Statements: Taking "Merit

Interactive" as an Example

Yuer Chen

a

Business School, Dalian University of Foreign Languages, Longtou Street, Lüshunkou District, Dalian, China

Keywords: Data Assets, Current Situation of Inclusion in Financial Statements, Merit Interactive, Economic

Consequences.

Abstract: The inclusion of data assets in financial statements is a crucial step in the digital transformation of enterprises.

It makes the value of data explicit, which is conducive to in-depth exploration and utilization. However,

existing research mainly stays at the theoretical level, lacking practical cases of implementation in enterprises,

and there is a problem of disconnection between theory and practice. Taking Merit Interactive as an example,

this paper uses the longitudinal single-case study method and the literature research method to study the

financial reports of this enterprise in the first three quarters of 2024. The study finds that the inclusion of data

assets in financial statements not only helps Merit Interactive turn losses into profits, but also has a positive

impact on the market value of the company. According to the study, promoting the inclusion of data assets of

data-driven intelligent enterprises in financial statements is conducive to making the value of their data

resources explicit. This paper attempts to explore the possible economic consequences of including data assets

in financial statements for data-driven intelligent enterprises, and provides empirical references for enterprises

to better realize the explicit manifestation of data assets.

1 INTRODUCTION

The digital economy is increasingly becoming a key

force in reorganizing global factor resources,

reshaping the global economic structure, and

changing the global competition pattern. As a core

production factor, data is of positive significance for

promoting the optimization of resource allocation and

facilitating the upgrading of the industrial structure

(Liu Liyan and Sun Yue, 2025). In order to unlock the

potential of data factors and strengthen, optimize, and

expand the digital economy, in 2022, the Central

Comprehensively Deepening Reforms Commission

adopted the "Twenty Provisions on Data", exploring

a new model for including data assets in financial

statements (Lv Meng et al., 2024). On August 21,

2023, the Ministry of Finance issued the "Interim

Provisions on the Accounting Treatment Related to

Enterprises' Data Resources", which marked that it

was "imperative" for data assets to be included in

financial statements in China. In September of the

a

https://orcid.org/0009-0003-2263-9972

same year, the China Association of Assets

Appraisers formulated the "Guiding Opinions on the

Appraisal of Data Assets". The introduction of the

above policies has made the inclusion of data assets

in financial statements more feasible.

Domestic A-share listed companies have

responded to national policies and carried out

preliminary explorations on including data assets in

financial statements. The financial data of the third-

quarter reports in 2024 show that among A-share

listed companies, the number of companies that have

included data assets in their financial statements has

reached 55, and the total amount included has

increased to 1.512 billion yuan (SAIF, 2025). From

the perspective of enterprises, the recognition and

inclusion of data assets in financial statements can

more truthfully and comprehensively reflect the asset

status of enterprises (Zhang Xinmin and Jin Ying,

2022). At the same time, inclusion in financial

statements can promote the transformation of data

from a cost center to a value center, enhance data

Chen, Y.

Practical Research on the Inclusion of Data Assets of Data-Driven Intelligent Enterprises in Financial Statements: Taking "Merit Interactive" as an Example.

DOI: 10.5220/0013832500004719

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 2nd International Conference on E-commerce and Modern Logistics (ICEML 2025), pages 49-56

ISBN: 978-989-758-775-7

Proceedings Copyright © 2025 by SCITEPRESS – Science and Technology Publications, Lda.

49

competitive advantages, and provide a basis for the

trading, pledging, and investment of data assets (Xie

Kang et al., 2020). However, due to the limitations of

enterprises' data management awareness and

capabilities, as well as the lack of relevant laws and

accounting rules, listed companies that present data

assets in the form of accounting items and

monetization and actively disclose information

account for less than 3% of the total market. The

massive amounts of data owned by most enterprises

have not yet become a source of value for production

and development (Cleveland H., 1982).

Considering that Merit Interactive Company

included data assets in its financial statements

relatively early, this paper takes Merit Interactive

Company as the research object, adopts the

longitudinal single-case study method and the

literature research method, and studies its financial

reports for the first three quarters of 2024. It explores

the practice of the accounting treatment and

disclosure of its data assets, and further discusses the

possible economic consequences. This study aims to

make contributions in two aspects: On the one hand,

it acquires and refines the application practices of the

businesses related to enterprises' data assets; on the

other hand, it explores and analyzes the possible

economic consequences that the inclusion of data

assets in financial statements may bring to data-

driven intelligent enterprises, so as to help enterprises

make the value of data assets explicit and enhance

their data competitiveness.

2 THE BUSINESS SITUATION OF

MERIT INTERACTIVE'S DATA

RESOURCES

2.1 The Formation Methods and

Application Scenarios of Data

Assets

The formation methods of data assets: Firstly, the

original data mainly comes from the company's

developer services. The accumulated data resources

are legally collected on the premise of users'

authorized consent, forming the original data of

relevant data resources, including device information,

network information, scenario information, APP

characteristics, etc. As of the first half of 2024, the

cumulative installation volume of the company's

software development kit (SDK) has exceeded 110

billion, the cumulative installation volume of the

software development kit (SDK) for smart Internet of

Things (IoT) devices has exceeded 370 million, and

the number of daily active independent devices (with

duplicates removed) of the SDK has exceeded 400

million. Secondly, a dedicated data team conducts in-

depth insights and governance on the data,

accumulating profound data assets and ensuring the

accuracy and effectiveness of the data. After data

governance and mining, more than 7,000 types of

data tags have been formed, and the cumulative

number of characteristic parameters directly involved

in calculations exceeds 200 million. Thirdly, the self-

developed data intelligent operating system (DiOS) is

used to process and govern the data, realizing the

collection of data, asset management, and integrated

application management. The generated data

products will be regularly iterated and optimized

(SAIF, 2024).

There are two types of application scenarios:

Firstly, the company utilizes data resources to provide

professional push solutions for mobile application

developers, including services such as message push

SDK and user operation platform SDK. Secondly,

relying on data resources, the company has developed

data intelligence applications for different industries,

such as intelligent transportation, medical and health

care, etc., and also provides data support for brand

marketing, public governance, etc. In addition, the

company is actively exploring the combination of

data resources with new technologies such as

artificial intelligence. For example, it has accessed

large models like ChatGPT and developed

applications of large models for vertical scenarios.

2.2 The Business Model of Data

Resources

The company's business logic is divided into three

layers (D-M-P, Data-Machine-People): The bottom

layer "D" refers to data accumulation. Based on the

data accumulated in developer services and in-depth

insights into massive dynamic data, the company

continuously provides data support for top-level

businesses. The middle layer "M" refers to data

governance. The company has created a data

intelligent operating system (DiOS), which can

collect and gather data, manage it as assets, and

conduct refined processing, and then provide the

upper-level business systems with the ability of data

services. The upper layer "P" refers to data

application. Combining data models with industry

understanding, the company has created productized

and large-scale profit-making data intelligent

applications in the fields of commercial services and

public services.

ICEML 2025 - International Conference on E-commerce and Modern Logistics

50

3 THE OVERALL SITUATION OF

MERIT INTERACTIVE'S

INCLUSION OF DATA ASSETS

IN FINANCIAL STATEMENTS

3.1 Inclusion of Data Resources in the

"Intangible Assets" Account

As of September 30, 2024, the carrying value of the

company's data resources at the end of the period was

32,840,600 yuan. Among the three ways of obtaining

intangible assets of data resources, the intangible

assets of data resources that Merit Interactive has

currently included in the financial statements are all

obtained through self-research and development, and

there is currently no involvement in acquisition

through external purchase or other means (Zou

Zhaoju, 2017). The company's data resources are

measured using the cost method as shown in Table 1.

Considering that the timeliness of data resources

generally decreases year by year, the accelerated

depreciation and amortization method is used for

amortization. Through a comprehensive analysis of

the historical data of the past three years, the

amortization period is confirmed to be 5 years.

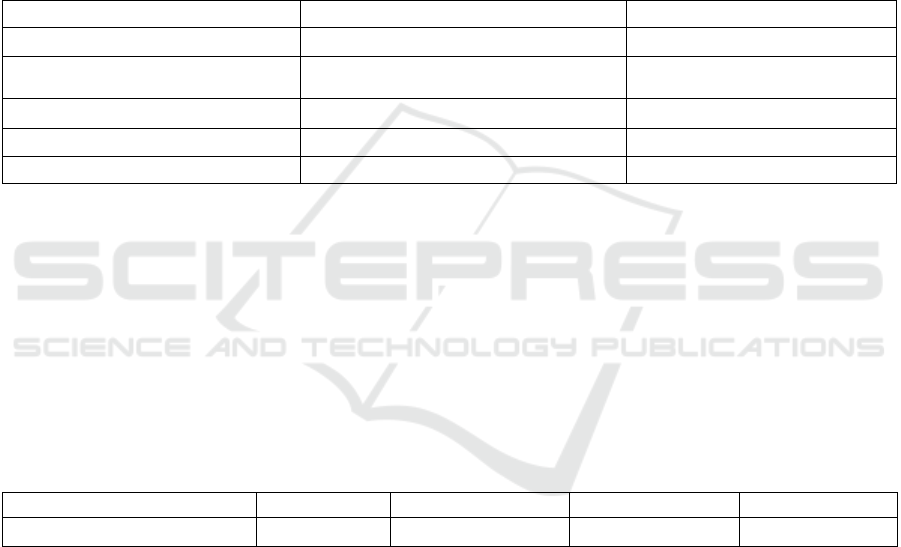

Table 1: Useful Life and Amortization Method of Merit Interactive's Data Resources.

Project Useful Life and Its Determination Basis Amortization Method

Land Use Right The land use term (50 years) Straight - line Method

Asset Groups Such as Copyrights,

Patents, and Trademarks

10 years Straight - line Method

Management Software 5 years Straight - line Method

Self - developed Operating System 5 years Straight - line Method

Data Resources 5 years Accelerated Amortization Method

Data Source: Merit Interactive's Financial Report (Juchao Information, 2024)

3.2 The Situation of Including Data

Assets in Financial Statements in

the First Three Quarters of 2024

and Comparative Analysis

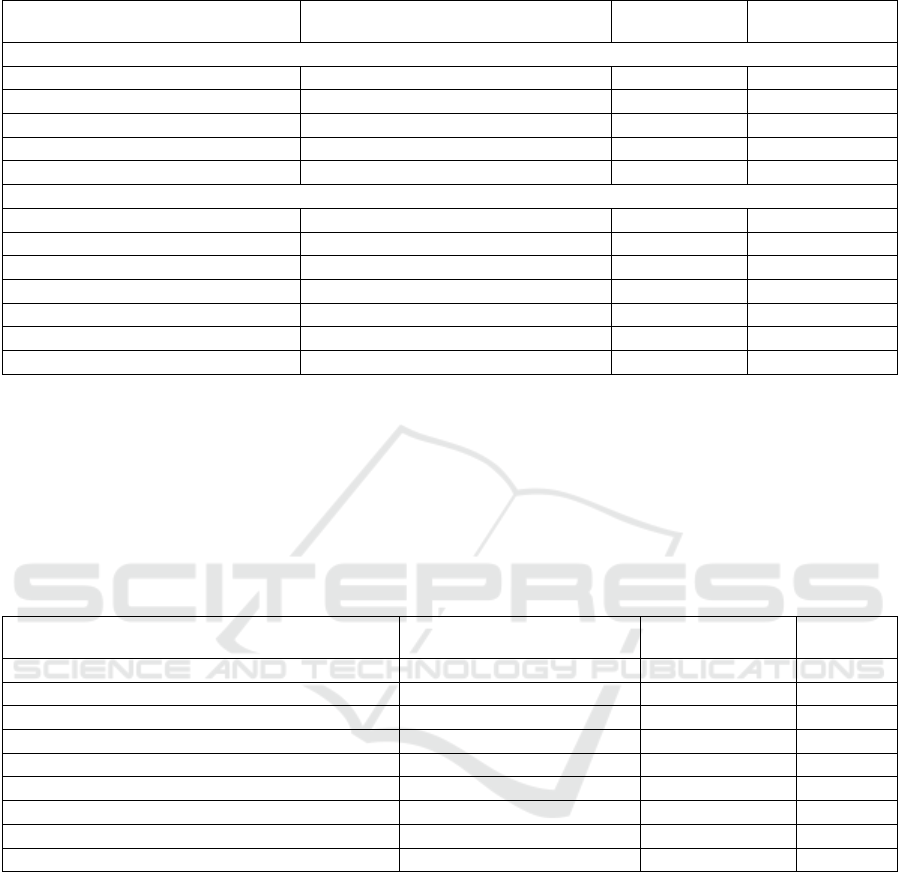

As shown in Table 2, in the third - quarter report of

2024, the intangible assets of Merit Interactive were

187.62 million yuan, including 32.8406 million yuan

of data resources, accounting for 17.50%. In the semi

- annual report of 2024, the intangible assets of Merit

Interactive were 183.0774 million yuan, including

23.3331 million yuan of data resources, accounting

for 12.75%. In the first quarter of 2024, Merit

Interactive included data resources in the financial

statements for the first time. As of March 31, the

company's intangible assets were 177.7344 million

yuan, including 12.8369 million yuan of data

resources, accounting for 7.22%.

Table 2: The Situation of Merit Interactive's Inclusion of Data Resources in Financial Statements (Unit: Yuan)

Intangible Assets 167,569,605.07 177,734,449.71 183,077,447.89 187,620,034.26

Among which: Data Resources

—

12,836,884.11 23,333,053.90 32,840,611.29

Data source: The financial report of Merit Interactive (Juchao Information, 2024)

3.3 Overview of the Impact of

Including Data Assets in Financial

Statements on the Company's

Profits

As shown in Table 3, as of September 30, 2024, the

company's total operating revenue was 333 million

yuan, an increase of 7.5%; the net profit was 5.9189

million yuan, an increase of 88%. The impact of

including data resources in the financial statements on

the net profit was 32.8406 million yuan, and the profit

margin was 1.78%. If the data resources had not been

included in the financial statements, the net profit

should have been -26.9217 million yuan, and the

profit margin would have been -8.08%. It can be seen

that the inclusion of data resources in the financial

statements helped the company turn losses into

profits.

Practical Research on the Inclusion of Data Assets of Data-Driven Intelligent Enterprises in Financial Statements: Taking "Merit Interactive"

as an Example

51

Table 3: The Impact of Including Data Assets in Financial Statements on Merit Interactive.

Com

p

an

y

Merit Interactive

Account for Inclusion in Financial Statements Intan

g

ible Assets

Total Amount of Data Resources Included in Financial Statements

(

Yuan

)

32,840,611.29

Asset-Liability Ratio 9.77%

Asset-Liability Ratio (Estimated) if Data Resources are not Included in Financial Statements 10.90%

Decrease in Asset-Liability Ratio after Including Data Resources in Financial Statements 1.13%

Profit Mar

g

in 1.78%

Profit Mar

g

in

(

Estimated

)

if Data Resources are not Included in Financial Statements -8.08%

Increase in Com

p

an

y

's Profit Mar

g

in after Includin

g

Data Resources in Financial Statements 9.86%

Data source: The financial report of Merit Interactive (Juchao Information, 2024)

The asset-liability ratio (estimated) when data

resources are not included in the financial statements

is equal to the total liabilities divided by (total assets

minus the total amount of data resources included in

the financial statements). The decrease in the asset-

liability ratio after including data resources in the

financial statements is equal to the asset-liability ratio

(estimated) when data resources are not included in

the financial statements minus the actual asset-

liability ratio. The profit margin (estimated) when

data resources are not included in the financial

statements is equal to (net profit minus the total

amount of data resources included in the financial

statements) divided by the total revenue. The increase

in the net profit margin after including data resources

in the financial statements is equal to the net profit

margin minus the profit margin (estimated) when data

resources are not included in the financial statements.

4 THE IMPACT OF INCLUDING

DATA RESOURCES IN

FINANCIAL STATEMENTS ON

THE FINANCIAL

PERFORMANCE AND

MARKET VALUE OF MERIT

INTERACTIVE

The financial information disclosed in Merit

Interactive's semi-annual report is more detailed than

that in the third-quarter report, making it more

suitable for the analysis of the company's financial

situation due to the inclusion of data assets in

financial statements. Based on this, this chapter

mainly explores the economic consequences and the

impact on the market value of the company caused by

the inclusion of data assets in financial statements by

obtaining and analyzing the data from Merit

Interactive's semi-annual report.

4.1 Analysis of the Financial

Performance Generated by

Including Data Resources in

Financial Statements

4.1.1 Analysis from the Changes in

Financial Statement Data

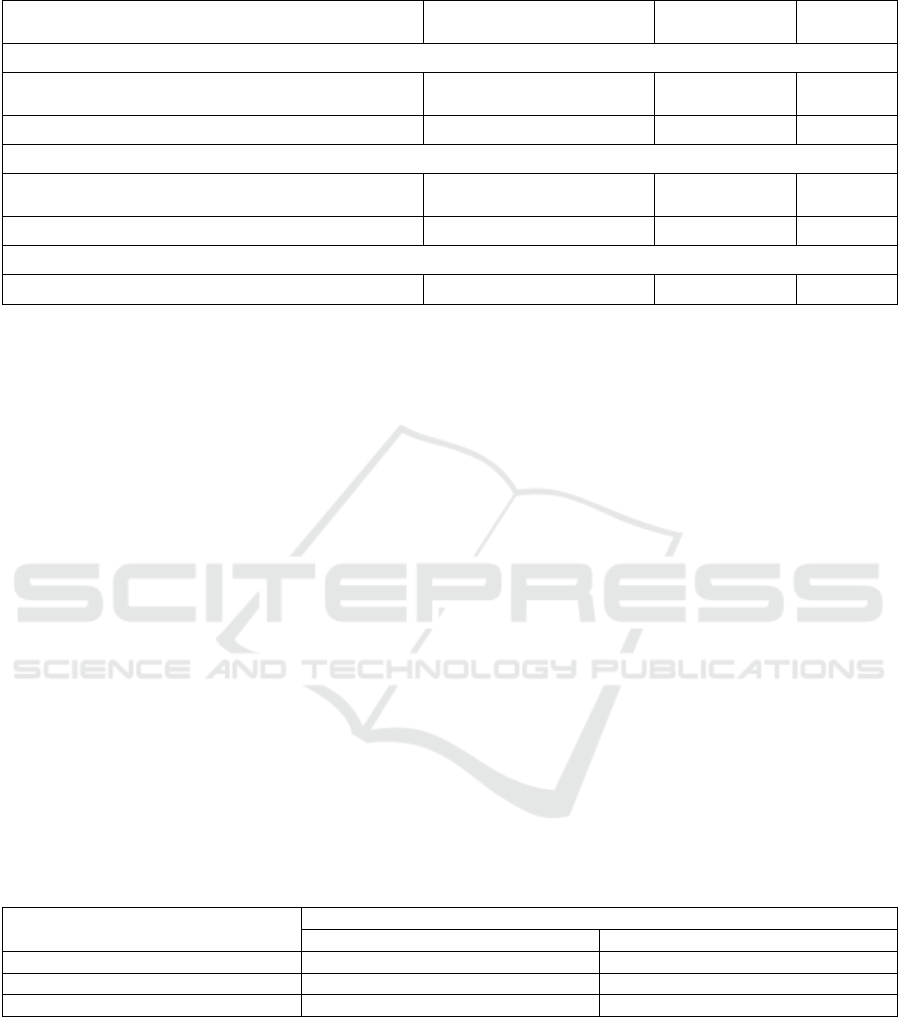

Firstly, this paper focuses on analyzing the changes in

the balance sheet before and after the inclusion of data

assets in financial statements. Before inclusion, there

were no accounts related to data assets in the

enterprise's balance sheet. After inclusion, data assets

that meet the recognition criteria of intangible assets

are recorded in the balance sheet. As shown in Table

4, the recognition of data assets leads to a

corresponding increase of 23,333,100 yuan in the

carrying value of intangible assets (after deducting

the amortization amount of the current year). At the

same time, since the data assets that were originally

expensed are recognized as intangible assets after

being included in the financial statements, the total

profit increases by 23,333,100 yuan. The intangible

assets formed by data assets in the current period are

amortized using the accelerated amortization method

over 5 years, and the deferred income tax assets

formed by the straight-line amortization of taxes over

10 years increase by 121,600 yuan. The

reclassification of research and development

expenses to data assets leads to a reduction of

4,024,000 yuan in the additional deduction of

research and development expenses. As a result, the

income tax payable (reflected in taxes payable)

increases by 7,645,600 yuan in a comprehensive

manner.

ICEML 2025 - International Conference on E-commerce and Modern Logistics

52

Table 4: Simplified Balance Sheets before and after the Inclusion of Data Assets in Financial Statements (Unit: Yuan)

Project

Before Inclusion (Estimated)

June 30, 2024

After Inclusion

June 30, 2024

Difference

Assets

Total Current Assets 70,058.66 70,058.66 0.00

Deferred Income Tax Assets 4,783.08 4,795.24 12.16

Intangible Assets 15,974.43 18,307.74 2,333.31

Total Non-current Assets 111,779.77 114,125.24 2,345.47

Total Assets 181,838.43 184,183.90 2,345.47

Liabilities and Owner's Equity

Taxes Payable 4,270,963.91 4,271,728.47 764.56

Total Current Liabilities 13,766.06 14,530.62 764.56

Total Non-current Liabilities 1,082.03 1,082.03 0.00

Total Liabilities 14,848.10 15,612.66 764.56

Undistributed Profits 46,310.92 47,891.83 1580.91

Total Owner's Equity 166,990.33 168,571.24 1580.91

Total Liabilities and Owner's Equity 181,838.43 184,183.90 2345.47

Secondly, analyze the changes in the income

statement before and after the inclusion of data assets

in the financial statements. Before the inclusion, the

enterprise accounted for the expenditures related to

data assets as expenses. After the inclusion, the

enterprise capitalized the expenditures that met the

asset recognition criteria. As can be seen from Table

5, the research and development expenses decreased

by 23,333,100 yuan. Due to the adjustment for

inclusion in the financial statements, the total profit

and net profit of the enterprise in the current period

increased significantly. Meanwhile, the income tax

expense also increased significantly, with an increase

of 6,999,900 yuan.

Table 5: Simplified Income Statements before and after the Inclusion of Data Assets in Financial Statements (Unit: Yuan)

Project

Before Inclusion (Estimated)

June 30, 2024

After Inclusion

June 30, 2024

Difference

Business Revenue 21,701.84 21,701.84 0.00

Less: Cost of Business Operations 4,867.24 4,867.24 0.00

Research and Development Expenses 8,393.37 6,060.06 -2,333.31

Other Expenses 10,207.31 10,207.31 0.00

Operating Profit (Loss is filled with the “-” sign) -1,766.08 567.23 2,333.31

Less: Non-operating Expenses 266.41 266.41 0.00

Total Profit (Total Loss is filled with the “-” sign) -2,032.49 300.82 2,333.31

Less: Income Tax Expenses -886.42 -226.39 660.03

Net Profit (Net Loss is filled with the “-” sign) -1,146.07 527.21 1,673.28

Finally, regarding the cash flow statement, the

inclusion of an enterprise's data assets in the financial

statements mainly affects the cash flow from

investing activities and the cash flow from operating

activities. Due to the increase in intangible assets of

data resources after inclusion, the item of "Cash paid

for the acquisition of fixed assets, intangible assets

and other long-term assets" increased by 23,333,100

yuan. At the same time, the cash payments for

operating activities (expenditures in the items of

"Cash paid to and on behalf of employees" and "Cash

paid for other operating activities") that were

originally included in the operating costs or research

and development expenses before inclusion

decreased by 23,333,100 yuan correspondingly. The

specific differences are shown in Table 6.

Practical Research on the Inclusion of Data Assets of Data-Driven Intelligent Enterprises in Financial Statements: Taking "Merit Interactive"

as an Example

53

Table 6: Simplified Cash Flow Statements before and after the Inclusion of Data Assets in Financial Statements (Unit: Yuan)

Project

Before Inclusion (Estimated)

June 30, 2024

After Inclusion

June 30, 2024

Difference

I. Cash Flows from Operating Activities:

Cash paid to and on behalf of employees and cash paid

for other operating activities

24,446.30 22,112.99 -2,333.31

Net cash flows from operating activities -9,676.17 -7,342.86 2,333.31

II. Cash Flows from Investing Activities:

Cash paid for the acquisition of fixed assets, intangible

assets and other lon

g

-term assets

2,091.26 4,424.57 2,333.31

Net cash flows from investing activities 9,264.38 6,931.07 -2,333.31

III. Cash Flows from Financing Activities:

Net cash flows from financing activities -14,612.02 -14,612.02 0.00

4.1.2 Comparative Analysis of Financial

Indicators Before and after the

Inclusion of Data Assets in Financial

Statements

Based on the above financial statements, this paper

calculates the key financial indicators before and after

the inclusion of data assets in financial statements,

including the current ratio, asset-liability ratio, return

on net assets, and gross profit margin, as shown in

Table 7. Through the comparative analysis of the

inclusion process and key indicators, the main

changes brought about by the inclusion of data assets

in financial statements are as follows: (1) The

inclusion leads to an increase in income tax expenses,

an increase in current liabilities such as taxes payable.

The increase in current liabilities is greater than that

of current assets, resulting in a decrease in the current

ratio; (2) The increase in total assets is caused by the

increase in intangible assets. However, due to the

increase in taxes payable and other factors, the change

range of liabilities before and after is greater than that

of assets, resulting in an increase in the asset-liability

ratio; (3) After data resources form intangible assets,

they need to be amortized according to the estimated

useful life. Although the inclusion of some expensed

data assets in the balance sheet in the current year of

inclusion leads to a decrease in current costs or

expenses, the amortization of intangible assets of data

resources in subsequent years will be included in the

current costs or expenses again until the intangible

assets are finally disposed of or scrapped. That is, the

inclusion may lead to a time difference in the

recognition of an enterprise's costs or expenses,

showing a pattern of being low first and then high; (4)

Assuming that the enterprise's revenue is stable, since

data assets are transformed from being expensed to

being capitalized, the costs or expenses included in

the current period are low first and then high,

enabling the profit to turn from loss to profit, and at

the same time showing a state of being high first and

then low. The gross profit margin and return on net

assets will also show a state of being high first and

then low; (5) Due to the change of profit being high

first and then low, it may lead to income tax also

showing a pattern of being high first and then low.

Table 7: Key Financial Indicators of Merit Interactive before and after the Inclusion of Data Assets in Financial Statements.

Indicator

June 30, 2024

Before Inclusion (Estimated) After Inclusion

Current Ratio 5.09 4.82

Asset-Liability Ratio (%) 8.17 8.48

Net Profit Rate

(

%

)

-5.28 2.43

4.2 The Impact of Including Data

Resources in Financial Statements

on Market Value

Based on the study of the impact of including data

assets in financial statements on the important

financial indicators of Merit Interactive, this paper

further explores whether, on the basis of improving

some financial indicators of the enterprise, it will

have an impact on the enterprise's market value or

stock price. Due to the influence of multiple factors

such as the stock market being affected by many

factors, it is difficult to evaluate the impact of

ICEML 2025 - International Conference on E-commerce and Modern Logistics

54

including data assets in financial statements on the

stock price or market value based on a single

hypothesis. At the same time, the annual income and

profits of many enterprises are not smoothly

distributed over the four quarters, and the estimation

based on semi-annual financial data and the

company's price-to-earnings ratio (PE) has relatively

low reference value, so it is not adopted for the time

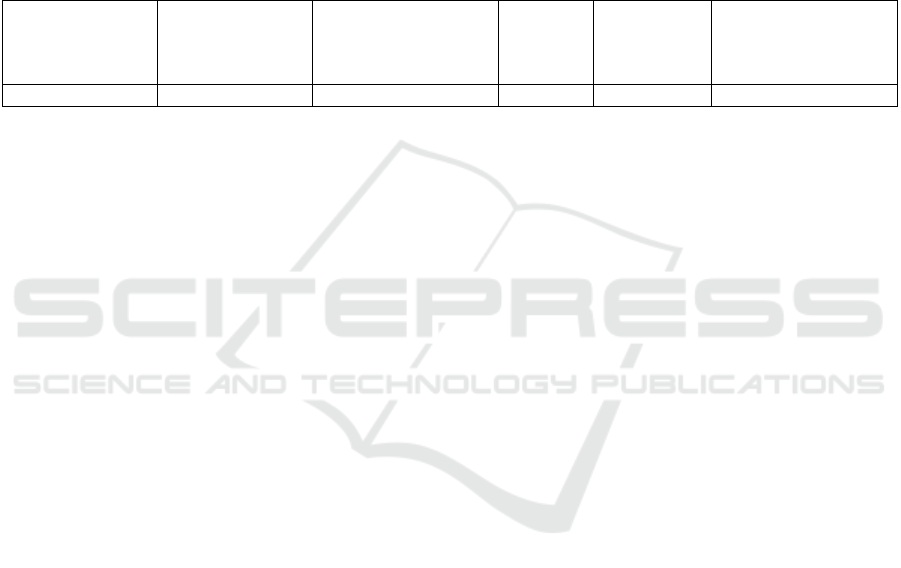

being. Therefore, this paper only calculates the

theoretical impact of including data assets in financial

statements on the market value of the listed company

by multiplying the increased value of assets brought

about by including data assets in financial statements

by the company's price-to-book ratio (PB) (Dong

Dongming, 2015). According to the calculation of the

marginal market value increment brought by

including data resources in financial statements

estimated by PB (see Table 8), the theoretical market

value increment brought to Merit Interactive by

including data assets in financial statements exceeds

1% of the company's market value.

Table 8: The Theoretical Marginal Impact on Market Value Brought by the Inclusion of Data Resources in Financial

Statements Estimated According to Merit Interactive's PB.

Company

Account for

Inclusion in

Financial

Statements

Total Amount of Data

Resources Included in

Financial Statements

(Yuan)

Average

PB Value

Marginal

Impact on

Market

Value

Proportion of Market

Value Impacted by

Data Assets to Total

Market Value

Merit Interactive Intan

g

ible Assets 23,333,054 2.38 55,431,474 1.57%

5 CONCLUSION

By analyzing the situation of Merit Interactive's

inclusion of data assets in financial statements, this

paper draws the conclusion that promoting the

inclusion of data assets in financial statements by data

- driven intelligent enterprises is conducive to making

the value of their data resources explicit. Firstly, this

paper uses the literature research method to explore

the formation methods and application scenarios of

Merit Interactive's data resources. At the same time,

it analyzes the current situation of Merit Interactive's

inclusion of data assets in financial statements

through the longitudinal single - case study method.

Furthermore, through a simulation analysis before

and after the inclusion of data assets in financial

statements, it examines the changes in financial

statements, the changes in key financial indicators,

and the impact on the company's market value. It is

found that the inclusion of data assets in financial

statements not only helps Merit Interactive turn losses

into profits but also has a positive impact on the

company's market value. However, it should be noted

that when data resources are transferred into

intangible assets, there may be impairment and

amortization, which will, to a certain extent, lead to

risks such as an increase in the later - stage asset -

liability ratio and a decrease in the return on net

assets. This research shows that the inclusion of data

assets in financial statements is not only an innovative

tool for enterprise value management but also a

systematic breakthrough in the in - depth

development of the digital economy. Enterprises need

to adopt a trinity strategy of organizational change

(such as establishing a data asset management

committee), technological enablement (deploying an

intelligent financial system), and ecological

collaboration (participating in the formulation of

industry standards) to achieve a dynamic balance

between the release of data factor value and financial

soundness.

This paper adopts a single - case study method,

which, to some extent, limits the general applicability

and extrapolation of the research results. Meanwhile,

there are certain subjective biases in the process of

case selection, data collection, and analysis, which

have a certain impact on the objective accuracy of the

research results. In the future, it is necessary to further

explore the impact of the data rights confirmation

mechanism on accounting recognition and the

compound value measurement model of data assets

under multi - scenario collaboration. It is

recommended to expand cross - industry comparative

research, especially paying attention to the

differential practices of ToB platform - based and

ToC service - based enterprises in the accounting

treatment of data assets, so as to provide a basis for

constructing a universal theoretical framework.

REFERENCES

Cleveland, H. (1982). Information as a resource. Futurist,

16(6), 34 - 39.

Practical Research on the Inclusion of Data Assets of Data-Driven Intelligent Enterprises in Financial Statements: Taking "Merit Interactive"

as an Example

55

Dong, D. M. (2015). Research on the influencing factors of

the price - to - book ratio of listed companies, Beijing

Jiaotong University.

Juchao Information. (2024). Merit Interactive's Semi -

annual Financial Report 2024.

https://file.finance.sina.com.cn/211.154.219.97:9494/

MRGG/CNSESZ_STOCK/2024/2024-8/2024-08-

27/10415502.PDF

Liu, L. Y., & Sun, Y. (2025). Practical research on the

inclusion of enterprise data assets in financial

statements: Taking "Flush" as an example. Friends of

Accounting, (01), 21 - 28.

Lv, M., Zhao, L. F., & Zhong, Y. C. (2024). A preliminary

exploration of the value effect and economic

consequences of including data assets in financial

statements. Management Review, 36(12), 47 - 59.

SAIF. (2024). Tracking Report on the Inclusion of Chinese

Enterprises' Data Assets in Financial Statements.

https://www.saif.sjtu.edu.cn/show-107-6480.html

SAIF. (2025). Tracking Report on the Inclusion of Chinese

Enterprises' Data Assets in Financial Statements.

https://www.saif.sjtu.edu.cn/show-107-6539.html

Xie, K., Xia, Z. H., & Xiao, J. H. (2020). The enterprise

realization mechanism for big data to become a real

production factor: From the perspective of product

innovation. China Industrial Economics, (05), 42 - 60.

Zhang, X. M., & Jin, Y. (2022). The reconstruction of the

balance sheet: A study based on the behavior of

enterprises in the digital economy era. Management

World, 38(9), 157 - 175.

Zou, Z. J. (2017). Discrimination of the asset attributes of

enterprise big data. Friends of Accounting, (12), 7 - 12.

ICEML 2025 - International Conference on E-commerce and Modern Logistics

56