Exploring A-H Share Price Differences: Arbitrage Opportunities and

Behavioural Finance Insights

Yan Chen

a

Bachelor of commerce, University of Melbourne, 260 Spencer St, Carlton, Victoria, Australia

Keywords: A-H Share, Arbitrage, Behavioural Finance.

Abstract: The price difference between the H-shares and the A-shares has been a source of concern for policymakers

and investors because of structural, investor, and regulatory divergences. This study aims to measure the gap

in the price of the H-shares and the A-shares, analyse cross-market arbitrage opportunities, and identify the

determinants that cause the gaps in prices. Based on historical data for Xinhua Pharmaceutical and CanSino

Biologics, this research investigates trends and determinants of the price gap between both markets. The

findings reveal that specific findings, one finds that premiums on the A-shares are driven by liquidity and the

nature of the retail investors, while the prices on the H-shares reflects tighter regulation and the rigorousness

of the institutions as investors. This study adds to the findings that investors must make the best out of cross-

market investments and reduce price gap-related risks. Based on these findings, authorities should focus on

to the authorities for enhanced coordination in the markets, information transparency, and convergence of the

prices on the A-shares and the H-shares towards an integrated and efficient capital market.

1 INTRODUCTION

Differences in market structure, investor sentiment,

regulation and liquidity has resulted in significant

price differences between the H-share and A-share

markets. Despite the introduction of programs such as

the Shanghai-Hong Kong and Shenzhen-Hong Kong

Stock Connect, the price difference between the two

markets remains high, particularly in the consumer

goods and pharmaceutical sectors (Wu, 2007).

Sentiment-driven trades are more common in the A-

share market, where retail investors dominate. On the

other hand, in the institution dominated H-share

market, prices are driven more by fundamentals, as

opposed to the H-share market, which has institutions,

and thus more rational prices (Chen, 2009). This

different investor base results in valuation premiums

or discounts on the same firm’s stock in the two

markets.

Behavioural finance theories, such as the

anchoring effect and Loss aversion can explain these

pricing mechanisms. In the anchoring effect,

investors base their decisions on arbitrary points of

reference, such as prior prices, leading to

overvaluation (Men & Li, 2010). Loss aversion, the

a

https://orcid.org/0009-0006-0277-7210

core principle of prospect theory, drives speculative

trading by the investors in the A-shares, who prefer

avoiding the realization of losses, hence sustaining

high valuations (Novemsky & Kahneman, 2005). In

the Efficient Market Hypothesis (EMH), the prices of

assets are designed to reflect all available information

in full (Fama, 1970). Empirical research, however,

records that the A-share market remains less efficient

due to information asymmetry and less stringent

regulation. In contrast, the H-share market, subject to

the stringent regulation requirements of Hong Kong,

enjoys higher transparency and efficiency. For

example, the regulation mechanism in the form of

stringent disclosure requirements and high corporate

governance standards in Hong Kong restricts

speculative trading and encourages rational pricing

(Liu, 2004). Liquidity, too, is a critical driver behind

valuation gaps. The higher trading frequency in the

A-share market, where the active participation by

individual investors generates a liquidity premium,

further drives the valuation of the A-shares. In

contrast, the lower H-share trading frequency reflects

the long-term investment attitude of the institutions,

leading to more stable prices (Zhang & Xu, 2011).

44

Chen, Y.

Exploring A-H Share Pr ice Differences: Arbitrage Opportunities and Behavioural Finance Insights.

DOI: 10.5220/0013832400004719

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 2nd International Conference on E-commerce and Modern Logistics (ICEML 2025), pages 44-48

ISBN: 978-989-758-775-7

Proceedings Copyright © 2025 by SCITEPRESS – Science and Technology Publications, Lda.

In consideration of these persistent valuation

differentials of A-H shares and their implication for

market efficiency, the aim of this research is to

measure the A-H share price differential on a

systematic level, examine cross-market arbitrage

opportunities, and determine the causes underlying

the valuation differentials. From the analysis of

sample firm past data, this report yields results that

allow investors to optimize cross-market investments

and assist policymakers in the formulation of

regulation to enhance market coordination and

transparency.

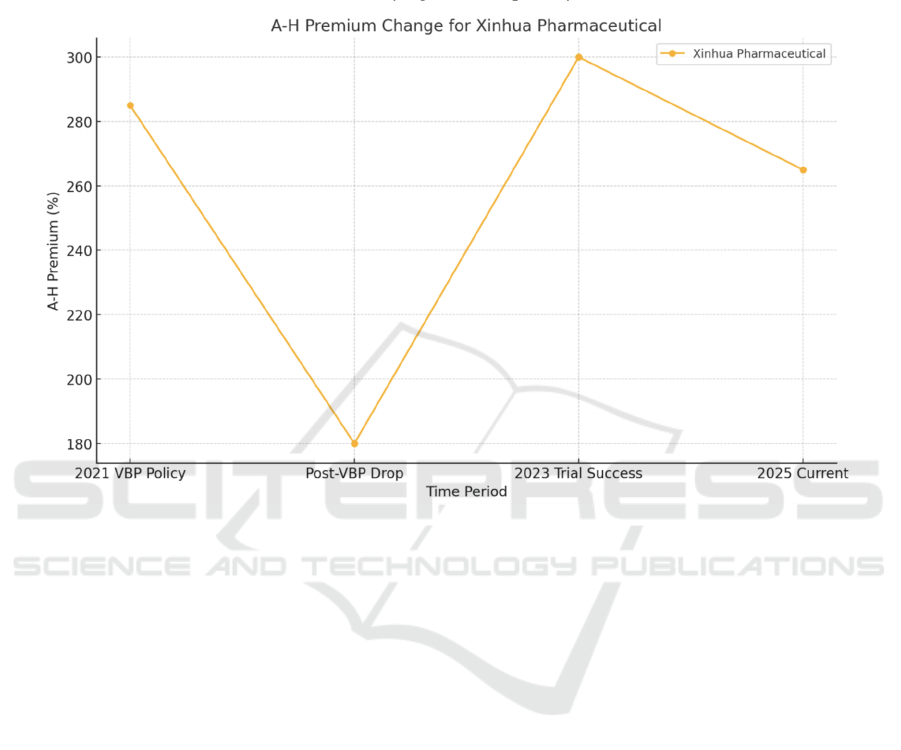

Figure 1: A-H Premium Change for Xinhua Pharmaceutical (Photo/Picture credit: Original).

2 XINHUA PHARMACEUTICAL

The substantial Xinhua Pharmaceutical A-share

premium reflects the impact of industry-related

factors and investor sentiments. Table 1 shows that on

February 13, 2025, the close price for Xinhua

Pharmaceutical’s A-shares was 15.23 RMB, with the

H-shares closing at 5.74 HKD. Applying the

exchange rate (1 HKD = 0.94 RMB), the A-share

premium amounted to approximately 265%. The

overvaluation of the A-shares reflects individual

investor optimism and speculation, while H-shares

are nearer to intrinsic value because of rational

thinking on the part of institutions.

The popularity of the pharmaceutical stocks in the

A-share market, coupled with policy favouring the

pharmaceutical industry, has boosted the valuation.

Retail investors are also likely to overreact to news

regarding the industry, inflating price fluctuations.

While the Chinese government implemented the

Volume-Based Procurement policy in 2021, Xinhua

Pharmaceutical’s A-share premium sharply declined

from the high of 285% to 180%. However, following

the announcement of the results of the Phase III

clinical trials in 2023, market optimism regarding the

success of the clinical trials drove the premium up to

300% (seen from Figure 1), forming a classic

“Innovation Perception Premium” (Ji, 2025).

According to the table 1, the prices of both Xinhua

Pharmaceutical’s A-shares and H-shares have

experienced slight fluctuations over the past three

months. For instance, the A-share price increased

slightly from 15.26 RMB to 15.35 RMB, while the H-

share price declined from 5.78 HKD to 5.45 HKD

(seen from Table 1). Although the overall changes

were relatively minor, loss aversion may cause

investors to perceive losses more strongly than they

derive satisfaction from gains. As a result, for A-share

investors, the price increase from 15.26 RMB to

15.35 RMB may represent a small profit. Driven by

loss aversion, investors may be inclined to “cash out”

early, selling shares quickly to avoid potential future

price declines. However, this premature profit-taking

behaviour can limit the upside potential of their

investment portfolios and hinder the realization of

long-term returns.

Exploring A-H Share Price Differences: Arbitrage Opportunities and Behavioural Finance Insights

45

Table 1: Xinhua Pharmaceutical A-H share price data.

Stock Date

Openin

g Price

Closin

g

Price

Daily

Chang

e

(

%

)

Xinhua

Pharmaceuti

cal A-share

2024/11/

15

15.26 15.35 0.59

Xinhua

Pharmaceuti

cal A-share

2024/12/

15

15.1 15.2 0.66

Xinhua

Pharmaceuti

cal A-share

2025/1/1

5

14.9 15 0.67

Xinhua

Pharmaceuti

cal H-share

2024/11/

15

5.78 5.64 -2.42

Xinhua

Pharmaceuti

cal H-share

2024/12/

15

5.6 5.55 -0.89

Xinhua

Pharmaceuti

cal H-share

2025/1/1

5

5.5 5.45 -0.91

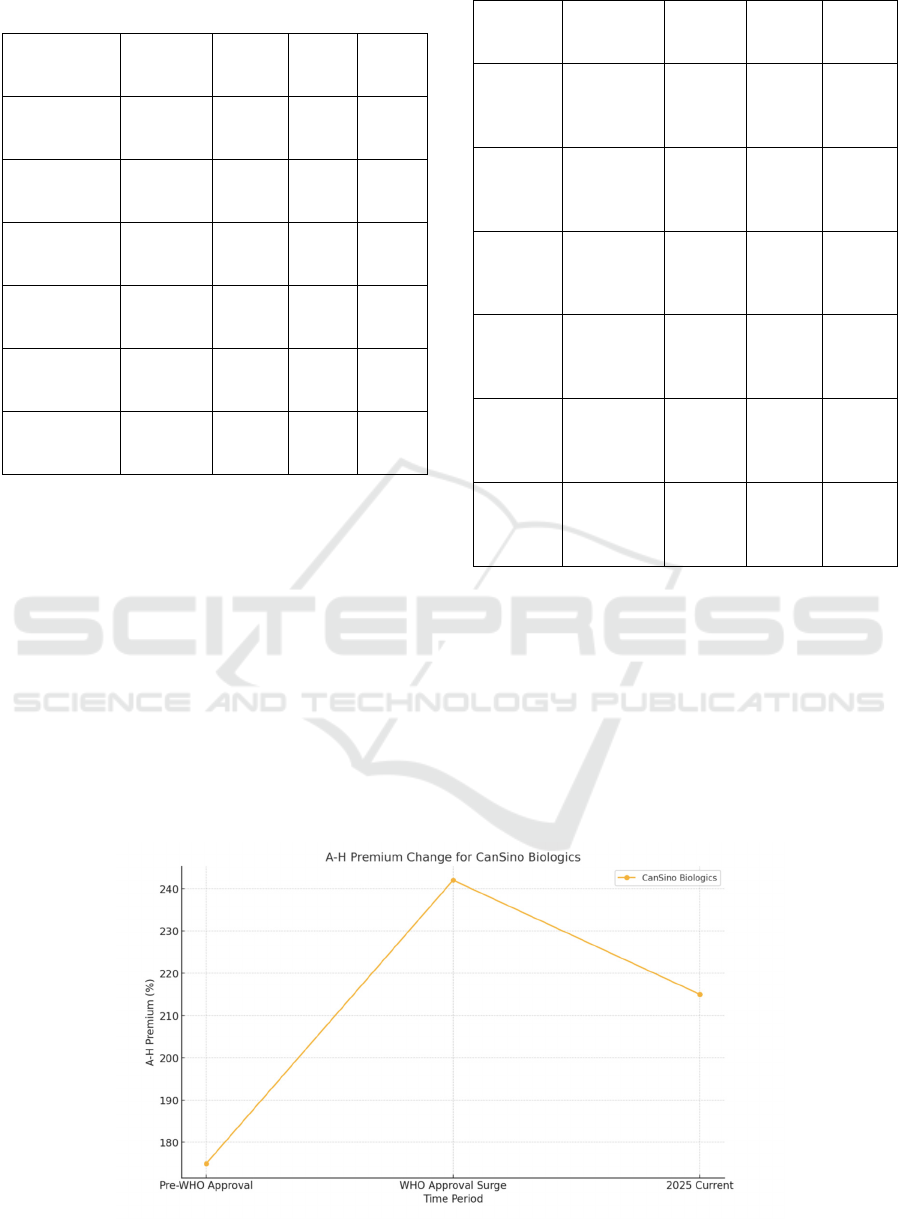

3 CANSINO BIOLOGICS

As an innovative vaccine developer, CanSino

Biologics shares prices change shows the impact of

innovation and policy on the A-H share price

disparity. Based on Table 2, at February 13, 2025, its

A-share price was 61.52 RMB, while its H-share

price stood at 30.80 HKD, reflecting a premium of

approximately 215%.

Table 2: CanSino Biologics A-H share price data.

Stock Date

Openin

g Price

Closin

g Price

Daily

Chang

e (%)

CanSino

Biologic

s A-

share

2024/11/1

5

62.03 61.39 -1.03

CanSino

Biologic

s A-

share

2024/12/1

5

60.5 60.00 -0.83

CanSino

Biologic

s A-

share

2025/1/15 59.8 59.5 -0.50

CanSino

Biologic

s H-

share

2024/11/1

5

31.35 30.40 -3.03

CanSino

Biologic

s H-

share

2024/12/1

5

30.2 30.00 -0.66

CanSino

Biologic

s H-

share

2025/1/15 29.8 29.5 -1.01

During the WHO certification of its COVID-19

vaccine in 2022, the A-share price surged, causing the

A-H share premium to soar from 175% to 242%

within just five trading days (seen from Figure 2).

Government support for vaccine research and

development, along with A-share investors’ high

expectations for the innovation sector, collectively

drove a significant increase in A-share valuation. In

contrast, the H-share market valuation reflects a more

cautious optimism among institutional investors, who

comprehensively assess long-term growth potential

(Chen, 2009).

Figure 2: A-H Premium Change for CanSino Biologics (Photo/Picture credit: Original).

ICEML 2025 - International Conference on E-commerce and Modern Logistics

46

4 IMPLICATIONS

The valuation disparity between A-shares and H-

shares highlights the tension between behavioural

finance and classical financial theories. Efficient

Market Hypothesis (EMH) forecasts price formation

in efficient markets, but theories of behavioural

finance, such as SP/A theory and loss aversion, better

capture markets where irrational investor sentiments

dominate. For instance, based on SP/A theory,

investors make decisions based on security, potential

and aspiration (Lopes, 1987). In the A-share market,

this dual motivation leads investors to overlook risks

and chase the potential for high returns.

Despite the wide price differentials, structural

limitations in the form of capital flow restrictions and

exchange rate volatility limit the scope for A-H share

arbitrage opportunities. Despite programs like the

Stock Connect schemes that enable cross-border

trading, their efficiency is undermined by quota limits

and delays in settlement, which increase the costs of

arbitrage and reduce efficiency. Hedging charges on

exchange rate volatility and regulation also limit the

operations of arbitrage. An analysis of the limits to

arbitrage based on Stock Connect data shows that

when the nominal premium exceeds the 200% mark,

the presence of the 15-day cross-border settlement

duration and hedging charges that capture 32% of

returns reduces the actual room for arbitrage to as low

as 28% of the theoretical value. More significantly,

the central bank’s “abnormal trading circuit breaker

mechanism” that became active in 2023 reduced the

number of trading days on which the premium

increased above 250% by 67%, effectively creating

an institutional barrier to arbitrage (People’s Bank of

China [PBOC], 2023). To narrow the gap in the

valuation of the A-shares, policy reforms must focus

on enhancing transparency in the market and investor

education. Institutional investors must be encouraged

to come in the A-share market, and strict disclosure

standards must be adopted to eliminate speculative

trading activity. Harmonization of the two markets'

regulatory systems would improve corporate

governance and transparency in general, creating an

integrated and efficient capital market.

5 CONCLUSIONS

To sum up, this study examines the A-H share price

difference, cross-market arbitrage opportunities, and

the determinants that influence them. The findings

indicate that the high premium on the A-share market

stems largely from the sentiment-driven trading by

individual investors, liquidity premiums, and varying

regulations, but H-share prices are more closely

associated with the underlying value because of the

strict regulatory policies. Behavioural finance

theories, such as the anchoring effect and the aversion

to loss, explain the preference by the investors in the

A-shares for high prices and their irrational trading.

Despite the mechanisms such as the Stock Connect

programs that increase the integration of the two

markets, the arbitrage trades remain limited by

exchange rate volatility, costs, and regulations. To

close the gap in the valuation of the A-share, the

future should be directed towards encouraging the

participation of institutions in the A-share market,

enhancing information transparency, and perfecting

cross-border investment mechanisms. As the capital

market reform in China goes deeper, the price gap

between the A-share and the H-share may narrow

gradually, but market sentiment and policy

adjustments will still dominate its dynamic

development. Hence, investors must pay close

attention to market structure and behavioural finance

when making cross-market investment decisions to

maximize returns and avoid potential risks. This

study has valuable insights for policy makers and

investors, as it helps better comprehend the dynamics

of the prices of A-H shares and makes

recommendations on enhancing the efficiency and

stability of the market.

REFERENCES

Chen, Y., 2009. An empirical study on the price difference

between A-shares and H-shares. Doctoral dissertation,

University of International Business and Economics.

Fama, E. F., 1970. Efficient capital markets: A review of

theory and empirical work. Journal of Finance, 25(2),

383–417.

Ji, B., 2025. Research on investor psychological bias and

value investment strategy. Doctoral dissertation,

Southwestern University of Finance and Economics.

Liu, X., 2004. A quantitative study on the relationship

between information asymmetry and H-share discount.

Finance & Economics Research, 30(4), 11.

Lopes, L., 1987. SP/A theory: The role of security,

potential, and aspiration in risky choice. Journal of

Mathematical Psychology, 43, 286–313.

Men, C., Li, Y., 2010. The impact of anchoring effect on

stock market efficiency. Modern Business, 21, 1.

Novemsky, N., Kahneman, D., 2005. The boundaries of

loss aversion. Journal of Marketing Research, 42(2),

119–128.

People’s Bank of China, 2023. Cross-border capital flow

management framework. People’s Bank of China Press.

Exploring A-H Share Price Differences: Arbitrage Opportunities and Behavioural Finance Insights

47

Wu, Z., 2007. Explanation and evidence: A-share and H-

share price disparity based on valuation concept

differences. Finance & Economics Science, 6, 8.

Zhang, R., Xu, S., 2011. Systemic risk and A+H share price

disparities. Shanghai Economic Research.

Zheng, S., 2021. The anchoring effect and its predictive

ability on stock returns: Evidence from China’s A-share

market. Doctoral dissertation, Zhongnan University of

Economics and Law.

ICEML 2025 - International Conference on E-commerce and Modern Logistics

48