Equity Premium Puzzle in Cambricon: Evidence from Behavioural

Finance

Zhixuan Li

1

a

and Weifeng Tian

2

b

1

School of Management, Shandong University, 27 Shanda Road, Jinan, China

2

School of Management, China University of Mining and Technology (Beijing), 11 Xueyuan Road, Beijing, China

Keywords: Behavioural Finance, Stock Premium Effect, Herding Behaviour, Investor Sentiment, Liquidity Risk.

Abstract: The stock premium effect in high-tech industries often deviates from the market effectiveness and investor

rationality emphasized by traditional financial theories. Based on behavioural finance theory, this study

analyses the premium effect of Cambricon, a leading Chinese AI chip company listed on the Science and

Technology Innovation Board (STB). Using financial indicators (e.g., negative price-to-earnings ratio, 58.03

times issue price-to-sales ratio), investor sentiment indices (e.g., Baidu search index) and institutional trading

data (2020-2025), the study finds that irrational factors-such as the herd effect, sentiment bias and narrative-

driven speculation (e.g., the “AI chip localization") drive high stock premiums to some extent. The results

suggest that the concentration of institutional positions and retail followers' behaviour together drive this

phenomenon, and the sentiment resonance mechanism exacerbates price distortions. The study proposes

regulatory reforms (e.g., dynamic position disclosure thresholds, ETF rule optimization) and institutional

strategies (e.g., long-term performance assessment) to curb speculative bubbles. These findings reveal the

role of behavioural factors in shaping tech stock premiums and provide a practical framework for stabilizing

high-volatility markets.

1 INTRODUCTION

In finance, the stock premium effect has been the

focus of research. However, empirical studies have

found that traditional financial theories based on the

efficient market hypothesis have difficulty in

explaining valuation deviations in high-tech stocks

(Fama, 1970; Shiller, 2003). Behavioural finance

proposes that the herd effect and investor sentiment

push up premiums through psychological account

segregation, while liquidity stratification exacerbates

price volatility (Bikhchandani et al., 1992; Baker &

Wurgler, 2006; Calzadilla et al., 2021; Thaler, 1985;

Shen, 2023).As a benchmark company in China's AI

chip industry, Cambricon occupies 30% of China's

cloud-based Ai chip market share and has received

capital injection from the National IC Industry

Investment Fund. It has attracted much attention since

its listing, with its capital fervour and domestic

substitution narrative providing an opportunity for

premium pricing(Li, 2020). Founded in 2016,

a

https://orcid.org/0009-0003-9287-0811

b

https://orcid.org/0009-0008-2129-557X

Cambium, which focuses on AI chip research and

development, has seen its revenues surge from

7,843,300 yuan in 2017 to 444 million yuan in 2019,

and through multiple rounds of financing was valued

at 2.5 billion dollars in 2018, making it a unicorn

enterprise. The stock price jumped 229.86% on the

first day of listing on the Science and Technology

Board in 2020, and rose over 1,089% after 2023

driven by the ChatGPT concept. The high level of

innovation and uncertainty in the AI industry has led

to technological developments, capital flows, and

macroeconomic changes significantly affecting

investor behaviour , which in turn leads to stock price

volatility. Existing studies mostly focus on traditional

industries, with insufficient research on the

behavioural premium mechanism of high-tech stocks,

and the special characteristics of China's science and

innovation board market due to the high proportion of

retail investors and strong policy drivers(Baker &

Wurgler, 2006). The high growth of the Ai chip

industry further increases irrational investor

30

Li, Z. and Tian, W.

Equity Premium Puzzle in Cambricon: Evidence from Behavioural Finance.

DOI: 10.5220/0013832200004719

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 2nd International Conference on E-commerce and Modern Logistics (ICEML 2025), pages 30-37

ISBN: 978-989-758-775-7

Proceedings Copyright © 2025 by SCITEPRESS – Science and Technology Publications, Lda.

behaviour, with Asia-Pacific ai spending projected to

reach $90.7 billion by 2027, with a CAGR of up to

28.9% from 2022 to 2027 (IDC, 2006), as high as

28.9% (IDC, 2023).

Based on this, this paper applies the theoretical

framework of behavioural finance and introduces

narrative economics in conjunction with the liquidity

layering model to reveal how the 'AI chip autonomy'

narrative forms a positive feedback loop through

institutional hugging and retail followers(Shiller,

2003). Clarify how the degree of premium is

calculated and invoke the sentiment index construct

(Baker & Wurgler, 2006). The study is conducted in

two ways: one, to quantify the degree of Cambricon

premium by comparing financial data with industry

averages; and two, to quantify the abnormal returns

on stock price from events such as the release of

ChatGPT's concept and its inclusion in the SSE 50

index using event analysis. This research enriches the

application scenarios of behavioural finance in the

stock premium of high-tech enterprises and extends

the 'cognitive bias-price feedback' model , which not

only analyses the impact of investors' behavioural

biases on stock prices and provides theoretical

support for their investment decisions, but also

provides government, It also provides suggestions for

government, institutions and individual investors to

help the government to better manage the market and

investors to make more rational decisions(Barberis &

Huang, 2008). It can also design 'sentiment warning

indicators' for retail investors to avoid the risk of

bubbles.

2 THEORETICAL

FOUNDATIONS

2.1 Relevant Theories of Behavioural

Finance

The traditional "efficient market hypothesis" holds

that investors are completely rational in making

investment decisions in financial markets. However,

research results in behavioural finance show that

investors are often influenced by the external

environment to create cognitive bias and deviate from

the efficient market when making investment

decisions (Tang et al., 2017). As a high volatility

technology stock, Cambricon's stock price may be

significantly stronger affected by behavioural finance

factors than traditional industries. Based on this, this

paper investigates four aspects: herd effect, loss

aversion, sentiment influence, and information effect.

Herding effect refers to the tendency of investors

to mimic others' decisions rather than analyse them

independently when information asymmetry or

uncertainty is high, resulting in excessive volatility as

a result of blindly following the herd (Bikhchandani

et al., 1992). As an emerging technology company,

Cambricon's technological complexity and

uncertainty of future profitability may lead investors

to rely on the behaviour of others and form a herd

effect. For example, concentrated positions of

institutional investors may trigger retail investors to

follow suit, further amplifying stock price volatility

(Lakonishok et al., 1992).

Loss Aversion (Loss Aversion) is a core concept

of Prospect Theory , which refers to the fact that

investors are more sensitive to losses than to

equivalent gains, and this psychology leads investors

to be more conservative in making investment

decisions, demanding higher risk premiums, and

leading to irrational position-taking behaviour

(Kahneman & Tversky, 1979 ;Gupta & Shrivastava,

2022). Sentiment Effect (Sentiment Effect) refers to

the significant impact of investor sentiment on stock

prices through media rendering, social media

communication and other channels, when investment

sentiment is high, over-optimism affects investor

valuation of stocks, which leads to risky decisions

(Baker & Wurgler, 2007). With the iteration of

ChatGPT, investors show overconfidence in AI-

related stocks, and as a tech hotspot company,

Cambricon, its stock price is vulnerable to market

sentiment-driven, leading to short-term overshooting

of the stock price.

2.2 Theories Related to the Premium

Effect

Liquidity premiums and risk premiums have an

important place in finance. The liquidity premium

reflects the link between transaction costs and asset

prices, with investors demanding a higher rate of

return to compensate for the risk of holding less liquid

assets. The risk premium, on the other hand, is the

return that investors expect to receive over and above

the risk-free rate for taking on additional risk.

In terms of liquidity premium, for example the

scale has expanded rapidly in recent years(Shen,

2023) . The literature takes the high-frequency

trading data of SSE 50ETF options and CSI 300ETF

options market as the research samples, and

concludes that there is a significant liquidity premium

phenomenon in the market of all moneyness

categories of SSE 50ETF options as well as OTM Put

and ATM Put categories of CSI 300ETF options

Equity Premium Puzzle in Cambricon: Evidence from Behavioural Finance

31

(Jiang, 2022). It is mentioned that liquidity premium

represents the extra rate of return that investors expect

to get to compensate for the risk of holding illiquid

assets, and in stock investment, the liquidity factor

captures the excess return from illiquid stocks, and it

is also suggested that investors should consider the

liquidity risk when pursuing the liquidity premium

and realize the balanced portfolio allocation to the

liquidity risk factors, and four measures of liquidity

in the stock market are also proposed. Indicators.

On risk premium, the uncertainty affecting asset

prices is categorized into fundamental uncertainty,

market-level and firm-level external factor

uncertainty (Yang, 2011). It is argued that investors

form heterogeneous beliefs about fundamentals and

external factors, respectively, on the basis of which a

model of consumer capital asset pricing based on

investors' heterogeneous beliefs is established, which

theoretically proves that in addition to the

fundamental risk from total consumption/endowment,

the differences in investors' beliefs about market-

level and firm-level external factors also have a

significant influence on the risk premium of

idiosyncratic volatility. In addition to the fundamental

risk from total consumption/endowment, it is

theoretically demonstrated that the differences in

investors' beliefs about market-level and firm-level

external factors are also risk factors affecting stock

prices Based on the perspective of institutional

investors, the study of China's financial risky

investment and bond risk premium empirically

examines the impact of institutional investors'

motivation of stockholding behaviour on bond risk

premium as well as the transmission paths of its

action mechanism, and points out that the different

risky investment behaviours of institutional investors

can be identified and manifested in bond risk

premiums(Guan, 2020).

Liquidity premiums and risk premiums play a

crucial role in financial markets and have an

important impact on investors' decisions and asset

pricing. An in-depth study of liquidity premiums and

risk premiums can help to better understand the

operating mechanism of financial markets and

provide investors with a more accurate basis for

investment decisions.

3 CASE DESCRIPTIONS

Founded in 2016, it is a leading AI chip enterprise in

China, focusing on the research and development of

AI chip products and technological innovation, and

providing a series of intelligent chip products and

platform-based system software with a unified

ecology, such as the integration of cloud, hardware

and software, and the integration of training and

reasoning.

Cambium-U, on June 23, 2020, received approval

from the China Securities Regulatory Commission

(CSRC) for the registration of its initial public

offering, and on July 20, it was listed on the Kechuan

Board of the Shanghai Stock Exchange. Initial public

offering of RMB 40.1 million ordinary shares to the

public, with a total share capital of 360 million shares

before issuance and 400.1 million shares after

issuance. On the first day of listing, the stock price

soared 229.86%, but since then the stock price fell

continuously, and once fell to 46.59 yuan/share in

2022. 2023 ushered in the rise by the concept of

Chatgpt, and rose 1089% since the beginning of 2023

to 2024. 2024 December 23, the intraday rose to 700

yuan/share, and then fell 4.02% on the same day to

close at 648.75 yuan / shares, January 24, 2025

closing share price of 612.98 yuan, compared with the

previous trading day fell 8.02 yuan, or 1.29%.

4 EFFECTS ANALYSES

4.1 Existence of Premium Issue

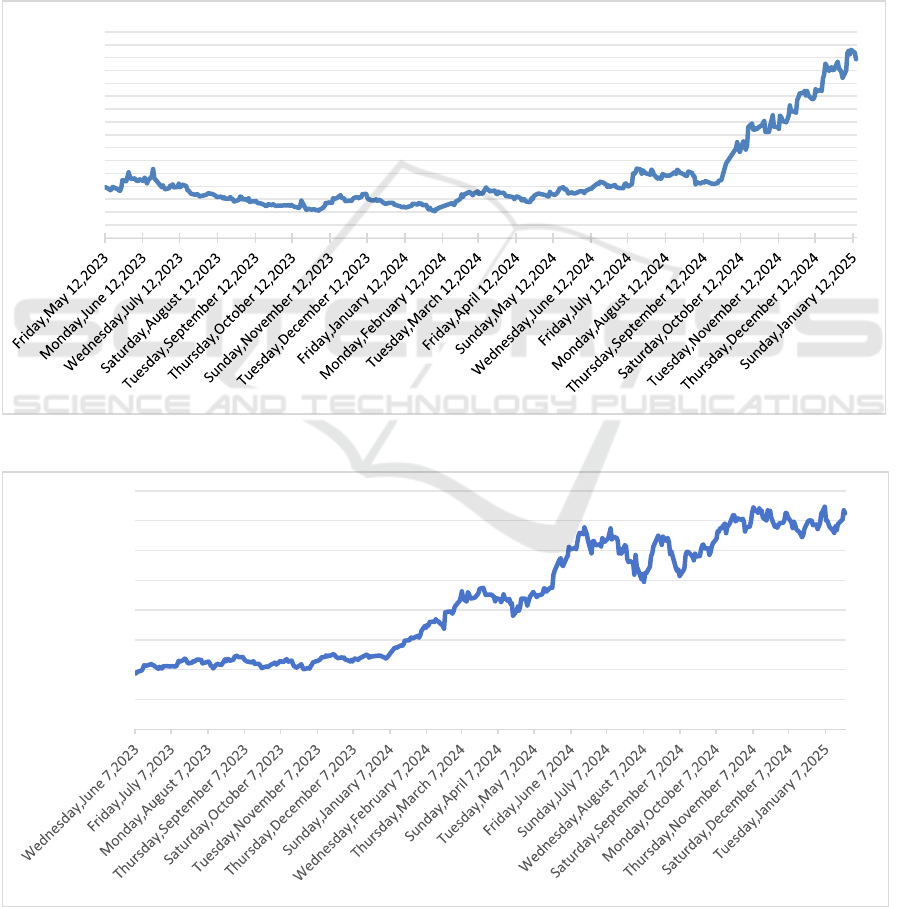

As shown in Fig. 1, Cambricon landed on the S&T

board in 2020 with an offering price of $64.39. From

the information provided in its prospectus, there is a

possibility that Cambricon's stock offering will be at

a premium. During the period 2017-2019, Cambricon

is in a continuous loss. Among them, the net profit

was -380,704,000 yuan in 2017, -410,465,000 yuan

in 2018, and -117,898,560,000 yuan in 2019. In the

case that the company has not yet achieved

profitability for the stock issue, its issue price is

difficult to obtain strong support from the current

earnings data, and is based more on the expectation

of future earnings. Analysed from the traditional

perspective of earnings valuation, the issue price

determined in this earnings situation is likely to be

overestimated, which also increases the possibility of

Cambricon stock premium issuance to a certain extent.

From the point of view of valuation indicators,

according to the prospectus and other public

information, although the price-earnings ratio was not

disclosed at the time of the issuance, the 2019 post-

issuance market-to-sales ratio was as high as 58.03

times, far exceeding the average static market-to-

sales ratio of comparable companies, which means

that relative to the level of the industry in the same

period, the market pricing or its market pricing is

ICEML 2025 - International Conference on E-commerce and Modern Logistics

32

overestimated. The market environment also has an

impact. 2020 Cambricon listing, the science and

technology innovation board for unprofitable

technology enterprises to open the listing channel, the

market for artificial intelligence and other emerging

technology fields enthusiasm. The opening price of

250 yuan on the first day of listing, the initial peak of

297.77 yuan, followed by significant fluctuations.

The dramatic ups and downs of the stock price reflect

the market's disagreement over the reasonableness of

its offering price, side by side indicating that there

may be a premium at the time of issuance. When

Cambricon went public in 2020, the Science and

Technology Innovation Board happened to open up a

listing channel for unprofitable technology

companies, which made the market unprecedentedly

enthusiastic about artificial intelligence and other

emerging technology fields. In this market

environment, investors generally have higher

expectations for emerging tech companies and are

more willing to give them higher valuations.

Cambricon's offering price is likely to be driven by

market sentiment and investor expectations, resulting

in a premium to some extent. This leads to the

conclusion that there is a degree of premium issuance

when Cambium issues in 2020.

Figure 1: Closing price of Cambricon stock from 2023 to 2025 on a line graph

(Photo/Picture credit: Original).

Figure 2: Line graph of closing price of NVIDIA stock from 2023 to 2025 (Photo/Picture credit: Original).

0

50

100

150

200

250

300

350

400

450

500

550

600

650

700

750

800

$0,00

$20,00

$40,00

$60,00

$80,00

$100,00

$120,00

$140,00

$160,00

Equity Premium Puzzle in Cambricon: Evidence from Behavioural Finance

33

4.2 Select Companies in the Same

Industry for Comparison to

Determine the Extent of Premiums

According to Dolphin Wealth's February 14, 2025

data, Cambricon has a negative TTM P/E ratio and is

in the red. Tiger International's February 13, 2025

data shows that NVIDIA has a P/E TTM of 53.42.

Finance's February 6, 2025 data shows that the

semiconductor industry has a P/E average of 123.31x

and a median of 73.16x (seen from Fig. 2).

Cambricon as a newcomer in the field of AI chips,

in the expansion period, a large number of resources

into research and development, resulting in the

current unprofitable, negative price-earnings ratio.

Nevertheless, the market is optimistic about its

potential in the domestic AI chip market, giving it a

high market value. NVIDIA, with its leading position

in the global AI chip and graphics processing field,

has achieved steady growth in revenue and profit by

virtue of its mature product line, extensive customer

base and stable market share, and its price-earnings

ratio reasonably reflects its operation and market

value. Cambricon cannot be directly compared with

the industry average due to losses, deviation is

obvious, reflecting market pricing based on future

expectations; NVIDIA's P/E ratio is lower than the

industry average but higher than the median, if only

compared with the industry's high-quality enterprises,

the level reflects its leading advantage.

Cambricon although losses but high market value,

indicating that the market for its future earnings

expectations are extremely high, the stock price or

there is an overdraft on future performance, contains

a large potential premium, if the future earnings are

less than expected, the stock price adjustment

pressure. Compared with the industry, the degree of

deviation reflects the market's high expectations for it

to become the domestic AI chip leader. For NVIDIA,

assuming that future earnings growth is sustained,

when your former price-earnings ratio is in a

reasonably high range, there is a certain premium,

which stems from the market's recognition of its

leading position, technological and market

advantages and future profitability. Compared to

industry averages, NVIDIA's price-earnings ratio is

low, but compared to high-quality companies in the

industry, the premium reflects the market's

confidence in its future earnings growth.

4.3 Analysis of the Reasons for the

Premium

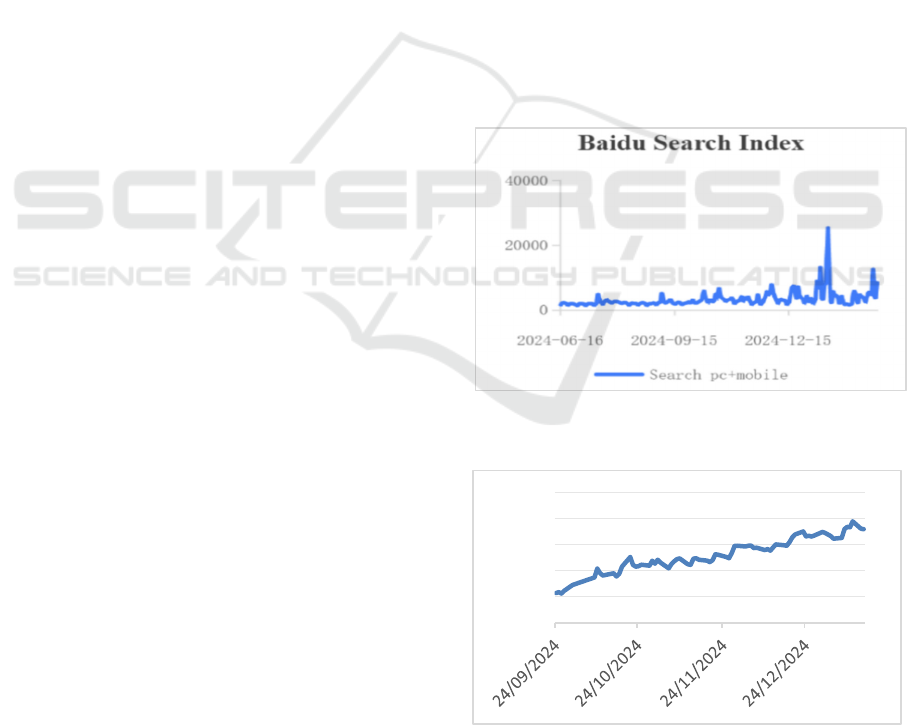

Investor sentiment amplifies irrational market

volatility through cognitive biases and group

contagion mechanisms, and when market sentiment is

in a state of exuberance, the valuation of emerging

technology assets may systematically deviate from

the fundamentals, creating a persistence premium

(Baker & Wurgler, 2006). Second, investors tend to

categorize risky assets in separate mental accounts

and relax risk constraints, resulting in significantly

higher allocation weights to Cambricon-related assets

than predicted by traditional asset pricing

models(Thaler, 1985) . Further, the overconfidence

bias prompts investors to focus excessively on

optimistic signals and ignore tail risks during

information processing, thus reinforcing the positive

feedback loop of premium formation (Odean, 1998) .

As an AI chip company at the forefront of technology,

Cambricon has a high level of industry attention.

Cambricon's stock price has risen sharply in 2024,

and the Baidu Information Index has crested more

and more frequently, indicating that investors

subconsciously amplify Cambricon's development

prospects and ignore some of the potential risks in

their decision-making, thus buying a large number of

Cambricon shares and pushing the stock price to

continue to rise (seen from Fig. 3).

Figure 3: Baidu Search Index (Photo/Picture credit:

Original).

Figure 4: Cambricon Share Price Trend (Photo/Picture

credit: Original).

0

200

400

600

800

1000

ICEML 2025 - International Conference on E-commerce and Modern Logistics

34

From the stock price volatility data (illustrated in

Fig. 4), Cambricon in 2023 at the end of September

stock price of about 230 yuan, to 2025 January rose

to more than 600 yuan, January 10 once rushed to

777.77 yuan, or 238%, more than the average rate of

increase of the artificial intelligence chip industry in

the same period. Seen from Table 1, on November 29,

2024, Cambricon was added to the SSE 50 index, and

its share price rose by +15% in the month before its

inclusion in the SSE 50, and +32% in the week after

its inclusion, with the turnover rate rising from 3.5%

to 12.8%. The impact of early leakage and official

release of information on the market should not be

underestimated, investors will adjust their investment

decisions based on this information, and the positive

nature of the information (e.g., inclusion in important

indices) makes investors more optimistic about the

future expectations of Cambricon, which increases

the demand for buying, and pushes the stock price up.

Table 1: Stock Price, Average Daily Volume, Turnover

Ratio.

Time Period Stock

Price

Increase

Average

daily

turnover

(billion yuan)

Turnover

Rate

One month

before

inclusion in

SSE

+15% 8.2 3.5%

One week

after inclusion

+32% 25.6 12.8%

Day after

brokerage

ratin

g

release

+12% 18.3 9.1%

Figure 5 Baidu Information Index (Photo/Picture credit:

Original).

As can be seen from the Baidu Information Index

given in Fig. 5, in order to meet the demand of

investors for relevant information, the organization

has increased its research investment. Positive ratings

and research reports from a number of investment

institutions have kept Cambricon hot. According to

the data of Securities Star, a total of 3 institutions

gave ratings, including 2 buy ratings and 1 hold rating.

This concentrated release of information and positive

guidance has intensified market demand for

Cambricon stock, driving the stock price ever higher.

From the data of the day following the release of the

brokerage ratings, the stock price rose by +12%, with

an average daily volume of 1.83 billion yuan and a

turnover rate of 9.1%, indicating that investors

reacted positively to this information, further pushing

the stock price away from the reasonable range and

causing the stock price to overflow (shown in Fig. 6).

The synergy of these three types of behavioural

mechanisms may trigger the phenomenon of

"cognitive resonance" , in which emotionally driven

attentional biases, the segregation effect of mental

accounts, and misattributions due to overconfidence

combine to drive up pricing distortions in specific

asset classes (Barberis & Huang, 2008).

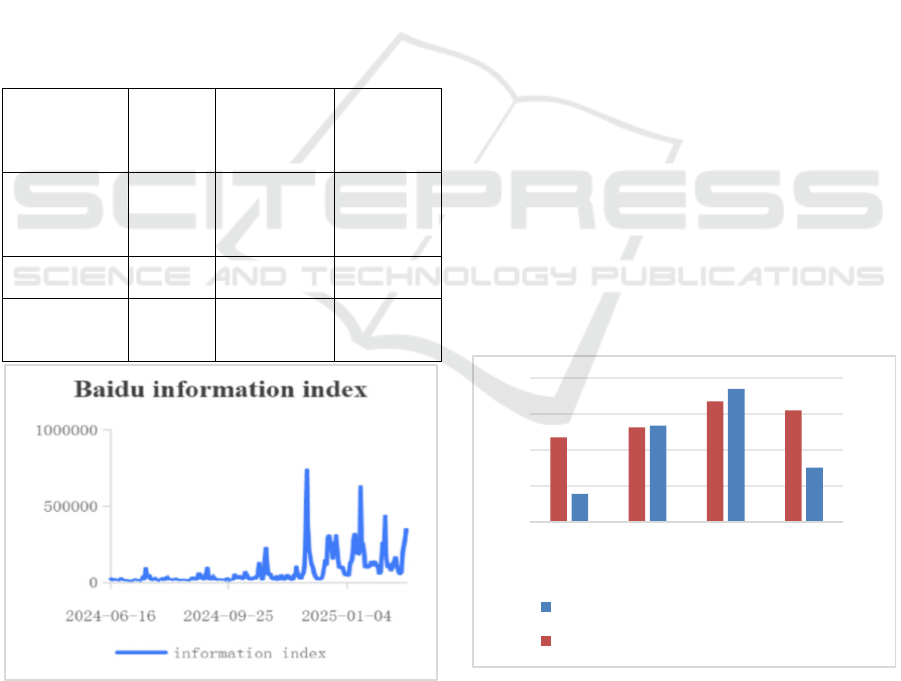

Herd Behavior is an irrational behavior in which

investors abandon their own information analysis and

blindly imitate others' decisions in an environment of

information asymmetry or uncertainty (Banerjee,

1992). When individuals believe that others' behavior

implies private information, they may choose to

follow it even if it contradicts their own judgments,

thus forming an information waterfall (Bikhchandani

et al., 1992). In financial markets, the herd effect is

often manifested as convergent trading by investors

influenced by the information waterfall, resulting in

asset prices deviating from fundamental value

Figure 6: Cambricon Institutional Positions and Shares

(Photo/Picture credit: Original).

The spike in Cambricon's stock price is essentially

a positive feedback loop triggered by the collective

irrational behaviour of market participants. Head

0

0,5

1

1,5

2

2,5

0

200

400

600

800

End of

2022

End of

2023

Mid 2024 Q3 2024

Institutional Position (number)

Number of Shares in Position (Billions)

Equity Premium Puzzle in Cambricon: Evidence from Behavioural Finance

35

institutions accelerated the concentration of positions,

institutional holdings soared from 146.6 million

shares in 2022 to 193.9 million shares in 2024Q3 (an

increase of 32.3%), but the number of institutions fell

from a peak of 739 to 302. Among the top ten

shareholders, Huaxia, Efontaine and other science

and technology ETFs combined position accounted

for more than 12% of the formation of passive capital

bottoming effect - index funds need to be configured

according to the weighting machinery, even if the

valuation of the abnormally high is still forced to buy

The relative return ranking mechanism used by

public equity funds has created a "prisoner's

dilemma" among fund managers. When technology

stocks like Cambricon show excess returns, even if

fund managers think the stock fundamentals may be

overvalued, but in order to avoid short-term

performance decline, they have to follow the buy,

which further pushes up the stock price. Vanguard

Mo Haibo has taken a long position in Cambricon for

six consecutive quarters since 2023, gaining a

demonstration effect of 37.63% excess returns,

triggering other fund managers to follow, which led

to the concentration of Cambricon's institutional

holdings soaring from 12.7% to 21.4% in three

months. As listed in Table 2, from the end of 2023 to

the third quarter of 2024, retail investors continued to

sell, while institutions absorbed chips through block

trading and other channels, the number of

shareholders fell from 33.18 million to 26.47 million.

2024, when the number of institutions reached 739,

the market is close to the "crowded trading" tipping

point. According to the game theory model, when

more than 70% of institutional positions are

concentrated in the same underlying, the individual

optimal strategy from "follow the group" to

"preemptive withdrawal". The number of institutions

slashed in the third quarter, but total holdings fell by

only 7.4%, suggesting that institutions still holding

shares are maintaining control by adding to their

positions, creating a new equilibrium.

Table 1: Concentration Quartile of Shareholding of Top 10

A-Shareholders (2000-2023)

Quartile 10% 25% 50% 75% 90%

Shareholdin

g

18% 24% 30% 33% 34%

The current shareholding of the top ten

shareholders has reached 37.2%, exceeding the 90%

quartile of A-share history. According to the liquidity

layering model, when the concentration of

institutional positions exceeds 30%, the market depth

(Market Depth) falls to the danger zone, when 1% of

the selling volume can trigger more than 15% of the

price retraction. The irrational prosperity of

Cambricon is the ultimate interpretation of narrative

economics. The grand narrative of "autonomous and

controllable AI chips" has made Cambricon a vehicle

for symbolic capital. Institutions have reinforced this

narrative by continuing to take positions, creating a

consensus premium similar to that of Bitcoin - prices

are no longer dependent on financial metrics, but

rather on the strength of participants' belief in the

narrative.

5 CONCLUSIONS

To sum up, the abnormal volatility of Cambricon's

stock price reveals the structural defects in the A-

share market in institutional design and behavioural

regulation. From the perspective of government

regulation, it is necessary to build a dynamic risk

prevention and control system: on the one hand, for

the risk of institutional position concentration

breaking through the historical quartile value, it is

recommended to introduce counter-cyclical

adjustment tools, dynamically adjust downward the

disclosure threshold for position concentration (e.g.,

mandatory disclosure of trading intent when the

shareholding ratio exceeds 25%), and correct

unilateral market volatility by expanding the

underlying securities financing and introducing

hedging tools such as individual stock options; on the

other hand, it is necessary to Optimize ETF

subscription and redemption rules, set valuation

deviation thresholds for index constituents (e.g., P/E

ratio deviating from the industry average ± 2 standard

deviations), and allow fund managers to suspend

subscriptions or adjust weightings to curb the bubble-

boosting effect of passive funds.

At the same time, the herd behaviour of

institutional investors and appraisal mechanism flaws

urgently need systematic correction. It is

recommended to reconstruct the appraisal system

with three-year rolling returns as the core, break the

“prisoner's dilemma” of short-term relative return

ranking, and establish an internal AI public opinion

monitoring system to identify emotional bias in the

market narrative (e.g., the concept of “localization of

AI chips” speculation). At the level of liquidity risk

management, it is necessary to preset rules for

mandatory position reduction (e.g., initiate a gradient

reduction when the concentration of positions

exceeds 30%), so as to avoid the risk of stampede due

to insufficient market depth.

For individual investors, behavioural finance

interventions are needed to improve decision-making

rationality. Investor education should strengthen the

ICEML 2025 - International Conference on E-commerce and Modern Logistics

36

correction of cognitive biases such as mental accounts

and overconfidence, and be especially alert to the risk

accumulation effect of categorizing high-risk assets

as “dream accounts”. At the practical level, we can

establish a reverse layout framework, when the stock

search index and the stock price show a positive

correlation (such as the correlation coefficient > 0.8),

it will be regarded as an early warning signal of a

bubble to implement the position reduction operation.

The above multi-dimensional policy synergies can

provide institutional safeguards to improve the

pricing efficiency of high-volatility technology

stocks.

AUTHOR CONTRIBUTIONS

All the authors contributed equally and their names

were listed in alphabetical order.

REFERENCES

Baker, M., Wurgler, J., 2006. Investor sentiment and the

cross-section of stock returns. Journal of Finance,

61(4), 1645-1680.

Banerjee, A. V., 1992. A simple model of herd behavior.

The Quarterly Journal of Economics, 107(3), 797-817.

Barberis, N., Huang, M., 2008. The loss aversion/narrow

framing approach to the equity premium puzzle.

Handbook of the Equity Risk Premium, 199-212.

Bikhchandani, S., Hirshleifer, D., Welch, I., 1992. A theory

of fads, fashion, custom, and cultural change as

informational cascades. Journal of political

Economy, 100(5), 992-1026.

Calzadilla, J. F., Bordonado-Bermejo, M. J., González-

Rodrigo, E., 2021. A systematic review of ordinary

people, behavioural financial biases. Economic

research-Ekonomska istraživanja, 34(1), 2767-2789.

Fama, E. F., 1970. Efficient Capital Markets: A Review of

Theory and Empirical Work. Journal of Finance, 25(2),

383-417.

Guan, 2020. Venture Capital and Bond Risk Premium:

From the Perspective of Institutional Investors. Beijing:

Social Sciences Academic Press.

Gupta, S., Shrivastava, M., 2022. Herding and loss aversion

in stock markets: mediating role of fear of missing out

(FOMO) in retail investors. International Journal of

Emerging Markets, 17(7), 1720-1737.

Jiang, B., 2022. Liquidity Premium. in: Investment

Strategies. Palgrave Macmillan.

Lakonishok, J., Shleifer, A., Vishny, R. W., 1992. The

impact of institutional trading on stock prices. Journal

of financial economics, 32(1), 23-43.

Odean, T., 1998. Volume, volatility, price, and profit when

all traders are above average. Journal of Finance, 53(6),

1887-1934.

Shen, W., 2023. Research on the Liquidity Premium in

China's Stock Option Market. Zhejiang University.

Shiller, R. J., 2003. From efficient markets theory to

behavioral finance. Journal of economic

perspectives, 17(1), 83-104.

Tang, W., Wu, T., Xu, L., 2017. Skewness Preference and

IPO Anomalies in China. Annals of Economics &

Finance, 18(1).

Thaler, R. H., 1985. Mental accounting and consumer

choice. Marketing Science, 4(3), 199-214.

Yang, H., 2011. External Risk, Heterogeneous Beliefs and

Idiosyncratic Volatility Risk Premium. Journal of

Management Sciences in China, 11, 71-80.

Equity Premium Puzzle in Cambricon: Evidence from Behavioural Finance

37