Beyond the Boundaries of Rationality: Evidence from Risk

Management Reconstruction of the USA Future Markets

Xinyi Li

1

School of Finance, Guangdong University of Finance and Economics, No.21 Luntou Road, Gangzhou, China

Keywords: Behavioural Finance, Futures Market, Flash Crash, EMH Failure, Margin Call Risk Control.

Abstract: As a powerful supplement to traditional finance, behavioural finance emphasizes the essential role of

investors' irrational behaviour and market psychology in market price fluctuations. This article summarizes

the application of behavioural finance in risk management in the US futures market, especially the practical

application and theoretical discussion of the futures market in flash crashes, margin calls caused by EMH

failure, and position limits. This research teases out the latest progress in these research fields, proposes the

necessity of introducing behavioural finance perspectives into risk management, and summarizes the main

research hotspots in this field, including investor sentiment, market manipulation, and irrational factors of

market efficiency. Based on comprehensive analysis, this paper further proposes the direction of optimizing

risk management methods in the future, especially in the context of using emerging technologies such as

artificial intelligence and big data, how behavioural finance can promote the reconstruction of the risk

management paradigm in the futures market.

1 INTRODUCTION

In recent years, the futures market has experienced

many volatile events, such as the 2008 financial crisis,

the flash crash in May 2010, and the Archegos

liquidation in 2021.These events show that traditional

risk management methods according to rational

investor hypothesis exist flaws (Borowiecki et al.,

2023). In addition, the behavioural finance challenges

the “rational person assumption”, which supposes

investors are often affected by psychological biases,

emotional fluctuations and other factors, causing

market prices to deviate from their intrinsic value.

This theory provides theoretical support for irrational

behaviour in financial markets, especially in futures

markets, where investors’ emotions and decision-

making behaviours have an increasingly significant

impact on market fluctuation (Tversky & Kahneman,

1979; Geboers et al., 2023). As one of the world's

largest and most liquid derivatives markets, the

stability of the U.S. futures market directly affects the

security of the global financial system.

Recently, the extreme volatility and frequent flash

crashes in the market have exposed the limitations of

traditional risk management methods. Especially,

when EMH fails, traditional quantitative models and

risk management strategies fail to effectively respond

to market crashes and leverage liquidations. The rise

of behavioural finance provides a new perspective for

solving this problem. By understanding investors'

psychological biases, irrational decision-making

behaviours and fluctuations in market sentiment, it

can provide more effective solutions for market risk

control. Moreover, with the rise of high-frequency

trading and algorithmic trading, flash crashes in the

futures market have occurred frequently. These

events usually occur in a very short period of time,

causing market prices to fluctuate violently and have

serious consequences. The explanation of flash

crashes by investor sentiment and market reactions

from the perspective of behavioural finance has

become one of the current research hotspots (Tian et

al., 2025). In addition,The failure of the efficient

market hypothesis has made systemic risks and

margin calls in the futures market more prominent.

Behavioural finance has proposed a new risk

management framework by explaining the irrational

behaviour of investors, especially how to effectively

manage market crash risks and leverage margin calls

when EMH fails (Cheng & Wang, 2022). Last but not

least, as a market risk control tool, the position limit

system has been widely used in the futures market.

Studies have shown that reasonable position limits

Li, X.

Beyond the Boundaries of Rationality: Evidence from Risk Management Reconstruction of the USA Future Markets.

DOI: 10.5220/0013832100004719

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 2nd International Conference on E-commerce and Modern Logistics (ICEML 2025), pages 23-29

ISBN: 978-989-758-775-7

Proceedings Copyright © 2025 by SCITEPRESS – Science and Technology Publications, Lda.

23

can effectively curb market manipulation and

excessive speculation, but overly strict position limits

may affect market liquidity. Therefore, how to

balance risk control and market efficiency has

become an important issue in current research (Zhou,

2020).

The main object of this study is the U.S. futures

market, especially how behavioural finance is applied

to risk management in situations such as financial

crises, flash crashes, leveraged trading, and position

restrictions. This paper aims to review the application

of behavioural finance in risk management in the U.S.

futures market, systematically summarize existing

research results, analyse its shortcomings, and

propose future research directions. The paper is

arranged as follows: the first part reviews the flash

crash phenomenon in the futures market and its

behavioural finance explanation; the second part

discusses the risk management of liquidation when

EMH fails, and analyses the risk control strategy from

the perspective of behavioural finance; the third part

discusses the theoretical basis and practice of position

limits, and analyses its impact on market stability and

liquidity; the last part summarizes the whole paper

and proposes the potential application and

development direction of behavioural finance in

futures market risk management.

2 FLASH CRASH PHENOMENON

AND MARKET RISKS

A flash crash is a violent price swing in a financial

market that occurs in a very short period of time,

usually accompanied by a brief collapse of the market,

followed by a rapid recovery in prices. This

phenomenon is different from general market

fluctuations, and is specialized by the extreme nature

of the speed and magnitude of the fluctuations.

Triggers are often not triggered by macroeconomic

data or fundamental factors, but by changes in the

market microstructure, feedback effects of trading

behavior, or technical factors. Compared with general

market volatility, flash crashes have the following

significant differences: the first is the time scale: flash

crashes usually occur in a very short period of time,

while general market volatility can last for hours,

days, or longer; The second is volatility: flash crashes

are accompanied by violent price fluctuations, which

can lose tens of percentage points in a matter of

minutes, while general market volatility is usually

relatively flat; The third is regression: flash crash

events are usually short-lived, and prices may quickly

rebound and return to normal levels after a rapid

decline, showing extremely high short-term market

uncertainty. These characteristics suggest that flash

crashes are not only price fluctuations in the market,

but also reflect the interaction of market structure,

investor behaviour, and trading technology under

extreme conditions.

High-Frequency Trading and Algorithmic

Trading are widely considered to be crucial catalysts

for flash crashes. In modern financial markets, high-

frequency trading algorithms execute transactions

within microseconds through automated programs.

These algorithms quickly drive market price

fluctuations through technical trading rules and

market liquidity arbitrage (Tian et al., 2025), then the

flash crash phenomenon occurs. Specifically,

algorithmic trading promotes flash crashes through

the following mechanisms:

Weakened market liquidity. Under normal

market conditions, algorithmic trading can

provide liquidity, but when the market

fluctuates violently, trading algorithms may

suspend trading or withdraw orders, which leads

to a sharp drop in market liquidity and further

exacerbates the violent price fluctuations

(Geboers et al., 2023).

Feedback mechanism. Algorithmic trading

usually responds to changes in market prices.

When prices fall rapidly, algorithms may

automatically trigger sell orders, forming an

"avalanche effect" and exacerbating further

price declines (Sun & Li, 2022).

Market chain reaction. When a flash crash

occurs, the reactions of algorithms are often not

isolated, and they will affect each other, thereby

accelerating the process of market collapse.

In March 2023, Silicon Valley Bank suffered a

liquidity because of asset-liability management errors,

which triggered a large-scale deposit run and

eventually led to its bankruptcy. Although this event

originated in the banking system, its impact quickly

spread to the futures market and other financial

derivatives markets. The panic in the market caused

violent fluctuations in futures contracts, especially in

financial derivatives and high-risk assets related to

Silicon Valley Bank, and the prices of futures

contracts plummeted. The flash crash characteristics

of this event are manifested as extreme price

fluctuations and loss of market confidence. Within

minutes of Silicon Valley Bank's bankruptcy

announcement, the prices of related assets in the

futures market (e.g., bank stock futures, bond futures)

fell sharply. Although there was a certain rebound

afterwards, the prices failed to quickly return to the

ICEML 2025 - International Conference on E-commerce and Modern Logistics

24

level before the crash (Song et al., 2023). Secondly,

the drastic change in investor sentiment caused the

futures market to panic, and many funds quickly

withdrew from related assets, forming a typical flash

crash phenomenon (Gärling et al., 2021).

Behavioural finance provides important

psychological and market sentiment explanations for

the flash crash phenomenon. Compared with

traditional rational economic theory, behavioural

finance emphasizes the irrational behaviour of

investors in the face of uncertainty, and how this

behaviour affects market price fluctuations.

Specifically, behavioural finance's explanation of

flash crashes can be expanded from the following

aspects:

Driven by cognitive bias. Investors tend to

overreact when faced with sudden information,

and emotional decisions cause prices to deviate

from fundamentals (Tversky & Kahneman,

1979). The herd effect induced by panic will

accelerate the spread of selling behaviour, such

as the contagious spread of market panic in the

Silicon Valley Bank incident in 2023 (Tian et al.,

2025).

Market mechanism amplification. The sudden

drop in liquidity resonates with the withdrawal

of high-frequency trading, and the lack of

market-making mechanism exacerbates price

fluctuations (Geboers et al., 2023). Feedback

trading forms a vicious cycle of price decline-

sell-off reinforcement, and the Archegos

liquidation incident shows this self-reinforcing

market effect (Sun & Li, 2022).

The flash crash phenomenon reveals the

profound impact of irrational behaviour, market

psychology and trading technology in the

financial market on market volatility. Although

high-frequency trading and algorithmic trading

contribute to market liquidity under normal

circumstances, they may also exacerbate price

fluctuations and form flash crashes under

extreme circumstances. Behavioural finance

provides a powerful theoretical explanation for

the flash crash phenomenon through factors

such as investors' psychological biases, herd

effects and feedback trading. Future market

supervision and risk management strategies

should fully consider these irrational factors to

improve market stability and transparency.

3 EMH FAILURE AND MARGIN

CALL RISK CONTROL

3.1 EMH Assumptions and Failure

Cases in the Real Market

EMH proposes that market prices always fully reflect

all information, so that investors cannot obtain excess

returns through technical analysis or fundamental

analysis. However, EMH is frequently challenged in

the real market, especially in the context of financial

crises and market crashes, when the market often

shows obvious irrational behaviour and price

inefficiency. The 2008 financial crisis is a classic

example of the failure of EMH. The outbreak of the

crisis stems from the bursting of the bubble in the US

real estate market, especially in the context of the

subprime mortgage crisis, when the excessive

leverage and risky investment behaviour of financial

institutions led to the market crash. The subprime

mortgage crisis shows that the market does not

effectively reflect risks and information as assumed

by the EMH. On the contrary, due to speculative

behaviour, overly optimistic expectations and

excessive reliance on asset prices, market prices have

deviated significantly from their actual values:

Irrational decision-making of financial

institutions. Before the crisis broke out, a large

number of financial institutions ignored

fundamental risks, engaged in high-leverage

speculation, and relied on incorrect information

assessment tools (such as credit ratings) to make

decisions. The information was seriously

lagging and incomplete, leading to systemic

failure of the market (Frydman & Camerer,

2016).

Overreaction and slowness of market reaction.

In the early stage of market turmoil, investors

overreacted, causing prices to plummet rapidly

and the market to recover slowly, proving that

the EMH theory fails in extreme situations

(Chen et al., 2015).

3.2 Leveraged Trading and

Liquidation Risk Management

Leveraged trading is a common strategy to amplify

investment returns, but when the market crashes, high

leverage trading tends to amplify risks, causing

investors to face the risk of liquidation. Historically,

many financial collapses have been closely related to

excessive leverage.

Beyond the Boundaries of Rationality: Evidence from Risk Management Reconstruction of the USA Future Markets

25

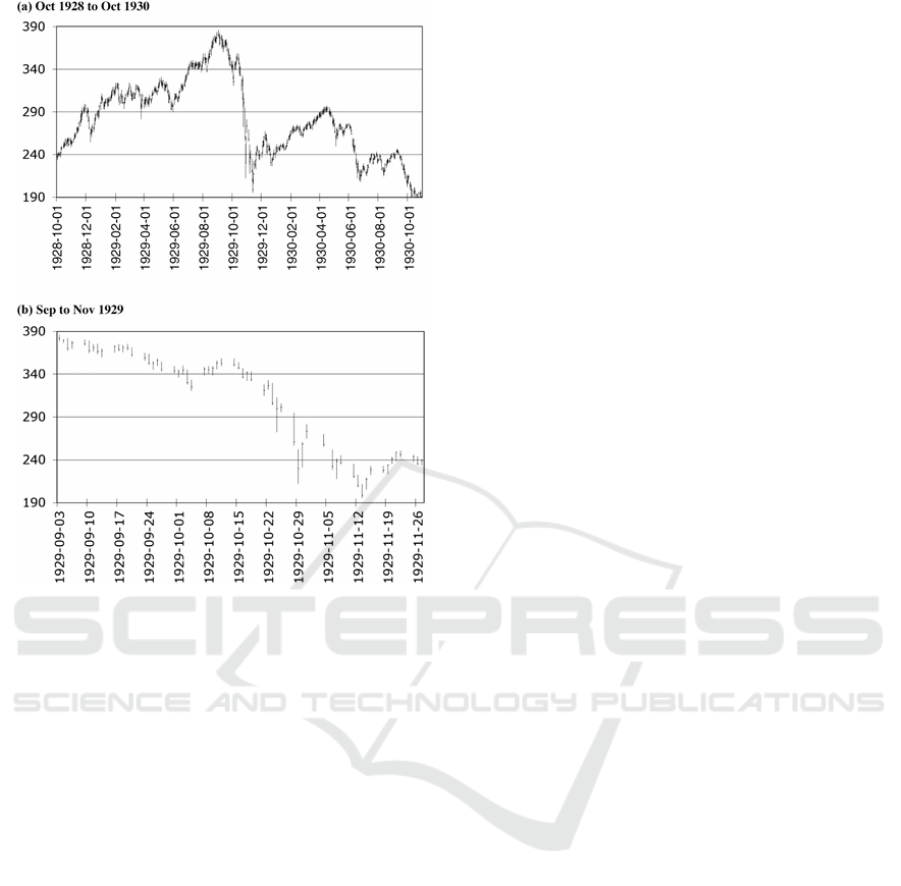

Figure 1: Leveraged Trading and Market Collapse in the

Wall Street Crash of 1929 (Borowiecki et al., 2023).

The 1929 Wall Street stock market crash is a

classic example of leveraged trading. As shown in

Figure 1, in the 1920s, stock market speculation was

prevalent, and investors widely used margin loans for

leveraged trading (Cao, 2010). At that time, investors

only needed to pay 10% of the stock price as margin

to borrow funds to buy stocks. This highly leveraged

trading magnified the market's rise in the bull market,

but when the stock market began to fall, the leverage

effect caused losses to be sharply magnified, leading

to large-scale liquidation and market collapse

(McNamara & Bromiley, 1997). The first reason is

the amplification of the leverage effect. Because of

excessive leverage, investors are unable to add

margin in time when the market goes down, and are

forced to close their positions, further exacerbating

the decline of the stock market (Borowiecki et al.,

2023). The spread of systemic risks also accounts.

Highly leveraged market participants occupy a

considerable market share, and their liquidation

behaviour exacerbates the panic in the market,

forming a self-reinforcing downward cycle.

In 2021, Archegos Capital's liquidation due to

high-leverage trading further revealed the risk

management issues of leveraged trading. Archegos

used derivatives such as Total Return Swaps (TRS) to

invest with extremely high leverage. However, due to

market volatility and the decline in the share prices of

its holdings, Archegos failed to meet margin

requirements in a timely manner and was eventually

forced to liquidate, causing the prices of related assets

to plummet and triggering widespread losses for

financial institutions. Archegos's liquidation incident

shows the huge risks of leveraged trading in the

financial derivatives market, especially when using

derivatives for high-leverage investment, small

market fluctuations may lead to liquidation (Cheng &

Wang, 2022). In the Archegos incident, the lack of

effective risk management and transparency,

especially the lack of supervision on leverage risks,

prevented financial institutions from effectively

identifying their potential risks, resulting in systemic

shocks in the market (Goldberg & Mahmoud, 2017).

3.3 Limitations and Improvements of

Traditional VaR Models

Value at Risk (VaR) is a common tool used by

financial institutions to measure portfolio risk. It

provides the maximum loss that a portfolio may

suffer at a given confidence level. However, the

performance of the VaR model in extreme market

environments has significant limitations. The basic

idea of the VaR model is to calculate the maximum

possible loss within a certain time frame through

historical data or simulation methods. Although VaR

is widely used in daily risk management, it has

limitations in the following aspects:

Underestimation of tail risk. The VaR model

based on the normal distribution assumption

cannot capture the risk of extreme events in the

fat-tail market (such as flash crashes), resulting

in the failure of tail loss prediction (Goldstein &

Taleb, 2007).

Lack of liquidity risk. The VaR model that relies

on historical volatility parameters cannot reflect

the real risk of abnormal price fluctuations when

market liquidity dries up (McNeil et al., 2015).

Short-sightedness in time dimension: The short-

term data dependence characteristic conceals

the long-term risk lag effect in the market

bubble accumulation and high leverage

environment (Goldberg & Mahmoud, 2017).

In order to overcome the limitations of the VaR

model, scholars have proposed a variety of

improvement plans, especially introducing the

perspective of behavioural finance to better capture

irrational factors in the market. By introducing

sentiment indexes in behavioural finance (such as the

ICEML 2025 - International Conference on E-commerce and Modern Logistics

26

market panic index), using big data to dynamically

adjust the VaR model, and combining conditional

value at risk (CVaR) to capture tail risks, the ability

to predict and manage risk events such as extreme

market volatility and liquidity crises can be improved.

Therefore, the failure of EMH, the risk of

liquidation caused by leveraged trading, and the

limitations of the traditional VaR model all reveal the

fragility of the financial market in the face of extreme

events. Improvement measures combined with the

perspective of behavioural finance are expected to

provide more effective risk management tools to help

the market better cope with the impact of extreme

events such as crashes and flash crashes. Future risk

management should focus on dynamic adjustment

and the introduction of irrational behavioural factors

to improve the stability and risk resistance of the

market.

4 POSITION LIMIT AND RISK

CONTROL STRATEGY

The position limit system is an essential tool in the

financial market. It aims to control the position of a

single investor or institution in the market, prevent

market manipulation, excessive speculation and

leverage risks, and ensure the healthy and stable

operation of the market. Its core goal is to reduce the

systemic risk of the market, prevent market prices

from being manipulated by individual large investors,

and maintain the fairness and liquidity of the market.

The theory of the position limit system is based on the

market microstructure theory, which focuses on how

market participants trade under incomplete and

asymmetric information. The position limit system

helps improve the transparency and fairness of the

market and ensures that prices can fully reflect the

relationship between supply and demand without

being affected by a few large investors. By limiting

positions, the market can more healthily reflect the

collective judgment of investors rather than being

dominated by a single market participant (Zhou,

2020).

The position limit system in the US futures market

is regulated by the Commodity Futures Trading

Commission (CFTC). According to CFTC

regulations, the position limit of certain futures

contracts is strictly limited, especially for speculative

traders. The position limit policy in the US futures

market has achieved certain success, especially in

reducing excessive speculation and reducing

systemic risks. However, with the development of

financial innovation and derivatives markets,

traditional position limit policies face new challenges,

such as the impact of high-frequency trading and

algorithmic trading on the market, and how to balance

liquidity and market stability.

4.1 The Impact of Position Limits on

Market Stability

The position limit system has a dual impact on market

stability. On the one hand, position limits can

effectively prevent market manipulation and

excessive speculation, and reduce systemic risks; on

the other hand, overly strict position limits may have

an adverse impact on market liquidity and inhibit

market activity. Position limits’ inhibitory effect on

market manipulation and systemic risk. The core role

of the position limit system is to reduce market

manipulation and reduce systemic risks. In the

absence of position limits, the speculative behaviour

of a single large investor or institution may cause

drastic market fluctuations or even market collapse.

For example, in the Wall Street crash of 1929 and the

financial crisis of 2008, excessive leverage and

uncontrolled speculation exacerbated the systemic

risk of the market. The position limit system can

effectively mitigate these risks by controlling the

positions of individual market participants. In the

absence of position limits, investors may manipulate

prices through centralized transactions, causing

market imbalances. The position limit system reduces

the market influence of a single investor, allowing

market prices to more fairly reflect the relationship

between supply and demand (Zhou, 2020). Highly

leveraged traders may face the situation of being

unable to add margin due to market emergencies,

which may lead to forced liquidation, further

exacerbating the downward pressure on the market.

By implementing position limits, investors' risk

exposure is effectively controlled, thereby reducing

the transmission of market systemic risks.

Potential impact of risk positions on market

liquidity and trading activity are as follows:

Although the position limit system can curb

excessive speculation and risk concentration, it

may also have a potential negative impact on

market liquidity. Too strict position limits may

cause market participants to reduce trading

volume, which in turn affects the depth and

price discovery function of the market.

Limited liquidity. If the position limit is too

strict, some investors in the market may be

forced to exit the market, resulting in a decrease

in market liquidity. For example, during the

Beyond the Boundaries of Rationality: Evidence from Risk Management Reconstruction of the USA Future Markets

27

2008 financial crisis, some investors had np

ability to adjust their positions due to the

position limit policy of regulators, which to

some extent exacerbated the liquidity crisis in

the market (Tian et al., 2025).

Suppressing market activity. The position limit

system may prevent some investors with large

amounts of funds from actively participating in

the market, reducing the trading activity of the

market. The decline in market activity may lead

to increased price volatility, especially when

market uncertainty is high, insufficient trading

volume may amplify price volatility (Geboers et

al., 2023).

4.2 Design of New Position Limit

System

With the rapid development of the financial market,

the traditional position limit system faces challenges

in the face of new trading methods such as high-

frequency trading and algorithmic trading. Therefore,

how to design a more flexible and dynamic position

limit system has become an important issue in

modern market supervision. By integrating artificial

intelligence and big data technologies, regulators can

analyse market dynamics, investor behaviour and

sentiment fluctuations (e.g., social media and news

sentiment indexes) in real time, and dynamically

optimize position limit strategies to improve market

stability and liquidity. Real-time risk monitoring and

position adjustments can respond to sudden

fluctuations (Sun & Li, 2022), while sentiment

analysis provides data support for predicting risks

(Geboers et al., 2023).

Dynamically adjusting position limit strategies

based on market volatility is a future trend. By

calculating market volatility indicators (such as risk

value), position limits can be tightened when the

market fluctuates violently to prevent the spread of

systemic risks, and the ratio can be appropriately

relaxed during stable periods to maintain healthy

market operations (Tian et al., 2025). At the same

time, combining algorithms to optimize position limit

strategies in real time (e.g., analysing investor

behaviour patterns) can break through the limitations

of traditional fixed standards and enhance risk

response flexibility (Sun & Li, 2022).

Therefore, the position limit system plays an

important role in maintaining market stability and

reducing systemic risks, but overly strict position

limits may have a negative impact on market liquidity.

The design of future position limit systems should be

combined with emerging technologies such as

artificial intelligence and big data to make dynamic

adjustments to meet the risk management needs in

different market environments. By monitoring market

sentiment and behaviour in real time and combining

volatility-driven position limit strategies, the

relationship between market stability and liquidity

can be more effectively balanced.

5 CONCLUSIONS

From the perspective of behavioural finance, this

paper reviews the relevant theories and practices of

futures market risk management, focusing on the core

issues such as flash crashes, EMH failure and

leverage blow-up risks, and position limit systems.

By analysing existing research results and actual

market cases, this paper argues that although

traditional financial theories and risk management

tools (e.g., VaR models) can cope with conventional

market fluctuations to a certain extent, their

performance in extreme market conditions has

significant limitations. Behavioural finance provides

a new perspective for risk management, especially

under the influence of investor irrational behaviour,

emotional fluctuations and market microstructure,

market price fluctuations often show irrational and

nonlinear characteristics.

The core theories of behavioural finance,

especially investor psychological biases

(overconfidence, loss aversion, herd effect, etc.),

provide a more comprehensive perspective for futures

market risk management. Traditional financial theory

assumes that the market is rational, but in reality,

investors' irrational behaviour often leads to

deviations in market prices. In the futures market,

especially in the high-leverage and derivatives market,

investors' emotional fluctuations and irrational

decisions often become the source of sharp price

fluctuations. Flash crashes and market manipulation

cases further confirm the profound impact of such

irrational behaviour on the market. By combining

behavioural finance, researchers have proposed more

complex risk management frameworks that can take

into account irrational factors in the market, such as

market sentiment and group behaviour.

Contemporarily, with the popularity of high-

frequency trading and algorithmic trading, the

dynamic changes in the market have become

increasingly complex, and traditional risk

management tools based on historical data and

rational assumptions have become insufficient. The

theory of behavioural finance provides strong support

for explaining these new phenomena, especially the

ICEML 2025 - International Conference on E-commerce and Modern Logistics

28

in-depth study of investors' reaction patterns,

decision-making processes, and market feedback

when facing extreme market fluctuations, making risk

management in the futures market more refined and

diversified.

Traditional risk management frameworks, rooted

in the efficient market hypothesis (EMH) and rational

actor assumptions, struggle to address real-world

market irrationality and extreme events (e.g., flash

crashes, high-leverage risks). Behavioural finance

has revolutionized this paradigm by integrating

quantified investor sentiment, psychological biases,

and behavioural patterns (e.g., social media sentiment

analysis) with AI and big data. This fusion enhances

risk prediction accuracy, particularly during crises,

while mitigating irrational volatility’s destabilizing

effects on derivatives markets. Dynamic risk

management strategies, enabled by real-time

monitoring of market sentiment and volatility, allow

flexible adjustments to leverage ratios and position

limits, overcoming the rigidity of static models.

Policymakers can leverage these insights to refine

regulations, prioritizing behavioural drivers of

systemic risks. Financial institutions must embed

behavioural factors into risk models, and investors

should adopt adaptive strategies with heightened

emotional discipline. Collectively, this approach

fosters a resilient ecosystem capable of navigating

complex market dynamics, balancing stability with

responsiveness to emerging threats.

The traditional risk management paradigm is

based on the efficient market hypothesis and the

rational person assumption, but in reality, irrational

market fluctuations and frequent extreme events (e.g.,

flash crashes and high leverage risks) have exposed

its limitations. The introduction of behavioural

finance has revolutionized the risk management

framework. By quantifying investor emotions,

psychology and behavioural patterns (e.g., social

media sentiment analysis), combined with artificial

intelligence and big data technology, it has not only

improved the accuracy of risk prediction (especially

in extreme events), but also enhanced market stability

and alleviated the impact of irrational fluctuations on

the derivatives market. Dynamic risk management

strategies can achieve flexible adjustments to

leverage ratios and position limit standards by

monitoring market sentiment and volatility in real

time, breaking through the rigidity of traditional static

models. Policymakers can use this to optimize

regulatory policies, financial institutions need to

incorporate behavioural factors into risk control

models, and investors need to strengthen emotional

management and dynamic adaptation of strategies to

jointly build a resilient system that adapts to complex

market environments.

REFERENCES

Borowiecki, K. J., Dzieliński, M., Tepper, A., 2023. The

great margin call: The role of leverage in the 1929 Wall

Street crash. The Economic History Review, 76(3), 807-

826.

Cao, Y., 2010. Risk Management and Financial Crisis:

Reflections from the Perspective of Behavioral Finance.

China Center for Insurance and Social Security

Research (CCISSR), Peking University. Insurance,

Finance and Economic Cycle: Proceedings of the

CCISSR Forum, 9.

Cheng, H., Wang, C., 2022. Regulatory Reform after the

Agus Liquidation Incident and Its Enlightenment to China:

From the Perspective of Securities Income Swap. Securities

Law Review, 1, 63-382.

Gärling, T., Fang, D., Holmen, M., Michaelsen, P., 2021.

Fast and slow investments in asset markets: Influences

on risk taking. Journal of Behavioral Finance, 22(1),

84-96.

Geboers, H., Depaire, B., Annaert, J., 2023. A review on

drawdown risk measures and their implications for risk

management. Journal of Economic Surveys, 37(3), 865-

889.

McNamara, G., Bromiley, P., 1997. Decision making in an

organizational setting: Cognitive and organizational

influences on risk assessment in commercial lending.

Academy of Management Journal, 40(5), 1063-1088.

Song, Y., Liao, M., Zhao, T., 2023. Silicon Valley Bank

flash crash financial crisis flash? Beijing Business Daily,

3(15), 3.

Sun, Y., Li, J., 2022. Deep learning for intelligent

assessment of financial investment risk prediction.

Computational Intelligence and Neuroscience, 2022(1),

3062566.

Tian, S., Liu, S., Mu, L., 2025. Spatial linkages of positive

feedback trading among the stock index futures markets.

The North American Journal of Economics and

Finance, 75, 102315.

Zhou, P., 2020. Research on the position limit system of

U.S. futures market. Futures and Derivatives Law

Review, 2, 185-205.

Beyond the Boundaries of Rationality: Evidence from Risk Management Reconstruction of the USA Future Markets

29