The Impact of Investor Sentiment Divergence on AH Share Premium:

Evidence from SMIC

Liqing Yin

a

Faculty of Economics and Management, South China Agricultural University, Wushan Street 483, Guangzhou, China

Keywords: AH Share Premium, Investor Sentiment, SMIC.

Abstract: As a matter of fact, plenty of Chinese companies increasingly choose to cross-list on both AH market.

However, many shares of Chinese companies listed on both sides of the border have a long history of high

AH share premiums. With this in mind, this study will take SMIC as an example to analyse the impacts,

whose AH share premium has been high for a long time. By means of using principal component analysis to

construct an index of investor sentiment difference between AH, this study will analyse the impact of investor

sentiment difference on its AH share premium, as well as further evaluate it based on the combination of

macro factors. According to the analysis, it is found that investor sentiment is closely related to AH share

premium, and the superimposed influence of macro factors and investor sentiment makes SMIC 's AH share

premium rate stay high for a long time. Overall, these results shed light on guiding further exploration of AH

share premium.

1 INTRODUCTION

Many Chinese companies are now successfully listed

on exchanges around the world, such as Hong Kong,

New York and London. The existence of A-shares

and H-shares provides Chinese companies with

multiple listing options. AH-share listed companies

refer to enterprises that are listed either sequentially

or concurrently in both Mainland China and Hong

Kong. As of the end of December 2024, 151

companies have opted for dual cross-listing to meet

their corporate development and expansion needs. In

line with the principle of the law of one price, stocks

listed in both places should maintain the same market

price. However, there has been a long-standing AH

share premium for stocks listed in both places.

Some scholars have analysed the causes of AH

share premium from the perspective of traditional

finance, giving explanations from the perspectives of

demand difference, liquidity difference, information

asymmetry and market segmentation (Andy et al.,

1998; Ding, 2023; Ma, 2020; Tan et al., 2017). Since

2014, despite the implementation of liberalization

policies such as the Shanghai-Hong Kong Stock

Connect and the Shenzhen-Hong Kong Stock

a

https://orcid.org/0009-0009-6552-9697

Connect, the AH share premium has not been

narrowed. Therefore, individual stock fundamentals

and market segmentation factors under rational

expectations cannot fully explain the phenomenon of

high AH stock premiums. With the development of

behavioural finance, many scholars try to explain the

discount-premium phenomenon of AH cross-listed

stocks from the perspective of investor sentiment. A

number of studies have shown that investor sentiment

significantly affects the market and has predictive

capacity for stock market premiums (Lu & Zhou,

2015; Liu & Guo ,2022; Zhang et al., 2013). Investor

sentiment may provide a new analytical perspective

to explain the AH stock premium.

Currently, most studies on AH share premiums

focus on the macro perspective. Few studies have

examined the impact of the difference in investor

sentiment between the two places on the AH share

premium from a micro perspective. At the industry

and company level, the semiconductor industry

rebounded in the first three quarters of 2024, with the

global semiconductor market registering a 26% year-

on-year growth in revenue, and the semiconductor

industry is receiving a lot of attention from the global

market. SMIC, a leading domestic foundry, has

successfully jumped to become the world's third

Yin, L.

The Impact of Investor Sentiment Divergence on AH Share Premium: Evidence from SMIC.

DOI: 10.5220/0013832000004719

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 2nd International Conference on E-commerce and Modern Logistics (ICEML 2025), pages 15-22

ISBN: 978-989-758-775-7

Proceedings Copyright © 2025 by SCITEPRESS – Science and Technology Publications, Lda.

15

largest foundry for chips after TSMC and Samsung

by increasing its market share to 6% in the third

quarter of 2024. Currently, China's overall domestic

chip self-sufficiency rate is low, and the demand for

domestic substitution is more urgent. With the

increasing support of national policies for the

semiconductor industry, SMIC is expected to gain

more market share in this trend. In addition, SMIC 's

strong market performance is characterized by a

significant AH share premium. In recent years, its

premium has been maintained at a high level for a

long time, even exceeding 200%, which is

representative.

In summary, SMIC 's outstanding performance in

the semiconductor industry and its AH share premium

characteristics make it a typical representative for

studying the impact of investor sentiment differences

between the two places on its AH share premium.

Therefore, this paper selects SMIC as the research

object to explore the impact of investor sentiment

differences between the two places on its AH share

premium.

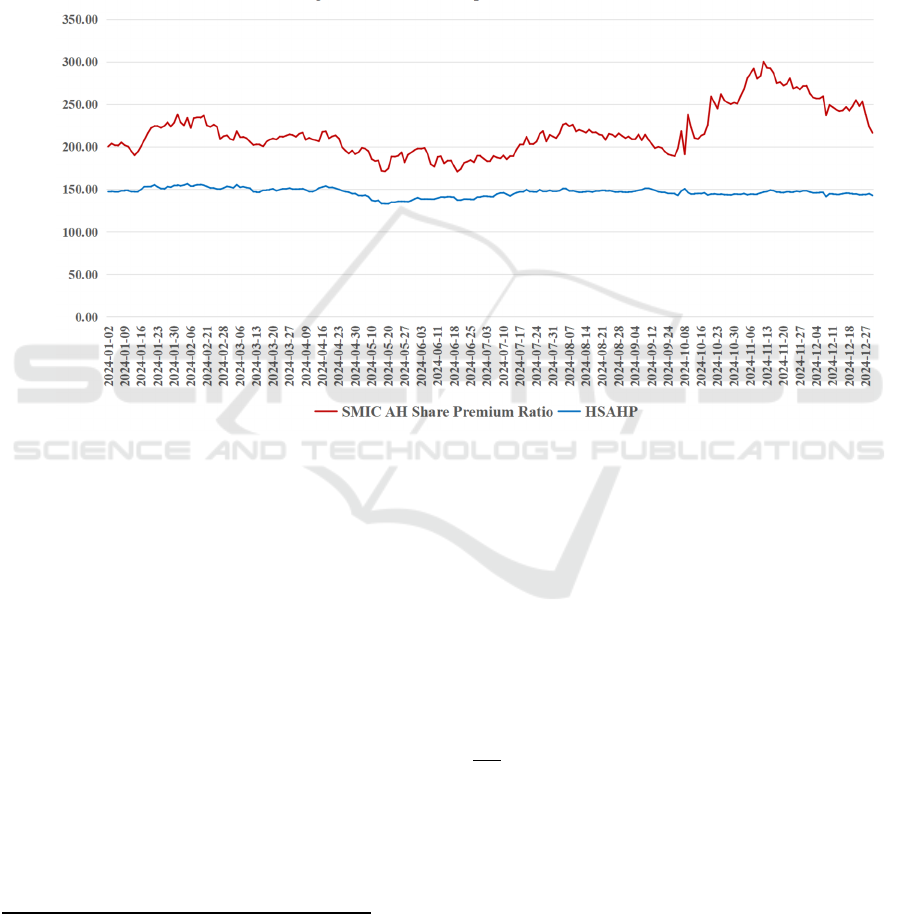

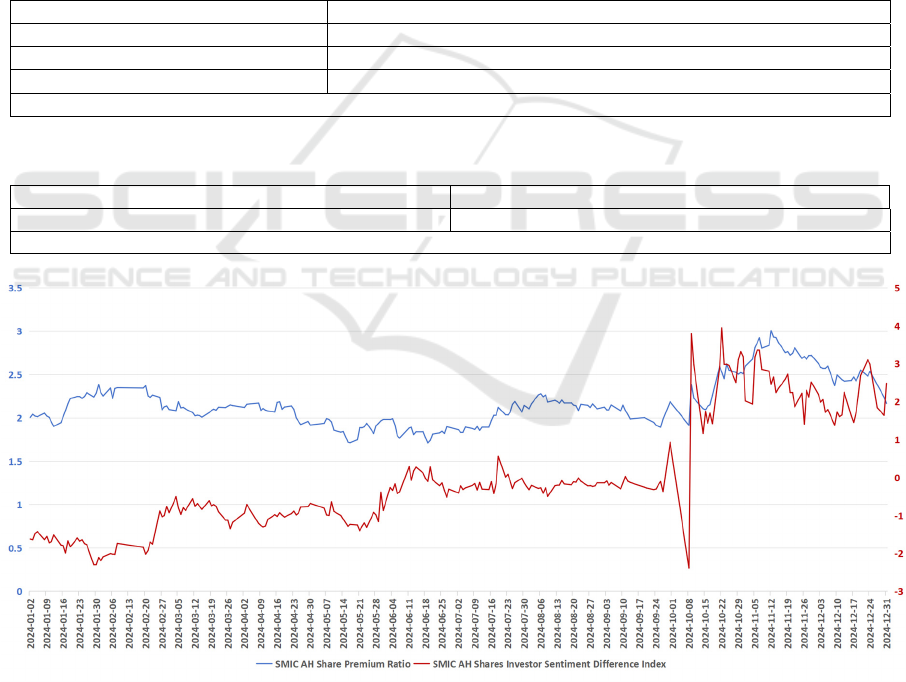

Figure 1: 2024-2025 SMIC AH share premium rate trend chart (Photo/Picture credit: Original).

2 CASE DESCRIPTION AND

RESEARCH HYPOTHESIS

SMIC was respectively listed in Hong Kong and

Shanghai in 2004 and 2020. SMIC is a foundry

offering a wide range of technology nodes from

0.35um to 14nm. Its technology nodes are mainly

used in smartphones, tablets, artificial intelligence,

automotive electronics, and Internet of Things. In

addition, SMIC has a broad customer base, including

well-known chip design companies at home and

abroad, such as Huawei Hesse and Qualcomm and

others. The premium situation in the AH share market

is usually measured by the AH share premium ratio,

which is calculated by the formula:

premium rate =

×

100% (1)

The Hang Seng Shanghai-Shenzhen-Hong Kong

Stock Connect AH Share Premium Index (HSAHP)

is commonly used in the market to reflect the overall

AH share premium. The index selects stocks listed on

both A-share and H-share lists that are eligible for

trading on the Shanghai-Hong Kong Stock Connect

or Shenzhen-Hong Kong Stock Connect as

constituents. The AH share premium of each

constituent is then weighted and averaged by the

outstanding market capitalization weights to arrive at

the overall premium index with the following formula:

HSAHP =

∑

AH share premium of constituent

×

(2)

where α in the formula is the outstanding market

capitalization of A-shares of constituent i, β is the

outstanding market capitalization of H-shares of

constituent i, and γ is the sum of the outstanding

market capitalization of A-shares and H-shares of all

constituents.

To reflect the AH share premium of SMIC, this

paper intercepts the daily closing price of SMIC A

shares after ex-rights, the daily closing price of H

ICEML 2025 - International Conference on E-commerce and Modern Logistics

16

shares after ex-rights, the daily exchange rate of HKD

to CNY, and the HSAHP for the period from January

1, 2024 to January 1, 2025. The trend of SMIC 's AH

share premium from 2024 to 2025 was calculated and

compiled as shown in Figure1.The long-term

fluctuation range of the HSAHP is generally between

130%-150%. As can be seen from Figure 1, SMIC 's

AH share premium has been significantly higher than

the HSAHP for a long period of time, and the

premium has been higher than 200%, or even more

than 300% for a long period of time, which indicates

the anomalous nature of its premium.

Based on the phenomenon of long-term high

premium of SMIC, combined with relevant theories,

this paper puts forward the following hypothesis: the

high premium of SMIC is not only the result of

traditional market segmentation, but also the

differentiated response of investors' sentiment in two

places to favorable policies and industry outlooks,

which leads to the long-term existence of the

premium. This driving mechanism will be verified by

principal component analysis and event study method

in the following section.

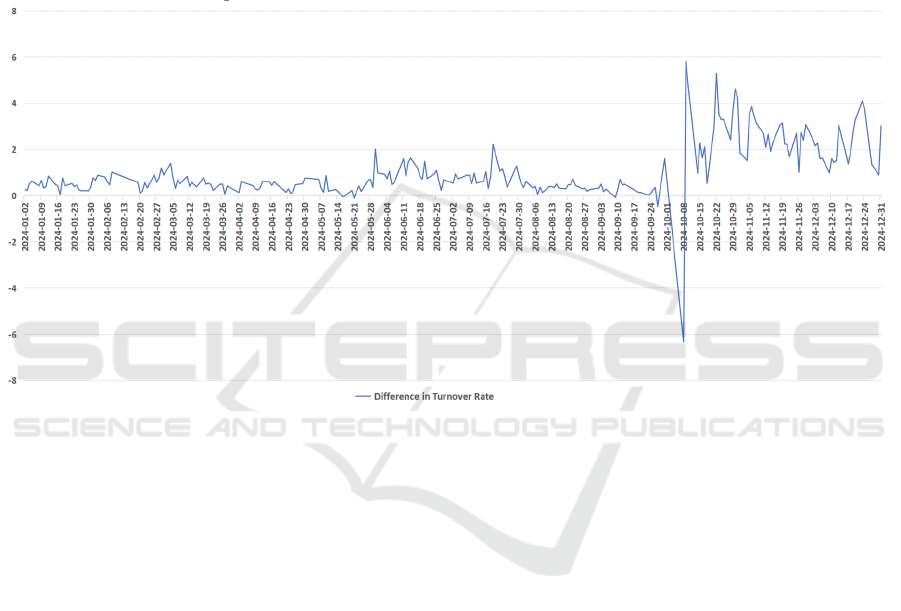

Figure 2: Difference in turnover rate variation analysis (Photo/Picture credit: Original).

3 SYNTHESIS OF SMIC AH-

SHARE INVESTOR

SENTIMENT DIFFERENCE

INDICE

Investor sentiment is observable market behavior that

can be indirectly measured by proxy variables. The

more dominant measure in existing research is the

synthesis of single direct or indirect indicators by

principal component analysis (Baker et al., 2006; Yi

et al., 2009). In order to measure the difference in

investor sentiment between SMIC AH shares, this

paper constructs an index of investor sentiment

difference between SMIC AH shares by principal

component analysis. Three indicators were selected

as proxy variables for this paper. The time span of

the data is from January 1, 2024 to January 1, 2025.

The data frequency is daily data.

The turnover ratio represents the proportion of a

stock's turnover relative to its outstanding share

capital during a specific time period. The turnover

rate reflects the frequency of market trades and

captures investor sentiment differences from the

short-term trading behaviour dimension. The higher

the investor sentiment, the higher the market turnover;

conversely, the lower the investor sentiment, the

lower the market turnover (Yu & Zhong, 2009). In

addition, there are limitations to the turnover ratio. It

is susceptible to short-term noise such as market

rumors and technical adjustments. However, by

analyzing the change in the turnover ratio over a

longer period of time and combining it with other

indicators to make a comprehensive judgment, the

possibility of being misled by short-term noise can be

reduced. The difference in turnover rate quoted in this

article is the difference between the daily turnover

rate in the A-share market and the daily turnover rate

in the H-share market. Figure 2 illustrates the

difference in turnover rate.

The Impact of Investor Sentiment Divergence on AH Share Premium: Evidence from SMIC

17

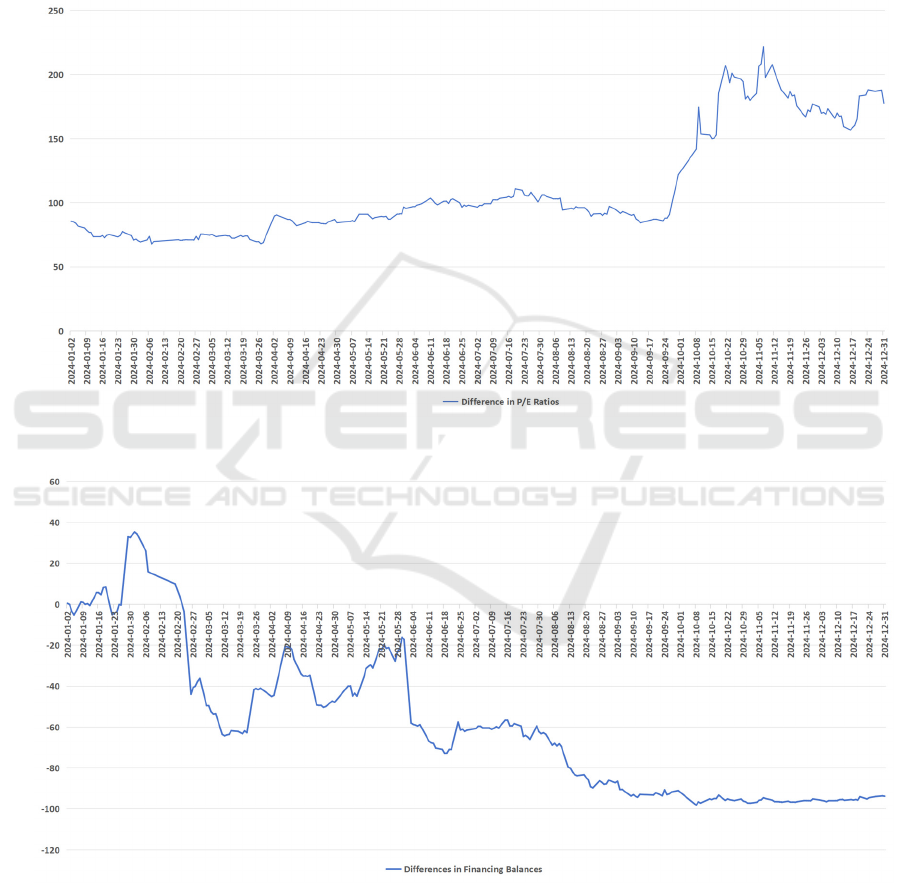

The P/E ratio is calculated by dividing the stock

price by the earnings per share, reflecting investors'

expectations of a company's future earnings. The P/E

ratio is viewed as a common metric for examining

whether a stock's valuation is reasonable. If a

company's P/E ratio is high, this may imply that the

company's stock is overvalued or that investors are

highly optimistic about future growth rates. In

addition, the P/E ratio can reflect investor sentiment

to some extent. Specifically, when investors are

bullish on the prospects of a stock or a company, its

P/E ratio will be high, reflecting high investor

sentiment (Yao et al., 2019) The P/E difference

quoted in this paper is the difference between the

daily rolling P/E of SMIC 's A-share market shares

and the daily rolling P/E of its H-share market shares

(seen from Figure 3).

Figure 3: Difference in P/E ratio variation analysis (Photo/Picture credit: Original).

Figure 4: Difference in the bond borrowing balance variation analysis (Photo/Picture credit: Original).

The bond borrowing balance is the sum of the

amounts investors have borrowed by borrowing

stocks and selling them short. Its change is a direct

reflection of the market's expectation of the future

price of the stock. There have been studies showing

that the bond borrowing balance is a valid indicator

of investor sentiment (Chu & Cao, 2018). The bond

borrowing balance are negatively correlated with

ICEML 2025 - International Conference on E-commerce and Modern Logistics

18

investor sentiment. Specifically, when investor

sentiment is high, the bond borrowing balance is

suppressed by reduced bearish demand. Whereas,

when sentiment is low, short-selling behavior

increases, leading to a rise in the bond borrowing

balance. To address the potential distortion caused by

the scale disparity in bond borrowing balances

between the A-share and H-share markets, this paper

employs the relative difference method to calculate

inter-market variations in bond borrowing balances.

The calculation formula is as follows:

Difference in Bond Borrowing Balance =

×

100% (3)

Here, μ is the balance of A-share bond borrowing and

φ is the balance of H-share bond borrowing.For the

sake of comparability, the H-share bond borrowing

balance in the formula is converted into CNY units

based on the exchange rate of HKD to CNY on the

same day. The analysis of the difference in the bond

borrowing balance is presented in Figure 4.

In this paper, SPSS statistical software is utilized

to implement the dimensionality reduction of the

datasets under principal component analysis. The

time span of the data in this paper is from January 1,

2024 to January 1, 2025, with a total of 233 data sets.

The data are obtained from Oriental Wealth Choice

database, Wind database, etc. In the first step, this

paper standardizes the three aforementioned variables

thereby eliminating the effect of the scale and

obtaining smoother data. In the second step,

correlation analysis between variables is performed.

If there is a strong correlation between the variables

and no multicollinearity it is more suitable for

principal component analysis. As can be seen from

Table 1, all variables are significantly correlated and

the absolute value of correlation coefficient is greater

than 0.3, indicating that principal component analysis

can be performed.

Table 1: Correlation analysis among proxy variables after dimensionless quantification.

Difference in Turnover Rate Difference in P/E Ratios

Difference in

Bond Borrowing Balance

Difference in Turnover Rate 1

Difference in P/E Ratios 0.730** 1

Difference in Bond Borrowing

Balance

-0.412** -0.680** 1

Note: ** indicates significant correlation at the 0.01 level.

Table 2: KMO and Barlett's test of sphericity.

KMO Value 0.577

Bartlett Sphericity Check

Approximate Chi-Square 324.487

df 3

P-Value 0.000

Table 3: Explanation of variance of each component and characteristic root table.

number

Characteristic Root Principal Component Extraction

Characteristic

Root

Variance Explaine

d

Rate%

accumulation

%

Characteristic

Root

Variance Explaine

d

Rate%

accumulation%

1 2.224 74.132 74.132 2.224 74.132 74.132

2 0.590 19.664 93.796 - - -

3 0.186 6.204 100.000 - - -

Table 4: Component matrix.

Variable Name

Variable

Symbol

Ingredient

Ingredient 1

Difference in Turnover Rate a 0.558

Difference in P/E Ratios b 0.632

Difference in Bond Borrowing

Balance

c -0.538

The Impact of Investor Sentiment Divergence on AH Share Premium: Evidence from SMIC

19

In the third step, KMO test and Barlett spherical

test were performed. As shown in Table 1, the KMO

value is 0.570, and the P value of Barlett's spherical

test is less than 0.05. The basic requirements of

principal component analysis are satisfied, and

principal component analysis can be carried out (seen

from Table 2).

The fourth step is to calculate SMIC AH Shares

Investor Sentiment Difference Index. According to

the Kaiser criterion, only principal components with

eigenvalues greater than 1 are retained, as these

principal components explain at least more variation

than one of the original variables. As can be seen from

Table 3, one principal component was extracted to

represent three surrogate variables for principal

component analysis.

In the fifth step, based on the results of the

component matrices in Table 4, the SMIC AH-share

Investor Sentiment Difference Index is synthesized. It

is calculated as follows:

The SMIC AH-share Investor Sentiment Difference

Index=0.558×a+0.632*×b-0.538*×c (4)

Finally, the correlation analysis between the

SMIC AH-share Investor Sentiment Difference Index

and three proxy variables was carried out. The results

are shown in Table 5. As can be seen from Table 5,

there is a significant correlation between the SMIC

AH-share Investor Sentiment Difference Index and

each proxy variable. Therefore, the SMIC AH Share

Investor Sentiment Difference Index can objectively

and accurately reflect the difference in sentiment

between AH investors.

Table 5: Correlation analysis between mood difference index and proxy variables.

The SMIC AH-share Investor Sentiment Difference Index

Difference in Turnover Rate 0.832**

Difference in P/E Ratios 0.942**

Difference in Bond Borrowin

g

Balance

-0.803**

Note: ** indicates significant correlation at the 0.01 level.

Table 6:Correlation analysis between mood difference index and AH share premium ratio.

SMIC AH Share Premium Ratio

The SMIC AH-share Investor Sentiment Difference Index 0.676**

Note: ** indicates significant correlation at the 0.01 level.

Figure 5: Time Series of the SMIC AH Shares Investor Sentiment Difference Index and SMIC AH Shares Premium Ratio

(Photo/Picture credit: Original).

ICEML 2025 - International Conference on E-commerce and Modern Logistics

20

4 CASE ANALYSIS

The correlation analysis between the SMIC AH-share

Investor Sentiment Difference Index and the

premium rate of SMIC AH shares was analysed. As

shown in Table 6, the SMIC AH-share Investor

Sentiment Difference Index is significantly and

positively correlated with its AH Share premium ratio.

That is, the SMIC AH-share Investor Sentiment

Difference Index is, the larger its AH-share premium

is. To further specifically analyses the relationship

between the two, this paper selects the SMIC AH-

share Investor Sentiment Difference Index and the

SMIC AH-share premium to construct a time series

chart as illustrated in Figure 4. Although the SMIC

AH Shares Investor Sentiment Difference Index and

the AH-share premium show a significant positive

correlation, the volatility trends of the two are

significantly inconsistent in some time periods. This

short-term volatility divergence suggests that investor

sentiment difference is not the only explanatory

variable, although it is an important factor driving the

AH share premium. This phenomenon can be

explained in two ways. On the one hand, there is a lag

effect in the transmission of investor sentiment, and it

takes time for the market to digest the information,

which leads to a lack of synchronization between the

movement of the sentiment difference and the

immediacy of the stock price reaction. On the other

hand, the construction of the sentiment difference

index in this paper is mainly based on the market

behaviour indicators, and the fluctuation of the AH

stock premium may also be affected by the

superimposed impact of other external shocks.

Therefore, the formation mechanism of SMIC 's

AH premium needs to be examined under a more

complex multi-factor framework. In the following

section, the paper will combine the factors of policy

support, geographic risk and industry cycle to reveal

how the interaction of sentiment differences and other

external factors together drive the long-term

deviation of the premium rate.

As the core carrier of China's semiconductor

localization, SMIC's special industry status and

intensive policy support have provided substantial

support for the A-share market's optimistic

expectations, while at the same time magnifying the

H-share market's sensitivity to geopolitical risks. This

dual effect makes the AH share premium a result of

the intertwined effects of policy, industry and

investor sentiment as given in Figure 5.

In 2020, SMIC was listed on the A-share Science

and Technology Innovation Board, raising RMB 53.2

billion. The scale of fundraising has set a record for

IPOs on the Science and Technology Innovation

Board, marking the strategic tilt of the semiconductor

industry at the policy level. In August of the same

year, the State Council of the People's Republic of

China issued the Integrated Circuit Industry Policy,

which provides comprehensive support for the

semiconductor industry chain through tax incentives,

R&D subsidies, and other initiatives. Among them,

SMIC, as an industry leader, was directly supported

by tax breaks and funding. The release of policy

dividends quickly boosted A-share investor

confidence, driving SMIC 's A-share valuation to rise

rapidly, and the AH-share premium rate climbed.

Between 2020 and 2022, the U.S. imposed

multiple rounds of sanctions on SMIC, limiting its

ability to acquire advanced technology and

equipment. In particular, the escalation of export

controls in 2022 caused serious disruptions to SMIC

's supply chain. In response to this event, foreign

institutions in the H-share market reduced their

holdings significantly due to the heightened

geopolitical risks, and the decline in liquidity further

dampened H-share valuations. On the other hand,

investor sentiment in the A-share market continues to

be high as the logic of “domestic substitution”

strengthens. The differentiated reaction of the two

markets to the same event has widened the premium

between A and H shares from 150% in 2020 to 250%

in 2022.

In 2024, the global semiconductor industry

ushered in the recovery, the first three quarters of

revenue growth of 26% year-on-year. During the

same period, the second phase of the National IC

Industry Investment Fund injected capital into SMIC,

and the industry subsidy policy came to fruition,

which directly pushed up the A-share valuation to an

all-time high, with the premium rate exceeding 300%.

However, in December of the same year, the U.S. new

semiconductor equipment export controls, SMIC

accelerated cooperation with local suppliers to

promote domestic equipment replacement process.

Against this backdrop, the A-share market due to

strong policy support for high sentiment to promote

the A-share valuation irrational rise; H-share market

is constrained by the withdrawal of foreign capital

and profitability uncertainty, resulting in low

valuations dominated by market forces. The two-

valuation logic is further polarized, resulting in a

premium rate showing the contradictory state of

“policy pulls up, market depresses”.

In summary, policy support has strengthened the

optimistic expectation of A-shares through industry

status, while geopolitical risks have magnified the

pessimistic expectation of H-shares through foreign

The Impact of Investor Sentiment Divergence on AH Share Premium: Evidence from SMIC

21

investment behaviour, and the superimposed impacts

of policy, industry and investor sentiment have

caused SMIC 's AH-share premium to deviate from

the traditional valuation framework for a long period

of time.

5 CONCLUSIONS

The relative difference in investor sentiment between

the two markets is one of the important reasons

affecting SMIC 's AH premium anomaly, and the

larger the AH investor sentiment difference index is,

the larger its AH premium is. In addition, policy

support strengthens the optimistic expectation of A-

shares through industry status, while geopolitical

risks amplify the pessimistic expectation of H-shares

through foreign investment behaviour. Overall, the

superimposed effects of policy, geopolitical risks,

industry and investor sentiment make SMIC 's high

AH share premium rate persist for a long time. In the

future, with the deepening of the semiconductor

industry's autonomy process and the normalization of

the international game, the interaction between policy

and sentiment may further solidify the structural

characteristics of the AH share premium. In view of

this, the government can embed sentiment

stabilization measures in the semiconductor industry

policy. Through the state-owned capital to increase

holdings of H-shares or the establishment of market

stabilization funds, slowing down the withdrawal of

foreign capital triggered by irrational pessimistic

expectations, guiding H-share investors to rationally

assess the long-term value of domestic substitution.

This paper contains two shortcomings. First, the

construction of the sentiment difference index in this

paper is mainly based on objective sentiment

indicators of market behaviour and does not

incorporate subjective sentiment indicators such as

investor confidence indicators. Second, when this

paper constructs the sentiment difference index from

the perspective of behavioural finance, it does not

control the important external conditions used to

explain the AH stock premium phenomenon under

the traditional finance perspective such as the AH

stock liquidity difference, which may have a certain

impact on the results of the study. Based on the above

shortcomings, in the future, a sentiment index can be

constructed that encompasses both objective and

subjective investor sentiment indicators, while

controlling for the same external conditions such as

AH stock liquidity differences.

REFERENCES

Andy, C. W. Chui, C., Chuck., 1998. Cross-auto correlation

between A shares and B shares in the Chinese stock

market. Journal of Financial Research, 21(3), 333-353

Baker, M., Jeffrey W., 2006. Investor Sentiment and the

Cross-Section of Stock Returns. Journal of Finance,

611, 1645-1680

Chu, X., Cao, J., 2018. Does financing and bonding amplify

investor sentiment effects. Securities Market Herald, 9,

22-30.

Ding, X., 2023. The Impact of Investor Sentiment on AH

Share Premiums. Suzhou University of Science and

Technology.

Lu, J., Zhou, Y., 2015. The Impact of Investor Sentiment

on Stock Prices: An Empirical Analysis Based on

Cross-listed AH Stocks. Chinese Journal of

Management Science, 23(11), 21-28.

Liu, L., Guo, L., 2022. Can sentiment differences explain

the AH share premium. Modern Finance and

Economics-Journal of Tianjin University of Finance

and Economics, 42(01), 66-80.

Ma, Y., 2020. Research on China's AH Stock Premium

Problem: An Empirical Analysis Based on Liquidity

Perspective. Modern Business, 23, 144-145.

Tan, X., Liu, H., Cao, Q., 2017. Does Capital Account

Liberalization Reduce the Premium of AH Stocks: An

empirical study based on panel data of AH stocks

before and after the opening of Shanghai-Hong Kong

Stock Connect. China Soft Sciences, 11, 39-53.

Yi, Z., Mao, N., 2009. Measuring Investor Sentiment in the

Chinese Stock Market: The Construction of the CICSI.

Journal of Financial Research, 11, 174-184.

Yu, P., Zhong, R., 2009. Can Individual Investor Sentiment

Predict Market Returns. Nankai Business Review,

12(01), 96-101.

Yao, Y., Yao, B., Zhong, Q., 2019. Research on the Impact

of Investors' Sentiment on Stock Returns: An Empirical

Analysis Based on SSE A-Share Data. Price: Theory &

Practice, 5, 88-91.

Zhang, T., Yu, J., Lv, D., 2013. Investor Sentiment and

Value Premium Anomalies in Emerging Markets: A

Comparative Analysis Based on Mainland China, Hong

Kong and Taiwan. Studies of International Finance, 1,

87-95.

ICEML 2025 - International Conference on E-commerce and Modern Logistics

22