Impacts for Different Markets on Stock Evaluation: Evidence from

BeiGene LTD

Zijing Wu

a

Business School, Macau University of Science Technology, Wailong Street, Macau, China

Keywords: Different Valuation of AH Share, Spatial Arbitrage, Investor Structure.

Abstract: Contemporarily, as more and more companies accomplished dual listing, the continued difference in

valuations of A-shares and H-shares has got more and more attention. On this basis, this study takes BeiGene

LTD. as an example, by analysing the investor structure, stock price momentum in its different markets.

Explain the reasons for the BeiGene LTD.’s valuation difference between A-share and H-Shares from the

perspective of behavioural finance as well as analyse the feasibility of spatial arbitrage. The research shows,

difference investor structure in difference market, overconfidence of investors in the A-share market and

herding often causes stock valuations to deviate from normal ranges, which results in the valuation difference

between A-shares and H-shares. Besides, arbitrage limits and weak from efficiency would make spatial

arbitrage difficult to achieve. These results help listed companies understand the differences in valuations of

their products by different market investors as well as provide new perspectives and empirical basis for the

development of financial theory.

1 INTRODUCTION

As more and more companies accomplished dual

listing, due to different investor structure and

valuation methods, there is often a significant price

difference between A-shares and H-shares (Dong,

2024). The current mainstream research directions are

exploring the formation mechanism of the premium

of A-shares relative to H-shares, specific reasons for

price differences (Gong, 2018), and the possibility of

spatial arbitrage. Current research results include

different structure have impact on stock valuation

(Paul & Jie, 2017), the macroeconomic environment

has a significant impact on stock valuation (Liu &

Shrestha, 2008). The topics to be studied are the

possibility of spatial arbitrage, specific reasons for

price differences.

BeiGene LTD.’s Market capitalization in the A-

share and H-share is similar, and both A-share and H-

share are big cap stocks, its stock price is relatively

stable. Since BeiGene LTD. went public, there has

been a price difference between its A-share and H-

share for a long time. For example, On February 6,

2025, BeiGene LTD.’s A-share closing price was

a

https://orcid.org/0009-0000-1830-3841

198.9RMB, H-share closing price was 140. 9HKD.Its

A-H share premium rate was up to 50.77%. Also, On

October 25, 2024, BeiGene LTD.’s A-share closing

price was172.6RMB, H-share closing price was

123.8HKD. It’s A-H share premium rate was up to

46.74%. The company's main business is innovative

drug research and development. Its price difference

between A-share and H-share can well reflect the

impact of investor behavior in different markets. This

article takes BeiGene LTD. as an example, by

analyzing its price difference between A-share and H-

share, make people understanding the reason which

causes the different valuations in different market

better, and analyze the feasibility of spatial arbitrage,

then provide investment advices.

The analysis focuses on three aspects: Different

investor structure in different markets,

overconfidence of investors in the A-share market

and herding often causes stock valuations to deviate

from normal ranges (Almansour et al., 2023).

arbitrage limits and weak from efficiency would

make spatial arbitrage difficult to achieve (Shleifer &

Vishny, 1997). Valuation differences between the A-

share and H-share markets.

10

Wu, Z.

Impacts for Different Markets on Stock Evaluation: Evidence from BeiGene LTD.

DOI: 10.5220/0013831900004719

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 2nd International Conference on E-commerce and Modern Logistics (ICEML 2025), pages 10-14

ISBN: 978-989-758-775-7

Proceedings Copyright © 2025 by SCITEPRESS – Science and Technology Publications, Lda.

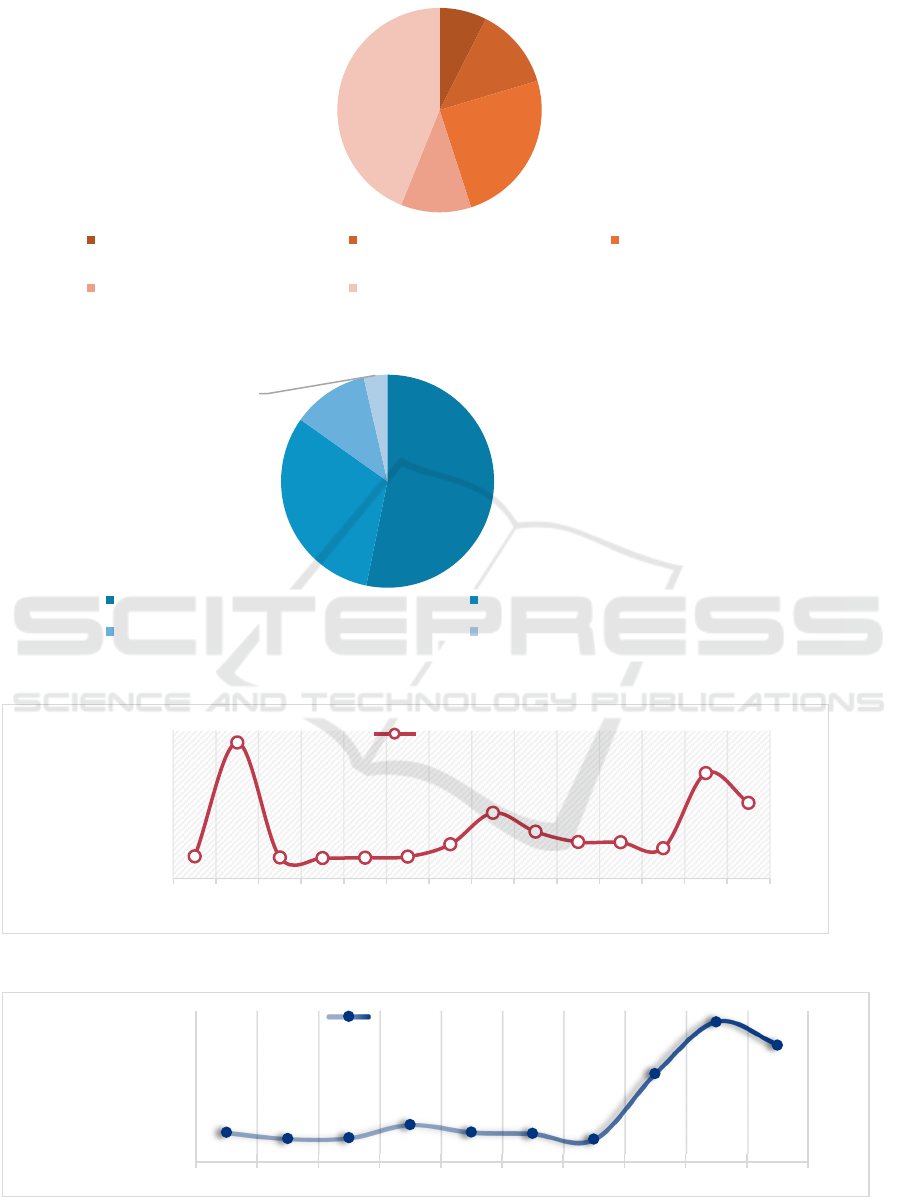

Figure 1: H-share market structure of data source from Wind (Photo/Picture credit: Original).

Figure 2: A-share market structure of data source from Wind (Photo/Picture credit: Original).

Figure 3: 9.19-10.9 H-share business volume of data source from Eastmoney (Photo/Picture credit: Original).

Figure 4: 9.19-10.9 A-share business volume of data source from Eastmoney (Photo/Picture credit: Original).

6%

10,30%

19,70%

8,90%

35,10%

Foreign individual investors local individual investors local institutional investors

Exchange participant Foreign institutional investors

53,20%

31,60%

11,60%

3,60%

General legal person Individual investor

Domestic professional organizations foreign investment

0

5

10

15

9.19 9.20. 9.23 9.24 9.25 9.26 9.27 9.3 10.2 10.3 10.4 10.7 10.8 10.9

Business Volume

Date

Business volume(100million)

0

5

10

15

9.19 9.20. 9.23 9.23 9.25 9.26 9.27 9.30. 10.8 10.9

Business volume

Date

Business volume(100million)

Impacts for Different Markets on Stock Evaluation: Evidence from BeiGene LTD

11

2 ANALYSES OF THE REASONS

FOR PRICE DIFFERENCE IN

DIFFERENT MARKETS

Different investor structure in different markets,

overconfidence of investors in the A-share market

and herding often causes stock valuations to deviate

from normal ranges. Based on the data shown in

Figure 1 and Figure 2, it can be known that in H-share

market, the proportion of institutional investors is

relatively high, and in A-share market, the proportion

of individual investor is relatively high. Institutional

investors’ decision making is more rational and

independent. However, individual investors’ decision

making often display overconfidence, and easily

influenced by herding (Nielsen et al., 2024), shown as

blindly follow the trend and buy when the price rise,

make the stock’s price beyond normal range.

Between September 19 and October 8, 2024, the

stock price of BeiGene LTD. was showing an upward

trend. As illustrated in the Figure 3, When the stock

price started to rise on September 20 and began to fall

on October 8, the business volume of H-share market

rose suddenly. It’s able to be seen that H-share

investors have a good grasp of market cycle, and their

decision is more independence. In contrast, the data

in Figure 4 demonstrates the business volume of A-

share market rose suddenly on September 30, daily

price momentum up to 12.96%. Soon afterwards, the

business volume reached a new peak on October 8

after the National Day holiday. When individual

investors saw the stock price rise; they would blindly

follow the trend and buy-in influenced by herding and

overconfidence. This makes the stock price of

BeiGene LTD. beyond normal range, make a price

difference between A-share and H-share.

The data of Table 1 of BeiGene LTD. 30-day price

momentum comparison shows, the valuation of H-

share is more stable. totally 30-day price momentum

of BeiGene Ltd.’s H-share was 0.22%. This reflects

institutional investors in H-share market who have

larger proportion make decision more rationally,

therefore, price of H-share will not deviate too much

from its original value; By contrast, the valuation of

A-share fluctuate greatly. Totally 30-day price

momentum of BeiGene Ltd.’s A-share is -6.05%. As

individual investors accounts for a large proportion of

A-share market, they are very sensitive to price

fluctuations and easily influenced by herding, which

will cause stock price to deviate from their original

value.

Table 1: 2023,3.1-3.30 BeiGene LTD. 30-day price

momentum comparison (data source: Eastmoney).

Date A-share price

momentum (%)

H-share price

momentum (%)

3.1 3.15 7.42

3.2 -0.94 0.07

3.3 -0.63 -0.07

3.6 2.8 0.7

3.7 -1.27 -1.45

3.8 -3.55 -3.16

3.9 1.22 -2.23

3.1 -2.37 -0.67

3.13 -1.12 0.9

3.14 8.94 6.67

3.15 0.51 1.94

3.16 -5.93 -6.4

3.17 -3.55 -2.77

3.2 0.64 -1.72

3.21 3.99 4.49

3.22 -2.18 -2.77

3.23 -2.36 -0.07

3.24 -1.11 0.53

3.27 0.12 -0.9

3.28 -1.52 -0.23

3.29 -0.18 0.91

3.3 -0.71 -0.97

Total -6.05 0.22

Individual investors account for a high proportion

of the A-share market, some of them overconfident in

their investment ability and judgment. When stock

price rise, they often show blindly optimistic attitudes,

plus the herd effect. So, when the market is trending

upward, a large number of individual investors will

follow tendency and buy-in; when market is trending

downward, there will be panic selling. So that the

stock price will deviate from their original value.

Investors in H-share market are mainly institutional

investors, they are more rational, investment

decisions are more independent, pay more attention

to risk control, and their valuations of stocks are more

conservative.

3 FEASIBILITIES FOR SPATIAL

ARBITRAGE

Limitation of arbitrage and weak from efficiency

would make spatial arbitrage difficult to achieve. The

main methods of space arbitrage for BeiGene LTD.

are: Simultaneous selling and buying of stocks or

Simultaneous short selling and purchasing of equities

in the A-share and H-share market. For the first

ICEML 2025 - International Conference on E-commerce and Modern Logistics

12

method, because Chinese stock market has price limit

rule, stocks are restricted or prevented from

exceeding a predetermined price level, which makes

it difficult for stock prices to effectively reach an

equilibrium level (Tan et al., 2021). Thus, leading to

price difference between BeiGene LTD.’s A-share

and H-share remaining unchanged, make spatial

arbitrage difficult to achieve. For the second method,

since Chinese stock market has Regulatory Short Sale

Prohibitions (Tan et al., 2021), investor can only short

celling through securities lending. But the handling

fee of securities lending is relatively high. In the case

of little change in the price difference between

BeiGene LTD.’s A-share and H-share, profits will be

consumed by excessive costs. Therefore, arbitrageurs

will give up arbitrage opportunities due to high costs.

Related studies have shown that the Chinese stock

market belongs to a weak from efficiency (Chao et al.,

2022), one can’t use the past price to predict the future

price due to the stock price change randomly, which

means the technical analysis will lose its effect, the

variation of new price only depends on the newly

emerging information. The unpredictability of the

price will make rational investors miss or give up the

opportunity of arbitration.

Behavioural Finance considered that the cost of

transportation, storage and transaction fees will limit

the behaviour of arbitrager. At the same time, the

spatial arbitrage involves the risks of exchange rate

fluctuation and policy change. Behavioural Finance

pointed out that arbitragers’ risk-bearing capability

are limited. Even if the stock price is departing from

the value, arbitrager may give up the potential

arbitrate opportunity due to excessive cost and risk

aversion.

4 ANALYSES OF THE

VALUATION DIFFERENCES

BETWEEN A-SHARE AND

H-SHARE MARKETS

Regarding to the analysis on the valuation differences

between domestic and foreign financial markets,

there are mainly six assumptions among the existing

explanations. First, Because the two markets are

segmented, onshore and offshore investors may need

different risk premiums (and hence different returns)

(Fernald & Rogers, 2002). Second, because their

investment options differ, onshore and offshore

investors may face distinct demands (Sun & Tong,

2000). Third, the discrepancies in liquidity

circumstances between the financial markets in Hong

Kong and the Mainland are also linked to the pricing

discrepancy (Chan & Kwok 2005). Forth, the

information obtained by onshore and offshore

investors differs, resulting in divergent valuations of

the same firm due to asymmetric knowledge

(Chakravarty et al., 1998). Fifth, the price disparity is

related to differences in aggregate market conditions

between the Mainland and Hong Kong financial

markets (Wang & Jiang, 2004). Finally, the pricing

disparity may also be attributed to macroeconomic

factors on the mainland.

5 CONCLUSIONS

To sum up, this study takes BeiGene LTD. as an

example, after analysis, it was found that Individual

investors account for a high proportion of the A-share

market, some of them overconfident in their

investment ability and judgment. When stock price

rise, they often show blindly optimistic attitudes, plus

the herd effect. Hence, when the market is trending

upward, a large number of individual investors will

follow tendency and buy-in; when market is trending

downward, there will be panic selling. In this case, the

stock price will deviate from their original value.

Investors in H-share market are mainly institutional

investors, they are more rational, investment

decisions are more independent, pay more attention

to risk control, and their valuations of stocks are more

conservative. Thus, differences in investor behaviour

and investor structure between A-shares and H-shares,

is the main factor causing the price difference

between A shares and H shares. Although there is a

price difference, as limitation of arbitrage and weak

from efficiency would make spatial arbitrage difficult

to achieve, arbitrager may give up the potential

arbitrate opportunity due to excessive cost and risk

aversion. The main contribution of this article is

identifying the factors that cause the difference in

valuation between A-share and H-share markets. This

article also analysed the feasibility of using valuation

differences for space arbitrage. In order to help

investors better understand the reasons for the price

differences between the A-share and H-share markets,

clarify investment strategy. Nevertheless, due to

limitations on data sources and research scope, this

research is unable to represent all listed companies in

multiple locations. In the future, researchers should

turn their attention to the futures and options markets,

which offer more opportunities.

Impacts for Different Markets on Stock Evaluation: Evidence from BeiGene LTD

13

REFERENCES

Almansour, B. Y., Elkrghli, S., Almansour, A. Y., 2023.

Behavioral finance factors and investment decisions: A

mediating role of risk perception. Cogent Economics &

Finance, 11(2), 2239032.

Chakravarty, S., Sarkar, A., Wu, L., 1998. Information

asymmetry, market segmentation and the pricing of

cross-listed shares: theory and evidence from Chinese

A and B shares. Journal of International Financial

Markets, Institutions and Money, 8(3-4), 325-356.

Chan, K., Kwok, J. K., 2005. Market segmentation and

share price premium: evidence from Chinese stock

markets. Journal of Emerging Market Finance, 4(1),

43-61.

Chao, Y., Luo., Q, Feng, Y., 2022. Research on the

Effectiveness of China’s Stock Market. Finance, 12,

195.

Dong, W., 2024. Formation Mechanism and Dynamic

Changes of the AH Premium: An Empirical Analysis

Based on Multi-factor Models. Journal of Fintech and

Business Analysis, 1, 31-35.

Fernald, J., Rogers, J. H., 2002. Puzzles in the Chinese

stock market. Review of Economics and Statistics,

84(3), 416-432

Gong, C., 2018. A Study on the Impact of the Shenzhen-

Hong Kong Stock Connect on the Price Difference

between A and H Shares. Master's Thesis, Shanghai

International Studies University.

Liu, M. H., Shrestha, K. M., 2008. Analysis of the long‐

term relationship between macro‐economic variables

and the Chinese stock market using heteroscedastic

cointegration. Managerial Finance, 34(11), 744-755.

Nielsen, K. R., Kaiser, M., Glückstad, F. K., 2024. The

effect of macroscopic herd inputs on individual

investment behaviour. Scientific Reports, 14(1), 3302.

Paul, B., Jie, Y., 2017. The effects of institutional investor

objectives on firm valuation and governance, Journal

of Financial Economics, 126, 171-199.

Shleifer, A., Vishny, R. W., 1997. The limits of arbitrage.

The Journal of finance, 52(1), 35-55.

Sun, Q., Tong, W. H., 2000. The effect of market

segmentation on stock prices: The China syndrome.

Journal of Banking & Finance, 24(12), 1875-1902.

Tan, X., Zhang, Z., Zhao, X., Wang, C., 2021. Investor

sentiment and limits of arbitrage: Evidence from

Chinese stock market. International Review of

Economics & Finance, 75, 577-595.

Wang, S. S., Jiang, L., 2004. Location of trade, ownership

restrictions, and market illiquidity: Examining Chinese

A-and H-shares. Journal of Banking & Finance, 28(6),

1273-1297.

ICEML 2025 - International Conference on E-commerce and Modern Logistics

14