Application of Planned Behaviour Theory in Chinese Market

Yixin Dong

a

Qingdao Innovation School of Qingdao Experimental High School Education Group,69 Shuoyang Road, Qingdao, China

Keywords: Theory of Planned Behaviour, Cultural Differences, Foreign Exchange Market, Investment Decision,

Behavioural Preference.

Abstract: The Theory of Planned Behaviour, as a famous theory used to predict behaviour, also takes part in Chinese

economic market. This study aims to explore the application of TPB theory in specific research aspects such

as Chinese stock market, fund investment and personal finance and analyse the influencing factors and

mechanisms of specific research variables such as investor sentiment, risk appetite and investment decision.

This essay begins with the introduction of basic definition of TPB theory and connect them with investment

decision and actual behaviour. Furthermore, this research explores and lists the limitation of TPB theory and

provide future solution eventually. This research improves the universality and flexibility of its findings,

guaranteeing their application in distinct culture and policy contexts by including the surveys from other

countries. Ultimately, the significance and future expectations of theory and practice are discussed, expanding

the application of TPB theory with other fields. These results help to deepen the understanding of investor

behaviour and provide theoretical basis for financial institutions to formulate marketing strategies and investor

education programs.

1 INTRODUCTION

In the financial market which full of uncertainty, the

decision-making behaviour of investors directly

influents asset prices and market efficiency.

Traditional financial theory assumes that investors

are perfectly rational and can make optimal decisions

based on diverse available information. However,

more and more empirical studies show that investor

behaviour often deviates from rational expectations,

showing various cognitive biases and emotional

characteristics.

The Theory of Planned Behaviour (TPB), which

proposed by Icek Ajzen in 1991, is an important

theoretical framework for explaining and predicting

human behaviour in the field of social psychology

(Ajzen & Driver, 1992). TPB theory is a variant of

Theory of Reasoned Action (TRA), which mentioned

by Ajzen and Fishbein, means that an individual's

behavioural intention for a particular behavioural

preference is influenced by the subjective norms of

whether the individual agrees with the attitude and

whether others support it. Although TRA has

considerable explanatory power for the behaviour

decision-making process, it is still limited (Hassan et

a

https://orcid.org/0009-0004-0718-329X

al., 2015). In reality, many behaviours are not

completely controlled by one's own will. Therefore,

Azen made improvements based on TRA and

proposed the TPB. The biggest difference between

planned behaviour theory and rational behaviour

theory is that planned behaviour theory overcomes

the limitation that rational behaviour theory cannot

reasonably explain behaviours that are not completely

controlled by will, and adds PBC (perceived control

belief) variables representing other irrational factors

into the original theoretical framework. Form TPB.

Therefore, when analysing behavioural intention and

actual behaviour, planned behaviour theory is

influenced not only by attitude and subjective norm,

but also by perception of behavioural control.

2 DEFINITIONS OF TPB

THEORY

Traditional TPB has focused primarily on cognitive

factors (attitudes, subjective norms, and perceived

behavioural control), but in recent years research has

begun to incorporate affective factors into models. To

be specific, an individual's emotional echoes to an

Dong, Y.

Application of Planned Behaviour Theory in Chinese Market.

DOI: 10.5220/0013829500004719

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 2nd International Conference on E-commerce and Modern Logistics (ICEML 2025), pages 5-9

ISBN: 978-989-758-775-7

Proceedings Copyright © 2025 by SCITEPRESS – Science and Technology Publications, Lda.

5

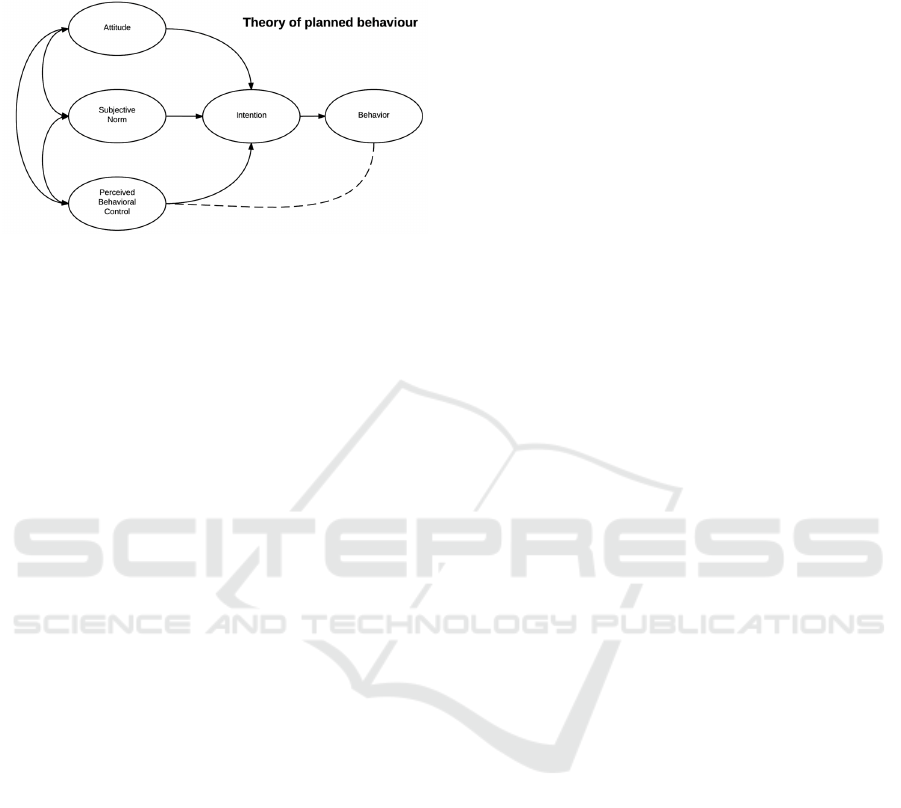

action may significantly influences behavioural intent

and actual behaviour. The research framework of this

theory is shown in Fig. 1.

Figure 1: Key Component (Photo/Picture credit: Original).

Nowadays, TPB theory is applicated increasingly

in investment field in order to explain and predict

decision-making behaviour of investors. Compared to

traditional financial theory, TPB theory can better

clarify the irrational components of investor

behaviour, such as herd behaviour, overconfidence

and loss aversion (Ajzen, 2020). TPB believes that

behavioral intention is the result of attitude,

subjective norm and perceived behavioral control,

and behavioral intention is a key factor in predicting

actual behaviour. TPB theory provides a new way to

understand market anomalies, formulate investment

strategies and educate investors by analysing

investors' behaviour attitudes, subjective norms and

perceived behaviour control (Lacasse et al., 2024).

3 THE INFLUENCE OF TPB

THEORY IN CHINA'S

INVESTMENT DECISION

TPB theory has a reflective influence on the decision-

making mode of Chinese investors. Investors are able

to evaluate their own decision-making process more

completely by introducing concepts such as attitudes,

subjective norms, and perceived behavioural control.

For instance, in stock investment decisions, TPB

theory can help investors identify and correct

cognitive biases such as overconfidence and herding.

In the aspect of risk management, the application

of TPB theory has also achieved significant results.

TPB theory can help investors formulate and improve

more reasonable risk control strategies through

developing investors' awareness of their own control

ability. However, the common risk aversion tendency

of Chinese investors might influence the application

effect of TPB theory, which needs to be adjusted and

optimized in practice (Kobbeltved & Wolff, 2009).

4 THE INFLUENCE OF

CULTURAL DIFFERENCES ON

THE APPLICATION OF TPB

THEORY

Diverse Cross-cultural have slightly different

responding norms into the theory of planned

behaviour. The characteristics of Chinese culture

have exerted an important impact on the application

of TPB theory. Collectivist tendencies are a

prominent feature of Chinese culture, which can

make investors more susceptible to social norms and

the opinions of others, thus influencing their

investment decisions. To be specific, in the stock

market, Chinese investors may be more inclined to

follow "expert" opinions or popular choices, a pattern

of behaviour that requires special concern according

to the framework of TPB theory.

Risk aversion is another important characteristic

of Chinese investors. This cultural tendency may

influence investors' assessment of risk perception and

control ability, thus affecting the application effect of

TPB theory (Morren & Grinstein, 2021). In practice,

it is necessary to adapt the theory to the risk appetite

of Chinese investors in order to improve the

applicability and prediction accuracy of TPB theory.

5 THE APPLICATION OF TPB

THEORY IN CHINA'S

FOREIGN EXCHANGE

MARKET

The uniqueness and complexity of China's foreign

exchange market provide ample research scenarios

for the application of TPB theory. TPB theory shows

significant advantages in forex market forecasting,

which can more accurately predict exchange rate

inclinations and market fluctuations by analysing

investors' attitudes, subjective norms and perceived

behaviour control. Considering the sensitivity of

Chinese investors to policy changes and herd

mentality can improve the accuracy of prediction

when studying the movement of RMB exchange rate.

Based on the theory of Planned behaviour (TPB),

this paper applies it to the study of investors' socially

responsible investing (SRI) behaviour in Chinese

stock market, and discusses the influence of various

factors and extended variables in the TPB model on

investors' SRI intentions and behaviours (Zhang &

Huang, 2024). Despite stock market and forex market,

TPB theory also plays an important role in the real

ICEML 2025 - International Conference on E-commerce and Modern Logistics

6

estate market as depicted in Fig. 2. Yanz concluded

in 2024 that the real estate decision affected by

combining the TPB theory with the specific factors,

puts forward the influence of attitude on the purchase

intention (Yanz & Ming, 2024). According to Yanz,

TPB theory helps to fully understand the

psychological and social factors in the decision-

making process of real estate consumers.

However, the application of TPB theory in

China's foreign exchange market also faces some

challenges. China's foreign exchange market is

subject to strict regulation and policy influences,

which can lead to a deviation between investors'

perceived behavioral control and their actual control

ability. In addition, the decision-making process of

Chinese investors may be influenced by traditional

culture and collectivist thinking, which require

special consideration while applying TPB theory.

Figure 2: The application ratio of TPB theory in different

investment fields in China (Photo/Picture credit: Original).

6 LIMITATIONS

Although TPB theory has significant value in

explaining and predicting investment behaviour, it

also has some limitations in its practical application.

These limitations might impress its explanatory

power and predictive accuracy, especially in the

complex Chinese market environment.

Firstly, TPB theory principally focuses on logical

inference, but ignores the influence of external

environmental factors on behaviour. China's

investment market is greatly affected by policies such

as government regulation and monetary policy

changes. These external factors may significantly

affect investor behaviour, but TPB theory does not

directly include these variables. For instance, in real

estate investment, the government's purchase

restriction policy may directly change the behaviour

of investors, and TPB theory is difficult to fully

explain such policy-driven behaviour changes

(Hemavathy Ramasubbian, 2018). Not only China,

but also other developing counties particularly India,

where development of the real estate industry is late,

and attitude is the most important factor affecting the

investment intention of this large population of

individual real estate investors (Singh, 2024).

Furthermore, TPB theory originated in a Western

cultural context, and its core assumptions may not be

fully applicable to markets with collectivist cultural

backgrounds such as China. Chinese investors

generally have a strong tendency of collectivism and

high-risk aversion, and these cultural factors may

significantly correspond to their attitudes, subjective

norms and perceived behaviour control, but TPB

theory does not fully consider these cultural

differences. For instance, Chinese investors tend to

rely more on social norms such as the opinions of

friends and family or expert advice, and TPB theory

may underestimate the importance of such social

effects.

Secondly, TPB theory is limited explanatory

power to dynamic behaviour because it primarily

focuses on behavioral intention at a certain point in

time, but investment behaviour is often dynamic and

impacted by a variety of factors for a long time. The

attitude and behaviour of investors may change over

time, during market fluctuations or economic cycles,

and TPB theory is difficult to capture such kinds of

dynamic changes. Hence, investors' risk appetite may

change significantly after a stock market crash, but

TPB theory cannot directly explain such long-term

behavioral changes.

Thirdly, the measurement of perceived behaviour

control is finite. The "perceived behavioral control"

in TPB theory depends on the subjective judgment of

the individual, but the subjective judgment may be

deviated from the actual control ability (Sniehotta,

Presseau, 2013). Chinese investors may overestimate

or underestimate their ability to control, when

participating in high-risk investments such as peer-to-

peer lending or digital currencies. As a result, this bias

may lead to inaccurate prediction results from TPB

theory. At the same time, TPB theory assumes that

individuals are rational, but in actual investment

behaviour, emotions and irrational factors may have

an important impact on decision-making. Chinese

investors generally have irrational behaviours such as

"chasing up and killing down" and "herding effect",

which are difficult to be fully explained by TPB

stock market forex market

real estate market other market

Application of Planned Behaviour Theory in Chinese Market

7

theory. To be specific, during a stock market bubble,

investors' emotions may dominate their decisions,

and TPB theory cannot directly incorporate sentiment

variables. Change Theories Collection refers that

humans sometimes act emotionally and are not

entirely rational, which makes the rational

assumption of the theory controversial. In addition,

the attitude and behaviours of Chinese investors may

be influenced by social expectation bias, which is a

deviation may lead to inaccurate analysis results of

TPB theory.

TPB theory is of great value in explaining and

predicting investment behaviours, but its limitations

should not be ignored. In the application of the

Chinese market, TPB theory needs to be adjusted and

optimized in combination with localization

characteristics, such as incorporating external

environmental factors, considering cultural

differences, and introducing emotional variables.

Future studies can try to combine TPB theory with

other theories such as behavioral finance and cultural

psychology to improve its explanatory power and

prediction accuracy.

7 PROSPECTS

TPB theory has shown great value in explaining and

predicting investor behaviours, but its application in

the Chinese market still has limitations, and future

research needs to be further explored in the following

directions. TPB theory needs to be combined with

behavioral finance, cultural psychology and other

disciplines to make up for its neglect of emotional

factors and external environment. For example, the

introduction of emotional variables can enhance the

explanatory power of irrational behaviours, while the

framework combined with behavioral finance can

more comprehensively analyse decision changes in

dynamic markets. The collectivist culture and risk

aversion tendency of Chinese market significantly

affect investors' subjective norms and perceived

behaviour control. Future studies need to incorporate

cultural dimensions and traditional values into the

TPB model and develop localized measurement tools

to enhance the applicability of the theory in cross-

cultural scenarios. China's financial market is subject

to strong policy intervention, and these external

factors may weaken the correlation between

perceived behavioral control and actual ability. The

future model should include policy variables to

analyse how they adjust the relationship between

three factors to better fit the realistic scenario.

8 CONCLUSIONS

In conclusion, TPB theory is of great value in

explaining and predicting investment behaviour, but

it needs to consider the influence of cultural

differences and external environmental factors in its

application in the Chinese market. This article

discussed the key component and fundamental

significance of TPB theory through summarizing

experiments and studies. Even though TPB theory is

one of the primary prediction theories, it has

subjective limitation. The application prospect of

TPB theory will be broader by combining the

characteristics of localization with other theories.

Overall, this research not only responses to previous

studies, but also provides profound collection and

analysis on the relationship between behaviour and

TPB theory, contributing precious insights to the

fields of Chinese market.

REFERENCES

Ajzen, I., 2020. The theory of planned behavior: Frequently

asked questions. Human behavior and emerging

technologies, 2(4), 314-324.

Ajzen, I., Driver, B. L., 1992. Application of the theory of

planned behavior to leisure choice. Journal of leisure

research, 24(3), 207-224.

Hassan, L. M., Shiu, E., Parry, S., 2015. Addressing the

cross

‐

country applicability of the theory of planned

behaviour (TPB): A structured review of multi

‐

country TPB studies. Journal of Consumer Behaviour,

15(1), 72–86.

Kobbeltved, T., Wolff, K., 2009. The Risk-as-feelings

hypothesis in a Theory-of-planned-behaviour

perspective. Judgment and Decision Making, 4(7),

567–586.

Lacasse, H., Buzas, J., Kolodinsky, J., Mark, T., Hill, R.,

Snell, W., Darby, H., 2024. Determinants of behavior

towards hemp-based products: an application of the

theory of planned behavior. British Food Journal,

126(13), 394-414.

Morren, M., Grinstein, A., 2021. The cross-cultural

challenges of integrating personal norms into the

Theory of Planned Behavior: A meta-analytic

structural equation modeling (MASEM) approach.

Journal of Environmental Psychology, 75, 101593.

Singh, A., Kumar, S., Goel, U., Johri, A., 2024. Predictors

of investment intention in real estate: Extending the

theory of planned behavior. International Journal of

Strategic Property Management, 28(6), 349–368.

Sniehotta, F. F., Presseau, J., Araújo-Soares, V., 2013. Time

to retire the theory of planned behaviour. Health

Psychology Review, 8(1), 1–7.

ICEML 2025 - International Conference on E-commerce and Modern Logistics

8

Yanz, Y., Ming, C. W., 2024. Understanding Consumer

Decision-Making in Real Estate: An Integrative

Analysis using the Theory of Planned Behavior. Journal

of Digitainability Realism & Mastery (DREAM),

3(08), 33–46.

Zhang, X., Huang, C., 2024. Investor characteristics,

intention toward socially responsible investment (SRI),

and SRI behavior in Chinese stock market: The

moderating role of risk propensity. Heliyon, 10(14),

e34230.

Application of Planned Behaviour Theory in Chinese Market

9