Research on Sales Forecasting of New Energy Vehicles Based on

Interbrand and SARIMA-BP Neural Network

Ruiqi Luo

a

School of Science, Minzu University of China, Beijing, China

Keywords: New Energy Vehicle Sales, Interbrand Model, SARIMA-BP Neural Network, Brand Influence, Sales

Forecasting Model.

Abstract: With the rapid development of the new energy vehicle market, accurate sales forecasting is crucial for industry

decision-making. This study proposes a forecasting method that combines the Interbrand model with the

Seasonal Autoregressive Integrated Moving Average - Back Propagation Neural Network (SARIMA-BP

neural network) to quantify brand influence and improve forecasting accuracy. Firstly, based on the improved

Interbrand model, the brand value of new energy vehicles is quantified from financial dimensions (new energy

business revenue, average vehicle price) and brand strength (segment market share, R&D investment, search

index) to solve the problem of data separation difficulties in traditional models. Secondly, a SARIMA-BP

neural network fusion model is constructed. SARIMA is used to process the linear and seasonal characteristics

of the sales time series, and the BP neural network is used to fit the nonlinear part, and brand influence is

introduced as the key independent variable. The empirical analysis uses 48 sets of monthly data from BYD,

Tesla, Li Auto, and NIO from 2021 to 2024 as samples. The results show that the fusion model is significantly

better than the single SARIMA model and the combined model that does not incorporate brand value in terms

of Root Mean Squared Error (RMSE) and Mean Absolute Percentage Error (MAPE), verifying the key role

of brand influence in sales forecasting. This research provides a new method for forecasting new energy

vehicle sales that takes into account both brand effects and data characteristics, and has reference value for

corporate market strategy formulation.

1 INTRODUCTION

As an important pillar of the national economy, the

automobile industry not only directly drives the

development of upstream and downstream industrial

chains but also profoundly affects the decision-

making of consumers, enterprises, and governments.

In recent years, with the development and progress of

new energy vehicle technology, the sales of new

energy vehicles have steadily increased year by year.

How to accurately predict the sales of new energy

vehicles based on market demand has become a

research hotspot (Chen 2011; Fan, 2017). At present,

the prediction methods applied to automobile sales

are mainly divided into two categories. The first

category is single model prediction, such as Back

Propagation Neural Network (BP neural network),

Seasonal Autoregressive Integrated Moving Average

a

https://orcid.org/0009-0009-9825-3252

(SARIMA) method, grey model, etc. For example, Xu

et al. (2021) used the Convolutional Neural Network

(CNN) to construct a stock trend prediction model and

obtained relatively accurate results. Xu et al. (2021)

completed the prediction of surface water quality

based on a BP neural network. Zhang et al. (2011)

used the SARIMA model to extract the monthly

frequency fluctuation characteristics in inflation,

effectively reducing the prediction error. The second

category is prediction based on fusion models, such

as the fusion of neural network and particle swarm

algorithm, the fusion of principal component analysis

and neural network, etc. For example, Zhao et al.

(2016) proposed a Seasonal Autoregressive

Integrated Moving Average - Group Method of Data

Handling (SARIMA-GMDH) combined

forecasting method to forecast the Consumer Price

Index (CPI) monthly series, effectively combining

Luo, R.

Research on Sales Forecasting of New Energy Vehicles Based on Interbrand and SARIMA-BP Neural Network.

DOI: 10.5220/0013826600004708

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 2nd International Conference on Innovations in Applied Mathematics, Physics, and Astronomy (IAMPA 2025), pages 397-401

ISBN: 978-989-758-774-0

Proceedings Copyright © 2025 by SCITEPRESS – Science and Technology Publications, Lda.

397

two single models with complementary advantages to

improve the forecasting accuracy. In general, a single

method has certain limitations in its adaptability to

data, while the fusion model has significant

advantages in matching degree and prediction

accuracy. Taking Seasonal Autoregressive Integrated

Moving Average - Back Propagation Neural Network

(SARIMA-BP) as an example, a single SARIMA

only processes the linear part of the time series data.

For its residual part, the BP neural network can be

used for learning and fitting to achieve the fitting of

the nonlinear part, ultimately improving the

prediction accuracy.

In addition, the quantification of automobile brand

influence is also a focus of this study. In 1974, John

Murphy developed an evaluation method, the

Interbrand Model. The brand excess return method

proposed by Li et al. (2016) optimizes the Interbrand

model. Based on this optimization method, this study

applies the Interbrand model to the quantitative study

of the brand influence of new energy vehicles and

regards brand influence as an important factor in

predicting the sales of new energy vehicles (Pi, Zhao

& Pen, 2016).

The forecast of new energy vehicle sales includes

both cyclical and seasonal related data and non-linear

related data. Therefore, this study adopts the

prediction method of the SARIMA-BP neural

network and takes into account the brand influence

obtained by using the Interbrand model. Based on

existing literature and research, this study will explore

in depth the factors that influence car prices and focus

on analyzing how to quantify the key factor of brand

influence, aiming to provide new ideas for new

energy vehicle sales forecasts and speculate on its

possible market trends.

2 METHODS

2.1 Data Source

This study takes the four major new energy vehicle

brands BYD, Tesla, Li Auto, and NIO as the research

objects, and collects data on the number of

automobile sales, average sales price, and market

share of each brand in each month from 2021 to 2024

from automobile data websites such as Autohome and

Autohome (Li et al., 2021). At the same time, this

study collects the revenue data of new energy

business and Research and Development Investment

(R&D investment) data of each automaker in its

annual financial reports and news reports, and collects

its search index for each month. In addition, this study

collects the consumer price index (CPI) for each

month from 2021 to 2024 and takes it into account.

The missing data are interpolated using the

interpolation method to obtain a complete data set of

48 months from 2021 to 2024.

2.2 Indicator Selection and Description

According to the Interbrand brand influence

quantification method and the SARIMA-BP neural

network prediction model used in this study, the

modeling indicators are selected as shown in Tables 1

and 2.

Table 1: Interbrand brand influence data

Data t

yp

es Indicator name

Financial

dimensions

New ener

gy

business revenue

Average price of vehicle models

Brand dimension

Market share by segment

R&D Investment

Search Index

Table 2: SARIMA-BP neural network sales forecast data

Data t

y

pes Core indicators

Dependent variable Brand sales

Independent

variable

Brand influence

(quantitative)

Avera

g

e sales price

CPI Index

Polic

y

subsid

y

2.3 Brand Influence Quantification

Method (Interbrand Model)

The traditional Interbrand model first predicts the

brand's future excess returns and discounts the excess

returns using the brand return index. It then quantifies

the brand strength score through brand strength factor

analysis and uses the S-curve function to derive the

brand multiplier.

𝐵𝑟𝑎𝑛𝑑 𝑣𝑎𝑙𝑢𝑒 = 𝑏𝑟𝑎𝑛𝑑 𝑟𝑒𝑣𝑒𝑛𝑢𝑒 ×

𝑏𝑟𝑎𝑛𝑑 𝑚𝑢𝑙𝑡𝑖𝑝𝑙𝑖𝑒𝑟;

𝐵𝑟𝑎𝑛𝑑 𝑏𝑒𝑛𝑒𝑓𝑖𝑡𝑠 = 𝑐𝑜𝑟𝑝𝑜𝑟𝑎𝑡𝑒 𝑏𝑒𝑛𝑒𝑓𝑖𝑡𝑠,×

𝑏𝑟𝑎𝑛𝑑 𝑏𝑒𝑛𝑒𝑓𝑖𝑡𝑠 𝑖𝑛𝑑𝑒𝑥. (1)

The improved Interbrand model takes company

brands as the evaluation object and follows the

principle of a small amount of data and easy access in

data selection, which solves the problem of difficulty

in separating product brand benefits. The excess

pricing method is used to calculate the brand's excess

return. The difference between the after-tax profit and

the industry average in the past three years is

multiplied by the sales revenue, and an adjustment

IAMPA 2025 - The International Conference on Innovations in Applied Mathematics, Physics, and Astronomy

398

coefficient 𝛿 (composed of the brand management

factor M and the system risk factor R) is introduced

to reduce the uncertainty of future return forecasts. In

constructing the brand multiplier, this study

comprehensively evaluate brand strength from the

perspective of the enterprise (factors such as brand

history, status, and trends, with differentiated weights

set according to brand type) and the consumer

(indicators such as brand awareness, loyalty, and

quality perception, using fuzzy evaluation methods),

and calculate the brand multiplier using Interbrand's

S-curve function relationship. The improved

Interbrand model has the advantages of scientific and

reasonable data selection, strong targeted evaluation

objects, comprehensive multi-perspective factors, and

high credibility of evaluation results, which can more

effectively reflect the true value of the brand.

According to Interbrand's brand value evaluation

formula, combined with new energy vehicle

enterprise data, brand benefits and excess benefits are

calculated. The brand contribution index is calculated

through the search index (a brand search

index/industry's highest search index), and multiplied

by the quarterly revenue to get the brand's direct

benefits:

𝐵𝑟𝑎𝑛𝑑 𝑟𝑒𝑣𝑒𝑛𝑢𝑒 = 𝑟𝑒𝑣𝑒𝑛𝑢𝑒×

(2)

Excess profit is calculated based on the difference

between brand profit margin and industry average

profit margin, and corrected by adjustment coefficient

δ (combining R&D investment stability and market

share fluctuations):

𝐸𝑥𝑐𝑒𝑠𝑠 𝑟𝑒𝑡𝑢𝑟𝑛 = (𝑏𝑟𝑎𝑛𝑑 𝑝𝑟𝑜𝑓𝑖𝑡 𝑚𝑎𝑟𝑔𝑖𝑛 −

12%) × 𝑞𝑢𝑎𝑟𝑡𝑒𝑟𝑙𝑦 𝑟𝑒𝑣𝑒𝑛𝑢𝑒 × 𝛿 (3)

Where,

𝛿=0.6 × 𝑅&𝐷 𝑖𝑛𝑣𝑒𝑠𝑡𝑚𝑒𝑛𝑡 𝑠𝑡𝑎𝑏𝑖𝑙𝑖𝑡𝑦 +

0.4 × 𝑚𝑎𝑟𝑘𝑒𝑡 𝑠ℎ𝑎𝑟𝑒 𝑠𝑡𝑎𝑏𝑖𝑙𝑖𝑡𝑦. (4)

The brand strength score (0-100 points) is

converted into a brand multiplier (reflecting future

earnings risk) through Interbrand's classic S-curve

function:

𝐵𝑟𝑎𝑛𝑑 𝑀𝑢𝑙𝑡𝑖𝑝𝑙𝑖𝑒𝑟=

√

2𝐼

(𝐼≤50)

10 +

√

2𝐼− 100

(

𝐼>50

)

(5)

Final brand value = excess return × brand

multiplier.

A quantitative analysis of new energy vehicle

brands from 2021Q1 to 2024Q4 based on the

Interbrand model shows that Tesla and BYD have

long been leading in brand value (US$28.178 billion

and US$10.488 billion in 2024Q4, respectively)

thanks to their high search index, significant market

share (BYD's average is 34.6%) and R&D investment

(BYD's average annual investment is 11.56 billion

yuan and Tesla's is 7.51 billion yuan). Among them,

Tesla's technology premium and BYD's scale

advantage are the core driving factors; Li Auto

achieved growth through precise positioning (brand

value of US$6.782 billion in 2023Q4), while NIO

performed relatively weakly due to insufficient

market share and limited R&D, and its profit margins

in some quarters were lower than the industry average

(Gui et al., 2021).

2.4 SARIMA-BP Neural Network

Prediction Model

Model principle: Decompose the automobile sales

time series into the linear part 𝐿

and the nonlinear

part 𝑆

, respectively adopt the SARIMA model and

BP neural network to model, and the final prediction

value is the sum of the prediction results of the two

parts 𝑋

=𝐿

+𝑆

.

The SARIMA model is used to deal with the linear

characteristics and seasonal fluctuations of time

series. The non-stationary series is converted into a

stationary series through seasonal differences, and the

model order is determined using the AIC or SBC

method. After completing parameter estimation and

significance testing, the linear part 𝐿

is fitted and

predicted.

The BP neural network model takes the

influencing factors (CPI index, average price, brand

value, new energy policy subsidies) as the input layer

for the nonlinear characteristics of the time series, and

realizes the modeling and prediction of the nonlinear

part 𝑆

through the nonlinear transformation of the

hidden layer and the gradient descent weight

adjustment of the output layer. The method evaluates

the performance through the Root Mean Squared

Error (RMSE) and Mean Absolute Percentage Error

(MAPE).

First, use the Augmented Dickey-Fuller (ADF)

test to test the stationarity of the original time series.

If the original series is non-stationary, perform first-

order differences on the series until the series reaches

a stationary state. During the difference process,

record the order d of the non-seasonal difference, but

to avoid excessive difference, limit the maximum

value of d to 2. For the series after non-seasonal

difference, check whether its seasonal part (with a

period of 12 months) is stationary. If not, perform

seasonal difference, record the order D of the seasonal

difference, and limit the maximum value of D to 1.

The non-random fluctuation series of new energy

vehicle sales volume is converted into a stationary

series using differential operation to obtain trend

Research on Sales Forecasting of New Energy Vehicles Based on Interbrand and SARIMA-BP Neural Network

399

information and related cycle information. The end

range of the SARIMA model is determined, and the

optimal model order is determined by the Akaike

Information Criterion (AIC). The optimal modeling

parameters of each car company are shown in Table 3.

Table 3: SARIMA model parameters for different car

companies

Car companies SARIMA parameters (p,d,q)

(P,D,Q)

s

BYD (0,1,2)(0,0,2)

12

Tesla

(

0,1,0

)(

0,1,2

)

12

Li Auto

(

0,1,2

)(

0,0,2

)

12

NIO (0,1,2)(0,0,2)

12

In order to build a new energy vehicle sales

forecasting model, this study combines SARIMA

residuals to build a BP neural network model. The

residuals between the fitted values and the true values

of the SARIMA model are calculated. These residuals

contain nonlinear information in the time series that

cannot be captured by the SARIMA model and can be

used as input data for the BP neural network.

The network structure is set to have 4 input layer

nodes, corresponding to 4 features; the hidden layer

contains two layers, 32 nodes (activation function is

Rectified Linear Unit (ReLU)) and 16 nodes

(activation function is ReLU), and a Dropout layer

(deactivation rate 0.2) is added after the first hidden

layer to prevent overfitting; the output layer has 1

node, matching the sales prediction target.

When compiling the model, the Adam optimizer

is selected, and the loss function is the mean square

error function. During the training process, the early

stopping callback (EarlyStopping) is set to monitor

the validation loss, and the patience value is 10; the

training rounds (epochs) are 200, the batch size

(batch_size) is 8, and the validation set ratio is 0.2.

Finally, the residual of the SARIMA model is learned

by training the BP neural network to achieve residual

prediction, thereby optimizing the overall sales

forecast results (Wang et al., 2021).

3 EXPERIMENTAL RESULTS

3.1 Model Comparison and Result

Analysis

The monthly sales volume of new energy vehicles

from 2021 to 2024 constitutes a time series, with a

total of 48 groups of experimental samples. Based on

Interbrand's quantitative brand influence and the

SARIMA-BP neural network model, simulation

prediction is performed. The prediction results of

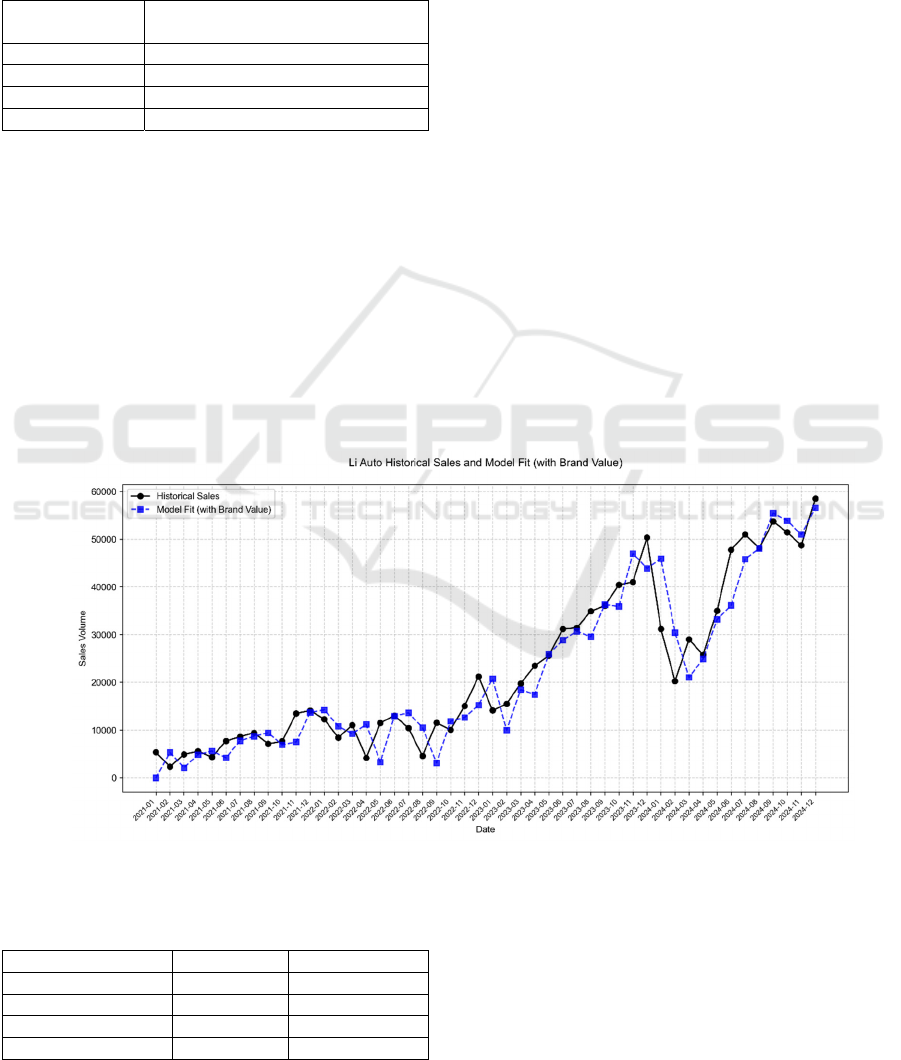

each brand are shown in Figure 1 and Table 4.

Figure 1: Li Auto car sales fitting forecast (Photo/Picture credit: Original).

Table 4: Prediction performance of each automaker based

on SARIMA-BP neural network model.

Car companies RMSE MAPE

BYD 3458.19 0.08

Tesla 3462.32 0.09

Li Auto 1108.19 0.07

NIO 1837.49 0.11

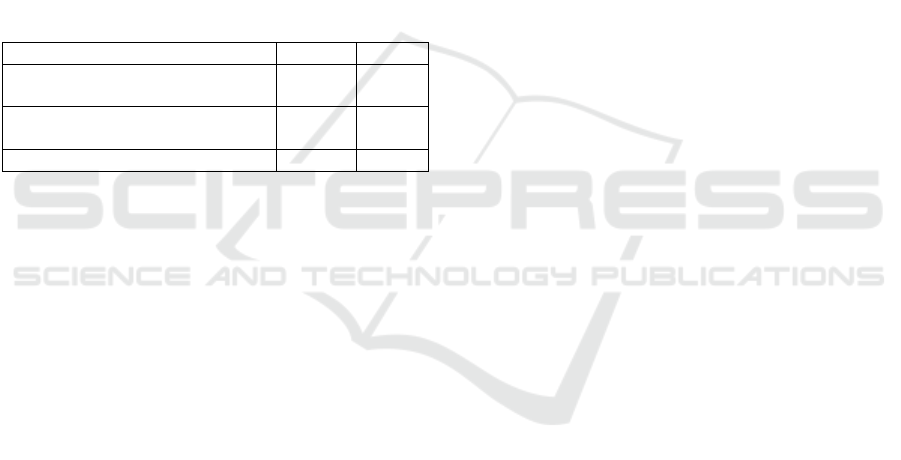

In order to further verify the superiority of using

the SARIMA-BP neural network model based on

Interbrand to quantify brand influence, the study

compared the accuracy indicators of the SARIMA

model and the combined model, as well as the

accuracy indicators of the combined model using

brand value and the combined model not using brand

IAMPA 2025 - The International Conference on Innovations in Applied Mathematics, Physics, and Astronomy

400

value, as shown in Table 5. Taking BYD as an

example, the RMSE and MAPE values of the

SARIMA-BP model based on brand value data are

3458.19 and 0.08 respectively, while the RMSE and

MAPE values of the SARIMA-BP model without

brand value data are 7932.81 and 0.17 respectively.

This shows that the brand quantitative influence

model based on Interbrand has a significant effect on

improving prediction accuracy. At the same time, the

MSE and MAPE values of the SARIMA model are

6527.61 and 0.14 respectively, indicating that the

SARIMA-BP model has improved the model fitting

effect and prediction effect by fitting the nonlinear

part of the residual of the SRAIMA model. The

superiority of the SARIMA-BP neural network model

based on Interbrand's quantitative brand influence in

this study is demonstrated (Yang, 2021).

Table 5: Comparison of model errors (taking BYD as an

example).

Model RMSE MAPE

SARIMA-BP (using brand value

data

)

3458.19 0.08

SARIMA-BP (brand value data not

used)

7932.81 0.17

SARIMA 6527.61 0.14

3.2 Improvement Plan

The shortcomings of this study are mainly reflected in

data collection and model tuning (Marco et al., 2012).

In terms of data collection, the acquisition of

automobile company financial report data is not

direct, and the problem of inaccurate data is common,

which makes it difficult for the improved Interbrand

brand value model to simulate real data and there are

errors in the calculation of brand value data; the

shortcomings of model tuning are mainly reflected in

the degree of adaptation of the BP neural network

model to the data. In addition, further research can be

supplemented in terms of factors such as new energy

policy subsidies mentioned by Liu (2021), and the

model explanatory variables can be added to improve

the model fitting accuracy (Hülsmann et al., 2012).

4 CONCLUSION

In the prediction of automobile sales, automobile

brand influence plays a vital role in sales. This paper

quantifies the brand influence of new energy vehicles

through the improved Interbrand method, and

integrates it into the SARIMA-BP neural network

model. This method is used to model and predict the

sales time series data of new energy vehicles, which

improves the accuracy of new energy vehicle sales

prediction. Compared with the standard SARIMA and

sales prediction models that do not consider brand

influence data, the model proposed in this study based

on Interbrand quantification of brand influence and

the use of SARIMA-BP neural network model

performs well in RMSE and MAPE indicators. It

provides new ideas for the quantification of

automobile brand influence and sales prediction.

REFERENCES

Chen, D., 2011. Chinese automobile demand prediction

based on ARIMA model. In International Conference

on Biomedical Engineering & Informatics. IEEE.

Fan, Q., 2017. Research on automobile sales forecast based

on SARIMA-BP neural network method. China

Business Review, (22), 3.

Gui, S., Sun, W., & Xu, X., 2021. Automobile sales forecast

analysis based on ARIMA and linear regression

combined model. Computer and Digital Engineering.

Hülsmann, M., Borscheid, D., Friedrich, C. M., 2012.

General sales forecast models for automobile markets

and their analysis. Ibai Publishing, 5(5), 65–86.

Li, J., & Wang, F., 2016. Research on the quantitative

evaluation model of brand value in China based on

Interbrand. Science and Management, 18(1), 5.

Li, N., Zhou, X., Zhang, H., & Deng, S., 2021. Research on

the quantitative evaluation of brand value of

geographical indication agricultural products based on

Interbrand: Taking Zhashui wood ear as an example.

Hubei Agricultural Sciences, 60(10), 156–161.

Liu, Y., Wang, M., & Wang, J., 2021. Research on China's

new energy vehicle market forecast. China Automotive

Industry Review, (2016-4), 86–91.

Marco, H., Borscheid, D., Friedrich, C. M., 2012. General

sales forecast models for automobile markets and their

analysis. Ibai Publishing, 5(5), 65–86.

Pi, J., Zhao, Q., & Peng, J., 2016. CPI combined prediction

model based on SARIMA-GMDH. Statistics and

Decision, (17), 4.、

Wang, J., Chen, L., Gong, Y., Zheng, Y., Xu, J., & Du, Y., et

al., 2021. A method and device for predicting surface

water quality indicators based on graph neural network.

Journal of Zhejiang University: Engineering Edition,

55(4), 7.

Xu, Y., Wang, Z., & Wu, Z., 2021. A stock trend prediction

model based on CNN-BiLSTM multi-feature fusion.

Modern Library and Information Technology, (007),

005.

Yang, D., 2021. New energy vehicle sales forecast based on

improved BP neural network. Automation and

Instrumentation, (011), 000.

Zhang, J., 2011. Application of SARIMA model in

predicting China's CPI. Statistics and Decision, (5), 3.

Research on Sales Forecasting of New Energy Vehicles Based on Interbrand and SARIMA-BP Neural Network

401