Forecasting the Electric Vehicle Market Based on Multiple Linear

Regression, Time Series Analysis, and DID Models

Yuchen Wu

a

School of Mathematics, Tianjin University, Tianjin, Tianjin, 300354, China

Keywords: Electric Vehicle Market, Multiple Linear Regression Model, Time Series Analysis, Difference-In-Differences

(DID) Model.

Abstract: In recent years, the electric vehicle market has seen significant growth, making the prediction of its market

prospects essential. This study analyzes the market outlook for electric vehicles, focusing on the relationship

between car prices and battery demand. A multiple linear regression model was employed to assess the impact

of these factors on car sales volume. The results show that car prices and sales are negatively correlated, while

battery demand is positively correlated with sales, highlighting key market dynamics. Additionally, time

series analysis was used to forecast Tesla's stock development, indicating a strong association between stock

price fluctuations and market trends. Using the difference-in-differences (DID) model, this paper evaluated

the effects of relevant policies on the electric car market, finding that policy incentives significantly boost

sales growth. Overall, this research offers a quantitative forecast for the electric vehicle market, validating the

influence of price and demand on sales and illustrating the interaction between market conditions and policy

factors. These insights are valuable for decision-makers and investors, suggesting a promising growth

potential for the electric car market in the future.

1 INTRODUCTION

The research on electric vehicle market outlook

forecasts has far-reaching implications for industry

participants, economic development, and

technological advancements. Electric vehicles (EVs)

significantly reduce greenhouse gas emissions and air

pollution, promoting sustainable development

(Pelegov & Chanaron, 2022). With accurate market

outlook forecasts, policymakers and businesses can

better understand the environmental impact of the

widespread adoption of EVs and effectively

formulate relevant policies and measures. Market

growth also brings new business opportunities, such

as battery manufacturing and the construction of

charging infrastructure. Forecasting market trends

can help companies and investors identify trends and

investment opportunities, optimizing resource

allocation and enhancing economic benefits.

Furthermore, the promotion of EVs is a crucial factor

in driving the energy transition, aiding the shift from

traditional energy sources to renewable energy.

a

https://orcid.org/0009-0008-6356-4504

Muhammad has revealed through the comparison

of air quality before and after the pandemic lockdown

that reducing car exhaust emissions can significantly

improve air quality (Muhammad, Long & Salman,

2020). Weng Xiaofeng also pointed out in his article

that severe smog is harming people's health, with car

exhaust emissions being a major cause of this

consequence (Weng, 2014). This emphasizes the

significant importance of developing EVs; however,

there are still many issues in the current electric

vehicle market. According to Weng Xiaofeng's

research, several key factors restricting the

development of EVs include poor battery efficiency,

high prices, lack of unified standards, and inadequate

infrastructure (Weng, 2014). It should be noted that

there is still considerable room for improvement in the

penetration rate of EVs in the global automotive

market. According to a relevant report by Caitong

Securities, in 2023, the penetration rate rose further

by 2.57% to 14.88%, indicating continued significant

growth (Automotive and Components, 2025).

Focusing on China, since 2021, the new energy

vehicle market has developed rapidly, driven by

384

Wu, Y.

Forecasting the Electric Vehicle Market Based on Multiple Linear Regression, Time Series Analysis, and DID Models.

DOI: 10.5220/0013826400004708

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 2nd International Conference on Innovations in Applied Mathematics, Physics, and Astronomy (IAMPA 2025), pages 384-390

ISBN: 978-989-758-774-0

Proceedings Copyright © 2025 by SCITEPRESS – Science and Technology Publications, Lda.

policies. In 2023, the penetration rate of new energy

passenger car sales in China rose to 33% (Automotive

and Components, 2024). However, as Ma pointed out,

the government's subsidy withdrawal mechanism also

has negative impacts. The ineffectiveness of electric

vehicle credit management, coupled with insufficient

market regulation, has led to a significant decline in

electric vehicle sales (Ma, 2022). The reasons behind

this deserve reflection. Yu Jiaxin systematically

sorted the subsidy policies for new energy vehicles in

China, and empirical analysis results showed that

after the subsidy withdrawal, the positive impact on

the promotion of the new energy passenger car market

significantly decreased. It was also found that

charging security policies can mitigate the impact of

subsidy withdrawal on the new energy vehicle market

(Yu, 2022). The development of the consumer market

cannot be separated from the main behaviors of

consumers, and advertising and brand awareness have

a significant influence on consumer decision-making.

Tesla, as an internationally renowned electric vehicle

brand, leads the entire society in the development of

EVs. Xuan Shao believes that researching brand

development has representative significance (Shao,

Wang & Yang, 2021). Coincidentally, Mangram

believes that Tesla's marketing strategy differs from

traditional methods in the automotive industry,

revealing more possibilities for interpreting the

electric vehicle market through the study of its

development history and marketing policies

(Mangram, 2012). Standage points out that urban

transportation is expected to be integrated into a

diversified system through smartphone technology,

further highlighting the promising prospects of the

electric vehicle market (Standage, 2021).

This article selects multiple linear regression

(MLR) models, time series models, and double

difference models to study the electric vehicle market,

aiming to draw relevant conclusions based on the

specific numerical results obtained from each model.

2 METHOD

2.1 Data Source

The automotive price data mentioned in this article is

sourced from the China Passenger Car Market

Information Joint Conference, covering the time span

from 2019 to 2022 on a monthly basis. It includes 8

well-known brands such as BMW and Mercedes-

Benz to showcase the potential advantages of EVs.

The data is also selected from the International

Energy Agency (IEA) and the China Automotive

Power Battery Industry Innovation Alliance to

illustrate the comparison and correlation of battery

demand between China, the United States, the

European Union, and other countries. By using

battery demand as a starting point, the prospects of the

Chinese electric vehicle market are further analyzed.

This study obtained over 2,500 stock data points

for Tesla from 2014 to 2024 from Kaggle, intending

to glimpse the electric vehicle development market by

predicting the stock market outlook (Tanmay Shukla,

2025).

Exploratory data was obtained from the National

Energy Administration and Yu Jiaxin's research to

understand the development of electric vehicle

policies in China from 2021 to 2023, thus analyzing

future market share in the Chinese automotive

market.

2.2 Indicator Selection

In this analysis, three key indicators have been

selected: car price, battery demand, and policy, as

shown in Table 1.

Table1: Indicator Description

Reasons Statistics

Car Price a crucial metric for comparing traditional

and EVs

Eight famous car brands from

2019 to 2022

Battery Demand be essential in assessing the growth

p

otential of EVs

Battery demand worldwide from

2019 to 2023

Policy plays a significant role in shaping the

electric vehicle landsca

p

e

electric vehicle policies in China

from 2021 to 2023

Price impacts the affordability and

competitiveness of traditional and EVs, affecting

consumer choices. Analyzing battery demand trends

from 2019 to 2022 reveals electric mobility's growth

potential. Additionally, examining policies in key

regions helps us understand their effects on electric

vehicle market share and future growth.

Forecasting the Electric Vehicle Market Based on Multiple Linear Regression, Time Series Analysis, and DID Models

385

2.3 Methods Introduction

2.3.1 MLR Model

This paper utilizes an MLR model to predict

fluctuations in market share between traditional and

EVs. By analyzing historical data, the model focuses

on key factors like battery demand, car prices, and

sales figures. Increased battery demand correlates

with rising electric vehicle sales, highlighting

industry trends. The framework quantifies how these

independent variables influence consumer behavior

and market dynamics, providing insights into the

electric vehicle market's sustainability and scalability,

which are essential for informing policymakers and

stakeholders of future trends.

2.3.2 Time Series Model for Tesla Stock

Prices

The stock market is vital for financial development,

with stock data acting as a time series that reveals

operational patterns. Analyzing these patterns enables

trend predictions, aiding investors in decision-making

and contributing to regional economic growth. The

ARIMA model is well-established for time series

analysis, offering accurate predictions for both

stationary and non-stationary data. This study applies

the ARIMA model to over 3,600 Tesla stock data

points from the past decade to analyze trends in the

electric vehicle market.

2.3.3 Difference-in-Differences (DID)

The DID method is used to evaluate the effects of

policy implementation by examining changes in

economic indicators before and after the policy is

enacted. This study focuses on the gradual increase of

subsidies for new energy vehicles, a national policy

affecting all cities. Using automobile sales as the

economic indicator, cities with license plate

restrictions serve as the control group, while cities

without restrictions act as the experimental group,

making the standard DID method suitable for

analysis.

This article will select the coverage rate of electric

vehicle charging stations in various cities

(coverage_rate), regional gross domestic product

(gdp), residents' savings balances (savings), and total

urban population (population) as control variables to

analyze the impact of gradually reducing subsidy

policies on the sales of new energy vehicles. The

specific model is as follows:

𝑌

=𝛼+𝛽

𝑇𝑖𝑚𝑒

+𝛽

𝑇𝑟𝑒𝑎𝑡𝑒𝑑

+𝛽

𝑑𝑖𝑑

+

𝛽

𝑍

+𝜀

(1)

In the above equation, 𝑌

represents the sales of

new energy passenger vehicles, 𝑇𝑖𝑚𝑒

is the

dummy variable for the subsidy reduction policy,

Treated is the urban dummy variable, 𝑑𝑖𝑑

is the

interaction term 𝑡𝑖𝑚𝑒 × 𝑡𝑟𝑒𝑎𝑡𝑒𝑑 , and 𝑍

represents a series of control variables. The

coefficient 𝛽

is the primary focus; when it is less

than 0, it indicates that the subsidy reduction policy

has decreased the positive impact on the market

promotion of new energy vehicles. Conversely, when

it is greater than 0, it demonstrates that the gradual

increase of subsidies has a stimulating effect on the

promotion of the new energy vehicle market.

3 RESULTS AND DISCUSSION

3.1 MLR Results

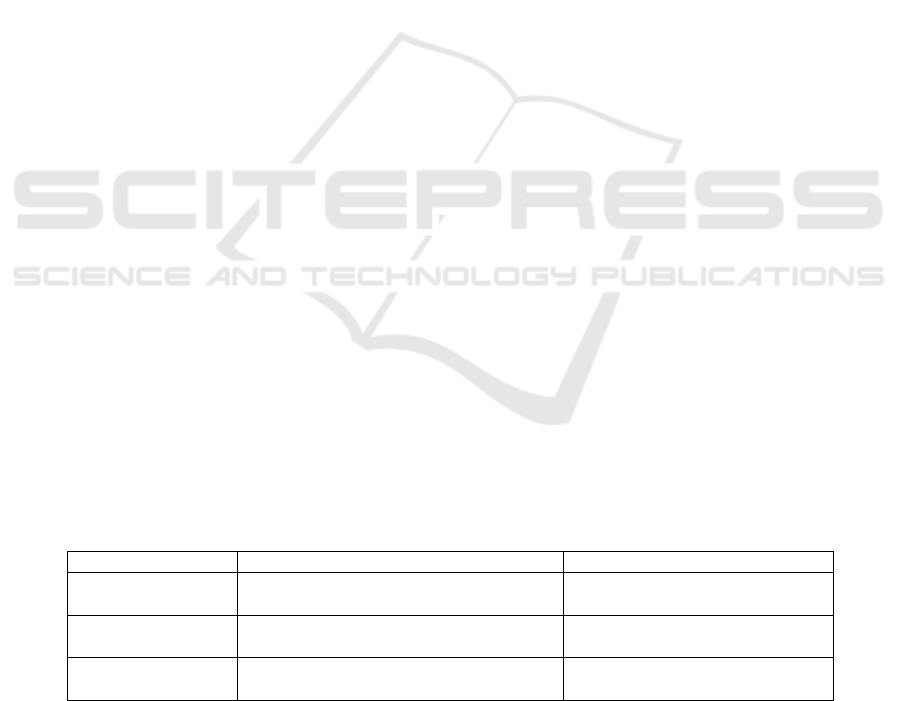

Figure 1 illustrates a price comparison between

electric vehicle brands and gasoline vehicles. From a

purchase price perspective, EVs generally cost more

than their gasoline counterparts within the same class.

This price discrepancy is largely due to the higher

costs associated with essential components such as

batteries, motors, and electronic controls in EVs.

However, government subsidies for new energy

vehicles and ongoing advancements in battery

technology are gradually reducing the prices of EVs.

Additionally, it is crucial to consider operating costs.

While EVs have a higher initial purchase cost, their

operating expenses tend to be significantly lower

compared to gasoline vehicles. This is primarily

because electricity costs are much lower than fuel

costs, and the maintenance expenses for EVs are

relatively minimal. Thus, from a cost-effectiveness

standpoint, EVs may offer advantages in the long run.

IAMPA 2025 - The International Conference on Innovations in Applied Mathematics, Physics, and Astronomy

386

Figure 1: Comparison of Electric and Fuel Car Price (Photo/Picture credit: Original).

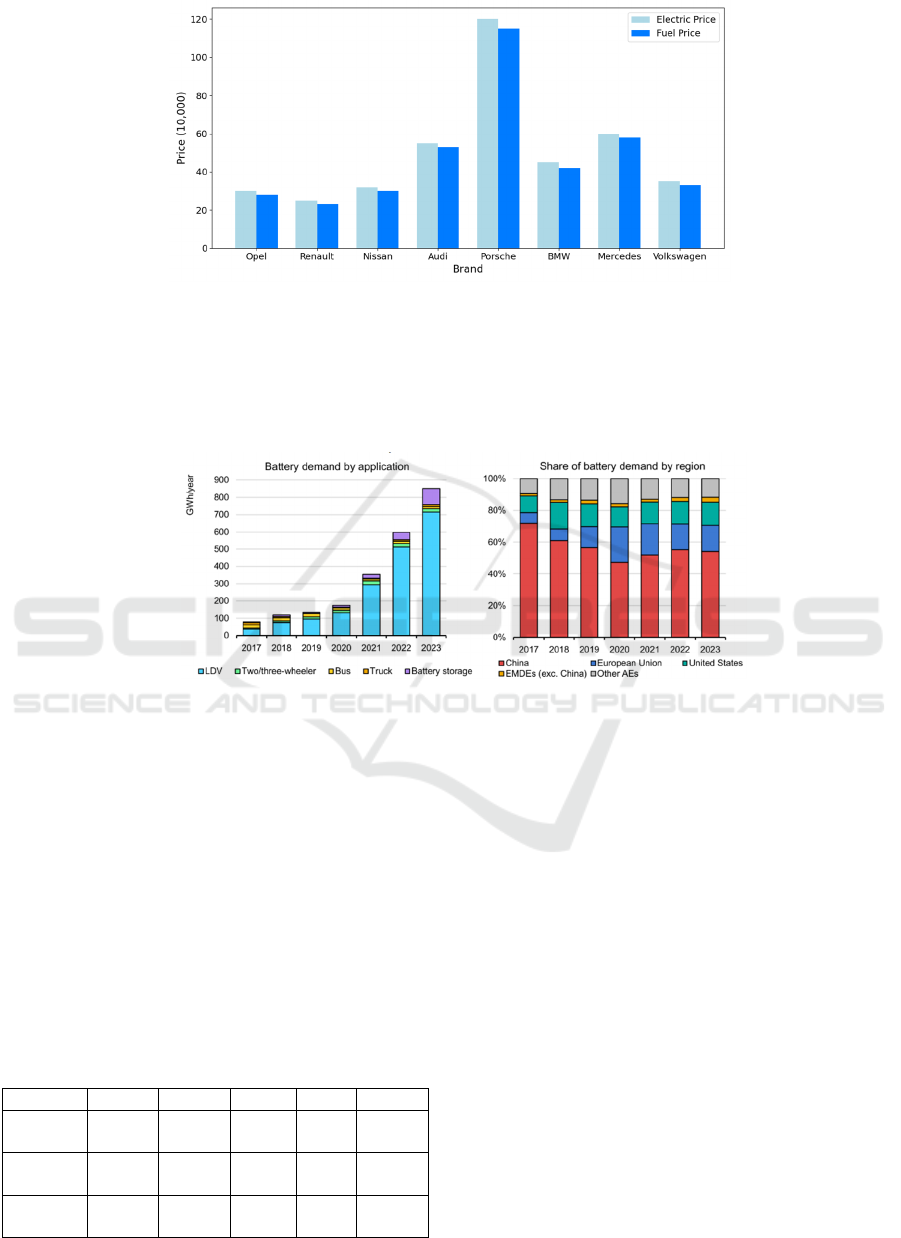

To predict the sustainability and scalability of

future development in the electric vehicle industry

based on trends in battery demand, this article

compiles battery demand data from multiple

countries. Three key terms are defined to clarify the

analysis. LDV means light-duty vehicle, including

cars and vans. EMDEs (esc. China) means emerging

markets and developing economies excluding China.

AEs means advanced economies.

(

a

)

Batter

y

Demand b

y

A

pp

lication

(

b

)

Share of Batter

y

Demand b

y

Re

g

ion

Figure 2: Battery Demand by Application and Region (IEA, 2024)

According to Figure 2, battery demand has surged

from 2021 to 2023, primarily fueled by the rapid

increase in electric vehicle sales. By 2023, pure EVs

accounted for approximately 90% of total battery

demand, indirectly reflecting the significant rise in

electric vehicle sales. Notably, China remains the

largest battery market, representing about 55% of

global demand in 2023, with the European Union and

the United States each comprising roughly 15%.

Given China’s substantial market share, analyzing its

electric vehicle market prospects is particularly

representative.

Table 2: MLR Results

Coef Std er

r

t P>

|

t

|

VIF

const 17190

0

18400

0

0.936 0.36

1

482.31

6

Car

Price

-1.103 1.244 -

0.887

0.38

6

1.619

Battery

Deman

d

22450 1388.5

58

16.16

9

0.00

1

1.619

Based on the analysis, this paper obtained the

results shown in Table 2. The VIF values for the

independent variables price and battery demand are

both less than 5, which indicates that there is no

significant multicollinearity issue between the two

independent variables. The coefficient for car price is

-1.1034, indicating a negative correlation between car

price and car sales. With a p-value of 0.386, the

statistical significance of this coefficient is low,

suggesting that the database chosen for this study can

be further optimized. The coefficient for battery

demand is approximately 22450, indicating a

significant positive impact of battery demand on sales

volume. The p-value for this coefficient is 0.001,

indicating very high significance. The R-squared

value of the model is 0.96, indicating that the model

performs well in explaining.

The results of this model clearly indicate that there

is a negative correlation between car prices and

automobile sales, while demand for car batteries

shows a significant positive correlation with sales.

Forecasting the Electric Vehicle Market Based on Multiple Linear Regression, Time Series Analysis, and DID Models

387

This suggests that increasing battery demand will

promote growth in automobile sales, whereas

excessively high car prices may suppress sales. To

boost car sales, manufacturers should consider

lowering car prices and enhancing battery demand

when formulating market strategies, optimizing

product mix, and pricing strategies to achieve

improved sales performance.

3.2 ARIMA Results

Table 3: ADF Test on the Original Sequence Results

Statistics Significance

Level

(

%

)

t P

ADF - -1.334 0.061

1 -3.433 -

Critical

Value

5

10

-2.863

-2.567

-

-

Next, this research will further explore this issue from

the perspective of car prices. This study takes Tesla, a

representative brand in the electric vehicle market, as

an example and derives conclusions by examining its

stock performance (Table 3).

The results obtained from the ADF test indicate

that Tesla's stock data is not stationary. Therefore, the

research considers applying differencing to the data in

an attempt to make it a stationary series. The results

after first-order differencing are shown in Table 4.

Table 4: ADF Test on the Original Sequence Results

Statistics

Significance

Level (%)

t P

ADF

- -10.248 0.000

1 -3.433 -

Critical

Value

5

10

-2.863

-2.567

-

-

After this, the researcher conducts order selection

for the ARIMA model by plotting the ACF and PACF

graphs to make judgments. It is determined that the

values of p and q are 5 or 6. After conducting the AIC,

BIC, and HQ values as well as white noise tests, this

research chooses ARIMA (6, 1, 5) as the testing

model, and the results are shown in Table 6.

Table 5: ARIMA model AIC, SC, and HQ test values

Model AIC BIC HQ lb_pvalue MSE RMSE

ARIMA

(

6,1,5

)

15913.265 15983.225 15938.656 0.331 54.059 7.353

ARIMA

(

5,1,6

)

15926.170 15996.130 15951.561 0.000 - -

From the last two columns of Table 5, it can be

seen that the MSE of ARIMA(6, 1, 5) is 54.059, and

the RMSE is 7.353, indicating that the average

prediction error for forecasting 180 data points is

approximately 7.35 units. Considering that the dataset

in this paper is based on over 2,500 stock data points

from the past decade, the variation range of actual

values is quite large, and an RMSE of 7.35 is

relatively acceptable. This also indicates that over the

past decade, Tesla's stock price has steadily risen, the

electric vehicle market has become increasingly

popular among the public, and more and more people

are choosing to buy Tesla as their means of

transportation.

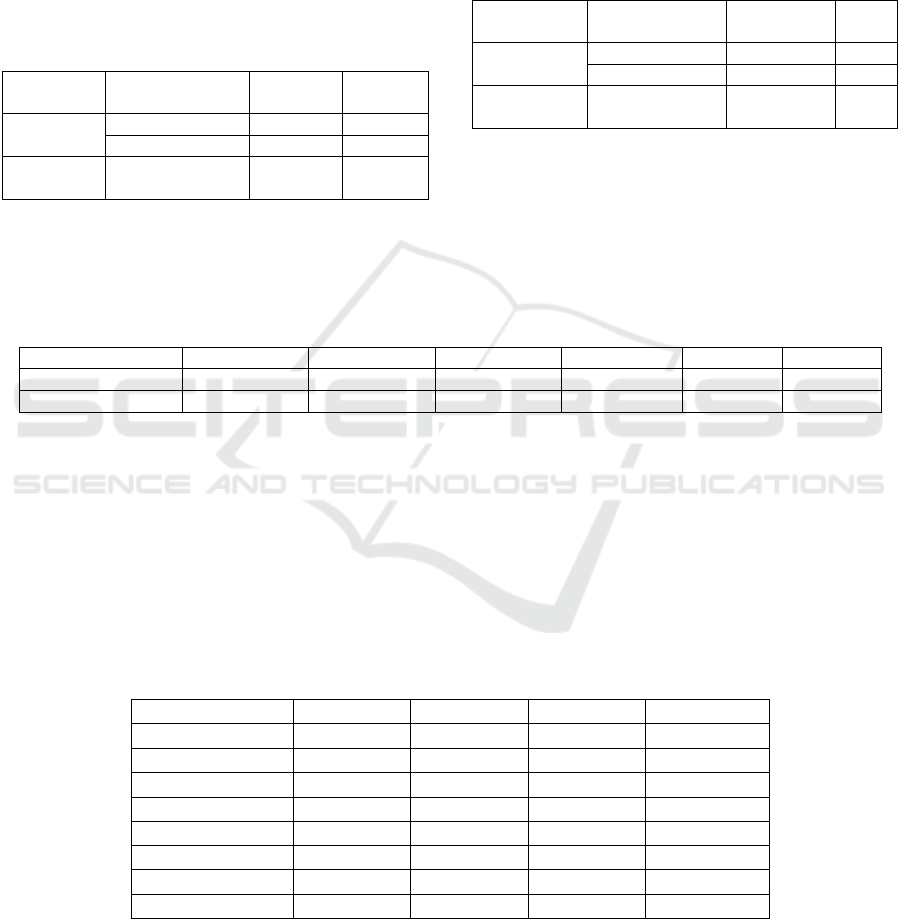

3.3 DID Results

Table 6: DID Results

Variables Model 1 Model 2 Model 3 Model 4

did

2.145

∗∗

-0.172

4.243

∗∗∗

2.573

∗∗

treated

8.476

∗∗∗

-2.745

∗∗

8.856

∗∗∗

-4.015

∗∗∗

time 2.145

∗∗

-0.172 4.243

∗∗∗

2.573

∗∗

coverage_rate - 3.512

∗∗∗

-4.748

∗∗∗

g

dp - 0.725 - 0.339

savin

g

s - 0.763 - 0.952

population - 1.302 -

4.037

∗∗∗

R2 0.173 0.759 0.180 0.703

Note: * indicates significance at the 10% level, ** indicates significance at the 5% level, and *** indicates

significance at the 1% level.

Based on theoretical analysis and data processing

of the new energy vehicle market, this paper selects

the sales data of urban new energy passenger vehicles

from January 2021 to December 2023 and conducts a

DID regression, with results shown in Table 6.

According to Table 6, Model 2 (experiment group

IAMPA 2025 - The International Conference on Innovations in Applied Mathematics, Physics, and Astronomy

388

with dependent variable) and Model 4 (control group

with dependent variable) have significantly better

fitting than Model 1 (experiment group without

dependent variable) and Model 3 (control group with

dependent variable), as the R-squared values of the

latter two are higher, indicating that adding more

independent variables enhances the model's

explanatory power. The negative coefficient for the

Treated group shows that the overall sales in the

control group are lower than in the experimental

group, suggesting that license restriction policies can

promote electric vehicle sales. In terms of

significance levels, coverage_rate shows a significant

impact in both the control and experimental groups,

indicating that as the coverage rate of charging piles

increases, vehicle sales also rise. It can be said that

increased subsidies for EVs can stimulate the

development of the electric vehicle market.

3.4 Discussion

Many areas need improvement and optimization in

this study.

Firstly, in the MLR model, the regression results

for car prices are not significant due to limitations in

the database selection. Future work could enhance the

selection of relevant data by increasing the dataset

with more car brands, expanding the database's

capacity, and simultaneously increasing the

complexity of the model to achieve more significant

metrics. This approach will help capture various

factors affecting car prices more comprehensively.

Secondly, regarding the time series model,

although the period of the selected data is relatively

long, the period for the prediction results is quite

brief. Therefore, using more advanced models (such

as decision trees) would help improve the accuracy of

long-term forecasts, providing more forward-looking

market insights.

Lastly, in the DID model, it is crucial to consider

more variable factors. For example, taking into

account the differences in economic development

levels across regions, understanding the differences in

consumer awareness levels in various regions through

surveys, and examining the proportion of households

owning gasoline and EVs can make the research

findings more meaningful on a practical level. Such

multidimensional analysis helps us gain a deeper

understanding of market dynamics, ensuring the

research's practicality and reference value.

By addressing these aspects, the overall study will

better reflect the true state of the electric vehicle

market, supporting subsequent policy

recommendations and business decisions.

4 CONCLUSION

This study concludes that car prices and battery

demand significantly influence electric vehicle sales,

with car prices exhibiting a negative correlation while

battery demand shows a positive correlation. These

findings highlight the critical roles of affordability

and technological advancements in driving market

growth within the electric vehicle sector.

The implications of this research extend to various

stakeholders, including policymakers, manufacturers,

and investors. By understanding how these factors

interact, decision-makers can formulate strategic

initiatives aimed at promoting electric vehicle

adoption, such as investment in charging

infrastructure and incentives for consumers. The

substantial impact of policy incentives on sales

growth suggests that targeted measures, such as tax

credits and rebates, could significantly accelerate

market expansion and enhance consumer interest.

Looking ahead, future research should consider

additional variables such as evolving consumer

preferences, competitive dynamics, and global market

influences to gain a more comprehensive

understanding of the electric vehicle landscape.

Furthermore, as the industry continues to evolve,

continuous monitoring of market trends and

technological innovations will be crucial for adapting

strategies to maximize growth potential. Ultimately,

this study underscores a promising future for the

electric vehicle market, shaped by the interplay of

price dynamics, advancements in battery technology,

and supportive governmental policies that facilitate a

transition toward sustainable transportation.

REFERENCES

IAM@Tanmay Shukla., 2025. Tesla Stock Data 2010–2025.

In Kaggle.

https://www.kaggle.com/datasets/iamtanmayshukla/tes

la-stocks-dataset

IEA., 2024. EV Battery Supply Chain Sustainability. In

International Energy Agency.

https://www.iea.org/reports/ev-battery-supply-chain-

sustainability

Ma, Y., 2022. Analysis of Influencing Factors and

Intervention Measures in the Electric Vehicle Market

(Master's Thesis, Northwest Normal University).

Master's thesis.

Mangram, M. E., 2012. The globalization of Tesla Motors:

A strategic marketing plan analysis. In Journal of

Strategic Marketing, 20(4), 289-312.

Muhammad, S., Long, X., & Salman, M., 2020. COVID-19

pandemic and environmental pollution: A blessing in

Forecasting the Electric Vehicle Market Based on Multiple Linear Regression, Time Series Analysis, and DID Models

389

disguise?. In Science of the Total Environment, 728,

138820.

Pelegov, D. V., & Chanaron, J. J., 2022. Electric car market

analysis using open data: Sales, volatility assessment,

and forecasting. In Sustainability, 15(1), 399.

Shao, X., Wang, Q., & Yang, H., 2021. Business Analysis

and Future Development of an Electric Vehicle

Company—Tesla.

Standage, T., 2021. The Lost History of the Electric Car—

and What It Tells Us About the Future of Transport. In

The Guardian, 3.

Weng, X., 2014. Analysis of Factors Influencing the

Development of China's Electric Vehicle Market and

Marketing Strategies. In Modern Property (Mid-month),

13(05), 22-23.

Yu, J., 2022. Statistical analysis of the impact of subsidy

policy decline on China's new energy vehicle market

(Master's Thesis, Dongbei University of Finance and

Economics). Master's thesis.

IAMPA 2025 - The International Conference on Innovations in Applied Mathematics, Physics, and Astronomy

390