Research on the Prediction of the Global Price of Gold

Zining Chen

a

Suzhou Foreign Language School, Suzhou, Jiangsu, 215000, China

Keywords: Prediction, Gold Price, ARIMA Model.

Abstract: Gold, as a safe-haven and value-preserving asset, has been brought to worldwide attention. However, its

price is influenced by numerous factors, making it difficult to predict and causing many investors to hesitate

about whether to invest. The Autoregressive Integrated Moving Average (ARIMA) model, a time series

model, has gained recognition and widespread adoption due to its accuracy. In this paper, the ARIMA

model is used to predict gold prices from Feb 22 to Mar 23. The findings indicate that the predicted values

also suggest further increases. The residual test confirms that the residuals of the ARIMA model's

predictions exhibit pure randomness, thereby validating the model's accuracy. This study confirms the

effectiveness of the ARIMA model in short-term gold price forecasting, yet its limitation lies in the

difficulty of predicting the multiple factors influencing gold prices. Future research may consider

incorporating additional exogenous variables and nonlinear models to enhance long-term predictive

performance.

a

https://orcid.org/0009-0007-2990-0263

1 INTRODUCTION

Gold, as a precious metal with significant economic

implications, experiences increasing annual demand

due to its properties as a hedge and a store of value.

The significant volatility and uncertainty of gold

price can be attributed to several key factors.

Initially, the supply and demand dynamics of gold

and rising interest rates can directly influence its

price (Davis & Thompson, 2018; Smith & Brown,

2021). Additionally, geopolitical instability and

rising inflation rates boost the demand for gold as a

store of value, which will lead to an increase in its

price (Johnson & Lee, 2019; Wang & Chen, 2019).

Furthermore, various technical analysis indicators

can also impact short-term fluctuations in gold

prices (Liu & Zhao, 2021).An increasing number of

investors are tending to invest in gold to get

long-term profit. Predicting gold prices can provide

valuable insights into economic cycle fluctuations

and market risk aversion, thereby guiding investors

in making rational decisions and reducing

investment risks (Chai, Zhao, Hu & Zhang, 2021).

The ARIMA model offers the following key

advantages in gold price forecasting: Gold prices

typically exhibit trend and seasonal fluctuations, and

the ARIMA model can effectively handle

non-stationary time series; Based on linear

regression and time series autocorrelation, ARIMA

has a transparent model structure with clear

interpretability and requires only historical gold

price data for modeling, reducing dependency on

external variables (Wang, 2021). Furthermore, In

Wang & Li (2018) study on gold price forecasting

for the Shanghai Gold Exchange, they demonstrated

that the ARIMA model achieved superior

performance with 68.4% directional accuracy in

five-minute high-frequency trading data,

outperforming all comparative models. This finding

substantiates the irreplaceable role of ARIMA

models in gold price prediction. This paper will

select an appropriate ARIMA model to predict gold

prices and evaluate the residuals.

2 METHODS

2.1 Data Sources

The gold price data is taken from Investing.com.

The data is the daily closing price of each ounce of

Chen, Z.

Research on the Prediction of the Global Price of Gold.

DOI: 10.5220/0013826300004708

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 2nd International Conference on Innovations in Applied Mathematics, Physics, and Astronomy (IAMPA 2025), pages 379-383

ISBN: 978-989-758-774-0

Proceedings Copyright © 2025 by SCITEPRESS – Science and Technology Publications, Lda.

379

gold calculated in US dollars. There a total of 557

data from Jan 2, 2023, to Feb 21, 2025. The gold

price data from Investing.com exhibits high

reliability as the platform directly interfaces with

authoritative exchanges and institutions while

employing cross-validation from multiple data

providers.

2.2 Variable Selection

The price of gold can be affected by many factors,

such as some big global events. Because of the

randomness of these factors, the gold price’s

fluctuation can be very frequent and substantial,

which is difficult to predict only by observing the

recent data. The data show that the recent gold

price shows an upward trend according to the figure.

However, the price also fluctuates greatly during the

period, with a maximal daily rise of 3.37% and drop

of -3.22%.

2.3 Model Selection

This article selects the Autoregressive Integrated

Moving Average (ARIMA) model, a typical type of

time series model, to analyse and predict the price.

The ARIMA model is used widely and is made up of

the autoregressive model (AR), integrated (I), and

moving average model (MA).

The AR part represents the linear relationship

between the current data and the past data, including

one or more time-delay terms to show the influence

of the current data by its coefficient. The I part is

used to deal with an unstable time series by using

differencing. The MA part represents the linear

relationship between the error term of the current

data and the past data by using a similar method as

the AR part.

The usual notation for the ARIMA model is

denoted by ARIMA(p, d, q), where p is the

autoregressive order, d is the difference order, and q

is the moving average order.

3 RESULTS AND DISCUSSIONS

3.1 Data Processing

Data used in the ARIMA model need to ensure its

stationarity and pure randomness (white noise).

Table 1: The ADF Test

Dickey-fuller Lag order p-value

-1.770 7 0.674

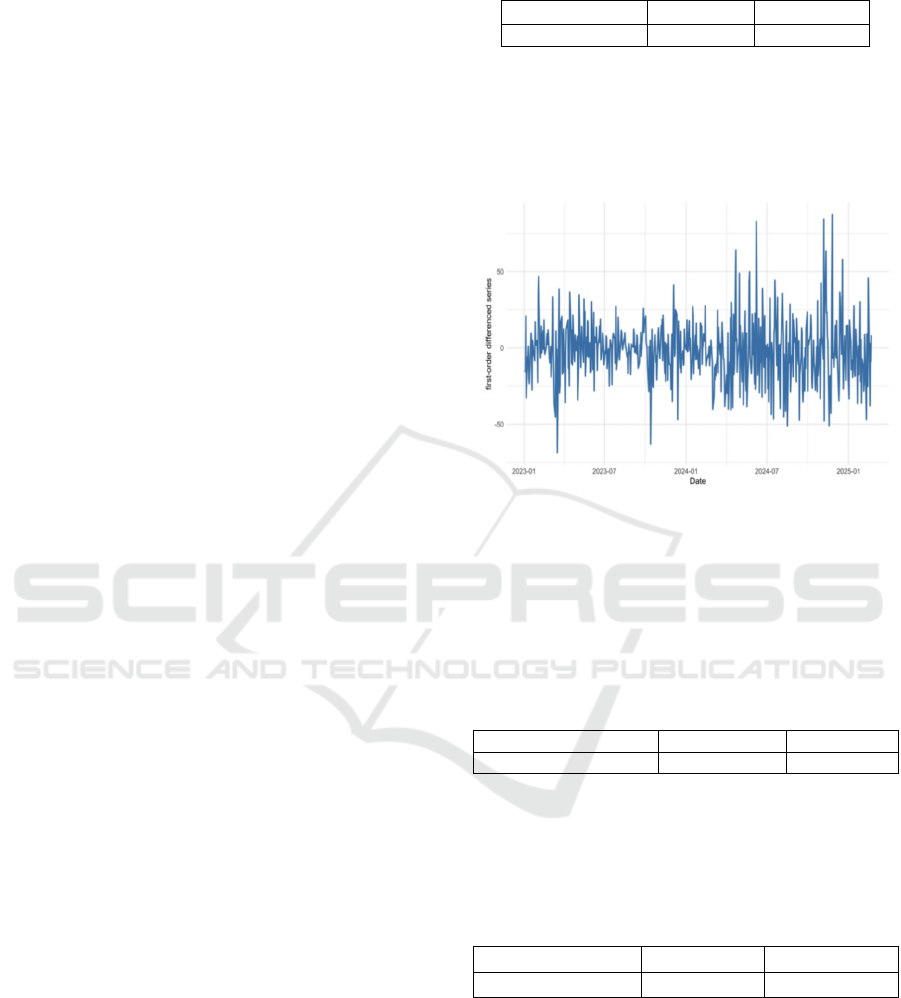

Noticed that the Table.1 shows that the p-value is

0.674 (>0.05), the paper conclude that the data isn’t

stationary. So, the paper performed first-order

differencing on it. The resulting differenced series is

presented in Figure 1.

Figure 1: First-order Differenced Series (Picture credit:

Original)

The results of the Augmented Dickey-Fuller

(ADF) test, used to examine the stationarity of the

first-order differenced series, are presented in Table

2.

Table 2: The ADF Test

Dickey-fulle

r

Lag orde

r

p

-value

-7.198 7 0.01

Since the p-value is 0.01 (<0.05), the paper

conclude that the first-order differenced series is

stationary. The results of the Ljung-Box (LB) test,

used to examine the pure randomness of the data, are

presented in Table 3.

Table 3: The Ljung-Box Test

X-squared df p-value

18.982 24 0.7529

Since the p-value is 0.7529 (>0.05), then paper

fail to reject the null hypothesis that the series is

white noise.

3.2 Model Evaluation and Selection

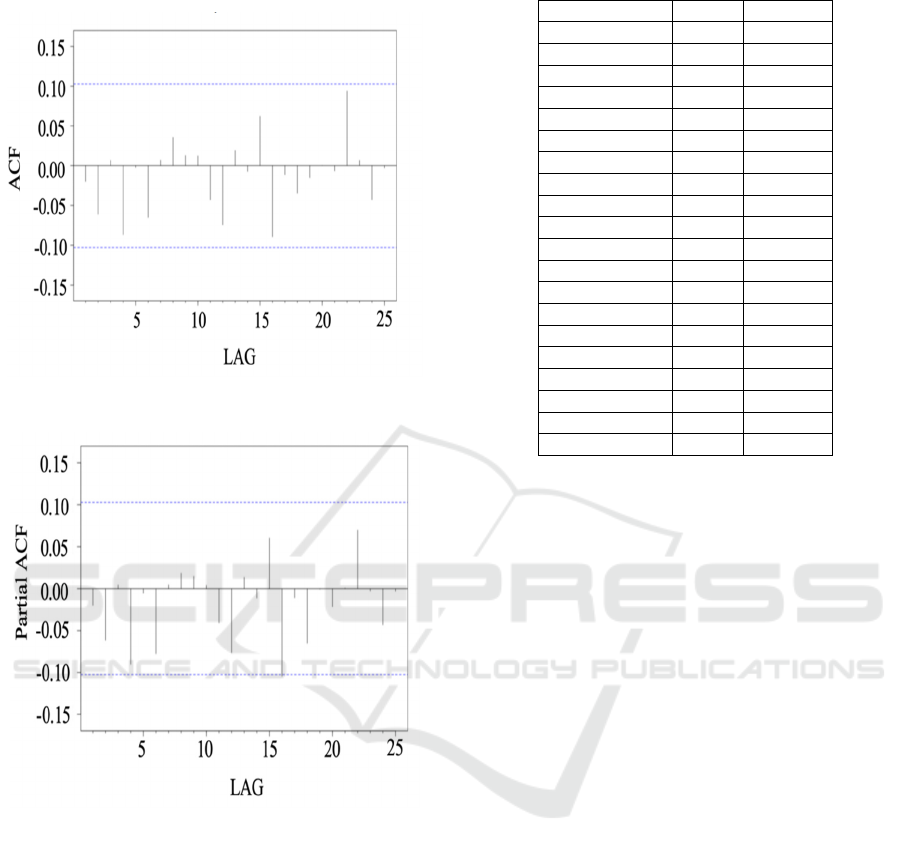

While using the ARIMA model to analyse and

forecast the price, the selection of the parameters is

of great significance. The ACF plot (Figure 2) and

IAMPA 2025 - The International Conference on Innovations in Applied Mathematics, Physics, and Astronomy

380

the PACF plot (Figure 3) can help to select the

parameters more accurately.

Figure 2: The ACF Plot (Picture credit: Original)

Figure 3: The PACF Plot (Picture credit: Original)

By testing ARIMA models with different

parameters, the selection of the model can be made

more accurate. In this article, the Root Mean Square

Error(RMSE) and Akaike Information

Criterion(AIC) values are used for evaluation.

RMSE measures the difference between the

predicted values and the actual values, while AIC is

used to assess the goodness of fit of the model. The

smaller these two values are, the more accurate the

model becomes. These two values together help us

select the optimal ARIMA model. The table (Table

4) below lists the RMSE and AIC values for

different ARIMA models applied to gold price data.

Table 4: ARIMA Model Evaluation

ARIMA Model RMSE AIC

(

0,1,1

)

4.3677 791.2459

(0,1,2) 4.6307 789.5815

(

0,1,3

)

4.5604 791.3864

(

0,1,4

)

4.8386 788.2144

(0,1,5) 4.8493 790.2117

(

1,1,0

)

4.3632 791.2661

(

1,1,1

)

7.7885 787.5097

(1,1,2) 4.4268 788.9579

(

1,1,3

)

4.4910 790.8374

(

1,1,4

)

4.8640 790.2081

(2,1,0) 4.5332 790.5929

(

2,1,1

)

4.4046 789.0548

(

2,1,2

)

7.8470 787.1255

(2,1,3) 7.7076 788.0462

(

3,1,0

)

4.4907 792.4458

(

3,1,1

)

4.4236 791.0303

(3,1,2) 7.7145 788.0075

(4,1,0) 4.7160 788.6824

(

4,1,1

)

4.6016 790.4662

(

5,1,0

)

4.7071 790.6794

From the table above, it can be observed that the

model (0,1,1) has the smallest values for both RMSE

and AIC. Therefore, the paper select the model

(0,1,1) as the optimal model. In the following

sections, the paper will use this model to forecast

gold prices.

3.3 Price Forecasting

This article will use ARIMA(0,1,1) to forecast the

coming 30 days’ price of gold and the prediction

data show that the price of gold is predicted to

maintain a sustained upward trend over the next

thirty days.

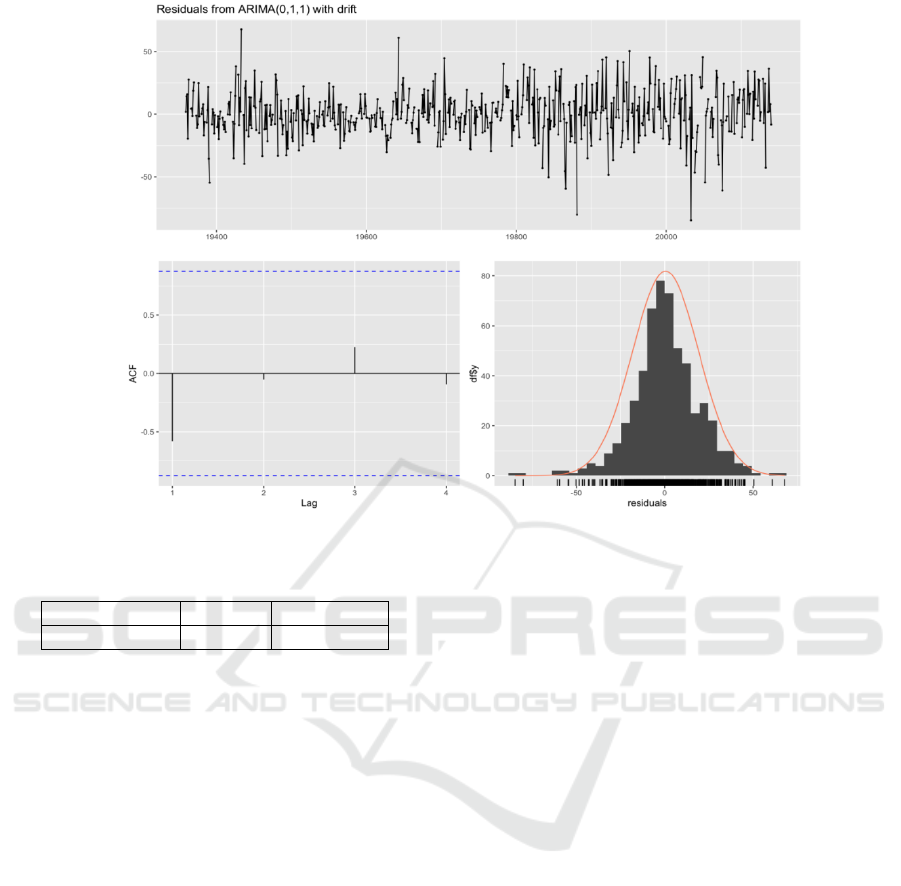

3.4 Residuals Checking

To ensure the accuracy of the prediction, the crucial

next step is to inspect the residual terms. In this

article, the ACF test and LB test will be used to

check the autocorrelation. The results from this

examination are depicted in Figure 4, Table 5.

Research on the Prediction of the Global Price of Gold

381

Figure 4: Residuals Testing (Picture credit: Original)

Table 5: Ljung-Box Test

X-square

d

df

p

-value

8.8321 10 0.5481

From the ACF plot on the bottom left, it can be

observed that all four values are significantly smaller

than the critical value. The plot on the bottom right

also indicates that the residuals closely follow a

normal distribution. Furthermore, the LB test shows

that the p-value is 0.5481, which is much greater

than 0.05, suggesting that the residuals do not

exhibit significant autocorrelation. This implies that

the prediction errors of the model are random, and

the ARIMA model fits the data very well.

3.5 Critical Thinking

Although the aforementioned predicted data have

passed various tests, to some extent indicating that

the predictions are reliable, the methodology used in

this study still has certain limitations. As previously

mentioned in this paper, gold prices are highly

influenced by major global events and economic

conditions. However, these factors were not taken

into account when using the ARIMA model for

prediction. Moreover, such global events are

inherently unpredictable. Therefore, this study still

has its limitations.

Comparisons of the effect of prediction between

ARIMA and machine learning models in gold price

forecasting demonstrate that ARIMA maintains

strong competitiveness for short-term (1-7 day)

predictions. However, its predictive accuracy

deteriorates significantly beyond 30-day horizons

due to the omission of macroeconomic variables

(Alameer et al., 2019). During the 2020-2023

Russia-Ukraine conflict period, the ARIMAX model

incorporating the Geopolitical Risk (GPR) index as

an exogenous variable achieved 17.8% higher

forecasting precision compared to conventional

ARIMA, substantiating the necessity of external

factors for enhancing ARIMA's long-term predictive

capacity(Abdollahi & Ranganathan, 2024).

In future research, the paper can integrate

ARIMA with machine learning models such as

LSTM and XGBoost to capture nonlinear

relationships. Additionally, a multivariate model

incorporating macroeconomic indicators, market

sentiment, and supply chain data could be developed

to enhance predictive performance.

4 CONCLUSION

Through the aforementioned research, it can be

concluded that gold prices exhibit a sustained

upward trend in the short term, and the ARIMA

IAMPA 2025 - The International Conference on Innovations in Applied Mathematics, Physics, and Astronomy

382

model's predictions strongly support this conclusion.

Therefore, this paper suggests that it is a wise

decision for investors to purchase gold at present to

capitalize on potential short-term gains.

Additionally, policymakers can use these prediction

data to assess economic risks and adjust monetary

policies accordingly. However, despite the relatively

high accuracy of the ARIMA model in forecasting,

certain limitations remain, such as the failure to

account for external factors. Future research could

collect more comprehensive data and advanced

models to further enhance prediction accuracy.

REFERENCES

Abdollahi, H., & Ranganathan, P., 2024. Geopolitical risks

and gold price prediction: An ARIMAX approach. In

Resources Policy, 88, 104512.

Alameer, Z., Adb Elaziz, M., Ewees, A. A., Ye, H., &

Jianhua, Z., 2019. Forecasting using improved

multilayer perceptron neural network and whale

optimization algorithm. In Resources Policy, 61,

250-260.

Chai, J., Zhao, C. Y., Hu, Y., & Zhang, Z. G., 2021.

Structure analysis and forecast of gold price return. In

Journal of Management Science and Engineering,

135-145.

Davis, S., & Thompson, R., 2018. A hybrid model for gold

price forecasting combining ARIMA and machine

learning. In Computational Economics, 52(3),

789-801.

Johnson, R., & Lee, K., 2019. The impact of geopolitical

risks on gold prices: A global perspective. In

Resources Policy, 63, 101-112.

Liu, Y., & Zhao, L., 2021. A machine learning-based

model for gold price prediction. In Journal of

Computer Applications, 38(5), 1456-1460.

Smith, J., & Brown, T., 2021. Forecasting gold prices

using deep learning techniques. In International

Journal of Forecasting, 37(4), 1234-1245.

Wang, W., & Chen, J., 2019. Gold price forecasting using

ARIMA model. In Statistics and Decision, 35(18),

80-83.

Wang, Y., 2021. Analysis and prediction of stock price

based on ARIMA model. In Productivity Research,

1004-2768.

Wang, Y., & Li, J., 2023. Intraday gold price forecasting: A

comparative study of time series and machine learning

models. In Finance Research Letter, 54, 103789.

Research on the Prediction of the Global Price of Gold

383