Analysis of Factors Influencing Electric Vehicle Sales Based on the

Multiple Linear Regression Model

Yangjian Xiao

*

a

Faculty of Mathematics, University of Waterloo, Waterloo, ON N2L 3G1, Canada

Keywords: Electric Vehicle, EV Stock, EV Sales Share, EV Stock Share.

Abstract: As electric vehicles are at the core of the global automotive industry's transformation and significantly reduce

greenhouse gas emissions, understanding the owners of electric vehicle sales is important for policymakers

and corporate partners. The main objective of this study is to examine the key drivers of electric vehicle (EV)

sales, with a particular focus on market penetration and stock dynamics. To achieve this, the study employs

multiple linear regression (MLR) analysis, a statistical technique that models the relationship between a

dependent variable and multiple independent variables using a linear equation. Utilizing detailed information

from 2010 to 2024 and predictions that extend to 2035, this research examines how combined EV stock, EV

sales share, and EV stock share affect regular EV sales across different areas. The results indicate that

combined EV stock and EV stock share are important indicators of EV sales, addressing the importance of

boosting EV market presence to drive adoption. By measuring these associations, this study provides valuable

insights for governments, businesses, and owners who want to encourage EV implementation through

appropriate legislation changes. These results support more extensive efforts to promote responsible travel

and decrease global carbon emissions.

1 INTRODUCTION

Electric vehicles (EVs) are receiving increased

attention for their capacity to curb air pollution and

decrease dependency on fossil fuels (Li & Ouyang,

2021). According to Ford (2023), large-scale datasets

of global EV trends indicate a sharp rise in both EV

stock and charging infrastructure from 2010 onward,

underscoring how supportive conditions can

powerfully shape market trajectories. The analysis of

factors affecting electric vehicles sales is of great

significance. In European contexts, Zhou and Li

(2022) argue that income levels and shifting fuel costs

substantially influence EV purchase decisions,

highlighting how financial considerations can differ

by region. Meanwhile, Kang and Park (2020)

emphasize the role of social dynamics and

environmental awareness, showing that broader

public support can accelerate EV adoption.

Zhang and Lu (2020) illustrate that in China, the

presence of robust charging networks corresponds

a

https://orcid.org/0009-0008-9741-3763

*

Corresponding author

directly to higher EV uptake, suggesting that

accessible infrastructure stands out as a key

determinant. Chen and Chou (2022) find that in the

United States, range anxiety remains a core consumer

concern, although lower operating costs still motivate

a growing segment of buyers. Wu and Zhao (2021)

contend that battery innovations, particularly those

improving driving range and energy density, have

steadily reduced technological barriers, making EVs

more palatable to mainstream markets.

Beyond these early adoption drivers, recent

analyses shine a fresh light on how EV sales, EV

stock, and market share metrics shape overall growth.

The International Energy Agency (IEA) (2022)

reports that total EV sales have been climbing

steadily, driven by a combination of cost reductions

and growing infrastructure investment. According to

BloombergNEF (2023), forecasts through the early

2030s suggest that EVs will likely dominate new car

registrations in several leading markets, pushing EV

stock share upward even in regions currently

dominated by internal combustion engines. Jin and

Xiao, Y.

Analysis of Factors Influencing Electric Vehicle Sales Based on the Multiple Linear Regression Model.

DOI: 10.5220/0013813400004708

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 2nd International Conference on Innovations in Applied Mathematics, Physics, and Astronomy (IAMPA 2025), pages 25-30

ISBN: 978-989-758-774-0

Proceedings Copyright © 2025 by SCITEPRESS – Science and Technology Publications, Lda.

25

Slowik (2021) find that such expansions in EV

market share often track closely with government

incentive programs, underscoring the importance of

strategic policy intervention. In parallel, Yang, Liao,

and van Wee (2020) confirm that subsidies and tax

rebates can significantly boost local EV sales,

influencing both consumer decisions and automaker

production choices. Sakti, Jaller, and Lee (2021) note

that as EV sales share rises, reinforcing charging

infrastructure and supply chains becomes critical to

sustaining the momentum.

In light of this global perspective, the adoption of

electric vehicles differs considerably. It is influenced

by several regional factors, including promoting

relationships, marketing trends, and charging

infrastructure. This research uses a multiple linear

regression approach to identify and analyze the main

factors that affect EV sales. We use robust standard

errors (HC3) and log transformations to increase

model reliability and address non-linearity and

heteroscedasticity. To aid the transition to sustainable

transportation systems, this study uses quantitative

measures like EV sales, EV sales share, EV stock, EV

stock share, and charging station size to provide

helpful insights to stakeholders, including urban

planners, automobile manufacturers, and

governments. Manufacturers and urban planners are

looking to accelerate the transition to sustainable

transportation systems.

2 METHODOLOGY

2.1 Data Source and Description

This study uses the IEA Global EV Data dataset from

Kaggle and the comprehensive data on electric

vehicle (EV) adoption across various regions between

2010 and 2024. Also, the database includes

projections for 2035. Along with EV sales, EV stock

prices, EV sales share, and EV stock share, analytical

variables like having details are included in the

database. The data covers a range of geographical

regions and years and thoroughly examines how

significant factors driving car implementation are.

According to uniformity, the factors measured on

several scales, such as the range of vehicles versus the

percentages, are standardized and similar across

several years and regions. The key features and

information from this study are summarized in Table

1.

Table 1: Definition of variables.

Variable Descri

p

tion Ran

g

e

EV Sales (𝑦)

Total number of EVs sold in the region (annual) [0.001, 62000000]

EV Charging points (𝑥

)

Total publicly accessible EV charging points in the region [0.1, 15000000]

EV Sales Share (𝑥

)

Percentage of EV sales in the total vehicle market [0.0000320, 93]

EV Stoc

k

(𝑥

)

Cumulative stock of EVs in the region. [1, 44000000]

EV Stock Share (𝑥

)

Percentage of EVs in the total vehicle stock. [0.0000150, 58]

2.2 Method Introduction

Given the continuous nature of EV sales, this study

employs Multiple Linear Regression (MLR) as the

primary method to assess the key factors influencing

electric vehicle (EV) sales. Multiple linear regression

can be used to model a regiment variable's

relationship to several separate parameters. This

technique is especially useful for examining how

variations in EV sales are influenced by charging

infrastructure, combined EV stock, EV sales share,

and EV stock share. The dependent variable (EV

Sales) is represented by a linear combination of

independent variables in multiple linear regression

models expressed as:

𝑦=𝛽

+𝛽

𝑥

+𝛽

𝑥

+⋯+𝛽

𝑥

+𝜀

(1)

Where 𝑦 represents the total EV sales, 𝑥

are the

independent variables that capture key economic and

infrastructural factors, 𝛽

are the regression

coefficients measuring the strength and direction of

influence, and 𝜀 is the error term, accounting for

variations not explained by the model. To estimate the

coefficients, this study employs the Ordinary Least

Squares (OLS) method, which minimizes the

discrepancy between actual and predicted sales

values. The objective function for optimization is

given by:

β

=argmin

𝑦

−𝑦

(2)

Which represents the estimation of regression

coefficients using the Ordinary Least Squares (OLS)

method. Here, β

denotes the estimated coefficients

that minimize the sum of squared residuals, where

IAMPA 2025 - The International Conference on Innovations in Applied Mathematics, Physics, and Astronomy

26

each residual is the difference between the observed

value 𝑦

and the predicted value 𝑦

. The term β

represents the set of regression coefficients being

optimized. The important work ensures that the

chosen coefficients provide the best possible right

match by reducing the regiment variable's common

error. The characteristics that best capture the contact

between the different and answer guidelines are

created in multiple linear regression. The research

software enables a deeper understanding of the

impact of each indicator on EV sales while avoiding

forecast error.

Given the continuous nature of EV sales and the

potential for non-linearity in the relationships

between predictors and the response variable, this

study employs a log-linear multiple regression model

as an extension of multiple linear regression. By

applying logarithmic transformations to both the

dependent variable and key predictors, the model

effectively captures proportional relationships and

reduces heteroscedasticity. The log-linear model

takes the following form:

𝑙𝑜𝑔𝑦 = 𝛽

+𝛽

𝑙𝑜𝑔𝑥

+𝛽

𝑙𝑜𝑔𝑥

+⋯

+𝛽

𝑙𝑜𝑔

𝑥

+𝜀

(3)

Applying this transformation allows us to

interpret the coefficients in terms of elasticity,

meaning that a 1% increase in a predictor corresponds

to an approximate β

% change in EV sales, holding

all other factors constant.

3 RESULTS AND DISCUSSION

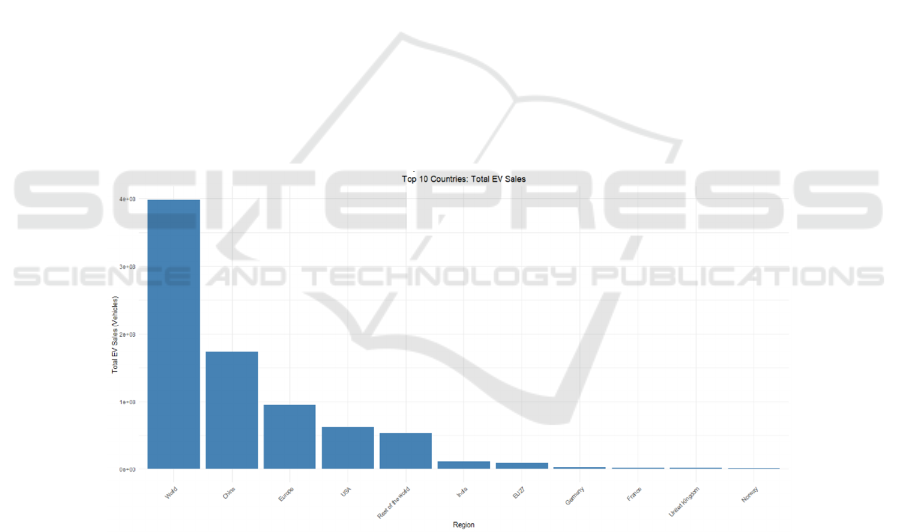

3.1 Visualization Analysis

To gain insights into the distribution of electric

vehicle (EV) sales across different regions, we first

conducted a preliminary data quality assessment,

which included checking for missing values and

ensuring the dataset’s integrity. After confirming the

dataset’s completeness and reliability, we proceeded

with data visualization to better understand the

regional disparities in EV sales. The bar chart (Figure

1) presented below provides a comparative analysis

of total EV sales worldwide, with a focused

examination of the top ten countries contributing

most significantly to global EV adoption. This

approach ensures clarity and highlights the dominant

regions in the EV market.

Figure 1: Total EV Sales Worldwide and in the Top 10 Countries (Photo/Picture credit: Original).

3.2 Model Result

Understanding the factors influencing EV sales is

crucial for policymaking, infrastructure development,

and market forecasting in an electric vehicle (EV)

market analysis. To achieve this, a log-linear

regression model was developed to measure the

relationship between EV sales and its essential factors,

including EV stock share, EV sales share, EV stock,

and EV charging points. With the aid of the log-linear

regression model, it can be determined whether or not

each indicator impacts the growth of EV sales and

whether these correlations are statistically significant.

The log-linear regression model is expressed as

follows:

log

𝑦

= −0.559 + 0.055log

𝑥

+0.194log

x

+0.905log

𝑥

−0.396log

𝑥

(4)

Analysis of Factors Influencing Electric Vehicle Sales Based on the Multiple Linear Regression Model

27

Table 2 presents the ordinary least squares (OLS)

regression results with heteroscedasticity-responsive

(HC3) standard errors to understand EV sales' main

determinants. For each indicator, the columns report

the estimated factor, strong common mistake, t-

statistics, p-value, and 95 percent trust period (CI),

and each row represents a model-independent

variable.

Table 2: OLS Regression Results table.

Feature Coefficient Robust SE t

p

-value [0.025 0.975]

const -0.559 0.118 -4.725 0.000*** -0.791 -0.327

Lo

g

EV char

g

in

g

p

oints 0.055 0.025 2.209 0.027** 0.006 0.104

Lo

g

EV sales share 0.194 0.031 6.308 0.000*** 0.134 0.254

Log EV stoc

k

0.905 0.025 35.413 0.000*** 0.855 0.955

Log EV stock share -0.396 0.045 -8.745 0.000*** -0.485 -0.307

Note: ***, **, and * represent significance levels of 1%, 5%, and 10%, respectively. The Standard Errors are

heteroscedasticity robust (HC3).

The intercept of the model is negative and

significant, meaning that when all predictors are zero,

the expected dependent variable value is negative. A

1% increase in EV charging points is associated with

a 0.055% increase in the dependent variable. The

effect is statistically significant at the 5% level.

Similarly, a 1% increase in the share of EV sales

correlates with a 0.194% increase in the dependent

variable. This relationship is strongly significant. A

1% increase in EV stock is associated with a 0.905%

increase in the dependent variable. This has the

largest effect and is highly significant. A 1% increase

in EV stock share correlates with a 0.396% decrease

in the dependent variable, suggesting a negative

effect.

Table 3 shows the VIF.

Table 3: Variance Inflation Factor (VIF) Analysis.

Feature VIF

const 20.036037

Log EV charging points 3.869944

Lo

g

EV sales share 3.275625

Log EV stoc

k

4.786732

Log EV stock share 2.909117

Table 4 shows the model fit.

Table 4: Model Fitness.

R-squared

Adj. R-

square

d

F-statistic

Prob (F-

statistic)

0.958 0.958 2591 2.20e-281

The variance inflation factor (VIF) analysis in

Table 3 indicates that multicollinearity is

manageable, ensuring the model's stability. These

findings reinforce the status of EV market penetration

and infrastructure expansion in generating potential

EV sales adjustments. Table 4 shows the model fit.

The R-squared is 0.958, which shows that the data fits

the regression model well. The F-statistics (2591)

indicate that the model is highly statistically

significant in explaining log (EV sales).

4 DISCUSSION

The Breusch-Pagan test confirms the presence of

heteroscedasticity in the model (LM Statistic =

21.1939, p-value = 0.0002898), necessitating the use

of heteroscedasticity-robust standard errors (HC3) for

valid statistical inference. The results from Table 2

show that all features are statistically significant,

highlighting the importance of EV stock, EV stock

share, and EV sales share in predicting EV sales.

Despite having a statistically significant impact, the

fairly minimal index of EV charging points suggests

that market penetration interactions play a secondary

part in EV implementation.

This research mainly analyzes the IEA Global EV

Data. Although this dataset contains information on

EV sales and ownership in many regions around the

world, it may still have limitations in terms of

geographical coverage or data segmentation. For

example, the real situation of some emerging markets

or countries with large regional differences may not

be fully reflected. To further improve external

validity, consider multi-source data integration:

Integrate public databases (such as IEA (2022),

BloombergNEF (2023), etc.) with official statistics

released by transportation departments and

automobile associations of various countries/regions

to obtain more detailed and representative data.

Supplement key segmentation indicators: For

example, quantitative indicators such as

supplementary fiscal subsidies, regional income

levels, and consumer environmental awareness

IAMPA 2025 - The International Conference on Innovations in Applied Mathematics, Physics, and Astronomy

28

indexes can help explain possible unobserved

heterogeneity in the model.

Although charging infrastructure exerts a

statistically significant positive impact, it shows a

smaller elasticity compared to EV stock and market

share. This may be partly explained by the fact that

consumers weigh other factors (e.g., policy

incentives, vehicle cost, perceived reliability) even

more heavily when deciding on an EV purchase

(Coffman, Jaller, and Wee, 2017). Past studies in

Norway have demonstrated that targeted incentives

like free parking, road toll exemptions, and tax

benefits can greatly stimulate EV uptake, particularly

in the early stages of market development (Bjerkan,

Nørbech and Nordtømme, 2016). Therefore, a

balanced approach that combines infrastructure

deployment with well-designed demand-side policies

(e.g., tax rebates, direct subsidies) is essential for

sustaining or boosting EV sales across different

market maturity phases (Narassimhan and Johnson,

2018).

This research uses a (logarithmic) multiple linear

regression model, which can effectively reveal the

linear relationship between EV sales and core

variables but may be insufficient when exploring

more complex dynamic processes or interactive

effects. Despite offering valuable insights, the current

research omits certain variables like consumer

preference evolution, oil price fluctuations, and

vehicle resale values that could further elucidate EV

adoption dynamics. Existing studies indicate that

such factors, along with regional socio-economic

conditions, strongly mediate EV growth trajectories

(Figenbaum, 2017). Future work could broaden the

dataset to include these additional covariates, employ

panel or longitudinal models to capture time-lag

effects, and integrate qualitative methods (e.g.,

consumer surveys) for a deeper understanding of

behavioral nuances. This expanded scope may yield a

more holistic view of how public policy, consumer

sentiment, and infrastructure co-evolve in shaping the

global EV landscape.

5 CONCLUSION

In summary, this research uses a multiple linear

regression model with logarithmic transformation to

analyze and underscores that cumulative EV stock,

EV stock share, and EV sales share exert the strongest

influence on annual EV sales. The paper also

performs data visualization and checks for

multicollinearity. Notably, the positive and

significant effect of EV stock highlights how a

growing fleet fuels further market growth by

enhancing consumer awareness and confidence.

However, the negative coefficient associated with EV

stock share suggests that higher saturation levels can

dampen new sales, indicating the possibility of a

diminishing return once EVs become more

mainstream. Although charging infrastructure plays

an important role, its comparatively smaller impact

points to the complexity of consumer decisions—

where vehicle availability, supportive policies, and

market maturity can outweigh charging accessibility.

For policymakers and industry stakeholders, these

findings emphasize the importance of strategically

expanding EV stocks and aligning infrastructure

investments with demand. Doing so will help sustain

healthy sales trajectories as electric vehicles continue

evolving from an emerging segment into a well-

established cornerstone of global transportation

systems.

REFERENCES

Bjerkan, K. Y., Nørbech, T. E., & Nordtømme, M. E. 2016.

Incentives for promoting battery electric vehicle BEV

adoption in Norway. Transportation Research Part D:

Transport and Environment, 43, 169–180.

BloombergNEF. 2023. Electric vehicle outlook 2023.

about.bnef.com. https://about.bnef.com/electric-

vehicle-outlook

Chen, Z., & Chou, A. 2022. Consumer preferences range

anxiety and the adoption of electric vehicles in the

United States. Resource and Energy Economics, 67,

101266.

Coffman, M., Bernstein, P., & Wee, S. 2017. Electric

vehicles revisited costs subsidies and prospects.

Transport Policy, 54, 50–59.

Figenbaum, E. 2017. Perspectives on Norway’s

supercharged electric vehicle policy. Environmental

Innovation and Societal Transitions, 25, 14–34.

Ford, P. L. 2023. Kaggle global EV sales 2010–2024.

kaggle.com.

https://www.kaggle.com/datasets/patricklford/global-

ev-sales-2010-2024

International Energy Agency. 2022. Global EV outlook

2022. iea.org. https://www.iea.org/reports/global-ev-

outlook-2022

Jin, L., & Slowik, P. 2021. Evaluation of electric vehicle

market growth across leading regions. Transportation

Research Part D: Transport and Environment, 96,

102874.

Kang, S., & Park, Y. 2020. Assessing consumer attitudes

toward electric vehicles the role of social influence and

ecological motives. Transportation Research Part D:

Transport and Environment, 82, 102296.

Analysis of Factors Influencing Electric Vehicle Sales Based on the Multiple Linear Regression Model

29

Li, X., & Ouyang, Y. 2021. Consumer concerns about

charging infrastructure and the adoption of electric

mobility. Energy Policy, 157, 112498.

Narassimhan, E., & Johnson, C. 2018. The role of demand-

side incentives and charging infrastructure in fostering

electric vehicle adoption analysis of US States. Journal

of Transport Geography, 72, 177–187.

Sakti, A., Jaller, M., & Lee, Y. 2021. Global patterns in

electric vehicle stock growth and charging

infrastructure development. Renewable and

Sustainable Energy Reviews, 146, 111161.

Wu, T., & Zhao, L. 2021. Advances in battery technology

and the accelerating expansion of electric vehicles.

Journal of Power Sources, 485, 229292.

Yang, J., Liao, F., & van Wee, B. 2020. Analyzing the

effects of financial incentives on electric vehicle sales

and market share. Energy Policy, 145, 111752.

Zhang, X., & Lu, Y. 2020. Infrastructure readiness and EV

adoption in China. Journal of Cleaner Production, 253,

119979.

Zhou, Y., & Li, J. 2022. Economics of electric vehicle

adoption in European countries. Transportation

Research Part D: Transport and Environment, 108,

103298.

IAMPA 2025 - The International Conference on Innovations in Applied Mathematics, Physics, and Astronomy

30