Research on Stock Price Prediction Based on Machine Learning

Techniques

Hongyu Yao

a

Business School, The University of Sydney, New South Wales, Australia

Keywords: Machine Learning, Financial Forecasting, Neural Networks, Regression Models.

Abstract: Considering that financial stock markets are volatile and non-linear, accurately predicting stock closure price

values is difficult. With the development of powerful machine learning methods and enhanced capacity for

computation, predicting stock prices using machine learning methods is preferred because of its efficiency

and effectiveness. In this project, Linear Regression (LR), Long Short-Term Memory (LSTM) and Gated

Recurrent Unit (GRU) algorithms have been used to forecast closing price values of Tesla. The original

financial data -- close price is regarded as the target variable, then open, high, low prices are used to calculate

new features. To avoid multicollinearity issues, only volume, Relative Strength Index(RSI) and high-low ratio

features are used as inputs for modelling part. Based on the standard strategic metrics, LR performs the best

with the lowest RMSE 6.8703, the lowest MAE 4.0410, and the highest R-squared (R2) 0.9705. All metrics

results suggest that LR has the most accurate results among all models. Furthermore, this article applies the

residual plot and Quantile-

1 INTRODUCTION

Tesla is regarded as one of the world's most valuable

automakers since 2020 and a trillion-dollar company

from 2021 to 2022, dominating the market for battery

electric vehicles in 2023 with a 19.9% share

(Cunningham, 2024). In this case, Tesla's stock

benchmarks the electric vehicle and renewable

(Cunningham, 2024). Its rapid growth and market

dominance also attract investors to optimize their

strategies to get returns.

To optimize profits and minimise losses,

techniques that analyze historical trends to forecast

future stock movements are valuable (Li et al., 2017).

However, forecasting stock prices is a difficult

project due to ever-changing and unanticipated nature

of the market, which is influenced by a number of

variables such firm performance, global economic

conditions, and changes in politics (Vijh et al., 2020).

Traditionally, stock price prediction has relied on

two main strategies: qualitative evaluation, which

takes into account external influences like economic

events, and quantitative evaluation, which makes use

of previous price data (Vijh et al., 2020). Nowadays,

a

https://orcid.org/0009-0005-4939-6709

machine learning techniques combining these two

approaches are used for more accurate predictions.

In terms of Linear Regression (LR), it is widely

used in business where forecasting and anticipation

are crucial. In 1973, Fama and MacBeth applied LR

to estimate the risk-return relationship in the stock

market. Since then, linear regression has been used

more frequently, especially for understanding

financial markets and forecasting stock values. In the

early 2000s, multiple linear regression began to be

applied using a broader set of features by Jegadeesh

and Titman (Jegadeesh & Titman, 2001). However,

while traditional techniques are labor-intensive and

time-consuming, neural networks were introduced.

They can generate accurate outputs without full

knowledge. Gated Recurrent Unit (GRU) and Long

Short-Term Memory (LSTM) are examples of

Recurrent Neural Networks (RNN). Increasing the

number of neurons improves their performance and

efficiency, but it may also limit their capacity to

generalize then result in overfitting (Mim et al., 2023).

Building upon prior research, this project is going

to predict Tesla's stock price using three machine

learning techniques: LR, LSTM, and GRU. The

performance of these models will be evaluated using

654

Yao, H.

Research on Stock Price Prediction Based on Machine Learning Techniques.

DOI: 10.5220/0013703600004670

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 2nd International Conference on Data Science and Engineering (ICDSE 2025), pages 654-659

ISBN: 978-989-758-765-8

Proceedings Copyright © 2025 by SCITEPRESS – Science and Technology Publications, Lda.

key metrics, including RMSE, MAE and R-squared

(R2), to compare their prediction efficiency and then

to select the best model that captures the most

Since there are no fundamental guidelines to

evaluate or predict the estimation of offers inside the

stock market, this article is motivated to enhance

financial decision-making by leveraging machine

learning models to predict stock price values and

trends more accurately. By minimizing human error

and improving operational efficiency, the research

aims to discuss and give financial analysts more

reliable tools and results for predicting market

movements.

2 DATA AND METHOD

The past data for Tesla has been gathered from

Kaggle and Yahoo Finance (Ibrahim, 2024). The

dataset consists of the last 8-year financial

information from 03/01/2017 to 29/11/2024. This

data contains information about stock volume, low,

high, open and closing prices. Some extra attributes

column with the rolling window size 10 and 30

respectively; Relative Strength Index (RSI); On-

Balance Volume (OBV); the high-low ratio which

assesses the volatility for a given trading period; and

the log return used as a stationary target variable.

The average of the data from the previous and

next days is used to fill in the missing numbers to

make the dataset clean.

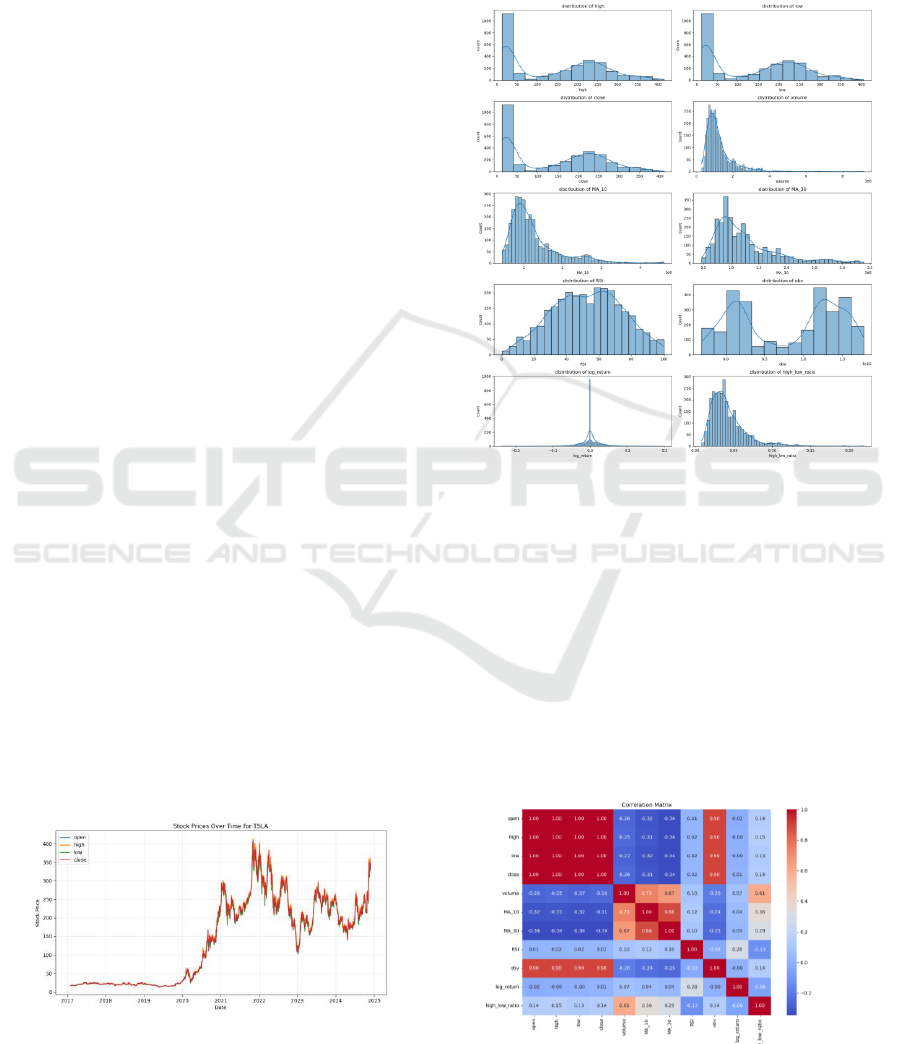

2.1 Exploratory Data Analytics

As for the Exploratory Data Analytics (EDA), a line

chart of open, high, low, close stock prices is drawn

in Figure 1. It demonstrates an increasing pattern

before 2022 and then decreases until 2024, showing a

non-stationary pattern of data.

Figure 1: Line chart for stock prices over time. (Picture

credit: Original).

In addition, the histogram graphs are

demonstrated to help understand the distribution of

data in Figure 2. It illustrates that the stock prices, RSI

and its log return are nearly normally distributed,

despite other variables do not follow the normal

distribution.

Figure 2: Histogram plot for stock prices and volume.

(Picture credit: Original).

Besides, the heatmap is also shown to illustrate

the correlation of different features used in this

dataset. It helps to visually represent the correlation

between each variable. Referred to Figure 3,

demonstrates that open, high, low, close prices are

perfectly correlated since their correlation is positive

1. MA_30 and MA_10, volume are strongly

correlated with large coefficients. Therefore, the

redundancy and multicollinearity in features should

be further considered.

Figure 3: Heatmap for features. (Picture credit: Original).

Research on Stock Price Prediction Based on Machine Learning Techniques

655

Then the Variance Inflation Factor (VIF) is used

since it quantifies the extent to which the variable's

correlation with the other variables in the model

inflates the variance of a regression line to detect

multicollinearity issue (Salmerón-Gómez et al.,

2025). A significant level of multicollinearity is

indicated if the VIF is more than 5. Since open, high,

means they are severely multicollinear, and only the

volume, RSI and high-e smallest

which less than 5.

2.2 Data Pre-processing

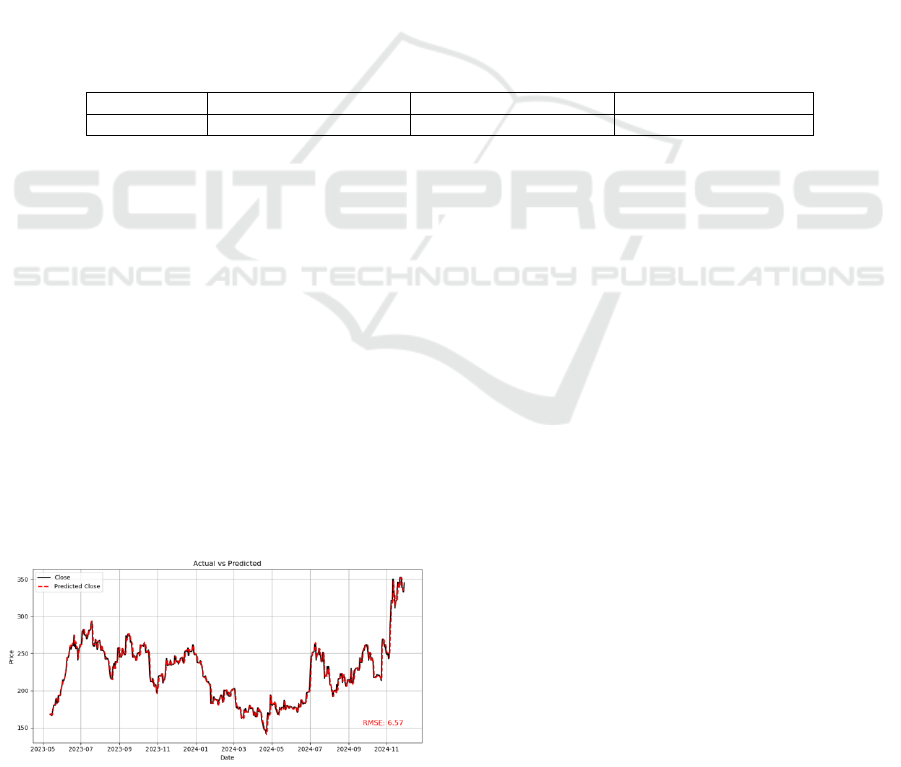

Then the dataset was separated into 80% for training

and 20% for testing, with the time interval shown in

Table 1.

This section must be in one column. In terms of

data preprocessing, different preprocessing

approaches are used for different models.

In terms of LR, in order to detect the

multicollinearity issue, the volume, RSI and high-low

ratio with the lowest VIF would be selected as

independent variables to satisfy the assumption of LR.

As for LSTM and GRU, since RNN is sensitive

to the scale of the input data. It is important to

standardize the data by Min-Max scaling (Jeyaraman,

2024). Then the input data is reshaped into a 3D

format suitable for these models. Using a sliding

window approach, the method extracts sequences of

mapping step lengths from the scaled data. Each

sequence, consisting of multiple time steps, is stored

in a 3D array.

By organizing the data into appropriate formats,

this integration of preprocessing enhances the

performance and accuracy of different models in

handling complex data.

Table 1: Time interval of the dataset.

Full dataset

Training dataset

Test Dataset

Time Interval

01/02/2017 29/11/2024

01/02/2017 07/05/2023

08/05/2023 29/11/2024

2.3 Linear Regression (LR)

LR is a statistical approach utilized to assess and

model the relationship between one or more predictor

variables and a response variable (Montgomery, Peck,

& Vining, 2013). LR finds the relationship of x and y

by fitting a specific linear equation with assumptions

of LR (Montgomery, Peck, & Vining, 2013). In this

project, all variables included are numerical. The

multiple linear regression describes this relationship

as shown in Equation (1).

where represents the stock prices of Tesla as the

target variable;

represents independent variable

stock closing price one day ago;

represents

independent variable two days ago;

represents

independent variable stock closing price three days

ago;

represents independent stock closing price

four days ago;

represents independent variable

stock closing price five days ago;

denotes

independent variable trading volume of the stock,

denotes independent variable RSI;

represents

independent variable ratio of high price to low price;

denotes the coefficients of variables

respectively,

denotes the intercept of the

regression plane; represents the error of residual

capturing the variance in target variable which is not

explained by LR model.

Figure 4: Actual and predicted results of Linear Regression.

(Picture credit: Original).

2.4 Long Short-Term Memory (LSTM)

LSTM network is a type of RNN capable of learning

long-term dependencies (Mim et al., 2023). The

vanishing gradient problem prevents traditional

RNNs from carrying forward information for lengthy

sequences since they only have short-term memory.

In order to solve this problem, LSTM uses memory

cells, which are managed by gates that control the

information flow and are able to retain their state

across time (Mim et al., 2023). Because they can hold

ICDSE 2025 - The International Conference on Data Science and Engineering

656

information over extended periods of time, they are

very useful for time series prediction problems.

The standard LSTM mainly consists of an input

gate shown in Equation (2), forget gate shown in

Equation (3), output gate shown in Equation (4), input

modulation gate shown in Equation (5), and memory

cell state shown in Equation (6), and the hidden state

is updated in Equation (7). One common LSTM unit

at time step t can be repressed in Equation (2) to (7).

Where the input gate, forget gate, output gate,

input modulation gate, and memory cell state are

denoted by the letters

,

,

,

, and

respectively;

and

)

denotes the sigmoid function; A hyperbolic tangent

tanh( ), while denotes an

elementwise multiplication;

is bias vector. In

particular, the forget gate

establishes the extent to

which the part of the prior

is involved in the

derivation of present

, whilst the input gate

regulates the input data's contributions for updating

the memory cell at time step t. The output gate

learns how to use the present state of the memory cell

to determine the LSTM unit's output (Shu et al.,

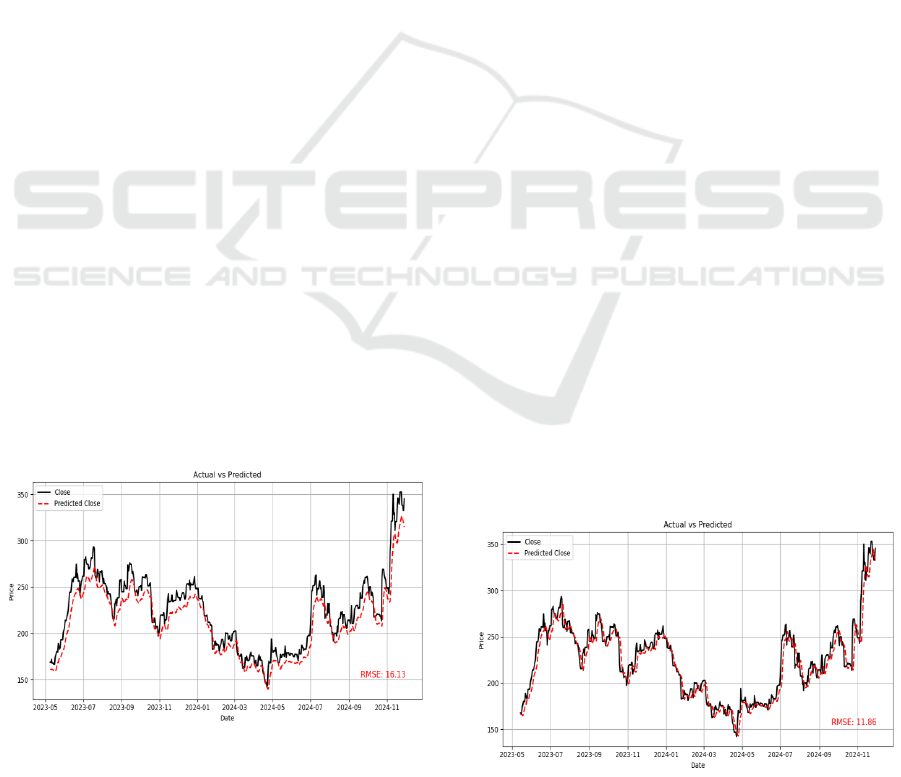

2021). And the actual stock values and predicted

values using LSTM are demonstrated in Figure 5.

Figure 5: Actual and predicted results of LSTM. (Picture

credit: Original).

2.5 Gated Recurrent Unit (GRU)

Similar to LSTM, GRU was first presented by Cho et

al. but uses a hidden state exclusively for memory

transfer and has fewer gates,

It uses two gates, the update gate z and the reset

gate r, as indicated in Equation (8), and has a similar

goal to LSTM (Pierre et al., 2023). Equation

(9) illustrates the update gate

, establishes how

much the new hidden state

is just the old state

,

and how much the new candidate state

is utilised

shown in Equation (10).

is

computed to propagate the retained information to the

subsequent unit

Figure 6: Actual and predicted results of Gated Recurrent

Unit. (Picture credit: Original).

Research on Stock Price Prediction Based on Machine Learning Techniques

657

3 RESULTS AND DISCUSSION

RMSE, MAE and R2 are used to compare the three

methodologies' effects on target variable in order to

assess these models' effectiveness. And they are all

assessed in the test data. A lower RMSE indicates a

better performance level of models and it is computed

in the following Equation (12).

Where

is the

original closing price value in

the test size,

reflects the

forecasted price and n

refers to the window size.

MAE is also called Mean Absolute Deviation. It

measures how well a model is performing by

processing the average amount that which the

forecasted values deviate from the true values (Pierre

et al., 2023). Smaller MAE values indicate that the

model's predictions are more aligned with the actual

outcomes, indicating a better performance. MAE is

expressed as the following mathematical Equation

(13).

Where n is the number of observations,

is the

actual value for the

data point in the test size,

is the predicted value for the

data point.

R2 is a key metric measuring how well the

variance in the dependent variable which can be

explained from the independent variables (Pierre et

al., 2023). A higher R2 represents a higher portion of

the variance in the dependent variable that is

predictable from the independent variables. It is

computed as well in the following Equation (14).

Where

is the original closing price in the test

size,

is referred to the predicted closing price,

is

to the mean of original closing price value.

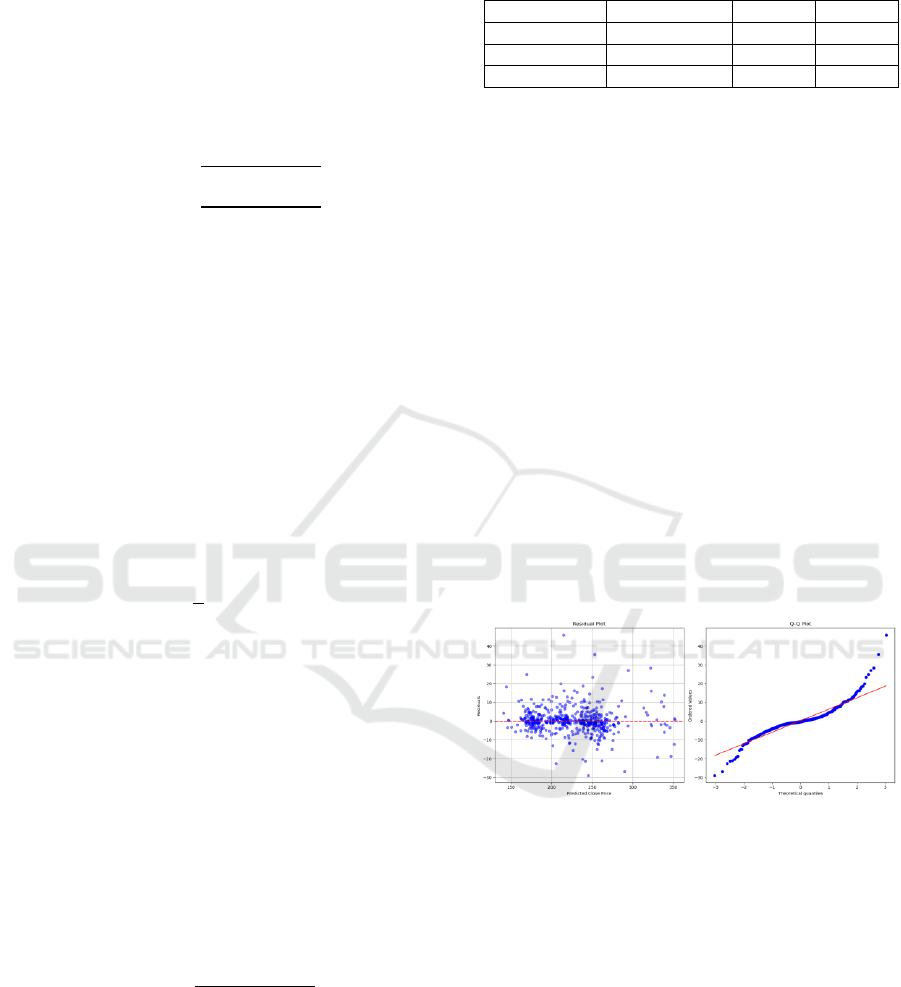

The comparative analysis of RMSE, MAE and R2

for three different models are demonstrated in Table

2.

Table 2: Comparative analysis of RMSE, MAE and R-

Squared.

RMSE

MAE

R2

LR

6.8703

4.0410

0.9705

LSTM

15.8470

13.0769

0.8442

GRU

11.7104

8.2189

0.9142

Based on three statistical metrics, the comparative

analysis indicates that LR has the best performance

with the lowest RMSE resulting in more accurate

predictions than other models, the lowest MAE

indicating a most robust model, and the highest R2

meaning that the most time series pattern is captured

among all the models.

Furthermore, the residual plot and Quantile-

performance based on its assumptions shown in

Figure 7. The assumption of linearity is met because

the associations in the residual plot can be thought of

as being randomly distributed about the zero-

horizontal line, and there is no evidence to violate the

independence assumption. In terms of

homoscedasticity, the variance in the residual plot has

a constant error, so homoscedasticity is satisfied.

Because in the Quantile-Quantile Plot the points lie

along a straight line, it suggests normality of errors.

In addition, there is no multicollinearity issue since

the VIF is tested. As a result, the assumptions of LR

are all satisfied, indicating the model is likely to

produce valid, unbiased and reliable prediction results.

Figure 7: -Q plot.

(Picture credit: Original).

4 CONCLUSIONS

The objective of the article is to forecast the value of

three models: LR, LSTM, and GRU. When

comparing the techniques and their results, the best-

performing model, with the lowest RMSE and MAE,

is LR.

To briefly summarise, the dataset found from

yahoo finance is cleaned and pre-processed with

specific EDA. Then three models LR, LSTM, and

GRU are applied and compared by their performance.

ICDSE 2025 - The International Conference on Data Science and Engineering

658

Referred to several key metrics, it demonstrates that

LR has the best performance among all the models

which has the most accurate results and the most

reliable prediction.

However, it is still a challenging task to predict

stock values in a complex pattern. Beyond traditional

financial parameters, plenty of external factors impact

the financial market, such as news sentiment,

geopolitical events, and macroeconomic conditions.

Therefore, relying solely on financial features may

not fully capture the complexity of stock dynamics.

Models can perform better and offer more accurate

and robust predictions when they incorporate

additional non-financial factors, because they offer a

more thorough comprehension of the behavior of the

market. Moreover, because time series data, in which

past prices affect future prices, is not inherently taken

into account by LR, the model might not effectively

capture temporal patterns such as trends or

seasonality, which are crucial for accurate stock price

forecasting, although LR performs better than LSTM

and GRU which are able to capture temporal patterns.

In the future, incorporating additional non-

financial features such as news sentiment, macro-

economic indicators could improve the precision of

stock price forecasts. Furthermore, combining LR

and LSTM together gives an opportunity to leverage

the strengths of both techniques. It will potentially

provide a more comprehensive and accurate model

for forecasting future stock prices.

The study underscores the significant role of

machine learning in the analysis of large-scale

financial data, enhancing both the speed and

efficiency of predictions. Furthermore, machine

learning contributes to the optimization of financial

investment strategies by generating more accurate

forecasts. By mitigating human error and bias,

machine learning emerges as a critical tool in the

financial sector, facilitating informed and data-driven

decision-making processes.

REFERENCES

Cunningham, D., 2024. Tesla regains $1 trillion in market

capitalization in post-election surge. U.S. News.

Fama, E. F., MacBeth, J. D., 1973. Risk, Return, and

Equilibrium: Empirical Tests. The Journal of Political

Economy.

Ibrahim, A.W., 2024. Tesla Stock Forecasting LSTM.

Kaggle.https://www.kaggle.com/code/abdallahwagih/te

sla-stock-forecasting-lstm/notebook

Jeyaraman, B. P., 2024. Predict stock prices with LSTM

networks, 1

st

edition.

Jegadeesh, N., Titman, S., 2001. Profitability of Momentum

Strategies: An Evaluation of Alternative Explanations.

The Journal of Finance (New York).

Li, L., Wu, Y., Ou, Y., Li, Q., Zhou, Y., Chen, D., 2017.

Research on machine learning algorithms and feature

extraction for time series. 2017 IEEE 28th Annual

International Symposium on Personal, Indoor, and

Mobile Radio Communications (PIMRC).

Mim, T. R., Amatullah, M., Afreen, S., Yousuf, M. A.,

Uddin, S., Alyami, S. A., Hasan, K. F., Moni, M. A.,

2023. GRU-INC: An inception-attention based

approach using GRU for human activity recognition.

Expert Systems with Applications.

Montgomery, D. C., Peck, E. A., Vining, G. G., 2013.

Introduction to linear regression analysis, Wiley. 5

th

edition.

Tesla Stock Price Prediction using GRU

Tutorial.Kaggle.

Pierre, A. A., Akim, S. A., Semenyo, A. K., Babiga, B.,

2023. Peak Electrical Energy Consumption Prediction

by ARIMA, LSTM, GRU, ARIMA-LSTM and

ARIMA-GRU Approaches. Energies (Basel).

Shu, X., Zhang, L., Sun, Y., Tang, J., 2021. Host-Parasite:

Graph LSTM-in-LSTM for Group Activity Recognition.

IEEE Transaction on Neural Networks and Learning

Systems.

Vijh, M., Chandola, D., Tikkiwal, V. A., Kumar, A., 2020.

Stock Closing Price Prediction using Machine Learning

Techniques. Procedia Computer Science.

Salmerón-Gómez, R., García-García, C. B., García-Pérez,

J., 2025. A Redefined Variance Inflation Factor:

Overcoming the Limitations of the Variance Inflation

Factor: A Redefined Variance Inflation Factor.

ComputationalEconomics.

Research on Stock Price Prediction Based on Machine Learning Techniques

659