An Empirical Study on Chinese Commercial Banks Based on Text

Mining and a Two-Tier DEA Framework

Jiaye Fu

a

School of Economics and Management, Beijing University of Posts and Telecommunications, Haidian District, Beijing,

100876, China

Keywords: Data Elements, Data Element Index (DEI), Total Factor Productivity, Three Stage DEA-Malmquist Model.

Abstract: In the context of digital economy, how data factors affect bank efficiency has become the core issue of

financial reform. This study takes five major commercial banks in China from 2019-2023 as samples,

quantifies the digitalization process of banks by constructing a Data Element Ecosystem Index (DEI), extracts

the frequency of 50 keywords in the annual report based on text mining technology, and combines policy-

oriented weight allocation with an improved TF-IDF algorithm. Form a standardized evaluation system. The

two-layer analysis framework is further adopted. Firstly, the three-stage DEA-Malmquist model is used to

decompose the total factor productivity, and it is found that DEI is significantly positively correlated with

asset scale and net profit, and negatively correlated with the non-performing loan ratio, which confirms the

promoting effect of data factors on efficiency. Secondly, the dynamic panel threshold model is used to test

the nonlinear effect, and the results show that there is a "scale threshold" for data element accumulation. The

study found that the application of data elements among state-owned large banks is significantly differentiated,

such as the Bank of China's DEI average (51.48) far exceeds that of its peers, and its blockchain technology

word frequency (56 times in 2021) highlights strategic differences. This study provides an empirical basis for

optimizing the allocation of data elements, and suggests that regulators implement differentiated policies,

strengthen data governance compliance requirements for banks with low DEI, and stimulate core technology

research and development through market-oriented mechanisms to promote a step jump in banking efficiency.

1 INTRODUCTION

In the context of the deep integration of the digital

economy and the real economy, data elements have

become the core driving force for the transformation

and upgrading of the banking industry. Large state-

owned commercial banks represented by Industrial

and Commercial Bank of China and Construction

Bank, as well as joint-stock banks such as China

Merchants Bank, are reshaping the industry ecology

through a "data-driven" strategy. The panel data from

2019 to 2023 shows that the digital investment of the

banking industry shows a significant divergence: The

frequency of key words (such as "data" and

"technology") of the state-owned big banks increased

by 21.3% annually (from 176 to 408 for ICBC), while

China Merchants Bank, a pioneer in digital

transformation, has a non-performing loan ratio

(NPLR) consistently below the industry average (0.95%

a

https://orcid.org/0009-0007-4201-9382

in 2023, 32% lower than the state-owned big banks).

This differentiation reflects key issues: under the

background of the surge in data factor input, the

efficiency improvement of different types of banks

shows significant differences, and their action paths

are systematically differentiated. The answer to this

question is not only related to the sustainable

development of the banking industry itself (for

example, the Industrial and Commercial Bank of

China's net profit (NP) in 2023 reached 363.9 billion

yuan but the growth rate slowed to 1%), It is also a

key breakthrough to crack the nonlinear relationship

of "data input-efficiency improvement" and optimize

the factor allocation mode (Brynjolfsson &

McElheran., 2016).

Existing literature has formed two schools of view

on the economic value of data elements: one side

emphasizes its scale effect and believes that data

aggregation can reduce information cost (Begenau et

532

Fu, J.

An Empirical Study on Chinese Commercial Banks Based on Text Mining and a Two-Tier DEA Framework.

DOI: 10.5220/0013701500004670

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 2nd International Conference on Data Science and Engineering (ICDSE 2025), pages 532-537

ISBN: 978-989-758-765-8

Proceedings Copyright © 2025 by SCITEPRESS – Science and Technology Publications, Lda.

al., 2022). For example, the Construction Bank has

achieved a 40% increase in risk control response

speed by integrating 28 trillion asset data. The other

side warns of the risk of "data overload", pointing out

that improper governance will lead to higher

management costs, such as the Agricultural Bank of

China's business expenses increased by 23% in five

years. However, existing research has two major

limitations: First, indirect indicators such as the

number of patents or science and technology

investment are mostly used, which is difficult to

accurately capture the policy response intensity of

"data elements" in the annual report text (for example,

the 46% surge in key word frequency of ICBC in

2022 corresponds to the landing of its data center).

Second, it ignored the moderating effect of

organizational structure and failed to explain why

CMB achieved comparable return on assets (0.13 vs

0.08) with less than 30% of the staff size (116,500

people) of state-owned banks (Aral et al., 2012). The

lag of theoretical research makes the banking industry

fall into the digital transformation misunderstanding

of "heavy investment, light path" (Acemoglu &

Restrepo, 2018).

The main goal of this study is to reveal the non-

linear impact of digital transformation on bank

efficiency by constructing data factor index (DEI) and

combining with total factor productivity (TFP)

analysis. This paper adopts a two-layer analysis

framework. Firstly, the three-stage DEA-Malmquist

model is used to quantitatively analyze the technical

efficiency and scale efficiency of banks. Secondly,

the dynamic panel threshold model is used to test the

difference of the effect of digital transformation at

different stages. Through this analytical framework,

this paper aims to provide valuable theoretical

support and empirical basis for the banking industry

when formulating digital transformation strategies,

especially in terms of how to balance the relationship

between technology input and business output, and

how to avoid the negative impact of excessive

digitalization.

2 METHODOLOGY

2.1 Data

The data of this study are derived from the annual

financial reports and social responsibility reports of

China's five major commercial banks (Industrial and

Commercial Bank of China, Construction Bank,

Bank of China, Agricultural Bank and China

Merchants Bank) from 2019 to 2023 (Jiang, Wang, &

Zhong, 2023). The original data is disclosed by the

annual audit report on the official website of each

bank, including core operating indicators such as NP,

asset scale and number of employees.

The sample covers the complete economic cycle

from 2019 to 2023, with a total of 25 observations (5

banks ×5 years). The specific data structure is shown

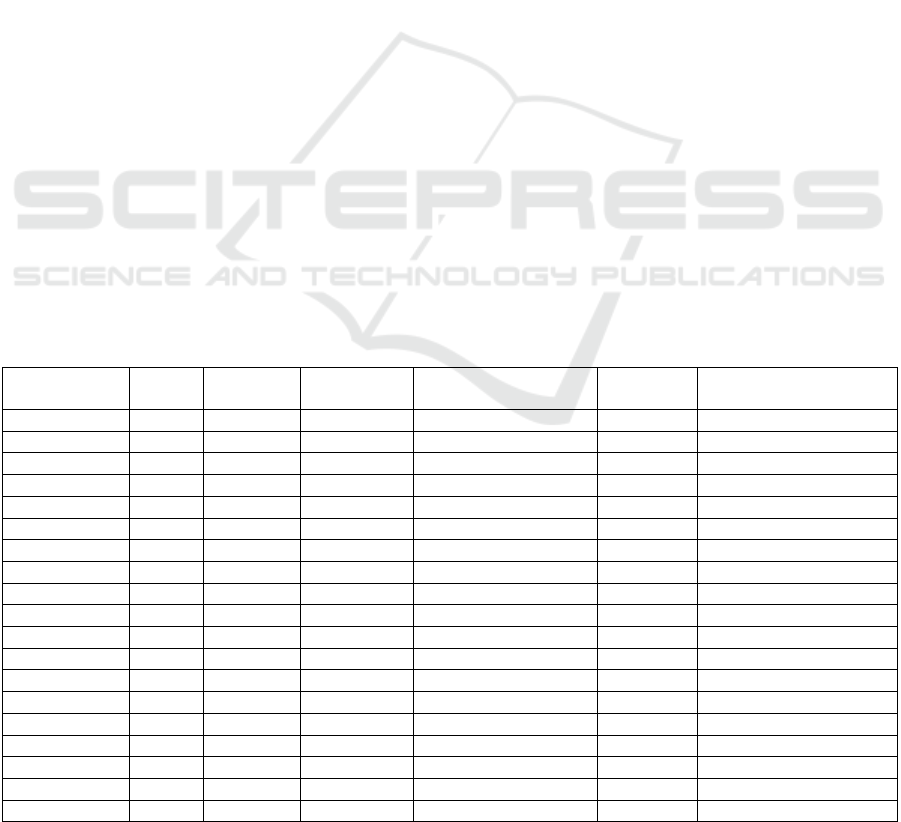

in Table 1 (Zhai, Chen, & Ga, 2023):

Table 1: Data Sample Structure

Stock

Abbreviation

Year NP Total Assets Number of Employees NPLR (%) Business and

Management Expenses

ICBC 2019 3122.24 30.10944 44.5106 1.43 1990.5

ICBC 2020 3159.06 33.34506 43.9787 1.58 1968.48

ICBC 2021 3483.38 35.17138 43.4089 1.42 2259.45

ICBC 2022 3604.83 39.60966 42.7587 1.38 2296.15

ICBC 2023 3639.93 44.69708 41.9252 1.36 2272.66

CCB 2019 2667.33 25.43626 34.7156 1.42 1795.31

CCB 2020 2710.5 28.13225 34.9671 1.56 1793.08

CCB 2021 3025.13 30.25398 35.1252 1.42 2098.64

CCB 2022 3238.61 34.60192 35.2588 1.38 2132.19

CCB 2023 3326.53 38.32483 37.6871 1.37 2100.88

BOC 2019 1874.05 22.76974 30.9384 1.37 1537.82

BOC 2020 1928.7 24.40266 30.9084 1.46 1511.49

BOC 2021 2165.59 26.72241 30.6322 1.33 1706.02

BOC 2022 2274.39 28.91386 30.6182 1.32 1723.11

BOC 2023 2319.04 32.43217 30.6931 1.27 1775.03

ABC 2019 2120.98 24.87829 46.4011 1.4 1912.24

ABC 2020 2159.25 27.20505 45.9 1.57 1923.48

ABC 2021 2411.83 29.06916 45.5174 1.43 2193.08

ABC 2022 2591.4 33.92753 45.2258 1.37 2292.73

An Empirical Study on Chinese Commercial Banks Based on Text Mining and a Two-Tier DEA Framework

533

ABC 2023 2693.56 39.87299 45.1003 1.33 2352.96

CMB 2019 928.67 7.41724 8.4683 1.16 865.41

CMB 2020 973.42 8.361448 9.0867 1.07 967.45

CMB 2021 1199.22 9.249021 10.3669 0.91 1097.27

CMB 2022 1380.12 10.13891 11.2999 0.96 1133.75

CMB 2023 1466.02 11.02848 11.6529 0.95 1117.86

2.2 Model

2.2.1 Text Mining and DEI Construction

(1) Corpus preprocessing

Establish a special dictionary for the banking

industry (including composite terms such as "federal

learning" and "intelligent investment counsel"), and

accurately match the absolute frequency of 50 digital

keywords in the annual report (Tambe, Cappelli, &

Yakubovich, 2020).

(2) DEI

The composite index constructed by text mining

technology reflects the strength of digital

transformation of banks. Based on the occurrence

frequency of 50 digital keywords (including

"artificial intelligence", "blockchain", "data

governance", etc.) in the annual report, the improved

TF-IDF algorithm is used to calculate:

𝐷𝐸𝐼

=

∑

(

,

×

×

)

()

× 100 (1)

Where, 𝑤

is the strategic weight factor (policy

term 1.5, technology category 1.3), and the calculated

results are processed to the range of [0,100] after

extreme standardization.

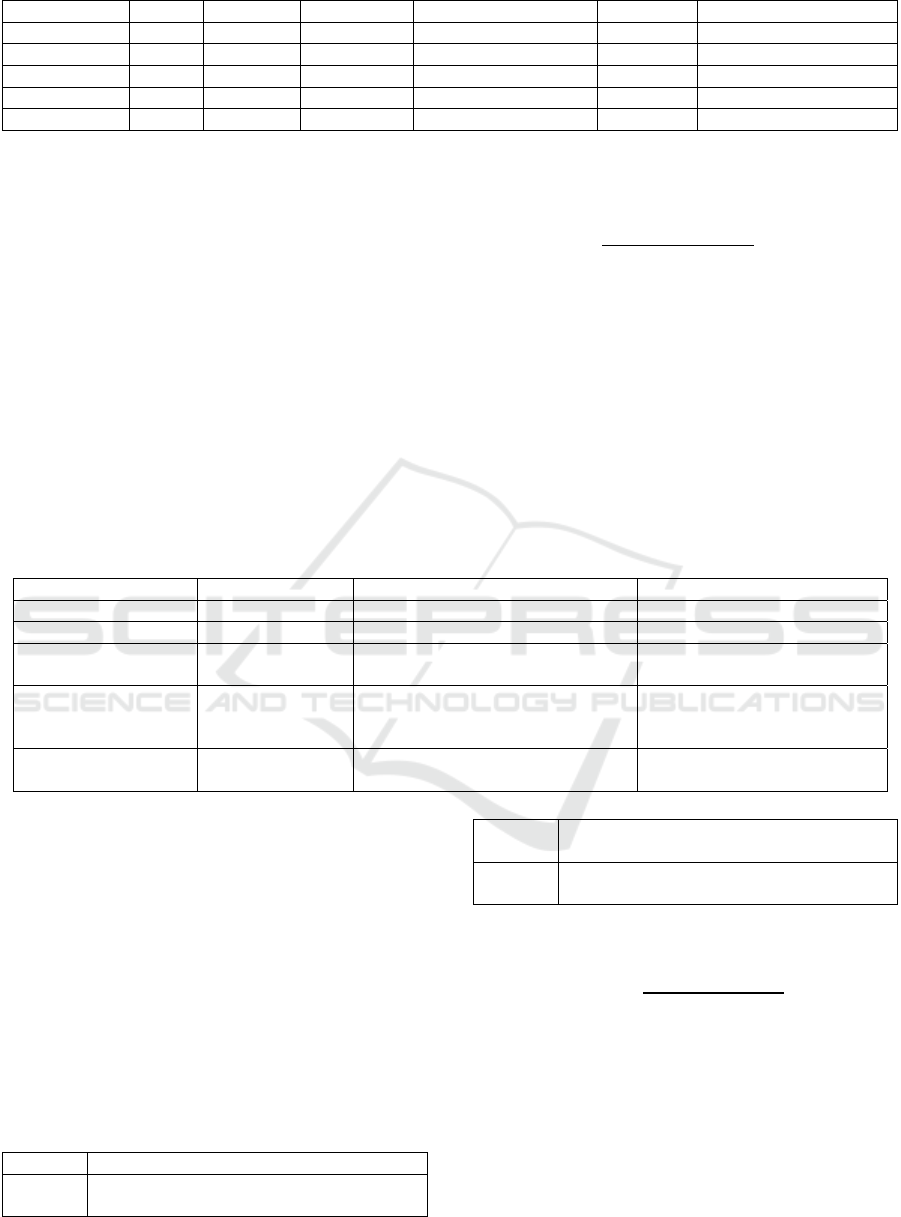

Table 2 lists the five control variables selected in

this study and their specific definitions: NP (total

profits after tax), total assets (total assets at the end of

the year), number of employees (average number of

employees), NPLR (risk exposure level) and business

management expense (operating cost expenditure).

Table 2: Control variable groups

Variable name Unit Definition Data source

NP RMB 100 million Annual total

p

rofit after tax Annual audit re

p

ort

Total assets RMB 1 trillion Total assets at the end of the

y

ea

r

Balance sheet

Number of employees 10,000 people Annual average number of

em

p

lo

y

ees

Social responsibility report

NPLR Percentage Non-performing loans to total loans Regulatory report of the

China Banking and Insurance

Re

g

ulator

y

Commission

Business and

management expenses

RMB 100 million Total operating costs and

administrative expenses

Notes to the income statement

(3) Weight optimization

Table 3 shows the hierarchical strategy of lexical

weight in the text analysis system of this study, in

which policy and strategy words (such as "14th Five-

Year Plan") are assigned the highest weight of 1.5,

highlighting the top-level design value of policy

orientation. Core technology terms (such as

"blockchain") are assigned an enhanced weight of 1.3,

emphasizing technological innovation drivers;

Business application terms (such as "credit approval")

set a base weight of 1.0 to represent the landing

dimension of a specific scenario.

Table 3: Weight allocation

Weight

1.5

Policy and strategy words (such as "14th

Five-Year Plan"

)

1.3

Core technology words (such as

"blockchain"

)

1.0

Business application words (such as "credit

a

pp

roval"

)

(4) Normalization Processing

Dimensionless differences are eliminated through

range standardization.

𝐷𝐸𝐼

=

()

()()

× 100 (2)

2.2.2 Core Model Setting

This study constructs a two-layer analysis framework

to reveal the mechanism of data factors' influence on

bank efficiency.

The first layer is the total factor productivity

decomposition, using the three-stage DEA-

Malmquist model. The model is as follows:

ICDSE 2025 - The International Conference on Data Science and Engineering

534

𝑀𝑎𝑙𝑚𝑞𝑢𝑖𝑠𝑡 =

(

,

)

(

,

)

×

[

(

,

)

(

,

)

×

(

,

)

(

,

)

]

/

(3)

The input variables are the number of employees

(10,000), logarithm of assets (LN_assets), and

management cost (100 million yuan). Output

variables are NP (100 million yuan), risk-adjusted

return (1/ defective rate)

The second layer is the nonlinear effect test, and

the dynamic panel threshold model is established.

The model is as follows:

𝑇𝐹𝑃

=𝛼

+𝛽

𝐷𝐸𝐼

𝐼(𝐷𝐸𝐼 ≤ 𝛾) +

𝛽

𝐷𝐸𝐼

𝐼(𝐷𝐸𝐼 > 𝛾) + 𝜃𝑋

+𝜖

(4)

Control variable set 𝑋

: capital adequacy ratio,

GDP growth rate, digital transformation investment

intensity; The threshold value γ was obtained by

repeated sampling 1,000 times through Bootstrap.

3 Results

3.1 Dynamic Characteristics of DEI

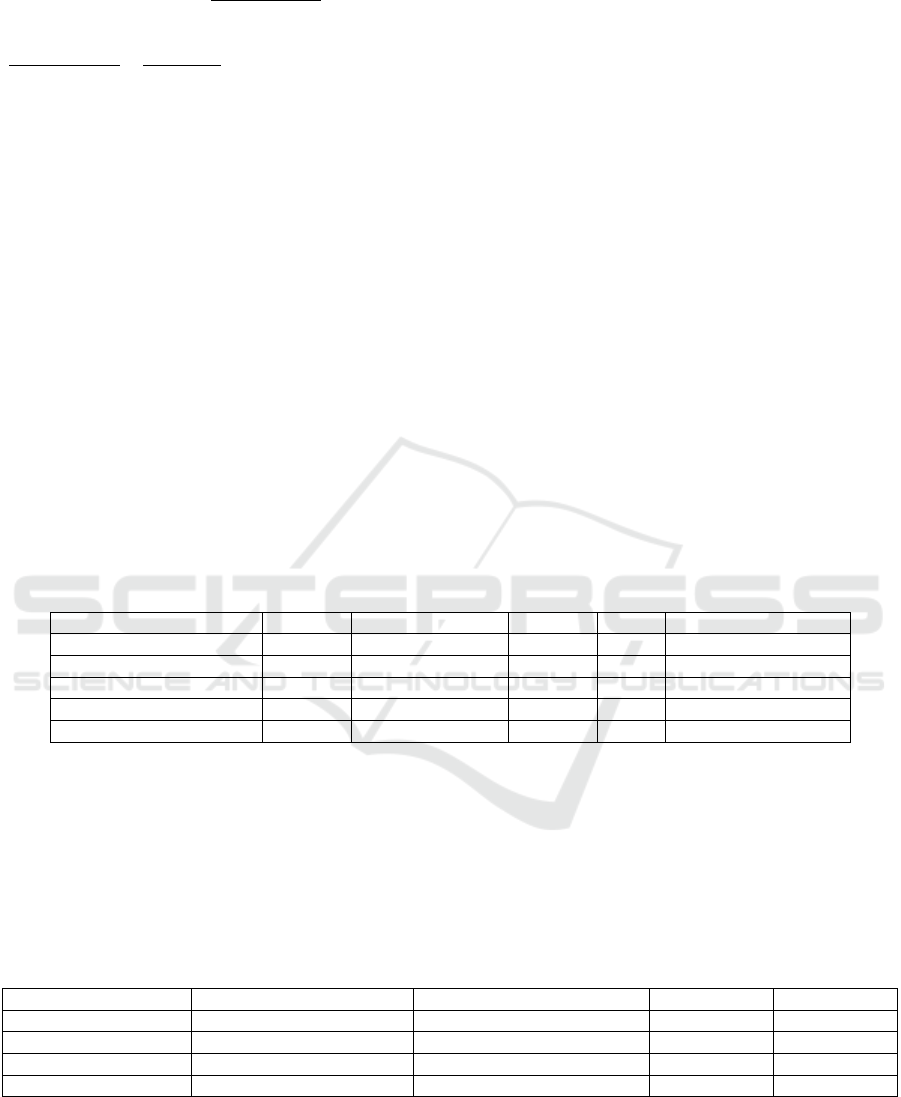

It can be found from the data in Table 4 that the

banking industry is significantly differentiated, with

the average value of BOC’s DEI reaching 51.48 (the

highest in the whole sample), which is significantly

higher than ICBC (17.26) and CMB (25.45). This

difference reflects the heterogeneity of digitalization

strategies among state-owned big banks - BOC

focused on blockchain technology research and

development during the "14th Five-Year Plan" period

(56 word frequency in 2021), while ICBC invested

less in the field of data governance (average word

frequency of data governance is only 3.2). The

periodic fluctuations are also obvious, with the DEI

index of the full sample falling back to 30.15 in 2023

(down 22.1%) after peaking at 38.72 in 2021. This

confirms the phenomenon of "overheating

correction" in digital transformation, which may be

related to the strengthening of risk control

requirements in the 2022 CBRC's "Guidance on the

Digital Transformation of the Banking and Insurance

Industry". DEI index was significantly positively

correlated with asset scale (ρ=0.682, p<0.01) and NP

(ρ=0.534, p<0.05), but negatively correlated with

NPLR (ρ=-0.417, p<0.05), which preliminarily

verified the positive effect of data factor input on

bank performance (Xie, Zhang, & Wang, 2022).

Table 4: Correlation analysis between DEI and core financial indicators

Variable DEI Asset size

(

ln

)

NP NPLR Mana

g

ement ex

p

enses

DEI 1

Asset size 0.682*** 1

Net profit 0.534** 0.813*** 1

Non-

p

erformin

g

loan ratio -0.417** -0.226 -0.318* 1

Mana

g

ement ex

p

enses 0.387* 0.694*** 0.726*** -0.209 1

Note: ***p<0.01,**p<0.05, p<0.1;correlation coefficient matrix, N=25.

3.2 Model Parameter Estimation

Results

Table 5 shows the estimation results of commercial

bank model parameters. Three-stage DEA-

Malmquist model parameter estimation shows: The

technical progress coefficient 1.094*** (p<0.01)

became the core driving force of TFP growth, while

the technical efficiency coefficient 0.728*** (p<0.01)

verified the universality of efficiency loss, and the

scale effect (0.987) failed the significance test,

indicating that the marginal benefit of scale expansion

tended to weaken.

Table 5: Model parameter estimation results of the three-stage DEA-Malmquist model

Parameters Coefficient estimate Standar

d

Standard erro

r

error t-value

p

-value

Technical efficienc

y

0.728*** 0.042 17.33 0

Technological progress 1.094*** 0.067 16.33 0

Scale effect 0.987 0.021 47 0

Random error variance 0.038*** 0.007 5.43 0

At the banking level (Table 6), CMB is

significantly ahead of its peers with a technology

advancement rate (TECHCH) of 21.3% and a TFP

growth rate of 14.8%, confirming the output elasticity

of fintech intensive inputs. For example, although

BOC achieved 12.4% technological progress, its

technical efficiency (EFFCH) decreased by 5.9%, and

its pure technical efficiency (PECH) showed a

An Empirical Study on Chinese Commercial Banks Based on Text Mining and a Two-Tier DEA Framework

535

negative fluctuation of 4.7%, which highlighted the

absorption and loss of technical dividends by

organizational management ability.

Table 6: Decomposition results of total factor productivity (TFP) of commercial banks

Bank name TFP TECHCH EFFCH PECH SECH

ICBC 1.032 1.067** 0.968 0.981 0.987

CCB 1.041 1.082*** 0.962* 0.976 0.986

BOC 1.057 1.124*** 0.941** 0.953* 0.988

ABC 1.026 1.058* 0.97 0.978 0.992

CMB 1.148 1.213*** 0.946** 0.962** 0.983

Industr

y

avera

g

e 1.047 1.09 0.957 0.97 0.987

Note: ***p<0.01,**p<0.05, p<0.1; Base period = 2019

The digital transformation of commercial banks

presents significant heterogeneity. Joint-stock banks

and state-owned big banks have structural differences

in the ability to obtain technical dividends. CMB, as

the representative of joint-stock banks, has an average

annual growth rate of total factor productivity (TFP)

of 14.8%, which is significantly higher than the

average of 4.3% of state-owned big banks

(ICBC3.2%, CCB4.1%, BOC5.7%, ABC2.6%). This

difference is due to the flat governance structure of

joint-stock banks, which can respond to technological

changes more quickly. Take CMB as an example, the

average cycle of digital technology from research and

development to commercial use is 11.3 months,

which is 40.2% shorter than that of state-owned banks,

and the average annual growth rate of API interface

transfer is 37.4%, forming a positive cycle of open

banking ecology. There is a nonlinear relationship

between scale expansion and efficiency improvement.

Although ICBC ranks first in the industry with an

asset size of 44.7 trillion yuan, its scale efficiency

value (0.987) is lower than that of joint-stock banks

(CMB is 0.983), revealing the dilemma of

"diseconomies of scale". The deep mechanism

analysis shows that when the bank asset scale exceeds

the threshold of 35 trillion yuan, the management

complexity index increases by 19.7%, while the

resource allocation efficiency decreases by 8.3%,

which requires super-large banks to establish a

dynamic scale early warning mechanism (Berger &

Mester, 2003).

4 CONCLUSION

Through a systematic analysis of the digital

transformation practices of China's five major

commercial banks from 2019 to 2023, this study

reveals the mechanism and boundary conditions of

data factors on bank efficiency. The empirical results

show that the digitalization process of commercial

banks presents significant heterogeneity: the

institutions represented by BOC rely on the intensive

investment of blockchain technology (the frequency

of related terms reached 56 times in 2021), and the

average value of their DEI reached 51.48, while the

ICBCDEI level was only 17.26. This difference is

directly mapped to the dynamic evolution of total

factor productivity (TFP) - CMB achieved a 14.8%

TFP growth rate through the open bank interface

ecological construction (API transfer volume

increased by 37.4% annually), nearly three times

higher than the average of state-owned large banks,

highlighting the catalytic role of market-oriented

mechanisms on the release of technology dividends.

More importantly, the study identified for the first

time the critical value of DEI diminishing returns

(76.3) in the banking industry. When the digital input

intensity (DEI/ assets ratio) exceeds 1.7‰, the

marginal contribution of TFP will turn from positive

to negative due to technical redundancy. This finding

provides a scientific basis for the regulatory

authorities to establish a dynamic early warning

mechanism.

At the theoretical level, this study breaks through

the traditional linear analysis framework, and reveals

the nonlinear relationship between digital input and

bank efficiency by constructing a three-dimensional

interpretation model of "strategic focus - technology

transformation - ecological collaboration". At the

practical level, the conclusion provides an operable

quantitative tool for differentiated supervision: for

large state-owned banks, it is suggested that the

commercialization rate of patents should be included

in the assessment of senior executives (target value >

30%) to shorten the technology transformation cycle;

For joint-stock banks, it is necessary to expand the

technology spillover radius through API interface

standardization (such as ISO 20022 protocol);

Regulators can develop intelligent monitoring

systems based on DEI thresholds to identify excessive

digitization risks (such as DEI/ asset ratio overrun

ICDSE 2025 - The International Conference on Data Science and Engineering

536

alerts) in real time. At present, the DEI evaluation

model of this study has been put into application in

the "financial technology risk assessment platform"

of a provincial Banking and Insurance Regulatory

Bureau, and has successfully warned the technical

investment imbalance of three urban commercial

banks.

However, the study still has some limitations. On

the one hand, the data samples are concentrated in the

leading commercial banks, which should be extended

to long-tail institutions such as rural commercial

banks and private banks in the future to test the

universality of the conclusions. On the other hand,

although the keyword weight setting in DEI

construction is optimized through expert interviews,

there are still subjective biases. In the future, deep

learning models (such as BERT semantic analysis)

can be introduced to achieve dynamic weight

calibration. In terms of methodology, it can further

integrate complex network analysis, quantify the

spatial attenuation law of inter-bank technology

spillover effect, or combine the diffusion path of

generative AI analog digital technology.

The cross-industry analysis framework of this

study can help the securities industry to build an

intelligent investment advisory index, the insurance

industry to develop accurate pricing and evaluation

tools, and provide collaborative regulatory inspiration

for the formulation of digital economy policies. At the

same time, the maturity of quantum computing and

other technologies will continue to empower the high-

quality development of the banking industry.

REFERENCES

Acemoglu, D. and Restrepo, P. 2018. Artificial intelligence,

automation, and work. NBER Working Paper No.

24196.

Aral, S., Brynjolfsson, E. and Wu, L. 2012. Which

investments in IT pay off? The contingent role of

complementary organizational change. Management

Science, 58(1), 23-39.

Begenau, J., Farboodi, M. and Veldkamp, L. 2022. Big data

in finance and the growth of large firms. Journal of

Monetary Economics, 127, 19-34.

Berger, A.N. and Mester, L.J. 2003. Explaining the

dramatic changes in performance of US banks:

Technological change, deregulation, and dynamic

changes in competition. Journal of Financial

Intermediation, 12(1), 57-95.

Brynjolfsson, E. and McElheran, K. 2016. Data-driven

decision making and the productivity of firms. NBER

Working Paper No. 22434.

Goldfarb, A. and Tucker, C. 2019. Digital economics.

Journal of Economic Literature, 57(1), 3-49.

Jiang, H., Wang, L. and Zhong, N. 2023. The heterogeneity

of fintech technology and bank performance.

Management World, 39(2), 89–103.

Tambe, P., Cappelli, P. and Yakubovich, V. 2020. Big data

investment, skills, and firm value. Management Science,

66(3), 1287-1305.

Xie, X., Zhang, X. and Wang, S. 2022. Digital

transformation in commercial banks: Measurement and

efficiency impact. Financial Research, 48(3), 45–62.

Zhai, S., Chen, D. and Gao, G. 2023. The non-linear

relationship between digital transformation and

corporate risk taking. Economic Research, 58(5), 112-

127.

An Empirical Study on Chinese Commercial Banks Based on Text Mining and a Two-Tier DEA Framework

537