The Comprehensive Analysis of Bank Loan Approval Prediction

Based on Machine Learning Models

Deyi Li

a

Boston University, One Silber Way, Boston, MA 02215, U.S.A.

Keywords: KNN, SVM, Decision Tree, Random Forest, XGboost.

Abstract: In contemporary society, given the current economic depression, many households are experiencing

significant financial pressure, making it increasingly challenging to meet large capital requirements. The price

and cost of products is increasing, and the capital required for a lump-sum purchase has become prohibitively

high. Therefore, obtaining a bank loan represents one of the most practical solutions to address this need.

However, for banks, the volume of daily loan applications is substantial, making it impractical to approve

every request. This necessitates the allocation of limited funds to reliable applicants who have a strong

likelihood of repayment. Most banks consider a customer’s credit score as a critical factor in loan approval.

However, when credit scores are unavailable in customer information, the alternative relevant data can be

utilized to assess risk. Five models of machine learning, in this study, were applied to predict loan issuance

status in both scenarios: including and excluding credit scores. The accuracy of prediction, precision of

prediction, recall score of prediction, f1 and Area Under Curve (AUC) score of these models were compared

and evaluated. When credit scores are available, the decision tree model attains the highest accuracy and AUC

score compared to other models; among predictions made without credit scores, the random forest model

provides the best comprehensive performance.

1 INTRODUCTION

In recent years, the loan industry has experienced

rapid growth alongside the swift economic expansion.

The development of the loan business has a

stimulating effect on improving domestic demand

and promoting consumption. The amount of personal

loans continues to grow. According to the statistical

data released by the Central Bank, as of the end of

2022, the balance of RMB loans extended by

financial institutions stood at 213.99 trillion yuan,

representing an 11.1% year-on-year increase. For the

entire year, RMB loans expanded by 21.31 trillion

yuan, marking a year-on-year rise of 1.36 trillion

yuan. The risk problems such as credit default are also

increasing, which partly limits the healthy

development of the credit market (Tumuluru et al.,

2022). Non-performing loans pose significant risks to

banks' financial health and operational stability. An

excessive accumulation of such loans can severely

impair a bank's ability to function effectively. (Sheikh

et al., 2020) Moreover, from a societal perspective,

a

https://orcid.org/0009-0009-1172-3435

non-performing loans can have detrimental effects,

leading to a cascade of adverse consequences.

Due to the increasing number of bank loan

applications, banks need to be very strict in the

comprehensive examination of all aspects of the

applicant. During this review process, banks must

accurately assess whether applicants meet the

eligibility criteria for loan approval based on the

available information, thereby mitigating potential

risks. (Anand et al., 2024) To realize an automatic

process, reduce labor costs, and minimize risk

exposure, banks can leverage machine learning

models to build predictive systems (Khan et al., 2021).

As a subset of the technology that can perform tasks

typically requiring human intelligence, machine

learning, is capable of rapidly processing and

analyzing vast datasets, enabling it to make informed

predictions based on historical data. (Uddin et al.,

2023).

A considerable body of research has explored this

topic as well. For instance, in research, the author

employed a range of machine learning algorithms,

Li, D.

The Comprehensive Analysis of Bank Loan Approval Prediction Based on Machine Learning Models.

DOI: 10.5220/0013701400004670

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 2nd International Conference on Data Science and Engineering (ICDSE 2025), pages 527-531

ISBN: 978-989-758-765-8

Proceedings Copyright © 2025 by SCITEPRESS – Science and Technology Publications, Lda.

527

such as Random Forest, Support Vector Machine, K-

Nearest Neighbor, and Logistic Regression, to

forecast the rate of loan approval eligibility and the

random forest algorithm yielded the most favorable

outcomes, achieving 81% accuracy (Tumuluru et al.,

2022). Similarly, both paper and research evaluated

the performances of these models and reported

random forest is better than another model, achieving

80% - 90% accuracy (Khan et al., 2021; Sarkar et al.,

2024).

The main objective of this research is utilizing an

extensive dataset encompassing customer data,

including credit score, annual income, loan amount,

loan term, various kinds of assets evaluations, etc. to

compare and evaluate the performance of various

kinds of models for predicting loan issuance under

two distinct feature combinations, to select the

optimal model that enhances audit efficiency and

accuracy while mitigating associated risks. These

predictive models not only help applicants reduce

waiting times for applications, but also assist banks in

minimizing risks and accurately identify customer

categories.

2 METHODOLOGY

2.1 Dataset Description

This dataset named loan approval is from Kaggle.

There are 4269 rows and 13 columns, including 10

numerical columns and 3 categorical columns, which

are some detailed information of applicant customers,

such as the number of their offspring, their income of

every year, their amount of loan, their total term of

loan, their credit score, the value of their different

kinds of properties. The target column is the status of

their loan, specifying whether each loan application

was approved or rejected. The original dataset was

split into two sets, a training set and a testing set, with

80% allocated to the training set. In this research, a

training set was used to train the five different models

based on all features mentioned above, and the rest of

the features except for credit score to predict whether

the customer in the testing set is approved for a loan

or not.

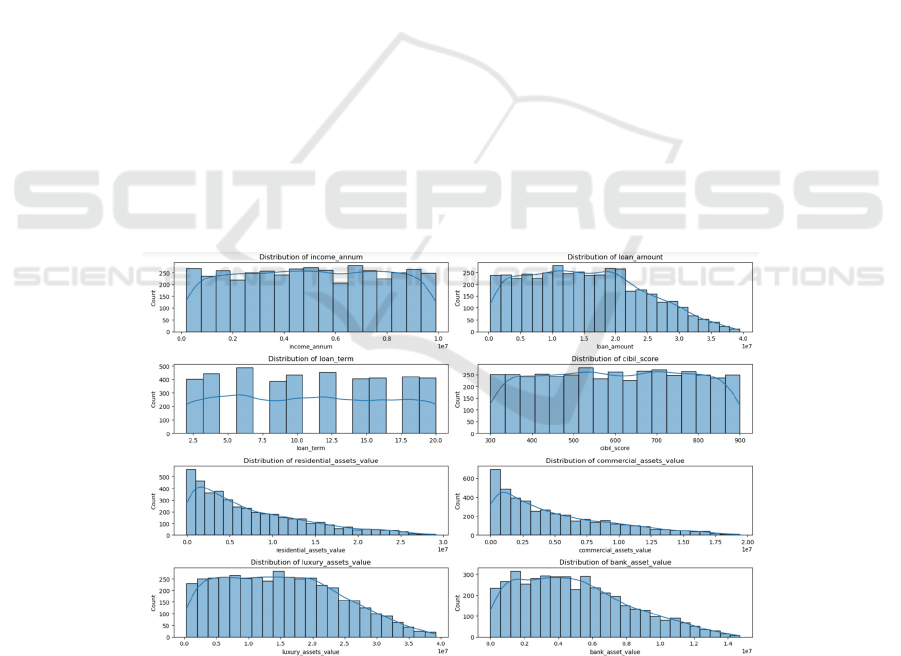

2.2 Exploratory Data Analysis

Some of the numerical features have imbalanced

distribution, such as the loan amount of those clients,

the value of those assets, including residential,

commercial, luxury, and bank property. Some of

numerical features are balanced distribution, such as

annual income, loan term, and credit score.

Categorical features are almost balanced. As shown

in two Figures 1, 2:

Figure 1: Numeric features distribution (Photo/Picture credit: Original).

ICDSE 2025 - The International Conference on Data Science and Engineering

528

Figure 2: Categorical features distribution (Photo/Picture credit: Original).

2.3 Data Preprocessing

The paper converted categorical variables into

numeric form. For example, in the education column,

1 represents graduate and 0 represents not graduate;

in the column which indicates the status of

employment, 1 represents that this person was self-

employed and 0 represents that this person was not

self-employed; in the column which indicates the

status of loan, 1 represents approved and 0 represents

rejected. The author also used standard scaler to scale

some numerical features, such as the residential,

commercial, luxury, and bank asset, these kinds of

assets value of customers.

2.4 Machine Learning Models

2.4.1 K Nearest Neighbors (KNN)

KNN, a supervised learning algorithm, suitable for

classification tasks, as well as regression tasks. (View

of Prediction of Loan Approval in Banks Using

Machine Learning Approach, 2025) The core concept

of KNN is to identify the K samples in the training

dataset that are most similar to a new data point based

on a predefined distance metric. For classification

tasks, the algorithm predicts the category of the new

data point by analyzing the categories of its nearest K

neighbors. And for regression tasks, it estimates the

value of a new data point by calculating the average

of the values of its nearest K neighbors.

2.4.2 Decision Tree (DT)

DT model, a kind of supervised learning algorithm, is

usually employed in classification programs, as well

as regression programs. This kind of predictive model

is constructed upon a flowchart framework, which

means that it makes choices based on input data. The

tree learning algorithm and supervised learning

technology can be applied to the prediction model

with high accuracy.

2.4.3 Support Vector Machine (SVM)

SVM, a kind of supervised learning algorithm, is

primarily utilized for classification tasks, as well as

regression tasks. SVM is particularly well-suited for

small sample datasets and high-dimensional data.

2.4.4 Random Forest (RF)

RF is one of the prominent supervised learning

methods mainly applied to machine learning

problems involving regression and classification.

The core of this approach is that mixing different

types of learning models together can enhance the

aggregated results. The RF method provides tree-

based prediction results and predicts the actual real

model based on the prediction results that received

the most votes. (Arun et al., n.d.) An increase in the

number of trees within a forest generally leads to

higher accuracy and reduces the likelihood of

overfitting. (Alaradi & Hilal, 2020)

2.4.5 XGBoost

XGBoost is an efficient supervised learning

algorithm suitable for classification and regression

tasks. It can efficiently solve problems in the real

world and is widely used in various competitions, so

it is one of the most mainstream models today.

It is especially effective when dealing with

structured data. (Yu et al., 2024) Its main idea is to

construct a robust model for prediction by integrating

multiple weak learners, thereby progressively

reducing the prediction error of the model. XGBoost

introduces several critical enhancements over

traditional gradient boosting machines (GBM), which

The Comprehensive Analysis of Bank Loan Approval Prediction Based on Machine Learning Models

529

substantially improve both the computational

efficiency and predictive performance of the model.

3 RESULTS

3.1 Result of Prediction 1

The accuracy score of prediction, the precision of

prediction, the recall of prediction, f1 score of

prediction, and AUC score of prediction for scenario

1 are calculated and shown in Table 1. Decision Tree

model performed best in terms of Accuracy and AUC

score, which means that Decision Tree model is

generally correct in prediction and has the best

discrimination power to distinguish between classes.

SVM model has the lowest Accuracy and AUC score,

which means that in this particular scenario, SVM

model may exhibit inferior performance compared to

alternative models.

Table 1: performance of models in scenario 1

Models Accurac

y

score Precision score Recall score F1 score AUC score

KNN 0.954333 0.969466 0.956685 0.963033 0.953575

Decision Tree 0.982436 0.984962 0.986817 0.985889 0.981025

SVM 0.943794 0.980119 0.928437 0.953578 0.948739

Random Forest 0.975410 0.982955 0.977401 0.980170 0.974769

XGBoost 0.977752 0.979401 0.984934 0.982160 0.975439

3.2 Result of Prediction 2

The accuracy score of prediction, the precision of

prediction, the recall of prediction, f1 score of

prediction, and the AUC score of prediction for

scenario 2 are calculated and shown in Table 2.

Overall, Random Forest model performed best in

terms of Accuracy and AUC score, which means that

Random Forest model is generally correct in

prediction and has the best discrimination power to

distinguish between classes. Decision Tree model has

the lowest Accuracy and SVM model has the lowest

AUC score.

Table 2: performance of models in scenario 2

Models Accurac

y

score Precision score Recall score F1 score AUC score

KNN 0.576112 0.639209 0.730697 0.681898 0.526339

Decision Tree 0.558548 0.644195 0.647834 0.646009 0.529799

SVM 0.621780 0.621780 1.000000 0.766787 0.500000

Random Forest 0.606557 0.639885 0.839925 0.726384 0.531417

XGBoost 0.572600 0.637417 0.725047 0.678414 0.523514

4 DISCUSSION

Compared to the findings of other studies, the random

forest model demonstrates superior performance as a

relatively optimal approach for predicting loan

eligibility. But, the dataset utilized for training the

model in this experiment is constrained, and future

enhancements could involve automating the model to

facilitate the automatic incorporation of new data into

the training database. This would contribute to more

robust training and improved predictive performance.

This research should also use k-fold cross-validation

in the experiment to ensure that the predictions are

stable and reliable (Khan et al., 2021). Loan

forecasting is a complex and challenging problem in

practice. Macroeconomic factors such as

unemployment and inflation can influence loan

defaults. Additionally, incomplete training data may

introduce biases, leading to unfair or inaccurate

predictions. These factors are inherently

unpredictable and difficult to quantify, necessitating

more comprehensive data for model training and

ongoing model optimization to ensure accurate and

robust predictions (Sarkar et al., 2024).

5 CONCLUSION

In this research, it conducted a comprehensive

comparison and analysis of machine learning models

utilized for predicting loan approvals. The predictive

process begins with data preprocessing, including

converting the categorical features into numerical

form, scaling the numerical features, and splitting the

original dataset into two parts: the training set and the

ICDSE 2025 - The International Conference on Data Science and Engineering

530

testing set, as well as utilizing K-Nearest Neighbors

(KNN), Support Vector Machine(SVM), Decision

Tree, Random Forest, and XGBoost, these five

models to learn and analyze the content of the training

model in the two scenarios respectively, and then

apply them to the testing set to predict whether to

issue loans for a customer. Finally, the accuracy score

of prediction, the precision score of prediction, the

recall score of prediction, f1 score of prediction, and

AUC score of prediction for scenario 1 and 2 are

calculated and the score of accuracy, as well as AUC

is used as evaluation factors to select the optimal

model.

In the case of credit scores, the Decision Tree

model exhibits the highest accuracy and AUC score,

making it the optimal choice. In the case of absence

credit score, the Random Forest (RF) model

outperforms other models in the comparison of

accuracy score and AUC values.

In the future, these models still need to be trained

on the large and noisy dataset to improve their

stability and accuracy. They will continue training

and testing repeatedly to perfect them to help banks

minimize the risk.

REFERENCES

Alaradi, M. and Hilal, S. 2020. Tree-Based Methods for

Loan Approval.

Anand, R., Singh, H., Sardana, K., Gupta, D. N., Sindhwani,

N. and Mittal, M. 2024. Loan Approval Prediction

Using Machine Learning. Lecture Notes in Networks

and Systems, 357–366.

Arun, K., Ishan, G. and Sanmeet, K. (n.d.) Loan Approval

Prediction based on Machine Learning Approach. IOSR

Journal of Computer Engineering (IOSR-JCE), 79–81.

Khan, A., Bhadola, E., Kumar, A. and Singh, N. 2021. Loan

Approval Prediction Model: A Comparative Analysis.

Advances and Applications in Mathematical Sciences,

20(3), 427–435.

Sarkar, T., Rakhra, M., Sharma, V. and Singh, A. 2024. An

Empirical Comparison of Machine Learning

Techniques for Bank Loan Approval Prediction.

Sheikh, M. A., Goel, A. K. and Kumar, T. 2020. An

Approach for Prediction of Loan Approval using

Machine Learning Algorithm. IEEE Xplore, 1 July.

Tumuluru, P., Burra, L. R., Loukya, M., Bhavana, S.,

SaiBaba, H. M. H. and Sunanda, N. 2022. Comparative

Analysis of Customer Loan Approval Prediction using

Machine Learning Algorithms. 2022 Second

International Conference on Artificial Intelligence and

Smart Energy (ICAIS).

Uddin, N., Ahamed, M. K. U., Uddin, M. A., Islam, M. M.,

Talukder, M. A. and Aryal, S. 2023. An Ensemble

Machine Learning Based Bank Loan Approval

Predictions System with a Smart Application.

International Journal of Cognitive Computing in

Engineering, 4, 327–339.

View of Prediction of Loan Approval in Banks using

Machine Learning Approach. 2025

vandanapublications.com. Available at:

https://ijemr.vandanapublications.com/index.php/j/arti

cle/view/1318/1163 (Accessed: 10 March 2025).

Yu, K., Xia, S., Zhang, Y. and Wang, S. 2024. Loan

Approval Prediction Improved by XGBoost Model

Based on Four-Vector Optimization Algorithm.

Applied and Computational Engineering, 82(1), pp.

35–44.

The Comprehensive Analysis of Bank Loan Approval Prediction Based on Machine Learning Models

531