LGBM on Stock Returns Prediction and Portfolio Construction

Hongyu Zhu

a

Business and Leadership School, Monash University, Wellington Rd, Clayton VIC 3800, Australia

Keywords: LGBM, Stock Returns Prediction, Portfolio Construction.

Abstract: Investors need accurate stock price forecasts because they raise the chances of successful investments. This

research assesses how machine learning methods predict the next day's daily returns of S&P 500 companies

based on the past 10 days' data. The study also focuses on building portfolios based on forecasted returns. The

study's dataset contains stock prices for S&P500 index companies and S&P500 index prices from 2014 to

2017, while including 497,472 total data points. The extended dataset includes 18 features which cover stock

market relationship indicators as well as technical analysis indicators. This study assessed predictive models

which consist of Random Forest, eXtreme Gradient Boosting (XGBoost) as well as Long Short-Term Memory

(LSTM) and Light Gradient Boosting Machine (LGBM). The analysis results show that the LGBM model

shows superior accuracy in forecasting the next day’s daily returns since it achieves an R-square value of

0.7377. Concurrently, this study utilized the predicted daily returns to construct a portfolio comprising 20

companies from the S&P500 index companies. Based on the objective of maximizing the portfolio alpha, the

optimal portfolio result contains 20 stocks of S&P500 companies, achieving an alpha over 10% and a total

return of by 20%.

1 INTRODUCTION

Accurate stock price predictions enable investors to

determine market conditions which lead to better

stock market decisions and ultimately results in

increased returns. Both individual and institutional

investors who master precise stock movement

predictions gain significant competitive advantages

in the present uncertain financial market (Soni,

Tewari, & Krishnan, 2022). Research shows that

predicting stock prices requires using multiple

analytical tools, including fundamental and technical

indicators, which help create investment strategies.

According to investigation sophisticated investors

now focus on using predicted daily returns to boost

alpha while managing risk exposure (Mohammed et

al., 2023). Also, according to Di’s research, the

employment of technical analysis indicators in the

context of price forecasting has been demonstrated to

achieve a maximum accuracy of over 70% (Di, 2014).

This efficacy can be attributed to the principles

underlying the efficient market hypothesis and the

random walk theory.

a

https://orcid.org/0009-0002-3023-357X

This study evaluates the effectiveness of machine

learning in forecasting next-day daily returns for S&P

500 firms and formulates an optimal portfolio using

these return predictions. Utilising data from 2014 to

2017 with over 497,000 points, the study integrates

technical and market features to enhance accuracy.

The research aims to optimize portfolio management,

improve returns, and refine risk control, offering

valuable insights for investors.

2 MODELS

The present study appraised five distinct models:

LSTM, LGBM, XGBoost, Random Forest and

Decision Tree. These models function as discrete

strategies for time series data processing and stock

market movement prediction, and machine learning

methods have been shown to be capable of

identifying complex patterns and connections within

voluminous datasets (Mohammed et al., 2023).

2.1 Long Short-Term Memory (LSTM)

LSTM demonstrates a particular aptitude for

sequence prediction tasks and the capture of long-

Zhu, H.

LGBM on Stock Returns Prediction and Portfolio Construction.

DOI: 10.5220/0013701300004670

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 2nd International Conference on Data Science and Engineering (ICDSE 2025), pages 521-526

ISBN: 978-989-758-765-8

Proceedings Copyright © 2025 by SCITEPRESS – Science and Technology Publications, Lda.

521

term dependencies, rendering it well-suited for

applications such as time series analysis, machine

translation, and speech recognition. LSTM networks

excel at sequence prediction and long-term

dependency modeling which makes them ideal for

time series analysis and machine translation

applications (Mehtab, Sen, & Dutta, 2020; Wen et al.,

2022).

2.2 LightGBM (LGBM)

LGBM is a fast, distributed framework based on

gradient boosting that uses leaf-wise growth to

optimize data partitioning and significantly reduce

the consumption of memory and computational

resources. Unlike the level-wise growth of XGBoost,

LGBM uses leaf-wise growth. At each iteration,

LGBM selects the node that yields the greatest gain

among all the current leaves for splitting, as opposed

to splitting by layer. This strategy is more effective in

reducing errors and enhancing model performance

(Ke et al., 2017).

2.3 Decision Tree

Decision tree is a data structure that conditionally

partitions data. Each node in the tree represents a test

of a specific feature, and the outcome of each test is

represented by a branch in the tree. The merits of

decision trees include their simplicity, intuition, ease

of interpretation, and rapid computation. However, it

should be noted that decision trees are sensitive to

noise in the data.

2.4 Random Forest

Random Forest is an integrated learning method that

improves model stability and accuracy by

constructing multiple decision trees and averaging

their outputs. In comparison with a solitary decision

tree, Random Forest exhibits a reduced risk of

overfitting, whilst simultaneously demonstrating

superior accuracy and learning capability in scenarios

characterized by noise and anomalies in the data.

2.5 XGBoost

The XGBoost algorithm develops from gradient

boosting by building sequential regression trees

which work to reduce errors that arise in previous

rounds. The addition of regularisation (L1 and L2)

helps enhance model generalisation by controlling

complexity and avoiding overfitting. XGBoost

achieves better efficiency and scalability using

parallelisation techniques combined with the

automatic handling of missing values and

approximate tree learning methods. XGBoost is

effective for extensive datasets and complex

dimensional challenges while delivering robust

predictive results (Song et al., 2022).

3 DATA PREPROCESSING

3.1 Features Prepared

The datasets utilized in this study encompass S&P

500 company stock prices and S&P 500 index prices

(“Stock Prices,” 2021) (“S&P 500 Historical Data,”

2020). These datasets encompass the opening price,

closing price, high price, low price, and trading

volume of all S&P 500 companies and the S&P 500

index, respectively, for each day between 2014 and

2017.

Traditional stock price prediction methods often

rely solely on historical price and volume data, which

limits their accuracy due to the reliance on a single

data source. This experiment aims to improve

prediction accuracy by incorporating the S&P500

index, which reflects overall market sentiment,

volatility, and the correlation of a stock with broader

market returns. By adding the S&P500 index as an

additional feature, the model leverages more

comprehensive information. At the same time,

technical analysts believe that by analyzing historical

data to create indicators that react to market trends

and reversals, they can help predict future price

movements. This study also explores the use of

specific technical analysis indicators to provide more

non-linear relationships for model training,

enhancing the model's explanatory power and

forecasting accuracy (Chong & Ng, 2008) (Agrawal

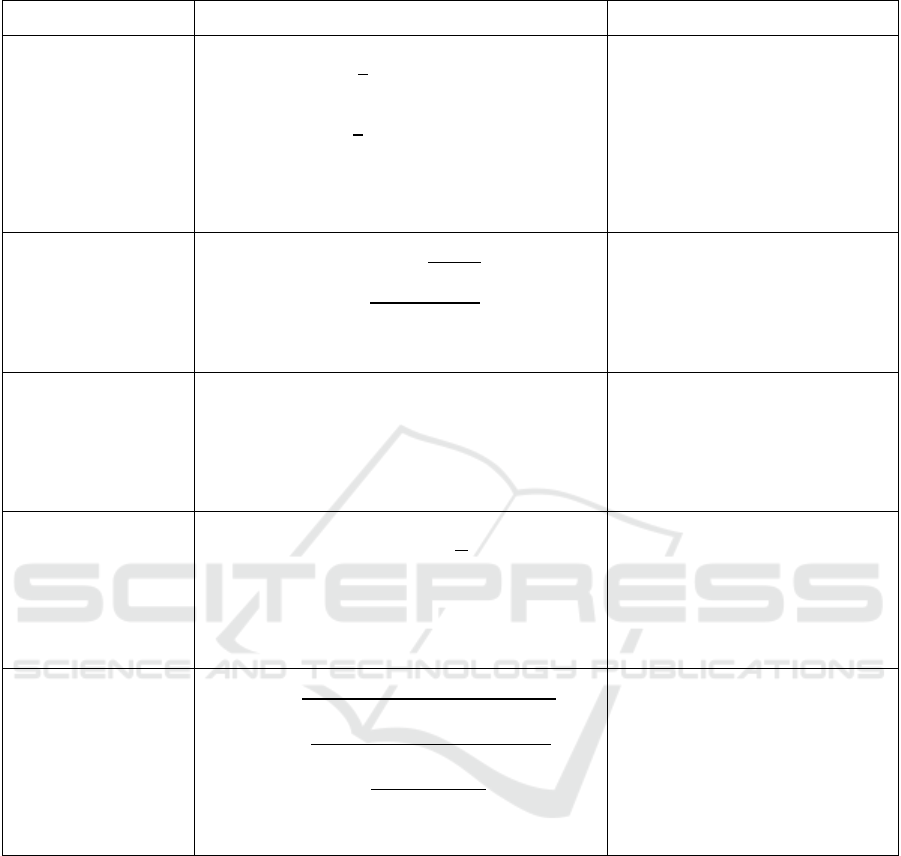

et al., 2021). Table 1 all the technical analysis

indicators in the dataset.

ICDSE 2025 - The International Conference on Data Science and Engineering

522

Table 1: Features prepared

Indicators Formula Application

Moving average

(MA5&20)

𝑀𝐴

=

1

𝑛

𝑃

;𝑛=5

𝑀𝐴

=

1

𝑛

𝑃

; 𝑛=20

𝑃𝑖: 𝑡ℎ𝑒 𝑐𝑙𝑜𝑠𝑒 𝑝𝑟𝑖𝑐𝑒 𝑜𝑓 𝑛 𝑑𝑎𝑦

𝑛: 𝑤𝑖𝑛𝑑𝑜𝑤 𝑠𝑖𝑧𝑒

𝑓

𝑜𝑟 𝑡ℎ𝑒𝑚𝑜𝑣𝑖𝑛𝑔 𝑎𝑣𝑒𝑟𝑎𝑔𝑒

𝑡: 𝑐𝑢𝑟𝑟𝑒𝑛𝑡 𝑡𝑖𝑚𝑒 𝑝𝑜𝑖𝑛𝑡

Moving average determines the

overall market trend and measures

the decrease in market noise.

Relative Strength

Index (RSI)

𝑅𝑆𝐼 =100 −

100

1+𝑅𝑆

𝑅𝑆 =

𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝑔𝑎𝑖𝑛

𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝑙𝑜𝑠𝑠

𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝑔𝑎𝑖𝑛: 𝑎𝑣𝑒𝑟𝑖𝑎𝑔𝑒 𝑝𝑟𝑖𝑐𝑒 𝑖𝑛𝑐𝑟𝑒𝑎𝑠𝑒𝑜𝑣𝑒𝑟20 𝑑𝑎

𝑦

𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝑙𝑜𝑠𝑠: 𝑎𝑣𝑒𝑟𝑖𝑎𝑔𝑒𝑝𝑟𝑖𝑐𝑒𝑑𝑒𝑐𝑟𝑒𝑎𝑠𝑒𝑜𝑣𝑒𝑟 20𝑑𝑎

𝑦

RSI is used to anticipate potential

price reversals in the market.

On-Balance Volume

(OBV)

𝑂𝐵𝑉

= 𝑂𝐵𝑉

+𝑆𝑖𝑔𝑛

(

𝑃

−𝑃

)

∗𝑉

𝑆𝑖𝑔𝑛

(

𝑃𝑡 − 𝑃𝑡− 𝑒

)

:+1𝑖𝑓𝑃

>𝑃

−1𝑖𝑓𝑃

<𝑃

; 𝑎𝑛𝑑 0 𝑜𝑡ℎ𝑒𝑟𝑤𝑖𝑠𝑒

𝑃

:𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝑝𝑟𝑖𝑐𝑒

𝑃

:𝑃𝑟𝑖𝑐𝑒𝑜𝑓𝑒𝑑𝑎𝑦𝑠𝑎𝑔𝑜

𝑉

:𝐶𝑢𝑟𝑟𝑒𝑛𝑡𝑡𝑟𝑎𝑑𝑖𝑛𝑔𝑣𝑜𝑙𝑢𝑚𝑛

OBV integrates trading volume

and price shifts to help understand

how capital enters and exits the

market cap.

Bollinger band uper

& lower

𝑀𝑖𝑑𝑑𝑙𝑒𝑙𝑖𝑛𝑒

(

𝑀𝐴

)

==

1

𝑁

𝑃

𝑈𝑝𝑝𝑒𝑟 𝐵𝑎𝑛𝑑 = 𝑀𝐴+ 2 ∗ 𝜎

𝐿𝑜𝑤𝑒𝑟 𝐵𝑎𝑛𝑑 = 𝑀𝐴 − 2 ∗ 𝜎

𝑃𝑖: 𝑡ℎ𝑒 𝑐𝑙𝑜𝑠𝑒𝑝𝑟𝑖𝑐𝑒 𝑜𝑓𝑛 𝑑𝑎𝑦

𝜎: 𝑠𝑡𝑎𝑛𝑑𝑎𝑟𝑑𝑑𝑒𝑣𝑖𝑎𝑡𝑖𝑜𝑛 𝑜𝑓𝑡ℎ𝑒𝑝𝑟𝑖𝑐𝑒

The stock reaches overbought or

oversold conditions when its price

moves beyond the upper or lower

band respectively.

Average Directional

Index (ADX)

+𝐷𝐼 =

(𝐶𝑢𝑟𝑟𝑒𝑛𝑡𝐻𝑖𝑔ℎ− 𝑃𝑟𝑒𝑣𝑖𝑜𝑢𝑠𝐻𝑖𝑔ℎ)

𝑇𝑟𝑢𝑒𝑅𝑎𝑛𝑔𝑒

−𝐷𝐼 =

(

𝑃𝑟𝑒𝑣𝑖𝑜𝑢𝑠𝐿𝑜𝑤−𝐶𝑢𝑟𝑒𝑒𝑛𝑡𝐿𝑜𝑤

)

𝑇𝑟𝑢𝑒 𝑅𝑎𝑛𝑔𝑒

𝐷𝑋 =

| + 𝐷𝐼 − −𝐷𝐼|

+𝐷𝐼 + −𝐷𝐼

𝐴𝐷𝑋 = 𝑆𝑚𝑜𝑜𝑡ℎ(𝐷𝑋)

True

R

ange: the maximum price range of a period

The ADX tool measures the

strength of current market

trends. When the ADX reads

above 25 it typically shows that

the market is in a strong trend

regardless of direction.

3.2 Time-Series Split

When dealing with financial data, time series split is

essential as stock data is usually organized in

chronological order. The underlying logic of

forecasting is that it is impossible to predict past data

using future data (LeBaron & Weigend, 1996).

The experiments used a time series split method

where the data was divided into 10 parts for 10 cross-

validations in chronological order. The main

advantage of this method is that it ensures that the

chronological order is maintained, thus avoiding the

influence of future data on model training. It unveils

a two- to threefold augmentation in the discrepancy

of model performance when subjected to varying

segmentations in comparison to the variations in

neural network parameters (LeBaron & Weigend,

1996). This underscores the necessity for a dynamic

validation framework when appraising models. With

LSTM, if the training set contains future data, the

effectiveness of LSTM can be inflated by data

leakage (Wang & Guo, 2020).

In addition, time series splitting facilitates

incremental training of the model, which is each split

progressively expanding the training set. This also

makes it possible to simulate a real-world situation

where more and more data is obtained over time.

LGBM on Stock Returns Prediction and Portfolio Construction

523

4 DAILY RETURN PREDICTION

AND PORTFOLIO

CONSTRICTION

Following an investigation into the efficacy of

mechanical learning in predicting the subsequent

day's closing price of S&P 500 company stocks, the

subsequent objective of this study is to predict the

subsequent day's daily return of S&P 500 company

stocks and to construct a portfolio that maximizes the

alpha based on the predicted daily return in S&P 500

company stocks. In addition, this segment of the

dataset has undergone a uniform preprocessing

procedure, identical to the one applied to the dataset

intended for the prediction of closing prices.

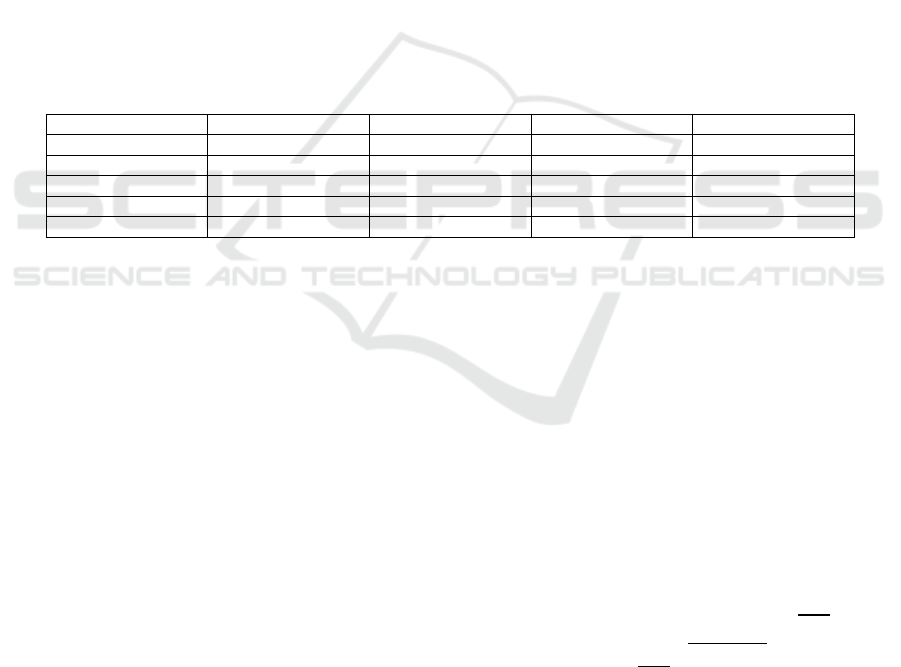

4.1 Prediction Results

The results of all the models investigated in this

section are compared in Table 2. Upon evaluation of

the mean absolute error (MAE) across all models the

LGBM model showed the lowest figure at 0.0013

which indicates its predictions were closest to the true

values. The Random Forest model comes next with

an MAE of 0.0014 while the LGBM model showed

better performance through its R² score and explained

variance which stood at 0.8384 and 0.8385

respectively. The model demonstrates an explanatory

power for the target variable variance of about 83.8%.

The LGBM model achieves the best results across

all evaluation metrics by having minimal error and

maximal explanatory power for the target variable.

Among the models tested Random Forest secures

second place in performance. The Decision Tree

model ranks below Random Forest and LGBM yet

remains a viable option. The performance of

XGBoost falls short of other models across all

evaluation metrics with marked weaknesses in error

rates and explanatory power which makes it an

unsuitable model for this dataset.

Table 2: Stock daily return prediction evaluation

MSE MAE R2 Ex

p

lain variance

LGBM 0.0000 0.0017 0.7377 0.7377

XGBoost 0.0000 0.0024 0.4959 0.4959

Decision tree 0.0000 0.0024 0.5352 0.5352

Random forest 0.0000 0.0022 0.6108 0.6108

LSTM 0.0000 0.0025 0.4905 0.4906

4.2 Portfolio Construction

In light of the predicted returns for S&P 500

companies the following day, it can be concluded that

the best-performing model is the LGBM. Therefore,

the subsequent section of this paper will utilize the

trained LGBM model to predict returns for all

subsequent days and construct a portfolio based on

the predicted returns in a manner that maximizes

alpha.

4.2.1 Portfolio Analysis

Firstly, the LGBM model, which was trained in the

previous section, is employed to predict the daily

returns for each day in the dataset. The predicted daily

returns are then converted into annual returns, and the

covariance matrix for each company within S&P500

is calculated.

The formula below is utilized in this study to

calculate the cumulative return, defined as the

annualized return for months. This is achieved by

multiplying the cumulative product of the returns of

all the trading days of each company each month.

𝐴𝑛𝑛𝑢𝑎𝑙𝑟𝑒𝑡𝑢𝑟𝑛𝑅

,

=1+𝑟

,,

−1

𝑅𝑖, 𝑚 ∶ 𝑡ℎ𝑒 𝑎𝑛𝑛𝑢𝑎𝑙 𝑟𝑒𝑡𝑢𝑟𝑛 𝑜𝑓 𝑎𝑠𝑠𝑒𝑡 𝑓𝑜𝑟 𝑚𝑜𝑛𝑡ℎ

𝑟𝑖, 𝑑,𝑚∶ 𝑡ℎ𝑒 𝑟𝑒𝑡𝑢𝑟𝑛 𝑜𝑓 𝑎𝑠𝑠𝑒 𝑜𝑛 𝑑𝑎𝑦 𝑤𝑖𝑡ℎ𝑖𝑛 𝑚𝑜𝑛𝑡ℎ

𝑡: 𝑡ℎ𝑒 𝑡𝑜𝑡𝑎𝑙 𝑛𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 𝑑𝑎𝑦𝑠 𝑖𝑛 𝑚𝑜𝑛𝑡ℎ (1)

The construction of the portfolio is informed by a

maximum alpha construction strategy, incorporating

20 stocks to achieve optimal diversification. The

weighting of each stock in the portfolio is determined

by a risk parity model, a strategic approach aimed at

minimizing the risk contribution of assets in the

portfolio.

𝑀𝑎𝑟𝑔𝑖𝑛𝑎𝑙𝑟𝑖𝑠𝑘𝑐𝑜𝑛𝑡𝑟𝑖𝑏𝑢𝑡𝑖𝑜𝑛

(

𝑀𝑅𝐶

)

=

𝜕𝜎

𝜕𝑤

=

𝜕

𝜕𝑤

𝑤

𝑊

𝑤𝑖:𝑡ℎ𝑒 𝑤𝑒𝑖𝑔ℎ𝑡 𝑜𝑓 𝑎𝑠𝑠𝑒𝑡 𝑖𝑛 𝑡ℎ𝑒 𝑝𝑜𝑟𝑡𝑓𝑜𝑙𝑖𝑜

𝑊: 𝑡ℎ𝑒 𝑣𝑒𝑐𝑡𝑜𝑟 𝑜𝑓 𝑎𝑙𝑙 𝑎𝑠𝑠𝑒𝑡 𝑤𝑒𝑖𝑔ℎ𝑡𝑠 𝑖𝑛 𝑡ℎ𝑒 𝑝𝑜𝑟𝑡𝑓𝑜𝑙𝑖𝑜

𝑅𝑖𝑠𝑘 𝑐𝑜𝑛𝑡𝑟𝑖𝑏𝑢𝑡𝑖𝑜𝑛 (𝑅𝐶

) = 𝑤

∗𝑀𝑅𝐶

(2)

ICDSE 2025 - The International Conference on Data Science and Engineering

524

𝑅𝑖𝑠𝑘 𝑝𝑎𝑟𝑖𝑡𝑦 𝑜𝑏𝑒𝑗𝑒𝑐𝑡𝑖𝑣𝑒

= 𝑚𝑖𝑛(𝑅𝐶

− 𝑚𝑒𝑎𝑛(𝑅𝐶

))

𝐴𝑙𝑝ℎ𝑎 = 𝑅

− (𝑅

+𝛽∗

(𝑅

−𝑅

)) (3)

After the initial period, in order to assess the

overall risk of the portfolio, the utilization of Value at

Risk (VARs) and Conditional Value at Risk(CVARs)

was introduced to evaluate the risk to which the

portfolio is exposed. Assuming the confidence

interval which is α is 95%.

𝑉𝑎𝑙𝑢𝑒 𝑎𝑡 𝑅𝑖𝑠𝑘(𝑉𝐴𝑅𝑠) = 𝑝𝑒𝑟𝑐𝑒𝑛𝑡𝑖𝑙𝑒(𝑟,5)

𝐶𝑜𝑛𝑑𝑖𝑡𝑖𝑜𝑛𝑎𝑙 𝑉𝑎𝑙𝑢𝑒 𝑎𝑡 𝑅𝑖𝑠𝑘(𝐶𝑉𝐴𝑅𝑠) =

𝑟(𝑥)𝑑𝑥

(4)

It is on this basis that the present study introduces

the Kelly criterion, which is utilized for the purpose

of calculating the optimal investment amount in a

portfolio, as determined by the market risk-free rate.

The residual amount is then invested at the risk-free

rate. Within the parameters of this study, the Kelly

criterion is calculated by assuming the probability of

success is 70%, according to the R2 of the LGBM

model, which is 0.7377.

𝐾𝑒𝑙𝑙𝑦𝐶𝑟𝑖𝑡𝑒𝑟𝑖𝑜𝑛

(

𝑓

∗

)

=

𝑝∗𝑏−

(

1−𝑝

)

𝑏

𝑝:𝑡ℎ𝑒 𝑝𝑟𝑜𝑏𝑎𝑏𝑖𝑙𝑖𝑡𝑦 𝑜𝑓 𝑤𝑖𝑛𝑛𝑖𝑛𝑔

𝑏: 𝑡𝑜𝑡𝑎𝑙 𝑟𝑒𝑡𝑢𝑟𝑛 𝑜𝑓 𝑡ℎ𝑒 𝑜𝑝𝑡𝑖𝑚𝑎𝑙 𝑝𝑜𝑟𝑡𝑓𝑜𝑙𝑖𝑜. (5)

4.2.2 Portfolio Results

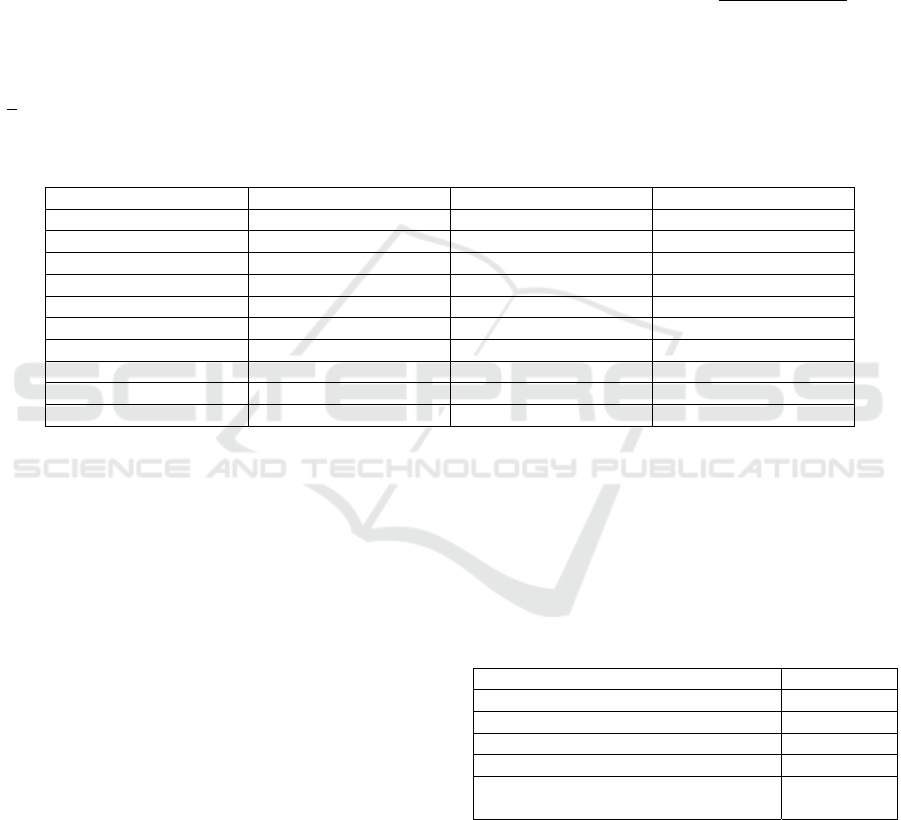

Table 3: Portfolio construction

Symbol Weight Symbol Weight

DOV 0.05 NWSA 0.05

EXPD 0.05 MA 0.05

DISCK 0.05 UA 0.05

HLT 0.05 WMT 0.05

KORS 0.05 TPR 0.05

AOS 0.05 DVN 0.05

UAL 0.05 BEN 0.05

HBI 0.05 MAT 0.05

GE 0.05 HP 0.05

LH 0.05 SNI 0.05

As shown in Table 3, this is a portfolio that is a

total of 20 stocks that make up this portfolio while

each one holds a 5% share of the overall investment

weight. The portfolio contains businesses across

multiple segments including consumer products,

financial services, technology firms and industrial

companies. The portfolio holds significant stocks

such as Disney (DISCK), Walmart (WMT), General

Electric (GE), and additional companies like Maersk

(EXPD), Hanesbrands (HBI), United Airlines (UAL).

Through diversification the portfolio reduces risk

exposure and offers protection from volatility of

individual market sectors and stocks. The portfolio

composition provides opportunities for sustained

growth while distributing investment across multiple

market sectors. Equal weight distribution across all

assets prevents excessive investment in one stock or

industry, thus maintaining portfolio stability while

reducing risk from sector-specific declines.

The provided Table 4 delivers insight into the

portfolio's risk and return characteristics. The

portfolio's risk level is measured through both VaR

and CVaR at 95% confidence interval to determine

potential losses under extreme market conditions. The

portfolio has a VaR of 0.1780 meaning it could lose

up to 17.80% in value with 95% confidence. When

losses exceed the threshold established by VaR, the

CVaR figure of 0.1773 indicates the average loss

reaches 17.73% in such cases with 95% confidence.

The figures given demonstrate how much the

portfolio is at risk of losing value.

Table 4: Portfolio evaluation

Metric Value

VaR

(

95%

)

0.1780

CVaR

(

95%

)

0.1773

Al

p

ha 0.1061

Total Return 0.1914

Optimal investment fraction

(

Kell

y

Criterion

)

-0.6327

The Alpha metric shows the portfolio's

performance relative to the market benchmark. The

portfolio delivered a positive Alpha of 0.1061, which

reveals its superior performance by 10.61% above the

market benchmark's results. The portfolio achieved

overall profitability, which is demonstrated by the

Total Return of 19.14%, that represents the combined

gain during the period covered.

LGBM on Stock Returns Prediction and Portfolio Construction

525

According to the Kelly formula investors should

reduce their portfolio exposure by lowering the

amount of capital they allocate to it. The most suitable

investment for the portfolio is -63.27%. The Kelly

formula suggests that, in this case, the portfolio

reveals excessive risk and may lead to losses and is

therefore not recommended for investment. This is

because the portfolio's winning percentage and

expected return are not satisfactory. By calculation,

assuming a constant portfolio win rate of 0.7, the

expected return on the portfolio would be a minimum

of 42.86%, if the objective is to achieve an investment

worthy of the Kelly model. This indicates that, with

the current portfolio win rate, the expected return

would need to increase by a minimum of another

23.72% to meet the requirement of being worthy of

investment.

Although the portfolio exhibits strong overall

alpha performance, it presents two critical

shortcomings when assessed in terms of win rate and

risk reporting: The model demonstrates limited

predictive accuracy through its low win rate while

also producing suboptimal returns. The portfolio’s

practical application and dependable performance in

real-world scenarios are severely impacted by these

limitations.

5 CONCLUSION

The study shows how machine learning techniques

can successfully predict stock returns and develop

effective investment portfolios. The LSTM, LGBM,

and XGBoost models successfully forecast daily

returns for S&P 500 companies where LGBM shows

superior performance in next day return predictions

and Random Forest leads in closing price predictions.

The portfolio delivers a strong return of 19.14%

while generating an alpha of 10.61% but presents risk

factors that create investor concerns. The Kelly

Criterion demonstrates that although the portfolio

delivers positive performance results its limited win

rate cannot merit the associated risk level which

renders it inappropriate for risk-averse investors.

Potential drawdowns and volatility undermine the

long-term sustainability of the current allocation

strategy.

Upcoming studies need to concentrate on

improving the risk-return trade-off while developing

advanced methods to control risk and increase the

precision of market predictions. Investment portfolio

construction improves when investment strategies

adapt to investor preferences through personalized

risk profiles. The inclusion of various asset types such

as gold, cryptocurrencies, and real estate into machine

learning models enhances portfolio resilience and

diversification. Ongoing advancements in machine

learning enable the creation of portfolio optimization

strategies that are adaptive, dynamic and robust.

REFERENCES

Agrawal, M. 2021. Stock prediction based on technical

indicators using Deep Learning Model. Computers,

Materials & Continua.

Chong, T. T. L., & Ng, W. K. 2008. Technical analysis and

the London stock exchange: testing the MACD and RSI

rules using the FT30. Applied Economics Letters,

15(14), 1111–1114.

Di, X. 2014. Stock trend prediction with technical

indicators using SVM.

Hanfei Wen, Jun Yu, Guangjin Pan, Xiaojing Chen,

Shunqing Zhang, & Shugong Xu. 2022. A Hybrid

CNN-LSTM Architecture for High Accurate Edge-

Assisted Bandwidth Prediction. IEEE Wireless

Communications Letters.

Ke, G., Meng, Q., Finley, T., Wang, T., Chen, W., Ma, W.,

Ye, Q., Liu, T.-Y. 2017. Lightgbm: A highly efficient

gradient boosting decision tree. Advances in Neural

Information Processing Systems, 30.

LeBaron, B., & Weigend, A. 1996. A Bootstrap Evaluation

of the Effect of Data Splitting on Financial Time Series.

Capital Markets eJournal.

Mehtab, S., Sen, J., & Dutta, A. 2020. Stock Price

Prediction Using Machine Learning and LSTM-Based

Deep Learning Models. ArXiv.

Mohammed, S. H. Krishna, P. Mudalkar, Narinder Verma,

P. Karthikeyan, & Ajay Singh Yadav. 2023. Stock

Market Price Prediction Using Machine Learning. 2023

5th International Conference on Smart Systems and

Inventive Technology (ICSSIT).

Song, Y., Li, H., Xu, P., & Liu, D. 2022. A Method of

Intrusion Detection Based on WOA-XGBoost

Algorithm. Discrete Dynamics in Nature and Society.

Soni, P., Tewari, Y., & Krishnan, D. 2022. Machine

Learning Approaches in Stock Price Prediction: A

Systematic Review. Journal of Physics: Conference

Series.

Wang, Y., & Guo, Y. 2020. Forecasting method of stock

market volatility in time series data based on mixed

model of ARIMA and XGBoost. China

Communications.

Stock prices. 2021, September 11. Kaggle.

https://www.kaggle.com/datasets/mysarahmadbhat/sto

ck-prices

S&P 500 historical data. 2020, November 5. Kaggle.

https://www.kaggle.com/datasets/henryhan117/sp-

500-historical-data

ICDSE 2025 - The International Conference on Data Science and Engineering

526