Time Series Analysis and Prediction of Future Commodities Prices

with SARIMA

Siyou Yao

a

Finance Management School, Shanghai University of International Business and Economics, Shanghai, China

Keywords: SARIMA, Future Commodities Prices, Forecast, Transaction.

Abstract: Commodities are one of the most important investing targets in the world. Forecasting the prices of

commodities precisely helps investors and corporations make reasonable transactions. This paper is based on

the prices of Brent oil, wheat, and aluminum and predicts the future prices of commodities in the energy

industry, the manufacturing industry, and the agricultural products industry. The results show that the

Seasonal Autoregressive Integrated Moving Average (SARIMA) model has a relatively excellent ability to

predict the future movements of the commodities prices. The prediction shows that all the commodities prices

will experience a decline in the next 10 months. However, the predictions are not exactly the same as the

actual movements. The fluctuation extent of the predictions is much smaller. Therefore, the SARIMA model

can help investors establish a broad idea of the future trend of the commodities prices, but it cannot help

investors do ultrashort-term trading. If the investors only focus on the trend during a longer period and ignore

making profits with the short-term fluctuations, the SARIMA model is suitable for them. In the end, this paper

suggests investors combine the fundamental analysis with the forecasting results generated by the SARIMA

model to make trading decisions.

1 INTRODUCTION

Commodities are raw materials and resources that are

normalized, tradable, and low value-added. They also

have a large volume in nature. Commodities are often

divided into three categories (Zhou, Song, & Ren,

2022): energy commodities, metal commodities, and

agricultural products commodities. As the upstream

raw material for many products, commodities have

important impacts on the development of the world

economy. Metals are unreplaceable resources and are

widely used in the manufacturing industry, oil and gas

are nonrenewable strategic resources that are the

objects of competition between the world's major

powers and leading economies, and agricultural

products are important in the food industry and can

help stabilize society (Guo, 2023). As the indicator of

the international situation, the movement of the prices

of commodities often represents macroeconomic

changes in the world, the change in supply and

demand, and the change in the market. Last but not

least, commodities can be traded by futures and

options. Investors can use commodities to earn

a

https://orcid.org/0009-0006-2814-2272

revenues and hedge risks. Therefore, it is meaningful

to predict the future movement of the prices of

commodities. It can help investors, companies, and

countries to make more reasonable decisions.

In 2021, Wanjuki et al. researched the Seasonal

Autoregressive Integrated Moving Average

(SARIMA)’s ability to forecast the price index of

food and beverages in Kenya (Wanjuki, Wagala, &

Muriithi, 2021). After comparing all the models with

different parameters, it turned out that SARIMA (1, 1,

1) (0, 1, 1)12 was the best fit for the data in the study.

In 2022, Li et al. applied the ARIMA model to gold

prices and gave investing suggestions based on the

forecasting results (Li, 2022). The study encouraged

investors to combine international situations with the

results. In 2023, ARIMA and SARIMA’s ability to

predict future crude oil prices were compared by

Ariyanti, and it turned out that both models were

excellent in forecasting (Ariyanti & Yusnitasari,

2023), which meant ARIMA and SARIMA models

were suitable for time series analysis of crude oil

prices. Gasper et al. conducted a study on forecasting

crude oil prices in Tanzania using the ARIMA model

Yao, S.

Time Ser ies Analysis and Prediction of Future Commodities Prices with SARIMA.

DOI: 10.5220/0013699500004670

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 2nd International Conference on Data Science and Engineering (ICDSE 2025), pages 467-475

ISBN: 978-989-758-765-8

Proceedings Copyright © 2025 by SCITEPRESS – Science and Technology Publications, Lda.

467

(Gasper & Mbwambo, 2023). This study found out

that even under the serious fluctuation caused by the

conflict in Ukraine and the coronavirus outbreak, the

ARIMA model could still capture the potential

movement in crude oil prices. In 2024, Guzman

affirmed ARIMA’s ability to predict future corn

prices in Mexico (Guzma, 2024). This research also

emphasized the importance of forecasting future

prices of agricultural products by pointing out that

future corn prices would influence farmers' interests

and sustainable agricultural development. Bagrecha

et al. used the ARIMA model to forecast silver prices

in India. However, the results only explained 26% of

the observed silver price changes. It suggested that

the ARIMA model was too simple for silver price

prediction and that more factors should be taken into

consideration (Bagrecha et al., 2024). In 2025, Ojha

et al. utilized the SARIMA model to predict global

wheat prices (Ojha & Karki, 2025). They pointed out

its importance in helping investors and countries

make reasonable strategic decisions. However, the

study claimed that the prediction is only suitable for

short-term analysis, and many external factors are not

considered. The results may not fit other commodities

and periods.

This paper aims to improve the ability to predict

the future prices of different commodities with the

SARIMA model, hoping to expand from the price

prediction of the commodity to the prediction of the

future development trend of the industry

corresponding to that commodity, and finally explore

the changes in industries and changes in the world

economy. This study first searches the prices of the

commodities in each of the three categories

mentioned above. Based on the different

characteristics of all the commodities in each

category, this study finally chooses aluminum in

metals, wheat in agricultural products, and Brent oil

in energy as the data to be researched. This paper first

applies pre-processing procedures to the data and then

uses the SARIMA model to fit the data and make

forecasts of future data in the next 10 months. The

differences between the future data and the actual

data are compared to evaluate the ability of the

SARIMA model. Conclusions are reached based on

the results and international events during the

research period.

2 DATASETS

2.1 Data Collection and Description

This paper extracts the datasets from Kaggle, and the

original datasets are extracted from Alpha Vantage

API using Python. The dataset contains monthly

historical prices of 10 different commodities from

January 1990 to March 2023. Prices are reported in

USD per unit of measurement for each commodity.

The prices of aluminum, wheat, and Brent crude oil

were selected in the study.

Crude oil is one of the most important energies in

the world. It can represent the energy industry. This

paper selects the price of the Brent crude oil which is

a blended crude stream produced in the North Sea

region. This is because Brent crude oil is one of the

most important crude oil pricing benchmarks in the

world. It is widely used in international oil price

quotation and contract settlement, and it serves as a

marker for pricing a number of other crude streams.

Compared with OPEC and WTI prices, the price of

Brent crude oil is more comprehensive and

transparent, because it is not affected by the US

domestic factors and the political factors of the

Organization of the Petroleum Exporting Countries

(OPEC).

Aluminum is widely used in aerospace,

automotive, construction, packaging, and many other

manufacturing and industrial sectors. It can represent

the manufacturing industry. The price movement of

aluminum directly reflects the economic performance

and industry cycles. Compared to gold and silver,

aluminum is less used as a precious metal and

investment target. Therefore, its price volatility is

usually less influenced by macroeconomic

uncertainty and safe-haven demand, which makes it

more appealing data in this study.

Wheat is one of the world's leading food crops. It

is widely used in food production and is important in

global agricultural trade. It can represent the

agricultural industry. Compared with other

agricultural products, wheat has a wider application.

For example, it can be processed into bread and beer.

2.2 Data Pre-processing

Since the characteristics of the prices of different

commodities are similar, the data pre-processing is

the same. Therefore, this paper will only focus on the

overall procedure in this part.

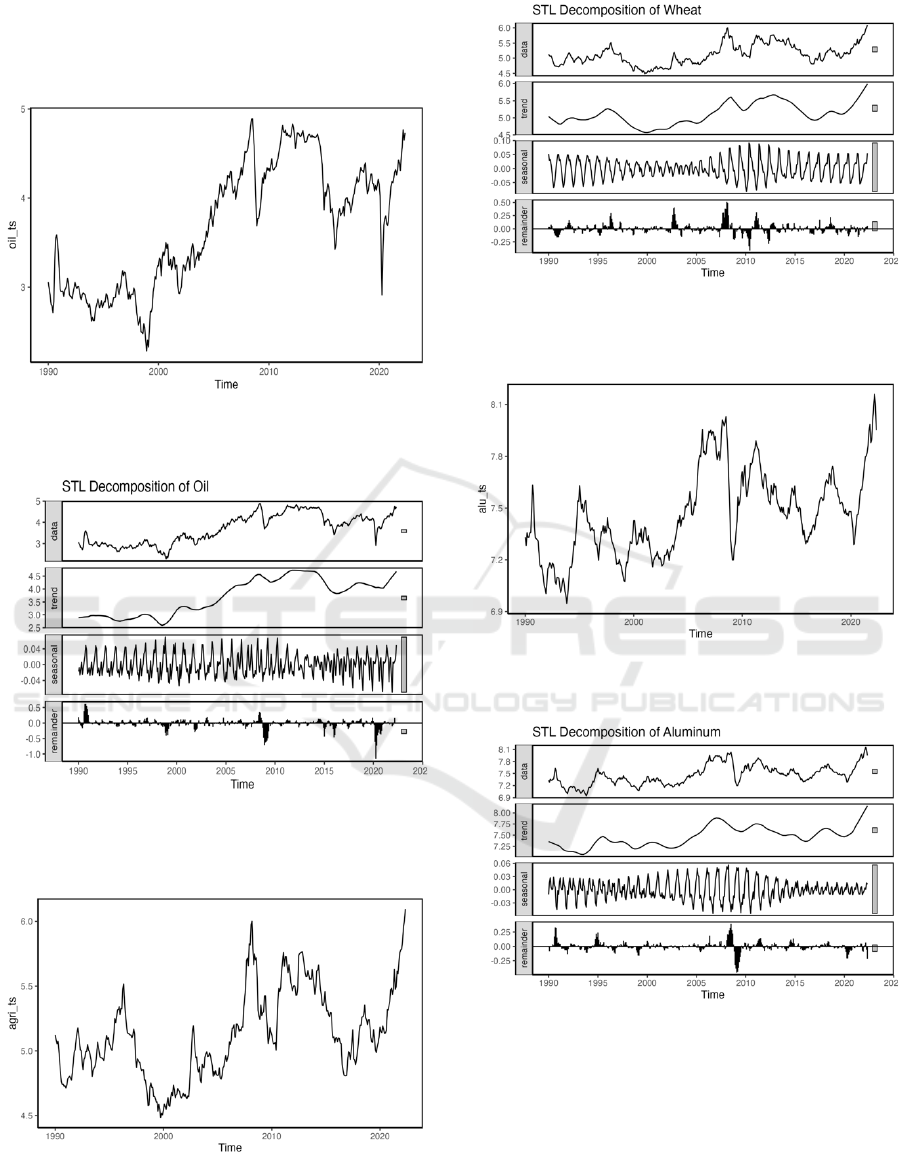

First of all, this paper generates the time series

plots of the prices of three commodities, the results

are shown in Figures 1, 3, and 5. From the plots, it

should be decided whether the prices of the three

commodities are stationary. This paper then applies

the log transformation to the data to make them

stationary. This paper also uses STL decomposition

to detect the characteristics of the data. The results are

shown in Figures 2, 4, and 6. From the four plots

ICDSE 2025 - The International Conference on Data Science and Engineering

468

generated by the STL decomposition, the seasonality,

trend, and volatility can be checked. Then, it can be

decided which model to use.

Figure 1: The Time Series Plot of the Brent Oil Prices after

Log Transformation. (Picture credit: Original)

Figure 2: The STL Decomposition on Brent Oil Prices.

(Picture credit: Original)

Figure 3: The Time Series Plot of the Wheat Prices after

Log Transformation. (Picture credit: Original)

Figure 4: The STL Decomposition on Wheat Prices.

(Picture credit: Original)

Figure 5: The Time Series Plot of the Aluminum Prices

after Log Transformation. (Picture credit: Original)

Figure 6: The STL Decomposition on Alunimun Prices.

(Picture credit: Original)

From the time series plot of the Brent oil prices,

wheat prices, and aluminum prices, it is obvious that

the data is not stationary even after the log

transformation. It means that the data need a

differencing process. According to the decomposition,

all the data show a slightly upward trend and

seasonality. The remainders show that the

Time Series Analysis and Prediction of Future Commodities Prices with SARIMA

469

characteristics of the data have been nearly fully

extracted by the trend and seasonality.

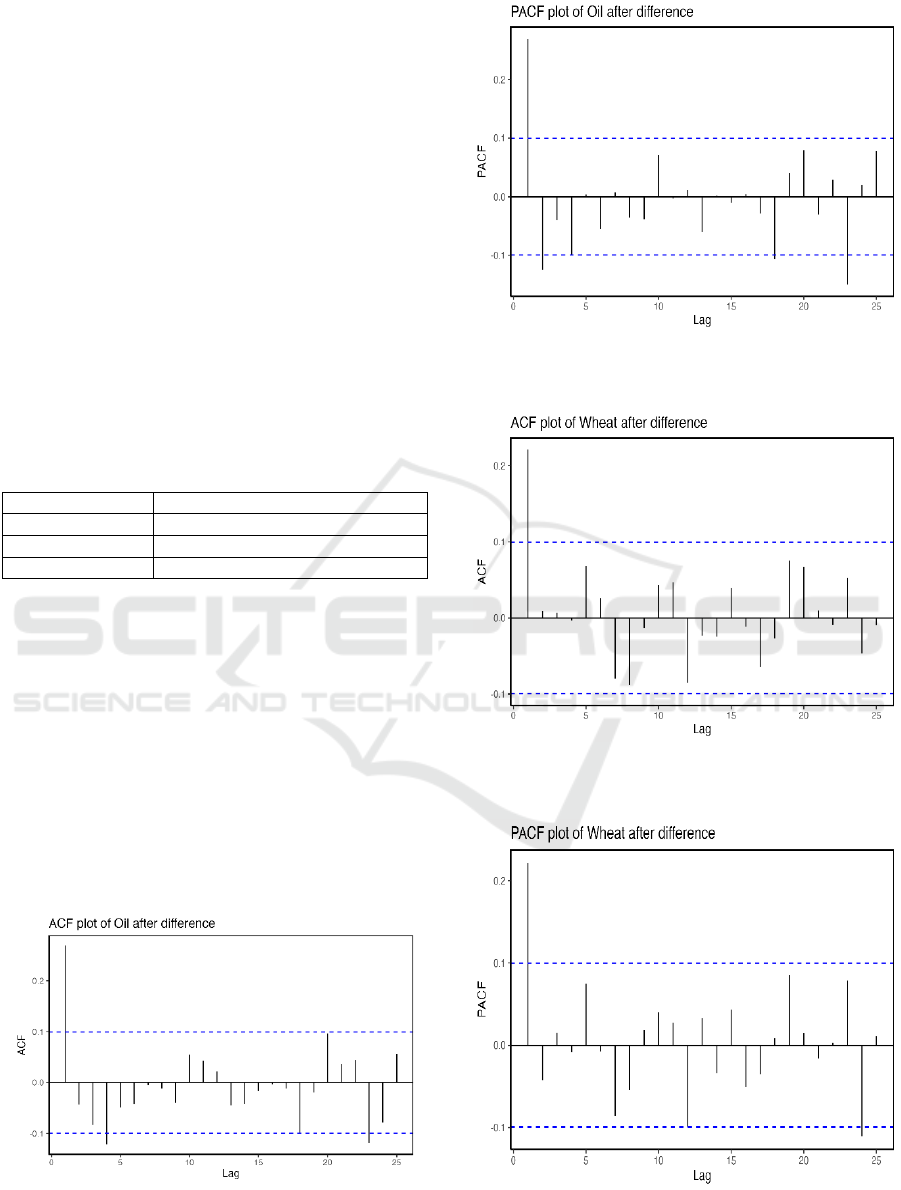

Therefore, this paper generates the ACF plot and

the PACF plot to further check whether the data are

stationary. The results show that the autocorrelation

of all three datasets has a downward trend as the lag

increases. In addition, the PACF values of the data are

extremely large when the lag equals one. All in all, it

means that the data are not stationary even after the

log transformation. The data may need differencing.

To further ensure whether the data need

differencing, this study also utilizes the Augmented

Dickey-Fuller unit root test as the stationary test. The

test can identify stationary data and judge whether the

data needs differencing. If the p-value is bigger than

0.05, the test will reject the null hypothesis that the

time series data is not stationary and has a unit root.

The results are shown in Table 1.

Table 1: The Results of ADF Tests on Commodities Before

Differencing.

Commodity

ADF test before differencing

Oil

p-value = 0.3696

Wheat

p-value = 0.4663

Aluminum

p-value = 0.03145

From Table 1, the p-values of the Brent oil prices,

the wheat prices, and the aluminum prices are 0.3696,

0.4663, and 0.03145 respectively. It can be seen that

the p-values of the Brent oil prices and the wheat

prices are much larger than 0.05, while the p-value of

the aluminum prices is less than 0.05. Combined with

all the results reached above, this research conducts a

first-order differencing to all the data.

After the differencing, both the ACF and PACF

plots and the ADF test are utilized again to decide

whether the data needs more processing procedures.

The results are shown in Figures 7, 8, 9, 10, 11, and

12 and Table 2.

Figure 7: The ACF Plot of the Brent Oil Prices after

Differencing. (Picture credit: Original)

Figure 8: The PACF Plot of the Brent Oil Prices after

Differencing. (Picture credit: Original)

Figure 9: The ACF Plot of the Wheat Prices after

Differencing. (Picture credit: Original)

Figure 10: The PACF Plot of the Wheat Prices after

Differencing. (Picture credit: Original)

ICDSE 2025 - The International Conference on Data Science and Engineering

470

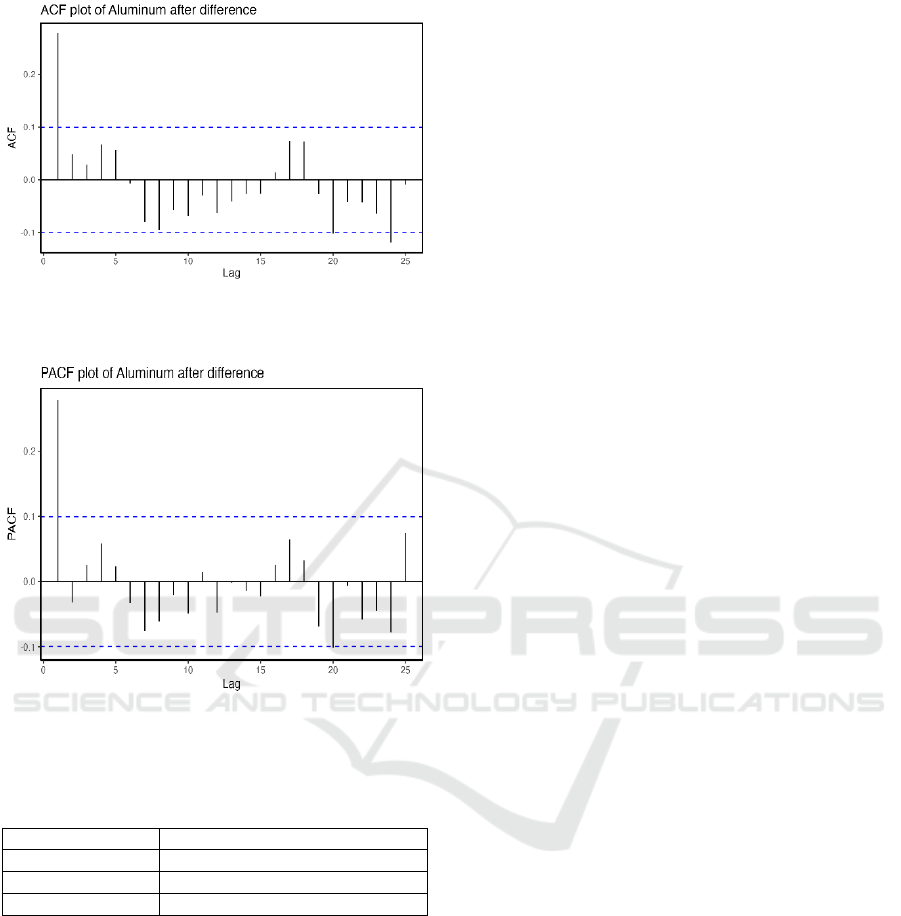

Figure 11: The ACF Plot of the Aluminum Prices after

Differencing. (Picture credit: Original)

Figure 12: The PACF Plot of the Aluminum Prices after

Differencing. (Picture credit: Original)

Table 2: The Results of ADF Tests on Commodities after

Differencing.

Commodity

ADF test after differencing

Oil

p-value = 0.01

Wheat

p-value = 0.01

Aluminum

p-value = 0.01

Based on the ACF and PACF plots, it can be

detected that the ACF and PACF are the largest when

the lag equals one. As the lag increases, the ACF and

PACF decrease immediately to zero. It means that the

AR (1) model is suitable for all the data and all the

data are stationary now.

After the differencing, all the data pass the ADF

test. Therefore, all the data are certainly stationary.

2.3 Model

This paper uses the decomposition method, plotting,

and the SARIMA model for analysis and prediction.

The ARIMA (Autoregressive Integrated Moving

Average) model developed by Box and Jenkins is one

of the most basic and important models in time series

analysis. The SARIMA model adds seasonal factors

to the original ARIMA model. It is more suitable for

the data with high seasonality. The SARIMA model

can be expressed as (1):

ARIMA

(

p, d, q

)(

P, D, Q

)

m

(

1

)

the parameter p represents the order of the AR

(Autoregressive) component, which captures the

linear relationship between the current observation

and its previous observations. The parameter d means

subtracting the previous observation from the current

one d times to remove trends and make the series

stationary. The parameter q is the order of the MA

(Moving Average) component, which shows the

relationship between an observation and a residual

error from a moving average model applied to lagged

observations. On the other hand, the parameters P, D,

and Q have similar functions with p, d, and q, but they

are applied to the seasonal components. m is the

seasonal period.

The auto.arima function is applied to the data to

make the computer automatically select the best

model. However, the model should be further selected

based on the evaluation indicators, and the PACF

plots.

2.4 Evaluation

This paper focuses on Root Mean Squared Error

(RMSE), Akaike Information Criterion (AIC), and

Bayesian Information Criterion (BIC) as the

evaluation indicators for prediction. RMSE calculates

the average of the squares of the differences between

predicted and actual values, which helps measure the

model error. AIC is an indicator used to select the

model, and it balances the goodness of fit and

complexity of the model. BIC punishes more on the

complex model compared to AIC. It tends to choose

a simpler model.

This paper also focuses on the fitting ability of the

SARIMA model. Considering that the SARIMA

model has 6 parameters, this study will use an

adjusted R square as the evaluation indicator. The

adjusted R square can help avoid the situation that the

R square will increase freely. as the complexity of the

model increases. It can protect the model from

overfitting.

Time Series Analysis and Prediction of Future Commodities Prices with SARIMA

471

3 EXPERIMENT RESULTS AND

ANALYSIS

Sometimes, the auto.arima function cannot select the

best model because it only focuses on minimizing the

AIC and BIC values but not the RMSE values.

Additionally, the auto.arima function may not try

every combination of the six parameters. This paper

further selected the model based on the values of AIC,

BIC, and RMSE. The smaller the values of these

indicators, the better the model is. Each combination

of the six parameters is tested. The parameters p, P, q,

and Q take the values 0, 1, and 2, the parameter d

constantly equals 1, and the parameter D takes the

values of 0 and 1. The results are shown in Tables 3,

4, and 5.

Table 3: SARIMA Models on Brent Oil Prices with

Different Parameters.

(p, d, q)

(P, D, Q)

AIC

BIC

RMSE

(0,1,1)

(0,0,1)

-696.566

-684.683

0.0978

(0,1,1)

(1,0,0)

-696.489

-684.606

0.0978

(0,1,1)

(0,0,2)

-696.636

-680.792

0.0974

(0,1,1)

(2,0,0)

-696.365

-680.521

0.0975

(0,1,1)

(1,0,1)

-696.195

-680.351

0.0975

(1,1,2)

(1,0,0)

-697.365

-677.56

0.0971

(0,1,1)

(2,0,2)

-698.882

-675.116

0.0947

Table 4: SARIMA Models on Aluminum Prices with

Different Parameters.

(p, d, q)

(P, D, Q)

AIC

BIC

RMSE

(1,1,0)

(2,0,0)

-1268.17

-1252.33

0.0466

(0,1,1)

(0,0,2)

-1268.16

-1252.32

0.0466

(0,1,1)

(2,0,0)

-1267.98

-1252.14

0.0466

(0,1,1)

(0,0,1)

-1263.53

-1251.65

0.0471

(2,1,0)

(0,0,2)

-1266.91

-1247.1

0.0466

(0,1,1)

(1,0,0)

-1262.94

-1251.06

0.0471

(1,1,1)

(0,0,2)

-1266.89

-1247.09

0.0466

Table 5: SARIMA Models on Wheat Prices with Different

Parameters.

(p, d, q)

(P, D,

Q)

AIC

BIC

RMSE

(0,1,1)

(0,0,1)

-1020.07

-1008.19

0.064

(0,1,1)

(1,0,0)

-1019.31

-1007.43

0.0645

(1,1,0)

(0,0,1)

-1019.14

-1007.26

0.0645

(1,1,0)

(1,0,0)

-1018.46

-1006.58

0.0645

(0,1,1)

(0,0,2)

-1020.44

-1004.6

0.0642

(2,1,1)

(0,0,1)

-1022.3

-1002.49

0.0638

(0,

1,1)

(1,

0,2)

-

1021.01

-

1001.21

0.0

638

Finally, the best model is selected for each

commodity. For Brent oil, the best model is SARIMA

(0, 1, 1) (2, 0, 2), and the AIC value equals -698.882,

the BIC value equals -675.116 and the RMSE value

equals 0.094708. For Aluminum, the best model is

SARIMA (1, 1, 0) (2, 0, 0), and the AIC value equals

-1268.17, the BIC value equals -1252.33 and the

RMSE value equals 0.046628. For the wheat, the best

model is SARIMA (2, 1, 1) (0, 0, 1), and the AIC

value equals -1022.3, the BIC value equals -1002.49

and the RMSE value equals 0.063838.

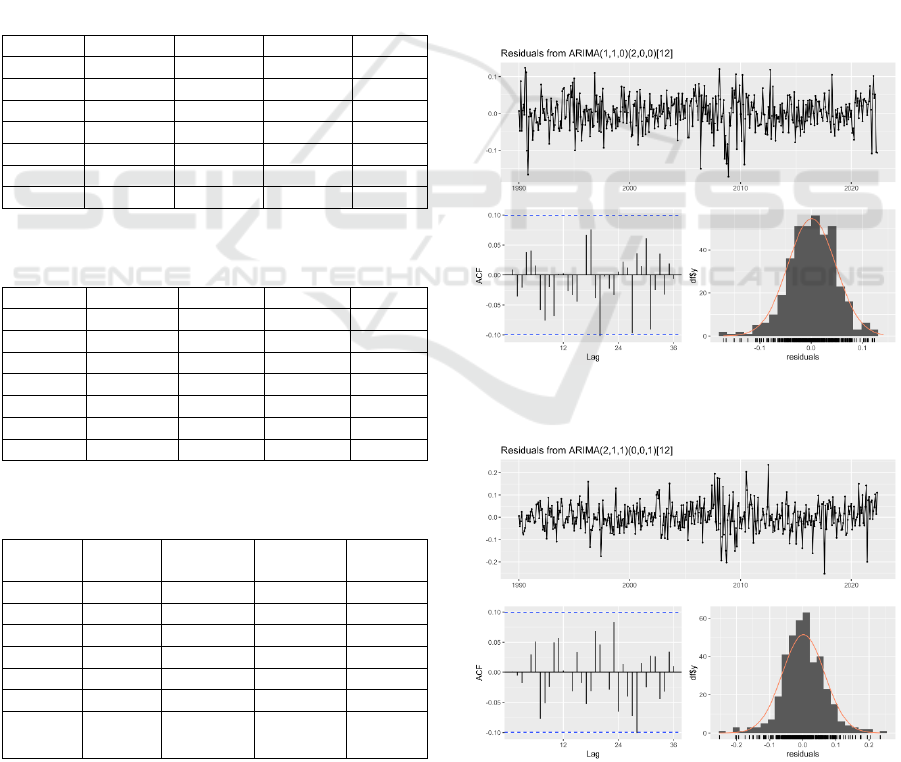

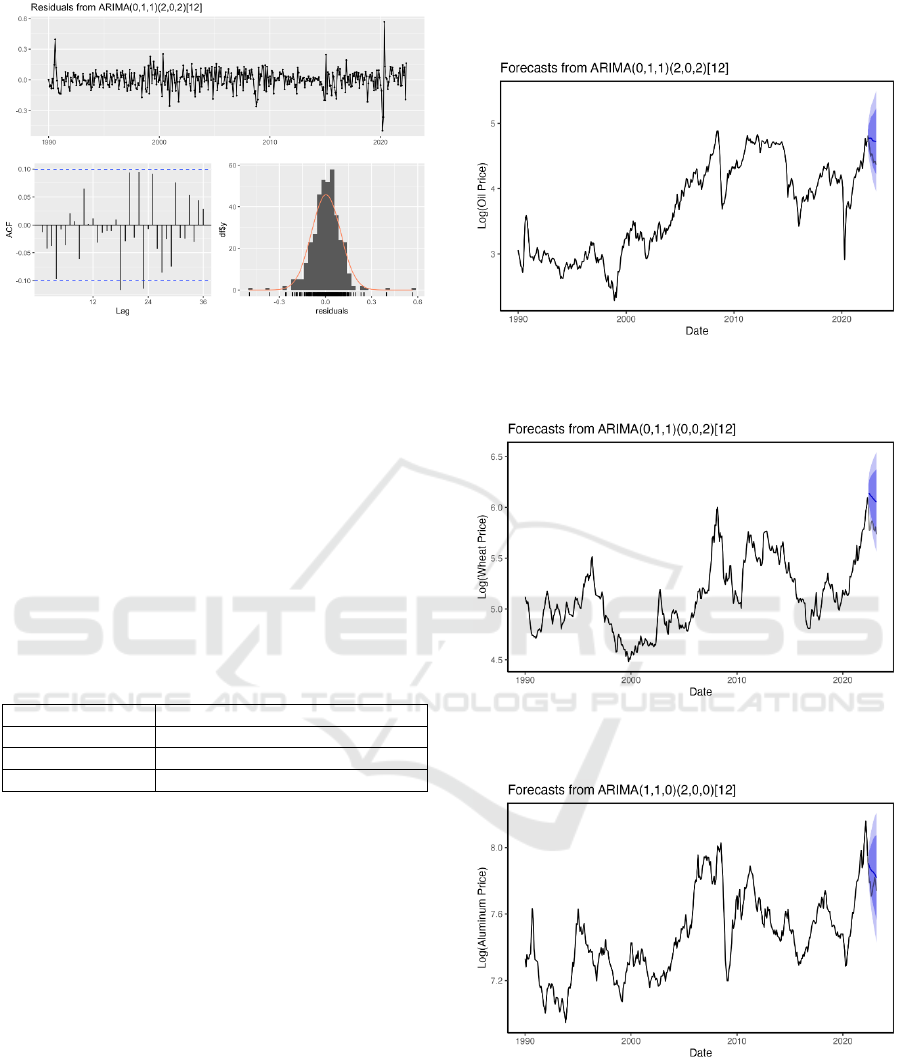

This paper uses the checkresiduals function to

check whether the residuals of the model are

consistent with the white noise. If the residuals are not

independent and are not consistent with normal

distribution, the model selected may not be suitable

for the study. Autocorrelation and time series plots of

the residuals can be tested by the ACF plot and the

Ljung-Box test in the function. The results of

aluminum prices, wheat prices, and Brent oil prices

are shown in Figures 13, 14, and 15 respectively. The

results of the Ljung-Box tests are shown in Table 6.

Figure 13: The Residuals Check on the SARIMA Model of

Aluminum Prices. (Picture credit: Original)

Figure 14: The Residuals Check on the SARIMA Model of

Wheat Prices. (Picture credit: Original)

ICDSE 2025 - The International Conference on Data Science and Engineering

472

Figure 15: The Residuals Check on the SARIMA Model of

Brent Oil Prices. (Picture credit: Original)

From the residuals plots, the residuals have

random fluctuations around zero mean, which means

that the model has a good fit. According to the ACF

plots of the SARIMA models of the data, the

autocorrelation values for most lags are within

confidence intervals, which means the residuals of the

SARIMA model are consistent with white noise.

According to the histogram, the residuals are

consistent with normal distribution. All the data pass

the residuals check.

Table 6: Ljung-Box Test of Residuals of All SARIMA

Models

Commodity

Ljung-Box test of Residuals

Oil

p-value = 0.08311

Wheat

p-value = 0.6398

Aluminum

p-value = 0.5808

All the p-values of the Ljung-Box test of residuals

are larger than 0.05. This indicates that there is no

significant autocorrelation in the residuals and that

the residuals are white noise. The model has captured

all the autocorrelation structures in the data, and the

residuals do not contain any systematic patterns,

which is the same as the conclusion from the ACF

plots above.

In the forecasting part, this research generates the

future movement of the prices of three commodities

in the next 10 months. The confidence intervals are

also generated. Finally, the real movement of the

prices is shown in the same picture as the predicted

movement to help offer some meaningful investing

suggestions. In the forecasting plots below, the

translucent black line indicates the historical data, the

blue line is the predicted mean, and the light blue and

dark blue areas indicate 80% and 95% confidence

intervals, respectively. The results are shown in

Figures 16, 17, and 18.

Figure 16: Brent Oil Prices Prediction Compared with

Actual Values. (Picture credit: Original)

Figure 17: Wheat Prices Prediction Compared with Actual

Values. (Picture credit: Original)

Figure 18: Aluminum Prices Prediction Compared with

Actual Values. (Picture credit: Original)

From the three plots above, the Brent oil price will

slightly go down in the next 10 months, and the prices

of aluminum and wheat will experience a sharp

decline in the next 10 months.

Time Series Analysis and Prediction of Future Commodities Prices with SARIMA

473

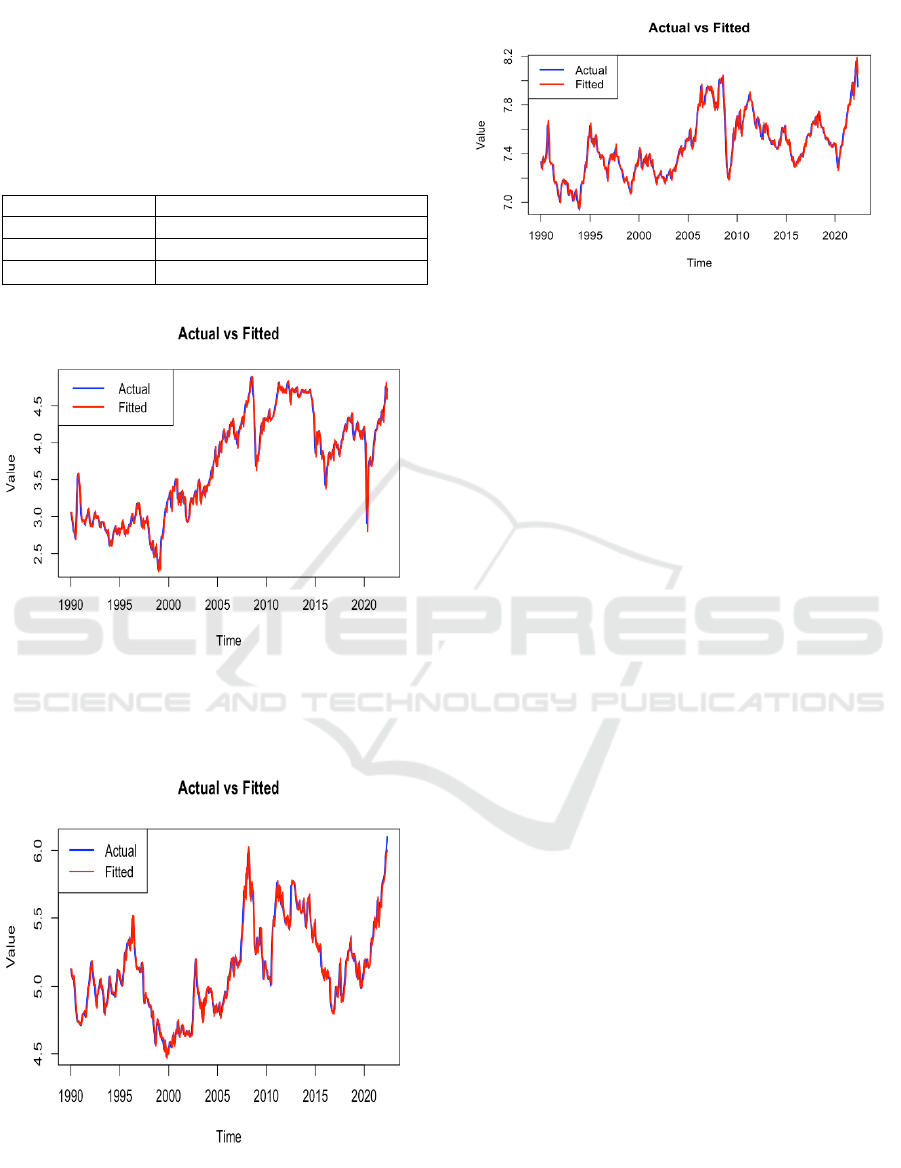

In the fitting part, this study calculated the

adjusted R square to find out the fitting ability of the

model. The results of the adjusted R square are shown

in Table 7. The plots of the actual values and the fitted

values of three commodities are shown in Figures 19,

20, and 21.

Table 7: Adjusted R2.

Commodity

Adjusted R square

Oil

0.9799

Wheat

0.9632

Aluminum

0.9631

Figure 19: Fit Chart of Brent Oil Prices. (Picture credit:

Original)

Figure 20: Fit Chart of Wheat Prices. (Picture credit:

Original)

Figure 21: Fit Chart of Aluminum Prices. (Picture credit:

Original)

It turns out that three SARIMA models fit well

with the data. The values of the adjusted R square of

Brent oil, wheat, and aluminum are 0.9799, 0.9632,

and 0.9631 respectively.

Although the forecasting declines are not that

serious compared with the actual fluctuation of the

prices of the three commodities. The trends of the

future movement are clear enough for investors to

decide their next transaction.

The results from this study are not enough because

the forecasting is not precise enough for investors to

decide when to buy and when to sell. Therefore,

investors need to combine some other factors such as

some international events in politics and some news

to make a reasonable transaction. In this study,

considering the decline in demand and supply caused

by the conflict in Ukraine, extreme weather, and

geopolitical conflicts (Ji, 2023), the commodities

prices are more likely to experience a downward

trend (Liu, 2022). Therefore, short selling for all

commodities mentioned above is a good choice.

In addition, some characteristics of the data may

not be extracted completely. To make a more precise

prediction and to help investors invest only by time

series analysis, a more complex model or a combined

model needs to be applied.

4 CONCLUSIONS

From the research, this paper discovers that the

SARIMA model has a relatively excellent ability to

predict the future prices of commodities. For

aluminum, the prediction shows that its price will go

down and the confidence interval is large, which

means it is not wise to buy aluminum in May 2022

and the price of aluminum can fluctuate a lot. For

wheat, the prediction also shows a decrease in price

ICDSE 2025 - The International Conference on Data Science and Engineering

474

but the confidence interval is smaller, which means it

is not wise to buy wheat in May 2022, and the

fluctuation in wheat price will be smoother. For oil,

the trend of the prediction is not obvious because

there is only a slight decrease, and the confidence

interval is also smaller, which means it may not be

wise to buy oil in May 2022, and the price of the oil

will not fluctuate a lot in the next 10 months. From

the actual values, it turns out that the real movement

of the prices of aluminum and wheat is almost the

same as the prediction. On the contrary, the difference

between the prediction of the Brent oil prices and the

actual values is not neglectable. It indicates that the

SARIMA model has a better forecasting ability in the

agricultural industry and the manufacturing industry

than in the energy industry. Overall, if investors make

decisions based on the prediction, they will not lose

money but can even earn some money by short selling.

However, the prediction of the future prices of three

commodities is not extremely precise, which means

people are not able to do short-term trading and

ultrashort-term trading because they will lose some

opportunities to make profits. In the future, more

complex models that can include more samples and

some other factors such as international events,

fundamental analysis, and investors’ minds should be

considered. In addition, the SARIMA model can be

combined with other methods, such as BNPP to

further make a more precise prediction.

REFERENCES

Ariyanti, V. P., & Yusnitasari, T. (2023). Comparison of

ARIMA and SARIMA for forecasting crude oil prices.

Jurnal RESTI (Rekayasa Sistem dan Teknologi

Informasi, 7(2), 405-413.

Bagrecha, C., Singh, K., Sharma, G., & Saranya, P. B.

(2024). Forecasting silver prices: A univariate ARIMA

approach and a proposed model for future direction.

Mineral Economics, 1-11.

Gasper, L., & Mbwambo, H. (2023). Forecasting crude oil

prices by using ARIMA model: Evidence from

Tanzania.

Guo, M. (2023). A study on the impact of international

commodity price volatility on China's macroeconomy

(Doctoral dissertation, Sichuan University).

Guzma, L. (2024). Application of ARIMA model to

forecast corn prices in Mexico. Scientia et PRAXIS,

4(08), 63-95.

Ji, J. (2023). Commodity price trends in 2022 and outlook

for 2023. Contemporary Petroleum and Petrochemicals,

31(4), 1-3.

Li, C. S. (2022). Forecasting gold price changes in China

using time series. Industrial Innovation Research, 23,

81-83.

Liu, N. (2022). Analysis of major commodity price trends

since 2022. China Price Regulation and Antimonopoly,

9, 68-69.

Ojha, S., & Karki, L. B. (2025). Forecasting global wheat

price in the context of changing climate and market

dynamics: An application of SARIMA modeling

technique.

Wanjuki, T. M., Wagala, A., & Muriithi, D. K. (2021).

Forecasting commodity price index of food and

beverages in Kenya using seasonal autoregressive

integrated moving average (SARIMA) models.

European Journal of Mathematics and Statistics, 2(6),

50-63.

Zhou, Z., Song, Z., & Ren, T. (2022). Predicting China's

CPI by scanner big data. arXiv preprint

arXiv:2211.16641.

Time Series Analysis and Prediction of Future Commodities Prices with SARIMA

475