Forecast USD/RMB Exchange Rate and Fitting Comparison Based on

Three Methods

Sitong Song

a

Statistics and Mathematics College, Inner Mongolia University of Finance and Economics, Hohhot, Inner Mongolia

Autonomous Region, China

Keywords: ARIMA, ETS, SMA, Exchange Rate Forecasting.

Abstract: In light of the current complex and volatile international landscape, continuously updated exchange rate

forecasts are indispensable. Accurate exchange rate forecasts enable enterprises to mitigate trade risks and

optimize investment decisions, assist financial institutions in risk management, and support policy

formulation. Furthermore, they provide robust support for macroeconomic policymakers, helping to maintain

exchange rate stability, balance international payments, and foster steady economic growth, which holds

significant importance across all economic levels. In this paper, through Auto-Regressive Integrated Moving

Average Model (ARIMA), Error-Trend-Seasonal (ETS) and Simple Moving Average (SMA) traditional time

series models forecast the next 10 steps (one step every five consecutive working days) based on the

USD/RMB exchange rate in 2022-2025. The result is compared with the actual value pair. In this study, the

Akaike Information Criterion (AIC) and Bayesian Information Criterion (BIC) are employed for model

selection when utilizing ARIMA, ETS, and SMA models. The model's performance was assessed using Root

Mean Squared Error (RMSE) and residual P-values. Given the volatile international situation, updated

exchange rate forecasts are needed. Accurate exchange rate forecasts enable enterprises to mitigate trade risks

and optimize investment decisions, assist financial institutions in risk management, and support policy

formulation.

1 INTRODUCTION

Over the past few decades, due directly to the factors

mentioned above, there has been a significant

acceleration in the expansion of forex exchange

markets driven by increased cross-border capital

flows (de Paula, Ferrari-Filho, & Gomes, 2013). A

number of economic indices exist for this market but

perhaps the most crucial is exchange rates (Baffour et

al., 2019). Exchange rate forecast is a very important

part of the foreign exchange market, and it plays a

very important role in the external development of

enterprises and social and economic development and

provides an important evaluation index. Previously,

many experts and scholars have used traditional time

series models to fit together and accurately updated

and adjusted the model to make it more suitable for

today's global situation. Even though conventional

models like the ARIMA are regarded as efficient

methods, they demand both stationary time series and

a

https://orcid.org/0009-0006-6825-1895

non - stationary time series that have been

appropriately transformed to become stationary

(Cappello et al., 2025). The ARIMA model was used

to stabilize the difference of the data and then proved

to reach the predictable stage by different test

standards. The model parameters were adjusted and

fitted, and the rationality of this model for short-term

exchange rate prediction was obtained. Using the

time series model to forecast the exchange rate over a

short period is beneficial to the trade development of

import and export enterprises and can provide

investment basis for international investors (Jiang &

Liu, 2022). The remaining two models underwent the

best process via steps similar to the first one. In this

study, the core objective is to identify the most

premier prediction model for short - term time series.

This is achieved by juxtaposing the three models

against the actual values. Initially, the paper

meticulously preprocesses the data and assesses its

fitting potential. Subsequently, distinct parameters

Song, S.

Forecast USD/RMB Exchange Rate and Fitting Comparison Based on Three Methods.

DOI: 10.5220/0013697800004670

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 2nd International Conference on Data Science and Engineering (ICDSE 2025), pages 379-384

ISBN: 978-989-758-765-8

Proceedings Copyright © 2025 by SCITEPRESS – Science and Technology Publications, Lda.

379

within different models are adjusted. Eventually, the

goodness of each model is evaluated from two diverse

dimensions, leading to a well - founded conclusion.

2 DATA AND METHOD

2.1 Data Collection and Description

This study acquires its data from China Money

Network by visiting the website and downloading the

data. This dataset includes 728 USD/RMB exchange

rate data from January 1, 2022 to January 1, 2025.

The data set is grouped by weekdays, that is, data

points are grouped by every five consecutive working

days. The specific sample information is shown in

Table 1:

Table 1: Sample description.

Statistical Index

Numerical

Value

Remark

Number of Data

Points

728

Daily data, spanning

two years

Exchange Rate

Minimum

6.3014

44621

Exchange Rate

Maximum

7.2258

45107

Average

Exchange Rate

6.85

Based on the data

Data Frequency

Everyday

One data point per

business day

Data Integrity

Integrity

No missing value

2.2 Data Pre-processing

Through data cleaning, the error value and missing

value in the data are eliminated. In this paper, RStudio

software was used to analyse the data, and the

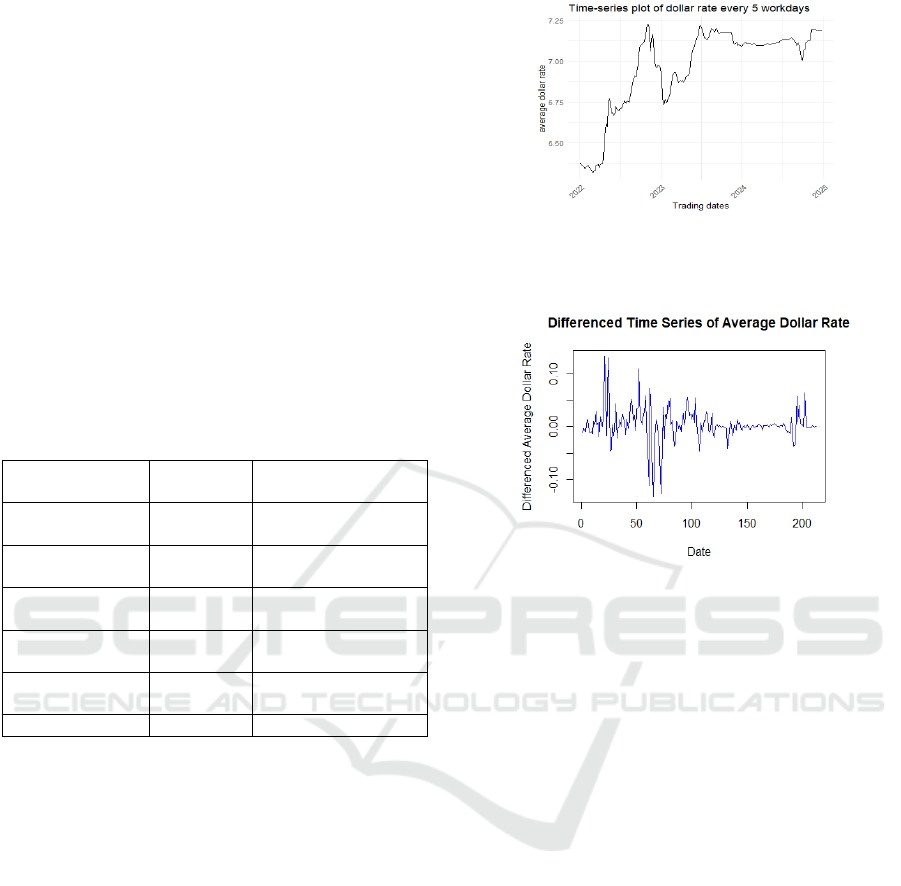

samples were drawn into a time series chart (Figure

1). It can be found that since the epidemic had just

ended at this time, economic activities and market

environment had not completely returned to the stable

state, so there was a sharp rise in the first period and

a sharp decline in the subsequent data, and the

subsequent data also fluctuated. The differential data

(Figure 2) are stable and eliminate long-term trends.

This represents an expansion of the Autoregressive

Moving Average Process applicable to time series

processes lacking stationarity. In this approach, the

data is subjected to a transformation so as to convert

the process into a stationary one (Marcy, 2021).

Figure 1: Timing diagram of original data (Picture credit:

Original)

Figure 2: Stationary sequence diagram after difference

(Picture credit: Original).

2.3 Auto-Regressive Integrated Moving

Average Model(ARIMA)Model

Principle

ARIMA is widely used in time series prediction

analysis. Its essence aims to transform non-stationary

time series into stationary ones through difference

operation, and then build ARIMA model and perform

prediction analysis. The ARIMA model, short for

moving average with auto-regressive integration is

usually represented as ARIMA. In this model, “p”

represents the order of the autoregressive part, “d”

indicates the level of differencing necessary, and “q”

stands for the order of the moving average part (Chen

et al., 2023). The basic structure of the model is

shown in formula (1), formula (2) and formula (3):

Where

is the polynomial of the moving

smoothness coefficient,

is the polynomial of

ICDSE 2025 - The International Conference on Data Science and Engineering

380

the autoregressive coefficient, and {

} is the zero-

mean white noise sequence (Sun & Cheng, 2016). In

the analysis of time series, autocorrelation and partial

autocorrelation tests are carried out for the difference

series, and the orders of autoregression (p) and

moving average (q) within the ARIMA model are

preliminarily inferred. Then, The Akaike Information

Criterion (AIC), Bayesian Information Criterion (BIC)

and Root Mean Squared Error (RMSE) were

comprehensively used to identify and determine the

ARIMA model more accurately, and the most

suitable ARIMA model was selected. After the model

is selected, the fitting performance of the model is

evaluated by its residual sequence and correlation

coefficient. If the remainder sequence is similar to the

white noise and the correlation coefficient is within a

reasonable range, it indicates that the model has a

good fitting effect on the data. If not, model flaws

exist; optimize. ARIMA forecasts, and real -

predicted value comparison gauges its practical

reliability.

2.4 Error-Trend-Seasonal(ETS)

Model Principle

Exponential smoothing method is to use the average

based on weighted values of the actual observed

amounts of the series to prognosticated the projected

value, the latest data in the series is multiplied by a

most substantial weight, and the data over the long

haul is added with a lesser weight (Shao et al., 2021).

TS model is a smoothing method, which is widely

used in processing time series data with seasonality

and trend (Li et al., 2025). Exponential smoothing

uses error, trend, seasonal params. ETS auto - selects,

adjusts, and evaluates to find best - performing model.

In the process of model selection, the best-fit model

is chosen relying on the minimum values of AIC, BIC

and RMSE. The P-value of the residual is tested by

Ljung-box Q to determine whether the residual is

white noise.

2.5 Simple Moving Average(SMA)

Model Principle

Moving average method is a method to calculate the

average containing a certain number of items to

reflect the changing trend of time series. The details

are shown in formula (4):

,

Where

is the moving average of the period

and represents the quantity of moving average

items.

The prediction method is shown in formula (5):

The period’s moving average is used as the

predictive value of period . By checking the P-

value of the residual, the people can judge whether

the residual is white noise. In general, the predicted

values of subsequent periods can be calculated

accordingly. Error accumulation causes larger errors

later; SMA suits one - period - ahead forecasts.

3 RESULTS AND DISCUSSION

3.1 ARIMA Model

3.1.1 Model Fitting

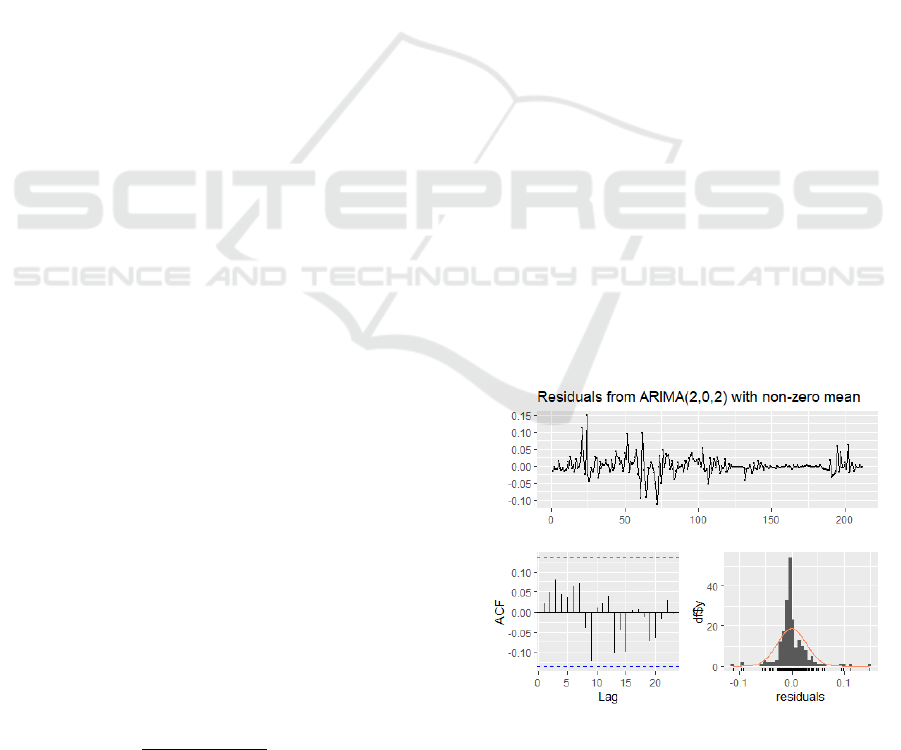

Autocorrelation Function (ACF) and Partial

Autocorrelation Function (PACF) of data after first-

order difference are shown in Figure 3. This article

uses RStudio to try different parameter combinations,

as shown in Table 2, and finally determines that

ARIMA (2,1,2) is optimal. AIC, BIC and RMSE of

ARIMA (2,1,2) are all the smallest. The residual P

value exceeded 0.05. At this time, the data of

logarithmic first-order difference have excellent

performance in AIC, BIC and RMSE detection. If the

residual is white noise, most of the information parts

of the model have been extracted and can be fitted.

Figure 3: ARIMA (2,1,2) residual test (Picture credit:

Original).

Forecast USD/RMB Exchange Rate and Fitting Comparison Based on Three Methods

381

Table 2: Comparison of different parameters.

Metric

ARIM

A

(2,1,2)

ARIM

A

(3,1,4)

ARIM

A

(2.1.3)

ARIM

A

(3,1,3)

AIC

-

915.21

-

904.32

-

905.11

-

904.37

BIC

-

895.07

-

-

-

RMSE

0.0271

0.0270

0.0272

0.0271

Residual p-

value

0.2045

0.1378

0.1435

0.1562

3.2 ETS Model

3.2.1 Model Fitting

In this paper, RStudio was used to try to predict

ETS. Different parameter combinations were shown

in Table 3, and it was found that ETS (A, N, N) was

the best. The residual P value of ETS (A, N, N) is

0.0506 and greater than 0.05, and the residual is white

noise. The test result of the residual is presented in

Figure 4, then the model has extracted most of the

information. Model AIC, BIC are small. After the

model's convergence is judged, it is found to fit well.

Figure 4: ETS (A, N, N) residuals test (Picture credit:

Original).

Table 3: ETS (A, N, N) Each detection index.

ETS (A, N, N)

AIC

-350.5486

BIC

-340.4789

RMSE

0.0176

Residuals p-

value

0.05063

3.3 SMA Model

3.3.1 Model Fitting

In this paper, RStudio was used to attempt SMA

prediction, and it was found that the residual error of

the SMA model after extracting information was

0.1787, greater than 0.05, and the residual error was

white noise, so the model had extracted most of the

information parts. When

test is carried out, it

reaches 1, which proves that the model has a good

fitting effect. By judging the convergence and

divergence of the model, it is found that it is

convergent, so it can be fitted.

3.4 Experimental Result

3.4.1 Comparison Model Parameter

In the fitting of ARIMA model and ETS model, AIC,

BIC and RMSE indictors were applied to assess the

feasibility of the model. In the comparison of model

goodness, the above indexes are first used for

selection.

Table 4: Comparison of ARIMA and ETS model goodness.

ARIMA (2,1,2)

ETS (A, N, N)

AIC

-915.21

-350.5486

BIC

895.07

-340.4789

RMSE

0.0271

0.0176

Residuals p-value

0.2045

0.05063

It is obvious that from Table 4 that the AIC, BIC

and RMSE of ARIMA (2,1,2) are smaller, so the

fitting influence of ARIMA (2,1,2) is better.

3.4.2 Contrast Error Value

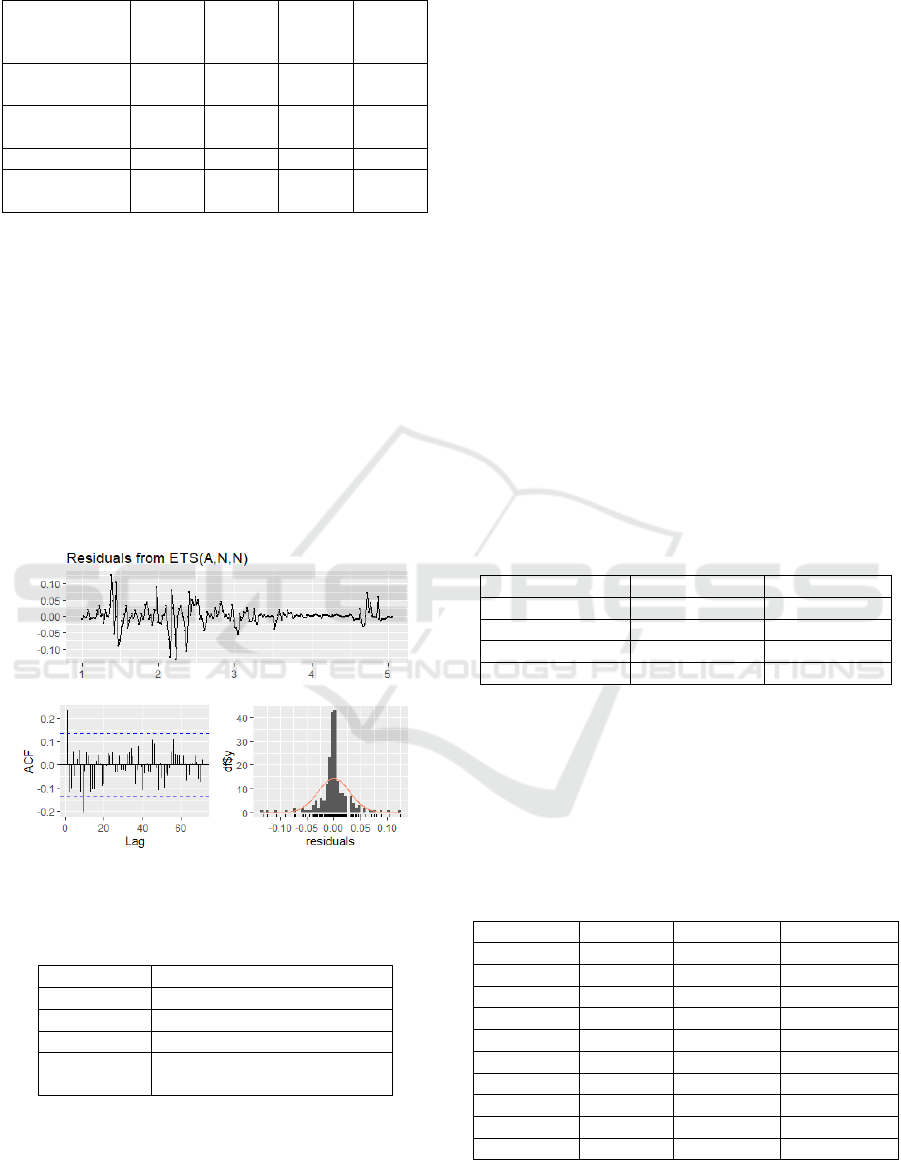

In the ARIMA (2,1,2) forecast:

Table5: ARIMA (2,1,2) Model Error.

Date

Forecast

TRUE

Error

2025,1

7.1897

7.1878

0.0019

2025,2

7.1933

7.1886

0.0047

2025,3

7.1923

7.1882

0.0041

2025,4

7.1917

7.1826

0.0091

2025,5

7.1925

7.1703

0.0222

2025,6

7.1922

7.1698

0.0224

2025,7

7.1921

7.1693

0.0228

2025,8

7.1923

7.1699

0.0224

2025,9

7.1922

7.1713

0.0209

2025,10

7.1922

7.1704

0.0218

ICDSE 2025 - The International Conference on Data Science and Engineering

382

Figure 5: ARIMA (2,1,2) Forecast Graph (Picture credit:

Original).

It is evident that Table 5 that the error is inside the

range of [0.0019,0.0228]. After calculation, the

average relative error is 0.01523, which is within the

normal range and the predicted value is too large. It

shows that it is feasible to use ARIMA model to

predicting RMB exchange rate, and the overall

prediction effect is good, which is capable of

effectively predict the future currency rate trend. In

addition, as the forecast time elapses, the deviation

among the forecast value and the factual value has a

tendency to expand, so this simulation is better

adapted to short-term exchange rate prediction (Zhu

& Hu, 2019). The forecast trend is shown in Figure 5.

In ETS(A,N,N) forecast:

Table 6: ETS (A, N, N) Model Error.

Date

Forecast

TRUE

Error

2025,1

7.1906

7.1878

0.0028

2025,2

7.1928

7.1886

0.0042

2025,3

7.195

7.1882

0.0068

2025,4

7.1971

7.1826

0.0145

2025,5

7.1993

7.1703

0.0290

2025,6

7.2015

7.1698

0.0317

2025,7

7.2037

7.1693

0.0344

2025,8

7.2059

7.1699

0.0360

2025,9

7.2081

7.1713

0.0368

2025,10

7.2102

7.1704

0.0398

Figure 6: ETS (A, N, N) Forecast Graph (Picture credit:

Original).

As is evident from Table 6 that the error falls

within the scope of [0.0028,0.0398]. After calculation,

the average relative error is 0.0236, which is within

the normal range and the predicted value is too large.

The specific forecast trend is shown in Figure 6.

In the SMA forecast:

Table 7: SMA Model Error.

Date

Forecast

TRUE

Error

2025,1

6.7919

7.1878

-0.3959

2025,2

6.9383

7.1886

-0.2503

2025,3

6.7388

7.1882

-0.4494

2025,4

7.0478

7.1826

-0.1348

2025,5

7.0204

7.1703

-0.1499

2025,6

6.9553

7.1698

-0.2145

2025,7

6.8683

7.1693

-0.3010

2025,8

6.7866

7.1699

-0.3833

2025,9

6.9466

7.1713

-0.2247

2025,10

6.9984

7.1704

-0.1720

Figure 7: SMA Comparison of model prediction and

original data (Picture credit: Original).

Table 7 reveals that the error is in the bounds of

[0.1348,0.4494]. Avg. rel. error (0.26758) exceeds

norm; predictions low. The comparison between the

specific predicted value and model fitting is shown in

Figure 7.

Among simple time - series models for

USD/RMB rate, ARIMA shows top - notch fit. It's

effective for stationary data, assuming linear future

value determination. However, many real-world time

series data exhibit complex nonlinear patterns that

ARIMA cannot model effectively (Zhang, 2023).

Simple moving average and exponential moving

average are two standard technical analysis

techniques (Billah et al., 2024). Predictions lose

accuracy as lead time increases (Tian, 2017).

Forecast USD/RMB Exchange Rate and Fitting Comparison Based on Three Methods

383

4 CONCLUSIONS

By comparing the estimated value and the value

observed in practice and drawing the time series

graph, this paper find that the ARIMA model has the

best fitting effect on the USD/RMB exchange rate. In

this paper, three traditional time series models of

ARIMA, ETS and SMA were used to predict the

USD/RMB exchange rate in the next 10 steps, and

then the goodness of fit of the three models was

evaluated through two dimensions. The first

dimension is that the results of ARIMA (2,1,2) model

are better by comparing AIC, BIC, RMSE and

residual P-value. The second dimension shows that

ARIMA (2,1,2) has the smallest error by comparing

the predicted value with the actual value, followed by

ETS (A, N, N), and finally SMA, and all three models

are within the normal error range. The limitation of

this paper is that the traditional time series model used

in this paper will lead to fitting errors when predicting

exchange rates with large fluctuations and

randomness. The traditional statistical model has the

disadvantage of being rigid, and the results obtained

will not have good fitting effect when the original

data does not meet some assumptions. Using the

traditional time series model to forecast the exchange

rate can make the innovation foundation more solid,

the thinking clearer, and the innovation more accurate

exchange rate prediction model. It can also be

concluded from the above methods that traditional

time series models like ARIMA model are suitable

for short-term forecasting and have higher accuracy

than long-term forecasting.

REFERENCES

Baffour, A. A., Feng, J., & Taylor, E. K. (2019). A hybrid

artificial neural network - GJR modeling approach to

forecasting currency exchange rate volatility.

Neurocomputing, 365, 285-301.

https://doi.org/10.1016/j.neucom.2019.07.088

Cappello, C., Congedi, A., De Iaco, S., & Mariella, L.

(2025). Traditional prediction techniques and machine

learning approaches for financial time series analysis.

Mathematics, 13(3), 537.

https://doi.org/10.3390/math13030537

Chen, Y. H., Bhutta, M. S., Abubakar, M., Xiao, D. T.,

Almasoudi, F. M., Naeem, H., & Faheem, M. (2023).

Evaluation of machine learning models for smart grid

parameters: Performance analysis of ARIMA and Bi-

LSTM. Sustainability, 15(11), 8555.

https://doi.org/10.3390/su15118555

de Paula, L. F., Ferrari-Filho, F., & Gomes, A. M. (2013).

Capital flows, international imbalances and economic

policies in Latin America. In Economic Policies,

Governance and the New Economics (pp. 209-248).

London: Palgrave Macmillan UK.

Jiang, Q., & Liu, Y. W. (2022). Prediction of US dollar

exchange rate based on ARIMA model. Economic

Research Guide, (20), 69-71.

Li, Y. L., Lin, S., Ni, Y. T., Yao, K. Y., & Li, Y. F. (2025).

Time-series forecasting of electric power material

demand based on the "STL+ARIMA" model. Internet

Weekly, (02).

Marcy, J. (2021). Time series regression and intervention

analysis [Doctoral dissertation, College of Charleston].

ProQuest Dissertations and Theses Global. (28866113)

Shao, Y. Q., Liu, H., Li, C. X., Meng, X. W., Li, L., Wang,

X., & Wu, Q. H. (2021). Application of SARIMA and

ETS models in predicting the incidence trend of

hemorrhagic fever with renal syndrome in Hunan

Province. Chinese Journal of Health Statistics, XX(XX),

XX-XX. https://doi.org/10.3969/j.issn.1002-

3674.2021.02.012

Sun, P., & Cheng, C. M. (2016). Research on exchange rate

forecasting based on ARIMA model: Taking the US

Dollar - RMB exchange rate as an example. Journal of

Liaoning University of Technology (Social Science

Edition), 18(6), 20-23.

https://doi.org/10.15916/j.issn1674-327x.2016.06.006

Zhu, J. M., & Hu, L. Y. (2019). Comparative analysis of

RMB exchange rate forecast based on ARIMA and BP

neural network——Take the exchange rate of US dollar

to RMB as an example. Journal of Chongqing

University of Technology (Natural Science), 33(5),

207-212. https://doi.org/10.3969/j.issn.1674-

8425(z).2019.05.032

Zhang, P. L. (2023). Research on Exchange Rate

Forecasting Based on Deep Learning under the

Influence of US Policies. Journal of Zhongnan

University of Economics and Law (Master's Thesis),

2023(01). DOI: 10.27660/d.cnki.gzczu.2021.000320

Billah, M. M., Sultana, A., Bhuiyan, F., & Kaosar, M. G.

(2024). Stock price prediction: comparison of different

moving average techniques using deep learning model.

Neural Computing and Applications, 36(10), 5861–

5871. https://doi.org/10.1007/s00521-023-09369-0

Tian, Z. W. (2017). Research on Time - Series Analysis

Methods and Their Application in Sino - US Exchange

Rate Forecasting. Journal of Dalian University of

Technology (Master's Thesis), 2017(03).

ICDSE 2025 - The International Conference on Data Science and Engineering

384