Short-Term Stock Price Forecasting Using ARIMA: A Case Study on

Apple and Amazon

Zikai Feng

a

Department of Athematics, The Chinese University of HongKong, HongKong, 999077, China

Keywords: ARIMA Model, Stock Price Prediction, Stock Market.

Abstract: In stock market, predicting stock price has attracted many researchers interest over years because of the non-

stationary and highly volatile nature of stock prices. Among various time series forecasting models, the Auto

Regressive Integrated Moving Average (ARIMA) model has been widely applied because of its ability to

capture the patterns for short term prediction. This study applies the Auto Regressive Integrated Moving

Average model to forecast Apple (AAPL) stock value and Amazon (AMZN) stock value. Using the Akaike

Information Criterion (AIC) to select the model that fits the best, and ARIMA (0,1,0) is found to be the best

option for both stocks. The Root Mean Square Error (RMSE) is used to estimate the accuracy of model

forecast. Result of this paper illustrate that ARIMA model exhibits an impressive aptitude for short-term stock

price predictions, offering a reference for future research and investment strategies. This study aims to

demonstrate the effectiveness of the ARIMA model in short-term stock value predicting, delivering a resource

for financial market analysts and financial institutions.

1 INTRODUCTION

With the rapid development of financial markets,

stock price prediction has become indispensable for

investment decision-making and risk management.

Stock prices exhibit complex characteristics such as

non-stationarity and nonlinearity, and high volatility

influenced by macroeconomic indicators,

geopolitical events, and irrational market behaviors

traditional analytical approaches often fail to capture

these dynamic patterns effectively (Devi, Sundar, &

Alli, 2013; Ariyo, Adewumi, & Ayo, 2014). Because

of their dependence on static assumptions, classic

analytical techniques like linear regression and

simple time-series models find it difficult to represent

the chaotic patterns created by these intricate

interactions. The Auto Regressive Integrated Moving

Average(ARIMA) model, proposed by Chen, has

been proven highly effective in handling financial

time series data with temporal dependencies. By

transforming non-stationary data into stationary

series after servals difference, the ARIMA model

would capture cyclical variations in the data and

provides short-term forecasts(Chen, 2022).

Stationarity, which requires constant mean, variance,

a

https://orcid.org/0009-0000-8778-7229

and autocorrelation structure over time, eliminates

spurious correlations caused by trends or seasonal

patterns, thereby allowing models to identify genuine

relationships within the data, using stationary data to

predict the stock price is more trustworthy (Dar et al.,

2024).

Several empirical investigations have been

conducted to assess the capacity for prediction of the

ARIMA model in the stock market. For example,

Almasarweh et al. applied an ARIMA (1,1,2) model

to predict Banking Stock Market Data and found that

the model performed well in forecasting the data

(Almasarweh & Wadi, 2018). Similarly Adebayo et

al. identified ARIMA (3,1,1) and ARIMA (1,1,4) as

optimal specifications for Botswana and Nigeria

markets, respectively (Adebayo, Sivasamy, &

Shangodoyin, 2014). Additionally, Adebiyi et al.

employed an ARIMA (2,1,0) model to predict the

Nokia Stock Index and an ARIMA (1,0,1) model for

the Zenith Bank Index, demonstrating that both

models effectively predicted stock price

movements(Adebiyi et al., 2014). These studies

emphasize the prediction capability of ARIMA model

by using stationary and accurate stock price.

366

Feng, Z.

Short-Term Stock Price Forecasting Using ARIMA: A Case Study on Apple and Amazon.

DOI: 10.5220/0013697500004670

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 2nd International Conference on Data Science and Engineering (ICDSE 2025), pages 366-371

ISBN: 978-989-758-765-8

Proceedings Copyright © 2025 by SCITEPRESS – Science and Technology Publications, Lda.

The aim of this paper is exploring application of

the ARIMA model in stock market price forecasting,

particularly its ability to predict short-term price

fluctuations. By doing so, this study seeks to provide

investors with an effective tool for short-term stock

price prediction, aiding them in making more rational

and efficient investment decisions.

The following is the framework of the paper.

Section 2 reviews the fundamental theory and

methodology of ARIMA model, as well as data

sources and model constructed. Section 3 describe the

forecast results obtained and the conclusions are

illustrated in section 4.

2 MODEL AND DATA

2.1 ARIMA Model

The ARIMA model is composed of different parts:

moving averages (MA), differencing (I), and

autoregression (AR).

The Equation (1) shows the equation for the

ARIMA model.

𝑦

= 𝜇+𝜙

𝑦

+𝜙

𝑦

+𝜙

𝑦

+ ⋯

+𝜙

𝑦

+ 𝜃

𝜀

+𝜃

𝜀

+⋯ 𝜃

𝜀

+𝜀

1

Where: 𝑦

is the time value of t, 𝜇 is the constant

mean, 𝜙

,

𝜙

,⋯, 𝜙

are the parameters for the

autoregressive terms, 𝜃

, 𝜃

,⋯,𝜃

are the

parameters for moving average terms, 𝜀

represents

the white noise (residuals) at time t.

The ARIMA model is a dynamic univariate

predictive method for predicting time series data.

Therefore, It is crucial for selecting a suitable model

to analyze stock price trends and provide sufficient

information for decision-making (Ganesan &

Kannan, 2021).

2.2 Data Resources

Yahoo Finance website is used in this study to gather

stock price data for Apple (AAPL) and Amazon

(AMZN) over the period of January 1st, 2020, to

December 31th, 2024. The dataset consists of the

following key components: Date, Open Value, High

Value, Low Value, Close Value, Adjusted Close

Value, and Volume.

The Adjusted Close price is selected as the main

variable for investigation. The adjusted closing price,

as opposed to the closing price, more closely

represents real market returns, as it accounts for

corporate actions such as dividends and stock splits,

thereby eliminating non-market factors that could

distort price movements. This approach enhances the

rigor and reliability of the analysis. The time frame

spanning January 1st, 2020, to December 1st, 2024,

is designated as the training set, while the period from

December 2nd, 2024, to December 31th, 2024, is

selected as the test set. By comparing the difference

between test set and the predicted value, such as

RMSE value, it provides a standard for judging the

model projections.

To visually illustrate the stock price trends of the

three companies, Figure 1 presents the AAPL price

trend, Figure 2 shows the AMZN price movement.

Figure 1: AAPL Adjusted price. (Picture credit: Original)

Figure 2: AMZN Adjusted price. (Picture credit: Original).

2.3 Model Construction

2.3.1 ARIMA (p, d, q) Model for APPL

Stock

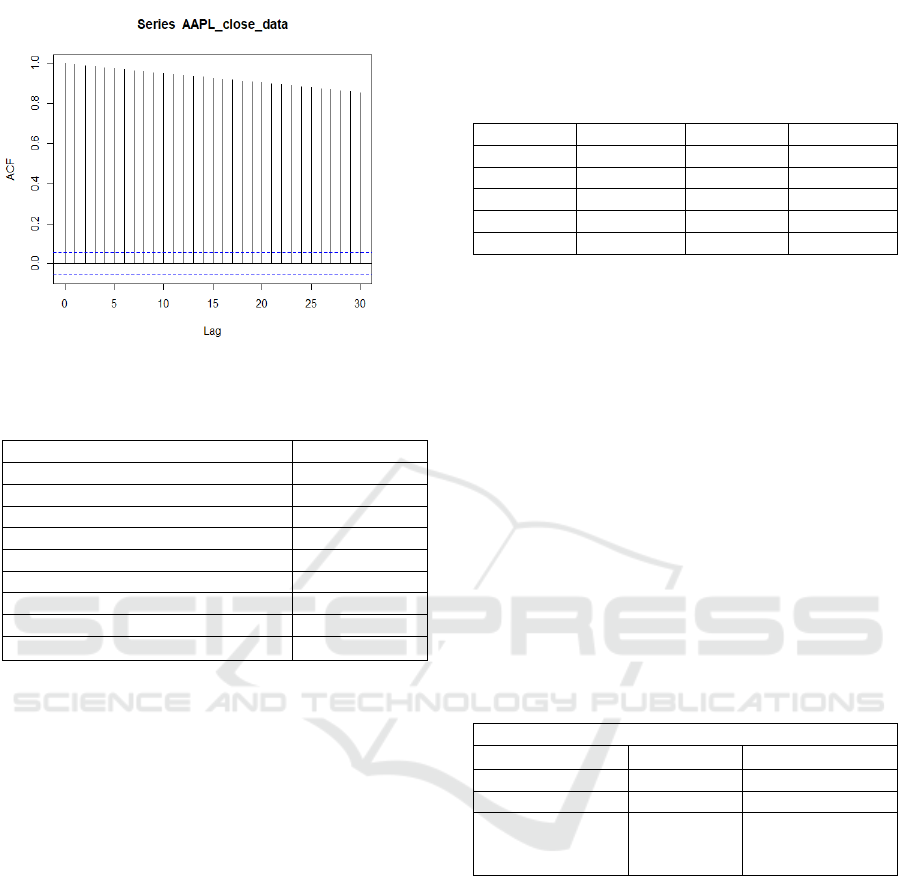

Figure 3 is the ACF plot of the AAPL stock adjusted

price, this picture exhibits a slow decay, indicating

that the data is non-stationary.

Short-Term Stock Price Forecasting Using ARIMA: A Case Study on Apple and Amazon

367

Figure 3: ACF of AAPL. (Picture credit: Original)

Table 1: ADF of AAPL Adjusted price.

Statistic Value

ADF Test Statistic -25.5625

1% value of Criticalit

y

-2.58

5% value of Criticalit

y

-1.95

10% value of Criticalit

y

-1.62

z.la

g

.1 Coefficient -1.03801

z.lag.1 Standard Erro

r

0.04061

R² 0.5079

F-Statistic 635.7

F-Statistic p-value < 2.2e-16

Utilizing the Augmented Dickey-Fuller (ADF)

test to determine if this data has reached stationarity

following the first difference(Dhyani et al., 2020).

The ADF test result verifies that the series is

stationary following the first difference, as table 1

illustrates that the test statistic (-25.5625) far below

the 1% critical value (-2.58). The unit root hypothesis

is rejected at the 99% confidence level (p < 0.001).

The best model was thought to be the ARIMA

model with the lowest AIC score, since the ARIMA

model can be constructed using different values of p,

d, and q to accommodate various time series

characteristics. The autoregressive order p represents

the order of the AR in the model, The number of times

the original time series is differentiated is indicated

by the difference order d, with the aim of satisfying

the stationarity assumption for the series, the moving

average order q symbolizes the order of the Moving

Average terms (MA) in model, which explains how

the real value and the forecast error at the previous q

time points are linearly related.

The parameter ranges for p, d, and q are restricted

from 0 to 2, because negative values are not

meaningful, and values exceeding 2 may lead to

unreliable parameter estimation(Mondal, Shit, &

Goswami, 2014).

Table 2: AIC value of different ARIMA model based on

AAPL data.

ARIMA AIC ARIMA AIC

(

1,0,0

)

5949.17

(

0,0,1

)

11063.27

(1,0,1) 5950.482 (0,1,2) 5936.885

(1,1,1) 5936.876 (0,1,0) 5933.821

(2,0,1) 5952.988 (0,2,0) 6804.786

(

2,1,1

)

5938.558

(

1,0,1

)

5935.519

ARIMA (0,1,0) is considered to be the best model

to predict the price of AAPL stock, as the value of this

model is the smallest in those models, with 5933.821.

Some AIC value of different models were listed in the

table 2. Table 3 illustrate the coefficient about

ARIMA (0,1,0) with drift. This model implies that at

each time step, the time series undergoes a fixed

change amount, combined with random fluctuations.

The ARIMA (0,1,0) with drift equation is given by

Equation (2)

𝑌

=𝑌

+ℎ×𝑐

2

Where: :𝑌

is the current stock price, ℎ is the

forecast time step, 𝑐 is the drift term (the fixed trend

value estimated by the model).

Table 3: Coefficients value of ARIMA (0,0,1) based on

AAPL data

ARIMA (0,1,0) with drift

Coefficient:

Drift

0.1330

S.E. 0.0757

sigma^2 = 7.097

log

likelihood =

-2964.37

AIC=5932.74

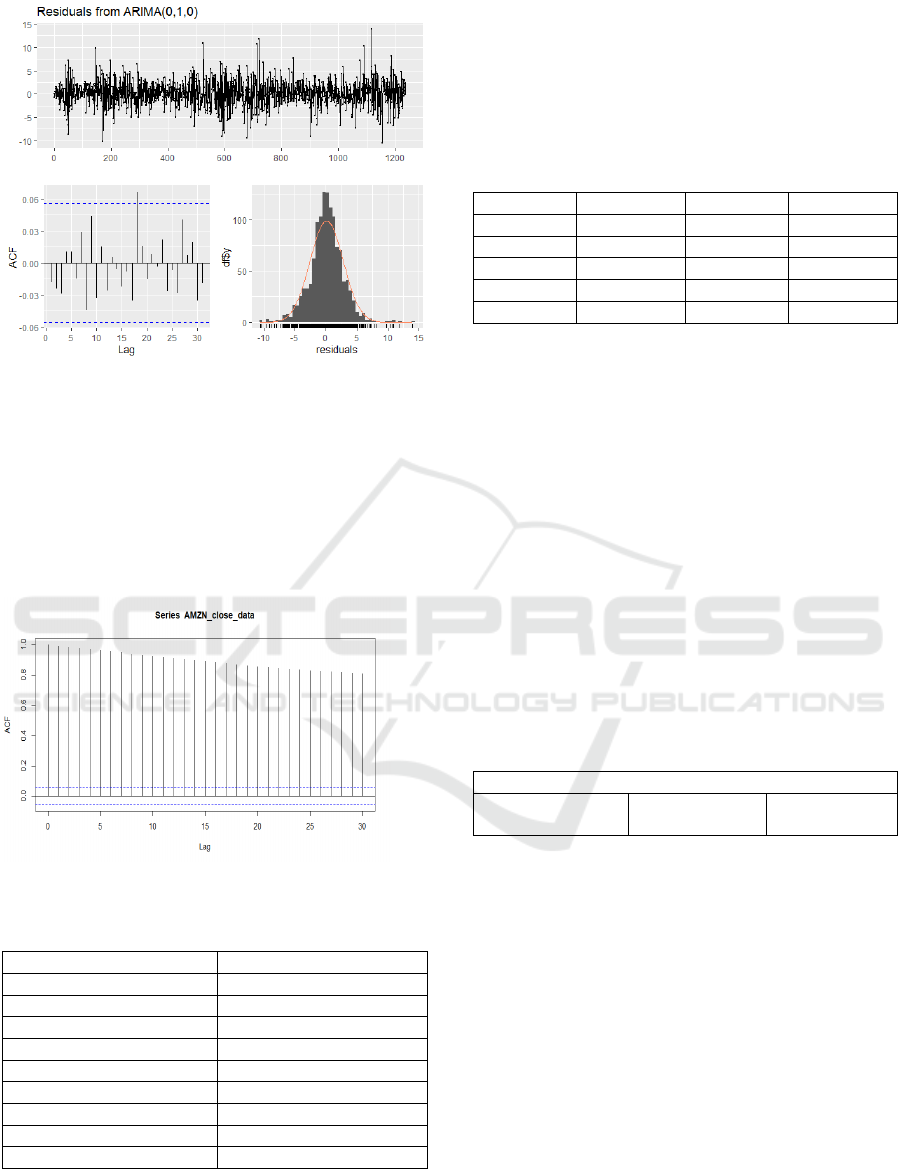

In figure 4 the residuals were checking with the

Ljung-Box test. The results show that the residuals

distribution is approximately normal, which means

the residuals were white noise and the fitted model

sufficiently explains the data, with no systematic

information remaining in the residuals. This model is

selected to forecast the APPL stock price from

December 2, 2024, to December 31.

ICDSE 2025 - The International Conference on Data Science and Engineering

368

Figure 4: Residuals of ARIMA (0,1,0) based. (Picture

credit: Original)

2.3.2 ARIMA (p, d, q) Model for APPL

Stock

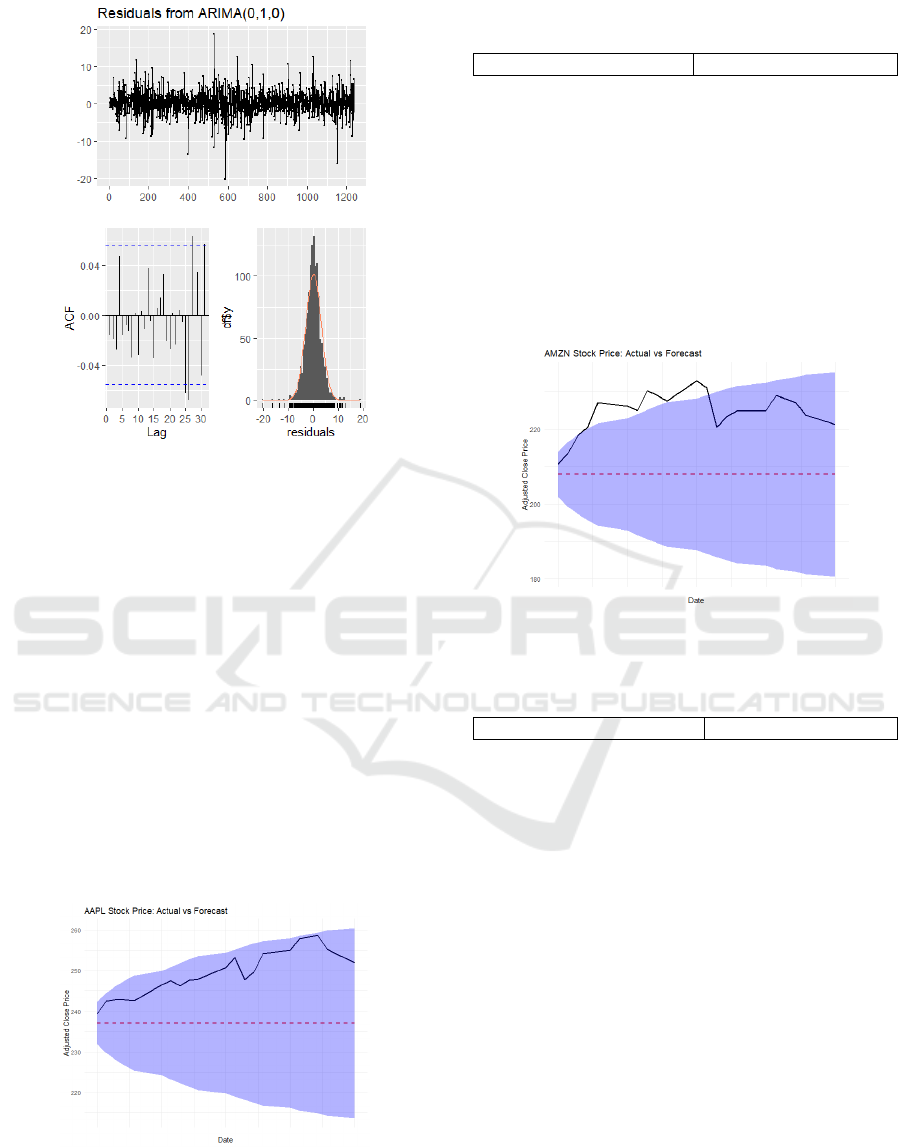

The Figure 5 exhibit a slowly dies down,

indicating that the AMZN data is non-stationary.

Following the first difference, the data's stationarity

is checked using the ADF test.

Figure 5: ACF of AMZN. (Picture credit: Original)

Table 4: ADF of AMZN data after first-difference.

Statistic Value

ADF Test Statistic -25.4769

1% value of Criticalit

y

-2.58

5% value of Criticalit

y

-1.95

10% value of Criticalit

y

-1.62

z.lag.1 Coefficient -1.03410

z.la

g

.1 Standard Erro

r

0.04059

R² 0.5077

F-Statistic 635.2

F-Statistic p-value < 2.2e-16

Table 4 shows the result of ADF test of AMZN

data after first-difference. It is cleared that the

standard error is 0.04059 and a lagged term

coefficient is -1.03410, which means the estimate is

deemed to be reasonably accurate. The AMZN stock

price after first-difference is a suitable set to design

an AIRMA model, as the F-statistic is 635.2 and the

p-value is much smaller than 0.05.

Table 5: AIC value of different ARIMA model based on

AMZN data.

ARIMA AIC ARIMA AIC

(

1,0,0

)

6334.658

(

0,0,1

)

10440.91

(1,0,1) 6336.521 (0,1,2) 6325.42

(1,1,1) 6325.463 (0,1,0) 6322.138

(

2,0,1

)

6338.182

(

0,2,0

)

7192.456

(

2,1,1

)

6327.25

(

1,0,1

)

6323.851

In table 5 illustrate the ARIMA (0,1,0) was

selected as the best fitted model to forecast the

AMZN stock price, since the AIC value of this model

is the smallest, with 6322.138. The Equation (3)

illustrates ARIMA (0,1,0) without drift equation

𝑌

=𝑌

+𝜖

3

Where: 𝑌

is the current value, 𝑌

is the value

from the previous time step, 𝜖

is the white noise

term, representing random error, usually following a

normal distribution N (0,𝜎

). It is noticeable that

there is a different between Equation (2) and

Equation(3) as it shows whether the model has a

deterministic temporal trend component or not.

Table 6: Coefficients value of ARIMA (0,1,0) based on

AMZN data

ARIMA (0,1,0)

sigma^2 = 9.733

log likelihood =

-3160.07

AIC= 6322.14

Table 6 presents the coefficients of the ARIMA

(0,1,0) model for AMZN stock prices. The ACF plot

in Figure 6 shows that most ACF values fall within

the confidence intervals, indicating no significant

autocorrelations in the residuals. Additionally, the

residuals follow a normal distribution and exhibit

white noise characteristics, suggesting that this model

effectively fits the stock price data. ARIMA (0,1,0)

model is selected to forecast the AMZN stock price.

Short-Term Stock Price Forecasting Using ARIMA: A Case Study on Apple and Amazon

369

Figure 6: Residuals of ARIMA (0,1,0). (Picture credit:

Original)

3 RESULTS AND DISCUSSION

3.1 ARIMA (0,1,0) With Drift based on

APPL Data

The figure 7 illustrates the forecasted and actual

values of Apple's stock price from December 2, 2024,

to December 31, 2024, employing the ARIMA (0,1,0)

model. The 95% confidence interval is consisted of

areas shaded in blue, whereas the red line represents

the expected mean. The black line indicates the actual

stock prices. As observed, the actual values totally

fall within the predicted confidence interval. The

table 7 illustrates the RMSE value of this model is

13.092.

Figure 7: Forecast of APPL stock. (Picture credit:

Original)

Table 7: RMSE value of ARIMA (0,1,0) based on APPL

data

RMSE of ARIMA (0,1,0) 13.09234

3.2 ARIMA (0,1,0) based on AMZN

Data

The figure 8 illustrates that the actual AMZN stock

price (black line) mostly falls within the confidence

interval, suggesting the model effectively captures

market fluctuations. However, the predicted mean

(red dashed line) is noticeably lower than the actual

upward trend. The table 8 shows that the RMSE value

of this model is 17.34869.

Figure 8: Forecast of AMZN stock (Picture credit: Original)

Table 8: RMSE value of ARIMA (0,1,0) based on AMZN

data

RMSE of ARIMA

(

0,1,0

)

17.34896

4 CONCLUSIONS

Accurate stock price forecasting plays a vital role in

financial decision-making, helping investors navigate

market fluctuations with data-driven insights. This

study selected optimal ARIMA models to forecast

stock prices of Apple and Amazon, collecting

sufficient stock data from Yahoo Finance. By

employing the AIC for parameter optimization and

rigorous residual diagnostics to ensure model

validity, the analysis identifies ARIMA (0,1,0) with

drift is the most effective model for AAPL, while the

ARIMA(0,1,0) without drift is the optimal model for

AMZN. This can guide investors to make sensible

investment decisions. The results illustrate the

ARIMA model demonstrates exceptional capability

in short-term forecasting. However, given the

inherent limitations of ARIMA models, such as their

reliance on historical data and assumption of linear

relationships, future research may explore hybrid

ICDSE 2025 - The International Conference on Data Science and Engineering

370

models or machine learning techniques to enhance

forecasting accuracy and robustness.

REFERENCES

Adebiyi, A. A., Adewumi, A. O., & Ayo, C. K. (2014,

March). Stock price prediction using the ARIMA

model. In 2014 UKSim-AMSS 16th International

Conference on Computer Modelling and Simulation

(pp. 106-112). IEEE.

Adebayo, F. A., Sivasamy, R., & Shangodoyin, D. K.

(2014). Forecasting stock market series with ARIMA

model. Journal of Statistical and Econometric Methods,

3(3), 65-77.

Almasarweh, M., & Wadi, S. A. (2018). ARIMA model in

predicting banking stock market data. Modern Applied

Science, 12(11), 309-317.

Chen, Z. (2022). Asset allocation strategy with Monte-

Carlo simulation for forecasting stock price by ARIMA

model. In Proceedings of the 2022 13th International

Conference on E-Education, E-Business, E-

Management, and E-Learning (pp. 481-485).

Dar, A. A., Jain, A., Malhotra, M., Farooqi, A. R., Albalawi,

O., Khan, M. S., & Hiba. (2024). Time series analysis

with ARIMA for historical stock data and future

projections. Soft Computing, 28, 12531-12542.

Devi, B. U., Sundar, D., & Alli, P. (2013). An effective time

series analysis for stock trend prediction using ARIMA

model for Nifty Midcap-50. International Journal of

Computer Science, Engineering and Applications

(IJCSEA), 3(2), 13-26.

Dhyani, B., Kumar, M., Verma, P., & Jain, A. (2020). Stock

market forecasting technique using ARIMA model.

International Journal of Recent Technology and

Engineering (IJRTE), 8(6), 456-460.

Ganesan, A., & Kannan, A. (2021). Stock price prediction

using ARIMA model. International Research Journal of

Engineering and Technology (IRJET), 8(8), 1234-

1240.

Mondal, P., Shit, L., & Goswami, S. (2014). Study of

effectiveness of time series modeling (ARIMA) in

forecasting stock prices. International Journal of

Computer Science, Engineering and Applications, 4(2),

13-29.

Short-Term Stock Price Forecasting Using ARIMA: A Case Study on Apple and Amazon

371