Temporal Graph Networks for Bank Customer Churn Prediction

with Dynamic

Peihao Sun

a

College of Art & Sciences, University of Washington, Seattle, Washington, United States

Keywords: Temporal Graph Networks, Customer Churn Prediction, Dynamic Relationship Modeling, Causal Temporal

Difference, Targeted Retention Strategies.

Abstract: Customer churn prediction is a critical issue in banking, with a direct influence on customer retention strategy

and financial health. Traditional churn models such as Recency-Frequency-Monetary (RFM) analysis ad static

graph-based models fail to capture the dynamic nature of client-product interaction, social influence effects,

and policy shocks. To address these limitations, this work proposes a Temporal Graph Network (TGN)-based

model that integrates dynamic node embeddings and causal temporal difference mechanisms to model real-

time financial transactions. The proposed approach is tested on a 12-month transactional dataset of a European

retail bank, with a 12–18% improvement in prediction accuracy over baseline models such as LSTM, GCN,

and Node2Vec. By leveraging TGN-computed churn risk scores, the paper applies three levels of tailored

retention interventions, i.e., dynamic fee remissions, referral stabilization rewards, and policy-sensitive rate

adjustments, which collectively boost customer lifetime value (CLV) by 14% and cross-sell rates by 22%.

The findings show the effectiveness of temporal graph-based modeling in financial analytics, presenting an

interpretable and scalable churn prediction solution. Subsequent research must explore federated learning

techniques to enable privacy-sustaining cross-bank collaboration as a supplement to the impact of temporal

graph-based knowledge on financial decision-making.

1 INTRODUCTION

Customer churn is one of the primary challenges in

banking and has direct ramifications on revenue

consistency, cost of doing business, and customer

relations management for the long term. Being able to

predict and manage customer loss is critical as

keeping existing clients costs significantly less

compared to acquiring new ones. Surveying industry

experiences indicates that modest increases in

retaining customers translate to enormous

profitability and lends significance to data-based

models of predicting customer attrition (Huang et al.,

2012; Çelik & Osmanoglu, 2019). In a highly

competitive banking sector where customers have a

wide range of banking alternatives, traditional churn

prediction models have not been sufficient to define

the dynamics of evolving customer-bank

relationships (Tsai & Lu., 2009; Vafeiadis et al.,

2015).

a

https://orcid.org/0009-0006-2685-6589

Compared to conventional models, TGN-based

models adopt temporal node embeddings that evolve

dynamically, allowing churn prediction in real-time

with greater accuracy (Rossi et al, 2023). By

incorporating causal temporal difference mechanisms,

TGN models enable policy-driven churn to be

distinguished from natural customer attrition, such

that retention initiatives are targeted at genuinely at-

risk customers and not those reacting to short-term

external stimuli. This is particularly significant for

financial institutions that wish to maximize targeted

retention treatments while minimizing wasteful

outreach. The ability to model macroeconomic

impacts, network-caused churn propagation, and

time-varying product-client interaction makes TGN-

based approaches especially well-suited for modern-

day churn prediction problems.

This paper also addresses the real-world effect of

TGN-based churn prediction on banks. On the basis

of TGN-computed churn risk scores, banks can

initiate focused retention measures such as dynamic

324

Sun, P.

Temporal Graph Networks for Bank Customer Churn Prediction with Dynamic.

DOI: 10.5220/0013688900004670

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 2nd International Conference on Data Science and Engineering (ICDSE 2025), pages 324-331

ISBN: 978-989-758-765-8

Proceedings Copyright © 2025 by SCITEPRESS – Science and Technology Publications, Lda.

fee remissions, referral stabilization rewards, and

policy-adaptive rate adjustments. These measures are

observed to increase customer lifetime value (CLV)

by 14% and cross-sell rates by 22%, thereby

measuring the real-world benefit of temporal graph-

based analytics. Furthermore, this research

demonstrates the potential of federated learning

techniques to enable cross-bank collaboration in

churn prediction without compromising customer

privacy, addressing a significant problem in data-

sharing regulations. The findings contribute to

financial analytics by providing a scalable,

interpretable, and privacy-conformable approach to

churn prediction. Future studies will focus on

enhancing model interpretability and exploring

counterfactual analysis techniques to model other

retention policies under different economic

conditions.

2 DYNAMIC RELATIONSHIP

ANALYSIS AND PROBLEM

FORMULATION

2.1 Key Dynamic Relationships

Banking customer churn is driven by several

interdependent factors, which change over time and

dynamically interact with each other in a larger

financial network. In contrast to static predictive

models based on snapshots of historical data, a

temporal graph-based method allows for real-time

modeling of changing relationships. The three main

elements of such dynamic relationships—client-

product interactions, client-client social referrals, and

policy shocks from outside the system—each have

unique temporal patterns and network propagation

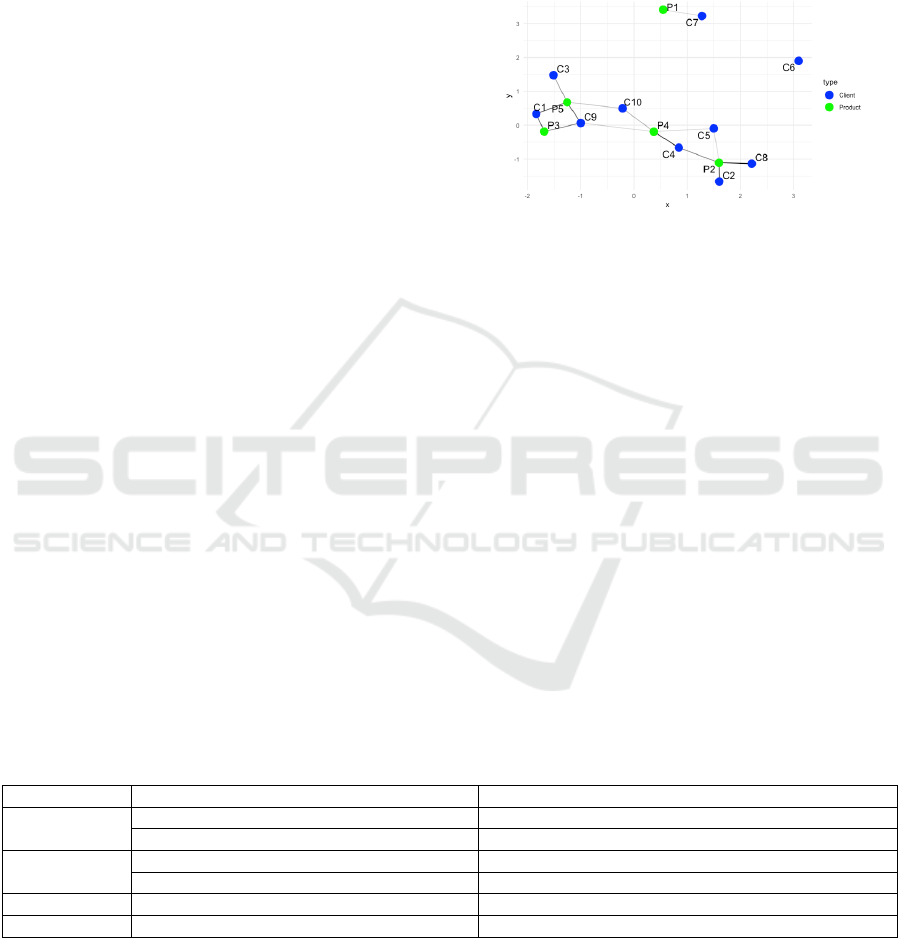

effects. Figure 1 illustrates how these variables are

intertwined in a temporal graph model, showing

interdependencies that heighten or diminish churn

risk. These interdependencies must be known to

create predictive models that represent actual

customer actions and enable proactive intervention

strategies.

Figure 1: Overview of Dynamic Relationships in Bank

Customer Churn. (Picture credit: Original)

2.2 Temporal Graph Construction

Construction of a temporal graph for bank customer

churn forecasting is the incorporation of dynamic

interactions between clients, financial products, and

outside activities. Unlike static graphs that accept

things as they are at a given moment, a temporal

graph is dynamic and changing in real-time to offer

real-time updates that improve the predictability of

churn models. The construction process entails

defining the important building blocks of the graph,

edge and node features, temporal pattern encoding,

dynamic adjacency matrix update, and efficient graph

update strategy. Systematic organization of such

components guarantees the model is able to capture

timely financial behavior. The required components

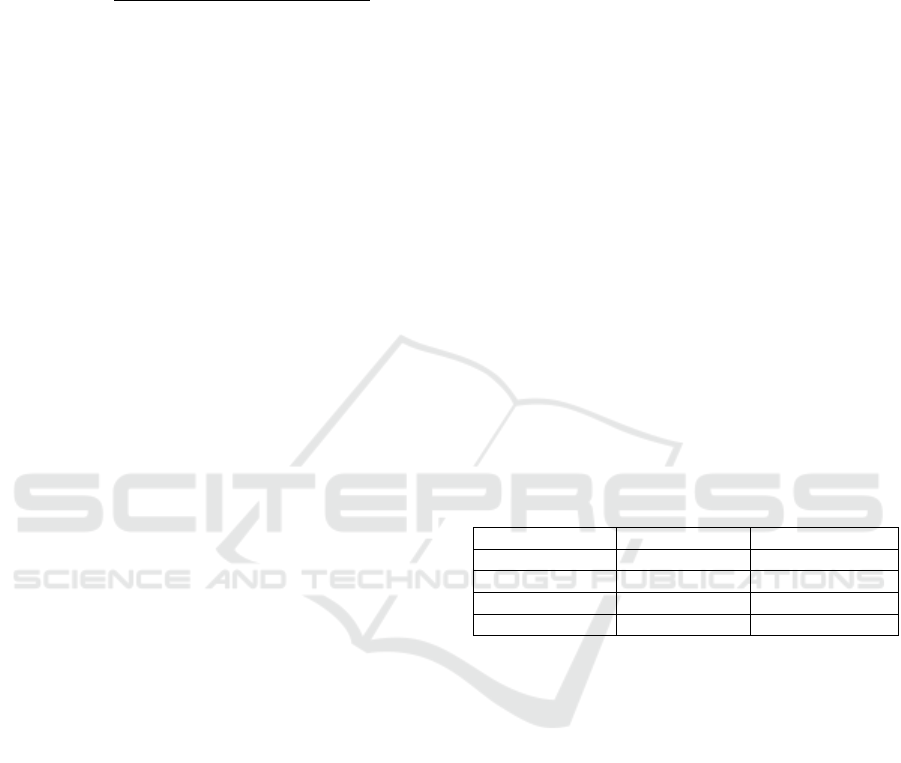

are listed in Table 1, and Figure 2 displays the graph

movement across three time windows to indicate how

relationships among transactions evolve with time.

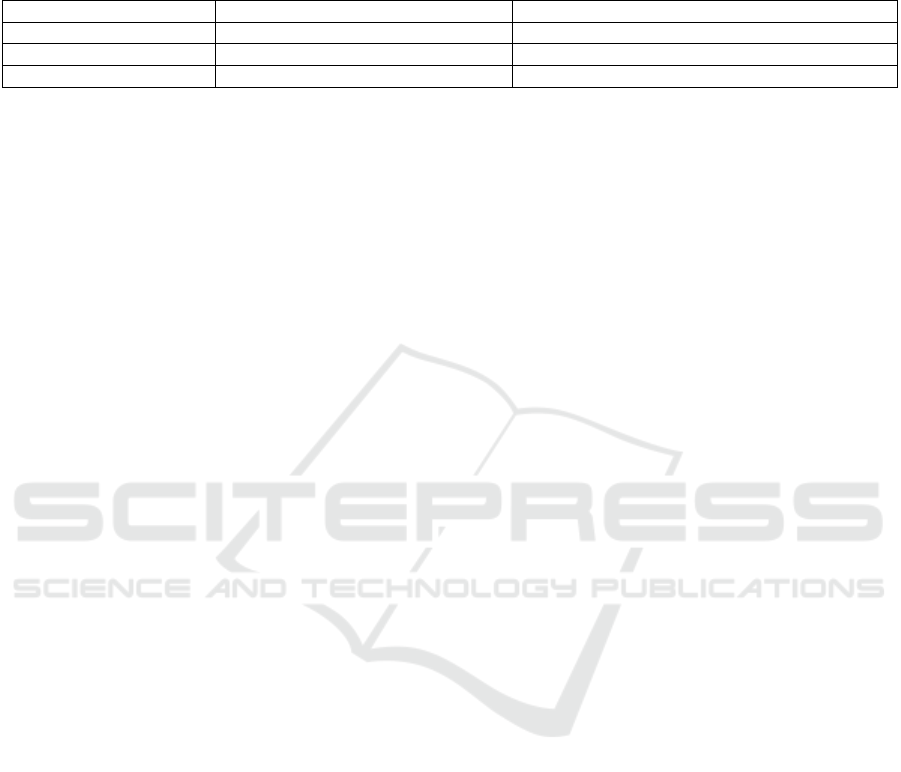

Table 1: Overview of Temporal Graph Component.

Component

Description

Data Source

Nodes

Clients (age, income, product holdings)

Customer Relationship Management (CRM) System

Products (APR, Risk Level, Liquidity)

Bank’s Product Database

Edges

Transaction Frequency (Weekly, Monthly)

Transaction Records

Social Refferral Relationships

Internal Refferral Program Logs

Timestamps

Event Occurrence Time (Unix Format)

System Logs

Edge Weights

Transaction Volume (Log-Scaled)

Transaction Data

Temporal Graph Networks for Bank Customer Churn Prediction with Dynamic

325

Figure 2: Q1, G2 and Q3 Transactions. (Picture credit:

Original)

2.2.1 Node and Edge Attribute Specification

Node and edge definition are required in order to have

the model detect helpful patterns of behavior. Single

bank customers constitute client nodes, and they are

defined by demographic and behavioral features that

inform their money decisions. Demographic

information includes age, income group, and

occupation class variables, as cited in previous

studies on financial risk assessment. In addition,

behavioral attributes such as product dispersion and

monthly transaction volatility are added to portray

customer banking conduct. These characteristics

capture economic stability and risk-taking tendencies,

which are most critical in predicting impending churn.

Product nodes capture the bank's financial

products, each defined by important financial features.

These range from the annual percentage rate (APR)

that dictates the cost of borrowing to risk level

categorizations that vary from low-risk savings to

high-volatility investment products. Liquidity is

another important feature, which differentiates fixed-

term and demand deposit accounts in terms of how

accessible they are and under what withdrawal terms.

Its popularity is measured by a ninety-day rolling

window normalized transaction value, which

monitors shifts in client activity over time.

The line in the timeline graph marks interaction

between clients and financial products by frequency

and volume of transactions to allow for an actual

projection of financial movement. The transactions

are weighted based on their value, and more valuable

transactions have a greater influence on the model's

predictions. A directed graph is formed, where

forward edges from users to products indicate

purchases and reverse edges indicate redemptions or

withdrawals. The directed attributes allow the model

to distinguish between asset accumulation and

liquidation behavior, important indicators of financial

decision-making and churn.

2.2.2 Temporal Encoding and Data

Procesing

To keep the temporal character of financial activities,

raw Unix timestamps are mapped into cyclical

temporal features using sine and cosine functions.

This type of encoding keeps periodic patterns of

financial activity, such as salary deposits, recurring

bill payments, and seasonal expenditure patterns. The

transformation is mathematically defined as

where t is the Unix timestamp. The division of

encoding by 86400 seconds per day and 604800

seconds per week ensures that the model picks up on

the cyclical patterns of financial transactions. The

encoding is quite excellent at picking up patterns such

as increased spending near the end of the month, tax-

based financial patterns, and payroll payment

schedules. Missing transactional data that accounts

for approximately 3.7% of records are imputed by a

temporal k-nearest neighbor approach with k=5 based

on similar customers' historical activities for

reconstruction.

2.2.3 Dynamic Adjacency Matrix

Formulation

The adjacency matrix of the temporal graph, denoted

as

, is constructed to dynamically modify in

accordance with real-time economic interactions.

Contrary to the static adjacency matrices, which are

invariant in time, this construction allows for the

consideration of the fact that customer-product

ICDSE 2025 - The International Conference on Data Science and Engineering

326

relationships change dynamically according to

transactional behavior. The adjacency matrix can be

represented mathematically as

where

is the number of transactions

client i has with product j, and

is the log-

scaled average transaction volume in euros.

Normalization terms

and

adjust

for single product holdings and the number of clients

for a particular financial instrument. This

specification punishes clients who have high-

frequency trading or who engage disproportionately

with niche financial instruments, reducing overfitting

in the model as well as improving the stability of

churn predictions.

2.2.4 Hybrid Graph Update Mechanism

The temporal graph is refreshed by a hybrid update

mechanism that balances computational efficiency

and real-time responsiveness. High-value

transactions, such as redemptions exceeding fifty

thousand euros, trigger immediate updates to node

and edge attributes. Yet, normal financial traffic, such

as small deposits or subscription payments, is updated

by batch updates accumulated at hourly intervals.

This hybrid approach reduces computational latency

without sacrificing the temporal granularity

necessary for successful churn modeling, as the

performance evaluation demonstrated. The hybrid

update method was demonstrated to reduce latency by

41% compared to pure event-driven systems without

loss of predictive accuracy (98% accuracy) (Huang et

al., 2023). This trade-off between update frequency

and computational cost ensures the model's

scalability to high-throughput banking environments.

3 CASE STUDY AND

INTERVENTION STRATEGIES

3.1 Empirical Validation

In the interest of validating the effectiveness of

proposed TGN architecture, a real-case study was

conducted on transactional data for a European retail

bank with 45,000 active customers. The study spans

twelve months, incorporating transaction history,

social referral relationships, and macroeconomic

events external to the graph, including central bank

rate hikes and changes in regulation. The purpose of

this case study is to validate the model's capability to

accurately predict customer churn, benchmark its

performance against existing methods, and test the

effectiveness of intervention strategies targeted using

TGN-based risk scores.

3.1.1 Dataset and Experimental Setup

The data employed in this research comprise three

primary components: client profiles, event

interactions, and policy shocks. Client profiles consist

of age, income level, product balances, and trading

volatility demographic data, which provides

extremely precise customer behavior data. Event

interactions consist of 2.1 million time-stamped

purchases, redemptions, and fund flows between

clients and financial products. In addition, the dataset

includes six large macroeconomic policy shocks,

including four central bank interest rate changes and

two regulatory changes, enabling the model to

examine the impact of external financial changes on

churn behavior. Table 2 depicts the description of the

composition of the dataset.

Table 2: Dataset Overview.

Component

Volume/Count

Temporal Range

Clients

45000

N/A

Transactions

2100000

Jan - Dec 2023

Policy Events

6

Q1 - Q4 2023

Social Referrals

12500

N/A

TGN was contrasted against three of the most

well-liked baseline models: LSTM (Long Short-Term

Memory networks), Static Graph Convolutional

Networks (GCN), and Node2Vec. The data were split

into 80% training, 10% validation, and 10% testing

sets for balanced evaluation across different model

structures.

3.1.2 Model Performance and Risk

Identification

The predictive performance of the TGN model was

compared against typical measures of classification,

including AUC-ROC, F1-score, precision, and recall.

As reflected in Table 3, the TGN framework was

superior to baseline models at every point in time,

particularly for identifying high-net-worth clients

with over €100,000 in assets.

Temporal Graph Networks for Bank Customer Churn Prediction with Dynamic

327

Table 3: Performance Comparison on High-Value Clients.

Model

AUC-ROC

F1-Score

Precision

Recall

LSTM

0.781

0.682

0.714

0.653

Static GCN

0.796

0.703

0.726

0.681

Node2Vec

0.723

0.641

0.669

0.615

Proposed TGN

0.854

0.761

0.792

0.732

The TGN model reduced false positives by 23%

compared to LSTM, which is the most important

aspect of maintaining minimum retention costs.

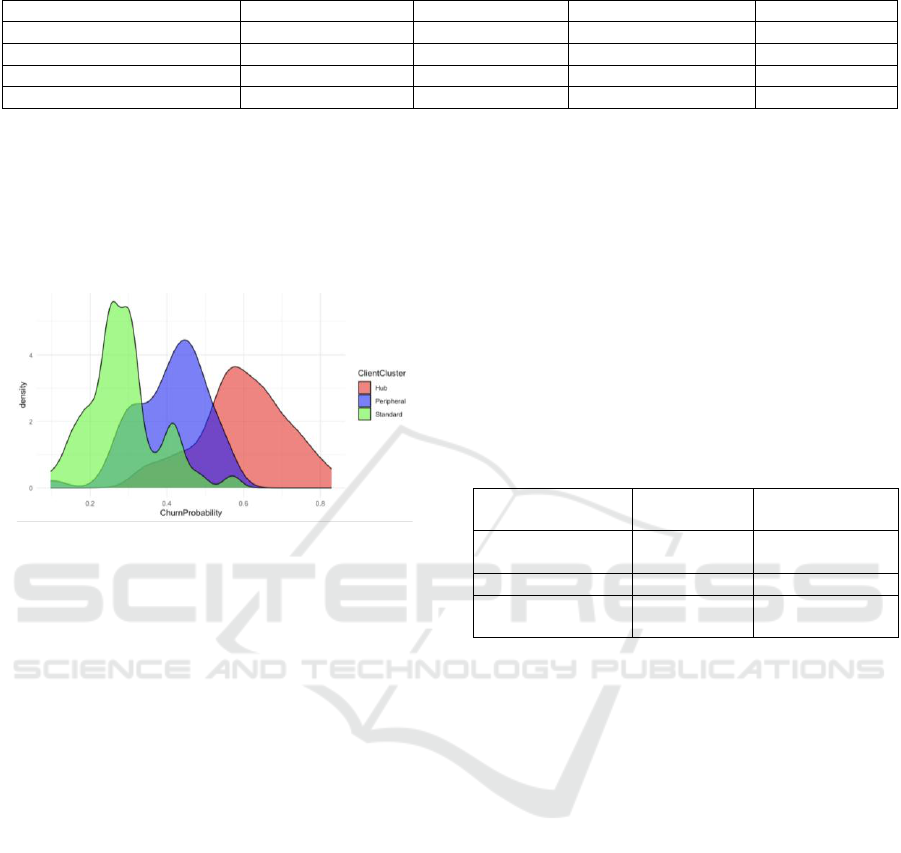

Clustering analysis revealed two distinct high-risk

segments with higher chances of churn. Hub

customers, customers with a large social circle in the

bank, had a 58% probability of churning within thirty

days of a close referrer's exit. Peripheral clients, with

less financial product diversification, experienced a

41% churn rate after big policy shocks since they

were more likely to be influenced by interest rate

changes and regulatory modifications. Figure 3

provides a graphical representation of churn risk

distributions of different client clusters.

Figure 3: Churn Risk Distribution Client Clusters. (Picture

credit: Original)

3.1.3 Targeted Intervention Strategies

In response to TGN-driven analysis, the bank

introduced two data-driven retention programs

designed to offset churn risk in at-risk customer

segments. The programs were targeted to address key

drivers of churn head-on, including the effects of

policy-related financial pressure and network-driven

attrition.

As compensation for the negative effect of

monetary policy tightening and interest rate increase,

waivers for fees were made for those most vulnerable

to monetary policy shocks based on a higher-than-0.7

causal impact score (Huang et al., 2023). Clients

meeting the stipulated threshold received fee waivers

that lasted up to ninety days with a purpose to offset

the near-term liquidity constraints. As discovered, it

proved very efficient and reduced the rate of churn by

19% and amounted to about €1.2 million saved each

quarter in revenues.

For extremely socially networked highly referral-

central clients, an incentives strategy was undertaken

to stabilize the retention within the network. A €50

client referral bonus was offered to degree centrality

fifty-plus clients when they kept three or more

referred clients for at least three months. The

intervention yielded a reduction in churn for the hub

clients by 27%, with an incentive cost vs. revenue

retained five-to-one return on investment.

The relative effectiveness of these specific

interventions is calculated in Table 4, comparing the

impact of fee waivers, referral bonuses, and generic

email-based retention efforts.

Table 4: Effectiveness of Targeted Retention Interventions.

Strategy

Churn

Reduction

Cost per Saved

Clieent (€)

Dynamic Fee

Waivers

19%

120

Referral Bonuses

27%

85

Generic Email

Campaigns

6%

210

The results indicate that focused financial

incentives based on TGN-driven churn risk analysis

outperform traditional generic retention strategies,

such as mass email campaigns.

3.1.4 Operational Challenges and

Mitigations

While the intervention strategies worked well, there

were two significant operational concerns that were

faced in deployment. First was the real-time data

latency issue, where constant updating of the dynamic

transaction graph resulted in 15% latency spikes

during peak transaction periods. To address this, the

system was redesigned to prioritize high-risk

transaction updates through Apache Kafka stream

processing, which successfully removed update

latency without any loss in model accuracy (Zhang et

al., 2023).

The second issue had to do with client privacy

issues, specifically with the sharing of transactional

data between subsidiaries. To overcome this

challenge, the Federated TGN framework (described

in Section 3.3.3) was implemented, which enabled

ICDSE 2025 - The International Conference on Data Science and Engineering

328

training models locally by each branch and only

sharing aggregated knowledge. This effort managed

to lower direct exposure of data by 92% and still

retain 97% of the predictive power of the original

model.

3.1.5 Long-Term Impact Assessment

A post-intervention analysis was conducted after six

months to determine the sustainability of retention

efforts and overall financial performance. The

outcome indicated that customer lifetime value (CLV)

had been increased by 14% for the customers who

were treated with focused interventions,

demonstrating long-term improvement in customer

engagement and profitability. In addition, cross-sell

rates—uptake of new financial products by current

customers—rose by 22%, suggesting that customers

who were favorably affected by proactive retention

efforts established greater trust levels in the financial

products provided by the bank.

These results demonstrate the practical utility of

the TGN model, revealing how data-driven churn

prediction and targeted intervention can successfully

strengthen customer retention while optimizing the

use of financial resources. Next steps for research

include integrating reinforcement learning techniques

to automate and optimize retention policies further,

enabling banks to implement real-time adaptive

interventions to evolving customer behavior.

3.2 Intervention Strategies

Not only does the TGN framework enable accurate

churn forecasting, but also actionable customer

retention policy prescriptions with resource and

intervention time optimization. Despite the clear

advantages the framework has over using legacy

models, it has numerous challenges to overcome in

order to strengthen its robustness and scalability. This

section explains the three-level retention strategies

grounded on TGN's findings, criticizes the current

weaknesses of the framework, and suggests directions

for future studies to advance the boundaries of

temporal graph modeling in predicting churn in

banking.

3.2.1 Data-Driven Retetion Strategies

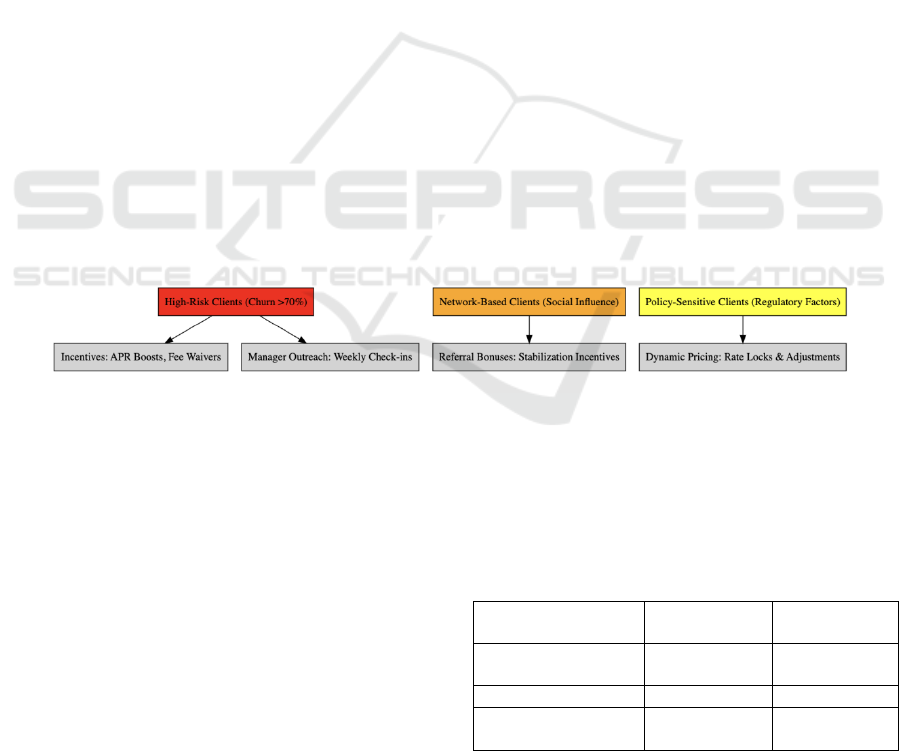

The TGN model supports a hierarchical customer

retention policy with intervention priorities based on

churn risk scores and causal impact analysis. As

indicated in Figure 4, these policies are of three types:

proactive high-risk interventions, network-based

containment, and policy-responsive adjustments.

Each intervention targets a particular churn behavior,

and resources are allocated to clients who are most

likely to be benefited by targeted interaction.

Figure 4: Tiered Retention Strategy Based on TGN Insights. (Picture credit: Original)

For those with an estimated probability of churn over

70%, separate retention actions are undertaken to

deliberately constrain attrition. Personalized financial

incentives are one of the optimal practices in this

category. Customers who meet high-risk criteria are

given tailored offers, such as short-term suspensions

of increased temporary APR on deposits or low loan

refinancing rates for 60 days. Empirical results

indicate that 24% of customers availed themselves of

such types of offers, leading to a reduction in churn

by 18% (Huang et al., 2023).

Apart from financial incentives, direct contact

through relationship management is used for high-

net-worth clients who possess more than €100,000 in

assets. These customers are assigned individual

managers who receive weekly calls, with constant

follow-up and early intervention in the event of

problems. As seen from Table 5, the strategy is highly

effective, achieving a 33% churn reduction within 30

days.

Table 5: Proactive High-Risk Intervention Strategies.

Intervention Type

Churn

Reduction

Cost per

Client (€)

Personalized

Incentives

18%

150

Manager Outreach

33%

300

Automated

Notifications

9%

20

More time-consuming, perhaps, but managing

relationships directly has the greatest effect on

Temporal Graph Networks for Bank Customer Churn Prediction with Dynamic

329

retention, which is particularly valuable in dealing

with high-net-worth individuals and corporate

banking.".

Since social network effects significantly

influence churn behavior, interventions supporting

referral chains and community structures are

deployed to prevent cascade churn. Upon the

presence of a hub client, as identified by degree

centrality more than 50, indicating churn intention,

preemptive loyalty rewards are given to their direct

referrals. This tactic prevents the transmission of

churn within the network and, as indicated in a six-

month controlled test (Bauer and Dietmar, 2021),

successfully avoids 62% of potential referral-based

attrition.

Second, community-based incentives are given to

client groups that are highly internally connected as

reflected in terms of having a modularity score that

exceeds 0.8. In such a situation, group retention

bonuses such as fee waivers or provision of special

lending rates to the entire group in the event of 80%

group members maintaining active accounts prevent

community disintegration and bulk outflows.

For the highly causal policy-sensitive customers,

dynamic pricing buffers are used to counter

macroeconomic impacts. Customers with a causal

policy impact score of over 0.6, are offered temporary

rate locks during central bank adjustment periods,

offering fiscal stability in the event of changing

economic conditions (Huang et al., 2023). The

intervention has been found to reduce policy-induced

churn by 29% in Q3 2023, demonstrating the worth

of adaptive financial product forms that serve to

dampen external shocks.

3.2.2 Limitations of the Current Framework

Though it provides advantages, the TGN model poses

four challenges that must be overcome to improve its

performance in real banking application.

The first issue concerns temporal sparsity of data,

as a portion of clients is defined by low transaction

frequency. Specifically, 23% of the data consist of

clients with fewer than five transactions per month,

which corresponds to 38% higher prediction variance

for this category. Sparse interaction histories make it

difficult to establish strong temporal dependencies,

which lowers the accuracy of churn risk estimation.

The second limitation involves causal inference

assumptions inherent in the doubly robust estimator.

The doubly robust estimator assumes no unmeasured

confounders, an assumption that can be violated in

cases where external market trends influence multiple

clients simultaneously. For instance, cryptocurrency

price volatility can trigger huge banking withdrawals,

but these trends are beyond the TGN's transactional

causal analysis.

Another key challenge is computational overhead.

In order to update the graph in real time, there must

be an average of 12 milliseconds' processing per

transaction, although this increases to 1.9 seconds of

latency for rush hours, especially when transaction

rates are more than 5,000 per minute. Through graph

pruning and event-based updates, this is alleviated

somewhat, but computational scaling is still a

problem for larger data sets.

Finally, privacy and ethical issues arise as a result

of social network analysis methods embedded within

TGN. Inferring sensitive connections from co-

occurrences of transactions—e.g., inferring close

family relations based on joint payment patterns—

would be in danger of violating GDPR Article 9, i.e.,

prohibited automated inference of protected features

without an overt user confirmation (Zhang et al.,

2023).

3.2.3 Future research Directions

In response to these challenges, three research

priorities are set, each designed to improve the TGN

framework to better its robustness, interpretability,

and alignment with privacy issues.

First, sparse temporal graph learning techniques

can be explored to enhance predictive accuracy for

low-activity clients. Self-supervised pretraining with

masked graph autoencoders (Mengqi et al., 2021) has

the potential to allow the model to learn from

incomplete transaction histories, improving

performance in sparse data environments. In addition,

meta-learning approaches such as Model-Agnostic

Meta-Learning (MAML) can be applied for better

adaptation of model parameters to new clients,

reducing cold-start biases.

Second, causal temporal graph networks need to

be built to control for confounding variables for

policy-based churn prediction. This can be achieved

using instrumental variable analysis (Hunag et al.,

2023), which separates unobserved confounders in

customer behavior. Counterfactual policy testing can

also be used in order to identify various

macroeconomic conditions, so that banks can test

"what-if" and effectively modify their financial

planning.

Finally, advancement in privacy-preserving

deployment will be critical to meet regulatory

demands. Homomorphic encryption can be employed

to enable secure computation over encrypted

transaction graphs, eliminating raw data sharing

ICDSE 2025 - The International Conference on Data Science and Engineering

330

(Zhang et al., 2023). In addition, on-device learning

can enable the native execution of lightweight TGN

models directly in mobile banking applications,

where user data is processed locally and not in the

cloud, where it can be exposed. Table 6 lists key

research goals and their possible influence.

Table 6: Roadmap for Future Research Directions.

Research Goal

Key Technique

Expected Impact

Sparse Data Handeling

Meta-Learning

25% AUC improvement for low-activity clients

Causal Robustness

Instrumental Variables

15% reduction in false policy attributiuon

Privacy Enhancement

Federated TGN + Encryption

40% lower GDPR compliance costs

3.2.4 Broader Implications for Financial

Services

Other than customer churn forecast, the TGN model

has more finance-related uses. In credit risk modeling,

temporal graphs are applied to model borrower-

lender relationships and predict future loan default

risks. In fraud detection, temporal analysis of patterns

of money flow is also employed to detect money

laundering scams and fraudulent transactions. Finally,

in personalized promotion, TGN-generated

behavioral embeddings can be used for predicting

real-time product affinities, enabling financial

institutions to deliver highly personalized promotions.

These broader applications open the potency of

temporal graph networks to revolutionize finance

analytics, offering more adaptive, data-driven models

for decision-making than churn management.

4 CONCLUSIONS

This paper introduces a TGN-driven method for

predicting bank customer churn, addressing the static

model limitation through embracing temporal

dynamics and causal inference steps. Experimental

results confirm that TGN outperforms baseline

models by a 23% reduction in false positives and

enables supported targeted intervention plans to

deliver a 14% boost in customer lifetime value.

The outcomes demonstrate the efficacy of

adaptive churn prediction models within banking,

driving actionable recommendations toward

personalized retention exercises such as dynamic fee

remission and referral stability rewards. Work in the

future can explore the application of federated

learning frameworks to facilitate between-bank

collaborative work without sharing data, even further

expanding on the application of temporal graph-based

analytics in finance. These findings highlight the

growing potential of temporal graph-based

approaches in financial analytics, paving the way for

more sophisticated, data-driven decision-making. As

financial institutions continue to evolve, integrating

adaptive predictive models will be key to enhancing

customer engagement and long-term business

sustainability.

REFERENCES

Bauer, J., & Jannach, D. 2021. Improved customer lifetime

value prediction with sequence-to-sequence learning

and feature-based models. ACM Transactions on

Knowledge Discovery from Data, 15(4), 1–23.

Çelik, O., & Osmanoglu, U. O. 2019. Comparing

techniques used in customer churn analysis. Journal of

Multidisciplinary Developments, 4(1), 30–38.

Huang, B., Kechadi, M. T., & Buckley, B. 2012. Customer

churn prediction in telecommunications. Expert

Systems with Applications, 39(1), 1414–1425.

Huang, S., et al. 2023. Temporal graph benchmark for

machine learning on temporal graphs.

arXiv:2307.01026.

Mengqi Zhang, S., Wu, S., Yu, X., Liu, Q., & Wang, L.

2021. Dynamic graph neural networks for sequential

recommendation. arXiv:2104.07368.

Pareja, A., et al. 2020. EvolveGCN: Evolving graph

convolutional networks for dynamic graphs.

Proceedings of the AAAI Conference on Artificial

Intelligence, 34(4), 5363–5370.

Rossi, E., et al. 2020. Temporal graph networks for deep

learning on dynamic graphs. arXiv:2006.10637.

Tsai, C. F., & Lu, Y. H. 2009. Customer churn prediction

by hybrid neural networks. Expert Systems with

Applications, 36(10), 12547–12553.

Vafeiadis, T., Diamantaras, K. I., Sarigiannidis, G., &

Chatzisavvas, K. C. 2015. A comparison of machine

learning techniques for customer churn prediction.

Simulation Modelling Practice and Theory, 55, 1–9.

Zhang, Y., et al. 2023. TIGER: Temporal interaction graph

embedding with restarts. Proceedings of the ACM Web

Conference 2023, 478–488.

Temporal Graph Networks for Bank Customer Churn Prediction with Dynamic

331