Predicting Stock Price Movement with LLM-Enhanced Tweet Emotion

Analysis

An Vuong and Susan Gauch

Department of Electrical Engineering and Computer Science, University of Arkansas,

1 University of Arkansas, Fayettville, Arkansas, U.S.A.

Keywords:

Emotion Analysis, Stock Prediction, Social Media, Classification, Large Language Model.

Abstract:

Accurately predicting short-term stock price movement remains a challenging task due to the market’s inherent

volatility and sensitivity to investor sentiment. This paper discusses a deep learning framework that integrates

emotion features extracted from tweet data with historical stock price information to forecast significant price

changes on the following day. We utilize Meta’s Llama 3.1-8B-Instruct model to preprocess tweet data, thereby

enhancing the quality of emotion features derived from three emotion analysis approaches: a transformer-

based DistilRoBERTa classifier from the Hugging Face library and two lexicon-based methods using National

Research Council Canada (NRC) resources. These features are combined with previous-day stock price data to

train a Long Short-Term Memory (LSTM) model. Experimental results on TSLA, AAPL, and AMZN stocks

show that all three emotion analysis methods improve the average accuracy for predicting significant price

movements, compared to the baseline model using only historical stock prices, which yields an accuracy of

13.5%. The DistilRoBERTa-based stock prediction model achives the best performance, with accuracy rising

from 23.6% to 38.5% when using LLaMA-enhanced emotion analysis. These results demonstrate that using

large language models to preprocess tweet content enhances the effectiveness of emotion analysis which in

turn improves the accuracy of predicting significant stock price movements.

1 INTRODUCTION

Financial time series forecasting, particularly stock

price prediction, has long been one of the most chal-

lenging problems for researchers and investors. With

the U.S. Securities and Exchange Commission offi-

cially transitioning the trade settlement cycle from

T+2 to T+1 on May 28, 2024 (Securities and Com-

mission, 2024), short-term trading strategies that in-

volve opening and closing positions within the same

day or by the following day, have become increas-

ingly common as traders seek to capture quick profits

from significant price movements. This shift, along

with the market’s inherent complexity and sensitiv-

ity to factors such as corporate news, macroeconomic

indicators, and investor sentiment, underscores the

growing importance of accurate stock price move-

ment prediction to support timely and informed trad-

ing decisions.

In recent years, researchers have increasingly in-

vestigated social media as a source of predictive sig-

nals for financial markets. For instance, Bollen et

al. (Bollen et al., 2011) and Nguyen et al. (Nguyen

et al., 2015) demonstrated that aggregate sentiment

from platforms such as Twitter and investor fo-

rums can enhance short-term stock movement predic-

tion. While traditional sentiment analysis typically

categorizes text into positive, negative, or neutral

(Wankhade et al., 2022), recent studies have shifted

toward emotion detection from text to capture more

nuanced linguistic signals across diverse domains, in-

cluding management and marketing, healthcare, ed-

ucation, public monitoring (Kusal et al., 2022). In

financial contexts, emotions such as fear, joy, sad-

ness, and stress extracted from social media textual

data have been shown to significantly influence short-

term returns and volatility in major indices like the

S&P 500 (Griffith et al., 2020). Although prior stud-

ies such as (Chun et al., 2022) have explored the use

of emotion features in financial forecasting, the in-

tegration of such features into stock price movement

prediction models remains relatively underexplored.

Our research developed a deep learning frame-

work that leverages emotion analysis of social me-

dia content to predict significant next-day stock price

movements. In this approach, features extracted from

the previous day are used to train the model in a su-

232

Vuong, A. and Gauch, S.

Predicting Stock Price Movement with LLM-Enhanced Tweet Emotion Analysis.

DOI: 10.5220/0013675900004000

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 17th International Joint Conference on Knowledge Discovery, Knowledge Engineering and Knowledge Management (IC3K 2025) - Volume 1: KDIR, pages 232-239

Proceedings Copyright © 2025 by SCITEPRESS – Science and Technology Publications, Lda.

pervised learning setting to classify whether the stock

will significantly increase, decrease, or remain stable

on the next day.

The main contributions of this study are as fol-

lows: (1) we leverage a large language model (Meta’s

Llama 3.1) to preprocess tweet content before apply-

ing emotion analysis, which improves the quality of

extracted emotional features; (2) we propose a novel

framework for stock price significant movement pre-

diction that integrates emotion features derived from

tweet data with daily stock price data; and (3) We sys-

tematically compare the predictive performance of a

baseline model that uses only historical stock prices

with three models that combine stock price data and

emotion features from 3 different emotion analysis

methods: the DistilRoBERTa-based Emotion Classi-

fication Model, the NRC Emotion Intensity Lexicon,

and the NRC Emotion Label Lexicon. Each emo-

tion analysis method is evaluated with and without

LLaMA-enhanced emotion analysis.

The remainder of this paper is organized as fol-

lows. Section 2 reviews related work on stock predic-

tion and the use of sentiment and emotion analysis

in financial contexts. Section 3 describes our pro-

posed methodology, including LLaMA-based tweet

preprocessing, emotion analysis on tweet data, and

the construction of the final dataset to predict signif-

icant stock price movements. Section 4 presents the

experimental results and evaluates the effectiveness of

three emotion analysis methods, both with and with-

out LLaMA-enhanced emotion analysis, in improv-

ing the accuracy of predicting significant stock price

movements. Finally, Section 5 concludes the paper

and discusses possible directions for future work.

2 RELATED WORK

Stock market prediction remains a highly active area

of research in both academia and industry. Over the

decades, numerous predictive models have been pro-

posed to address the inherent complexity and non-

linearity of financial time series.

In the 1990s, artificial neural networks (ANNs)

were the most widely used models for stock market

prediction (Atsalakis and Valavanis, 2009). For in-

stance, Kimoto et al. (Kimoto et al., 1990) imple-

mented a modular neural network model using his-

torical stock prices, technical indicators, and macroe-

conomic variables as input features to predict one-

month-ahead movements of the Tokyo Stock Price In-

dex (TOPIX). In the following decade, support vec-

tor machines (SVM) (Huang et al., 2005) and sup-

port vector regression (SVR) (Huang and Tsai, 2009)

emerged as popular alternatives, offering improved

generalization and robustness by leveraging the struc-

tural risk minimization principle. Specifically, Huang

et al. (Huang et al., 2005) applied a support vector

machine (SVM) to predict the directional movement

of the NIKKEI 225 Index using macroeconomic data,

and demonstrated that SVM outperformed artificial

neural networks (ANNs) in classification accuracy. In

the past decade, deep learning techniques have gained

increasing attention in financial forecasting. Among

them, Long Short-Term Memory (LSTM) networks

and their variants have been widely adopted for stock

market prediction (Jiang, 2021). A particularly rep-

resentative work is that of Nelson et al. (Nelson et al.,

2017), who applied an LSTM-based model to predict

stock price movement of Brazilian stocks and demon-

strated that it achieved significantly higher accuracy

compared to four traditional machine learning mod-

els.

Recent studies have increasingly incorporated ex-

ternal textual sources such as financial news, social

media, and web searches. A common method to

process this unstructured data is sentiment analysis,

which determines whether the content reflects a pos-

itive or negative outlook on the market (Balaji et al.,

2017). In 2011, Bollen et al. (Bollen et al., 2011)

used sentiment analysis to extract mood from Twitter

data and integrated these features with daily DJIA-

closing values to predict the movement of the Dow

Jones Industrial Average (DJIA). Similarly, Nguyen

et al. (Nguyen et al., 2015) proposed a hybrid model

that integrates sentiment features extracted from fi-

nancial message boards with lagged stock prices to

predict daily stock movement.

In recent years, emotion analysis has been widely

applied to domains such as healthcare, education,

marketing, and finance, with a primary focus on ana-

lyzing text from online social media, review systems,

and conversational agents (Kusal et al., 2022) (Kusal

et al., 2022). For example, Mackey et al. (Mackey

et al., 2021) proposed a fake news detection frame-

work that combines emotional features extracted from

news articles with BERT embeddings. Their model

incorporates discrete emotion vectors such as anger,

trust, and joy, as well as continuous emotion di-

mensions including valence and arousal, to improve

the classification of misinformation into categories

such as satire, hoax, propaganda, and clickbait. In

the context of stock market prediction, the applica-

tion of text-based emotion analysis remains relatively

limited. Among the few existing studies, Chun et

al. (Chun et al., 2022) proposed an emotion-based

stock prediction system that integrates multiple emo-

tional categories including joy, interest, surprise, fear,

Predicting Stock Price Movement with LLM-Enhanced Tweet Emotion Analysis

233

anger, sadness, and disgust, extracted from investor

microblogs. Their model was designed to predict the

daily directional movement of the KOSPI 200 index

futures based on these multidimensional emotional

indicators.

3 APPROACH

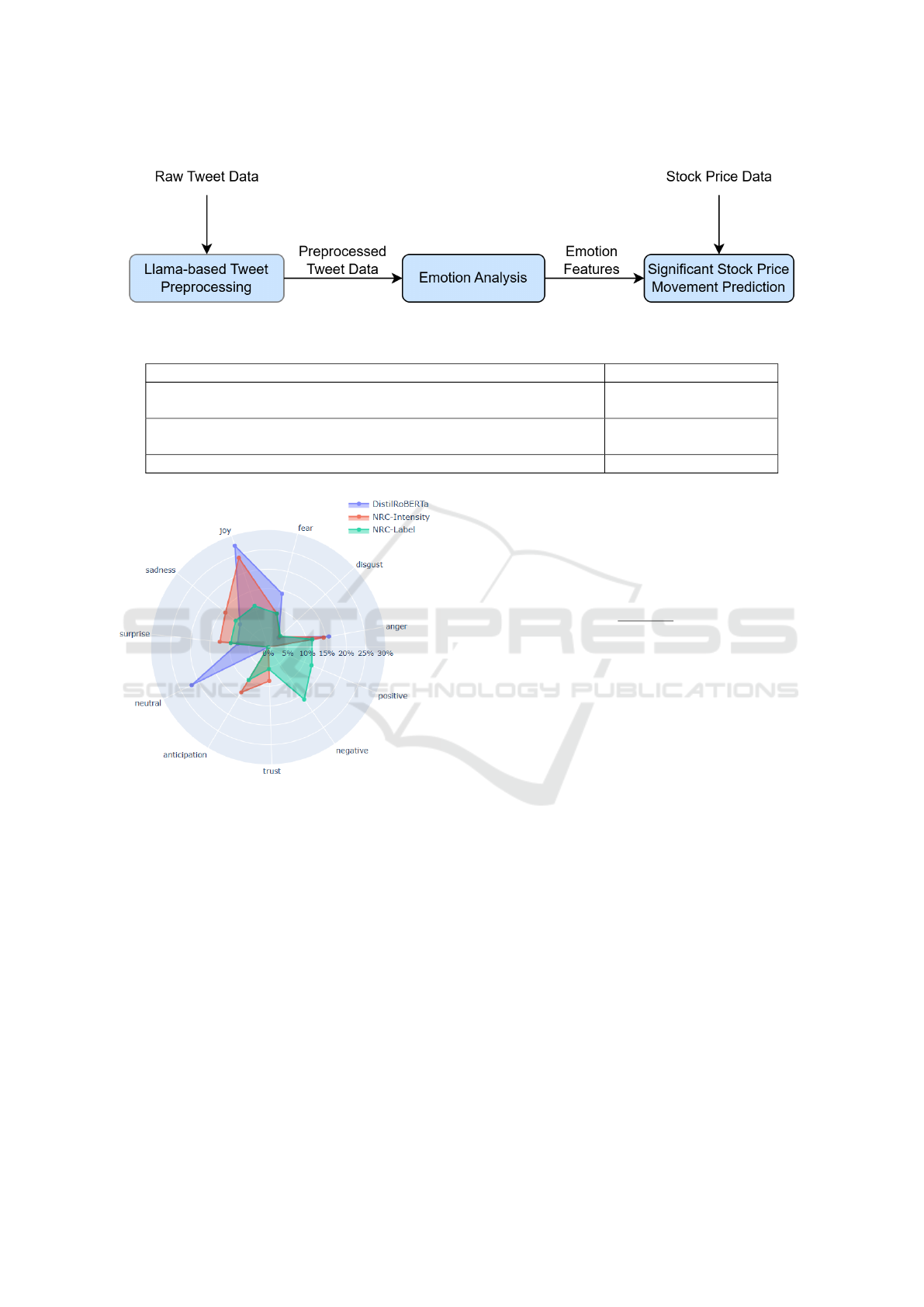

In this section, we present our framework for predict-

ing significant stock price movements by integrating

emotion analysis results from tweet content with his-

torical stock price data. Figure 1 illustrates that our

approach comprises three main components: (1) pre-

processing stock-related tweets using a large language

model, (2) generating three sets of emotion features

using a transformer-based classifier and two lexicon-

based methods, and (3) integrating the extracted emo-

tion features with historical stock prices to construct

the final dataset, which is then used to train an LSTM

model to predict the next day’s significant stock price

movement.

3.1 Llama-Based Tweet Preprocessing

Let D = {x

1

, x

2

, ...,x

N

} denote a dataset of N tweets,

where each x

i

is a raw tweet content. To extract emo-

tional information from these tweets, we employ a

prompt-based querying mechanism using the Meta’s

Llama 3.1-8B-Instruct model (AI, 2024). For each

tweet x

i

∈ D, we construct a prompt x

prompt

i

that is

passed into the LLM to produce a set of predicted

emotion annotations, denoted by ˆy

LLM

i

:

ˆy

i

LLM

= LLM(x

i

prompt

)

Prompt Template. Each tweet x

i

is passed into the

following prompt template to create the final input

x

prompt

i

for the LLaMA model:

You will be given a human-written tweet.

Identify all possible emotions expressed in

the tweet. Return the output as a comma-

separated list of emotion-related words that

are relevant to the stock market context. If no

emotion is detected, return ”no emotion”.

Tweets that return “no emotion” are removed

(LLaMA-based emotion filtering). The remaining

tweets are then further preprocessed using the NLTK

toolkit, including converting text to lowercase, re-

moving stop words and punctuation. Examples of

LLaMA-based tweet preprocessing are provided in

Table 1.

3.2 Emotion Analysis

In this study, we explore three emotion analysis meth-

ods applied to stock-related tweets. Each method

produces a different emotion representation, which

is then combined with daily stock price data to form

multiple versions of the final dataset.

Method 1 (DistilRoBERTa) utilizes a pre-trained

DistilRoBERTa-based model available through the

Hugging Face library (Hartmann, 2022). For each

tweet, the model returns probability scores across

seven emotions. These scores represent the model’s

confidence in the presence of each emotional state and

form the following seven-dimensional emotion vec-

tor:

E

1

= {anger, disgust, neutral, fear, joy, sadness,

surprise}

Method 2 (NRC-Intensity) and Method 3

(NRC-Binary) are lexicon-based methods that gen-

erate tweet-level emotion vectors using the Na-

tional Research Council Canada (NRC) emotion re-

sources (Mohammad and Turney, 2013). We follow

the emotion vector construction approach described

in Mackey et al. (Mackey et al., 2021), where each

text instance is represented by aggregating lexicon-

based emotion scores of matched tokens. In this work,

each tweet is tokenized and matched against the cor-

responding lexicon to compute an emotion vector.

In Method 2, each token is assigned an intensity

score ranging from 0 to 1 across the following eight

emotions:

E

2

= {anger, anticipation, disgust, fear, joy,

sadness, surprise, trust}

In Method 3, each token is assigned a binary score

(0 or 1) for ten emotion categories, including two ad-

ditional polarity dimensions:

E

3

= {anger, anticipation, disgust, fear, joy,

sadness, surprise, trust, positive, negative}

For both methods, the normalized score for each emo-

tion i is calculated as:

ˆe

i

=

1

|M|

∑

w∈T

s(w, i),

where T is the set of tokens in the tweet, M is the

subset of tokens matched to at least one emotion, and

s(w, i) represents either the intensity score (Method 2)

or the binary score (Method 3) for word w and emo-

tion i.

KDIR 2025 - 17th International Conference on Knowledge Discovery and Information Retrieval

234

Figure 1: The overall pipeline for predicting significant stock price movements.

Table 1: Examples of Llama-based tweet preprocessing.

Tweet Extracted Emotions

CPI numbers drop tomorrow. If it comes in soft, TSLA is gonna explode.

Loaded up today.

anticipation, excitement,

confidence

Feeling uneasy about tomorrow’s Fed meeting. Already trimmed some

AAPL just in case.

anxiety, fear, caution

MSFT Q2 report is scheduled for Thursday after market close. no emotion

Figure 2: Distribution of extracted emotions from tweets

using three different emotion analysis methods.

3.3 Significant Stock Price Movement

Prediction

After computing tweet-level emotion scores, we ag-

gregate them by day to obtain the average probability

of each emotion. These daily averages reflect how

strongly and frequently each emotion is expressed

across tweets, providing insight into the dominant

emotional tone of the day. This information serves

as a valuable signal for predicting stock price move-

ments. Additionally, we record the number of raw

tweets before Llama-based filtering to capture daily

public attention. A higher tweet volume may indicate

increased market interest and a greater likelihood of

significant price movement.

Historical stock price data is collected from Yahoo Fi-

nance (Yahoo Finance) to align with the tweet dataset.

To capture daily price volatility of each stock, we cal-

culate the daily percentage change of the closing price

as follows:

PC

t

=

P

t

− P

t−1

P

t−1

× 100

where PC

t

is the percentage change of the closing

price at day t, P

t

is the closing price at day t, and P

t−1

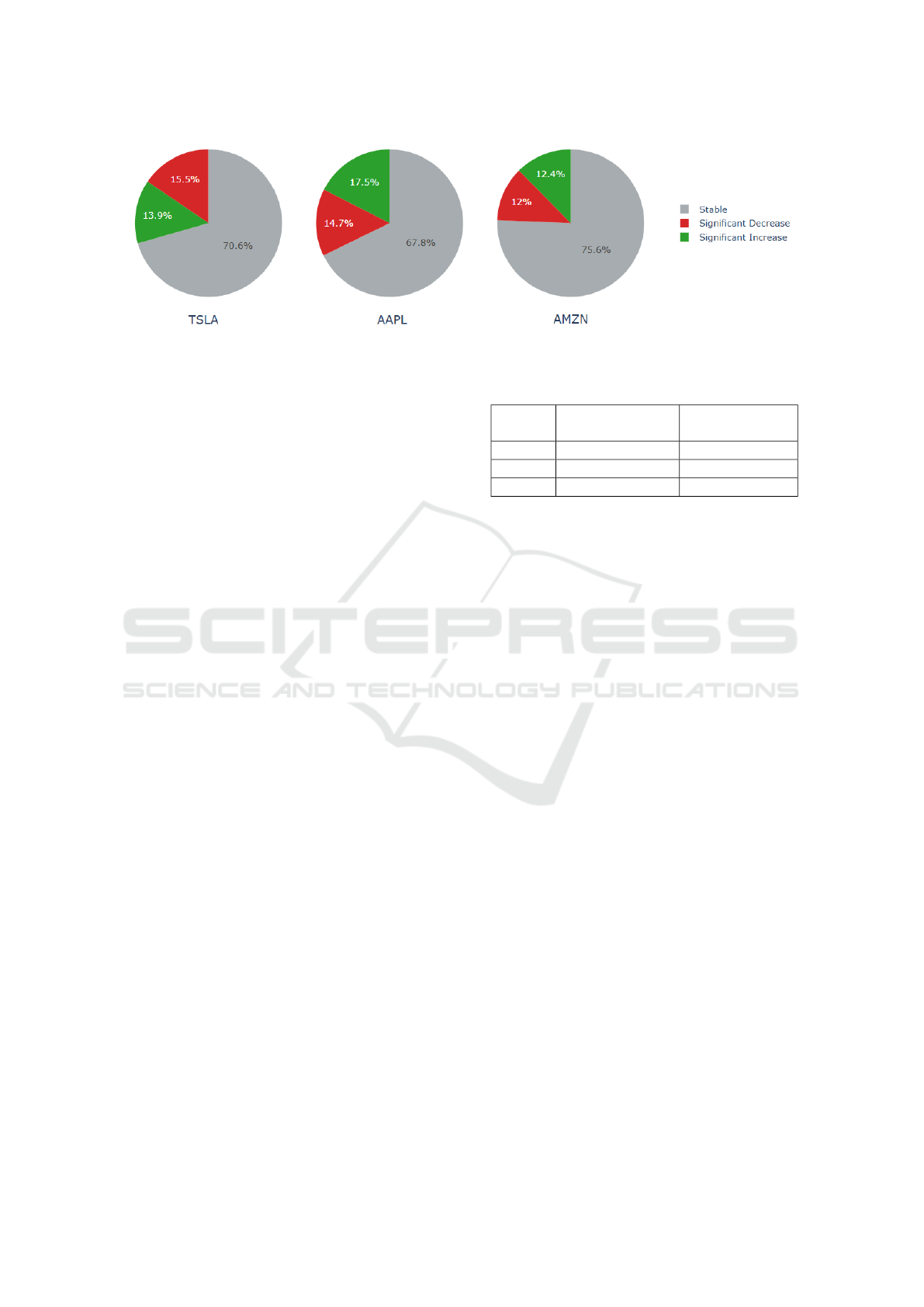

is the closing price on the previous day t −1.

Each stock price movement is then classified into

one of three classes based on the standard deviation

(σ) of its percentage changes:

• Stable: if the daily percentage change is within

[−σ, +σ]

• Significant Increase: if the daily percentage

change exceeds +σ

• Significant Decrease: if the daily percentage

change is lower than −σ

After labeling, each day’s stock price data is

merged with the corresponding emotion features, in-

cluding the average emotion scores and tweet volume.

The final dataset consists of the following features:

• Date

• Change Level: stock price movement label (Sta-

ble, Significant Increase, Significant Decrease)

• Stock Price Features: open price, close price,

high price, low price, volume

• Emotion Features: daily average emotion scores

and tweet volume

Predicting Stock Price Movement with LLM-Enhanced Tweet Emotion Analysis

235

Figure 3: Class distribution of daily significant stock price movements for TSLA, AAPL, and AMZN.

We formulate the prediction of significant stock

price movements as a multi-class classification task,

where the goal is to categorize daily stock movement

into three classes: Stable, Significant Increase, and

Significant Decrease.

Following prior studies, we adopt Long Short-Term

Memory (LSTM) networks due to their effectiveness

in modeling sequential dependencies and non-linear

patterns in financial time series data (Jiang, 2021).

The LSTM model consists of two stacked LSTM lay-

ers with 128 hidden units each, followed by Dropout

layers with a rate of 0.2 to prevent overfitting. The fi-

nal Dense layer with softmax activation outputs the

probability distribution across the three movement

classes: Stable, Significant Increase, and Significant

Decrease. The model is trained using the Adam opti-

mizer with a learning rate of 0.01 for 200 epochs and

a batch size of 32.

4 EXPERIMENTS

4.1 Dataset

In this study, we used stock-related tweets collected

from an open-source dataset on Kaggle (equinxx,

2022), covering the period from September 30, 2021

to September 30, 2022. The dataset includes tweets

associated with three prominent U.S. technology

stocks: Tesla (TSLA), Apple (AAPL), and Amazon

(AMZN). Each tweet entry contains the tweet con-

tent, posting date, stock ticker, and company name.

Table 2 presents the number of tweets of each stock

before and after applying Llama-based emotion filter-

ing.

The second data source is historical daily stock

price data for TSLA, AAPL, and AMZN, collected

from Yahoo Finance. This data includes five columns:

open, close, high, low prices, and trading volume.

The stock price data corresponds to the same period

as the tweet dataset. After applying emotion anal-

ysis to the emotion labels extracted by the Llama-

Table 2: Tweet Volume Before and After Llama-Based Fil-

tering.

Stock

Name

Tweets Volume

Before Filtering

Tweets Volume

After Filtering

TSLA 37173 18080

AAPL 5033 2046

AMZN 4077 1659

based tweet preprocessing, the results were merged

with corresponding stock price data, we constructed

a combined dataset covering the period from Septem-

ber 30, 2021 to September 30, 2022.

4.2 Experiment Setup

We conduct experiments under two main settings to

evaluate the contribution of emotion features in pre-

dicting significant stock price movements. First, we

establish a baseline by training an LSTM model us-

ing only historical stock price features. Next, we

augment the model with emotion features derived

from three different emotion analysis methods: (1) a

DistilRoBERTa-based Emotion Classification Model

(DistilRoBERTa), (2) NRC Emotion Intensity Lex-

icon (NRC-Intensity), and (3) NRC Emotion Label

Lexicon (NRC-Lexicon). Each method is evaluated

under two different stock prediction methods:

• Emotion Analysis: Emotion features are ex-

tracted from tweets that have been preprocessed

using standard text cleaning techniques (e.g., tok-

enization, stopword removal with NLTK toolkit).

• Llama-enhanced Emotion Analysis: Tweets are

first preprocessed using Meta’s Llama 3.1-8B-

Instruct model to extract emotion labels and then

remove tweets with no emotional content. The re-

maining tweets are then further cleaned using the

same NLTK preprocessing before applying emo-

tion analysis.

In both stock prediction methods, emotion fea-

tures, tweet volume before emotion-based filtering,

KDIR 2025 - 17th International Conference on Knowledge Discovery and Information Retrieval

236

and stock price features from the previous trading day

are used to predict the movement class (Stable, Sig-

nificant Increase, or Significant Decrease) for the fol-

lowing day. This design choice is motivated by prior

findings that the predictive power of tweet-based sen-

timent signals decays rapidly over time, with one-day

lagged sentiment exhibiting the strongest correlation

with stock price movements (Teti et al., 2019).

The combined dataset covers the period from

September 30, 2021 to September 30, 2022, which

includes 250 trading days. We split the data chrono-

logically into 70% for training (175 days) and 30%

for testing (75 days). Each experimental configura-

tion is run 10 times to account for the randomness in

LSTM training, and we report the average results to

ensure consistency and robustness.

To evaluate the classification performance of our

models, we use four metrics, each capturing the

model’s ability to detect a specific type of stock price

movement:

• Significant Increase Accuracy (S-I): Accuracy

in predicting days with a significant upward price

movement.

• Significant Decrease Accuracy (S-D): Accuracy

in predicting days with a significant downward

price movement.

• Stable Accuracy: Accuracy in identifying days

when the stock price remains within a stable

range.

• Average S-I and S-D Accuracy: The average

accuracy of predicting significant increase and

significant decrease movements, reflecting the

model’s overall ability to capture high-volatility

movements.

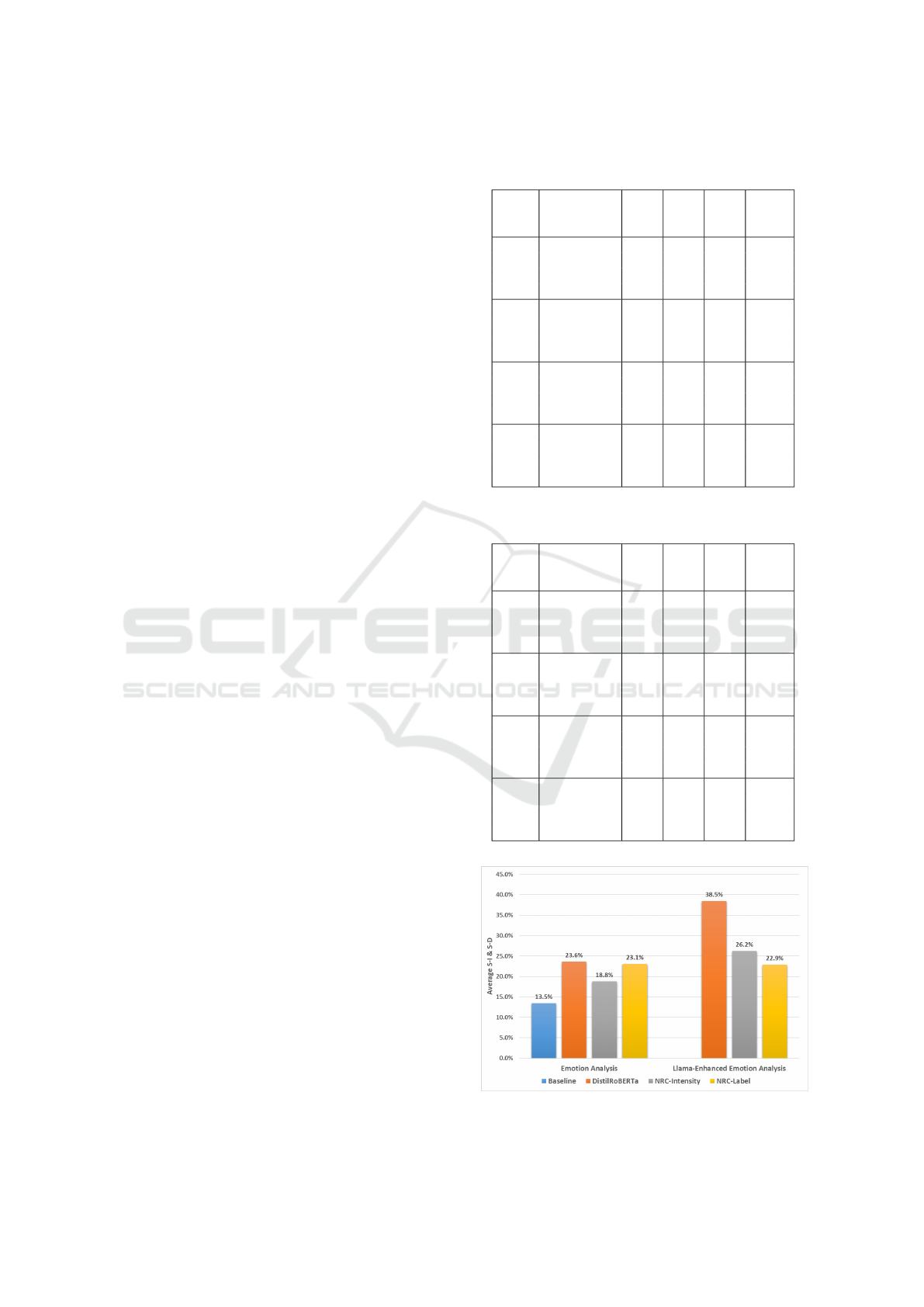

4.3 Experimental Results

Table 3 summarizes the result of the stock predic-

tion method using emotion analysis methods , includ-

ing DistilRoBERTa, NRC-Intensity, and NRC-Label.

The results show that incorporating emotion features

improves the model’s ability to detect high-volatility

movements. Specifically, the overall average of S-

I and S-D accuracy across all three stocks increases

from 13.5% (baseline) to 23.6% (DistilRoBERTa),

18.8% (NRC-Intensity), and 23.1% (NRC-Label).

While this improvement results in a decrease in sta-

ble accuracy, from 81.9% (baseline) to 57.4%, 58.2%,

and 57.8% respectively, all models using emotion

features still demonstrate strong overall performance.

Among them, DistilRoBERTa achieves the best trade-

off between detecting volatile movements and main-

taining stability.

Table 3: Stock Price Prediction Results with Emotion Anal-

ysis.

Stock

Name

Emotion

Analysis

Method

S-I S-D Stable

Average

S-I

& S-D

TSLA

Baseline 17.5% 1.7% 82.5% 9.6%

DistilRoBERTa 16.2% 8.3% 62.5% 12.3%

NRC-Intensity 26.2% 8.3% 71.8% 17.3%

NRC-Label 23.8% 6.7% 74.3% 15.2%

AAPL

Baseline 10.7% 0.0% 97.0% 5.4%

DistilRoBERTa 16.7% 28.0% 60.2% 22.3%

NRC-Intensity 18.6% 0.0% 66.0% 9.3%

NRC-Label 36.4% 27.5% 59.2% 32.0%

AMZN

Baseline 50.8% 0.0% 66.1% 25.4%

DistilRoBERTa 32.5% 40.0% 49.4% 36.3%

NRC-Intensity 35.0% 24.4% 36.9% 29.7%

NRC-Label 30.0% 14.0% 39.8% 22.0%

Average

Baseline 26.3% 0.6% 81.9% 13.5%

DistilRoBERTa 21.8% 25.4% 57.4% 23.6%

NRC-Intensity 26.6% 10.9% 58.2% 18.8%

NRC-Label 30.1% 16.1% 57.8% 23.1%

Table 4: Stock Price Prediction Results with Llama-

Enhanced Emotion Analysis.

Stock

Name

Emotion

Analysis

Method

S-I S-D Stable

Average

S-I

& S-D

TSLA

Baseline 17.5% 1.7% 82.5% 9.6%

DistilRoBERTa 41.2% 35.0% 65.6% 38.1%

NRC-Intensity 36.2% 3.3% 65.9% 19.8%

NRC-Label 35.0% 26.7% 59.5% 30.8%

AAPL

Baseline 10.7% 0.0% 97.0% 5.4%

DistilRoBERTa 27.7% 40.0% 66.2% 33.8%

NRC-Intensity 7.7% 35.0% 67.5% 21.3%

NRC-Label 15.0% 4.0% 67.1% 9.5%

AMZN

Baseline 50.8% 0.0% 66.1% 25.4%

DistilRoBERTa 50.0% 37.0% 41.0% 43.5%

NRC-Intensity 36.7% 38.6% 41.4% 37.6%

NRC-Label 36.7% 20.0% 40.2% 28.3%

Average

Baseline 26.3% 0.6% 81.9% 13.5%

DistilRoBERTa 39.6% 37.3% 57.6% 38.5%

NRC-Intensity 26.9% 25.6% 58.3% 26.2%

NRC-Label 28.9% 16.9% 55.6% 22.9%

Figure 4: Overall Average Accuracy for Predicting Signifi-

cant Increase and Decrease Movements Across 3 Stocks.

Predicting Stock Price Movement with LLM-Enhanced Tweet Emotion Analysis

237

Table 4 presents the results of the stock predic-

tion method using Llama-enhanced emotion analysis

methods, including DistilRoBERTa, NRC-Intensity,

and NRC-Label. DistilRoBERTa achieves the best

performance, with the overall Average S-I and S-D

accuracy rising from 23.6% (with Emotion Analysis)

to 38.5% (with Llama-enhanced Emotion Analysis),

while maintaining a stable accuracy of 57.6%. NRC-

Intensity improves from 18.8% to 26.2%, with sta-

ble accuracy of 58.3%. NRC-Label slightly declines

from 23.1% to 22.9%, with stable accuracy of 55.6%.

Overall, DistilRoBERTa demonstrates the most bal-

anced and robust performance. Figure 4 illustrates

the overall average accuracy for predicting signifi-

cant increase and decrease movements across TSLA,

AAPL, and AMZN stocks. Among all tested mod-

els, the DistilRoBERTa-based model consistently out-

performs others. Without Llama-enhanced emotion

analysis, it achieves the highest accuracy at 23.6%,

surpassing the baseline model and both NRC-based

approaches. With LLaMA-enhanced emotion anal-

ysis, the DistilRoBERTa-based model enables the

LSTM model to achieve 38.5% accuracy, signifi-

cantly outperforming the baseline across all three

stocks. This improvement is statistically significant,

with p − value < 0.05.

5 CONCLUSIONS

This paper proposes a novel framework for significant

stock price movement prediction by integrating emo-

tion features extracted from social media with histor-

ical price data. We applied the Meta’s Llama 3.1-

8B-Instruct model to preprocess tweets before cal-

culating emotion features using three emotion anal-

ysis methods: a DistilRoBERTa-based Emotion Clas-

sification model, NRC Emotion Intensity Lexicon,

and NRC Emotion Label Lexicon. These features

were combined with stock prices and used to train

an LSTM model that takes the previous day’s data as

input to predict the following day’s significant stock

price movement. Experimental results show that in-

corporating emotion features improves predictive per-

formance compared to using only historical stock

prices; the DistilRoBERTa-based Emotion Classifi-

cation Model configuration increased average sig-

nificant increase and decrease accuracy from 13.5%

(baseline) to 23.6% with emotion analysis, and fur-

ther to 38.5% with Llama-enhanced emotion analysis.

These findings highlight the effectiveness of emotion

analysis applied to social media data in financial fore-

casting and the added value of leveraging large lan-

guage models to enhance emotion analysis.

While our study demonstrates the utility of

emotion-based features for predicting significant

stock price movements, recent findings (Chartr and

Journal, 2024) indicate that consumer sentiment does

not always align directly with market trends. To better

capture short-term market direction, future research

could combine emotion analysis with technical indi-

cators and financial news signals to improve the accu-

racy of short-term stock price movement predictions.

CODE AVAILABILITY

The source code for this paper is available at: https:

//github.com/anv0101/stock-prediction

ACKNOWLEDGEMENTS

We utilized OpenAI’s ChatGPT (OpenAI, 2024), a

large language model, to revise the author’s written

text with the aim of improving its clarity, grammar,

and style.

REFERENCES

AI, M. (2024). Llama 3.1 8b instruct. https:

//huggingface.co/meta-llama/Llama-3.1-

8B-Instruct. Accessed: 2025-04-28.

Atsalakis, G. S. and Valavanis, K. P. (2009). Surveying

stock market forecasting techniques – part ii: Soft

computing methods. Expert Systems with Applica-

tions, 36(3):5932–5941.

Balaji, S. N., Paul, P. V., and Saravanan, R. (2017). Survey

on sentiment analysis based stock prediction using big

data analytics. In 2017 Innovations in Power and Ad-

vanced Computing Technologies (i-PACT), pages 1–5.

IEEE.

Bollen, J., Mao, H., and Zeng, X. (2011). Twitter mood

predicts the stock market. Journal of Computational

Science, 2(1):1–8.

Chartr and Journal, T. W. S. (2024). Sometimes,

the stock market hates good vibes. https:

//www.wsj.com/finance/investing/consumer-

sentiment-stock-market-research-68b80102.

Accessed: May 1, 2025.

Chun, J., Lee, S., Chang, Y., and Lee, S. (2022). Us-

ing deep learning to develop a stock price prediction

model based on individual investor emotions. Journal

of Behavioral Finance, 23(4):479–488.

equinxx (2022). Stock tweets for sentiment analysis and

prediction. Accessed: April 2025.

Griffith, J., Najand, M., and Shen, J. (2020). Emotions

in the stock market. Journal of Behavioral Finance,

21(1):42–56.

KDIR 2025 - 17th International Conference on Knowledge Discovery and Information Retrieval

238

Hartmann, J. C. (2022). emotion-english-distilroberta-

base. https://huggingface.co/j-hartmann/

emotion-english-distilroberta-base. Ac-

cessed: April 2025.

Huang, C.-L. and Tsai, C.-Y. (2009). A hybrid sofm-svr

with a filter-based feature selection for stock mar-

ket forecasting. Expert Systems with Applications,

36(2):1529–1539.

Huang, W., Nakamori, Y., and Wang, S.-Y. (2005). Fore-

casting stock market movement direction with support

vector machine. Computers & Operations Research,

32(10):2513–2522.

Jiang, W. (2021). Applications of deep learning in stock

market prediction: Recent progress. In Expert Systems

with Applications, 184, 115537. Elsevier.

Kimoto, T., Asakawa, K., Yoda, M., and Takeoka, M.

(1990). Stock market prediction system with modu-

lar neural networks. In Proceedings of the Interna-

tional Joint Conference on Neural Networks (IJCNN).

IEEE. Developed by Fujitsu and Nikko Securities for

forecasting TOPIX.

Kusal, S., Patil, S., Choudrie, J., Kotecha, K., Vora, D., and

Pappas, I. (2022). A review on text-based emotion de-

tection – techniques, applications, datasets, and future

directions. Artificial Intelligence Review. Available

via Springer or institutional access.

Mackey, A. L., Gauch, S., and Labille, K. (2021). Detect-

ing fake news through emotion analysis. In Proceed-

ings of the Thirteenth International Conference on

Information, Process, and Knowledge Management

(eKNOW 2021).

Mohammad, S. M. and Turney, P. D. (2013). Crowdsourc-

ing a word–emotion association lexicon. Computa-

tional Intelligence, 29(3):436–465.

Nelson, D. M. Q., Pereira, A. C. M., and de Oliveira,

R. A. (2017). Stock market’s price movement predic-

tion with lstm neural networks. In 2017 International

Joint Conference on Neural Networks (IJCNN), pages

1419–1426. IEEE.

Nguyen, T. H., Shirai, K., and Velcin, J. (2015). Sentiment

analysis on social media for stock movement predic-

tion. Expert Systems with Applications, 42(24):9603–

9611.

OpenAI (2024). Gpt-4o: Openai’s newest multimodal

model. https://openai.com/index/gpt-4o. Ac-

cessed: 2025-05-15.

Securities, U. and Commission, E. (2024). Sec reminds

market participants of may 28 transition to t+1 set-

tlement cycle. Accessed May 1, 2025.

Teti, E., Dallocchio, M., and Aniasi, A. (2019). The rela-

tionship between twitter and stock prices: Evidence

from the us technology industry. Technological Fore-

casting and Social Change, 149:119747.

Wankhade, M., Rao, A. C. S., and Kulkarni, C. (2022).

A survey on sentiment analysis methods, applica-

tions, and challenges. Artificial Intelligence Review,

55(7):5731–5780.

Yahoo Finance, Yahoo Finance Historical Market Data,

https://finance.yahoo.com, Accessed: 2024-05-11.

Predicting Stock Price Movement with LLM-Enhanced Tweet Emotion Analysis

239