A Microservice-Based Architecture for Real-Time Credit Card Fraud

Detection with Observability

Robson S. Santos

1

, Robesv

ˆ

ania Ara

´

ujo

1

, Paulo A. L. Rego

1

, Jos

´

e M. da S. M. Filho

1

,

Jar

´

elio G. da S. Filho

2

, Jos

´

e D. C. Neto

2

, Nicksson C. A. de Freitas

2

,

Emanuel B. Rodrigues

1

, Francisco Gomes

1

and Fernando Trinta

1

1

Federal University of Cear

´

a (UFC), Av. Humberto Monte, s/n, Pici – 60440-593 – Fortaleza – CE, Brazil

2

Sidi – Institute of Innovation for Digital Society, Av. Rep

´

ublica do L

´

ıbano, 251 – 51110-160 – Recife – PE, Brazil

fi

Keywords:

Fraud Detection, Financial Systems, Microservice Architecture, Machine Learning, Observability, Scalability.

Abstract:

The growth of real-time financial transactions has increased the demand for scalable and transparent fraud

detection systems. This paper presents a microservice-based architecture designed to detect credit card fraud in

real time, integrating machine learning models with observability tools to monitor operational behavior. Built

on OpenTelemetry (OTel), the architecture enables detailed tracking of performance metrics, resource usage,

and system bottlenecks. Experiments conducted in a cloud-based environment demonstrate the scalability

and efficiency of the solution under different workloads. Among the tested models, XGBoost outperformed

Random Forest in throughput and latency, handling over 25,000 concurrent requests with response times under

50 ms. Compared to previous work focused solely on model accuracy, this study advances toward real-world

applicability by combining fraud detection with runtime observability and elastic deployment. The solution

is open-source and reproducible, and it contributes to the development of robust data-driven systems in the

financial domain.

1 INTRODUCTION

The rapid adoption of real-time payment systems

has revolutionized financial transactions by increas-

ing their speed, convenience, and accessibility. How-

ever, this transformation has also led to a dramatic

rise in financial fraud, especially scams that exploit

immediacy and user trust (Abdallah et al., 2016). In

Brazil, one of the largest and fastest-growing real-

time payment markets, fraud-related losses reached

nearly USD 380 million in 2023 and are expected to

increase by 40% by 2028 ACI Worldwide - Scam-

scope Report (2023). These challenges highlight the

urgent need for fraud detection solutions that are ac-

curate, fast, scalable, and resilient to real-world oper-

ational demands.

Fraud detection systems face multiple techni-

cal and operational challenges: handling large vol-

umes of imbalanced and anonymized data, adapting

to changing fraud patterns, minimizing false nega-

tives, and ensuring the timely processing of high-

throughput requests. Moreover, modern deployments

are increasingly based on microservices, which intro-

duce complexity in monitoring and diagnosing perfor-

mance issues. Traditional monitoring tools offer lim-

ited visibility into distributed systems, where identify-

ing latency spikes, resource bottlenecks, or degraded

model performance is crucial.

This paper proposes a real-time fraud detection ar-

chitecture based on microservices and enhanced by

observability. Using OpenTelemetry (OTel) (Blanco,

2023), an open-source framework that provides stan-

dardized APIs, SDKs, and tools for collecting teleme-

try data, the system captures operational informa-

tion across services and infrastructure layers, en-

abling detailed analysis of request paths, bottlenecks,

and model behaviors. The architecture is modular,

scalable, and designed to integrate different machine

learning (ML) models for fraud prediction. We com-

pare Random Forest and XGBoost under varying user

loads and system configurations, using both classic

ML metrics (accuracy, precision, F1 score, and recall)

and telemetry-based indicators: CPU usage, response

time and request throughput.

Our contributions are threefold:

• We present a microservice-based architecture for

748

Santos, R. S., Araújo, R., Rego, P. A. L., Filho, J. M. S. M., Filho, J. G. S., Neto, J. D. C., A. de Freitas, N. C., Rodrigues, E. B., Gomes, F., Trinta and F.

A Microservice-Based Architecture for Real-Time Credit Card Fraud Detection with Observability.

DOI: 10.5220/0013650000003967

In Proceedings of the 14th International Conference on Data Science, Technology and Applications (DATA 2025), pages 748-755

ISBN: 978-989-758-758-0; ISSN: 2184-285X

Copyright © 2025 by Paper published under CC license (CC BY-NC-ND 4.0)

real-time fraud detection with integrated observ-

ability.

• We compare two machine learning models under

different data balancing techniques and load con-

ditions, emphasizing recall and latency.

• We demonstrate how observability tools support

model evaluation, bottleneck identification, and

system scalability.

The remainder of this paper is organized as follows:

Section 2 discusses background concepts on fraud de-

tection and observability. Section 3 reviews related

work. Section 4 introduces the real-time fraud detec-

tion architecture. Section 5 presents the conducted

experiments. Section 6 details the machine learning

pipeline. Section 7 reports model evaluation results.

Section 8 describes the experimental setup. Section

9 compares our approach with state-of-the-art solu-

tions. Section 10 concludes the paper and outlines

future work.

2 BACKGROUND

2.1 Fraud Detection in Financial

Systems

The rise of real-time payment systems has increased

both the frequency and sophistication of financial

fraud. Traditional rule-based systems are no longer

sufficient to detect evolving fraud patterns, especially

in scenarios where users, under social engineering

pressure, authorize fraudulent transactions. Machine

learning (ML) has emerged as a key technology to

detect these fraudulent transactions by learning from

historical data and identifying behavioral anomalies.

Despite their effectiveness, ML-based fraud detec-

tion systems face several challenges: highly imbal-

anced datasets that increase false negatives, evolving

fraud patterns requiring continuous retraining, and

anonymized features that limit model interpretability

and feature engineering.

To address these issues, various techniques have

been adopted, including random oversampling and

undersampling, synthetic data generation such as

SMOTE, feature selection based on importance

scores, and ensemble methods. Among classification

algorithms, tree-based models such as Random For-

est (RF) and XGBoost have gained prominence due

to their robustness, accuracy, and suitability for tabu-

lar and imbalanced data (Fatima et al., 2023).

2.2 Observability and Microservices in

ML Deployments

With the growing deployment of fraud detection sys-

tems in cloud-native environments, microservice ar-

chitectures have become the standard. Microservices

promote scalability, modularity, and fault isolation by

decoupling components such as transaction ingestion,

enrichment, classification, and authorization into in-

dependent services. However, this architectural style

also introduces complexity in terms of system moni-

toring, diagnosis, and performance tuning.

Traditional monitoring tools often fail to provide

end-to-end visibility across services, especially when

analyzing the behavior of deployed machine learning

models under different workloads. This gap has led to

the adoption of observability, a concept that goes be-

yond traditional monitoring by incorporating metrics,

logs, and distributed traces to infer the internal state

of systems from their external outputs.

OpenTelemetry (OTel) is currently the most

widely adopted observability framework, providing

language-agnostic SDKs and exporters for telemetry

data. Combined with backends such as Prometheus

for metrics and Jaeger for tracing, OTel enables the

collection and correlation of performance data across

microservices and infrastructure components. In ML

deployments, observability supports runtime model

evaluation, identification of bottlenecks, and valida-

tion of system behavior under high traffic or unex-

pected loads. This is especially critical in real-time

fraud detection, where latency and scalability directly

impact effectiveness.

3 RELATED WORK

Recent research on fraud detection has emphasized

both model-level and architectural advancements. A

critical area of focus has been handling class imbal-

ance in fraud datasets. Mienye and Sun (Mienye and

Sun, 2023) propose a deep ensemble framework com-

bining GRU, LSTM, and MLP networks with syn-

thetic oversampling to achieve high recall and adapt

to evolving fraud patterns. Gupta et al.(Gupta et al.,

2023) conduct a comprehensive comparison of bal-

ancing techniques, including SMOTE, showing im-

proved generalization in classifiers such as XGBoost.

Bakhtiari et al.(Bakhtiari et al., 2023) also explore

gradient boosting models like LightGBM and Lite-

MORT, using metrics such as AUC-ROC, F1-score,

and recall to evaluate fraud detection performance.

In terms of architectural design, several stud-

ies adopt high-throughput infrastructures for real-

A Microservice-Based Architecture for Real-Time Credit Card Fraud Detection with Observability

749

time fraud detection. The SCARFF framework (Car-

cillo et al., 2018) integrates Apache Spark, Kafka,

and Cassandra to process streaming data at scale,

enabling online detection over evolving transaction

flows. Surianarayanan et al.(Surianarayanan et al.,

2024) present a low-latency architecture using Kafka

and Random Forest, emphasizing scalability and re-

sponsiveness. Thennakoon et al.(Thennakoon et al.,

2019) explore pipelines with real-time user interfaces

for fraud management under peak loads, while Men-

shchikov et al.(Menshchikov et al., 2022) examine ar-

chitectural trade-offs in Big Data antifraud systems

using Apache-based components. Prusti et al.(Prusti

et al., 2021) propose a graph-based approach lever-

aging Neo4j to enhance prediction accuracy with

relational patterns in transaction networks. Com-

pared to these efforts, our architecture uniquely com-

bines modular microservices, telemetry instrumenta-

tion, and dynamic scaling through Kubernetes.

Observability has gained relevance in ML system

deployments. Karumuri et al.(Karumuri et al., 2021)

outline challenges in large-scale traceability and pro-

pose structured practices for telemetry and bottleneck

detection. Kosinska et al.(Kosi

´

nska et al., 2023) advo-

cate for the convergence of observability and MLOps

using tools like MLflow, Airflow, and OpenTeleme-

try. Majors (Majors et al., 2022) further supports the

adoption of vendor-neutral observability frameworks

to enable consistent visibility across services and in-

frastructure. Our solution incorporates OpenTeleme-

try for full-stack observability, although orchestration

tools are not yet included, we consider their integra-

tion a direction for future work.

Some initiatives have explored architectural as-

pects more explicitly. Coelho et al. (Coelho et al.,

2024) employ XGBoost to detect malicious activity in

academic networks, but without a microservice-based

deployment or integrated telemetry. Previous work by

(Santos et al., 2023) proposed a multilayered archi-

tecture using Random Forest for fraud detection in a

simulated bank environment, achieving high accuracy

in controlled tests.

Compared to this previous work, the present study

introduces several key advancements:

• Model Evolution: adopting XGBoost improves

processing time and system responsiveness under

high load.

• Observability Integration: the use of Open-

Telemetry, combined with Prometheus and Jaeger,

allows for real-time performance monitoring,

traceability, and resource usage analysis.

• Scalability Testing: the system undergoes test-

ing under multiple configurations of service repli-

cas and concurrent user loads, enabling a realistic

analysis of its elastic behavior.

• Open-Source and Reproducibility: all code,

datasets, and deployment configurations are pub-

licly available to support further experimentation

and evaluation.

To the best of our knowledge, this is one of the first

studies to integrate machine learning, microservices,

and observability in a unified architecture tailored for

real-time fraud detection in the financial domain.

4 PROPOSED ARCHITECTURE

The proposed system is based on a microservice-

oriented architecture designed to enable real-time

credit card fraud detection with high scalability, mod-

ularity, and observability. Each service is responsible

for a specific task in the fraud detection pipeline, al-

lowing for independent deployment, horizontal scal-

ing, and fault isolation. Services communicate via

REST APIs and are orchestrated using Kubernetes.

The architecture includes the following core ser-

vices:

• Transaction Ingestion Service: receives transac-

tion data from clients or upstream systems.

• Feature Enrichment Service: enhances incom-

ing transactions with derived features and contex-

tual metadata.

• Fraud Detection Service: applies the trained ma-

chine learning model to classify transactions as ei-

ther fraudulent or legitimate.

• Telemetry Service: integrates OpenTelemetry

agents to collect metrics, logs, and distributed

traces.

• Gateway/API Manager: acts as the central entry

point for all external requests.

Observability is achieved through OpenTelemetry

(OTel), in combination with Prometheus for met-

rics collection and Jaeger for distributed tracing. To-

gether, these tools provide comprehensive, end-to-end

visibility across all services, enabling fine-grained

monitoring of request latency, model inference times,

resource utilization, and inter-service dependencies.

5 MACHINE LEARNING

PIPELINE

This section presents the proposed approach for de-

tecting credit card fraud, detailing each stage of the

DATA 2025 - 14th International Conference on Data Science, Technology and Applications

750

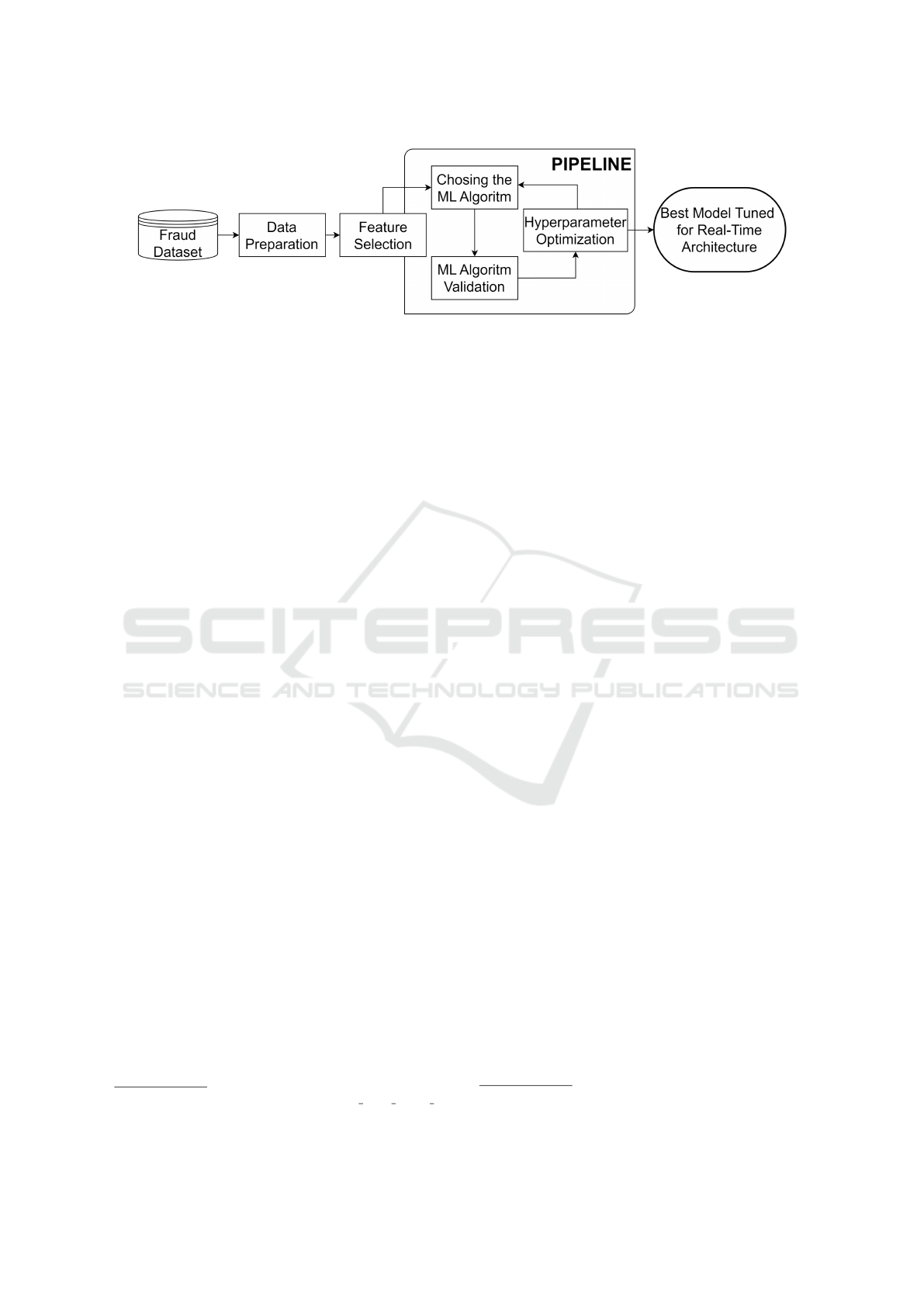

machine learning pipeline. Figure 1 illustrates the

workflow of the system. We describe the main com-

ponents involved in data preprocessing, feature selec-

tion, and model development.

5.1 Dataset

This study uses the IEEE-CIS Fraud Detection

dataset

1

, designed for developing and testing fraud

detection systems in e-commerce environments. The

dataset comprises two main tables: one containing

transaction details (e.g., amount and card data) and

the other providing demographic and device-related

information. Of the 434 available features, 400 are

anonymized. Each transaction is labeled as either le-

gitimate or fraudulent, enabling binary classification.

Due to the size of the dataset, we restricted our analy-

sis to the train identity and train transaction subsets,

which were merged to form the working dataset.

5.2 Data Preparation

Due to the complexity of the dataset, which contains

numerous columns, a significant amount of missing

data, and alphanumeric variables, it was necessary

to perform a data preprocessing step (Gupta et al.,

2023). This process included several activities, such

as: (i) removing columns with excessive missing data;

(ii) imputing missing values using the median calcu-

lated for each attribute; (iii) removing duplicate rows;

(iv) encoding categorical alphanumeric values into

numerical values; and (v) grouping related attributes.

After this stage, the dataset was reduced from 434 to

224 attributes.

5.3 Feature Selection

After data preparation, we applied a decision tree-

based technique to determine feature importance, se-

lecting attributes with a score above 0.01. This step

reduced noise, improved model efficiency, and re-

sulted in the 25 most relevant features.

Key transaction information (e.g., transactionID,

TransactionAmt, card1, addr1, P emaildomain) is

submitted by the client during requests, while ad-

ditional attributes (e.g., C1, D1, M4, V317) are re-

trieved from the database. These features include pay-

ment card details, counts, temporal differences, and

anonymized behavioral patterns relevant for fraud de-

tection.

1

https://www.kaggle.com/competitions/ieee-fraud-det

ection

5.4 Pipeline Modeling

The labeled dataset was split into training (75%) and

testing (25%) sets using StratifiedShuffleSplit to pre-

serve class proportions. Four classification algorithms

were evaluated: Logistic Regression, Decision Tree

(DT), Random Forest (RF), and XGBoost, under three

conditions: original imbalance, random undersam-

pling, and random oversampling.

Hyperparameter tuning was performed using grid

search with 5-fold cross-validation, where each

model underwent 10 evaluation experiments. The

best configuration based on accuracy was then used

to retrain the model and evaluate it on the test set.

5.5 Best Model Selection

Once the experimental phase was completed, it be-

came crucial to identify the most effective model

based on specific performance metrics, which were

calculated using the test set results. The evaluation

metrics adopted include accuracy, precision, recall

and F1-score.

Recognizing the importance of each metric, our

evaluation emphasizes minimizing false negatives,

given the critical nature of fraud detection. A false

negative occurs when a fraudulent transaction is mis-

takenly validated as safe, posing a substantial risk.

In contrast, false positives, though inconvenient, typi-

cally have minor consequences as they only temporar-

ily block a legitimate transaction. Thus, recall and F1-

score are prioritized in our selection process to ensure

the integrity and reliability of the fraud detection sys-

tem. All scripts and code developed during the exper-

iments are publicly available on GitHub

2

.

5.6 Model Evaluation

The best results were obtained using randomly over-

sampled data. Logistic Regression showed the low-

est performance, while Decision Tree improved to

99.52% accuracy. Random Forest achieved 99.98%

accuracy with near-perfect precision and recall, while

XGBoost reached 99.84% accuracy and 100% recall,

offering slightly lower accuracy but comparable over-

all effectiveness.

These results emphasize the importance of metrics

like precision and F1-score in imbalanced datasets.

XGBoost’s consistent performance and faster infer-

ence justify its adoption in the proposed real-time

fraud detection solution.

2

https://github.com/robsonsants/Credit Card Fraud-D

etection Pipeline

A Microservice-Based Architecture for Real-Time Credit Card Fraud Detection with Observability

751

Figure 1: Machine learning model for fraud detection.

6 EXPERIMENTAL SETUP

The architecture was deployed on Amazon AWS us-

ing t2.medium and c4.xlarge EC2 instances. Services

(Manager, Data Enricher, Fraud Detection,

Transaction Service) were containerized with

Docker and orchestrated via Kubernetes. Additional

machines hosted the Locust load-testing tool.

The system was implemented in Python

3

, employ-

ing libraries such as FastAPI, Scikit-learn, NumPy,

and PyMongo. Docker and Kubernetes ensured con-

sistent deployments and scalability.

Locust simulated 60 to 200 concurrent users. Ob-

servability was achieved with OpenTelemetry (OTel),

Prometheus, and Jaeger, capturing latency, through-

put, CPU usage, and traces.

As a limitation, experiments relied on a single

dataset. Future work will explore multi-dataset eval-

uations and enhanced cross-validation.

7 REAL-TIME FRAUD

DETECTION ARCHITECTURE

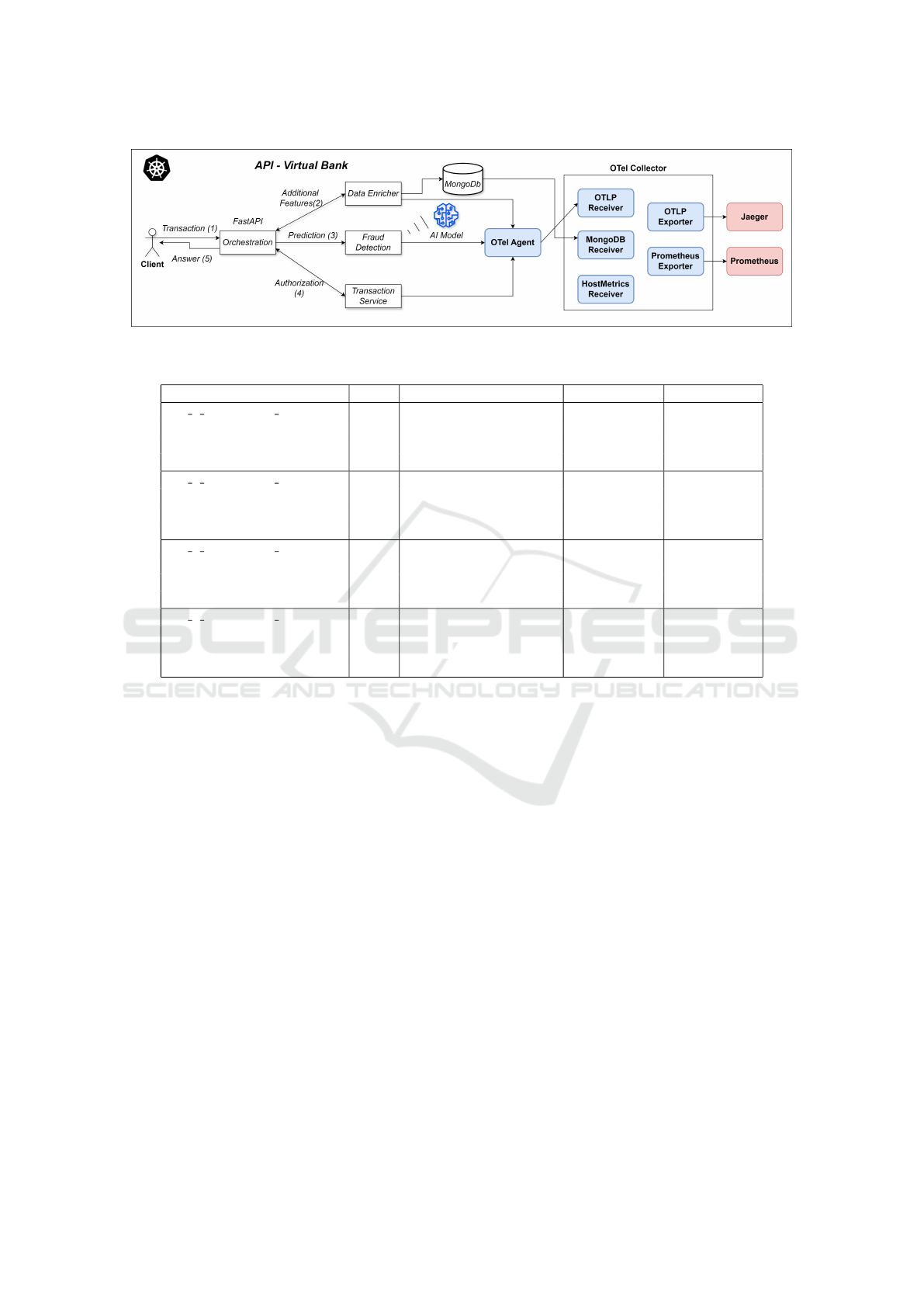

Figure 2 provides an overview of the proposed archi-

tecture, consisting of four microservices: Manager,

Data Enricher, Fraud Detection, Transaction

Service, and a MongoDB database.

The Manager service coordinates workflow or-

chestration (Megargel et al., 2021), initially receiving

transaction data from clients. The Data Enricher

adds additional features retrieved from MongoDB,

aligning transactions with the attributes used for train-

ing.

The enriched transaction is classified by the Fraud

Detection service using the XGBoost model. Based

on the result, the Manager requests authorization from

the Transaction Service and informs the client of

the outcome.

3

https://github.com/robsonsants/Credit Card Fraud D

etection

Observability is integrated through OpenTeleme-

try (OTel). Services export telemetry data (metrics,

traces, and logs) via an OTel Collector, enabling uni-

fied data processing and transmission based on the

OpenTelemetry Protocol (OTLP).

Monitoring and visualization are supported by

Prometheus

4

and Jaeger

5

. The system collects full-

stack telemetry using three receivers (application,

MongoDB, and host metrics) and two exporters

(OTLP for Jaeger and Prometheus format).

7.1 Conducted Experiments

We evaluated system performance and scalability us-

ing Locust to simulate workloads and capture metrics

such as response time, throughput, and CPU usage.

Observability data collected via OTel, Prometheus,

and Jaeger provided detailed logs of service behavior

under load.

Experiments varied the number of clients (60,

100, 150, and 200), service replicas (1–2 for the

manager and 1–3–4–5 for the transaction service),

and machine learning models (Random Forest and

XGBoost). Each run lasted 5 minutes, excluding

the initial 10% of requests to mitigate cold start ef-

fects (Ebrahimi et al., 2024).

The next section presents the performance results

under these conditions.

7.2 Experiment Results

The workload consisted of purchase transactions sub-

mitted by a variable number of clients. The evaluated

metrics include average response time (ms), total re-

quests processed, and peak CPU usage. These metrics

allow us to assess the system’s performance in terms

of processing efficiency and scalability.

4

https://prometheus.io/

5

https://www.jaegertracing.io/

DATA 2025 - 14th International Conference on Data Science, Technology and Applications

752

Figure 2: Real-time architecture for fraud detection.

Table 1: Performance metrics for Random Forest model.

Model Configuration Users Avg. Response Time (ms) Total Requests Max CPU (%)

RF 1 manager + 1 transaction 60 1454 4649 63

100 3778 4712 64

150 5655 4657 64

200 6830 4694 64

RF 1 manager + 3 transaction 60 191 8148 110

100 1181 9331 145

150 2104 9345 145

200 2747 9350 145

RF 2 manager + 4 transaction 60 137 8426 130

100 735 11169 185

150 1508 11205 185

200 2039 11242 185

RF 2 manager + 5 transaction 60 121 8508 130

100 714 11313 195

150 1515 11151 195

200 2029 11281 195

8 RESULTS AND DISCUSSION

8.1 ML Models Comparison

Table 2 and Table 1 compare model performance un-

der varying system loads. Although Random Forest

achieved the highest accuracy and F1-score, XGBoost

demonstrated superior responsiveness and lower la-

tency, with response times under 90 ms even for 200

users. Recall values above 99% for both models con-

firm their effectiveness, with XGBoost favored for

production deployment due to its lighter footprint and

consistent performance.

8.2 System Scalability

Scaling the number of replicas significantly im-

pacted performance. As the number of Transaction

Service replicas increased, the system handled more

requests with lower latency. For example, deploying

5 replicas allowed XGBoost to process over 25,000

requests with sub-50 ms latency. This highlights

the system’s elastic scalability under Kubernetes, al-

though dynamic auto-scaling policies remain a future

improvement.

8.3 Observability Insights

Observability through OpenTelemetry (OTel) proved

fundamental for diagnosing performance bottlenecks

and understanding service behavior. Metrics and

traces were collected from all components, including

application services, MongoDB, and host infrastruc-

ture, and exported to Prometheus and Jaeger for anal-

ysis.

Jaeger traces revealed that the Random Forest

model took approximately 71.41 ms per prediction,

while XGBoost completed predictions in 26.77 ms,

making it about 2.67 times faster. Prometheus met-

rics helped monitor CPU consumption and request

throughput across different service configurations,

supporting decisions about service scaling and re-

source allocation. Locust also contributed by gener-

ating workload and capturing per-request latency.

A Microservice-Based Architecture for Real-Time Credit Card Fraud Detection with Observability

753

Table 2: Performance metrics for XGBoost model.

Model Configuration Users Avg. Response Time (ms) Total Requests Max CPU (%)

XG 1 manager + 1 transaction 60 30 9005 27

100 35 16316 43

150 47 21842 74

200 82 25283 92

XG 1 manager + 3 transaction 60 31 8996 27

100 37 16337 40

150 49 21838 65

200 90 25264 100

XG 2 manager + 4 transaction 60 28 9004 28

100 33 16335 38

150 38 21978 58

200 46 25928 95

XG 2 manager + 5 transaction 60 29 9043 27

100 33 16350 41

150 39 21961 70

200 48 25961 86

Overall, OTel-based observability enabled precise

evaluation of system performance, guided the choice

of the production model, and identified scalability op-

portunities. It played a key role in validating archi-

tectural decisions and preparing the system for real-

world deployment. Additionally, distributed tracing

allowed precise breakdown of service latencies, sup-

porting real-time bottleneck identification.

9 COMPARISON WITH STATE OF

THE ART

Our proposed architecture differentiates itself from

existing fraud detection solutions by combining low-

latency inference, integrated observability, modular

microservices, and elastic scalability.

Unlike traditional ML orchestration tools such as

Airflow and MLflow, which are oriented to batch

processing and complex workflows, our approach

targets real-time detection with immediate response,

maintaining latencies below 50 ms.

Frameworks like SCARFF (Carcillo et al.,

2018) and anomaly detection systems such as

RAVEN (Coelho et al., 2024) achieve high accuracy

but lack native observability and efficient scaling for

real-time environments. Other studies (Menshchikov

et al., 2022), (Thennakoon et al., 2019) explore archi-

tectural optimizations but do not integrate end-to-end

monitoring or reproducibility.

The main differentiators of our architecture in-

clude:

• Low-Latency Inference: XGBoost-based model

with sub-50 ms response under concurrent load.

• Integrated Observability: full-stack instrumen-

tation with OpenTelemetry, Prometheus, and

Jaeger.

• Elastic Scalability: dynamic service replication

via Kubernetes.

• Modular and Lightweight Design: decoupled

microservices with REST interfaces.

• Reproducibility: all code, configurations, and

datasets are publicly available.

These attributes make our solution particularly

suited for high-demand, latency-sensitive environ-

ments such as digital banking and real-time financial

services.

10 CONCLUSION AND FUTURE

WORK

This study proposed an observable and scalable

architecture for real-time credit card fraud detec-

tion. Among the evaluated models, XGBoost outper-

formed Random Forest in response time, throughput,

and CPU usage, confirming its suitability for high-

demand environments.

The microservice-based design enabled modular

deployment and horizontal scaling, while observabil-

ity through OpenTelemetry facilitated real-time per-

formance analysis and resource monitoring. Corre-

lating telemetry with model performance provided a

more holistic view for production deployments. The

open-source availability of the solution further pro-

motes reproducibility.

Future work will explore: (i) experiments on

more powerful infrastructures; (ii) advanced balanc-

DATA 2025 - 14th International Conference on Data Science, Technology and Applications

754

ing techniques like SMOTE; (iii) dynamic scaling and

replication strategies; and (iv) broader evaluations us-

ing diverse datasets and comparisons with MLOps

platforms such as MLFlow and Kubeflow.

ACKNOWLEDGEMENTS

This work was supported by the Brazilian Federal

Agency for Support and Evaluation of Graduate Edu-

cation (CAPES) – Finance Code 001.

The authors would like to thank FUNCAP – Cear

´

a

Foundation for Scientific and Technological Develop-

ment Support – for the support provided throughout

this work.

REFERENCES

Abdallah, A., Maarof, M. A., and Zainal, A. (2016). Fraud

detection system: A survey. Journal of Network and

Computer Applications, 68:90–113.

Bakhtiari, S., Nasiri, Z., and Vahidi, J. (2023). Credit card

fraud detection using ensemble data mining methods.

Multimedia Tools and Applications, pages 1–19.

Blanco, D. G. (2023). Practical OpenTelemetry. Springer.

Carcillo, F., Dal Pozzolo, A., Le Borgne, Y.-A., Caelen, O.,

Mazzer, Y., and Bontempi, G. (2018). Scarff: a scal-

able framework for streaming credit card fraud detec-

tion with spark. Information fusion, 41:182–194.

Coelho, W., Zanotelli, V., Comarela, G., and Villac¸a, R.

(2024). Raven: Detecc¸

˜

ao e classificac¸

˜

ao precoce de

atores maliciosos em uma rede acad

ˆ

emica. In Anais

do XLII Simp

´

osio Brasileiro de Redes de Computa-

dores e Sistemas Distribu

´

ıdos, pages 351–364, Porto

Alegre, RS, Brasil. SBC.

Ebrahimi, A., Ghobaei-Arani, M., and Saboohi, H. (2024).

Cold start latency mitigation mechanisms in serverless

computing: taxonomy, review, and future directions.

Journal of Systems Architecture, page 103115.

Fatima, S., Hussain, A., Amir, S. B., Ahmed, S. H., Aslam,

S. M. H., et al. (2023). Xgboost and random forest

algorithms: an in depth analysis. Pakistan Journal of

Scientific Research, 3(1):26–31.

Gupta, P., Varshney, A., Khan, M. R., Ahmed, R., Shuaib,

M., and Alam, S. (2023). Unbalanced credit card

fraud detection data: a machine learning-oriented

comparative study of balancing techniques. Procedia

Computer Science, 218:2575–2584.

Karumuri, S., Solleza, F., Zdonik, S., and Tatbul, N.

(2021). Towards observability data management at

scale. ACM SIGMOD Record, 49(4):18–23.

Kosi

´

nska, J., Bali

´

s, B., Konieczny, M., Malawski, M., and

Zielin

´

ski, S. (2023). Towards the observability of

cloud-native applications: The overview of the state-

of-the-art. IEEE Access.

Majors, C., Fong-Jones, L., and Miranda, G. (2022). Ob-

servability Engineering: Achieving Production Excel-

lence. O’Reilly Media, Incorporated.

Megargel, A., Poskitt, C. M., and Shankararaman, V.

(2021). Microservices orchestration vs. choreogra-

phy: A decision framework. In 2021 IEEE 25th In-

ternational Enterprise Distributed Object Computing

Conference (EDOC), pages 134–141. IEEE.

Menshchikov, A., Perfilev, V., Roenko, D., Zykin, M., and

Fedosenko, M. (2022). Comparative analysis of ma-

chine learning methods application for financial fraud

detection. In 2022 32nd Conference of Open Innova-

tions Association (FRUCT), pages 178–186. IEEE.

Mienye, I. D. and Sun, Y. (2023). A deep learning ensemble

with data resampling for credit card fraud detection.

IEEE Access, 11:30628–30638.

Prusti, D., Das, D., and Rath, S. K. (2021). Credit card

fraud detection technique by applying graph database

model. Arabian Journal for Science and Engineering,

46(9):1–20.

Santos, R. S., Ara

´

ujo, R., Rego, P. A., da SM Filho, J. M.,

da S Filho, J. G., Neto, J. D., de Freitas, N. C., and

Rodrigues, E. B. (2023). Arquitetura de tempo real

e modelo de aprendizado de m

´

aquina para detecc¸ao

de fraudes de cartao de cr

´

edito. In Anais do XXIII

Simp

´

osio Brasileiro em Seguranc¸a da Informac¸

˜

ao e

de Sistemas Computacionais, pages 265–278. SBC.

Surianarayanan, C., Kunasekaran, S., and Chelliah, P. R.

(2024). A high-throughput architecture for anomaly

detection in streaming data using machine learning al-

gorithms. International Journal of Information Tech-

nology, 16(1):493–506.

Thennakoon, A., Bhagyani, C., Premadasa, S., Mihiranga,

S., and Kuruwitaarachchi, N. (2019). Real-time credit

card fraud detection using machine learning. In

2019 9th International Conference on Cloud Comput-

ing, Data Science & Engineering (Confluence), pages

488–493. IEEE.

APPENDIX

The metrics used and the results obtained are avail-

able at the following link

6

.

6

https://drive.google.com/file/d/1eAMEmJ2sQlHhzvD

DOTZBvLujaWGRP0TD/view?usp=sharing

A Microservice-Based Architecture for Real-Time Credit Card Fraud Detection with Observability

755