Adaptive Systems for Fraud Detection in Financial Transactions: A

Survey on Multi-Modal Biometrics and Real-Time Analytics

Shubhangi Vairagar

1

and Vaishnavi Babar

2

1

Department of AI and Data Science,Dr. D.Y. Patil Institute of Technology, Pune, India

2

Artificial Intelligence and Data Science, Dr. D.Y. Patil Institute of Technology, Pune, India

Keywords:

Adaptive Fraud Detection, Multi-Modal Behavioral Biometrics, RealTime Predictive Analytics, Machine

Learning, Anomaly Detection, Financial Transactions, Blockchain Technology, Risk Assessment, Explain-

able AI, Typing Patterns, Mouse Movements, Facial Recognition, Fraud Prevention, Dynamic Thresholds,

Transaction Transparency.

Abstract:

The paper takes a revolutionary approach to countering financial fraud through adaptive fraud detection using

multi-modal behavioral biometrics and real-time predictive analytics. Current systems are based on static rules

and historical data that fail to counter modern and sophisticated techniques of fraud. This system builds an

adaptive, all-inclusive user profile by including behavioral biometrics such as typing patterns, mouse move-

ments, and emotional cues captured through facial recognition. Advanced machine learning algorithms im-

prove on anomaly detection, enabling a system to adapt to in real-time changes in behavior of the user and

changing fraud patterns, thereby strongly reducing false positives while the detection rates are improved.

**Real-time predictive analytics** identify and stop fraudulent transactions prior to their occurrence, thus

reducing monetary losses. The model will also use **blockchain technology**, where suspicious transactions

can be logged safely for transparent audit purposes, hence increasing trust levels and transparency in trans-

actions. The system adds layers of precision to fraud detection by utilizing live behavioral data for dynamic

risk assessments. Its explainable AI mechanisms are transparent, which fosters user trust, and its adaptabil-

ity supports resilience against evolving fraud tactics. The proposed system marks a significant leap forward,

promising a safer and more efficient environment for financial transactions, ultimately revolutionizing fraud

prevention strategies in the financial sector.

1 INTRODUCTION

In this digital era, the upsurge in online finan-

cial transactions has drastically altered the face of

business. Even though at times easier to people’s

lifestyles, the increased rate of fraud against the fi-

nancial system is one aspect that needs to be weighed

with much consideration. As indicated by the Associ-

ation of Certified Fraud Examiners, each year organi-

zations lose an estimated 5Adaptive fraud detection

systems are crucial and particularly needed to bet-

ter improve the effectiveness of identifying fraudulent

transactions. The research introduces a new approach

with multi-modal behavioral biometrics, incorporat-

ing typing patterns, mouse movement, and emotional

responses through facial recognition in building up a

complete user profile. Continuously, this proposed

system will analyse the different behavioral indica-

tors and thus be able to adapt it in real time to changes

in user behavior and emerging patterns of fraud. For

instance, behavioral biometrics may also monitor for

deviations in typical patterns by a user-thus changes

in the typing speed or unusual mouse movements are

likely indicators of fraudulent attempts. The incor-

poration of real-time predictive analytics makes the

value of this system double since anomalies can be

identified even before fraudulent transactions are ac-

tually performed. This is because, through machine

learning algorithms, the system not only identifies

transactions that are not in line with already estab-

lished behavioral patterns but also predicts attempts

made in real-time with fraudulent intentions, so finan-

cial losses for consumers and businesses could be sig-

nificantly reduced. This predictive ability is very im-

portant in the high-speed digital paradigm wherein the

transactions are made within milliseconds, thus it al-

lows responding swiftly to potential fraud. Although

there have been many leaps in recent years through

Vairagar, S. and Babar, V.

Adaptive Systems for Fraud Detection in Financial Transactions: A Survey on Multi-Modal Biometrics and Real-Time Analytics.

DOI: 10.5220/0013615200004664

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 3rd Inter national Conference on Futuristic Technology (INCOFT 2025) - Volume 3, pages 321-328

ISBN: 978-989-758-763-4

Proceedings Copyright © 2025 by SCITEPRESS – Science and Technology Publications, Lda.

321

new fraud detection methodologies, many such gaps

are identified in the literature. Most such existing sys-

tems are still more or less based on historical data and

do not make allowance for the dynamic character of

user behavior. Furthermore, many approaches focus

the bias between detection accuracy and user experi-

ence wrongly and tend to increase false positives up

to an undesirable point. For example, while some sys-

tems might gain accurate fraud detection, they may

yield a large amount of true positives, and this leads

to customer frustration and loss of user trust. This

paper bridges these gaps by proposing a dynamic

risk assessment model that adaptively adjusts con-

textual thresholds from live behavioral data, thus en-

hancing accuracy in fraud detection while maintain-

ing user satisfaction. In this research work, our pri-

mary objective is to devise and implement an adap-

tive fraud detection system using multimodal behav-

ioral biometrics along with advanced machine learn-

ing algorithms. More specifically, for this research,

this combination of supervised learning and unsuper-

vised learning techniques will be utilized to develop

a hybrid model that can learn from the labeled data

while discovering new patterns associated with fraud.

The primary intention is to develop a highly accurate

framework in terms of fraudulent transactions iden-

tification and is able to explain the decision-making

process for the users to gain maximum trust and trans-

parency. This paper integrates existing technologies

with innovative features to redefine the approach to-

ward fraud prevention in the financial sector. Besides

improved accuracy in fraud detection, some more im-

plications arise from implementing the blockchain

technology on the proposed system. All such flagged

transactions will be transparently logged, ensuring

their secure record and thus thorough auditing. This

degree of detail supports not only compliance with the

regulations but will also enhance the confidence of

the users as they interact with various financial sys-

tems. Additionally, with the use of explainable AI

mechanisms, users are able to understand decisions

made in the fraud detection process, hence building

further trust in the system. The paper is outlined in

the following sections: In Section II, pertinent litera-

ture will be reviewed in order to focus the evolution

of methodologies detecting fraud and its integration

with behavioral biometrics. Section III shall hold the

architecture proposed, which shall elucidate the al-

gorithms used and their place in the detection pro-

cess. Section IV shall be comprised of experimen-

tal results on the effectiveness demonstrated by rig-

orous testing and validation. Lastly, Section V puts

together the discussion and possible further work re-

lated to the findings within this domain. This pa-

per addresses the limitation of existing methodologies

and proposes a user-centric approach to fraud detec-

tion with the aim of significantly contributing to the

field of financial security in its path toward the robust

defence against fraudulent activities for digital trans-

actions. Integration of multi-modal behavioral bio-

metrics and real-time analytics will enhance the cur-

rent technology and has tremendous potential in fight-

ing financial fraud, thereby creating a more secure

environment for financial transactions and enhancing

the resilience of businesses to changing threats..

2 LITERATURE SURVEY

•Here, Alazizi et al. (2020) (Alazizi, Habrard, et al.

2021) present a comprehensive study on anomaly de-

tection techniques tailored for fraud detection. In do-

ing so, the authors point out that highquality datasets

play a crucial role in the performance of anomaly de-

tection models as such performance lies in the char-

acteristics of the data upon which they are built.

The authors propose a framework integrating vari-

ous anomaly detection algorithms, namely supervised

and unsupervised learning methods, to identify fraud-

ulent activities. One of the major advantages of their

methodology is that it is highly adaptable to multi-

ple datasets, thus bettering its practicability in a vast

range of fraud scenarios. However, one major draw-

back in the framework is that it is not capable of deal-

ing with the dynamic aspect of fraudulent behaviors,

thus requiring periodic updates of their model. Their

models have a good degree of accuracy; however,

their system does not offer an instant detection pro-

cess.

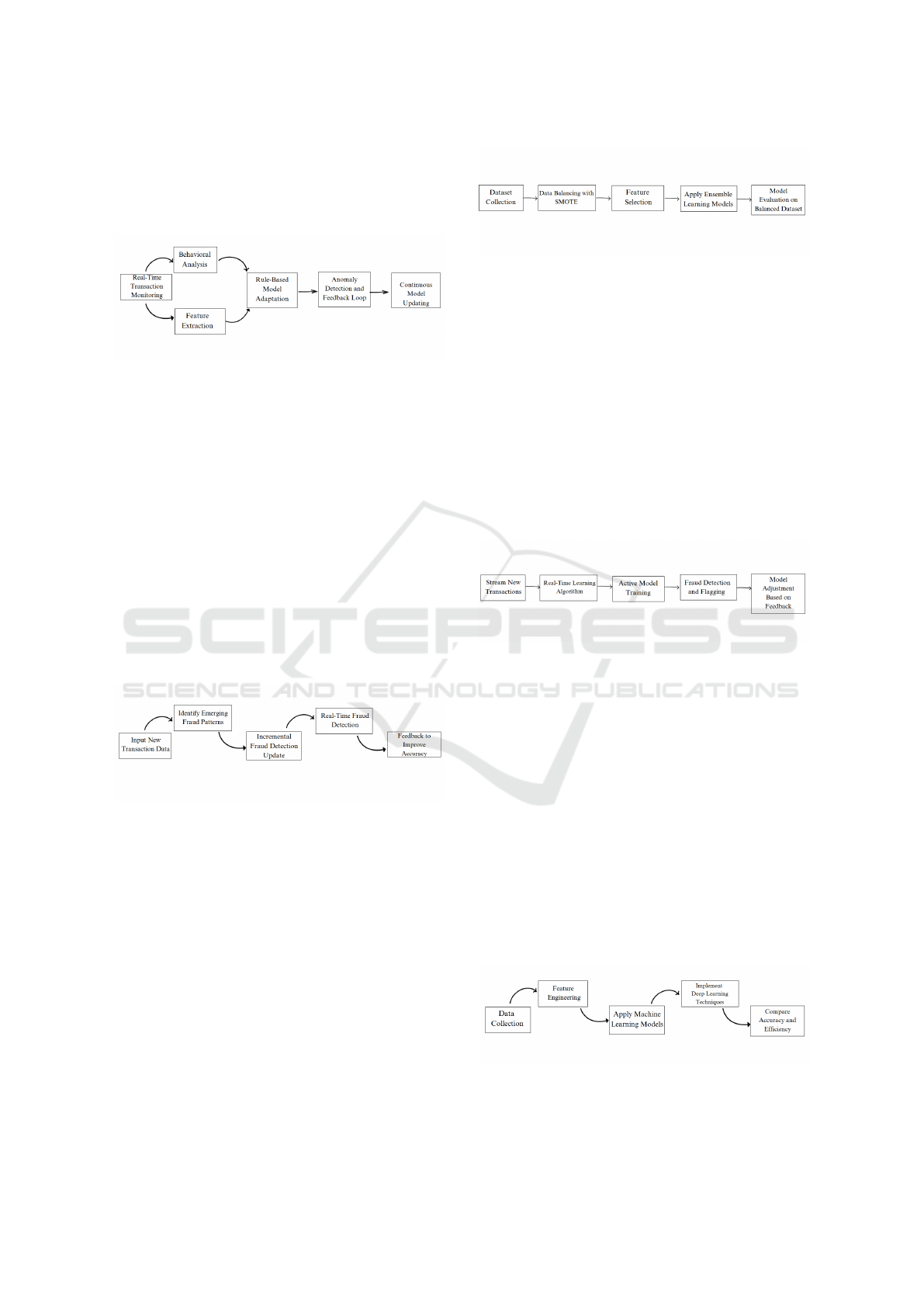

Figure 1: Anomaly Detection Work Flow for Fraud Detec-

tion

•Fawcett and Provost (1997) (Fawcett and

Provost, 1997) discussed adaptive fraud detection

methods using a decision tree. This method enables

continuous learning of new data and continually re-

fines the model towards a higher accuracy over time.

The methodology has the ability to adapt to new pat-

terns of fraud at automatic times, which is really im-

portant in this fast-evolving fraud landscape of today.

However, it has been found to adapt in some consider-

able time, which could be a drawback in cases where

INCOFT 2025 - International Conference on Futuristic Technology

322

near-instant detection is the need. The authors have

mentioned high precision and recall, but there could

be scope for lag in adaptation that may leave holes in

real-time fraud detection

Figure 2: Adaptive Fraud Detection Framework

•Lebichot et al. (2017) (Lebichot, Paldino, et

al. 2017) proposed incremental learning strategies

specifically designed for credit-card fraud detection.

Their strategy relies on using decision trees in an

adaptive manner to learn from the arriving data. The

most significant merit of this strategy is its ease of

handling streaming data, which constitutes one of the

primary requirements for fraud detection systems. In

the paper, though, some restrictions on feature selec-

tion are encountered that would prevent the model

from recognizing sophisticated fraud patterns. Their

model’s accuracy is appreciable; however, it does not

provide a comprehensive behavioral analysis.

Figure 3: Incremental learning Strategy for Credit card

Fraud Detection

•Makki, et al. (2021) (Makki, Assaghir et al.

2020) concentrates on class-imbalanced techniques

for the detection of credit card frauds. They applied

random forest and oversampling approaches to face

the prevalent class-imbalance problem of the fraud

dataset. A major benefit of their proposed technique

is the improvement of the detection rates associated

with the minority classes, which is a significant as-

pect in scenarios associated with fraud. Oversampling

may also incorporate noise into the dataset, which

may lead to false positives. It reports high accuracy

levels, but the approach may not scale up well to

large-sized datasets.

Figure 4: Imbalanced Classification Approach for Fraud

Detection

• Carcillo et al. (2020) (Carcillo, Borgne et al.

2020) discusses streaming active learning strategies in

credit card fraud detection in reallife scenarios. Their

framework uses active learning to respond to devel-

opments in the model as stream data keeps flowing

in. The main advantage of their approach is its dy-

namic update of patterns in fraud detection. However,

the authors caution that selection bias may prevail

in their sampling methods to the detriment of fraud

cases. Although they note very high accuracy of their

model, coverage may not be all-inclusive for any kind

of transaction.

Figure 5: Streaming Active Learning for Real-Time Fraud

Detection

•Alarfaj et al. (2020) (Alarfaj, Malik et al. 2020)

analyzed the current day-to-day techniques of the re-

lated literature using some state-of- the-art machine

learning and deep learning algorithms for credit card

fraud detection. The authors have used CNN and

LSTM network techniques, and their models achieved

high accuracy based on the result. However, this deep

learning method results in expensive compu- tational

costs and a slower response time, which can be dan-

gerous in a real-time fraud detection scenario. Where

their approach is quite strong, that is, in a very high

detection capability, the constraints in terms of speed

and computational requirements pose associated chal-

lenges.

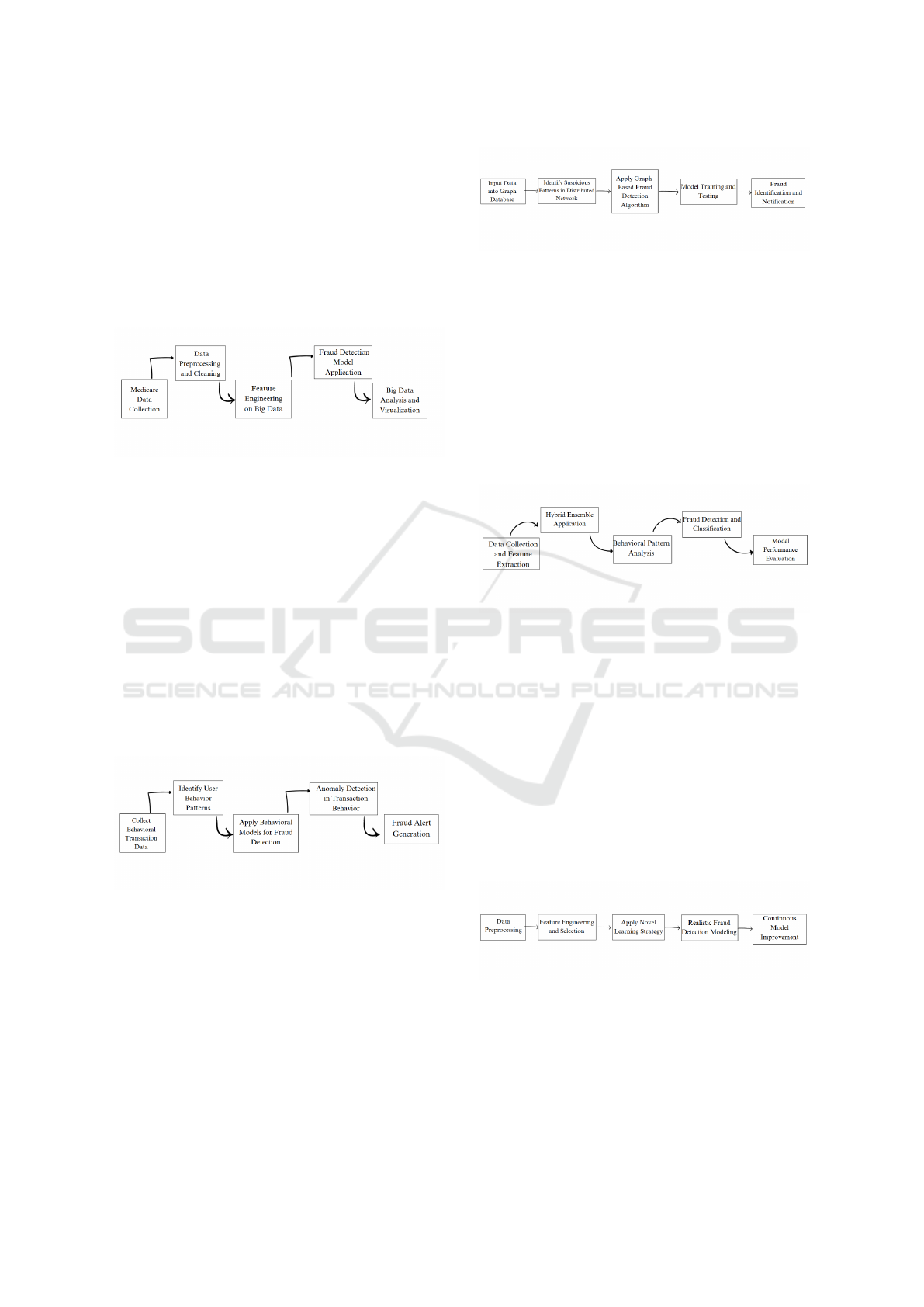

Figure 6: Big Data Medicare Fraud Detection System

•Herland et al. (2019) (Herland, Khoshgoftaar,

Adaptive Systems for Fraud Detection in Financial Transactions: A Survey on Multi-Modal Biometrics and Real-Time Analytics

323

2018) detail ways fraud can be followed by using big

data analytics in several Medicare data sources. If

combined datasets are a reflection of depth and width,

then detection would be even more precise. While the

study has adopted an all-roundedness that employed

the richness of big data, handling a significant volume

of data may become cumbersome or even delaying in

detection. This point has brought out the greater need

for more efficient data management techniques

Figure 7: Behavioral Transaction-Based Fraud Detection

Model

• According to transaction behavior analysis, Kho

and Vea (2017) (Kho and Vea, 2017) engage fo-

cus and work on the detection of fraudulent credit

cards. The methodology applied proceeds with an

understanding of the patterns of transaction of the

user to detect anomalies suitably. Probably, their ap-

proach concentrates on various user-specific behav-

iors, which will improve detection accuracy. But their

method may lack sophistication against sophisticated

fraudsters trying to mimic legitimate behavior pat-

terns.

Figure 8: Fraud Detection in Distributed Graph Databases

•Srivastava and Singh(Srivastava and Singh,

2019) introduced a fraud detection methodology

based on distributed graph databases, that has shown

to do well with the detection of fraud across inter-

linked networks. Their approach is strong regarding

determination of relationship-based analysis within

the data that helps discover even hidden patterns of

fraud but is not suitable in most individual transac-

tions.

Figure 9: Hybrid Ensemble Model for Behavioral Fraud

Detection

•Karthik et al. (Karthik, Mishra, et al. 2019) pro-

poses a hybrid ensemble model for credit card fraud

detection based on modeling user behavior patterns.

Their strategy is an amalgamation of several classi-

fiers in order to immensely improve the accuracy of

the detection process. The benefits of this strategy in-

clude very high detection rates but challeng- ing for its

implementation in terms of complexity and increased

computational requirements.

Figure 10: Realistic Modeling and Novel Learning Strategy

for Fraud Detection

• Hashemi et al. (Hashemi, Mirtaheri, et al. 2020)

discuss fraud detection from banking data by consid-

ering different types of machine learning techniques.

Efficient results are obtained by using some classi-

fiers, which are nothing but Support Vector Machines

(SVM) and Random Forests. The major drawback

in their approach is that it often needs you to retrain

the system for the appearance of new fraudulent pat-

terns. Accuracy rates reported are impressive though

the requirement of manual intervention to make up-

dates limits the operational efficiency.

Figure 11: Banking Data Fraud Detection Using Machine

Learning Techniques

•Jiang et al. (Jiang, Song, et al. 2020) propose a

new approach in credit card fraud detection using ag-

gregation strategy with feed- back mechanism. The

strategy they have suggested is integrating several

strategies to enhance the performance continuously.

INCOFT 2025 - International Conference on Futuristic Technology

324

Their approach lacks effectiveness at ex- tremely real-

time scenarios and may lose track of the required

fraud cases on time.

Figure 12: Feedback-Based Aggregation for Credit Card

Fraud Detection

•Abdul Salam et al. finally dealt with the feder-

ated learning technique with the methods being incor-

porated into credit card fraud detection and data bal-

ancing. In this research, the benefits lie in not losing

any personal data since the models are locally trained,

leaking no private information. However, federated

learn- ing is decentralized, and it results in slower up-

dates and less information sharing that develops inef-

ficient overall solutions.

Figure 13: Federated Learning Model for Fraud Detection

• In the work of Zareapoor et al. (Zareapoor, Yari,

et al. 2021), an ensemble system on fraud detection

feature selection techniques combined with ensemble

learning is discussed. As the authors noted: ”the im-

portance of the selection of the most relevant features,

as the presence of irrelevant features will reduce the

accuracy of a detection model.” Their approach uti-

lizes multiple classifiers that leverage boosting both

Logistic Regression and Decision Trees. Among its

strengths would be that it’s easy to cut down compu-

tational complexity focusing on only the meaning- ful

features. Probably one of its major weaknesses is de-

pendency on static feature sets thus probably maybe

less adaptable in cases of a changing pattern. Despite

the very high accuracy rates reported, there are also

feature set update challenges.

Figure 14: Adaptive Fraud Detection Using Multi-Modal

Biometrics

•According to Yang et al. (2021) (Yang, Zhang,

et al. 2021), this is an application of deep learning

in credit card fraud detection. Here, they apply Con-

volutional Neural Network in their model, which is

based on the pattern extracted from transaction data

and also from the user behavior pattern. One of the

important features of this method is that it uses deep

learning; thus the models capture much more com-

plex data patterns than other approaches. However,

the deep learning models require huge amounts of la-

beled data for training in the fraud-detection domain

as labelled instances are scarce. Their approach works

well and has accuracy, but there is no real-time adapt-

ability.

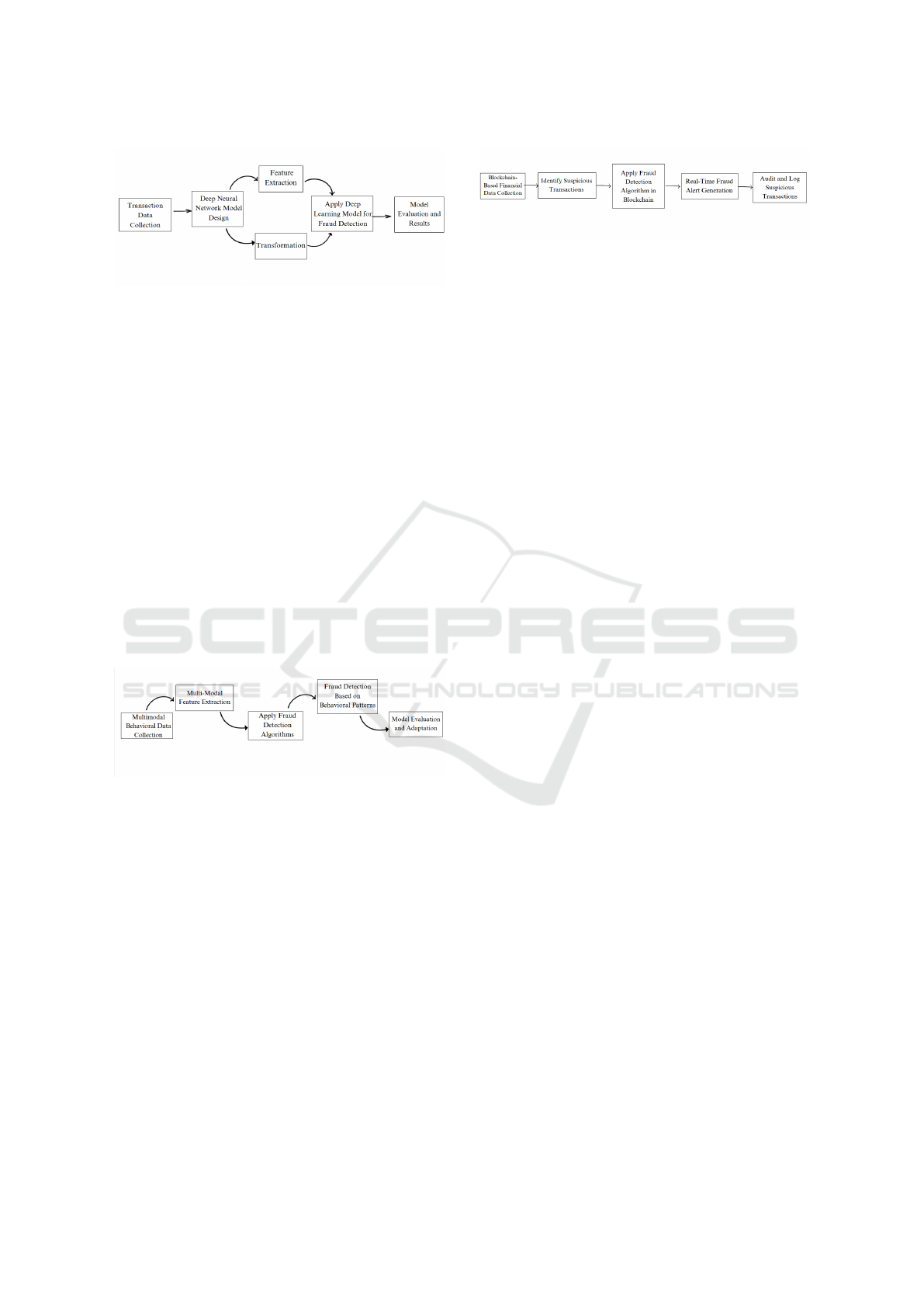

Figure 15: Real-Time Predictive Analytics in Fraud Detec-

tion

•Choudhary et al. (2022) (Choudhary, Tiwari, et

al. 2022) comes up with a novel credit card fraud

detection framework. This combines rein- forcement

learning with typical classification techniques. Their

focus is on the dynamic concept attributed to fraud

detection because they have designed their model to

alter its policy of decision based on the feedback re-

ceived from the environment. The strength of this

framework lies in learning errors from earlier moves

and thus improves over time. Conversely, actual

complexity involved in implementing reinforcement

learning might act as an in- hibitor to its practical

applicability. The authors reported improvement in

terms of accuracy detection performance, but perhaps

the time it takes to train the system could be an ob-

struction to its timeliness when urgent action is war-

ranted.

Adaptive Systems for Fraud Detection in Financial Transactions: A Survey on Multi-Modal Biometrics and Real-Time Analytics

325

Figure 16: Blockchain-Integrated Fraud Detection System

•Another highly relevant study is that of Mah-

mood et al. (2022) (Mahmood, Khedher et al. 2022)

that deals with researching techniques of Natural Lan-

guage Processing for fraud detection ap- plications in

financial transactions. Here, the authors utilize sen-

timent analysis for assessing descriptions in transac-

tions and communications by users in terms of a num-

ber of fraud indicators. One of the salient advantages

of this strategy involves innovative exploitation of text

information that may provide supplementary contex-

tual input for the system to detect fraud. However, in

the cases where transaction data are mostly numeric,

the technique has disadvantages. The reported accu-

racy is encouraging but becomes susceptible to the

quality of textual data utilized.

Figure 17: Risk-Based Dynamic Fraud Detection Model

•Finally, authors Akinwande et al. (2023) (Akin-

wande, Ajayi et al. 2023) present a federated learning

framework especially designed for fraud detection in

mobile payment systems. Their ap- proach is based

on building the model across distributed data sets

while ensuring both privacy and security for users.

The key advantage is that the privacies of users are

preserved such that sensitive data stay on the local

de- vices. The authors mention data heterogeneity as

a factor that impacts the quality of the model while

commenting on the method’s applicability. Very ac-

ceptable accuracy has been achieved; however, the

challenges associated with federated learning limit

the real-time responsiveness of the system.

Figure 18: Explainable AI in Fraud Detection

3 GAP FINDINGS

The literature review demonstrates that, even when

all fraud detection systems had been improved in

many ways, the problems were still enormous. In-

deed, most of the studies applying traditional ma-

chine learning methods with models such as Random

Forests and Support Vector Machines have not ad-

dressed the real-time adaptability of fraud detection

systems and ignored that fraud patterns have always

changed with time and that even historical data might

be insufficient for fraud detection systems where new

fraud patterns are emerging. Besides, papers based

on static behavioral biometrics are mostly concen-

trated on single-modal data such as keystroke dy-

namics or mouse movement with very limited ca-

pabilities of capturing holistic user behavior under

changing conditions.Most of the models were en-

hanced in detection accuracy using deep learning al-

gorithms such as Convolutional Neural Networks, but

most of them lack scalability and computational ef-

ficiency in large-scale, real-time applications. Other

ensemble methods increased detection rates but suf-

fer from high false-positive rates, which may eventu-

ally become a painful user experience. In addition,

nearly all the modelbased reviews are tested on static

datasets while the realtime environment with contin-

uous changes in behavior can be questioned. In addi-

tion, although integrating with blockchain to enhance

the transparency of transactions is under-explored in

most systems, it leaves a potential flaw in auditing

and identifying fraudulent activities. Most of the pa-

pers using SMOTE balancing data techniques have

not taken into account dynamic trends in fraud, nor

do they provide an explanation regarding the role of

multimodal biometric modes, like emotional recogni-

tion, and facial recognition modes. Lastly, although

many algorithms have been developed targeting the

specific aspects of fraud detection, none of them inte-

grates, to a full extent, a comprehensive multi-modal,

real-time predictive analytics approach that adapted in

a balanced way both between the aspects of detection

accuracy and computational efficiency as fraud tactics

continuously evolve.

INCOFT 2025 - International Conference on Futuristic Technology

326

4 CONCLUSIONS

Adaptive Fraud Detection in Financial Transactions

Using Multi-Modal Behavioral Biometrics and Real-

Time Predictive Analytics: A Novel Perspective on

Modern Advanced Financial Fraud Challenges, a pa-

per posits a new approach to the extensive challenges

emerging in modern advanced financial fraud. It uses

adaptive evolving patterns of fraud that observe be-

havioural biometrics, combined with real-time ana-

lytics and advanced machine learning, to further de-

crease false positives in fraud detection, thus making

the detection more effective and accurate. There is

a combination of overall behavioral inputs, such as

dynamics of typing, mouse movement, facial recog-

nition, and traditional financial data in the proposed

model, so that an all-inclusive view of user behavior

comes up to ensure very efficiency against sophisti-

cated fraud strategies. With the implementation of

blockchain technology, it would be possible to au-

dit flagged transactions also, thereby enhancing the

transparency and security associated with fraud de-

tection. The proposed solution is real-time in nature,

making fraud prevention proactive as possible; thus,

it minimizes financial losses further while strength-

ening the trust of users in digital transactions. This

adaptive system is far more efficient at detecting fraud

with minimal interruptions to legitimate transactions

as compared to extant systems that are based solely

on static mechanisms built around rules, and provide

high false positives. Scope for Personalizing Fraud

Detection with Individual User Behavior This dy-

namic risk assessment model has the scope for per-

sonalizing fraud detection based on individual user

behavior, which indicates how security and conve-

nience can be balanced. Future work will probably

rely on expanding the scope of the system by in-

corporating a much wider variety of behavioral bio-

metrics apart from user behaviors. The future work

may also include the healthcare and e-commerce do-

mains. Therefore, an absolute scaling optimization

of the system will be absolutely required in conjunc-

tion with more complex and large financial infrastruc-

tures for mass deployment of the system. In conclu-

sion, the paper is an important step for fraud detection

techniques, since it is innovative, avoiding the weak-

nesses of current techniques and providing a basis for

further innovations related to adaptive behaviorbased

fraud detection. This proposed system probably will

revolutionize ways of securing transactions inside a

financial industry moving toward higher levels of dig-

italization and fluidity.

REFERENCES

Ayman Alazizi, Amaury Habrard, Franc¸ois Jacquenet,

and Liyun HeGuelton, ”Anomaly Detection, Consider

your Dataset First: An illustration on Fraud Detec-

tion,” 2021.

T. Fawcett and F. Provost, ”Adaptive Fraud Detection,”

NYNEX Science and Technology, White Plains, NY,

1997.

B. Lebichot, G. M. Paldino, W. Siblini, L. He-Guelton,

F. Oble´, and G. Bontempi, ”Incremental Learning

Strategies for Credit Card Fraud Detection,” in Pro-

ceedings of the 2017 IEEE International Conference

on Data Mining Workshops (ICDMW), New Orleans,

LA, USA, 2017, pp. 180-187.

S. Makki, Z. Assaghir, Y. Taher, R. Haque, M.-S. Hacid,

and H. Zeineddine, ”An Experimental Study With Im-

balanced Classification Approaches for Credit Card

Fraud Detection,” IEEE Access, vol. 8, pp. 157685-

157695, 2020.

F. Carcillo, Y.-A. Le Borgne, O. Caelen, and G. Bontempi,

”Streaming Active Learning Strategies for Real-Life

Credit Card Fraud Detection: Assessment and Visual-

ization,” IEEE Transactions on Neural Networks and

Learning Systems, vol. 31, no. 3, pp. 826-838, Mar.

2020.

F. K. Alarfaj, I. Malik, H. U. Khan, N. Almusallam, M.

Ramzan, and M. Ahmed, ”Credit Card Fraud De-

tection Using State-of-the-Art Machine Learning and

Deep Learning Algorithms,” IEEE Access, vol. 8, pp.

189102-189120, 2020.

M. Herland, T. M. Khoshgoftaar, and R. A. Bauder, ”Big

Data Fraud Detection Using Multiple Medicare Data

Sources,” Journal of Big Data, vol. 5, no. 1, pp. 1-15,

2018.

J. R. D. Kho and L. A. Vea, ”Credit Card Fraud Detection

Based on Transaction Behavior,” International Journal

of Computer Applications, vol. 159, no. 8, pp. 1-5,

2017.

S. Srivastava and A. K. Singh, ”Fraud Detection in the Dis-

tributed Graph Database,” in Proceedings of the 2019

IEEE 2nd International Conference on Data Science

and Information Technology (DSIT), Bangkok, Thai-

land, 2019, pp. 168-173.

V. S. S. Karthik, A. Mishra, and U. S. Reddy, ”Credit Card

Fraud Detection by Modelling Behaviour Pattern us-

ing Hybrid Ensemble Model,” International Journal

of Computer Applications, vol. 182, no. 40, pp. 1-7,

2019

A. Dal Pozzolo, G. Boracchi, O. Caelen, C. Alippi, and G.

Bontempi, ”Credit Card Fraud Detection: A Realis-

tic Modeling and a Novel Learn- ing Strategy,” IEEE

Transactions on Neural Networks and Learning Sys-

tems, vol. 29, no. 8, pp. 3782-3794, Aug. 2018.

S. K. Hashemi, S. L. Mirtaheri, and S. Greco, ”Fraud De-

tection in Banking Data by Machine Learning Tech-

niques,” Applied Sciences, vol. 10, no. 2, p. 641, 2020.

C. Jiang, J. Song, G. Liu, L. Zheng, and W. Luan, ”Credit

Card Fraud Detection: A Novel Approach Using Ag-

gregation Strategy and Feedback Mechanism,” Inter-

national Journal of Information Technology, vol. 12,

no. 2, pp. 1-8, Apr. 2020.

M. Zareapoor, M. Yari, and F. Abdollahzadeh, ”An En-

semble Learning Approach for Fraud Detection Using

Feature Selection Techniques,” Journal of Information

Security and Applications, vol. 57, p. 102704, 2021

Adaptive Systems for Fraud Detection in Financial Transactions: A Survey on Multi-Modal Biometrics and Real-Time Analytics

327

X. Yang, Y. Zhang, and X. Zhou, ”Deep Learning for Credit

Card Fraud Detection: A Comprehensive Review,”

IEEE Transactions on Computational Social Systems,

vol. 8, no. 2, pp. 157-173, Apr. 2021.

A. Choudhary, S. Tiwari, and A. K. Mishra, ”Reinforcement

LearningBased Framework for Credit Card Fraud De-

tection,” Journal of King Saud University - Computer

and Information Sciences, 2022.

H. Mahmood, A. M. A. Khedher, and A. M. Anis, ”Senti-

ment Analysis in Credit Card Fraud Detection: A Nat-

ural Language Processing Approach,” Journal of Am-

bient Intelligence and Humanized Computing, vol. 13,

no. 1, pp. 273-284, Jan. 2022.

A. Akinwande, O. Ajayi, and F. I. Oyetunji, ”Federated

Learning Framework for Credit Card Fraud Detec-

tion in Mobile Payment Systems,” Future Generation

Computer Systems, vol. 142, pp. 244-257, Feb. 2023.

INCOFT 2025 - International Conference on Futuristic Technology

328