Predictive Modeling of Bitcoin Transaction: Daily Analysis

Dharshini G

1

a

, Bhavadharani K

1

b

, Dhivya Bharathi T

2

c

and Arunkumar T

2

d

1

Kongu Engineering College, Erode, Tamil Nadu, India

2

Department of Computer Science and Engineering, Erode, India

Keywords: Cryptocurrency-Bitcoin, Blockchain, Deep Learning, Prophet, LSTM, GRU.

Abstract: With the fast development of the cryptocurrency market, the accurate price prediction of cryptocurrency has

become a fault finding for traders. However, because of the difficult and unpredictable nature of price

movements which do not have a simple pattern. This makes it complex to examine sequential data points

covered over a long period of time. The prediction of cryptocurrency by researchers has explored various

approaches which includes Machine Learning (ML) and Deep Learning (DL) to forecast price movements.

Factors such as sudden market shifts, external events and investor sentiment contribute to unpredictability.

To forecast the price of bitcoin cryptocurrency with Prophet, Long short term memory (LSTM), gated

recurrent neural networks to segment the data which consists of daily and half-hourly data transactions were

used. In terms of evaluation metrics Mean Absolute Error (MAE), R-Squared, Mean squared error (MSE)

were used.

1 INTRODUCTION

Considering the high volatility of cryptocurrency and

potential for rapid appreciation, cryptocurrencies

have evolved into a prominent category of securities

in the global financial system, grabbing the curiosity

of both investors and researchers. The global trading

of Bitcoin, Ethereum, and other digital currencies

over a spectrum of platforms result in sophisticated

price swings that are influenced by a multitude of

factors, including sentiment among investors,

transaction volumes, and external regulatory

modifications. Although these markets are so

unreliable and non-linear, estimating the pricing of

bitcoin is still always pretty challenging promise.

Blockchain technology, which underpins

cryptocurrencies, provides a wealth of publicly

available transaction data. This data includes

variables such as transaction volume, mining

difficulty, and the total number of transactions, all of

which can offer insights into market behavior and

price trends. By leveraging this blockchain

transaction data, researchers have turned to advanced

time series forecasting models to predict market

prices in real-time.

This literature review focuses on the application

of three models—Prophet, Long Short-Term Memory

(LSTM), and Gated Recurrent Unit (GRU) - to

cryptocurrency price prediction. Each of these

models has distinct strengths and weaknesses when

dealing with time series data, particularly in the

context of volatile markets. The review examines

how these models have been employed in similar

studies, compares their performance, and discusses

the challenges and future directions in cryptocurrency

price forecasting.

2 RELATED WORK

The research effort explores at how social media

activity, including data from Twitter and Google

Trends, might be used to forecast changes in the

prices of Bitcoin and Ethereum. It emphasises that

tweet volume, which is consistently overwhelmingly

optimistic despite market trends, is a more accurate

indicator of price fluctuations than sentiment

analysis. Price changes are accurately predicted using

a linear model that incorporates tweet volume and

Google Trends data, providing traders with useful

information for making decisions. The study comes

to the conclusion that keeping an eye on tweet volume

gives traders of cryptocurrencies a major advantage

by improving their capacity to predict market

G, D., K, B., T, D. B. and T, A.

Predictive Modeling of Bitcoin Transaction: Daily Analysis.

DOI: 10.5220/0013611300004664

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 3rd Inter national Conference on Futuristic Technology (INCOFT 2025) - Volume 3, pages 173-180

ISBN: 978-989-758-763-4

Proceedings Copyright © 2025 by SCITEPRESS – Science and Technology Publications, Lda.

173

moves(Abraham, Higdon, et al. , 2018). The survey

article on change point identification in historical data

is briefly represented in this paragraph. Change

points, or sudden changes in data patterns, are usually

employed to indicate state transitions and have a wide

range of uses, such as human activity detection,

healthcare inspection, climate analysis, and voice and

depict processing. It also describes potential hurdles

for the field's advancement and presents criteria for

analysing these algorithms. Researchers as well as

professionals interested in the analysis of time series

and its various applications will find this thorough

overview to be pertinent(Aminikhanghahi, and,

Cook, 2016).

It examines the privacy restrictions of Bitcoin in

an academic context by examining both simulated

and actual transactions. Approximately 40% of the

user database could be recreated even with the usage

of suggested privacy precautions. This paper provides

an in-depth assessment of Bitcoin's privacy concerns,

highlighting its problems with

transparency(Androulaki, Karame, et al. , 2013). The

research used a vector Auto regression (VAR) model

to examine what macroeconomic factors affected

Ghana's exchange rates between 2000 and 2019. Real

GDP granger causes exchange rate initiatives,

whereas other variables have indirect effects,

according to an analysis of the broad money supply

(M2), lending rates, inflation, and real GDP. The

analysis was supported by data from the Ghana

Statistical Service, World Development Indicators,

and the Bank of Ghana. In order to lower inflation,

boost output, and eventually stabilise the exchange

rate through higher GDP, the study suggests measures

that lower lending rates and the money supply.

(Antwi, Issah, et al. , 2020). A pair of methods for

effectively detecting segment neighbourhoods—

contiguous residue sets with common features—are

presented in the current investigation. These methods,

which support a variety of models and fit functions

which includes maximum likelihood and least

squares, estimate the model parameters essential

define these communities and establish their

boundaries. They provide versatility for a range of

applications by iteratively detecting significant

sequence properties. When one technique was used to

the influenza virus's haemagglutinin protein, a break

in the powerful heptad repeat structure suggested a

possible mechanism for conformational shift. This

demonstrates how useful the algorithms can be in

researching structural biology (Auger, Lawrence, et

al. , 1889). The increasing market value of digital

currencies and their potential to consolidate power

and lessen global dominance are examined in this

article. It draws attention to the erratic nature of

virtual currencies and the need for accurate

techniques for predicting their prices. Incorporating

characteristics like stock market the capitalisation,

trade volume, distribution, and delivery indicators, a

new forecasting model is presented. The method

shows how effective the model is in predicting the

values of digital currencies by using active LSTM

networks to examine benchmark datasets and long-

term trends. The results highlight how sophisticated

machine learning methods might enhance

cryptocurrency prediction(Biswas, Pawar, et al. ,

2021).

Wild Binary Segmentation (WBS), a novel

technique for estimating the quantity and positions of

authority of many change-points in data, is introduced

in this study. WBS uses a random globalisation

mechanism, which allows it to detect small jump

magnitudes and closely spaced change-points without

the need for a window or span parameter, in contrast

to normal binary segmentation. This method

preserves implementation simplicity and

computational efficiency. With suggested parameter

defaults, the authors suggest two stopping criteria:

thresholding and a reinforced Schwarz information

criterion. The R function wbs on CRAN offers WBS's

implementation, and comparative analyses

demonstrate its superior performance (Fryzlewicz, ,

et al. , 2014). According to the paper's assessment of

RNN models for cryptocurrency price prediction,

GRU has the lowest MAPE scores and is the most

precise for Bitcoin, Litecoin, and Ethereum. To

increase predicting accuracy, future research suggests

merging social media and trade volume (Hamayel,

and, Owda, 2021). The paper evaluates deep learning

models for predicting bitcoin prices, such as CNN,

LSTM, and BiLSTM, and concludes that they are

inadequate for capturing market complexity. To

increase forecasting accuracy, it recommends

investigating cutting-edge algorithms and feature

engineering.

Using significant supply and demand-related

aspects from blockchain data, this study investigates

the use of Bayesian Neural Networks (BNNs) for

modelling and forecasting Bitcoin price time series.

When comparing BNNs to other benchmark models,

empirical research shows how successfully they

anticipate prices and account for the extreme

volatility of Bitcoin. This demonstrates how BNNs

can be used to increase the forecasting accuracy of

price of bitcoin(Jang, Lee, et al. , 2017).

INCOFT 2025 - International Conference on Futuristic Technology

174

3 PROPOSED WORK

This section demonstrates the existing work relevant

to blockchain technology. We have discussed the

methods based on machine learning and deep

learning.

3.1 Time Series

By investigating past developments while

establishing an assumption that future trends will

appear similar, it is one of the most effective

approaches for anticipating circumstances with an

appropriate degree of future unpredictability. With

the goal to cope with forecasting obstacles with a time

component, time series forecasting additionally

incorporates data for efficient and effective

preparation.

3.2 Approaches For Bitcoin Prediction

Recurrent Neural Network: Neural networks that

are artificial were inspired by the information

receiving processes that operate in the human brain.

The computerized neurons that make up the neural

network are defined by its architecture. RNNs differ

from traditional neural networks in that they typically

consist of feedback loops. Therefore, it matters

whether the context of that data influences how well

a prediction can be generated. The recurrent

arrangement of an RNN's layers implies that each

neuron's present configuration depends on its

previous state, thereby giving the neural network a

limited amount of memory. A neural network with

recurrent operation can accept sequential data as

input, and its result and input networks may both be

sequences of different lengths that progressively visit

each cell.

Prophet: Prophet is a strategy to anticipate time

series data utilising an additive model. It combines

non-linear trends with seasonality on a daily, weekly,

and yearly schedule, alongside the effects from

breaks. Strong seasonal consequences within time

series and numerous seasons of historical information

are ideal considering their efficacy. Prophet generally

handles anomalies well and is impervious to

insufficient figures and trend fluctuations.

Random Forest Regressor: Regarding

regression-related responsibilities, an algorithm

based on Deep Learning referred to as Random Forest

Regressor is implemented. This collaborative

technique of learning integrates numerous decision

tree models in order to arrive at predictions. The

Random Forest Regression Technique creates a forest

of trees of decisions, whereas every one of them, after

training on a randomly assigned portion of the

training data including substitution (self-funded

sample), generates a distinct prediction. Either the

overwhelming percentage of the vote (for

categorisation) or the computation of each tree's

forecast (for regression) yields the final predicted

value of the Random Forest Regressor (RF

Regressor).

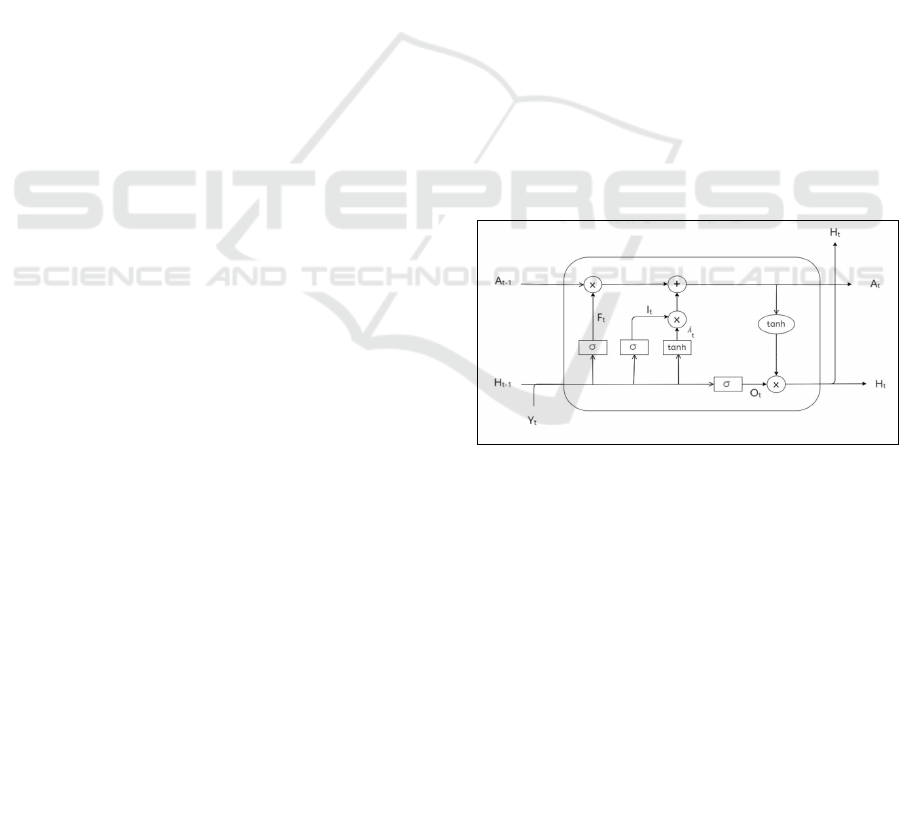

Long short-term memory: Recurrent neural

network (RNN) layers with Long Short-Term

Memory are specifically engineered to manage

sequential data. By adding gating methods, they solve

the vanishing gradient issue with conventional RNNs

and improve their ability to capture long-term

dependencies. The input gate (I), forget gate (F), and

output gate (O) make up its three gates. Over time,

the LSTM can recall or forget information thanks to

these gates, which regulate the information flow

across the cell state. Because of the extra gate (forget

gate), LSTM usually has more parameters than GRU.

This can increase the power of LSTM but also

increase its susceptibility to overfitting, particularly

on smaller datasets. LSTM has the capacity to

discover more intricate patterns and relationships in

the data because of its more intricate design. It works

effectively for assignments where documenting long-

term dependencies is essential.

Figure 1: LSTM architecture.

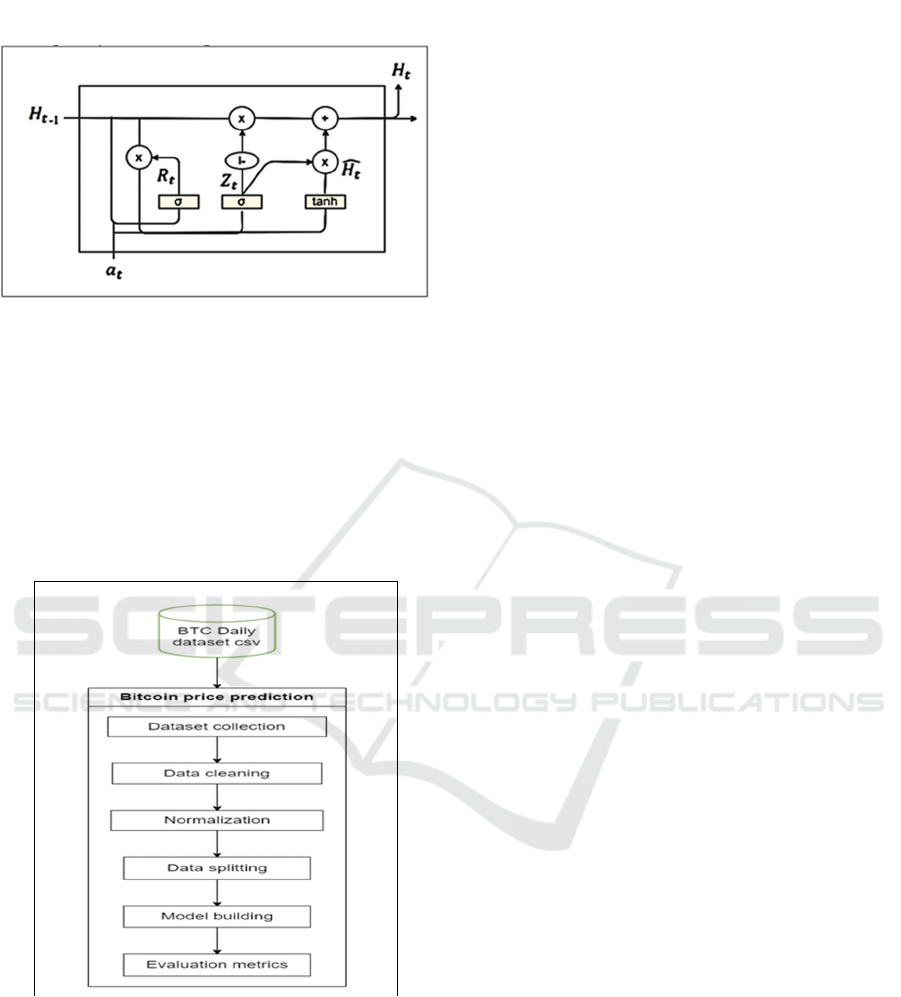

Gated Recurrent Unit (GRU): The two gates

that make up the simplified architecture of GRU are

the reset gate (R) and the update gate (Z). The reset

gate chooses what information should be erased from

the past, while the update gate decides how much of

the prior hidden state should be kept. Due to the forget

gate's absence, GRU has fewer parameters. It can be

less prone to overfitting and more computationally

efficient as a result, which makes it an excellent

option for smaller datasets. GRU is still capable of

efficiently capturing long-term dependencies despite

its simplicity. It is a common choice for a variety of

sequence modeling applications and works well in

many natural language processing jobs. GRU may be

Predictive Modeling of Bitcoin Transaction: Daily Analysis

175

more effective for larger datasets because it can train

more quickly with fewer parameters.

Figure 2: GRU architecture.

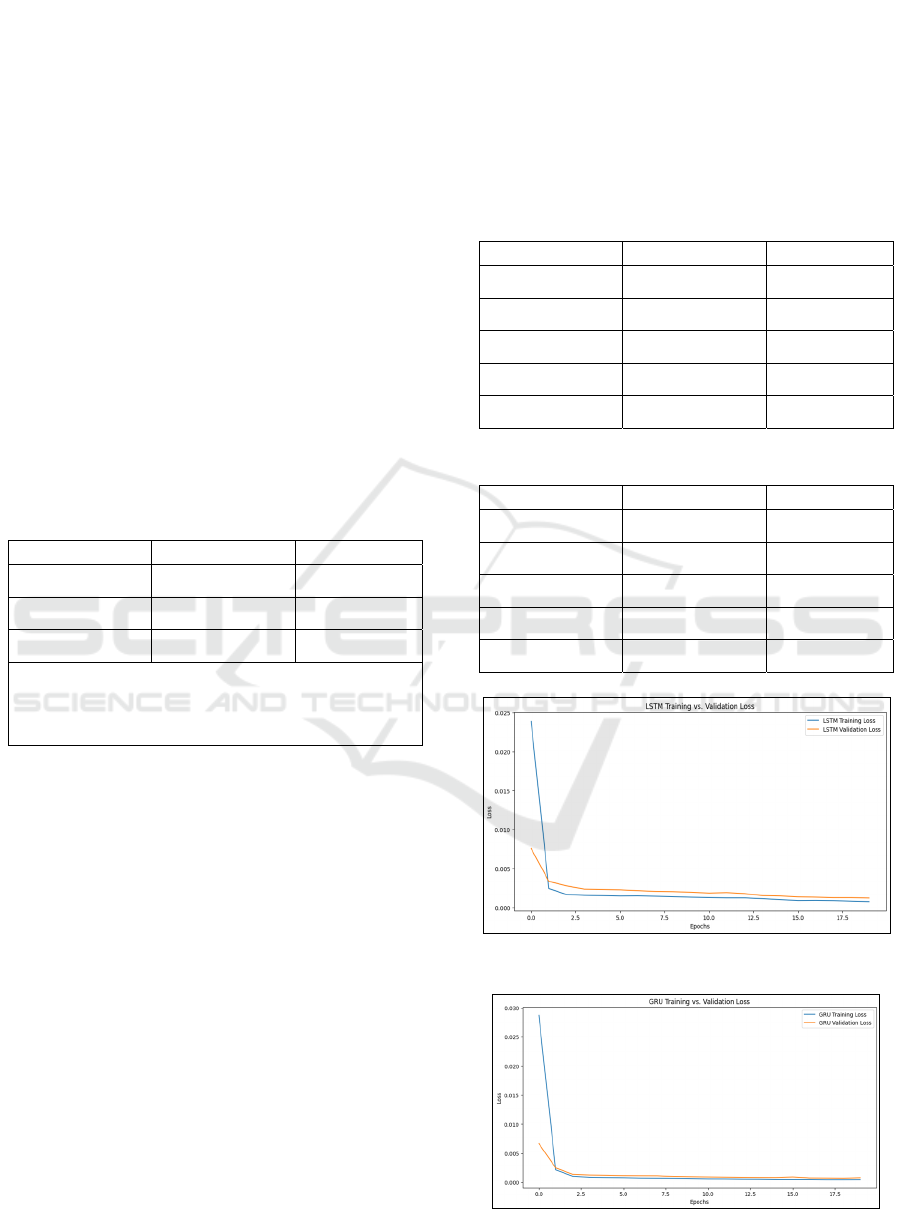

4 PROPOSED MODEL:

PREDICTIVE ANALYSIS

This section on three basic elements. They are

used to predict the price of cryptocurrency: 1)

Collection of dataset over a time; 2) Pre-processing;

3) Model building based on the algorithm

Figure 3 Proposed model for BTC transaction.

In our paper, we used similar methods which includes

Prophet, LSTM, GRU with different datasets with huge

amounts of data from Kaggle website. With all these

algorithms we have evaluated. These all the methods helped

to improve the accuracy.

5 TESTING THE PROPOSED

MODEL

An experiment tested with the DL models (RNN,

LSTM, GRU, Prophet) for forecasting BTC price.

5.1 Data Collection

The analysis used data that had been obtained from

the Bitcoin digital currencies in CSV format, consult

the Kaggle website. The dataset includes numerous

rows, such as mempool size, transaction rate, market

cap usd, average block size, market price usd,

exchange volume usd, average confirmation time,

hash rate, difficulty, miners revenue, total transaction

fees as illustrated in Fig. 5, the time span 2015-01-01

to 2023-09-02.Sample information retrieved from the

cryptocurrency records employed in the research,

with the investigation serving to be the only primary

variable and the present day market value for Bitcoin.

5.2 Data Preprocessing

Preprocessing steps are crucial for cleaning and

preparing the data before analysis or modeling. Raw

data often contains inconsistencies, formatting issues,

or non-numerical elements that need to be addressed

to ensure accurate results.

• Data Cleaning: The dataset contains more

number of null values and they are preprocessed

by calculating the mean value of the missing

values and some formats are to preprocessed

• Feature Selection: Converting the values to a

numerical format like float enables various

mathematical calculations, statistical analyses,

and machine learning algorithms that require

numerical data. Before doing some numerical

calculations we have to remove dollor signs,

commas.

• Normalization or Standardization: The

preprocessing of the dataset involves using the

formulas for the standard scaler and minmax

scaler functions. The data has been scaled with

the aid of this function to provide values that lie

between zero to one.

• Test-Train splitting: Use train_test_split to split

the sequences and targets into training and

testing sets (e.g., 80% training, 20% testing). The

training set is used to train your model, while the

test set is used to evaluate its performance on

unseen data. This helps you avoid overfitting,

which occurs when your model memorizes the

INCOFT 2025 - International Conference on Futuristic Technology

176

training data too well and doesn't generalize well

to new data.

5.3 Bitcoin Price Movement Prediction

using Deep learning models

The model processes historical data, including price,

volume, and market trends, to forecast future price

movements. The project helps traders and investors

make informed decisions by providing accurate price

predictions based on past patterns. The architecture of

the DL models: (1) Prophet (2) LSTM (3) GRU is

shown below:

Prophet : Facebook's Prophet model is a

sophisticated forecasting engine that can handle time-

series information effectively, especially during

instances involving significant trends, seasonality,

and anomalies. It is appropriate for datasets that can

show abrupt shifts or cyclical patterns, such as

transactions made on Bitcoin. The time sequence has

been divided down by the model into the following

three primary groups: trend, seasonality, and

holidays/events. While the volatility component

models recurrent patterns (such as weekly or annual

cycles), the trend factor captures the broader long-

term growth or decrease in the data. Furthermore,

users can define additional occurrences (for instance,

market announcements) that could influence the data;

the seasonal component takes responsibility for

everything.

A dataframe with two columns, y (the target

variable) and ds (the timestamp), makes up Prophet's

input. Regarding the forecasting of transactions made

using Bitcoin, y could indicate for either the market

price or the volume of transactions, while ds stands

for the daily timestamps. In order to forecast the

future, Prophet analyses this previous data and

discovers the underlying trends. It is a useful option

for cryptocurrency data since it can automatically

identify the trend and seasonal patterns of the time-

series and has the flexibility to take into account

varying growth rates and irregular patterns.

Prophet can produce projections for a given

number of future periods once the model has been

trained. In order to present a range of possible

outcomes, the output contains anticipated values

(yhat) for each future time step together with

uncertainty intervals (yhat_lower and yhat_upper). In

your situation, this entails forecasting future

transaction volumes or Bitcoin prices by utilising the

seasonality and pattern identified from historical data.

The output of the model is quite interpretable, which

facilitates understanding of the elements influencing

the forecasts and offers insightful information about

potential future transaction behaviour.

Long Short Term Memory: A particular kind of

recurrent neural network (RNN) called Long Short-

Term Memory (LSTM) is made especially to process

sequential data and identify long-term dependencies.

When data points are temporally sensitive, such as in

time-series forecasting jobs like predicting Bitcoin

transactions, it works quite well. Because LSTM

resolves the issue of vanishing and exploding

gradients, it can learn patterns across lengthy

sequences, in contrast to conventional RNNs. LSTMs

control the information flow by combining input,

forget, and output gates. This allows the network to

gradually retain or forget different types of

information based on how important they are to the

prediction.

A three-dimensional tensor with the shape of

(samples, time steps, features) is the input for an

LSTM. Every time step in your model correlates to a

point in the residual series that was derived from the

predictions of the Prophet model. To anticipate the

next point, the model uses sequences of ten points of

information from the residual series as input, for

example, if you set the time step to 10. The input units

in each LSTM layer have 50 memory cells (or

neurons), and the network is built in a way that sends

an ordered set of variables to the subsequent LSTM

layer or to the most dense layer, regardless of whether

the output is returned for each time step or solely the

last one as shown in Table I.

To improve the forecast, the Prophet model's

predictions are coupled with the LSTM output, which

is a projected future point. After that, MinMaxScaler

is used to scale the residuals back to their original

form, producing residual predictions that improve the

accuracy of Bitcoin transaction forecasts.

Table 1: Long Short Term Memory (LSTM).

Layer(type) Output shape Param #

lstm (LSTM) (None, 1, 50) 10,400

lstm_1 (LSTM) (None, 50) 20,200

dense (Dense) (None, 1) 51

Total params: 91,955

Trainable params: 30,651

Non-trainable params: 0

O

p

timizer

p

arams: 61,304

Gated Recurrent Unit: The Gated Recurrent

Unit (GRU) is a streamlined version of the LSTM

model, intended to identify sequential patterns in

time-series data while exhibiting reduced

computational complexity. Similar to LSTM, GRU

Predictive Modeling of Bitcoin Transaction: Daily Analysis

177

effectively manages long-term dependencies while

streamlining its internal architecture by minimising

the number of gates utilised. It uses just two gates—

an update gate and a reset gate—to manage the flow

of information. The update gate lets the model decide

how much past knowledge needs to be carried

forward, while the reset gate determines how much of

the past information to forget. This reduced

architecture makes GRU faster to train compared to

LSTM, while still being powerful for jobs like

forecasting Bitcoin transaction trends.

A Broader Regression (GRU) model handles a

series of residuals gathered from the Prophet model

using a three-dimension tensor input, comparable to

an LSTM. Each layer of the GRU contains 50 neural

networks that use the data to learn temporal

correlations. The result is a series of anticipated

residual values that demonstrate brief variations in

Bitcoin transaction data. These values are merged

with LSTM and Prophet forecasts to improve the

forecast throughout its entirety, as shown in Table II.

Table 2: Gated Recurrent Unit (GRU).

Layer(type) Output shape Param #

gru _2 (GRU) (None, 10, 50) 7,950

gru_3 (GRU) (None, 50) 15,300

dense_6 (Dense) (None, 1) 51

Total params: 69,905

Trainable params: 23,301

Non-trainable params: 0

O

p

timizer

p

arams: 46,604

6 EXPERIMENTAL RESULTS

AND DISCUSSION

6.1 Model Training

In the first step, we trained with DL models on the

dataset, dividing it into two groups of eighty percent

training and twenty per cent testing, in order to

determine the optimal DL model. As will be

discussed within Section 6, the DL models were

evaluated and compared using four assessment

measures: MSE, MAE, and R-squared error.

6.2 Epochs

An algorithm's complete traversal through a training

dataset is called an epoch. When the information set

completes both forward and backward passes, it has

completed one pass. The aim of an epoch is used to

modify the model's parameters in order eliminate

error and enhance accuracy depending on the training

set. The algorithm iterates through the training dataset

based on the number of epochs; batch gradient

descent iterates through a single batch. Until the error

rate of the model is deemed acceptable, the process is

repeated. Therefore, we used 100 epochs.

Table 3: Loss Vs Val_loss of LSTM.

Epoch Loss Val_loss

1/100 0.0611 0.0076

2/100 0.0030 0.0036

3/100 0.0018 0.0025

4/100 0.0017 0.0024

5/100 0.0016 0.0023

Table 4: Loss Vs Val_loss of GRU.

Epoch Loss Val_loss

1/100 0.0423 0.0052

2/100 0.0018 0.0019

3/100 0.0012 0.0013

4/100 0.0010 0.0013

5/100 0.0009 0.0012

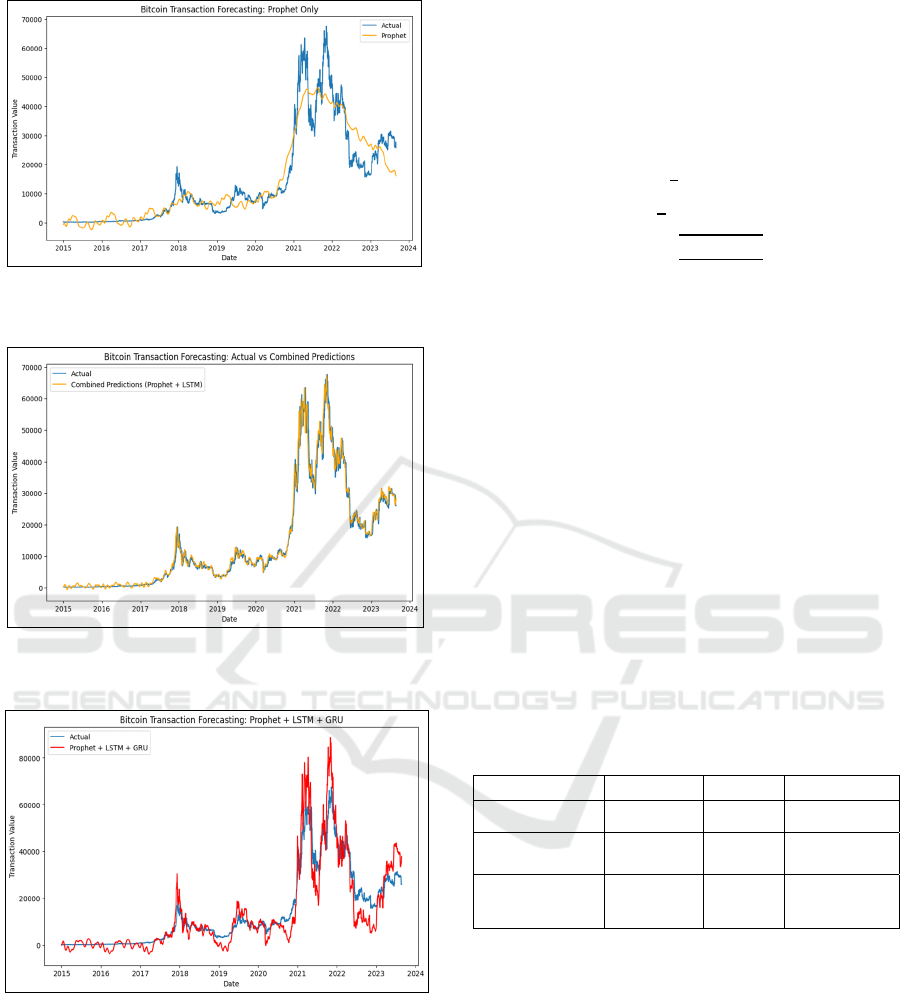

Figure 4: LSTM model loss for training and validation.

Figure 5: GRU model loss for training and validation.

INCOFT 2025 - International Conference on Futuristic Technology

178

Figure 6: BTC transaction prediction based on Prophet

model

.

Figure 7: BTC transaction prediction based on

Prophet+LSTM.

Figure 8. BTC transaction prediction based on

Prophet+LSTM+GRU.

Tables III to IV shows the validation loss and loss

of each epoch on LSTM and GRU. Fig 4 to 5,

indicates the model performance which decrease for

each epoch that performs optimally. The prediction

model of actual and predicted pharse are shawn in Fig

6 to 8.

6.3 Evaluation Metrics

We measure the forecast mistakes using the Mean

Absolute Error (MAE), Means Square Error (MSE)

and Root Mean Squared Error (RMSE) in order to

assess the effectiveness of model forecasting.

MAE =

∑

|𝑧 𝑧̂|

(1)

MSE =

∑

𝑧 𝑧̂

(2)

RMSE =

∑

̂

(3)

Despite grabbing responsibility for their direction,

the MAE evaluates the mean magnitude of the falls in

a series of forecasting. Authenticity for variables that

are continuous is tracked.

6.4 Prediction Model Outcomes

This section preforms predictive modeling of Bitcoin

transaction dataset between 2015-01-01 and 2023-09-

02. Table 5 shows the overall outcome of our error

values. The comparison between actual and predicted

values of BTC transaction of daily analysis is shown

in Fig as well.

Table 5 shows that Prophet+LSTM has the lowest

MAE, MSE values and the greatest R-squared values

when compared to other. Prophet+LSTM is better

than Prophet and combination of Prophet, LSTM and

GRU.

Table 5: Summary Of Model Predictions.

Model MAE R2 MSE

Prophet 3752.754 0.8812 30643.45

Prophet+

LSTM

1274.5235 0.9818 46804.31

Prophet+

LSTM+GRU

4163.4421 0.8489 39044.20

7 CONCLUSION AND FUTURE

WORK

In this research, the market capitalization price of

transactional Bitcoin was used to predict the price

using some DL algorithms. The method described

here explains the suggested techniques to determine

an accurate and profitable implementation of the

digital currency bitcoin price prediction. The method

renders use of methods involving deep learning to

reach the established prediction goals. The project's

Predictive Modeling of Bitcoin Transaction: Daily Analysis

179

primary objective is to forecast the incredibly volatile

crypto price and provide profit for the investors. The

dataset is assembled, trained, and then examined in

order to carry out this. To do this, it will employ a

variety of deep learning models to discover which

methodology yields the greatest amount of accuracy.

We have predicted the daily transaction of Bitcoin.

The remaining process can be processed as the future

work which will be continued

In the future, the researcher intends to use more

hybrid DL models or deep learning algorithms to

improve the accuracy of BTC predictions. To obtain

a higher accuracy rate, the period size may also be

raised. In addition, deep learning techniques will look

into how tweets and emotion impact Bitcoin price.

REFERENCES

Abraham, J., Higdon, D., Nelson, J., & Ibarra, J. (n.d.).

Cryptocurrency price prediction using tweet volumes

and sentiment analysis. SMU Scholar.

https://scholar.smu.edu/datasciencereview/vol1/iss3/1

Aminikhanghahi, S., & Cook, D. J. (2016). A survey of

methods for time series change point detection.

Knowledge and Information Systems, 51(2), 339–367.

https://doi.org/10.1007/s10115-016-0987-z

Androulaki, E., Karame, G. O., Roeschlin, M., Scherer, T.,

& Capkun, S. (2013). Evaluating user privacy in

Bitcoin. In Lecture notes in computer science (pp. 34–

51). https://doi.org/10.1007/978-3-642-39884-1_4

Antwi, S., Issah, M., Patience, A., & Antwi, S. (2020a). The

effect of macroeconomic variables on exchange rate:

Evidence from Ghana. Cogent Economics & Finance,

8(1), 1821483.

https://doi.org/10.1080/23322039.2020.1821483

Auger, I., & Lawrence, C. (1989). Algorithms for the

optimal identification of segment neighborhoods.

Bulletin of Mathematical Biology, 51(1), 39–54.

https://doi.org/10.1016/s0092-8240(89)80047-3

Biswas, S., Pawar, M., Badole, S., Galande, N., & Rathod,

S. (2021). Cryptocurrency Price Prediction Using

Neural Networks and Deep Learning. IEEE.

https://doi.org/10.1109/icaccs51430.2021.9441872

Fryzlewicz, P. (2014). Wild binary segmentation for

multiple change-point detection. The Annals of

Statistics, 42(6). https://doi.org/10.1214/14-aos1245

Hamayel, M. J., & Owda, A. Y. (2021). A novel

cryptocurrency price prediction model using GRU,

LSTM and bi-LSTM machine learning algorithms. AI,

2(4), 477–496. https://doi.org/10.3390/ai2040030

Investigating the Problem of Cryptocurrency Price

Prediction: A Deep Learning approach. (n.d.).

https://rdcu.be/dM1sA

Jang, H., & Lee, J. (2017). An empirical study on modeling

and prediction of Bitcoin prices with Bayesian neural

networks based on blockchain information. IEEE

Access, 6, 5427–5437.

https://doi.org/10.1109/access.2017.2779181

Jay, P., Kalariya, V., Parmar, P., Tanwar, S., Kumar, N., &

Alazab, M. (2020). Stochastic neural networks for

cryptocurrency price prediction. IEEE Access, 8,

82804–82818.

https://doi.org/10.1109/access.2020.2990659

Khedr, A. M., Arif, I., P, P. R., V., El‐Bannany, M.,

Alhashmi, S. M., & Sreedharan, M. (2021).

Cryptocurrency price prediction using traditional

statistical and machine‐learning techniques: A survey.

Intelligent Systems in Accounting Finance &

Management, 28(1), 3–34.

https://doi.org/10.1002/isaf.1488

Lahmiri, S., & Bekiros, S. (2018). Cryptocurrency

forecasting with deep learning chaotic neural networks.

Chaos Solitons & Fractals, 118, 35–40.

https://doi.org/10.1016/j.chaos.2018.11.014

Liu, Y., & Sun, L. (2008). Analysis of Cointegration

between Macroeconomic Variables and Stock Index.

IEEE. https://doi.org/10.1109/icnc.2008.689

Moser, M., Bohme, R., & Breuker, D. (2013). An inquiry

into money laundering tools in the Bitcoin ecosystem.

IEEE. https://doi.org/10.1109/ecrs.2013.6805780

INCOFT 2025 - International Conference on Futuristic Technology

180