Fintech Startups: Evolutionary Trends and Disruptive Forces in the

Indian Financial Ecosystem

Malika Pahwa

1

, Shipra Agarwal

1

, Varnika Dhyani

1

, Tanya Rawal

1

, Medhavi Vishnoi

2

and Riya Sharma

1

1

Deprtment of Commerce, Graphic Era Deemed to be University, Dehradun, India

2

Department of Professional Communication, Graphic Era Deemed to be University, Dehradun, India

Keywords: Fintech, Startups, Financial Institutions, Technologies, India.

Abstract: Fintech, in simple words, is all about integrating advanced technology with the financial industry for better,

more modernized financial services. This encompasses a number of sectors, including banking, investment,

insurance, and payment systems. In India, the rise of fintech startups has been remarkable, triggered by rapid

technological changes, friendly government policies, and a young, tech-oriented population. These startups

pioneered digital payments, peer-to-peer lending platforms, and robo-advisory services—the effects of which

have actually transformed the face of financial services. This phenomenon was studied for its impact on

traditional financial intermediaries and the wider financial system by secondary data analysis supported with

qualitative research methods, whereby a probe into the profound implications of fintech was found. The

findings showed that while disrupting the financial sector, fintech startups in India were also advancing it.

While compelling conventional banks to adapt digital solutions, on the other side, they were also promoting

financial inclusion by making financial services reach a larger population. The fintech ecosystem of India is

very dynamic, courtesy of government initiatives and growing collaborations with traditional financial

institutions. This synergy will go a long way in helping India retain its leading position in the fintech arena

globally. As fintech continues to evolve, it holds great promise for the future, both in India and worldwide.

1 INTRODUCTION

Financial technology, usually abbreviated to Fintech,

is the application of technologies in the financial

industry. This was one of the factors behind the recent

revolution in finance that has changed the present

landscape and brought about the new streams of

revenue in the form of the digital banks, new wallet

systems etc. Furthermore, FinTech has incorporated

an unused demographic in terms of being financially

included. Therefore, financial services need to be at

the forefront and the sector has to develop and change

(Maurya, H., & Kulkarni, P. (2022)). Fintech is the

integration of technology and innovation in the

financial sector that guarantees the provision of

advanced and quality financial services in several

spheres including banking, asset and wealth

management, investment, insurance, mortgage, etc.

(YADAV, V. 2023). In this rapidly developing area

of the economy, new start-ups focusing on

technology and other players are reinventing the

traditional ways of finance services delivery (Gupta,

N, et.al.2023).

The growing reliance of every service on

technology has brought number of important

socioeconomic changes. Services and financial

support are now easier and more conveniently

available. Competing with conventional financial

services, Financial Technology seeks to provide

continuous and individualised support. Fast technical

progress has created the conditions for the fintech

ecosystem to thrive. Equipped with state-of-the-art

technology such as blockchain, big data analytics, and

artificial intelligence, fintech start-ups have become

major participants in the financial market. These

upstarts have offered customized and streamlined

digital solutions. From peer-to-peer providing and

digital payments to robo-advisory facilities,

crowdfunding sites, and cryptocurrency exchanges,

fintech has created new channels for group,

individuals and companies to obtain financial

services.

560

Pahwa, M., Agarwal, S., Dhyani, V., Rawal, T., Vishnoi, M. and Sharma, R.

Fintech Startups: Evolutionary Trends and Disruptive Forces in the Indian Financial Ecosystem.

DOI: 10.5220/0013596800004664

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 3rd International Conference on Futuristic Technology (INCOFT 2025) - Volume 2, pages 560-567

ISBN: 978-989-758-763-4

Proceedings Copyright © 2025 by SCITEPRESS – Science and Technology Publications, Lda.

With the increased online movement of financial

services, the risks of data breaches and cybersecurity

attacks are increasing. Customer data and privacy

protection is highly essential; thus, sound

cybersecurity protocols and legal frameworks are

very much needed to ensure that consumer

confidence is maintained. To stay abreast with

financial stability, innovation promotion, and

consumer protection, even regulatory frameworks

must change pace with technology (Saini, A. K.

2023).

FinTech, or innovative financial innovations, has

taken off globally. The recent study by CB Insights

ranks these 20 Indian fintech companies among 250

most promising startups globally. In addition,

payment wallets, digital banks, UPI, BHIM, and

many more services are easily accessible and make

extensive use of them. Every consumer can now

receive personalized banking and financial services

online around the clock with the help of fintech.

Improvements and innovations in the provision of

banking and financial services have come about

because of it.

Fintech has a number of advantages and can

revolutionize the way we conduct financial

transactions. Convenience is one of the benefits;

Fintech let consumers do a number of financial chores

from their computers or mobile devices without going

to a real bank. Fintech has also accelerated financial

transactions to almost instantaneous speeds, saving

time and boosting productivity (VERMA, A. N).

FinTech is developing a commercial model that

can control risk and assure reporting requirements. It

safeguards conventional financial establishments

from fraudulent operations. It also attempts to create

a safe environment so that financial institutions may

shift various financial products. FinTech is

contributing toward the stability standards and the

soaring systems of soundness and customer

satisfaction, thereby facilitating financial stability.

The larger the FinTech initiatives are, the more

significant they are on financial stability (Gupta,

S.2023).

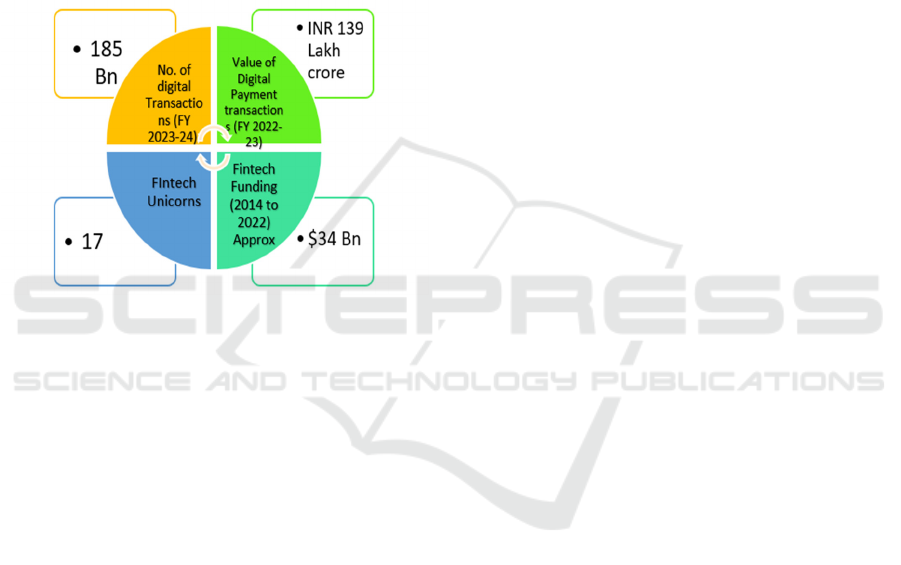

Figure 1: Fintech Applications

2 LITERATURE REVIEW

Neha Gupta et al, 2023 talks about the positive

influence of FinTech on financial markets and their

inclusion of innovative services while making the

financial institutions strong. FinTech is the infusion

of technology in the financial sector. The use of

technology in finance created inventive business

models, complex operations, and novel

products/services. Fintech created an empowering

environment for FinTech startups to thrive in India

and possibly attain billion-dollar valuations .

Maurya, H., & Kulkarni, P., 2022 studied that the

evolution of Fintech has brought substitute

technology for banking and non-banking finance

services, which has revolutionised the finance

industry. Fintech services are spreading rapidly in

India and it creates a huge impact on policies and

procedures of financial institutions. Fintech platforms

are valued for the ability to improve customer safety

through digital transfers, easy user interface, and

lower cost of operation. So, they are revolutionizing

the Indian financial scene .

Ajay Kumar Saini, 2023 advocated that fintech

has the potential to greatly alter the banking sector by

offering personalised services, increased

accessibility, and convenience that improve client

experiences. Traditional banking methods are being

revolutionised by fintech solutions, which provide

personalised services and greater accessibility .

Navleen, Kaur, 2021 interpreted that prime Minister

Narendra Modi initiatives "Make in India" and

"Digital India” are major forces behind India's

economic growth. Sustainable development, digital

empowerment, and self-reliance are the goals of these

programmes. This tendency is being propelled by

campaigns like "Digital India" and demonetization. It

demonstrates the progressive shift towards a more

digitalized economy by highlighting the quick uptake

Fintech Startups: Evolutionary Trends and Disruptive Forces in the Indian Financial Ecosystem

561

of digital payment technologies including NEFT,

IMPS, RTGS, E-wallets, Aadhar Pay, Debit Cards,

and UPI .

C., Vijai., 2019 interpreted that fintech is a new

idea that offers substitutes for traditional banking and

non-banking financing services. Fintech services,

which provide advantages including digitalized

transactions, improved customer security, lower

operating costs, and intuitive interfaces, are

expanding quickly in India. The potential of fintech

services in India to revolutionise the practices and

customs of the nation's finance sector, signifying a

substantial change in the sector's environment .

Mengting, Li., 2022 analysed that India is

becoming a hub for financial innovations globally,

and as a result, the fintech business there is expanding

quickly. The fintech industry in India includes a

range of financial technologies that offer modern

account management tools, such as innovations in

retail banking, investment management, and

cryptocurrency like bitcoin. Fintech also offers

opportunities for financing small businesses through

crowdfunding and other mechanisms that allow

investors to contribute for purposes other than

financial gain. Asset management services simplify

financial necessities like insurance, retirement

planning, and portfolio management. They provide

financial and investment counselling services to high-

net-worth clients. Fintech companies' online factoring

and credit services give small business owners new

avenues for working capital access, streamlining

procedures like selling accounts receivable for fast

funding .

Bhura, P., & Bansal, S., 2023 has brought about a

global transformation in the financial sector by giving

cutting-edge financial services and digital

transactions. Fintech has become popular very rapidly

in India, changing financial habits and behaviors and

offering opportunities as well as difficulties to the

nation. India's fintech services are growing rapidly,

thereby becoming one of the global fintech market

place with the fastest rate of growth. The adoption of

fintech in India has revolutionized banking product

access, investment, and transactional practices and

thus shows that the nation is moving toward

digitization .

According to research conducted by Anubhav,

Manglick.et al, (2022), because of its population

being above 1.3 billion, India's fintech market is

rapidly developing. Consequently, it becomes a

relatively attractive destination for improving the

financial technology environment. Over the last 5

years, fintech in India has grown highly, and it is

estimated that its growth will rise continuously.

3 OBJECTIVES

• To explore the rise of fintech startups in

India.

• To examine how these startups are

expanding and transforming the financial

market in India.

• To evaluate the emergence of fintech

startups in India signifies a disruption or an

evolution over current standards.

• To Assess the issues encountered by these

startups and potential pathways for success

4 RESEARCH METHODOLOGY

The study examines Fintech companies in India,

focusing on their growth through secondary data

analysis and a qualitative research approach. The

literature for the review (Articles and Journals) was

collected from Google Scholar (Published Research

articles). Most of the data is from online papers,

articles, and internet resources on Fintech startups

and the Indian financial sector. Through rigorous

analysis to track the development of Fintech

companies, their impact on old banking models, and

implications across the Indian economy, the

evaluation works to trace overall movement. All

references use APA (American Psychological

Association) style referencing guidelines to guarantee

accuracy and agreement.

5 DISCUSSION

5.1 Fintech in India

The fintech boom started lifting off in 2010 with the

arrival of companies like Venmo, Square, and Stripe.

The fintech industry grew further when companies

like Stripe and Plaid came up with new payment

processing methods in 2019. By using a traditional

payment processor, these technologies enabled

businesses to collect payments from clients quickly

and securely. Contactless payments began to be

implemented generally in 2020, meaning consumers

can pay for things using a mobile phone and other

forms of mobile devices. The companies supporting

contactless payment solutions are Google Pay, Apple

Pay, and Samsung Pay. From 2021 to 2023,

companies are leveraging blockchain, artificial

intelligence (AI), and machine learning (ML)

technologies in more effective and secure financial

INCOFT 2025 - International Conference on Futuristic Technology

562

services developments; the fintech sector will expand

even further into the future (Mishra, M. 2023).

In India, FinTech is still growing at a rapid pace,

almost exclusively due to the growing population of

new FinTech businesses and a strong wave of

technology development.

With investment growth at a CAGR of 98%

during the last six years, the FinTech industry of India

has experienced a fiscal surge over the last half-

decade. At a national level, there already are more

than 1200 FinTech companies in operation and this

number is constantly rising. At 2,565 companies

operating as of now, up from just 737 in 2014, India

boasts the second-largest fintech cluster in the world.

Most of the Indian fintech companies are payments-

oriented with lending, wealth technology, personal

finance, insurtech, regtech, and others being second

in line. Some of the more fascinating Indian Fintech

deals of 2019 included digital insurance and

RazorPay, the payments start-up that took in $75

million from Sequoia and Ribbit Capital in June.

According to KPMG, the fintechs have taken in some

around $1.7 billion of funds for the first six months of

2020. Fintech companies have raised threefold more

funds than at the same period last year, when it was

$726.6 million. By 2023, India will account for 2.2%

of the global digital payment market, and by 2025, the

value of transactions will reach $12.4 trillion.

Financial institutions, startups, government, venture

investors, and regulators must collaborate to make it

a centralised and collaborative environment (Li, M.

2022) Indian FinTech companies set a new

benchmark for the country's financial services sector.

In India, different government initiatives, such as Jan

Dhan Yojana, Aadhaar, and UPI, give a very robust

foundation to improve financial inclusion in the

country and statistically, 88% males and 84% of

females used FinTech applications; age-wise, people

between 25 and 44 years are the largest consumers of

FinTech's, at around 94%; and worldwide, the same

age group uses Fintech's at about 73%. India is a

global leader in FinTech innovation, and findings are

applicable to all economies regardless of

development stage (IMF, 2022; BIS, 2019).

Google presented India's Unified Payment

Interface (UPI) as a model for digital infrastructure

and policy making, despite opposition from the US

banking sector. UPI is a shared public platform that

enables real-time payments and is supported by the

Reserve Bank of India.

The FinTech industry in India has seen

tremendous growth with over 2000 firms coming into

existence since 2015 and an inrush of foreign

investments. Major Indian cities do relatively well in

global rankings by creation rate, investment, and

valuation. New Delhi ranked 13th, Bangalore ranked

20th, and Mumbai ranked 23rd as per the Findexable's

2021 Global City Rankings. According to the 2018

Global FinTech Hub study, Bangalore ranked 25th

over Mumbai at 26; despite this, they ranked behind

Chinese and US cities, CCAF. Therefore, these

growing trends will mean that FinTech now presents

new opportunities to be exploited by financial hubs

(Arora, S., & Madan, P. 2023).

5.2 Fintech Growth and Market Size in

India

The Indian fintech industry 2022 at about $584

billion, a potential growth to approximately $1.5

trillion by the end of 2025. This growth rate is led by

a healthy total addressable market estimated at $1.3

trillion by the end of 2025. Assets under management

for the industry will be a $1 trillion by the close of

2030. Revenue will hit $200 billion by 2030. The key

segments driving this growth include payments,

digital lending, insurtech, and wealthtech. The

payments landscape in India is also quite distinctive,

with projections toward $100 trillion in volume and

$50 billion revenue by 2030. Similarly, the digital

lending market, which was valued at $270 billion in

2022, is said to increase to $350 billion in 2023. India,

therefore, holds the second-largest insurtech market

in the Asia-Pacific region. It is likely to grow nearly

15 times to reach $88.4 billion by 2030. The

wealthtech industry in India is going to reach $237

billion by 2030, and it is also going to have a base of

retail investors. It is big numbers speaking to the

vibrancy and rapidly changing landscape of the

fintech ecosystem in India. India ranks third in the

world for the fintech ecosystem, with over 3000

registered fintech startups by DPIIT. This is excellent

evidence of how fast the country is changing digitally,

with innovative strides in financial services. In 2022,

India accounted for an overwhelming 46% of

international real-time transactions, demonstrating

global dominance in digital payments. It would, in

fact be a proud achievement which would come

largely from an extremely high penetration of such

systems as UPI changing the face of individual

transactions.

India's fintech landscape is characterized by high

adoption rates, an 87% adoption rate among the users,

as compared to the global average at 64%. The India

fintech industry size estimated in 2022 reached $584

billion and projected to reach $1.5 trillion by 2025.

Payment, digital lending, insurtech, and wealthtech

are some of the key segments within the fintech

Fintech Startups: Evolutionary Trends and Disruptive Forces in the Indian Financial Ecosystem

563

industry1. According to estimates, by 2030, the

digital payment market will touch $100 trillion in

terms of transaction volumes and $50 billion in

revenues.

The fintech transformation of India is led by the

initiatives of JAM: Jan Dhan-Aadhaar-Mobile, UPI,

and ULI: Unified Logistics Interface. These have

successfully redefined financial inclusion and access.

Therefore, millions residing in remote areas can

access financial services through their cell phones. In

testimony to the success of the platforms, the highest

volumes ever recorded in digital transactions are that

of UPI with more than 16.58 billion daily transactions

in October 2024.

Figure 2: Growth of Fintech startups in India (Invest India,

2024).

5.3 Factors Leading to the Growth of

Fintech Industry in India

Several drivers have given a significant push to the

expansion of the Indian fintech industry. The most

important factor is that because of the wide adoption

of smart phones and increasing internet penetration, a

robust digital infrastructure has been created that puts

financial services within reach for a much larger

segment. This digital revolution has been

accompanied by the Indian government's initiatives

toward making the economy cashless, where it

introduced demonetization in 2016 and promoted

digital payment systems, such as Unified Payments

Interface (UPI), which accelerated the shift to digital

transactions.

There are also demographic profiles of the Indian

population that have played an important role. With a

very high percentage of the population consisting of

young and tech-savvy people, the natural tendency is

to look for innovative financial solutions. This

youthful demographic is relatively more open to

using mobile apps and online platforms to get their

financial needs met and thus drives the demand for

fintech services.

This improves the Indian regulatory environment

that is more supportive in the growth of fintech.

Reserves Bank of India, the RBI together with other

regulators have devised numerous frameworks as

well as guidelines aimed at offering room for

innovation in relation to consumer protection and

financial stability. One example for this would be that

using Aadhaar-based KYC simplifies onboarding by

creating an avenue for customers so it becomes

smooth for the new users into the systems by the

fintech.

The other significant factor is the increasing

collaboration between the traditional banks and

fintech start-ups. They understand the importance of

fintech innovations, and thus banks have already

started forming strategic partnerships for the

enhancement of service portfolios. In this way, the

firms in the fintech domain are being allowed to

leverage the infrastructures along with the customer

bases already developed by the traditional banks for

offering innovative technology solutions.

More so, the increased venture capital and private

equity investments in the Indian fintech sector have

also been critical in funding innovative startups with

scale-up capital. More and more investors are getting

interested in the Indian fintech market, where they

invest heavily in such markets for their scale up.

In that way, the COVID-19 pandemic has also

been an enabler of growth in the Indian fintech

industry. Being a pandemic that disallows the people

from meeting each other, consumers as well as

businesses are using the digital platforms to perform

the financial transactions.

5.4 Fintech Startups in India

Represents a Disruptive Force or

an Evolutionary

From one angle, one could say that the story of fintech

success is India is a revolutionary development. On

the other hand, it is an evolutionary step, for it is

apparent that the introduction of such new

technologies by these startups into finance has

disrupted some bases of traditional financial services.

This disruption can be seen, for example, in

payments, lending, and personal finance management

areas where fintech companies have been using AI ,

mobile technology, and big data analytics to give

services that are faster, more accessible, and less

expensive than those offered by traditional banks.

Fintech innovativeness has not only transformed

customer money management but also compelled

INCOFT 2025 - International Conference on Futuristic Technology

564

conventional old-time financial institutions to alter

some practices and embrace digital solutions and

service delivery not to be left behind and remain

relevant.

On the other hand, the growth of fintech startups

in India is an evolutionary step in the financial sector.

Most fintech companies do not try to overthrow the

traditional financial systems but instead work

together with traditional banks and other financial

institutions to enhance services already provided and

offer new opportunities for financial inclusion. This

is highly useful in a country like India, where most of

its population is either unbanked or underbanked.

Fintech startups bridge this gap by integrating

advanced technologies in the established

infrastructure of the traditional banks. This has to be

an evolutionary process for both parties to appreciate:

the future of finance has to be a hybrid model making

the best out of the other's strengths regarding the

traditional and digital financial services.

Additionally, with the regulatory environment in

India changing to facilitate this hybrid trajectory of

disruption and evolution, regulatory bodies like RBI

have come up with innovative frameworks and

guidelines that allow it to be an innovative source

while protecting the consumer along with financial

stability. Innovations such as the Aadhaar-based

Know Your Customer process are examples of how

the evolution in regulation can lead to a comfortable

environment for the growth of fintech while helping

both startups and consumers to grow.

5.5 Challenges and Opportunities

Faced by Fintech Startups in India

Indian fintech startups face the running of the

landscape under pretty tough challenges and

opportunities against innovation and transformation

into financial services. Among those critical

challenges, the first point is actually raising enough

capital. Even at such a potential for high return,

investor caution is still pretty high where investors

quite quickly reject multiple times the startup before

they raise the capital. The very nature of the very

nature of the Indian festival further complicates

regulations. India has regulatory system the presence

of numerous bodies such as SEBI, RBI and IRDAI

thus setting several compliance requirements for

banks and financial institutions. Therefore, their

understanding is quite cumbersome and takes plenty

of time. Infrastructure problems, especially in the

rural areas, may hamper the smooth running of the

services: whereas there is stiff competition within

there is stiff competition within the sector that forces

startups to constantly innovate, and be distinct.

Economic shocks contribute to the risks too, because

economic fluctuations affect investor confidence and

consumer spending, which impacts the growth

prospects of such startups.

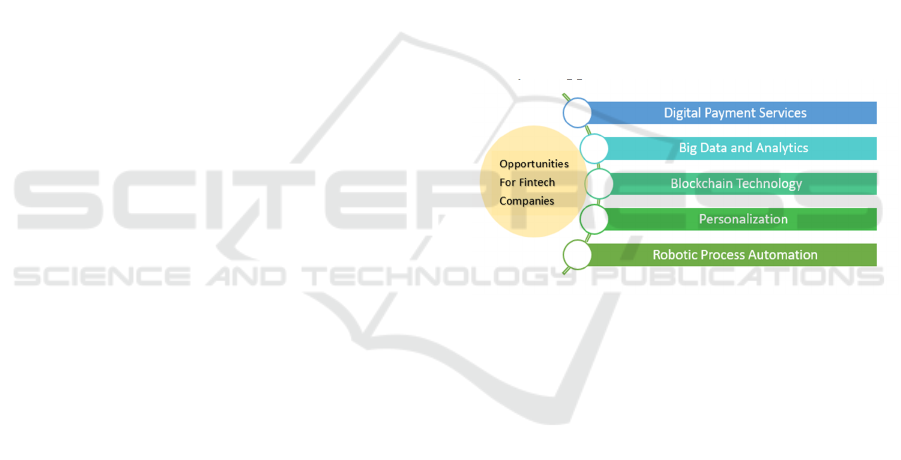

On the other hand, these fintech startups in India

are provided with a whole bunch of opportunities that

will catapult them to great growth. The Indian

Government has been very supportive of fin-tech

innovation by introducing measures that encourage

digital payments and facilitate financial inclusion.

Such governmental facilitation creates a conducive

environment to nurture startups. India also has among

the highest fintech adoption rates globally. That is an

indication that the market for such fintech services is

rather good. The pace by which technologies advance

provides fintech firms with tools that can be applied

to innovate and provide new services. A great and

diverse population in India with a rapidly growing

middle-class presents the opportunity for massive,

mostly untapped, market for fintech solutions.

Figure 3: Opportunities for Fintech Companies

6 CONCLUSIONS

India's fintech ecosystem is a fast-growing segment

within the global startup arena and serves as a key

enabler for government initiatives targeting the

digital economy and financial inclusion. The fintech

landscape in India has evolved beyond mere hype,

and continued innovation combined with government

support will ensure the country's leadership in the

global fintech space.

This growth in India's fintech business has been

driven by a combination of factors, including

technological advancements, supportive government

policies, a favorable demographic profile, a

conducive regulatory environment, increased

collaboration with traditional financial institutions,

substantial investment inflows, and the impact of the

COVID-19 pandemic. Together, these elements have

created fertile ground for the fintech sector to thrive

Fintech Startups: Evolutionary Trends and Disruptive Forces in the Indian Financial Ecosystem

565

and reshape India's financial landscape. Banks should

look into how technology could be able to offer their

clients cutting-edge products and services. They must

also make investments in the development of digital

platforms and infrastructure in order to provide the

best possible customer experience.

Growing stream of fintech startups in India cannot

be viewed in line with disruption-versus-evolution,

and it is truly an interaction game between a

disrupting component that is evolutionary that the

fintech companies represent to overcome the older

models but propels evolutionary expansion in the

financial industry as well. With this juxtaposition of

both conflicting elements, the Indian financial system

goes dynamic toward innovation, learning, and

growth in leading toward increased financial

inclusion as well as towards economic development.

In the main, fintech start-ups in India are ready to

exploit all these opportunities to their best, facing the

challenges arising from them and propelling

innovations in financial sector. The success would

depend on the ways they manoeuvre through

regulatory landscapes, secure funding, and constantly

innovate to become competitive in competition.

7 FUTURE SCOPE

The future of fintech startups in India is filled with

immense opportunities, fueled by technological

advancements, favorable government policies, and an

increasing base of digitally-driven consumers. Next-

Gen Financial Services: The New-age Innovations in

Emerging Fields like AI, Blockchain, and Quantum

Computing. Given the fact that the vast majority of

financial services in the region still operate with a

reliance on outdated workflows, there is quite a bit of

room for growth in rural and underserved markets

where customer-tailored solutions for micro-lending,

digital banking, and insurance can open up greater

financial inclusion.

Every next jurisdiction and each new industry that

gets regulated, from the European Data Protection

Board and GDPR to the Payment Functions Supplies

Act and Basic Cost Companies Regulation, has

introduced complex layers that create a large extra

puzzle, one that may solely be solved by deep

experience should you strategize the sustainability of

your corporation. Core themes such as trust and

consumer behavior will still dominate, shaping

categories such as what drives adoption and what

builds trust for digital transactions — and they will

inform the way products are structured to ensure that

users are retained over the long term. Cooperation

between fintech startups and traditional financial

institutions will also grow, promoting innovation and

improving service offerings. Fostering India's fintech

ecosystem holds promise for establishing it as a

global fintech hub, taking international footprints,

cross-border synergies with ever-increasing capital in

the global financial framework. Understanding these

emerging trends through research will enable the

fintech sector to address its challenges while keeping

India ahead of the curve and a leading innovator in

the world.

REFERENCES

Maurya, H., & Kulkarni, P. (2022). Fintech In Indian

Capital Markets. Cardiometry, (24), 843-848.

YADAV, V. (2023). Analyzing opportunities and obstacles

of fintech in indian financial market. International

Journal of Research in Education Humanities and

Commerce, 4(01), 25-35.

Gupta, N., Agarwal, A., & Agarwal, V. (2023). Journey of

fintechs in india from evolution to revolution. In

Handbook of Research on the Interplay Between

Service Quality and Customer Delight (pp. 252-271).

IGI Global.

Saini, A. K. (2023). The Fintech Revolution and Future of

Banking and Financial Institutions: A Quantitative

Investigation.

VERMA, A. N. ROLE OF DIGITAL MEDIA IN

FINTECH INDUSTRY.

Gupta, S., & Agrawal, A. (2021). Analytical study of

fintech in India: Pre & Post Pandemic covid-19. Indian

Journal of Economics and Business, 20(3), 33-71.

Kaur, N., Sahdev, S. L., Chhabra, M., & Agarwal, S. M.

(2021, September). FinTech Evolution to Revolution in

India-From Minicorns to Soonicorns to Unicorns. In

2021 9th International Conference on Reliability,

Infocom Technologies and Optimization (Trends and

Future Directions) (ICRITO) (pp. 1-6). IEEE.

Vijai, C. (2019). FinTech in India–opportunities and

challenges. SAARJ Journal on Banking & Insurance

Research (SJBIR) Vol, 8.

Li, M. (2022). Major opportunities, challenges, and

financial technological implications of fintech in the

Indian context. International Journal of Research

Publication and Reviews, 3(1), 1-9.

Bhura, P., & Bansal, S. (2023). CURRENT STATUS,

TRENDS & PROSPECTS OF FINTECH IN INDIA.

International Journal of Management, Public Policy and

Research, 2(4), 131-138.

Sharma, S., Srivastav, S., Gupta, A., & Manglick, A. (2022,

February). Application of Technology and Innovation

in Fintech and it's adaptability in India. In 2022 2nd

International Conference on Innovative Practices in

Technology and Management (ICIPTM) (Vol. 2, pp.

305-311). IEEE.

INCOFT 2025 - International Conference on Futuristic Technology

566

Mishra, M. (2023). Exploring the Potential of Fintech in

India: A Comprehensive Analysis.

Arora, S., & Madan, P. (2023). Conceptual framework

depicting the drivers for the fintech growth: an outlook

for India. In Contemporary Studies of Risks in

Emerging Technology, Part A (pp. 197-220). Emerald

Publishing Limited.

Invest India. (n.d.). BFSI - FinTech & financial services.

Invest India. Retrieved November 30, 2024, from

https://www.investindia.gov.in/sector/bfsi-FinTech-

financial-services.

ACI Worldwide. (n.d.). Real-time payments in India. ACI

Worldwide. Retrieved November 30, 2024, from

https://www.aciworldwide.com/realtime/india?form=

MG0AV3

Sharma, I., & Sharma, S. (2023, May). Cognitive Privacy

of Personalized Digital Finance Images on Social

Media Platforms Using Artificial Neural Networks. In

2023 4th International Conference for Emerging

Technology (INCET) (pp. 1-6). IEEE.

Sharma, A., Mohan, A., & Johri, A. (2024, April). Impact

of Financial Technology (Fin-Tech) on the

Restructuring of the Agrarian Economy: A

Comprehensive Systematic Review. In 2024 Sixth

International Conference on Computational

Intelligence and Communication Technologies

(CCICT) (pp. 249-252). IEEE.

Naik, A. H. (2023). The revolutionized finance sector with

reference to fintech industry in India. International

Journal of Research Publication and Reviews, 4(02),

1595-1599.

Vajid, A., & Farooqi, A. W. (2022). Issues and Challenges

to Fintech Industry in India. EPRA International

Journal of Economic and Business Review, 10(12), 16-

22.

Rajeswari, P., & Vijai, C. (2021). Fintech industry in India:

the revolutionized finance sector. Eur. J. Mol. Clin.

Med, 8(11), 4300-4306.

Muthukannan, P., Tan, B., Gozman, D., & Johnson, L.

(2020). The emergence of a Fintech Ecosystem: A case

study of the Vizag Fintech Valley in India. Information

& Management, 57(8), 103385.

Moosa, I. (2022). The evolution and revolution of fintech.

In Fintech (pp. 18-32). Edward Elgar Publishing.

Gomber, P., Kauffman, R. J., Parker, C., & Weber, B. W.

(2018). On the fintech revolution: Interpreting the

forces of innovation, disruption, and transformation in

financial services. Journal of management information

systems, 35(1), 220-265.

Jucevičius, G., Jucevičienė, R., & Žigienė, G. (2021,

August). Patterns of disruptive and sustaining

innovations in Fintech: a diversity of emerging

landscape. In 2021 IEEE International Conference on

Technology and Entrepreneurship (ICTE) (pp. 1-6).

IEEE.

Alam, N., Gupta, L., Zameni, A., Alam, N., Gupta, L., &

Zameni, A. (2019). Fintech as Disruptors and

Empowering Financial Industry. Fintech and Islamic

Finance: Digitalization, Development and Disruption,

37-62.

Prakash, N., Indiradevan, Y., & Subhasri, P. (2022). A

Study on Fintech Revolution in India: A Review. i-

Manager's Journal on Management, 17(2), 31.

Geranio, M. (2017). Fintech in the exchange industry:

Potential for disruption? Masaryk University Journal of

Law and Technology, 11(2), 245-266.

Setiawan, K., & Maulisa, N. (2020, March). The evolution

of fintech: a regulatory approach perspective. In 3rd

International Conference on Law and Governance

(ICLAVE 2019) (pp. 218-225). Atlantis Press.

Chiu, I. H. (2017). The disruptive implications of fintech-

policy themes for financial regulators. Journal of

Technology Law & Policy, 21(1).

Arjunwadkar, P. Y. (2018). FinTech: The technology

driving disruption in the financial services industry.

Auerbach Publications.

Kukreja, G., Bahl, D., & Gupta, R. (2021). The impact of

Fintech on financial services in India: Past, present, and

future trends. In Innovative strategies for implementing

Fintech in banking (pp. 191-200). IGI Global.

Kaur, J. (2019). Growth potential and challenges for fintech

in india. Future of FinTech: Innovative Business Model

for Financial Inclusion, 37.

Agrawal, S., Gupta, G., & Zagade, A. (2020). Fintech: a

New Revolution in India. JournalNX, 47-57.

Fintech Startups: Evolutionary Trends and Disruptive Forces in the Indian Financial Ecosystem

567