Exploring the Integration Among Artificial Intelligence, Fintech, and

Sustainable Investing in ESG Funds in India: A Bibliometric

Perspective

Durgesh Bahuguna

a

, Rajesh Tiwari

b

and Sanjay Taneja

c

Department of Management, Graphic Era (Deemed to be University), Dehradun, India

Keywords: AI, ESG Funds, Sustainable Investing, Financial Technology.

Abstract: Although various research studies have been done on the topics of sustainable finance, financial technology,

and ESG funds, particularly over the decades, more research studies are still required to clarify the strength

and integration between these research areas. The objective of this research is to find the connection and

integration between financial technology, sustainability, and ESG funds through a bibliometric and systematic

literature approach using VOS-Viewer software and the Scopus database. The study has different results.

Regarding keywords, sustainable development, financial technology, and finance have maximum link

strength. From the viewpoint of co-citation analysis, resource policy is the source with the maximum citations,

followed by environment and science. The best quality papers are provided by the top three countries:

Germany, Bahrain, and the United Kingdom. The University of Bahrain is the top-ranked university that has

produced the maximum documents on the keywords sustainable investing, financial technology, and ESG.

Eventually, the research article emphasizes upcoming research challenges, limitations, and directions.

1 INTRODUCTION

The financial institutions are greatly affected by

evolving and developing technologies that have made

dynamic changes in transferring money globally

(Macpherson et. al., 2021). AI, Sustainable finance,

ESG funds, and financial technology have become

integral parts of financial development. Financial

technology is such a phenomenon that is affecting

companies, institutions, financial sectors,

stakeholders, investors, researchers, managers, ESG,

and sustainability (Thottoli, 2024). However,

sustainability and financial technology have not yet

been adequately explored and determined (Taneja et

al., 2024). The advancement of sustainable

development on the basis of sustainable financial

technology has gained attention from financial

institutions rather than economic growth (Colledge,

2017). Very few studies are researching the topic of

how AI, financial technology and sustainability are

affecting each other (Vergara and Agudo, 2021).

a

https://orcid.org/0009-0007-7782-6862

b

https://orcid.org/0000-0002-5345-2508

c

https://orcid.org/0000-0002-3632-4053

According to a recent and unique study, the adoption

of Financial Technology has a favourable and

harmonized impact on enterprises' environmental and

social sustainability performance (Siddik et al.,

2023). A number of research studies have been

reviewed pertaining to Environmental Social

Governance issues, mostly emphasizing ESG

performance and ESG disclosure (Jain et al., 2023;

Galletta et al., 2022). It is noteworthy that research

concentrating on specific Financial Technology

concerns that either indirectly or directly integrate

with sustainability themes is starting to be conducted.

AI and Machine Learning are helping hands in

different sectors for the evaluation of Sustainable

finance and ESG funds through Neural Networks,

Algorithms, Models, and Software. AI in the context

of ESG minimizes risk while maximizing its benefits

(Xu, 2024).

Bahuguna, D., Tiwari, R. and Taneja, S.

Exploring the Integration Among Artificial Intelligence, Fintech, and Sustainable Investing in ESG Funds in India: A Bibliometric Perspective.

DOI: 10.5220/0013586700004664

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 3rd International Conference on Futuristic Technology (INCOFT 2025) - Volume 2, pages 65-70

ISBN: 978-989-758-763-4

Proceedings Copyright © 2025 by SCITEPRESS – Science and Technology Publications, Lda.

65

2 LITERATURE REVIEW

Policy makers who care about the development goals

based on sustainability, as well as research scholars

studying the effects of digitalization and technology,

have a keen interest in financial technology and

sustainability (Ellili, 2022). Financial inclusion is

mainly motivated by financial technology; this, in

turn, supports balanced and sustainable development.

Financial technology, financial inclusion, and

sustainability have the tremendous power to change

the whole society, finance, and economy (Arner et al.,

2022). Social impact is a factor that promotes

technology adoption in the banking industry, and it is

powered by ESG aspects. It is reasonable for

institutions to organize financial technology training

sessions for managers and staff in order to enhance

their comprehension of ESG topics and enable more

effective implementation of sustainable practices

(Galeone et al., 2024). The most important factor

influencing corporate social responsibility

performance is inclusive finance and corporate ESG

performance. This also plays a vital role in helping

corporations satisfy their environmental obligations.

The development of inclusive finance has the

potential to boost companies' green technology

innovation, which in turn raises corporate green

sustainability and boosts corporate ESG performance

(Li and Pang, 2023). Two key fundamentals of the

current E.U. policy agenda are the Sustainable

Finance Strategy and the Digital Finance Action Plan.

There is an in-depth link between sustainability,

finance, and financial technology, which provides us

protection in pandemics like COVID-19

(Macchiavello and Siri, 2023). The most appropriate

measure to use for evaluating how the ESG factor is

affecting a firm is its market value. ESG development

will boost the situation of the firm and would lead the

performance upward (Gorova et al., 2022). Financial

technology will undoubtedly revolutionize banking

services and institutions more quickly. The traditional

system of banks should remember that society has the

ability to push for the things that will improve their

lives (Kashif et al., 2023). Technological

improvements and advancements have not only

revolutionized businesses but have also optimized

several financial services' functional areas. In

addition, fintech and green finance are crucial

instruments for achieving goals for sustainable

development. Green finance, green technology, and

green innovation aid in the fulfilment of sustainable

development objectives (Khalil et al., 2023).

Financial technology improves ESG. Nevertheless,

natural resource dependence limits the influence of

financial technology’s improvement on corporate

ESG. Financial technology’s ability to accelerate

digital transformation and minimize financial barriers

can have an impact on corporate ESG (Sang et al.,

2024).

3 METHOD

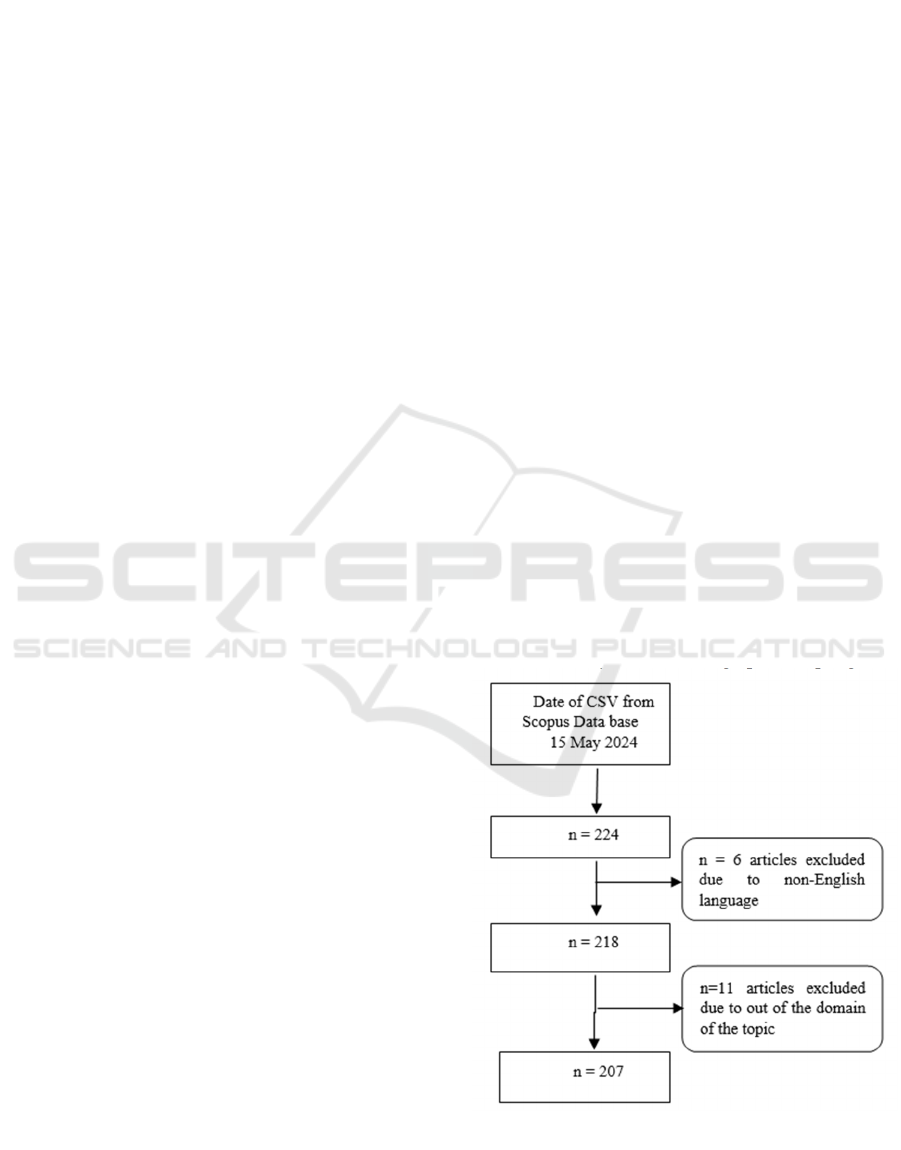

In this research study, we used bibliometric methods

in integration with literature review analysis to evolve

the participation between financial technology,

sustainability, and ESG funds. Bibliometric analysis

helps to define, analyze, visualize, and compare the

data (Żarczyńska, 2009). Review quality has been

improved through visualization and a systematic

method of analysis (Ankenbrand et al., 2024). Data is

collected from the Scopus database in the form of a

CSV file. Financial Technology, Sustainable Finance,

and ESG were the key terms used in searching the

data in the Scopus database. The data belongs to the

years 2017 to 2024 (8 years). A total of 224

documents were found, comprising articles, book

chapters, books, etc. The date of retrieval was May

15, 2024. Articles that were not written in English

were removed from the CSV file, as well as articles

that were not exactly related to our topic, which were

also excluded from the data. VOS-Viewer 1.6.20

version was used to analyze citation analysis, co-

citation analysis, co-authorship analysis, co-

occurrence analysis, and bibliographic coupling.

Figure 1: Inclusion and Exclusion Criteria

INCOFT 2025 - International Conference on Futuristic Technology

66

4 RESULTS

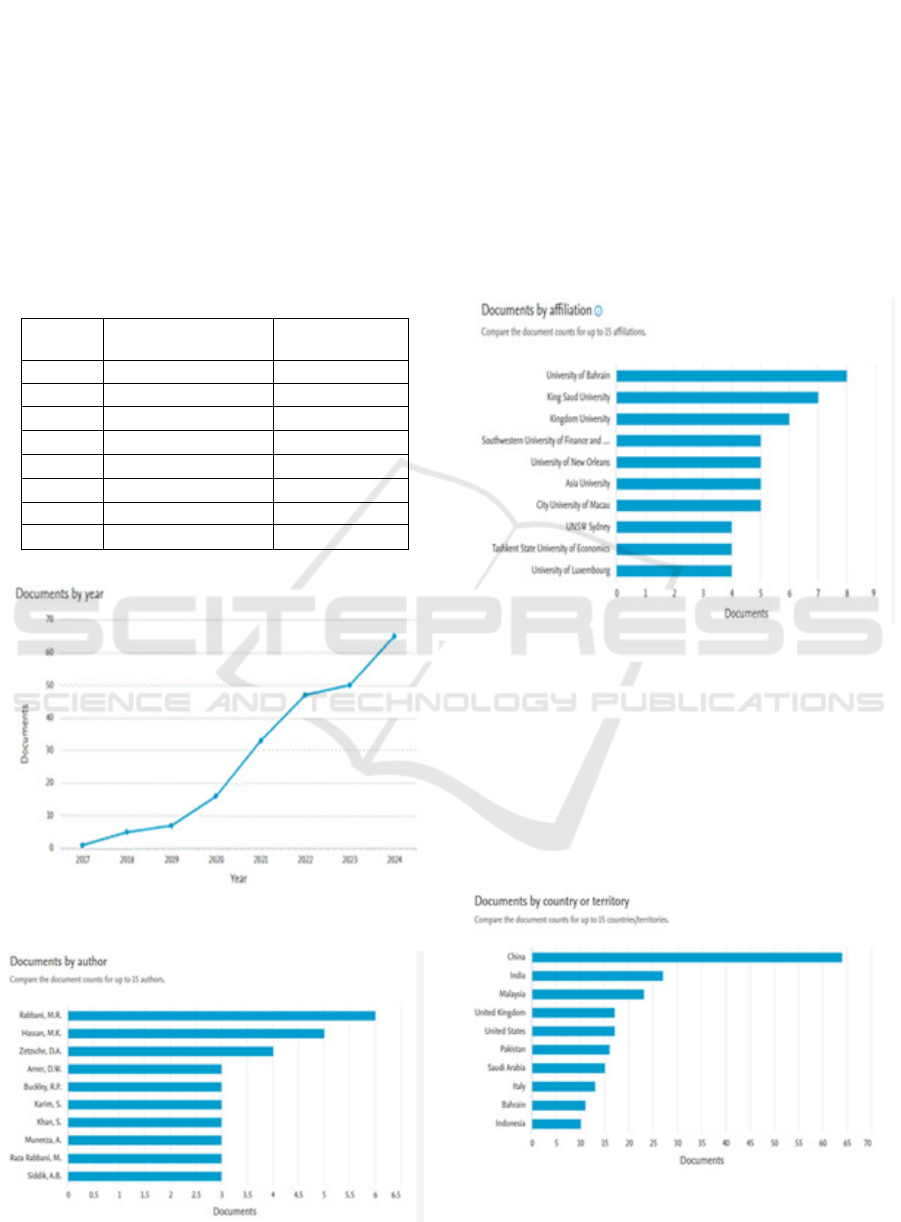

The publication has increased from 1 in 2017 to 61 in

2024. In the year 2017, gradually the publications

have increased from 5 in 2018, 5 in 2019, to 7 in 2020.

The publication number became 14, and gradually the

number of papers has increased year to year with a

high rate of citation numbers. By the end of 2024, 24

publications with citations have been published. The

publication matrix shows that year by year the quality

and number of publications have increased.

Table 1: Publication Trend

Year Total Number of

Publications

Total number

of Citations

2017 1 19

2018 5 46

2019 7 195

2020 14 567

2021 30 451

2022 44 567

2023 44 367

2024 61 54

Figure 2: Yearly Trend of Publications

Figure 3: Prominent Authors

Rabbanim has the highest number of documents,

followed by Hassan, Zetzsche, Arner, and Buckley.

These authors have published the maximum number

of documents in the fields of financial technology,

sustainability, and ESG. The University of Bahrain

has produced the maximum number of documents,

followed by King Saud University, Kingdom

University, Southwestern University of Finance, the

University of New Orleans, City University of

Macau, UNSW Sydney, and Tashkent State

University, which are the top-ranked universities that

have published the maximum number of documents

on the same keywords.

Figure.4: Prominent Organisations

Figure 5 depicts prominent countries in research

on sustainable investing, ESG, and financial

technology. Analyzing documents, China was listed

as the top country. China has published the maximum

number of documents related to key words, followed

by India, the United Kingdom, the United States,

Pakistan, Saudi Arabia, Italy, Bahrain, and Indonesia.

Among the top ten, Indonesia is the country that has

published the least number of articles.

Figure 5: Prominent Countries

Exploring the Integration Among Artificial Intelligence, Fintech, and Sustainable Investing in ESG Funds in India: A Bibliometric

Perspective

67

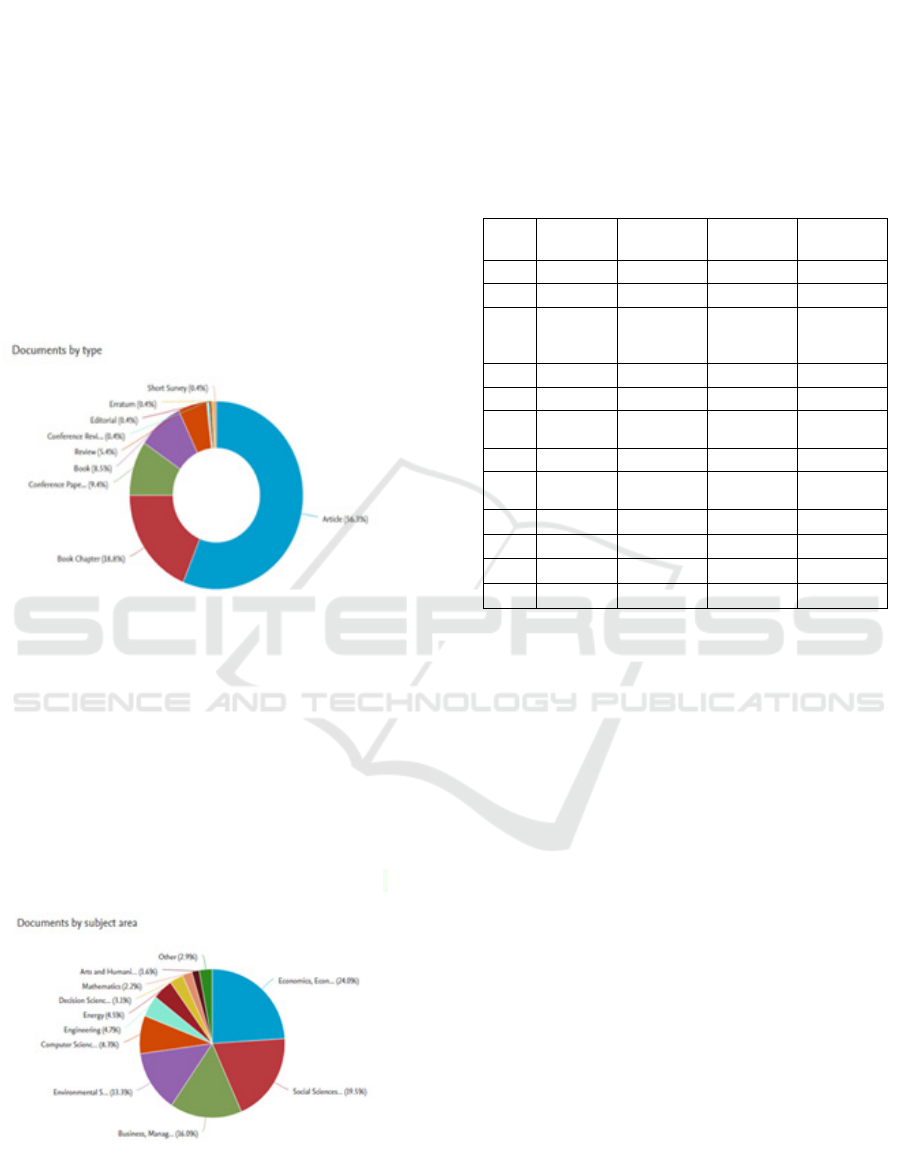

Figure 6 shows the types of documents published

in the maximum number. The participation of articles

was highest at 126, followed by 42 book chapters, 21

conference papers, 19 books, 12 reviews, and the rest

were editorial, short surveys, and errata.

Figure 7 depicts subject-wise publications. The

contribution of economics, econometrics, and finance

is 24 percent, which is the highest with 133

documents. Then there are 108 documents in social

science, 89 documents in business, management, and

accounting, 74 documents in environmental science,

46 documents in computer science, 26 documents in

engineering, and the rest of the documents belong to

energy, mathematics, etc."

Figure 6: Documents Types

Figure 7 below shows in which subject domain it

has participated the most. The contribution of the area

of Economics, Econometrics, and Finance is 24

percent, which is the highest, with 133 documents.

Then there are 108 documents in social science, 89

documents in Business, Management, and

Accounting, 74 documents in Environmental

Science, 46 documents in Computer Science, 26

documents in Engineering, and the rest of the

documents belong to Energy, Mathematics, etc.

Figure 7: Documents by subject areas

The citation is related to the frequency of a paper

or document; an article is used by other researchers

for their research work. So, if the citation number is

high, it means it is being valued or is becoming

famous. Citation analysis was performed with a

threshold of 5 citations. In this way, 33 countries met

the criteria.

Table 2: Prominent cited countries

S.N

o. Country

Docume

nts Citations

Link

Strength

1 China 62 596 30

2 Malysia 23 426 8

3

United

Kingdo

m 16 353 14

4 USA 17 328 6

5 India 25 292 15

6

German

y 8 268 2

7 Bahrain 10 234 6

8

Indonesi

a 9 182 2

9 Italy 13 155 26

10 France 7 136 6

11 Pakistan 14 119 7

12 Taiwan 8 86 4

Table 2 shows the top 12 countries with their

highest citations. China holds the top position with

the highest citation of 596 and a maximum of 62

documents with link strength of 30. The next country

is Malaysia, having 426 citations, 23 documents, and

a link strength of 8, followed by the United Kingdom

with 353 citations, 16 documents, and a link strength

of 14. The USA is in fourth position, having 328

citations, 17 documents, and a link strength of 6,

followed by India with 292 citations, 25 documents,

and a link strength of 15. Germany is in 6th position

with 268 citations and 6 documents. In the same

sequence, Bahrain, Italy, France, Pakistan, and

Taiwan have also made a good contribution to

publishing documents on the topics of sustainable

investing, financial technology, and ESG. On the

other hand, if we analyze the quality of documents per

paper, we find that Germany ranks first, having 34

citations per paper, followed by Bahrain with 23

citations per document. Consequently, the United

Kingdom (22), Indonesia (20), France (19), the USA

(19), Malaysia (19), Italy (12), India (12), Taiwan

(11), China (10), and Pakistan (9) are the countries in

declining order of citations per document or quality

work on keywords.

INCOFT 2025 - International Conference on Futuristic Technology

68

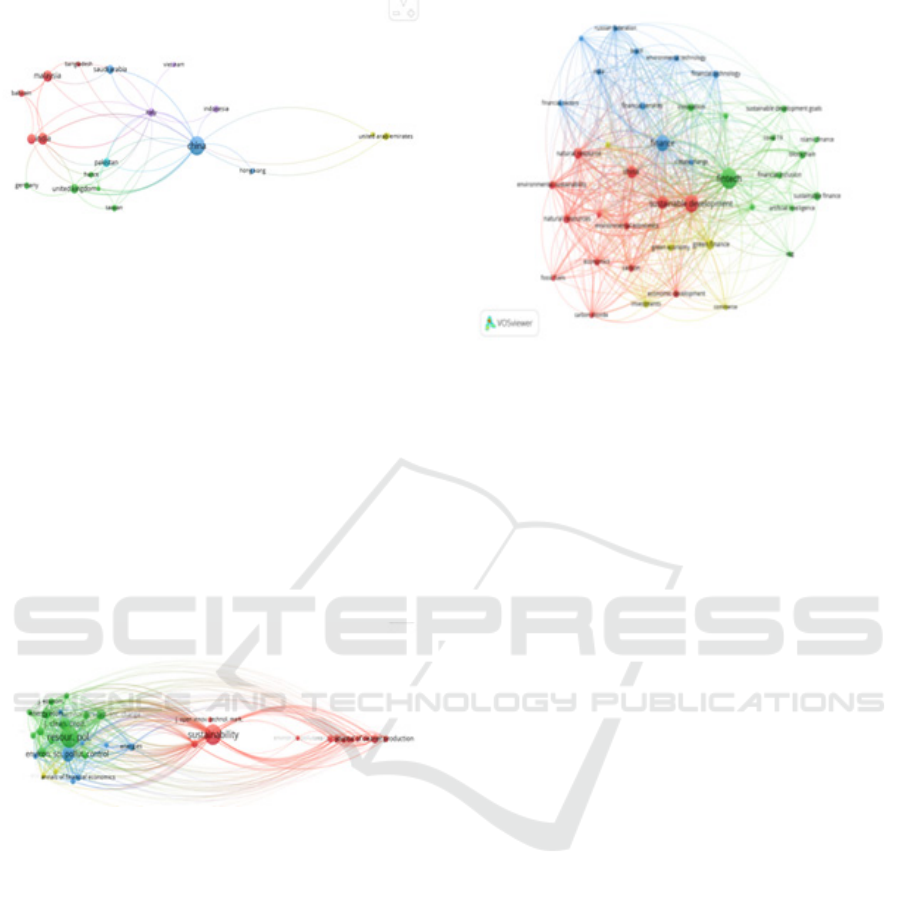

Figure 8: Network Map of Countries

Co-citation shows the number of documents that

are cited mutually in the same research work. Briefly,

we can say how many times two studies are cited

mutually by other studies. Co-citation analysis

evaluates the integration strength of citations in

research articles that are cited together frequently.

The resource policy source has the maximum

citations (367), followed by environmental science

and pollution control with 367 citations. The third

rank goes to Sustainability (327 citations). The

remaining sources are as follows: Journal of Cleaner

Production (137), Energy Economics (87),

Renewable Energy (83), Technological Forecasting

(89), Science of the Total Environment (55), etc.

Figure 9: Co-Citation Map

Network mapping shows the integration strength

of the keywords with each other. Moreover, it also

explains the clusters of keywords and how they are

interlinked. This analysis assists researchers in the

research study of financial technology, sustainable

investing, and ESG.

With a minimum number of occurrences of 7 out

of the 1545 keywords, 48 meet the threshold limit.

Sustainable Development has the maximum total link

strength (517), followed by Financial Technology

(512). In third place is Finance (474), and fourth place

goes to Sustainability (369). China (330), Natural

Resources (319), Environmental Sustainability (184),

Environmental Economics (154), Green Finance

(146), and Economics (134) are the remaining

keywords that make an important contribution to the

keyword mapping network.

Figure 10: Keyword Map

5 CONCLUSIONS

This paper analyzed 224 documents from the Scopus

Database on AI, financial technology, and ESG

funds. The research study produced various results.

Regarding keywords, sustainable development has

the maximum link strength, followed by AI, financial

technology, and finance. In the perspective of co-

citation analysis, Resource Policy is the source with

the maximum citations, followed by Environment and

Science. The best quality papers on the keywords

were produced by Germany, with 34 citations per

paper. Consequently, Bahrain, the United Kingdom,

Indonesia, France, and the USA are countries that

have good quality papers published. Considering the

maximum citations, China is the country with the

most citations on documents, followed by Malaysia,

the United Kingdom, and the USA. If we consider the

maximum number of documents published by

authors, Rabbanim took first place, followed by

Hassan, Zetzsche, and Arner, who are the best

contributing authors for the keywords AI, financial

technology, sustainable investing, and ESG funds.

The University of Bahrain, King Saud University,

Kingdom University, South-western University of

Finance, and the University of New Orleans are the

top five universities that have produced the maximum

number of documents on the keywords. There are

different methods to calculate ESG funds'

performance in AI and machine learning, which are

accurate for results that could lead to optimal

decision-making for policymakers and professionals

to maintain a sustainable environment.

Exploring the Integration Among Artificial Intelligence, Fintech, and Sustainable Investing in ESG Funds in India: A Bibliometric

Perspective

69

6 LIMITATIONS AND FUTURE

SCOPE

The research study is limited to the Scopus database;

it may have ignored a few studies that exist in other

databases, such as PubMed, IEEE, and ScienceDirect.

Additionally, there may be other technological

synonyms that could be used as crucial research

phrases for future research. The combination of AI,

financial technology, and ESG funds is helpful for the

private sector in terms of operational achievements,

sustainable growth, and reducing risks, which leads to

long-term growth and highly responsible business

practices. Due to the high accuracy of results

provided by AI and fintech for ESG funds, the

participation of AI and fintech should be increased so

that a sustainable environment can be achieved. AI

and machine learning are changing the global

financial positions of countries; hence, the

participation of AI should be encouraged in the

financial system (Garfield, 1964).

REFERENCES

A. A. Gorova, S. V. Grishunin, and A. M. Karminsky, “The

Impact of ESG factors on the performance of

Information Technology Companies,” Procedia

Computer Science, vol. 199, pp. 339–345, 2022.

A. B. Siddik, M. N. Rahman, and L. Yong, “Do fintech

adoption and financial literacy improve corporate

sustainability performance? The mediating role of

access to finance,” J. Clean. Prod., vol. 421, no.

137658, p. 137658, 2023.

A. Żarczyńska, “Nicola DE Bellis: Bibliometrics and

citation analysis, from the science citation index to

cybermetrics, Lanham, Toronto, Plymouth

2009,” Toruńskie Stud. Bibliol., vol. 5, no. 1 (8), 2012.

C. Vergara and C. Ferruz Agudo, “Fintech and

sustainability: do they affect each

other?,” Sustainability, vol. 13, no. 13, pp. 1–19, 2021.

D. W. Arner, R. P. Buckley, D. A. Zetzsche, and R. Veidt,

“Sustainability, FinTech and financial inclusion,” Eur.

Bus. Organ. Law Rev., vol. 21, no. 1, pp. 7–35, 2020.

E. Garfield, The use of citation data in writing the history

of science. Philadelphia Institute of Scientific

Information, 1964.

E. Macchiavello and M. Siri, “Sustainable finance and

fintech: Can technology contribute to achieving

environmental goals? A preliminary assessment of

‘green fintech’and ‘sustainable digital

finance,” European Company and Financial Law

Review, vol. 19, no. 1, pp. 128–174, 2022.

G. Galeone, S. Ranaldo, and A. Fusco, “ESG and FinTech:

Are they connected?,” Res. Int. Bus. Fin., vol. 69, no.

102225, p. 102225, 2024

J. Xu, “AI in ESG for financial institutions: An industrial

survey,” arXiv [cs.CY], 2024.

K. Jain and P. S. Tripathi, “Mapping the environmental,

social and governance literature: a bibliometric and

content analysis,” J. Strategy Manag, vol. 16, no. 3, pp.

397–428, 2023.

L. Colledge, “Snowball metrics recipe book standardised

research metrics-by the sector, for the sector,” Snowball

Metrics, vol. 2, 2017.

M. Kashif, C. Pinglu, S. Ullah, and M. Zaman, “Evaluating

the influence of financial technology (FinTech) on

sustainable finance: a comprehensive global

analysis,” Financial Markets and Portfolio

Management, pp. 1–33, 2023.

M. M. Thottoli, “The tactician role of FinTech in the

accounting and auditing field: a bibliometric analysis,”

Qual. Res. Fin. Mark., vol. 16, no. 2, pp. 213–238,

2024.

M. Macpherson, A. Gasperini, and M. Bosco, “Artificial

intelligence and FinTech technologies for ESG data and

analysis,” SSRN Electron. J., 2021.

N. O. D. Ellili, “Is there any association between FinTech

and sustainability? Evidence from bibliometric review

and content analysis,” J. Fin. Serv. Mark., 2022.

R. G. Khalil, S. Damrah, M. Bajaher, and F. A. Shawtari,

“Unveiling the relationship of ESG, fintech, green

finance, innovation and susainability: case of Gulf

countries,” Environmental Science and Pollution

Research, vol. 30, no. 54, pp. 116299–116312, 2023.

S. Galletta, S. Mazzù, and V. Naciti, “A bibliometric

analysis of ESG performance in the banking industry:

From the current status to future directions,” Res. Int.

Bus. Fin., vol. 62, no. 101684, p. 101684, 2022.

S. Taneja, A. Siraj, L. Ali, A. Kumar, S. Luthra, and Y. Zhu,

“Is FinTech implementation a strategic step for

sustainability in today’s changing landscape? An

empirical investigation,” IEEE Trans. Eng. Manage.,

pp. 1–13, 2024.

T. Ankenbrand, D. Bieri, L. ReichmuthL. “IFZ FinTech

Study”. 2024.

W. Li and W. Pang, “The impact of digital inclusive finance

on corporate ESG performance: based on the

perspective of corporate green technology

innovation,” Environ. Sci. Pollut. Res. Int., vol. 30, no.

24, pp. 65314–65327, 2023.

Y. Sang, M. Xie, X. Bai, and F. Guo, “Does natural resource

dependence influence the impact of financial

technologies on corporate ESG and digital governance

in China’s listed enterprises?,” Resour. Policy, vol. 91,

no. 104948, p. 104948, 2024.

INCOFT 2025 - International Conference on Futuristic Technology

70