Machine Learning Innovations in Credit Card Approval: A Comparative

Study of Algorithms

Aman P Joy, Reshma R Bhat and Vidya Rao

∗

Department of Data Science and Computer Applications, Manipal Institute of Technology,

Manipal Academy of Higher Education, Manipal, India

Keywords:

Credit Card, Machine Learning, Online Transactions, Credit Score, Fraud Detection, Credit Risk.

Abstract:

In the ever-changing financial services industry, credit card approval is increasingly reliant on innovative

creditworthiness assessment algorithms. Traditional evaluation techniques, which examine applicants’ demo-

graphic and financial information, are no longer adequate because of the amount and complexity of informa-

tion accessible. By using machine learning (ML) models—specifically, logistic regression, random forests,

decision trees, and support vector machines—to increase predictive accuracy over traditional credit scoring

systems, this study seeks to improve the credit card acceptance process. By employing accurate experimental

methodologies, the efficiency of these models is compared to traditional credit scoring techniques, reveal-

ing significant enhancements in credit card approval precision, reducing errors and improving fraud detection

capabilities, especially in developing countries. This study provides significant insights for financial orga-

nizations looking to improve their methods for managing credit risk and address issues such as integrity,

interpretation, and dynamic risk evaluation in credit card acceptance processes.

1 INTRODUCTION

Traditionally, credit card approval involves analyz-

ing applicants based on a variety of financial and

social factors, such as employment status, earnings,

and credit history. The integrity of the financial sys-

tem is preserved by this process, which lowers credit

risk and guarantees that only eligible applicants are

given finance (Pristyanto et al., 2019). However, tra-

ditional ways have grown less successful as data vol-

ume and complexity have expanded, leading financial

institutions to investigate more advanced alternatives

(Bhatore et al., 2020). In this regard, machine learn-

ing has become a powerful instrument for examining

big datasets and locating patterns that are frequently

challenging to find using traditional methods. Re-

cent research have proved the predictive efficacy of

machine learning models, particularly Support Vec-

tor Machines (SVM) and Artificial Neural Networks

(ANN), in anticipating credit card acceptance out-

comes (Pristyanto et al., 2019). By using feature se-

lection approaches including information gain, gain

ratio, and correlation-based feature selection (CBFS),

these models can increase their prediction accuracy,

leading to a more reliable and effective credit card ac-

ceptance process (Fan et al., 2020).

This paper examines the use of machine learning

in credit card acceptance in the context of internet fi-

nancing(Karthiban et al., 2019). It provides a thor-

ough analysis of the growth of credit risk management

by comparing methods with recently developed ma-

chine learning algorithms. This paper measures how

different machine learning algorithms work in assess-

ing credit and determines which machine learning

algorithms are related to credit card approval meth-

ods(Gupta and Goyal, 2018). It advices banks how to

use machine learning(ML) to optimize their processes

and fix mistakes, especially in developing countries.

This paper’s main objective is to act as a guide for

improving credit risk management practices and fi-

nancial performance.(Sutedja et al., 2024)

The rising rate of digital payments and credit card

fraud (CCF) highlights the urgent need for effective

fraud detection and credit approval techniques (Alar-

faj et al., 2022).The present study examines the lit-

erature on deep learning (DL) and machine learning

(ML) models in relation to these systems.In order to

address issues including class imbalance, human er-

ror, and controlling financial risks in a cashless econ-

omy, the study aims to analyze recent developments

in these areas, highlighting the insights learnt from

various approaches(Bansal and Punjabi, 2021).

592

P Joy, A., R Bhat, R. and Rao, V.

Machine Learning Innovations in Credit Card Approval: A Comparative Study of Algorithms.

DOI: 10.5220/0013582200004664

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 3rd International Conference on Futuristic Technology (INCOFT 2025) - Volume 1, pages 592-599

ISBN: 978-989-758-763-4

Proceedings Copyright © 2025 by SCITEPRESS – Science and Technology Publications, Lda.

The goal of this paper is to examine how ma-

chine learning algorithms are used in the credit

card approval process(Awoyemi et al., 2017), han-

dling current issues including unbalanced datasets

and changing fraudulent activity. This work aims to

provide a comprehensive evaluation of various ma-

chine learning-based models and their ability to pre-

dict credit card acceptance outcomes(Arora et al.,

2022).The results of this study are meant to provide

clarity on and improve understanding of a credit card

acceptance mechanism, with major implications for

financial groups and guidance for future research in

this quickly evolving field.

2 EVALUATING CRITERIA FOR

CREDIT CARD APPROVAL

Banks usually use several critical methodologies for

credit card approval, each including different models

and cycles. The following are three different ways

banks endorse credit card applications:

2.1 Credit Score-Based Approval:

Credit card approval typically relies on loan scores,

especially credit scores or VantageScores, that are ba-

sic indicators of a person’s financial stability. These

record scores are numerical representations that help

banks coordinate their underwriting choices. Banks

could disperse (Fan et al., 2020) small score advan-

tages for certain Visa items, favoring emerging appli-

cants who surpass these limits and overlooking those

who fall short. Furthermore, financial evaluations

have a significant impact on the terms anticipated for

credit card offers, such as initial expenses, credit re-

strictions, and associated fees. Higher scores typi-

cally translate into better terms, which is consistent

with the chance-based assessment rule.

2.2 Income and Business Verification:

Verification plays a crucial role in the credit card

approval process. Banks assess applicants’ income

to determine their ability to meet credit card repay-

ment obligations. This is often done by reviewing

pay stubs, expense reports , or other financial docu-

ments for confirmation (Karthiban et al., 2019). Addi-

tionally, applicants with stable employment histories

and higher incomes are generally considered lower-

risk borrowers, increasing their chances of approval.

This evaluation of job stability and income level con-

tributes significantly to the overall assessment of an

applicant’s financial reliability.

2.3 Debt-to-Pay Extent (DTI):

Debt-to-income ratio (DTI) is pivotal in credit card

approval. Banks figure DTI by looking at a can-

didate’s month-to-month commitment portions (con-

tracts, vehicle propels, existing Visa commitment)

(Gupta and Goyal, 2018) to their gross month-to-

month pay. A lower DTI implies more optional in-

come, exhibiting better financial capacity to manage

additional charge card commitments and further de-

veloping support prospects. DTI is a basic bet assess-

ment metric banks use to evaluate candidates mone-

tary prosperity and choose monetary sufficiency.

3 MACHINE LEARNING

APPROACHES IN CREDIT

CARD APPROVAL

Machine learning has reformed different businesses,

and its application in credit card approval process is

no exception. By harnessing the force of information-

driven calculations, monetary organizations can dis-

sect immense measures of client data to go with addi-

tional precise and productive choices regarding credit

card approval. These methods collectively enhance

the effectiveness and reliability of credit card approval

decisions.

3.1 Credit Risk Assessment

In this framework, machine learning algorithms are

entirely prepared based on authentic credit informa-

tion to anticipate the probability of default or wrong-

doing for new credit card candidates.(Patel, 2023)

3.1.1 Feature Engineering

Various features such as credit scores, income, em-

ployment status, debt-to-income ratio, payment his-

tory, and utilization rates are incorporated into pre-

dictive models to assess credit risk.

3.1.2 Ensemble Methods

Procedures like random forests, gradient boosting,

and ensemble learning are used to combine multiple

models including Decision Trees and AdaBoost, to

improve prediction accuracy.

3.2 Fraud Detection

Fraud detection is vital before credit card approval,

identifying potential risks by analyzing transaction

Machine Learning Innovations in Credit Card Approval: A Comparative Study of Algorithms

593

patterns and customer behavior to ensure only qual-

ified applicants receive credit.(Patel, 2023)

3.2.1 Anomaly Detection

Machine learning can distinguish unusual patterns or

transactions indicative of fraudulent activity, like un-

expected spikes in spending, transactions demonstra-

tive of fraudulent movement, unforeseen spikes in

spending, transactions in unfamiliar areas, or pur-

chases outside a cardholder’s typical approach to pay-

ments.For instance, a transaction that differs from

normal spending may be flagged by models like

SVM, Random Forest, or other statistical methods.

3.2.2 Behavioral Analytics

Analytical models see cardholder habits for a long

time to recognize standard spending plans and per-

ceive any irregularities that could propose likely

fraudulent exercises(Mahmoodi et al., 2021).Tech-

niques such as clustering algorithms (e.g., k-means)

and neural networks can be used to analyze spending

behavior.

3.2.3 Real-time Monitoring

AI frameworks transactions in real-time, flagging

possibly fraudulent movements for immediate exam-

ination or blocking.Logistic regression and decision

trees are often used for real-time scoring of transac-

tions, allowing financial institutions to quickly assess

the likelihood of fraud.

3.3 Customer Division and Targeting

Customer division and targeting help financial in-

stitutions engage different segments effectively. By

using machine learning to analyze spending habits

and preferences, they can customize their offerings,

which enhances customer satisfaction and increases

the chances of credit card approvals.(Zhou et al.,

2020)

3.3.1 Clustering Algorithms

Machine learning methods such as k-means and hi-

erarchical clustering order credit card clients into

groups in view of their approach to spending ways,

inclinations, and segment data.

3.3.2 Personalized Offers

Financial institutions use machine learning to cus-

tomize credit card offers and rewards for various

customer segments, boosting engagement and satis-

faction. Models like decision trees and support vector

machines analyze customer data to predict the most

appealing offers for individuals, enabling targeted

marketing strategies.

4 KEY FINDINGS AND

SOLUTIONS

Naman Dalsania et al., (Dalsania et al., 2022) pro-

posed a review directed to foresee the endorsement

probability of a credit card demand utilizing super-

vised machine learning models. The review used

a dataset from Kaggle and applied pre-processing

strategies and exploratory data analysis. Three classi-

fication algorithms were carried out: AdaBoost Clas-

sifier, Support Vector Classifier, and Gradient Boost-

ing Algorithm. The outcomes show that the Gradi-

ent Boosting Algorithm accomplishes the most ele-

vated scores for exactness, accuracy, recall, and F1-

Score, while the Support Vector Classifier likewise

performed well. The research proposes using deep

learning models to expand the framework’s accuracy

in revealing hidden patterns and correlations inside

the information. Besides, it examines different AI ap-

proaches zeroed in on gauging credit card approval

results.

Yiran Zhao (Zhao, 2022) predicted the precision

of numerous regression models and classifiers to find

out the ideal model with the highest accuracy. The

trial models utilized in the examination incorporate

Logistic Regression, Linear SVC, and Na

¨

ıve Bayes

Classifier. The outcomes show that Linear SVC

played out the best with the highest Balanced Ac-

curacy (89.09%) and Accuracy Rate (88.48%). In

any case, the paper has restrictions as it doesn’t think

about computational productivity, reject deduction,

and exception taking care of variables in surveying

prediction performance.a

Harsha Vardhan Peela et al., (Peela et al., ) pro-

posed utilizing data analysis and machine learning

to decide the most fundamental boundaries for credit

card acceptance. The technique included examining

applications, taking care of missing values, and pre-

processing the information. A model of logistic re-

gression was fitted to the training set, and devices

were utilized to work on the model’s performance.

The outcomes demonstrated that utilizing both ran-

dom forest and logistic regression models prompted

a pinnacle precision of 86%. In spite of leading a

hunt to further develop execution, there could have

been no further improvement. Generally, this study

INCOFT 2025 - International Conference on Futuristic Technology

594

offers bits of knowledge into the components affect-

ing credit card approval while additionally revealing

insight into the difficulties related to achieving more

prominent accuracy.

Ying Chen et al., (Chen and Zhang, ) Proposed

a structure for forecasting credit card defaults using

a blend of k-means SMOTE and BP neural network

methodologies. The creators address the information

irregularity issue and propose utilizing the k-means

SMOTE algorithm to change the data distribution.

They likewise work out the significance of data fea-

tures utilizing random forest and use it to initialize

the weights of the BP neural network. The discover-

ies exhibit that the upgraded k-means SMOTE algo-

rithm successfully handles data imbalance character-

istics and improves forecast precision. Moreover, uti-

lizing the component significance from random forest

marginally works on the prediction. The support vec-

tor machine accomplished the most noteworthy score

among the six models assessed. The paper recog-

nizes the restriction of deficient information for run-

ning the BP neural network algorithm and highlights

that credit card approval is subjective and uncontrol-

lable.

Md.Golam Kibria et al., (Kibria and Sevkli, 2021)

proposed using deep learning to make credit card ap-

proval decisions. The researchers developed a pro-

found learning architecture using UCI datasets and

then considered its viability in contrast to logistic re-

gression and support vector machine models. The

outcomes showed that the deep learning model had

the most elevated exactness rate at 87.10%, while

the other two models had a precision rate of 86.23%.

However, the paper’s primary downside is that it just

contrasted the deep learning model and two custom-

ary machine learning algorithms, and more correla-

tions with different algorithms would be expected to

lay out its benefit over other algorithms.

Makumburage Poornima Chathurangi Peiris

(Peiris, 2022) recommended the utilization of deep

learning for credit card approval decisions, explicitly

artificial neural networks and support vector mech-

anisms, to anticipate client qualification for a credit

card and moderate potential credit risk for banks.

The review assesses three classifiers and finds that

the nonlinear help vector machine (SVM) model

outperforms the artificial neural network (ANN) and

linear SVM models. The nonlinear SVM model

accomplishes an accuracy of 0.88, precision of 0.88,

recall of 0.90, and area under the curve (AUC) of

0.89. They feature that the underlying dataset was

exceptionally imbalanced, and SMOTE was applied

to resolve this issue.

Abhishek Agarwal et al., (Abhishek Agarwal and

Verma, 2020) have proposed that PCA can be ap-

plied to enhance the credit card dataset classification

methods. They evaluated the performance of four al-

gorithms: This includes, Logistic Regression, Deci-

sion Tree, K-Nearest Neighbour (K-NN), and Naive

Bayes. The results obtained from their study revealed

that logistic regression had higher accuracy rates be-

fore and after using PCA than other methods. They

also established that Naive Bayes had high rates of

recall and ROC after using PCA. It can be seen that

Logistic Regression is the most accurate model on this

dataset, meanwhile PCA does not affect decision tree

accuracy at all. Their study can assist banking insti-

tutions in their efforts to define probable defaulters

by constructing enhanced algorithms with greater ac-

curacy, precision, recall, F1-score, and ROC through

PCA.

Rejwan Sulaiman et al., (Sulaiman et al., 2022)

proposed the different purposes of machine learning

techniques for credit card fraud detection (CCFD) and

information classification. Numerous methods were

analyzed, such as random forest, artificial neural net-

work, support vector machine, K-Nearest Neighbour,

hybrid approach, privacy-preserving techniques, and

blockchain technology. The dataset was divided into

training, validation, and testing sets. The investiga-

tion discovered that a hybrid solution involving neu-

ral networks in a federated learning structure accom-

plished higher precision in CCFD while guaranteeing

security. The proposed system may confront restric-

tions because of severe standards and guidelines from

banks and monetary establishments. By and large, the

exploration features the capability of machine learn-

ing for CCFD; however, it recognizes the need to con-

sider reasonable requirements while executing such

frameworks.

Yanbo Shen et al., (Fan et al., 2020) proposed

a superior credit evaluation model utilizing the XG-

Boost machine learning algorithm for Internet finan-

cial institutions. The model is contrasted with a cus-

tomary credit card scoring model utilizing a contex-

tual investigation from a Web loaning organization

in China. The trial results show that the Machine

Learning model beats the conventional model regard-

ing the KS value, demonstrating specific benefits in

Web monetary risk control. Nonetheless, the disad-

vantages are setting model boundaries in advance and

the relatively high error rate in judging bad samples as

good samples. In general, the paper features the ca-

pability of machine learning-based methods for credit

scoring in internet monetary risk control while recog-

nizing areas for development.

Harish Paruchuri (Paruchuri, 2017) proposed the

different issues of credit card fraud in online shopping

Machine Learning Innovations in Credit Card Approval: A Comparative Study of Algorithms

595

and investigated utilizing different machine learning

algorithms to identify fraudulent exchanges. The al-

gorithms referenced in the paper incorporate neu-

ral networks, decision trees, SVM, logistic regres-

sion, genetic algorithms, and random forests. The

paper presents genuine situations where these algo-

rithms were utilized to tackle credit card fraud issues.

Nonetheless, it doesn’t give a specialized examination

or precision evaluation of these algorithms in unam-

biguous data sets. It sums up how individual calcula-

tions have been utilized for credit card fraud predic-

tion.

5 DIFFERENT ALGORITHMS

USED IN CREDIT CARD

APPROVAL

Machine learning algorithms are employed in credit

card approval systems to assess credit risk and make

endorsement decisions. The following are some com-

monly used algorithms: These algorithms primarily

operate as classification methods, categorizing appli-

cants into distinct classes such as approved or denied

based on a variety of financial and demographic fea-

tures.

5.1 Logistic Regression

- Logistic regression is a well-known algorithm for

binary classification undertakings like credit card ap-

proval. In light of info highlights, it estimates the like-

lihood that an occurrence has a place with a specific

class (e.g., approved or denied). It’s straightforward,

interpretable, and efficient, making it reasonable for

credit risk evaluation undertakings where transper-

ancy and explainability are significant(Peela et al., ;

Karthiban et al., 2019; Fan et al., 2020; Zhao, 2022;

Kibria and Sevkli, 2021; Paruchuri, 2017).

5.2 Decision Trees

- Decision trees recursively split the dataset into sub-

sets according to the worth of input features, making a

tree-like design where each interior node addresses a

decision in light of a feature, and the leaf node shows

the last grouping or result. Decision trees are justifi-

able and can perceive non-linear connections between

features. They might be inclined to overfitting, par-

ticularly with complex datasets(Marqu

´

es et al., 2012;

Arora et al., 2022; Bansal and Punjabi, 2021; Sutedja

et al., 2024).

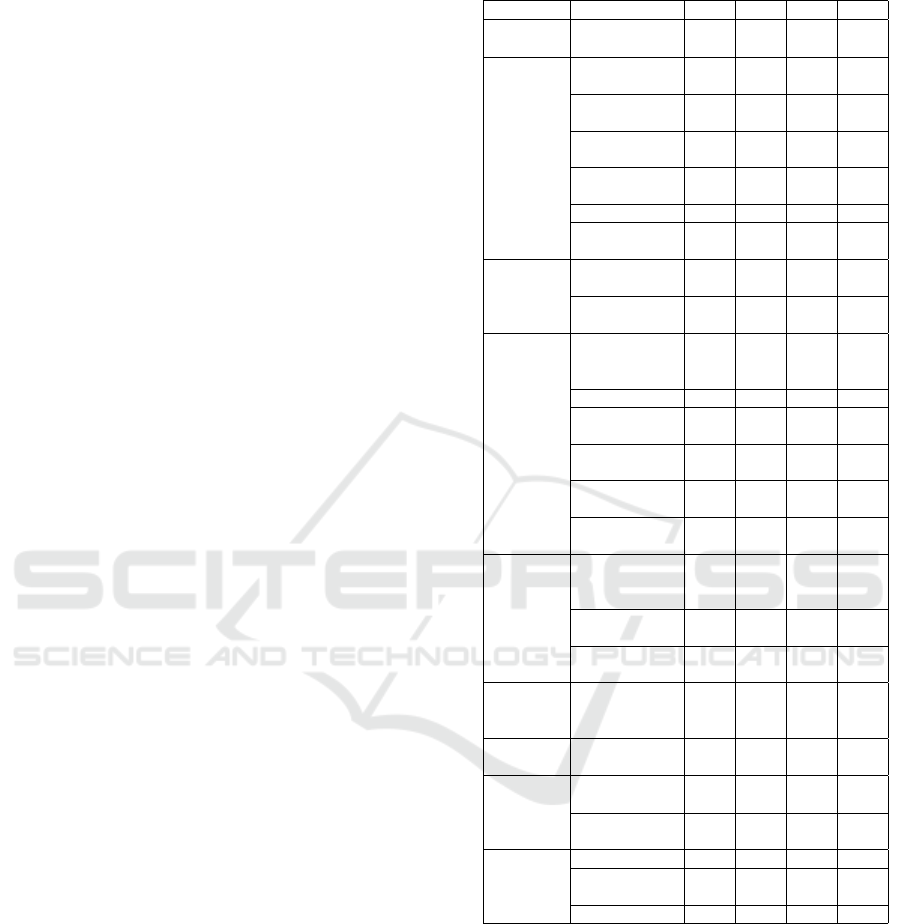

Table 1: Algorithm Comparison Table

Algorithm Papers Acc. Prec. Rec. F1

Gradient

Boosting

(Dalsania

et al., 2022)

0.90 0.90 0.90 0.90

SVM (Dalsania

et al., 2022)

0.85 0.83 0.88 0.86

(Chen and

Zhang, )

0.88 0.88 0.88 0.88

(Kibria and

Sevkli, 2021)

0.86 0.868 0.862 0.863

(Sulaiman

et al., 2022)

0.91 - - -

(Peiris, 2022) 0.71 0.83 0.55 0.71

(Fan et al.,

2020)

0.77 - - -

Random

Forest

(Peela et al., ) 0.86 - - -

(Chen and

Zhang, )

0.81 0.87 0.87 0.87

Logistic

Reg.

(Abhishek Agar-

wal and

Verma, 2020)

0.806 0.699 0.225 0.341

(Peela et al., ) 0.86 - - -

(Chen and

Zhang, )

0.87 0.87 0.88 0.87

(Kibria and

Sevkli, 2021)

0.86 0.864 0.862 0.861

(Sulaiman

et al., 2022)

0.95 - - -

(Fan et al.,

2020)

0.70 - - -

KNN (Abhishek Agar-

wal and

Verma, 2020)

0.801 0.592 0.339 0.431

(Chen and

Zhang, )

0.86 0.87 0.87 0.87

(Sulaiman

et al., 2022)

0.72 - - -

Decision

Tree

(Abhishek Agar-

wal and

Verma, 2020)

0.729 0.392 0.396 0.394

(Chen and

Zhang, )

0.87 0.82 0.815 0.817

Deep

Learning

(Kibria and

Sevkli, 2021)

0.87 0.879 0.892 0.886

(Sulaiman

et al., 2022)

0.95 - - -

ANN - 0.87 - - -

(Sulaiman

et al., 2022)

0.92 - - -

(Peiris, 2022) 0.78 0.81 0.73 0.76

5.3 Random Forests

- Random Forests resemble a group of leaders. They

assemble many rather than depending on only one in-

dividual (or decision tree). Every choice tree checks

out various pieces of an individual’s monetary cir-

cumstance, similar to pay and record. Then, at that

point, they all decide whether to support the individ-

ual with a credit card. This cooperation approach as-

sists banks with settling on additional exact decisions

about who to approve for a credit card, lessening the

INCOFT 2025 - International Conference on Futuristic Technology

596

risk of giving cards to individuals who can’t repay

them(Peela et al., ; Chen and Zhang, ; Kibria and

Sevkli, 2021; Arora et al., 2022; Sutedja et al., 2024;

Alarfaj et al., 2022).

5.4 Support Vector Machines (SVM)

- Support Vector Machines (SVMs) resemble walls

that differentiate various gatherings by defining

boundaries between them to maximize the distance

between the groups. In credit card approval sys-

tems, SVMs utilize monetary data like pay and credit

records as consumers to conclude who ought to get

a card and who shouldn’t. By tracking down the

best line to isolate great candidates from risky ones,

SVMs assist banks with settling on more smart deci-

sions about who to approve for a credit card, limit-

ing the possibility of giving cards to individuals who

could battle to repay them(Bhatore et al., 2020; Fan

et al., 2020; Zhao, 2022; Arora et al., 2022; Kibria

and Sevkli, 2021; Sutedja et al., 2024).

5.5 Neural Networks

- Neural Networks like multi-layer perceptrons

(MLPs) or convolutional neural networks (CNNs) go

about as cutting-edge analysts in credit card endorse-

ment frameworks, dissecting different monetary vari-

ables to foresee an individual’s probability of capably

dealing with credit cards. They require loads of in-

formation and processing power but battle with inter-

pretation. Despite this, they further improve decision-

making accuracy, helping banks approve credit cards

wisely and reduce default risks(Bhatore et al., 2020;

Sulaiman et al., 2022; Peiris, 2022).

5.6 K-Nearest Neighbors (KNN)

- KNN, or K-Nearest Neighbors, resembles request-

ing neighbors for advice to make decisions. It no-

tices the way of behaving of comparative people in a

neighborhood of data of interest and uses their ma-

jority behavior part to foresee results. In credit card

approval systems, KNN assists banks with survey-

ing a candidate’s reliability by contrasting their mon-

etary profile with those of comparable people who

have recently been supported or turned down regard-

ing credit cards. Despite its simplicity and usabil-

ity, KNN might be slow and computationally costly

with enormous datasets or various monetary factors.

Yet, it helps banks arrive at additional educated con-

clusions about broadening credit while overseeing

chances(Arora et al., 2022; Awoyemi et al., 2017; Su-

laiman et al., 2022).

6 CHALLENGES AND

OPPORTUNITIES

6.1 Challenges

6.1.1 Data Imbalance

Fraud detection in credit card approval systems is a

problem because the number of positive and negative

instances is highly uneven(Ahmed and Shamsuddin,

2021). This can make the machine learning models

predict that there was no fraud, this leads to failure to

detect fraud incidences.

6.1.2 Fairness and Bias

Machine learning models may unintentionally reflect

biases found in historical data, influencing decisions

based on gender, race, or income level. Ensuring fair-

ness in credit decisions is an important concern(Wu,

2024).

6.1.3 Regulatory Compliance

Regulatory compliance focuses on organizations fol-

lowing legislation laws and guidelines to achieve

organizational objectives and increase stakeholder

value.(Hassan et al., 2023) Policies regarding the

credit approval models should be adhered to strictly

because they provide guidelines on how a customer’s

creditworthiness is determined. These regulations

and model compliance make the deployment of these

machine-learning systems challenging.

6.1.4 Evolving Fraud Patterns

The nature of fraud strategies is not static, so the mod-

els will always find it hard to cope.(Faraji, 2022) To

counter such trends, machine learning models have to

be trained constantly – a process that requires a lot of

time and money.

6.2 Opportunities

6.2.1 Improved Predictive Accuracy

Machine learning techniques, such as Logistic Re-

gression and RF models, lead to improved prediction

of credit card approvals, which can help detect fraud

more effectively than traditional methods (Mahbobi

et al., 2023).

6.2.2 Advanced Fraud Detection

Techniques such as the anomaly detection technique

and the real-time monitoring technique will detect

Machine Learning Innovations in Credit Card Approval: A Comparative Study of Algorithms

597

fraudulence more efficiently.(Faraji, 2022) Examin-

ing the spending pattern makes it possible for banks

to identify potentially fraudulent transactions before

they happen.

6.2.3 Enhanced Personalization

Deep learning can be adopted to process customer

spending behavior to ensure that financial institutions

develop and provide credit card products and services

that suit market needs and increase customer satisfac-

tion(Gigante and Zago, 2023).

6.2.4 Quantum Computing Potential

Quantum computing has the potential to revolutionize

the use of predictive analytics in credit card fraud so-

lutions(Egger et al., 2020). Future work could investi-

gate how such quantum algorithms may enhance real-

time fraud detection given even massive data sets.

Therefore, credit card approval systems offer

many chances for improvement even if they also con-

front many obstacles, including data imbalance, inter-

pretability issues, regulatory compliance, and chang-

ing fraud trends. By utilizing machine learning tech-

niques, financial organizations can increase fraud de-

tection skills and forecast accuracy. Furthermore,

there are encouraging opportunities to provide more

individualized and efficient credit services because

of developments like quantum computing and behav-

ioral economics.

7 CONCLUSION

In conclusion, the approval of credit cards will be ef-

fective for financial institutions that apply standard

analytical tools combined with modern artificial in-

telligence approaches. This assessment should be

used to study a person’s financial stability, primar-

ily based on his credit payment history, credit bene-

fits, and working conditions. Credit risk appraisal and

detection of fraud, client segmentation, speeding up

approvals, and reducing the probable risks are made

possible with the help of Machine Learning.

However, there are clear assessment opportunities

and prospects here. Many concepts are valuable in

this process, mainly settling sensibility, control, inter-

pretability, and dynamic risk appraisal, as they help

guarantee impartial treatment and trust from the peo-

ple being governed. Future assessments can target us-

ing valid artificial intelligence approaches and moral

standards and changing the organization to maintain

customer satisfaction and financial health. Similarly,

the mixture of adopting advances such as blockchain

and decentralized finance offers security for reformed

credit frameworks and economic considerations.

By overcoming these challenges and paying atten-

tion to the new strategies for potential customers, ap-

plying Machine Learning to credit card approval can

introduce transparent, effective, and profitable finan-

cial systems for both organizations and customers.

REFERENCES

Abhishek Agarwal, Amit Rana, K. G. and Verma, N.

(2020). A comparative study and enhancement of

classification techniques using principal component

analysis for credit card dataset. In 2020 International

Conference on Intelligent Engineering and Manage-

ment (ICIEM), pages 443–448. IEEE.

Ahmed, F. and Shamsuddin, R. (2021). A comparative

study of credit card fraud detection using the combina-

tion of machine learning techniques with data imbal-

ance solution. In 2021 2nd International Conference

on Computing and Data Science (CDS), pages 112–

118. IEEE.

Alarfaj, F. K., Malik, I., Khan, H. U., Almusallam, N.,

Ramzan, M., and Ahmed, M. (2022). Credit card

fraud detection using state-of-the-art machine learn-

ing and deep learning algorithms. IEEE Access,

10:39700–39715.

Arora, S., Bindra, S., Singh, S., and Nassa, V. K. (2022).

Prediction of credit card defaults through data analysis

and machine learning techniques. Materials Today:

Proceedings, 51:110–117.

Awoyemi, J. O., Adetunmbi, A. O., and Oluwadare, S. A.

(2017). Credit card fraud detection using machine

learning techniques: A comparative analysis. In 2017

International Conference on Computing Networking

and Informatics (ICCNI), pages 1–9. IEEE.

Bansal, S. and Punjabi, T. (2021). Comparison of differ-

ent supervised machine learning classifiers to predict

credit card approvals. International Research Journal

of Engineering and Technology, 8(3):1339–1348.

Bhatore, S., Mohan, L., and Reddy, Y. R. (2020). Machine

learning techniques for credit risk evaluation: a sys-

tematic literature review. Journal of Banking and Fi-

nancial Technology, 4(1):111–138.

Chen, Y. and Zhang, R. Research on credit card default

prediction based on k-means smote and bp neural net-

work. Complexity, 2021:1–13.

Dalsania, N., Punatar, D., and Kothari, D. (2022). Credit

card approval prediction using classification algo-

rithms. International Journal For Research in Applied

Science and Engineering Technology, 10(11).

Egger, D. J., Gambella, C., Marecek, J., McFaddin, S.,

Mevissen, M., Raymond, R., Simonetto, A., Woerner,

S., and Yndurain, E. (2020). Quantum computing for

finance: State-of-the-art and future prospects. IEEE

Transactions on Quantum Engineering, 1:1–24.

Fan, S., Shen, Y., and Peng, S. (2020). Improved ml-based

INCOFT 2025 - International Conference on Futuristic Technology

598

technique for credit card scoring in internet financial

risk control. Complexity, 2020:1–14.

Faraji, Z. (2022). A review of machine learning applica-

tions for credit card fraud detection with a case study.

SEISENSE Journal of Management, 5(1):49–59.

Gigante, G. and Zago, A. (2023). Darq technologies in the

financial sector: artificial intelligence applications in

personalized banking. Qualitative Research in Finan-

cial Markets, 15(1):29–57.

Gupta, D. K. and Goyal, S. (2018). Credit risk predic-

tion using artificial neural network algorithm. Inter-

national Journal of Modern Education and Computer

Science, 10(5):9–16.

Hassan, M., Aziz, L. A.-R., and Andriansyah, Y. (2023).

The role artificial intelligence in modern banking:

an exploration of ai-driven approaches for enhanced

fraud prevention, risk management, and regulatory

compliance. Reviews of Contemporary Business Ana-

lytics, 6(1):110–132.

Karthiban, R., Ambika, M., and Kannammal, K. (2019).

A review on machine learning classification technique

for bank loan approval. In 2019 International Con-

ference on Computer Communication and Informatics

(ICCCI), pages 1–6. IEEE.

Kibria, M. G. and Sevkli, M. (2021). Application of deep

learning for credit card approval: A comparison with

two machine learning techniques. International Jour-

nal of Machine Learning and Computing, 11(4):286–

290.

Mahbobi, M., Kimiagari, S., and Vasudevan, M. (2023).

Credit risk classification: an integrated predictive ac-

curacy algorithm using artificial and deep neural net-

works. Annals of Operations Research, 330(1):609–

637.

Mahmoodi, J., Patel, M. K., and Brosch, T. (2021). Pay

now, save later: Using insights from behavioural eco-

nomics to commit consumers to environmental sus-

tainability. Journal of Environmental Psychology,

76:101625.

Marqu

´

es, A., Garc

´

ıa, V., and S

´

anchez, J. S. (2012). Two-

level classifier ensembles for credit risk assessment.

Expert Systems with Applications, 39(12):10916–

10922.

Paruchuri, H. (2017). Credit card fraud detection using ma-

chine learning: A systematic literature review. ABC

Journal of Advanced Research, 6(2):113–120.

Patel, K. (2023). Credit card analytics: a review of fraud

detection and risk assessment techniques. In Interna-

tional Journal of Computer Trends and Technology,

volume 71, pages 69–79.

Peela, H. V., Gupta, T., Rathod, N., Bose, T., and Sharma,

N. Prediction of credit card approval. International

Journal of Soft Computing and Engineering, 11(2):1–

6.

Peiris, M. (2022). Credit Card Approval Prediction by Us-

ing Machine Learning Techniques. PhD thesis.

Pristyanto, Y., Adi, S., and Sunyoto, A. (2019). The ef-

fect of feature selection on classification algorithms

in credit approval. In 2019 International Confer-

ence on Information and Communications Technology

(ICOIACT), pages 451–456. IEEE.

Sulaiman, R. B., Schetinin, V., and Sant, P. (2022). Review

of machine learning approach on credit card fraud

detection. Human-Centric Intelligent Systems, 2(1-

2):55–68.

Sutedja, I., Lim, J., Setiawan, E., and Adiputra, F. R. (2024).

Credit card approval prediction: A systematic. Jour-

nal of Theoretical and Applied Information Technol-

ogy, 102(3).

Wu, J. J.-X. (2024). Algorithmic fairness in consumer credit

underwriting: Towards a harm-based framework for ai

fair lending. Berkeley Bus. LJ, 21:65.

Zhao, Y. (2022). Credit card approval predictions using lo-

gistic regression, linear svm and naive bayes classifier.

In 2022 International Conference on Machine Learn-

ing and Knowledge Engineering (MLKE), pages 207–

211. IEEE.

Zhou, Y., J

´

ılkov

´

a, P., Chen, G., and Weisl, D. (2020).

New methods of customer segmentation and individ-

ual credit evaluation based on machine learning. In

New Silk Road: Business Cooperation and Prospec-

tive of Economic Development (NSRBCPED 2019),

pages 925–931. Atlantis Press.

Machine Learning Innovations in Credit Card Approval: A Comparative Study of Algorithms

599