Research on the Role of Computer Security Management in

Preventing Financial Technology Risks

Lanlan Wan

School of Economics and Management, Shanghai University of Political Science and Law, 201701, China

Keywords: Computer Network, Security Management Technology, Meta-Network Approach, Fintech Risks.

Abstract: The role of computer security management technology in preventing financial technology risks is very

important, but there is a problem of inaccurate assessment of risk judgment results. The intrusion detection

method cannot solve the problem of result judgment error in fintech risk prevention management. Therefore,

a computer security management scheme based on meta-network method is proposed to prevent financial

technology risks Analyse. Firstly, the concept of trust domain is adopted to determine different entity sets

according to different levels of security requirements, and divide the levels according to the risk prevention

annotation to reduce the interference factor of the error of determining the risk level. Then, through the

information interaction properties within the meta-network structure, the computer network with specific

needs and functions can be described, and the results of preventing financial technology risks can be

comprehensively analyzed. The results of MATLAB simulation experiments show that under the background

of unified judgment standards, the meta-network is based The computer security management technology of

the method is applied to financial technology risk prevention, and its accuracy and timeliness are better than

that of the intrusion detection method.

1 INTRODUCTION

With the rapid development of Internet technology,

computer networks, especially securities, futures and

banks and many other enterprises have also been

widely used, and the business of enterprises is

basically based on computer networks (Agustina, and

Subagyo, et al. 2022). Although the maintenance and

security of computer networks of financial and

securities companies will be periodically managed,

there are still certain network security incidents

(Rahmattullah, and Suman, et al. 2021). Some

scholars believe that applying business process-based

computer security methods to enterprise fintech risk

detection can effectively detect the security problems

existing in enterprise networks and provide

corresponding support for enterprise network security

prevention (Marandi, and dogra, et al. 2022). On this

basis, this paper proposes a meta-network method to

optimize the risk scheme of enterprise

fintech and

verify the effectiveness of the model (ALMahadin,

and Hiari, et al. 2022).

2 RELATED CONCEPTS

2.1 Mathematical Description of the

Meta-Network Approach

The meta-network method uses the concept of trust

domain to optimize the security system, and finds the

insecure factors in the security system according to

the indicators in the security system and integrate the

security precautionary scheme to finally judge the

feasibility of computer security management

(Chenniappanadar, and Gnanamurthy, et al. 2022).

The meta-network method combines the advantages

of trust domain theory, and uses the characteristics of

information interaction within the meta-network

structure to describe the specific functions of the

computer network, thereby enhancing the risk of

fintech of the quality of prevention.

Suppose I. Fintech risk prevention requirements

are

i

x

, computer network security management

scheme is

i

f

it

, computer network security

management scheme satisfaction is

i

N

, The

Wan, L.

Research on the Role of Computer Security Management in Preventing Financial Technology Risks.

DOI: 10.5220/0013545600004664

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 3rd International Conference on Futuristic Technology (INCOFT 2025) - Volume 1, pages 463-467

ISBN: 978-989-758-763-4

Proceedings Copyright © 2025 by SCITEPRESS – Science and Technology Publications, Lda.

463

judgment function of the computer network security

management scheme is

(0)

i

Tx≈

as shown in

Equation (1).

()

ii i

Tx

f

it N

∧

=⎯⎯→

(1

)

2.2 Selection of Computer Network

Security Management Scheme

Hypothesis II The fintech risk prevention function is

()

i

Qx

and the weight coefficient is

i

w

, then, the

security management requirements are not applied,

the fintech risk prevention model as shown in

Equation (2):

()= (, )

ii ii i

Qx K Fx N w

τ

⋅−⊗

∏

(1)

2.3 Analysis of Fintech Risk Security

Management Program

Before the meta-network method, a multi-

dimensional analysis of the enterprise fintech risk

prevention scheme should be carried out, and the risk

prevention requirements should be mapped to the

computer network security management database to

eliminate unqualified risk prevention Scheme. First,

the fintech risk prevention scheme is

comprehensively analyzed, and the threshold and

index weights of the risk prevention scheme are set to

ensure the accuracy of the meta-network method.

Financial technology risk prevention management is

a system test security management plan, which needs

to be optimized and improved. If the fintech risk is in

a non-normal distribution, its computational network

security management scheme will be affected,

reducing overall risk prevention management

accuracy. In order to improve the accuracy of the grey

correlation algorithm and improve the level of risk

prevention management, it is necessary to select the

risk security management plan, and the specific

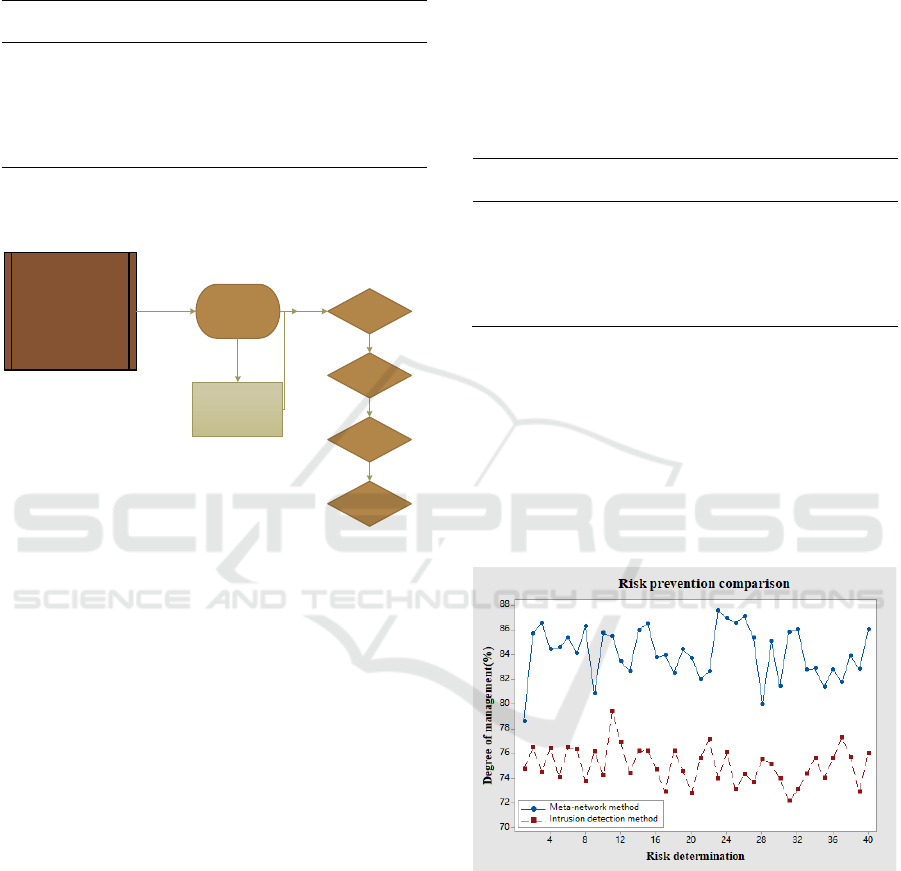

scheme selection is shown in Figure 1 shown.

The investigation of the risk and security

management scheme shows that the risk security

management scheme presents a multi-dimensional

distribution, which is in line with the objective facts.

Risk security management is not directional,

indicating that the risk security management scheme

User terminal

Network

connection

device

Network

access

device

Central

Management

Server

Network

ReliableDNS

Tampered

withDNS

Figure 1: Results of selection of fintech risk prevention

solutions

has strong randomness, so it is regarded as a high

analytical study. Risk security management meets the

normal requirements, mainly the meta-network

method adjusts the financial technology risk

prevention management, removes duplicate and

irrelevant schemes, and supplements the default

scheme, so that the whole The dynamic correlation of

risk prevention management solutions is strong.

3 OPTIMIZATION STRATEGIES

FOR FINTECH RISK

PREVENTION MANAGEMENT

The meta-network method adopts a random

optimization strategy for fintech risk prevention, and

adjusts talent parameters to optimize the solution of

fintech risk prevention management. The meta-

network method divides fintech risk prevention into

different management levels, and randomly selects

different solutions. In the iterative process, the risk

prevention schemes of different prevention

management levels are optimized and improved.

After the optimization and promotion analysis is

completed, the prevention and management level of

different solutions is compared, and the best financial

technology risk prevention and management methods

are recorded.

4 PRACTICAL CASES OF

FINTECH RISK PREVENTION

MANAGEMENT

4.1 Introduction to Risk Prevention

and Management

In order to facilitate fintech risk management, this

paper takes fintech risk management in complex

situations as the research object, with 12 paths and a

INCOFT 2025 - International Conference on Futuristic Technology

464

test time of 12h The evaluation scheme of fintech risk

management is shown in Table 1.

Table 1: Fintech risk management requirements

Scope of

a

pp

lication

Management

level

Manage

effects

Manage

q

ualit

y

Bank I 64.38 61.74

II 63.74 62.41

Securities

companies

I 62.75 64.64

II 63.09 62.55

Futures

companies

I 65.05 62.16

II 64.95 57.99

The fintech risk management process in Table 1 is

shown in Figure 2.

Risk prevention of

financial technology

Computer

security

Meta-network

method

Risk

prediction

Data set

Constraint

condition

Results

Figure 2:The analysis process of fintech risk prevention

management

Compared with the intrusion detection method,

the computer security management scheme of the

meta-network method is closer to the actual fintech

risk prevention management requirements. In terms

of the rationality and fluctuation range of financial

technology risk prevention management, the meta-

network method is better than the PLD teaching

mode. The changes in the fintech risk prevention

management scheme in Figure II show that the meta-

network method has better stability and faster

judgment speed. Therefore, the meta-network

method's fintech risk prevention and management

scheme has more advantages in the speed and

stability of the judgment of security issues.

4.2 Fintech Risk Management

The financial technology risk prevention program for

computer security management includes non-

structural, semi-structured, and structural

information. After the pre-selection of the meta-

network method, a preliminary fintech risk

prevention scheme for computer security

management is obtained, and the computer security

management is obtained Analysis of the feasibility of

fintech risk prevention solutions. In order to more

accurately verify the effect of financial technology

risk prevention and management, select different risk

prevention levels of financial technology risk

prevention solutions to prevent the management

effect This is shown in Table 2.

Table 2: The overall situation of the fintech risk prevention

management plan

Level of

p

rotection

Manage

satisfaction

Risk

determination

Class I 85.73 74.21

Class II 85.47 79.38

Grade III 83.41 76.82

Class IV 82.65 74.42

Class V 85.95 76.17

P=4.15

4.3 The Effect and Stability of

Financial Technology Risk

Prevention in Computer Security

Management

In order to verify the accuracy of the meta-network

method, the fintech risk prevention scheme is

compared with the intrusion detection method, and

the prevention evaluation effect is shown in Figure 3.

Figure 3: Fintech risk prevention results of different

algorithms

It can be seen from Figure 3 that the fintech risk

prevention effect of the meta-network method is

higher than that of the intrusion detection method, but

the error rate is lower, indicating that the meta-

network method is based on it The risk prevention

effect of computer security management of fintech is

relatively stable, while the risk prevention detection

of intrusion detection method is uneven. The average

Research on the Role of Computer Security Management in Preventing Financial Technology Risks

465

preventive effect of the above methods is shown in

Table 3.

Table 3. Comparison of risk prevention accuracy of

different methods

Algorithm Quality of

risk

p

revention

Magnitude

of change

Error

Meta-network

methods

90.58 91.87 1.29

Intrusion

detection

79.09 83.26 4.17

Network

antivirus

detection

64.38 61.27 3.11

By Table 3, it can be seen that the intrusion

detection method has deficiencies in the prevention

effect and stability of financial technology risk

prevention effect, the quality of risk prevention has

changed significantly, and the error rate is high. The

general results of the meta-network method have a

higher quality of risk prevention than the intrusion

detection method. At the same time, the quality of

financial technology risk prevention management of

computer security management is greater than 90%,

and the accuracy has not changed significantly. In

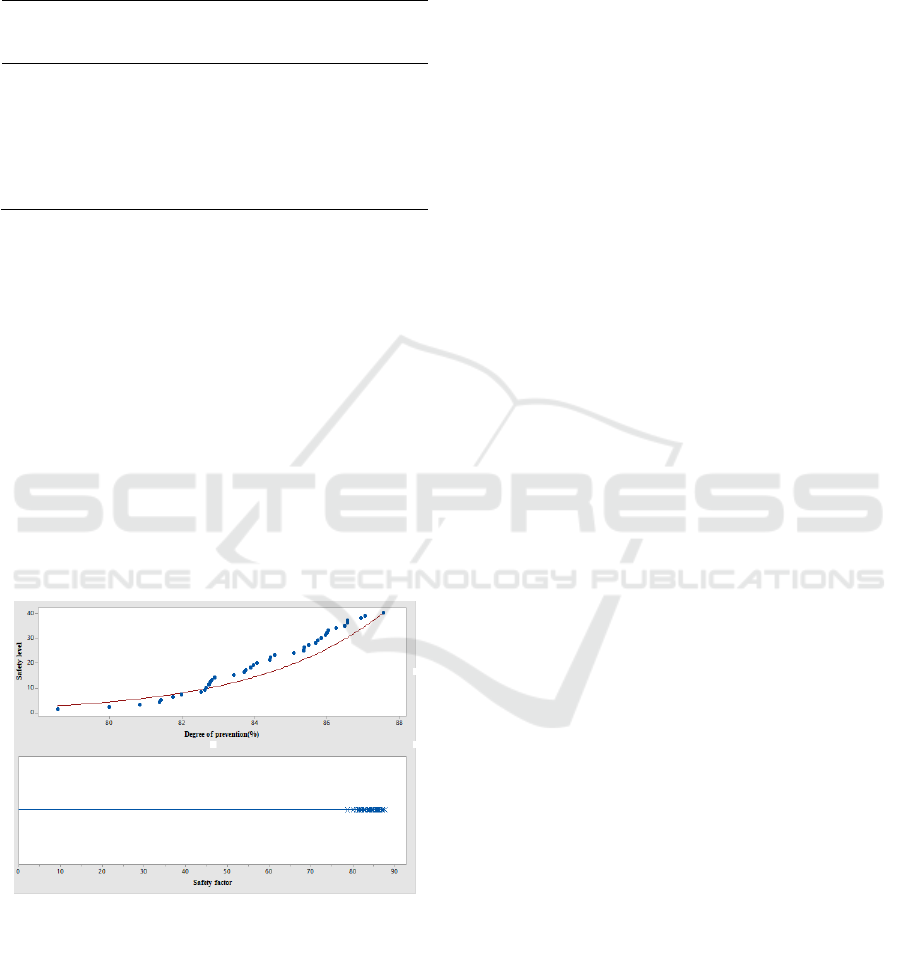

order to further verify the superiority of the meta-

network method. In order to further verify the

effectiveness of the proposed method, the meta-

network method is generally analyzed by different

methods, as shown in Figure 4.

Figure 4: Fintech risk prevention based on meta-network

approach

By Figure 4 It can be seen that the fintech risk

prevention quality of the meta-network method is

significantly better than that of the intrusion detection

method, and the reason is that the meta-network

method increases the financial risk prevention Adjust

the coefficient, and set the threshold of talents, and

eliminate risk prevention plans that do not meet the

requirements.

5 CONCLUSIONS

Aiming at the problem that financial technology risk

prevention is not ideal, this paper proposes a

computer security management scheme based on

meta-network method, and combines the trust domain

theory to optimize the risk prevention management of

financial technology. At the same time, the risk

prevention management requirements and threshold

sets are analyzed in depth, and the requirements of

different information are constructed. The research

shows that the meta-network method can improve the

accuracy of fintech risk prevention and management,

and stability can prevent and manage fintech risks

Conduct general effect judgments. However, in the

process of meta-network method operation, too much

attention is paid to the analysis of risk prevention

quality evaluation, resulting in irrationality in the

selection of financial technology risk prevention

management indicators.

REFERENCES

Agustina, Y., Subagyo, & Istanti, L. N. (2022). How money

circulates in Indonesian SMEs: An analysis of Financial

Literacy, Business Performance, Financial

Management Behavior and Financial Attitude .

Educational Administration: Theory and Practice,

28(02), 122–132.

Rahmattullah, M. ., , W., Suman, A. ., & Witjaksono, M. .

(2021). Economic learning Educational Practices for

Local Values of "Baharit" Culture Based

on the Perspective of Sustainable Development

. Educational Administration: Theory and

Practice, 27(3), 1160–1167.

Marandi, D. A. K. ., dogra, M. ., Bhatt, R. ., Gupta, . M. R.

., Reddy, S. ., & Barve, D. A. . (2022). Generative

Boltzmann Adversarial Network in Manet Attack

Detection and QOS Enhancement with

Latency. International Journal of Communication

Networks and Information Security (IJCNIS), 14(3),

199–213.

ALMahadin, G. ., Hiari, M. O. ., Hussein, A. H. ., Turab,

N. M. M. ., Alkhresheh, A. ., & Al-Tarawneh, M. A. B.

. (2022). Performance Evaluation of an Intelligent and

Optimized Machine Learning Framework for Attack

Detection. International Journal of Communication

Networks and Information Security (IJCNIS), 14(3),

358–371.

Chenniappanadar, S. K. ., Gnanamurthy, S. ., Sakthivelu,

V. K. ., & Kaliappan, V. K. . (2022). A Supervised

INCOFT 2025 - International Conference on Futuristic Technology

466

Machine Learning Based Intrusion Detection Model for

Detecting Cyber-Attacks Against Computer

System. International Journal of Communication

Networks and Information Security (IJCNIS), 14(3),

16–25.

Research on the Role of Computer Security Management in Preventing Financial Technology Risks

467