Financial Early-Warning of Information Technology Enterprises

Based on Support Vector Machine Algorithm

Shi Yan

Criminal Investigation Police University of China, Shenyang City, Liaoning Province, 110854, China

Keyword: Support Vector Machine, Corporate Finance, Information Technology, Financial Early Warning.

Abstract: Support Vector Machines (SVM for short) is a new machine learning method developed on the basis of

statistical learning theory. By adopting the principle of structural risk minimization, SVM can better solve the

problem of limited sample learning. It has many excellent characteristics, such as using kernel function to

avoid local minimum of solution, having sparsity of solution, achieving capacity control or support vector

number control through the role of boundary, etc. It shows many unique advantages in solving the problem

of limited samples, nonlinear and high-dimensional pattern recognition. This research applies support vector

machine (SVM) algorithm to predict the future information technology enterprises in the market. SVM is a

supervised learning method for analyzing data and predicting results. In this paper, we focus on financial

forecasting using SVM algorithm. Specifically, we use the public historical data of annual revenue and market

value of IT companies to develop a model to predict the future annual revenue of IT companies based on the

past revenue growth rate. The performance of our prediction model is verified by cross validation analysis.

1 INTRODUCTION

Data based machine learning is an important research

content in modern intelligent technology, and one of

its specific applications is to use certain learning

algorithms to achieve early warning of enterprise

status from observation data (samples). However, the

small sample size, high-dimensional, non-linear data

characteristics commonly encountered in enterprise

early warning have become the bottleneck restricting

its accuracy; Therefore, it is particularly urgent to

study the enterprise financial pre densification

method under the environment of small sample size

and high-dimensional data. A new general learning

method, support vector machine (SVM), developed

on the basis of statistical learning theory (SLT), has

been applied to many aspects and has shown many

excellent performances. It provides a good

implementation technology and means for machine

learning with limited samples (Cao and Shao, et al.

2021). Its outstanding generalization performance has

aroused the enthusiasm of many researchers. The

main research content of this paper is to apply support

vector machine method to enterprise financial early

warning to improve the accuracy of system prediction

and the generalization performance of the learning

model (Zhu and Liu 2021).

The financial crisis of any enterprise is by no

means sudden. It is often due to the lack of attention

paid by enterprise managers to the monitoring of

financial risks and the various signs before the crisis,

and the failure to take timely measures, so that the

financial crisis continues to deteriorate and finally

leads to the outbreak of the crisis. Therefore, we

should track and monitor the financial operation

process of the enterprise, find problems in the

financial management of the enterprise in a timely

manner, detect the signal of the financial crisis as

early as possible, predict the financial crisis of the

enterprise, so that the operators can take effective

measures to improve the operation and management

of the enterprise in the bud of the financial crisis,

prevent failures, and improve the management

quality. From the research status of financial early

warning system at home and abroad, we can see that

most of the current theories are relatively mature and

have a good early warning ability. However, due to

the limitation of too large data and complex

calculation, it cannot provide enterprises with a real-

time and effective financial early warning mechanism

(Pan and Liu et al. 2021). Therefore, it is necessary to

Yan, S.

Financial Early-Warning of Information Technology Enterprises Based on Support Vector Machine Algorithm.

DOI: 10.5220/0013543900004664

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 3rd International Conference on Futuristic Technology (INCOFT 2025) - Volume 1, pages 379-382

ISBN: 978-989-758-763-4

Proceedings Copyright © 2025 by SCITEPRESS – Science and Technology Publications, Lda.

379

use new methods and technologies to realize the

financial early warning system.

2 RELATED WORKS

2.1 Research status of support vector

machine theory

Because of the potential application value of SVM

algorithm, it has attracted many well-known scholars

in the world. In recent years, there have been many

developed and improved support vector machine

algorithms, as described in the literature; Research

methods of kernel in nonlinear SVM. It is worth

mentioning that in 1998, Smola studied in detail the

mechanism and application of various kernels in

SVM algorithm in his doctoral dissertation, making

an important contribution to further improve the

nonlinear algorithm of SVM.

SVM has some applications in pattern

recognition, such as handwritten digit recognition,

face recognition and face detection, text classification

and other fields. In addition, SVM is also well applied

to the research of time series analysis and regression

analysis. For example, MIT, Bell Lab and Microsoft

Research Institute have successfully applied SVM

algorithm to face tracking, signal processing,

language recognition, image classification and

control systems of dynamic images (Li, 2021).

The performance evaluation of listed companies

and its development forecast is a new research topic

in the field of economic management, and also a new

practice of enterprises under the socialist market

economy system. Enterprise performance evaluation

refers to the value judgment of the enterprise's

business process and results by using specific

indicators and standards and scientific methods in

order to achieve the strategic objectives of the

enterprise. Looking at the performance evaluation

practice in China in recent years, although the

relevant domestic departments and research

institutions have actively explored the performance

evaluation work, the performance evaluation system

of Chinese enterprises has not yet been fully

established, especially for the performance evaluation

of listed companies, there is still a lack of scientific,

systematic and operable evaluation system (Chen,

2021).

2.2 Development Status of Financial

Early Warning

At present, there are qualitative and quantitative

methods to identify enterprise financial risks. Most of

the traditional methods start from qualitative analysis,

select the research object, implement it to quantitative

analysis, and reflect and predict the operation of the

enterprise by analyzing multiple indicators of the

enterprise. Among them, the most widely used are:

univariate analysis model, multivariable z-score

model based on z-score model improved model and

the application of artificial neural network. Because

of the good performance of neural network in the field

of pattern recognition, it is also widely used in the

financial (economic) field to establish a new early

warning model (Yang, 2021).

Hu Yanjing used the improved BP neural network

method to establish China's financial risk early

warning model. Yang Baoan used the three-layer BP

neural network to approximate the characteristics of

nonlinear functions with arbitrary accuracy, and used

the BP network as a tool to classify the state of

enterprises. In addition, the enterprise early warning

support system based on multi-agent (Agent)

proposed by Wang Qi and Huang Jihong designs each

qualitative or quantitative early warning method into

an early warning agent. Each early warning agent has

the corresponding solving method, knowledge

processing and the ability to communicate and

cooperate with other agents, and each agent has the

ability to constantly learn to improve its own ability,

so as to improve the accuracy of the early warning

system (Song, Yu et al. 2022). Hu Yilang put forward

the theoretical model of fuzzy pattern recognition. By

establishing the relative membership matrix and the

over standard weight matrix, he constructed the fuzzy

recognition matrix by applying the theoretical model

to the index value matrix to achieve the early warning

research of financial crisis. Qualitative and

quantitative early warning analysis method: "A"

scoring method, also known as management scoring

method, first lists various phenomena or landmark

factors related to enterprise risk, assigns values

according to their impact on enterprise operation

failure, and then adds up the value or score of an

enterprise to know the exact risk level of the

enterprise (Cao and Shao, et al. 2022).

The above methods have done a lot of work on

enterprise classification. However, due to the fact that

small sample size, high-dimensional and nonlinear

data characteristics are commonly encountered in

enterprise early warning, their accuracy is greatly

INCOFT 2025 - International Conference on Futuristic Technology

380

restricted. This is one of the fundamental reasons for

this topic.

3 BASIS OF SUPPORT VECTOR

MACHINE

Statistical learning theory has received more and

more attention since the 1990s, largely because it has

developed support vector machine, a universal

learning method. Support vector machine (SVM) is a

non parametric machine learning method, which well

implements the design idea of structural risk

minimization (SRM) principle; Many problems

puzzling machine learning methods in the past, such

as model selection, over learning and under learning,

nonlinear and dimension disaster, and local minima

in neural networks, have been well solved in SVM

(Chen and Yang et al. 2021).

The basic idea of support vector machine can be

summarized as follows: it maps the input vector X to

a high-dimensional feature space z through some pre

selected nonlinear mapping, and then constructs the

optimal classification hyperplane in this feature

space. The above nonlinear mapping is realized by

defining an appropriate inner product function. Its

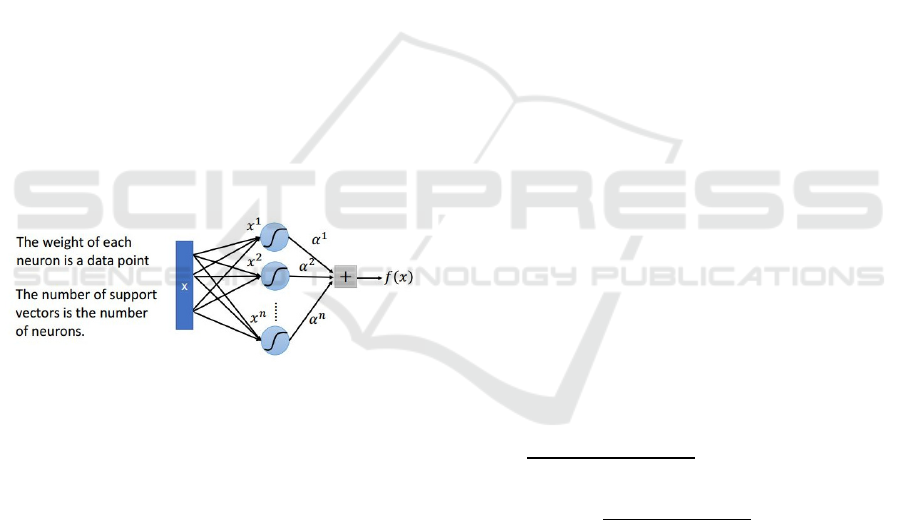

structure is shown in Figure 1.

Figure 1: Schematic diagram of support vector machine

In the method of pattern classification with

support vector machine in the case of linear

inseparability, the key idea is to transform a complex

classification task mapping into a linear classification

problem by using kernel function, and construct a

classification hyperplane with maximum spacing in

high-dimensional feature space. The learning

problem of SVM is to find the maximum interval

classification hyperplane. The maximum interval

classification hyperplane can be obtained by solving

a quadratic programming problem, including linearly

separable, nonlinearly separable and noisy cases.

Linear separable time can construct classification

hyperplane in input space, and nonlinear separable

time can use kernel function mapping; When noise

data is considered, relaxation variables are introduced

to construct classification hyperplane (An and Xu et

al. 2021). SVM conforms to the principle of structural

risk minimization. It controls the complexity of the

set of classification hyperplanes while keeping the

training errors fixed, so as to minimize the confidence

range and thus minimize the upper bound of test

errors.

4 FINANCIAL EARLY WARNING

OF INFORMATION

TECHNOLOGY ENTERPRISES

BASED ON SUPPORT VECTOR

MACHINE ALGORITHM

The support vector machine method model based on

principal component analysis proposed in this paper

is based on the financial ratio of enterprises to classify

and identify the operation status of enterprises. Its

main process is: First, the original data is

preprocessed, and samples are selected from it by

certain methods to form sample data; Then, principal

component analysis (PCA) is carried out on the

sample data to extract a few factors with the most

abundant information for analysis; Finally, use SVM

(Support Vector Machine) to build an enterprise early

warning model. Among them, principal component

analysis of data and SVM classification can be

regarded as two parts of a complete model.

Therefore, the algorithm model proposed in this

paper has two main functions: one is to reduce the

dimension of the input vector and simplify the data

effectively; Second, it has realized the recognition

and classification of enterprise status, and effectively

realized the prediction of enterprise financial status.

‖

∆𝑥

𝑡

‖

≤

𝑚

‖

∆𝑢

𝑡

‖

+

𝑝𝑑

(1)

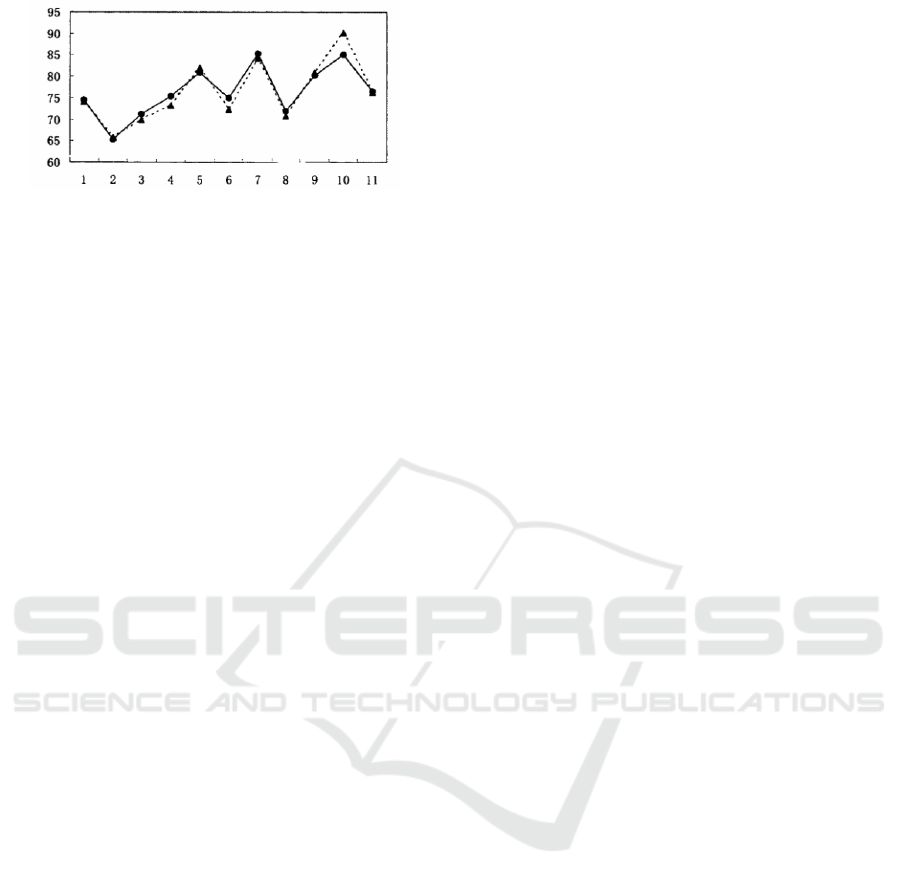

In terms of the selection of kernel functions,

because the support vector machine technology does

not provide the corresponding theory, this paper uses

experimental means to confirm and select Gaussian

kernel functions and polynomial kernel functions.

Experiments show that the two kernel functions have

very similar test performance. However, the Gaussian

kernel function is slightly better than the polynomial

kernel function, and its test accuracy is 0.28% higher.

The detailed experimental results are shown in Figure

2:

Financial Early-Warning of Information Technology Enterprises Based on Support Vector Machine Algorithm

381

Figure 2: Performance comparison of SVM under different

kernel functions

PCA-SVM model includes the regularity of

sample categories in the internal parameters of SVM.

It does not need to be determined by calculation

again. It can collect data in a specific industry and

within a small range, establish a model, and make

judgments. This is determined by the good

discrimination ability of SVM small sample

classification. This overcomes the shortcoming that

the F score model is large and comprehensive, but it

is more general. In specific industries, due to the

limitation of sample distribution and quantity, an

effective F value cannot be determined as the

classification standard.

SVM is used to extract the internal laws among

various data of enterprises judged as excellent,

medium and poor by experts, as the basis for judging

the state of enterprises. It overcomes the limitation of

determining the evaluation area of the enterprise's

financial situation through the score of linear

discriminant and the score of limited samples.

5 CONCLUSIONS

Support vector machine is a new machine learning

method, which is based on statistical learning theory.

It originates from the study of linear discriminant

function and integrates statistical learning,

operational research optimization, computer science

and other disciplines to solve machine learning

problems. In the face of a large number of data and

lack of theoretical models, statistics is often the most

basic (and only) means to analyze problems. Without

statistical knowledge, there can be no structural risk

minimization principle and no support vector

machine method; The reason why support vector

machine has been accepted and gradually become a

research hotspot is that it is guaranteed by statistical

learning theory. With the theoretical guarantee, but if

there is no appropriate method to solve it, the model

will slowly lose its opportunity for development.

Because the support vector machine is a simple

quadratic programming problem in the model, any

algorithm research that makes the quadratic

programming problem can be realized quickly and

easily will become very meaningful, and other

modifications can not be separated from the category

of the programming problem, thus making

operational optimization have a great use.

REFERENCES

Cao Y , Shao Y , Zhang H . Study on early warning of E-

commerce enterprise financial risk based on deep

learning algorithm[J]. Electronic Commerce Research,

2021(320).

Zhu Z , Liu N . Early Warning of Financial Risk Based on

K-Means Clustering Algorithm[J]. Complexity, 2021,

2021(24):1-12.

Pan W T , Liu Y , Jiang H , et al. Model Construction of

Enterprise Financial Early Warning Based on Quantum

FOA-SVR[J]. Hindawi Limited, 2021.

Li X . Improved Nearest Neighbor Propagation Algorithm

Based on Internet of Things Technology in Financial

Management Early Warning[J]. Hindawi, 2021.

Chen Y . BP Neural Network Based on Simulated

Annealing Algorithm Optimization for Financial Crisis

Dynamic Early Warning Model.[J]. Hindawi Limited,

2021.

Yang Y . Intelligent Informatization Early Warning

Analysis of Agricultural Economy Based on Support

Vector Sequential Regression Model[J]. Journal of

Mathematics, 2021, 2021.

Song R , Yu B , Shi H , et al. Support vector machine fault

diagnosis based on sparse scaling convex hull[J]. IOP

Publishing Ltd, 2022.

Cao Y , Shao Y , Zhang H , et al. Study on early warning

of E-commerce enterprise financial risk based on deep

learning algorithm[J]. 2022.

Chen C , Yang J , Shu W , et al. Measurement of premixed

propane combustion equivalence ratio based on flame

image color and support vector machine[C]// ICCDA

2021: 2021 The 5th International Conference on

Compute and Data Analysis. 2021.

An R , Xu Y , Liu X . A rough margin-based multi-task ν

-twin support vector machine for pattern

classification[J]. Applied Soft Computing, 2021.

INCOFT 2025 - International Conference on Futuristic Technology

382