Enterprise Financial Fraud Early Warning and Risk Assessment

Model Based on Machine Learning Algorithm

Xin Yao and Juan Xu

Shandong Institute of Commerce and Technology, Jinan, 250000 Shandong, China

Keywords: Statistical Theory, Machine Learning Algorithms, Fraud Warning, Risk Assessment Model, Corporate

Finance.

Abstract: Fraud early warning and risk assessment models play an important role in corporate finance, but there is the

problem of inaccurate risk positioning. The traditional genetic algorithm cannot solve the problem of early

warning evaluation in enterprise finance, and the effect is not satisfactory. In an increasingly complex business

environment, businesses face increasing financial risk, with financial fraud being particularly devastating. As

technology advances, machine learning algorithms have become a powerful tool for improving businesses'

ability to identify potential financial fraud and conduct effective risk assessments. This article will explore

the application of machine learning in financial alerting and risk assessment, and highlight its importance in

maintaining healthy business operations.

1 INTRODUCTION

Machine learning algorithms train models by

analyzing large amounts of historical data, allowing

them to identify patterns and anomalies in the data. In

the financial realm, this means that algorithms can

learn to identify normal financial activity versus

abnormal activity that may point to fraud (Zhao and

Wang, et al. 2022). This capability is essential for

early detection of potential financial problems, as it

provides a window of time for businesses to take

action to prevent further losses.

2 RELATED CONCEPTS

2.1 Mathematical Description of a

Machine Learning Algorithm

For example, if a business has a sudden increase in

spending or trading patterns that don't meet industry

standards, machine learning models can flag these

anomalous activities as potential risk points (Sun and

Liu, et al. 2022). By monitoring and analyzing

transaction data in real-time, machine learning can

help businesses respond quickly to these warning

signs and conduct further investigations (Shao and

Huidan, 2022).

(1)

In addition, machine learning algorithms can be

used to build comprehensive financial risk

assessment models. .

(2)

These models can integrate multiple data sources,

including financial statements, market trends,

macroeconomic indicators, and more, to provide

insight into the overall health of the business (Mao

and Shi, et al. 2022). Through the comprehensive

analysis of this data, machine learning models can

help businesses predict their future financial situation

and assess the potential risks of different strategies.

.

(3)

()

!

lim( ) max( 2)

!!

iij ij ij

x

n

yt y t

rnr

→∞

⋅= ≥ ÷

−

(

iij

tol y t⋅ )

2

max( ) ( 2 ) 2( 4)

ij ij ij ij

ttt t=∂ + ⋅ +

M

(0)

i

Ft≈

() 2 7

ii i

Fd t

y

ξ

=⋅→⋅

kA

Yao, X. and Xu, J.

Enterprise Financial Fraud Early Warning and Risk Assessment Model Based on Machine Learning Algorithm.

DOI: 10.5220/0013543800004664

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 3rd International Conference on Futuristic Technology (INCOFT 2025) - Volume 1, pages 373-378

ISBN: 978-989-758-763-4

Proceedings Copyright © 2025 by SCITEPRESS – Science and Technology Publications, Lda.

373

2.2 Selection of Fraud Early Warning

and Risk Assessment Model

Schemes

It's important to note that the effectiveness of a

machine learning model is largely dependent on the

quality and quantity of data used. Therefore,

businesses need to ensure that there is an accurate,

complete, and updated data set so that models can

learn and predict effectively (Wang and Xue, et al.

2023). At the same time, the design and training of

the model requires the cooperation of professional

data scientists and financial experts to ensure the

accuracy and usefulness of the model.

(4)

In practice, companies that have adopted machine

learning algorithms have seen significant results..

(5)

Not only do these algorithms improve the speed

and accuracy of fraud detection, but they also enhance

the overall understanding of risk for businesses. The

application of this technology allows companies to

manage their financial risks more proactively, rather

than just reacting to losses that have already occurred.

(6)

2.3 Analysis of Fraud Early Warning

and Risk Assessment Model

Schemes

In summary, machine learning algorithms are playing

an increasingly important role in corporate financial

fraud warning and risk assessment. By harnessing the

analytical power of these algorithms, businesses can

better identify potential risk points, take preventive

measures, and make more informed financial

decisions (Wang and Zhu, et al. 2022). As technology

continues to advance and more data becomes

available, we can foresee that machine learning will

continue to play a key role in protecting businesses

from the threat of financial fraud. .

(7)

Among them, it is In the

digital age, businesses face unprecedented data

growth and complexity. This environment creates a

hidden space for financial misconduct, making

traditional regulatory approaches inadequate to deal

with increasingly sophisticated financial fraud.

(8)

Therefore, the use of machine learning algorithms

for financial fraud early warning has become one of

the key technologies to improve enterprise risk

management capabilities (Qi and Xu, et al. 2023).

This article will explore how machine learning

algorithms can be effectively used to identify

potential financial risks and provide a strong early

warning mechanism for businesses

shown in Equation (9).

(9)

Financial fraud not only causes significant

economic losses to the enterprises themselves, but

also undermines market order and damages investor

confidence (Li and Hu, et al. 2022). With the

development of technology, machine learning has

gradually become a powerful tool for preventing and

detecting financial fraud due to its excellent data

processing ability and pattern recognition capabilities

(Jiang and Li, et al. 2022). By learning and analyzing

large amounts of historical data, machine learning

algorithms can reveal abnormal transaction behaviors

and potential risk points, so as to warn companies to

take measures to prevent fraud in advance

.

1

()= ( )

2

ii i i

dy

gt x z Fd w

dx

⋅−Γ

∏

lim ( ) ( ) max( )

ii ij

x

gt Fd t

→∞

+≤

1

() ( ) ( 4)

2

ii ij

gt Fd t+↔ +

()

i

No t

2

() ( )

() 4

(4)

ii

i

ij

gt Fd

No t b ac

mean t

+

=−

+

() ( )

1

(4)

ii

ij

gt Fd

mean t

+

≤

+

() [ () ( )]

iii

Zh t g t F d=+Κ

()

i

unno t

()

i

accur t

min[ ( ) ( )]

( ) 100%

() ( )

ii

i

ii

gt Fd

accur t

gt Fd

+

=×

+

()

i

randon t

INCOFT 2025 - International Conference on Futuristic Technology

374

(10)

The core strength of machine learning is its ability

to learn and adapt itself. By training models to

identify normal and abnormal patterns of financial

behavior, machine learning is able to continuously

optimize the accuracy of forecasts (Xu and Yang, et

al. 2022). This means that as more and more data is

analyzed, the predictive power of the algorithm will

gradually increase. In addition, machine learning

algorithms can process high-dimensional datasets,

which is difficult to achieve with traditional manual

methods.

3 OPTIMIZATION STRATEGY

OF FRAUD EARLY WARNING

AND RISK ASSESSMENT

MODEL

In practice, machine learning techniques such as

random forests, neural networks, and support vector

machines have been used to build early warning

systems. These systems analyze financial statements,

transactions, and other relevant data to identify

anomalous indicators such as abnormal cash flows,

inconsistent account movements, or unusual financial

ratios. When these abnormal signals are detected, the

system can issue a warning in time, prompting further

investigation by the relevant departments.

4 PRACTICAL EXAMPLES OF

FRAUD EARLY WARNING AND

RISK ASSESSMENT MODELS

4.1 Introduction to the Fraud Early

Warning and Risk Assessment

Model

Many studies have confirmed the effectiveness of

machine learning in financial fraud identification. For

example, some banks have used machine learning

algorithms to monitor credit card transactions, which

has led to a reduction in the incidence of fraud. In

another case, a large retailer significantly reduced

inventory theft incidents by applying anomaly

detection algorithms. These examples show that the

use of advanced data analytics technology can greatly

improve the risk management and prevention

capabilities of enterprises.

The fraud early warning and risk assessment

model process in Table I. is shown in Figure I.

Table 1: Fraud early warning and risk assessment model

requirements

Scope of

application

Grade Accuracy Fraud early

warning and

risk assessment

model

Prevent

financial

frau

d

I 85.00 78.86

II 81.97 78.45

Manage risk I 83.81 81.31

II 83.34 78.19

Assist in

decision-

makin

g

I 79.56 81.99

II 79.10 80.11

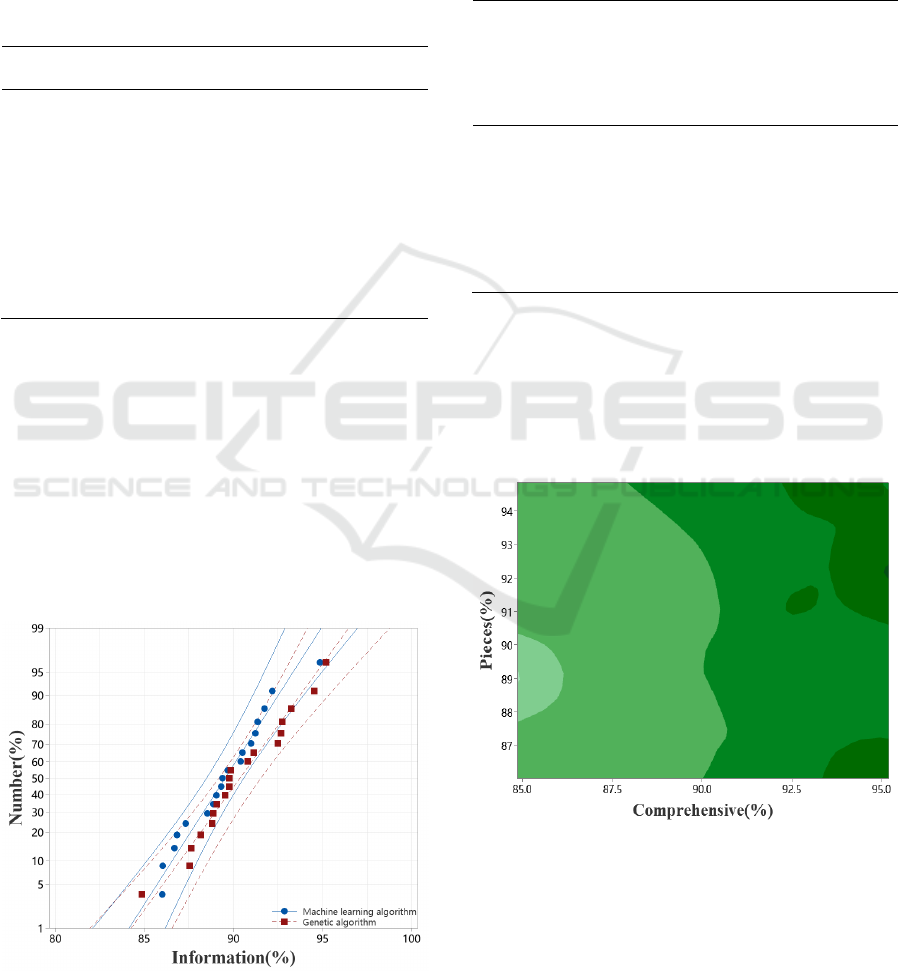

Figure 1: The analysis process of fraud early warning and

risk assessment models

While machine learning has made significant

progress in financial fraud early warning, challenges

remain. The quality and completeness of the data

directly affects the performance of the model, and the

data in the real world is often missing or noisy. In

addition, as financial fraud methods continue to

evolve, algorithms need to be constantly updated to

adapt to new situations. In the future, the combination

of other areas of AI, such as natural language

processing and reinforcement learning, will further

enhance the effectiveness of early warning systems.

4.2 Fraud Early Warning and Risk

Assessment Model

Overall, machine learning algorithms provide

businesses with a powerful tool for early warning of

financial fraud. By in-depth analysis and learning

min[ ( ) ( )]

() ()

2

ii

ii

gt Fd

accur t randon t

+

=+

M

Enterprise Financial Fraud Early Warning and Risk Assessment Model Based on Machine Learning Algorithm

375

from historical data, they can efficiently identify

potential financial risks and anomalous behavior.

However, to reach its full potential, organizations

need to invest resources to maintain data quality and

ensure that models are continuously updated and

improved. In the face of the ongoing threat of

financial fraud, embracing machine learning is a

critical step in building a corporate line of defense.

Table 2: Overall picture of the fraud early warning and risk

assessment model scheme

Category Random

data

Reliability Analysis

rate

Prevent

financial

frau

d

85.32 85.90 83.95

Manage

ris

k

86.36 82.51 84.29

Assist in

decision-

making

84.16 84.92 83.68

Mean 86.84 84.85 84.40

X6 83.04 86.03 84.32

P=1.249

4.3 Fraud Early Warning and Risk

Assessment Model and Stability

In this data-driven era, machine learning algorithms

have become an important weapon for businesses to

prevent financial fraud. By intelligently analyzing

massive amounts of data, machine learning can help

not only discover known risk patterns, but also predict

and identify new risk trends. While challenges

remain, the development of machine learning has

undoubtedly provided a more secure and transparent

financial environment for businesses.

Figure 2: Fraud early warning and risk assessment models

with different algorithms

As technology continues to advance, there is

reason to believe that the future of financial risk

management will be smarter and more efficient, and

machine learning will play a crucial role in this

transformation.

Table 3: Comparison of fraud early warning and risk

assessment model accuracy of different methods

Algorith

m

Surve

y data

Fraud

early

warning

and risk

assessmen

t model

Magnitud

e of

change

Error

Machine

learning

algorithm

s

85.33 85.15 82.88 84.9

5

Genetic

algorith

m

85.20 83.41 86.01 85.7

5

P 87.17 87.62 84.48 86.9

7

In today's digital age, the financial management of

enterprises has become increasingly complex. This

has been followed by an increase in financial fraud,

which not only threatens the survival and

development of enterprises, but also has a serious

impact on the stability of the entire market.

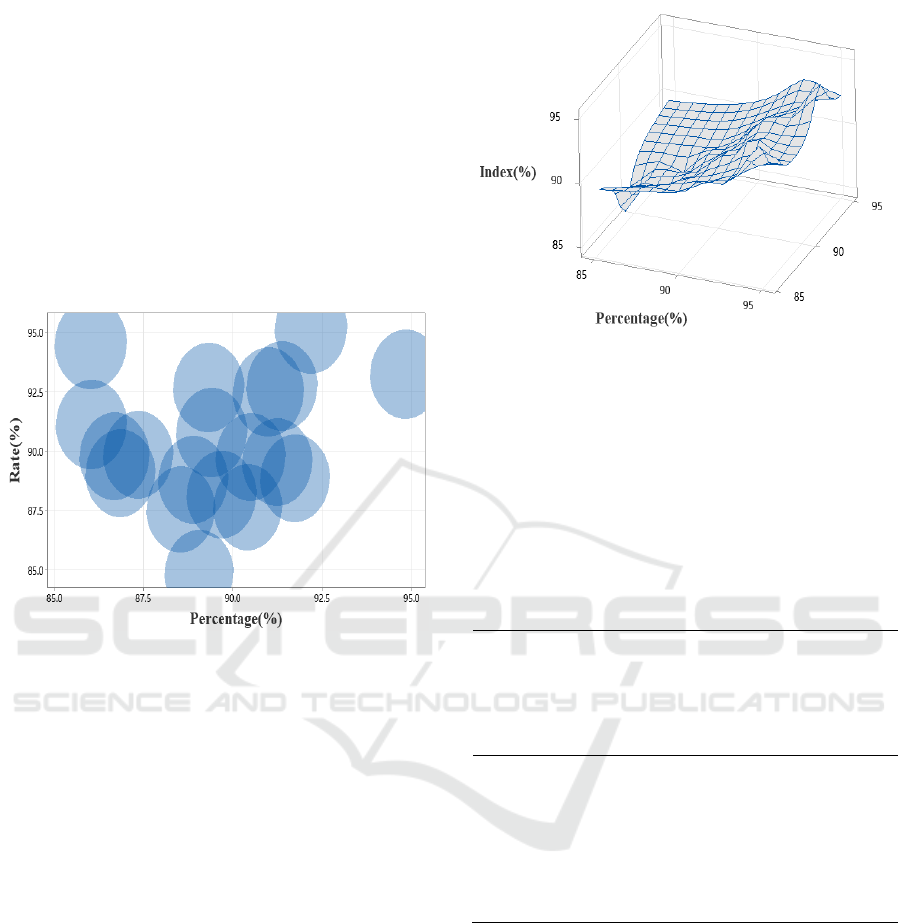

Figure 3: Fraud early warning and risk assessment model

for machine learning algorithms

A machine learning algorithm is a model trained

on a large amount of data that can predict the

occurrence of future events by learning patterns and

patterns in historical data. This feature makes

machine learning algorithms excellent at detecting

anomalous behavior.

INCOFT 2025 - International Conference on Futuristic Technology

376

4.4 Reasonableness of Fraud Early

Warning and Risk Assessment

Models

For example, when a business's revenue suddenly

spikes or costs are abnormally low, it can be a sign of

revenue manipulation, while a large long-term

difference between cash flow and net profit can mean

that there is a risk of inflating assets. Machine

learning algorithms can analyze historical data to

build a financial model of the company's normal

operations, and monitor the deviation of actual data

from it in real time.

Figure 4: Fraud early warning and risk assessment models

with different algorithms

Once a major deviation is found, the system will

automatically issue a warning to help the enterprise

identify the problem in time and take action.

4.5 Effectiveness of Fraud Early

Warning and Risk Assessment

Models

Of course, the application of machine learning

algorithms is not without its challenges. First, it

requires a lot of clean, accurate data as a foundation.

If the data quality is poor, the performance of the

algorithm will also be greatly reduced. Second, the

design and tuning of algorithms requires a certain

amount of expertise, which may require companies to

invest corresponding human resources. Finally,

although algorithms can provide a high degree of

automation and accuracy, the final decision still

requires human judgment. Therefore, when applying

machine learning algorithms, enterprises should

combine the opinions of professionals to ensure the

correctness of decision-making.

Figure 5: Fraud early warning and risk assessment models

with different algorithms

In corporate finance, any transaction or statement

item that deviates from the norm can be an indication

of potential fraud. Machine learning algorithms can

pinpoint these anomalous indicators so they can alert

managers to take action in a timely manner.

Table 4: Comparison of the effectiveness of fraud early

warning and risk assessment models of different methods

Algorith

m

Surve

y data

Fraud

early

warning

and risk

assessmen

t model

Magnitud

e of

change

Error

Machine

learning

algorithm

s

82.21 85.92 84.59 82.8

5

Genetic

algorith

m

83.73 84.23 84.41 83.5

5

P 84.20 87.39 84.76 83.9

0

In addition, another advantage of machine

learning algorithms is their ability to learn and adapt

on their own. With the passage of time and the

accumulation of data, the algorithm will continue to

optimize its model and improve the accuracy of

detection. This means that machine learning

algorithms remain highly effective at detecting even

in the face of evolving fraud methods.

Enterprise Financial Fraud Early Warning and Risk Assessment Model Based on Machine Learning Algorithm

377

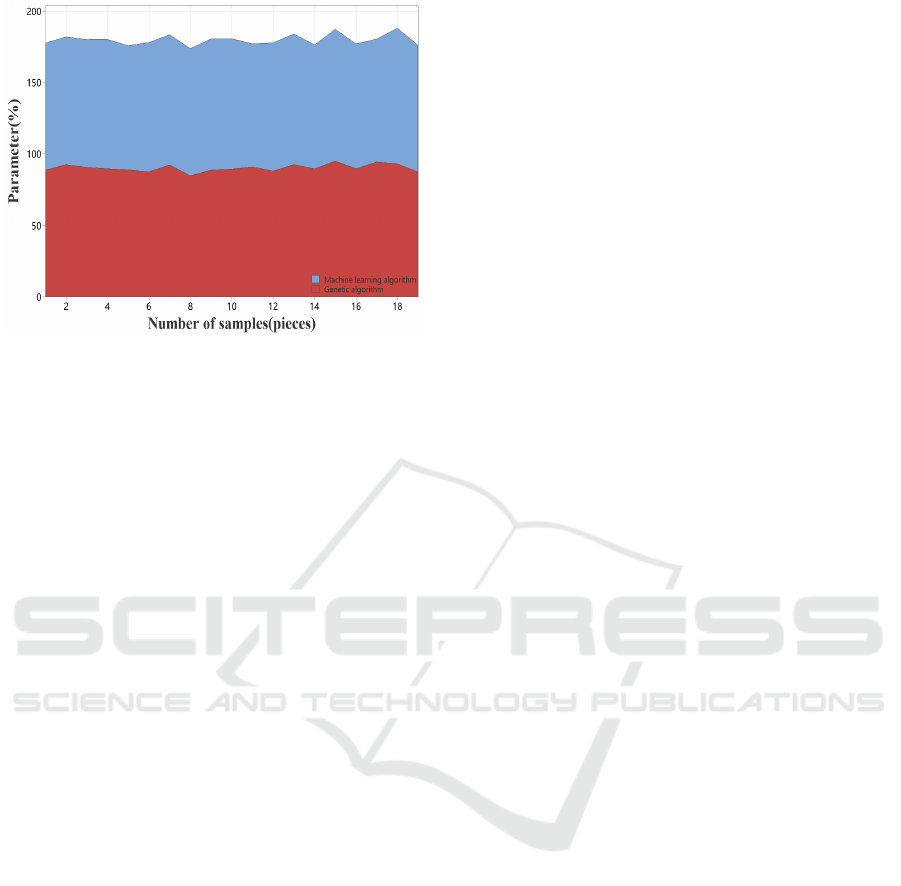

Figure 6: Machine learning algorithm, fraud early warning

and risk assessment model

Therefore, how to effectively identify and prevent

financial fraud has become a problem that cannot be

ignored in enterprise management. Fortunately, with

the advancement of technology, machine learning

algorithms provide a completely new solution for

enterprises.

5 CONCLUSIONS

In conclusion, machine learning algorithms show

great potential in the management of corporate

financial fraud risk. Not only does it help companies

detect anomalies in a timely manner, but it also

improves their performance over time. In the digital

age, the use of machine learning algorithms to prevent

financial fraud has become an important tool for

enterprise risk management. As technology continues

to advance, there is reason to believe that machine

learning will play an even more critical role in the

future of financial management. Enterprises should

keep their finger on the pulse of the times and actively

introduce and apply machine learning algorithms to

build a safer and more stable financial environment..

REFERENCES

Zhao Zhiyao, Wang Ziyi, Yu Jiabin, Xu Jiping, Bai

Yuting,&Wang Xiaoyi (2022) A rice safety risk

assessment method based on multi machine learning

algorithm fusion CN202210306564.2

Sun Peng, Liu Guoni, Liang Yuanyuan, Li Hu, Chen

Donghua,&Liu Yufeng (2022) Dynamic Assessment of

Agricultural Drought Risk in Anhui Province Based on

Machine Learning Algorithms Water Resources and

Hydropower Technology (Chinese and English), 53 (5),

14

Shao Yongyun,&Huidan (2022) Empirical analysis of

credit risk assessment model for small and medium-

sized enterprises based on machine learning Journal of

Shenyang Normal University: Natural Science Edition

(004), 040

Mao Jinfeng, Shi Hongxia, Cui Xinchen, Cai Yuchang, and

Song Mei (2022) Research on Audit Risk Assessment

Based on Stacking Integrated Machine Learning

Algorithm Computer Knowledge and Technology:

Academic Exchange (018-004)

Wang Jiaxu, Xue Peng, Jiang Yu,&Qiao Youlin (2023) A

cervical cancer assisted diagnosis model based on

machine learning algorithms Chinese Journal of Cancer

Prevention and Treatment

Wang Jun, Zhu Zhikui, Wang Jianfeng,&Zhou Gongzi

(2022) A machine learning based bond risk assessment

method and system CN202211061131.1

Qi Haiou, Xu Xin,&Xue Zihao (2023) The application

progress of machine learning algorithms in operating

room management Nursing and rehabilitation

Li Xiao, Hu Bing,&Bai Wenkun (2022) Research progress

on the application of machine learning algorithms based

on ultrasound images in carotid plaque risk assessment

Chinese Journal of Medical Ultrasound: Electronic

Edition, 19 (10), 4

Jiang Rongrong, Li Pingting, and Yang Tao (2022)

Research on Building a Cardiovascular Disease Risk

Assessment Model Based on Machine Learning China's

Health Industry, 19 (18), 145-148

Tong Xu, Yang Chun,&Meng Qinggang (2022)

Construction of the risk assessment model of diabetes

nephropathy based on multi label machine learning

Chinese General Medicine, 20 (2), 6

INCOFT 2025 - International Conference on Futuristic Technology

378