Empirical Research on Dynamic Asset Allocation Based on Index

Hierarchical Structure Algorithm

Fuxiang Yu

Business School, Hangzhou City University, No. 48 Huzhou Street, Hangzhou, 310015, China

Keywords: Social Network Analysis Theory, Exponential Hierarchy Algorithm, Configure Empirical Studies, Dynamic,

Assets.

Abstract: Empirical research on allocation plays an important role in dynamic asset allocation, but there is the problem

of inaccurate empirical positioning. The traditional ant colony algorithm cannot solve the asset research

problem in dynamic asset allocation, and the effect is not satisfactory. With the continuous development of

the financial market and the diversification of investment needs, how to achieve the optimal allocation of

assets in different market environments has become the focus of investors' attention. Traditional asset

allocation methods tend to conduct static analysis based on historical data, ignoring the immediate changes in

the market and the uncertainty of future trends. To solve this problem, the index hierarchical structure

algorithm was developed, which dynamically adjusts the asset portfolio to adapt to market changes and pursue

optimal returns. This paper will deeply explore the application of the exponential hierarchical structure

algorithm in dynamic asset allocation, and verify its effectiveness through empirical analysis.

1 INTRODUCTION

First of all, we need to clarify what an exponential

hierarchical structure algorithm is. In simple terms, it

is a method of classifying and allocating assets

according to the different levels of market indices

(Tan, 2023). This algorithm is usually based on multi-

dimensional indicators such as volatility, market

capitalization, and growth of the index, so as to

identify asset classes with different risk and return

characteristics (Wu, 2022). In dynamic asset

allocation, the index hierarchical structure algorithm

can monitor market changes in real time (Wang Ping,

2022) and automatically adjust the weighting of

various assets to ensure that the portfolio always

matches the risk appetite and market conditions of

investors (Geng and Zhang, 2022).

2 RELATED CONCEPTS

2.1 Mathematical Description of the

Exponential Hierarchical Structure

Algorithm

In order to test the practical effect of the exponential

hierarchical structure algorithm (Liu, 2022), we

conducted an empirical analysis of a series of

historical data (Zhang and Liang, et al. 2023). We

have selected a variety of indices including large-cap

indices, small- and mid-cap indices, bond indices, and

commodity indices for our research, and used

historical data from the past decade to simulate

different market conditions (Li and Hao, et al. 2022).

By stratifying the historical performance of these

indices, we find that there are significant differences

and regularities in the performance of assets at each

level.

2

4

lim( ) max( 2)

2

iij ij ij

x

bb ac

yt y t

a

→∞

−± −

⋅= ≥ ÷

(1)

366

Yu, F.

Empirical Research on Dynamic Asset Allocation Based on Index Hierarchical Structure Algorithm.

DOI: 10.5220/0013543700004664

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 3rd International Conference on Futuristic Technology (INCOFT 2025) - Volume 1, pages 366-372

ISBN: 978-989-758-763-4

Proceedings Copyright © 2025 by SCITEPRESS – Science and Technology Publications, Lda.

In the dynamic simulation, we set up different

market scenarios, including bull market, bear market,

volatile market, etc.

2

max( ) ( 2 ) ( 4)

ij ij ij ij

ttt t=∂ + ⋅ +

M

(2)

Applied the index hierarchical structure algorithm

to optimize the asset allocation under these scenarios.

The results show that, compared with the traditional

static allocation strategy, the asset portfolio using the

index hierarchical structure algorithm shows higher

adaptability and return under different market

scenarios. Especially in periods of large market

fluctuations or transitions, the algorithm can adjust

the asset ratio in time, reduce unnecessary losses, and

even achieve excess returns in some cases..

2

() 4 2 7

iii

F

dbact y

ξ

=− ⋅→⋅

(3)

2.2 Selection of Configuration

Empirical Research Protocols

In addition, we also note that the index hierarchical

structure algorithm not only helps to improve

investment returns, but also reduces investment risks

to a certain extent. By analyzing the volatility and

correlation of assets at different levels

1

()= ( )

2

ii i i

dy

gt x z Fd w

dx

⋅−Γ

∏

(4)

The algorithm can effectively identify and

diversify specific risks, thereby improving the overall

stability of the portfolio. This finding is particularly

important for investors looking for a solid return on

their investment.

lim ( ) ( ) max( )

ii ij

x

gt Fd t

→∞

+≤

(5)

Although the results of the empirical analysis

support the application of exponential hierarchical

algorithms in dynamic asset allocation, we also

recognize that no model or algorithm can fully predict

the complexity and volatility of the market.

22

() ( ) ( 4)

ii ij

abgt Fd mean t++↔ +

(6)

2.3 Analysis of the Configuration of the

Empirical Research Protocol

Therefore, investors should still maintain flexibility

and prudence when using the algorithm based on their

own investment philosophy and market judgment.

2

() ( )

() 4

(4)

ii

i

ij

gt Fd

No t b ac

mean t

+

=−

+

(7)

In summary, the index hierarchical algorithm

provides us with a new tool to address asset allocation

challenges in dynamic markets (Xu, 2022). Through

the empirical analysis of this paper, we can see that

the algorithm can not only enhance the adaptability of

asset portfolios (Zhan and Zeng, et al. 2022), but also

help investors obtain more stable and considerable

returns in the ever-changing market. With the

advancement of financial technology and the

deepening of data analysis, we have reason to believe

that the index hierarchical structure algorithm will

play a more important role in asset management

practice in the future.

() [ () ( )]

iii

Z

ht gt F d=+

(8)

In the field of investment management, dynamic

asset allocation is one of the key strategies to achieve

portfolio optimization and risk control. With the

continuous development of financial technology, the

index hierarchical structure algorithm, as an advanced

technical means, is changing the traditional asset

allocation model and providing investors with more

accurate and efficient investment solutions.

min[ ( ) ( )]

()

() ( )

ii

i

ii

gt Fd

accur t

gt Fd

+

=

+

MA

(9)

The index hierarchical algorithm, in short, is a

technique that classifies assets according to their

characteristics and implements dynamic adjustments

based on them. This algorithm analyzes market data

in real-time to identify correlations between different

assets and trends that evolve over time, guiding

investors to make more flexible asset allocation

decisions (Liu and Gang, et al. 2022). At its core, it

uses complex mathematical models and big data

analysis techniques to conduct in-depth analysis of

the historical performance and future expectations of

Empirical Research on Dynamic Asset Allocation Based on Index Hierarchical Structure Algorithm

367

various assets, which can be used as the basis for

allocating the proportion of assets.

min[ ( ) ( )]

() ()

() ( )

ii

ii

ii

gt Fd

accur t randon t

gt Fd

+

=+

+

(10)

In practical applications, the index hierarchical

structure algorithm first needs to stratify various types

of assets according to their risk and return

characteristics.

3 CONFIGURE THE

OPTIMIZATION STRATEGY

OF EMPIRICAL RESEARCH

This includes, but is not limited to, stocks, bonds,

commodities and other financial derivatives. Each tier

of assets is given a specific weight based on their

historical performance and current market conditions.

These weights are not fixed, but are adjusted in real-

time in response to market changes in order to achieve

optimal portfolio performance.

3.1 Introduction to the Configuration

of Empirical Research

For example, if the stock market enters a bull market,

the traditional 60/40 allocation to stocks and bonds

may no longer be the best option. At this time, the

index hierarchical structure algorithm will capture the

growth signal of the stock market and dynamically

increase the weight of equity assets according to the

predicted market direction, while reducing the

allocation of bonds accordingly. Conversely, in

anticipation of increased market volatility or

recession, the algorithm protects the portfolio from

extreme market volatility by reducing the proportion

of risky assets and increasing holdings of bonds or

other low-risk assets.

Table 1: Configure empirical research requirements

Scope of

application

Grade Accuracy Configure

empirical

studies

Economic

Research

I 85.00 78.86

II 81.97 78.45

Institutional

investors

I 83.81 81.31

II 83.34 78.19

Individual

investors

I 79.56 81.99

II 79.10 80.11

In addition, the algorithm is able to handle the

problem of correlation between multiple asset classes.

In a diversified portfolio, there may be some

correlation between different assets, such as the price

of certain stocks and bonds that tend to be influenced

by the same macroeconomic factors. With the index

hierarchical algorithm, investors can better

understand these correlations and avoid over-

focusing on a specific risk factor when building

portfolios, thus effectively diversifying risk.

Index

stratification

Social

network

Analyse

Configuration

of empirical

Trends

Structural

algorithm

Distance

measure

Figure 1: Configure the analytical process for empirical

research

3.2 Configure Empirical Studies

At the operational level, the use of the index

hierarchical structure algorithm requires investors to

have the corresponding technical platform and

analytical tools. This often involves a series of

complex processes such as the acquisition, cleaning,

and processing of high-frequency data, as well as the

establishment and testing of models. Therefore, it

may be difficult for the average investor to apply

directly. However, they can indirectly enjoy the

benefits of this technology by purchasing fund

products or services that use such algorithms.

Table 2: Configure the overall picture of the empirical

research protocol

Category Random

data

Reliability Analysis

rate

Economic

Research

85.32 85.90 83.95

Institutional

investors

86.36 82.51 84.29

Individual

investors

84.16 84.92 83.68

Mean 86.84 84.85 84.40

X6 83.04 86.03 84.32

P=1.249

INCOFT 2025 - International Conference on Futuristic Technology

368

3.3 Configuration Empirical Research

and Stability

In summary, the index hierarchical structure

algorithm provides a scientific and refined approach

for dynamic asset allocation. It can not only adjust the

asset allocation in real time according to market

conditions, but also help investors grasp the

relationship between multiple asset classes, so as to

better diversify risks and pursue long-term stable

investment returns. In the modern financial

environment, mastering and applying such advanced

algorithms will undoubtedly become an important

magic weapon for investment success.

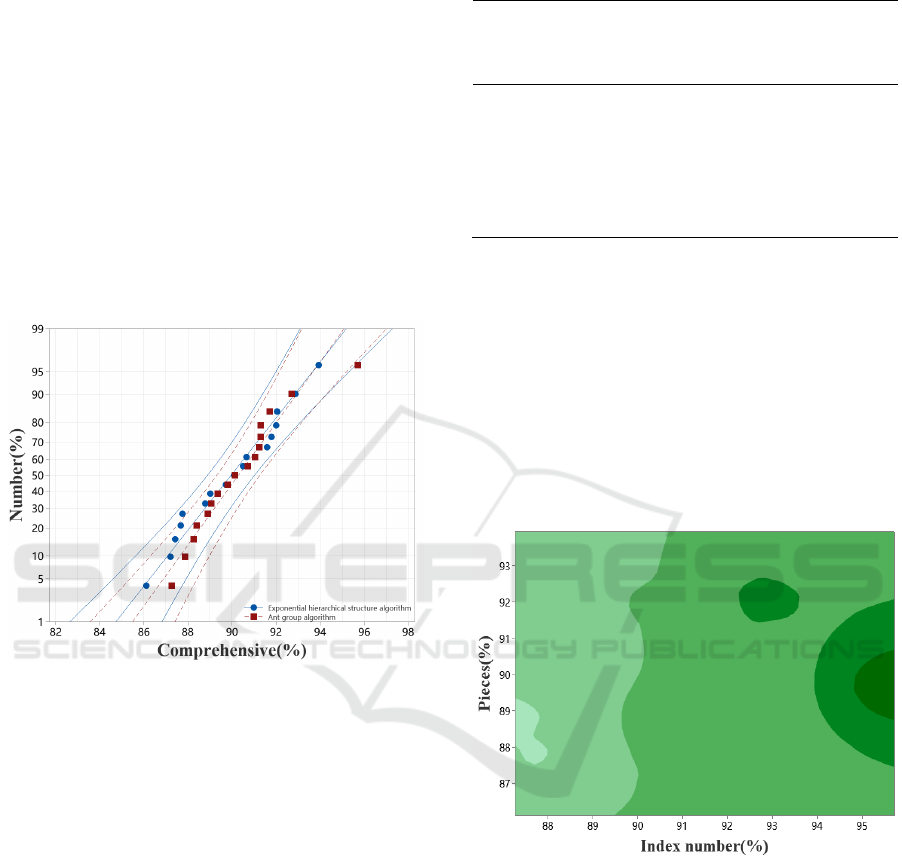

Figure 2: Empirical study on the configuration of different

algorithms

In the volatile waves of financial markets, asset

managers always seek to optimize their portfolios to

achieve the best risk-reward ratio. As one of the core

strategies of investment management, dynamic asset

allocation adjusts the weighting of asset classes at

different points in time to adapt to market changes

and capture investment opportunities. In this process,

the use of hierarchical structures plays a crucial role,

which not only improves the flexibility and efficiency

of asset allocation, but also provides a solid

foundation for risk management and long-term value-

added. This article will explore in detail the role of

hierarchical structures in dynamic asset allocation,

revealing their indispensable value in achieving asset

allocation goals.

Table 3: Comparison of the accuracy of empirical studies

on configuration of different methods

Algorithm Surve

y data

Configur

e

empirical

studies

Magnitud

e of

change

Error

Exponentia

l hierarchy

al

g

orith

m

85.33 85.15 82.88 84.9

5

Ant colony

algorithm

85.20 83.41 86.01 85.7

5

P 87.17 87.62 84.48 86.9

7

Hierarchical structure refers to the management

and configuration of assets into different tiers

according to different criteria. These criteria typically

include the asset's risk profile, expected return,

liquidity requirements, and correlation with other

assets, among other things. Through stratification,

asset managers can monitor the performance of

various assets in more detail and make timely

adjustments to ensure that the risk and expected

return of the entire portfolio are always within a

reasonable range.

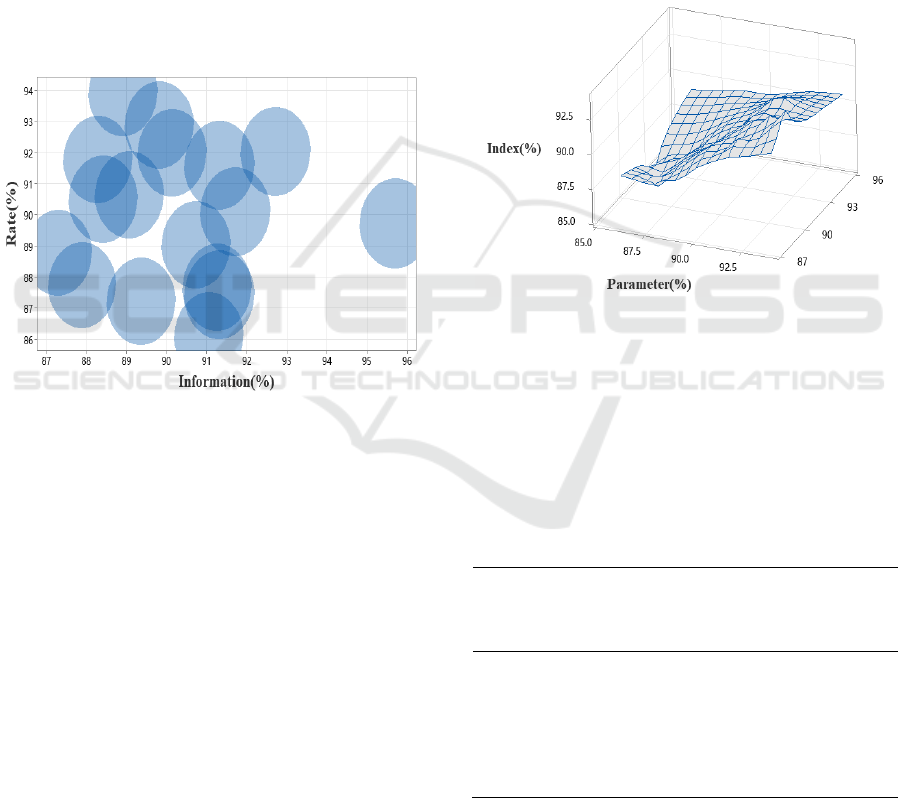

Figure 3: An empirical study on the configuration of

exponential hierarchical structure algorithm

Dynamic asset allocation requires managers to

continuously adjust their portfolios based on market

volatility and forecasts, and the hierarchical structure

provides a clear operating framework. First, it helps

managers quickly identify the performance of assets

at various levels so as to make targeted adjustments;

secondly, it also helps to balance risks and returns in

different market environments, especially under

extreme market conditions, which can effectively

limit losses; thirdly, the hierarchical structure makes

asset allocation decisions more scientific and

Empirical Research on Dynamic Asset Allocation Based on Index Hierarchical Structure Algorithm

369

systematic, avoiding the excessive impact of a single

event.

3.4 Rationality of Configuring

Empirical Research

Risk management is a key component of dynamic

asset allocation. The hierarchical structure allows for

more precise quantification and control of risk, as

each layer of assets has its own specific risk tolerance

boundaries. For example, a conservative asset tier can

provide a stable income base and risk buffer for the

portfolio, while an aggressive asset tier may provide

additional growth momentum when the market is up.

By fine-tuning the risk exposure between these levels,

asset managers can better grasp the overall risk level

and develop effective risk response strategies.

Figure 4: Empirical study on the configuration of different

algorithms

For investors looking for long-term growth, a

hierarchical structure can help build a portfolio that

evolves over time. As market conditions change and

individual investment goals adjust, asset managers

can gradually adapt to changes by rebalancing the

ratios between different tiers, thereby maintaining the

growth momentum and stability of the portfolio. In

addition, a hierarchical structure can help managers

grasp the best time to reallocate assets, such as

moving a particular asset to another tier or category

when it reaches a predetermined return target, so as to

lock in earnings and reallocate funds.

3.5 Configure the Validity of Empirical

Research

In summary, the hierarchical structure plays a

multifaceted role in dynamic asset allocation, which

not only enhances the flexibility and systematization

of management, but also significantly improves the

effectiveness of risk control. Through meticulous

hierarchical division and scientific adjustment

mechanism, asset managers can navigate steadily in

the changing market environment and escort

investors' long-term asset appreciation. Therefore,

understanding and applying hierarchical structures as

an integral part of modern dynamic asset allocation is

a critical step on the road to successful investing.

At the operational level, the use of the index

hierarchical structure algorithm requires investors to

have the corresponding technical platform and

analytical tools. This often involves a series of

complex processes such as the acquisition, cleaning,

and processing of high-frequency data, as well as the

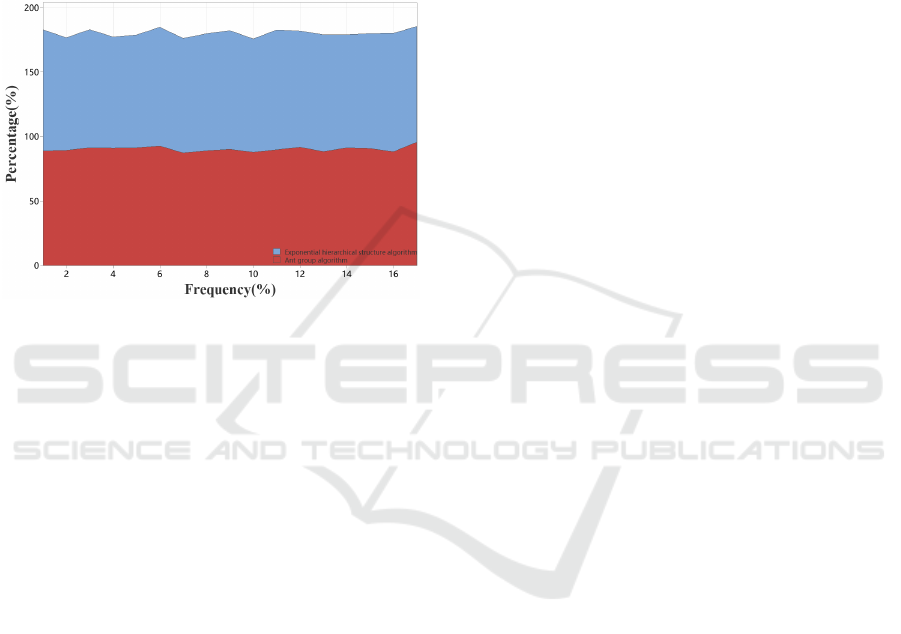

Figure 5: Empirical study on configuration of different

algorithms

establishment and testing of models. Therefore, it

may be difficult for the average investor to apply

directly. However, they can indirectly enjoy the

benefits of this technology by purchasing fund

products or services that use such algorithms.

Table 4: Comparison of the effectiveness of empirical

studies on the configuration of different methods

Algorithm Surve

y data

Configur

e

empirical

studies

Magnitud

e of

change

Error

Exponentia

l hierarchy

algorith

m

82.21 85.92 84.59 82.8

5

Ant colony

algorith

m

83.73 84.23 84.41 83.5

5

P 84.20 87.39 84.76 83.9

0

In the volatile waves of financial markets, asset

managers always seek to optimize their portfolios to

achieve the best risk-reward ratio. As one of the core

strategies of investment management, dynamic asset

INCOFT 2025 - International Conference on Futuristic Technology

370

allocation adjusts the weighting of asset classes at

different points in time to adapt to market changes

and capture investment opportunities. In this process,

the use of hierarchical structures plays a crucial role,

which not only improves the flexibility and efficiency

of asset allocation, but also provides a solid

foundation for risk management and long-term value-

added. This article will explore in detail the role of

hierarchical structures in dynamic asset allocation,

revealing their indispensable value in achieving asset

allocation goals.

Figure 6: An empirical study on the allocation of

exponential hierarchical structure algorithm

For investors looking for long-term growth, a

hierarchical structure can help build a portfolio that

evolves over time. As market conditions change and

individual investment goals adjust, asset managers

can gradually adapt to changes by rebalancing the

ratios between different tiers, thereby maintaining the

growth momentum and stability of the portfolio. In

addition, a hierarchical structure can help managers

grasp the best time to reallocate assets, such as

moving a particular asset to another tier or category

when it reaches a predetermined return target, so as to

lock in earnings and reallocate funds.

4 CONCLUSIONS

In addition, the algorithm is able to handle the

problem of correlation between multiple asset classes.

In a diversified portfolio, there may be some

correlation between different assets, such as the price

of certain stocks and bonds that tend to be influenced

by the same macroeconomic factors. With the index

hierarchical algorithm, investors can better

understand these correlations and avoid over-

focusing on a specific risk factor when building

portfolios, thus effectively diversifying risk.

At the operational level, the use of the index

hierarchical structure algorithm requires investors to

have the corresponding technical platform and

analytical tools. This often involves a series of

complex processes such as the acquisition, cleaning,

and processing of high-frequency data, as well as the

establishment and testing of models. Therefore, it

may be difficult for the average investor to apply

directly. However, they can indirectly enjoy the

benefits of this technology by purchasing fund

products or services that use such algorithms.

REFERENCES

Tan Wei (2023) Research on the prediction model of

dynamic rebound modulus of fine-grained soil in

roadbed based on physical properties indicators Sino

foreign highways

Wu Jiaxian (2022) Tail risk and asset pricing in the A-share

market: an empirical study based on MEES indicators

(Doctoral dissertation, Southwest University of Finance

and Economics)

Wang Ping (2022) An Empirical Study on the Efficiency of

Investment and Allocation of Higher Education Funds

in Hebei Province - Based on the DEA and Malmquist

Index Models Research on Education Finance and

Accounting, 33 (5), 3-9

Geng Wenhui,&Zhang Zhifeng (2022) The Dynamic

Evaluation of Green Total Factor Productivity of the

Shanghai Cooperation Organization: An Empirical

Study Based on the DEA Malmquist Index Chinese

Business Theory (8), 4

Liu Mengting (2022) The Operational Efficiency of Basic

Pension Insurance for Urban and Rural Residents in

China: An Empirical Study Based on the DEA Model

and Malmquist Index Technology and Market, 29 (7),

5

Zhang Jiangfeng, Liang Longxue, Li Yao, Wu Xiaosuo,

Wang Jiawei,&Sun Chenglong (2023) Research on

micro ring resonators assisted by one-dimensional

photonic crystal nanobeam cavities Journal of Optics,

43 (22)

Li Jianping, Hao Jun,&Yuan Jiaxin (2022) A dynamic

optimization ensemble prediction method for price

index based on spectral clustering CN202211388148.8

Xu Zhenhua (2022) The Impact of ETFs on the Volatility

of Component Stock Returns: An Empirical Study

Based on the Chinese A-share Market (Doctoral

dissertation, Southwest University of Finance and

Economics)

Zhan Lin, Zeng Xianhui,&Dai Kaixuan (2022) A user

behavior anomaly detection algorithm based on

dynamic time span and clustering difference index

Microcomputers and Applications (004), 041

Liu Huanhuan, Gang Chengcheng, Wen Zhongming, Chen

Tongde, Liu Yue,&Chen Yin (2022) Spatial and

temporal dynamic analysis of soil erosion in the Yanhe

Empirical Research on Dynamic Asset Allocation Based on Index Hierarchical Structure Algorithm

371

River Basin based on structured vegetation index

Research on Soil and Water Conservation (005), 029

INCOFT 2025 - International Conference on Futuristic Technology

372