Financial Early Warning Model of Electric Power Enterprises Based

on Attribute Reduction Algorithm

Xiufeng Le, Dong Wang, Yongbing Yan, Shuai Zhang and Hongmei Zhang

Beijing China-Power Information Technology Co. Ltd., 102200, China

Keywords: Rough Theory, Property Reduction Algorithm, Financial Early Warning Model, Electricity, Corporate

Finance.

Abstract: Financial early warning model plays an important role in the finance of power enterprises, but there is the

problem of inaccurate forecasting. In data analysis, attribute reduction is a process of reducing the number of

features in a dataset with the aim of removing those attributes that have little impact on classification or

prediction results, thereby improving data processing efficiency and reducing computational costs, while

avoiding "dimensional disasters". Attribute reduction methods usually include feature selection and feature

extraction. In the realm of financial management within power companies, maintaining a robust system that

can accurately predict financial risks and pitfalls is paramount. One innovative approach that has gained

significant traction for improving the forecasting accuracy is the implementation of attribute reduction

algorithms. These algorithms are designed to simplify data sets by identifying and eliminating irrelevant or

redundant attributes, which can significantly enhance the effectiveness of financial early warning systems. In

this article, we will delve into the advantages, applications, and potential challenges associated with attribute

reduction algorithms in the context of power enterprises' financial risk forecasting.

1 INTRODUCTION

The power industry is a crucial component of any

modern economy (Zhong, 2011), providing the

necessary energy for businesses to operate (Zhang,

2022), homes to stay lit (Li and Lu, 2021), and society

to function effectively (Ma, Yang, et al. 2021).

However, as with any industry, financial stability and

sustainability are paramount concerns (He, 2022). In

recent years, the need for effective financial

forecasting (Zhang, 2022) and early warning systems

in electricity companies (Liu, 2021) has become

increasingly apparent (Li, 2021). This article will

explore the importance of comprehensive financial

forecasting for these companies (La, and Shao, 2023),

highlighting the key indicators and strategies that can

help prevent financial crises (Dong, 2021) and ensure

long-term profitability (Lin, Li, et al. 2021).

2 RELATED CONCEPTS

2.1 Mathematical Description of the

Attribute Reduction Algorithm

To begin with, it is essential to understand the

significance of accurate financial projections for

electricity companies. These organizations are

heavily reliant on capital-intensive projects and

investments, making them vulnerable to sudden

changes in market conditions or unforeseen events

such as natural disasters. Accurate financial forecasts

enable companies to identify potential risks early on,

mitigate their impact, and make informed decisions

regarding future investments or divestments.

Moreover, sound financial planning can enhance

shareholder confidence, improve credit ratings, and

secure access to funding at favorable termsl, and the

calculation is shown in Equation (1).

lim( ) max( 2)

iij ij ij

x

yt y t

→∞

⋅=≥ ÷

(1

)

Le, X., Wang, D., Yan, Y., Zhang, S. and Zhang, H.

Financial Early Warning Model of Electric Power Enterprises Based on Attribute Reduction Algorithm.

DOI: 10.5220/0013535100004664

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 3rd International Conference on Futuristic Technology (INCOFT 2025) - Volume 1, pages 45-50

ISBN: 978-989-758-763-4

Proceedings Copyright © 2025 by SCITEPRESS – Science and Technology Publications, Lda.

45

Among them, the judgment of outliers is shown in

Equation (2).

2

max( ) ( 2 ) ( 4)

ij ij ij ij

tttmeant=∂ + ⋅ +

M

(2)

In creating an effective financial forecasting

system, electricity companies should focus on several

core components. Firstly, it is vital to establish a

robust set of financial metrics that accurately capture

the organization's financial health. Key performance

indicators (KPIs) such as cash flow, debt-to-equity

ratio, return on assets (ROA), and operating margin

should be regularly monitored and analyzed. By

doing so, companies can gain a clear understanding

of their financial status and identify areas for

improvement or concern.

𝐹(𝑑

)=ℝ 𝑡

𝜉⋅

√

2 →

𝑦

⋅7

(3

)

2.2 Selection of Financial Early

Warning Model Scheme

This collaborative approach not only enhances the

accuracy of forecasts but also strengthens team

morale and commitment to the organization's long-

term success.

()= ( )

ii i i

dy

g

txz Fd w

dx

⋅−

∏

(4

)

Based on Assumptions I and II, the comprehensive

function of the financial early warning model can be

obtained, as shown in Equation (5).

lim ( ) ( ) max( )

ii ij

x

gt Fd t

→∞

+≤

(5

)

It is crucial to regularly review and update financial

forecasts as new data becomes available or market

conditions change. This ongoing process allows

companies to adapt to evolving circumstances, refine

their predictions, and maintain a competitive edge in

the industry

𝑔(𝑡

)+𝐹(𝑑

)

↔𝑚𝑒𝑎𝑛(𝑡

+4)

(6

)

2.3 Analysis of Financial Early

Warning Model Scenarios

Ensuring proper communication and collaboration

between different departments within the

organization is critical. Finance teams must work

closely with operational, sales, and marketing

departments to gather information on upcoming

projects, market developments, and customer

behavior. By combining this information with

financial data, more holistic and accurate forecasts

can be produced.

𝑁𝑜(𝑡

)=

𝑔(𝑡

)+𝐹(𝑑

)

𝑚𝑒𝑎𝑛(

∑

𝑡

+4)

𝑏

−4𝑎𝑐

(7

)

Fostering a culture of transparency and

accountability is essential for successful financial

forecasting. Senior management should encourage

open dialogue about potential risks and challenges,

allowing employees to contribute their insights and

ideas.

() [ () ( )]

iii

Z

ht gt F d=+

(8

)

Secondly, adopting a forward-looking perspective

is crucial when developing financial forecasts. This

involves analyzing historical data, current trends, and

macroeconomic factors that may affect the industry.

It is also essential to consider potential scenarios,

including both positive outcomes and potential risks,

allowing the organization to prepare for various

possibilities. Additionally, implementing scenario

analysis techniques, such as Monte Carlo simulations,

can further enhance the accuracy of predictions by

accounting for the variability and uncertainty inherent

in financial data.

𝑎𝑐𝑐𝑢𝑟(𝑡

)=

𝑚𝑖𝑛[

∑

𝑔(𝑡

)+𝐹(𝑑

)

]

∑

𝑔(𝑡

)+𝐹(𝑑

)

× 100%

(9

)

Thirdly, incorporating advanced technology and

analytical tools can significantly improve the

effectiveness of financial forecasting. Artificial

intelligence (AI) and machine learning algorithms

can analyze vast amounts of data more efficiently

than traditional methods, identifying patterns and

predicting future trends with greater accuracy.

Moreover, utilizing cloud-based platforms enables

real-time data collection and sharing, allowing for

more timely decision-making and risk management.

𝑎𝑐𝑐𝑢𝑟(𝑡

)=

𝑚𝑖𝑛[

∑

𝑔(𝑡

)+𝐹(𝑑

)

]

∑

𝑔(𝑡

)+𝐹(𝑑

)

+ 𝑟𝑎𝑛𝑑𝑜𝑛(𝑡

)

(10

)

Another consideration is that of balancing data

reduction with information loss. While the goal is to

eliminate redundant or less informative attributes,

doing so must not sacrifice valuable insights. Striking

INCOFT 2025 - International Conference on Futuristic Technology

46

this balance requires a nuanced approach, combining

domain expertise with data mining expertise to ensure

that the reduced data set still captures the complexity

of financial dynamics within the power sector.

3 OPTIMIZATION STRATEGY

OF FINANCIAL EARLY

WA RN I N G M O D E L

Power enterprises are complex entities operating

within a dynamic environment, where numerous

factors such as fluctuating energy demands,

regulatory changes, and market fluctuations can

impact their financial stability. Financial risk

management, particularly the capability to anticipate

and prepare for potential financial distress, is critical

for these companies to sustain their operations and

growth. The traditional methods of financial analysis

often involve extensive data collection, including

both financial and non-financial variables. However,

not all collected data are equally informative or

relevant, which can lead to complications in

predictive models and diminish their accuracy. This

is where attribute reduction techniques step in,

offering a pathway to streamline data and focus on the

most pertinent indicators for financial health.

4 PRACTICAL EXAMPLES OF

FINANCIAL EARLY WARNING

MODELS

4.1 Introduction to the Financial Early

Warning Model

In addition, as with any model-based approach, the

effectiveness of attribute reduction algorithms can be

influenced by external factors such as changes in

market conditions, new regulations, or shifts in

consumer behavior. Therefore, it's essential for power

enterprises to regularly review and update their

financial early warning systems to reflect the current

state of affairs accurately, and the financial early

warning model scheme of the specific financial early

warning model is shown in Table 1.

The financial early warning model process in

table I, as shown in figure 1.

Table 1: Financial early warning model requirements.

Scope of

application

Grade Accuracy Financial

early warning

model

Profit

assessment

I 85.00 78.86

II 81.97 78.45

Fundraising

I 83.81 81.31

II 83.34 78.19

Risk

monitoring

I 79.56 81.99

II 79.10 80.11

Attribute

reduction

Analysis

Financing

Rough theory

Financial early

warning

Electric Company

Figure 1: The analytical process of the financial early

warning model.

Attribute reduction algorithms, drawing from the

fields of artificial intelligence and computational

intelligence, are methodologies that analyze large

datasets to discern patterns and relationships among

various data points. They employ techniques such as

rough set theory, discernibility matrix, and heuristic

algorithms to identify core variables that contribute

most significantly to the prediction of a target

outcome – in our case, the financial well-being of a

power enterprise. By stripping away superfluous data,

these algorithms not only improve the efficiency of

data processing but also enhance the clarity and

reliability of forecasting models.

4.2 Financial Early Warning Model

The application of these algorithms in financial early

warning systems within power companies offers

several benefits. Firstly, it enables more precise

identification of leading indicators of financial

distress. These might include metrics like cash flow

adequacy, debt-to-equity ratios, profitability trends,

and others that have been empirically demonstrated to

be strong predictors of financial health. Secondly, the

simplified data structure allows analysts to more

easily visualize the interrelations between different

indicators, providing a clearer understanding of the

underlying drivers of financial performance. Thirdly,

Financial Early Warning Model of Electric Power Enterprises Based on Attribute Reduction Algorithm

47

by reducing noise in the data, attribute reduction can

minimize false positives or negatives in predictions,

thereby increasing the trustworthiness of the warning

system, and the scheme of financial early warning

model is shown in Table 2.

Table 2: Overall status of the financial early warning model

scenario.

Category Random

data

Reliability Analysis

rate

Profit

assessment

85.32 85.90 83.95

Fundraisin

g

86.36 82.51 84.29

Risk

monitorin

g

84.16 84.92 83.68

mean 86.84 84.85 84.40

X6 83.04 86.03 84.32

P=1.249

4.3 Financial Early Warning Model

and Stability

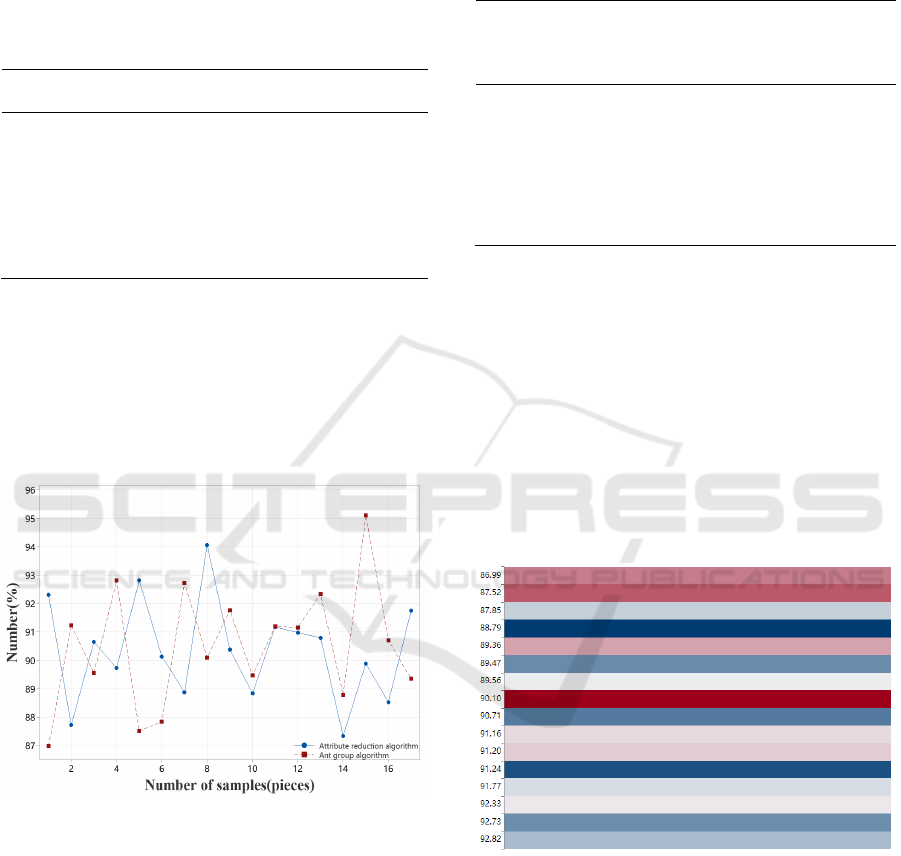

Additionally, conducting periodic stress tests can help

identify potential vulnerabilities and inform

contingency planning efforts, and the financial early

warning model scheme is shown in Figure 2.

Figure 2: Financial early warning models with different

algorithms.

However, the integration of attribute reduction

techniques into financial forecasting models does

present certain challenges. One of the primary

concerns is the need for expert knowledge in both

finance and data analytics to select the appropriate

algorithm and interpret its outcomes correctly.

Moreover, the quality and integrity of the original

dataset are crucial; errors or inconsistencies in the

input data can adversely affect the results of the

algorithm, potentially leading to misleading

conclusions. The average financial early warning

model scheme of the above three algorithms is shown

in Table 3.

Table 3: Comparison of the accuracy of financial early

warning models of different methods.

Algorithm Survey

data

Financial

early

warning

model

Magnitude

of change

Error

Attribute

reduction

algorithm

85.33 85.15 82.88 84.95

Ant

colony

algorith

m

85.20 83.41 86.01 85.75

P 87.17 87.62 84.48 86.97

To maximize the value derived from attribute

reduction algorithms, power companies should also

consider integrating them into a comprehensive

decision support system. This integration would

allow for real-time monitoring of financial health

indicators and proactive intervention when early

signs of financial distress are detected. Additionally,

leveraging the insights from these algorithms can

guide strategic planning efforts, such as capital

allocation, risk mitigation strategies, and long-term

investment decisions, the attribute reduction

algorithm is generally analyzed by different methods,

Figure 3 shown.

Figure 3: Financial early warning model with attribute

reduction algorithm.

In addition, as with any model-based approach,

the effectiveness of attribute reduction algorithms can

be influenced by external factors such as changes in

market conditions, new regulations, or shifts in

consumer behavior. Therefore, it's essential for power

enterprises to regularly review and update their

financial early warning systems to reflect the current

state of affairs accurately.

INCOFT 2025 - International Conference on Futuristic Technology

48

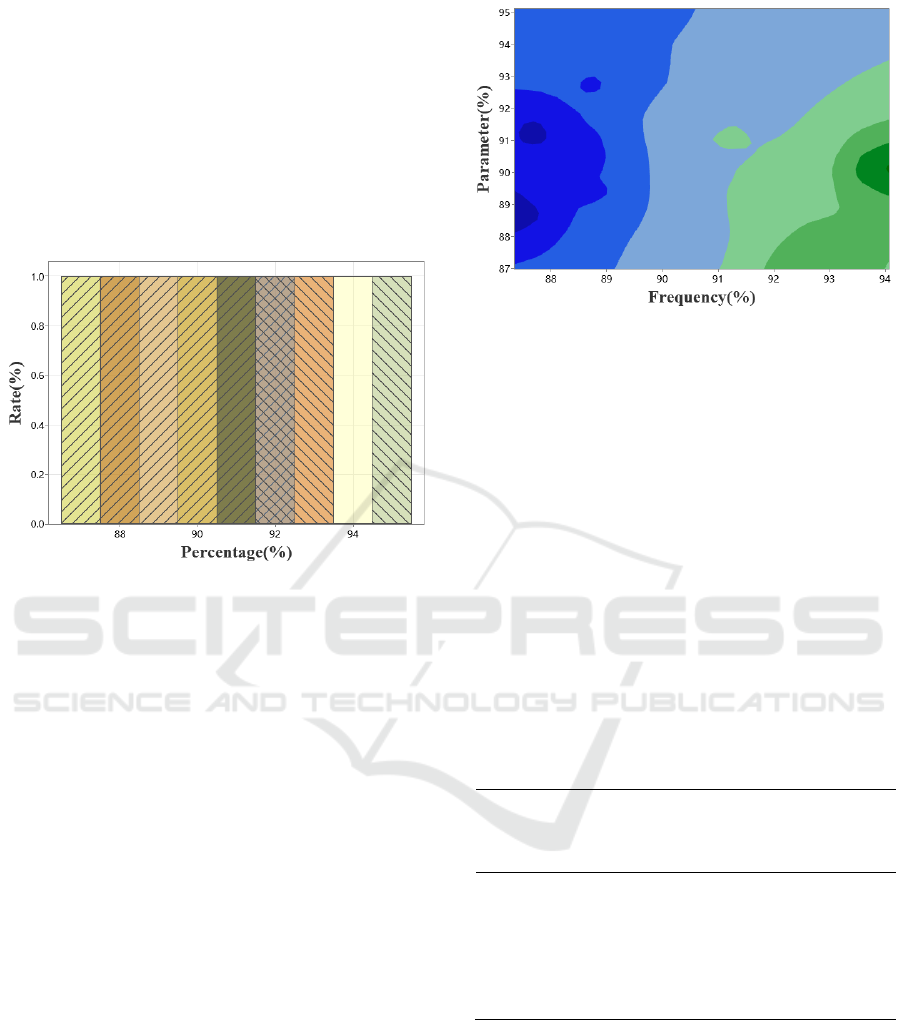

4.4 Rationality of the Financial Early

Warning Model

Through this processing, it not only reduces the input

variables of the model and simplifies the subsequent

calculation process, but also helps to eliminate the

multicollinearity problem between variables, and

enhances the generalization ability and prediction

accuracy of the mode, and the financial early warning

model scheme is shown in Figure 4.

Figure 4: Financial early warning models with different

algorithms.

In conclusion, the adoption of attribute reduction

algorithms presents an exciting opportunity for power

enterprises to refine their financial risk forecasting

capabilities. By embracing this cutting-edge

technology, companies can create more accurate and

reliable early warning systems, which are crucial in

today's ever-changing economic landscape. As we

continue to navigate through a future defined by data

abundance, the ability to distill information down to

its most actionable form will undoubtedly give those

who master it a competitive edge, ensuring the

continued vitality and success of the power industry

for years to come.

4.5 Effectiveness of the Financial Early

Warning Model

Taking principal component analysis as an example,

we can combine many financial ratios to extract a few

principal components that are independent of each

other and represent the majority of the information,

he financial early warning model scheme is shown in

Figure V shown.

Figure 5: Financial early warning models with different

algorithms.

By focusing on robust financial metrics, adopting

a forward-looking perspective, leveraging advanced

technology, fostering cross-functional collaboration,

promoting a culture of transparency and

accountability, and maintaining regular reviews and

updates, companies can significantly enhance their

financial stability and resilience. With a

comprehensive approach to financial forecasting,

electricity companies can confidently navigate

through uncertain times and emerge stronger, more

profitable, and better prepared for future

challenges.The average financial early warning

model scheme of the above three algorithms is shown

in Table 4.

Table 4: Comparison of the effectiveness of financial early

warning models of different methods.

Algorithm Survey

data

Financial

early

warning

model

Magnitude

of change

Error

Attribute

reduction

al

g

orith

m

82.21 85.92 84.59 82.85

Ant

colony

algorith

m

83.73 84.23 84.41 83.55

P 84.20 87.39 84.76 83.90

In the realm of financial management within

power companies, maintaining a robust system that

can accurately predict financial risks and pitfalls is

paramount. One innovative approach that has gained

significant traction for improving the forecasting

accuracy is the implementation of attribute reduction

algorithms. These algorithms are designed to simplify

data sets by identifying and eliminating irrelevant or

Financial Early Warning Model of Electric Power Enterprises Based on Attribute Reduction Algorithm

49

redundant attributes, which can significantly enhance

the effectiveness of financial early warning systems.

In this article, we will delve into the advantages,

applications, and potential challenges associated with

attribute reduction algorithms in the context of power

enterprises' financial risk forecasting, Figure VI

shown.

Figure 6: Attribute reduction algorithm, financial early

warning model.

It is worth mentioning that although the attribute

reduction algorithm can greatly improve the

efficiency and accuracy of the model, it also has

certain limitations. For example, PCA assumes that

the data conform to a normal distribution and that the

principal components are independent of each other,

which is not always true in the actual complex and

volatile financial data. Therefore, in practice, we need

to combine a variety of algorithms and expert

experience to continuously optimize and adjust the

model.

5 CONCLUSIONS

In conclusion, by introducing the attribute reduction

algorithm, we can create an efficient and accurate

financial early warning model for power companies.

The model can not only help power managers and

investors identify potential financial problems early,

but also provide decision-making support for relevant

regulatory authorities, so as to maintain the stable

development of the entire industry. In the future, with

the continuous advancement of big data and artificial

intelligence technology, more innovative methods

and practical solutions will emerge in this field to

provide strong support for the risk management work

of power enterprises.

REFERENCES

Zhong Yu. (2011). Research on financial early warning

model of power enterprises based on attribute reduction

algorithm. China Economic and Trade Guide(5), 2.

Zhang Xinyao. (2022). Research on financial crisis early

warning of listed companies in the power industry -

based on logistic regression model. Economic Research

Guide(32), 3.

Li Haiqun, & Lu Yu. (2021). Research on financial audit

capability evaluation of power grid enterprises based on

"capability maturity model". (2019-7), 45-47.

Ma Guohan, Yang Xin, Zhuo Junyu, Gao Chengmin, &

Zhou Qiang. (2021). Research on enterprise operation

risk early warning model based on power data. Electric

Power Supply and Demand, 38(4), 6.

He Yinchuan. (2022). Research on attribute reduction

algorithm for decision information system based on

attribute similarity. Automation Technology and

Applications(007), 041.

Zhang Weiqiang. (2022). Empirical research on financial

early warning model of listed companies based on

industry classification using text clustering. (Doctoral

dissertation, Southwest University of Finance and

Economics).

Liu Jin. (2021). Construction and application of financial

risk early warning model based on efficacy coefficient

method - taking D Logistics Company as an example.

(Doctoral dissertation, Jiangxi Normal University).

Li Jingjing. (2021). Research on financial crisis early

warning of enterprises based on GA-BP neural

network. Hebei Enterprises, 000(004), 81-83.

La Lei, & Shao Liwei. (2023). Research on the focal points

of ideological and political students in course based on

online comments. Computer Science and Application,

13(8), 9.

Dong Chunhua. (2021). Research on financial crisis early

warning analysis model for small and medium-sized

enterprises based on artificial intelligence.

Lin Dannan, Li Shanshan, Xiao Shilong, & Zhang Deyu.

(2021). Research on financial risk early warning model

of enterprises based on long short-term memory neural

network. Journal of Nanjing University of Science and

Technology, 45(3), 6.

INCOFT 2025 - International Conference on Futuristic Technology

50