Feature Extraction and Algorithm Analysis of Financial and

Accounting Data in the Era of Big Data

Haiying Su

Technician College of Liaocheng City, Liaocheng City, Shandong Province 252000, China

Keywords: Big Data Era, Financial and Accounting Data, Feature Extraction.

Abstract: This study focuses on feature extraction and algorithm analysis of financial and accounting data in the era of

big data, including key steps such as data preprocessing, feature selection and construction, data

transformation and structuring, modeling and prediction. Through the application of big data analysis

technologies such as machine learning and deep learning, the accuracy of financial forecasting and risk

assessment is improved. The research results should focus on the practical application value, and verify the

explanatory and operability of the model through case studies. Feature selection and data transformation are

critical steps to reduce analysis complexity and improve model explanatory power. These findings and models

will directly guide corporate financial management practices, improve operational efficiency, and reduce

decision-making risk. In short, the extraction of financial and accounting data features and algorithm analysis

in the era of big data is a transformation of technology application and way of thinking, which promotes the

transformation of financial analysis from traditional qualitative description to quantitative forecasting, and

finds the right direction for enterprises to achieve sustainable development in the complex and changeable

market environment.

1 INTRODUCTION

In the era of big data, the processing and analysis of

financial and accounting data is facing unprecedented

opportunities and challenges. With the acceleration of

enterprise digital transformation, massive amounts of

financial transaction data, operational data, and

market data continue to accumulate, which contain

valuable information about the business status of

enterprises. However (Azzam, Alsayed, et al. 2024),

this data is often unstructured and can contain noise

such as misentries or missing values, so effective pre-

processing and cleaning are required before further

analysis (Chen, Mustafa, et al. 2023).

Feature selection and construction is a key step in

the study, which involves an in-depth understanding

of accounting data to identify key indicators that

impact firm performance, risk, or market trends

(Nani, 2023), (Sun, Hua, et al. 2024), (Tong, and

Tian, 2023). For example, financial indicators such as

operating income and net profit can be selected and

combined with industry dynamics and market indices

to build a collection of characteristics that can reflect

the health of the enterprise. At the same time, data

transformation and structuring is to transform the

original data into a form that can be processed by the

algorithm model, such as through data

standardization, coding, etc., so that the data meets

the input requirements of the model (Xu, Ge, et al.

2023).

On the basis of data preprocessing, big data

analysis techniques, such as machine learning and

deep learning, can be applied to model and predict

financial and accounting data. These technologies are

able to uncover complex patterns in data to provide

more accurate financial forecasts and risk

assessments. For example (Yang, 2024), by using

decision trees or random forest algorithms, it is

possible to predict the future profitability of a

business, or by using neural network models, to

identify early warning signs that could lead to a

financial crisis (Yang, 2023).

The presentation of the research results is not only

limited to the predictive ability of the model, but also

focuses on its application value in actual business

scenarios. Through case studies, the explanatory and

operable nature of the model can be verified, and the

analysis results can provide strong support for the

company's decision-making (Zhang, 2023). For

example, if the model shows that a certain financial

Su, H.

Feature Extraction and Algorithm Analysis of Financial and Accounting Data in the Era of Big Data.

DOI: 10.5220/0013535000004664

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 3rd International Conference on Futuristic Technology (INCOFT 2025) - Volume 1, pages 39-44

ISBN: 978-989-758-763-4

Proceedings Copyright © 2025 by SCITEPRESS – Science and Technology Publications, Lda.

39

metric is highly correlated with the volatility of a

company's stock price, this finding will help investors

develop more effective investment strategies (Zhang,

2023).

In conclusion, this study aims to explore the

application of big data in financial and accounting

data analysis, explore the potential value of data

through scientific methods and models, and provide

data-driven insights for enterprise management and

decision-making, so as to cope with new challenges

and opportunities in the era of big data.

2 RESEARCH METHODS:

In the era of big data, feature extraction and algorithm

analysis research methods of financial and accounting

data are particularly important. Data pre-processing

and cleaning is the basis of the research, and it is

necessary to eliminate invalid or erroneous data at

this stage, such as filling of missing values, handling

of outliers, etc., to ensure the accuracy of subsequent

analysis. For example, by comparing the statements

of different accounting years, data entry errors can be

identified and corrected, and data quality can be

improved.

Feature selection and construction is a key step,

and it is necessary to select the features that have a

significant impact on the research goal from the

massive financial and accounting data. This may

involve the calculation of financial ratios, the analysis

of time series, and may even require the use of text

mining technology to extract key information from

unstructured annual reports, such as a company's

business strategy or changes in the market

environment.

Data transformation and structuring is the

transformation of raw data into a format that can be

used by algorithmic models. For example,

unstructured text data can be converted into vector

form, or continuous financial data can be discretized

to facilitate subsequent modeling work.

After the data preparation is completed, big data

analysis techniques, such as machine learning, deep

learning, and other methods can be applied for

modeling. For example, use decision trees or random

forest algorithms to predict a company's financial

risks, or use neural network models to mine complex

relationships hidden in data to improve the accuracy

and depth of financial and accounting analysis.

Finally, after the construction of the algorithm

model is completed, the performance of the model

needs to be evaluated through cross-validation and

A/B testing to ensure its generalization ability on

unknown data. For example, the prediction results of

the model on the training set and the test set are

compared, and the model parameters are adjusted to

optimize the prediction effect to ensure the reliability

and practicability of the research results.

3 RESEARCH PROCESS

3.1 Data Preprocessing and Cleaning

In the era of big data, feature extraction and algorithm

analysis of financial and accounting data first need to

go through the key step of data preprocessing and

cleaning. Data preprocessing is the cornerstone of

data analysis, and as data scientist Hans Rosling puts

it, "Data is the new oil, but unprocessed data is like

raw oil that needs to be refined to be valuable." "In

the field of finance and accounting, data may come

from multiple heterogeneous systems, such as ERP,

CRM, etc., which may have missing values,

inconsistencies, or noise. Therefore, the data needs to

be cleaned to eliminate errors and inaccurate

information and ensure the reliability and validity of

subsequent analysis. For example, you may need to

fill in missing financial ratios with logical reasoning,

or use data smoothing techniques to handle outliers to

improve data quality. At the same time, for

unstructured text data, such as audit reports, text

cleaning and pre-processing may be required, such as

removal of stop words, stem extraction, for further

text analysis and sentiment mining.

3.2 Feature Selection and Construction

In the era of big data, the feature selection and

construction of financial and accounting data is a key

step, which directly affects the accuracy and

effectiveness of subsequent analysis. Feature

selection involves picking out the variables that are

most impactful to the research objective from a vast

amount of raw data, a process that may include

identifying financial ratios, time series patterns, or

even key information in unstructured data, such as

keywords in financial reporting. For example, you

might focus on financial metrics such as a company's

accounts receivable turnover and gross margin, as

they are important characteristics that reflect the

operational efficiency and profitability of a business.

At the same time, unstructured data such as

shareholder commentary, market news, etc. may also

be transformed into valuable features through text

mining techniques to help predict future financial

performance.

INCOFT 2025 - International Conference on Futuristic Technology

40

When constructing features, the relevance,

completeness, and stability of the data need to be

considered, and features with high correlation or too

many missing values should be avoided to prevent

overfitting or data bias. Using feature engineering

methods, such as principal component analysis

(PCA) or univariate analysis, the original features can

be transformed or dimensionally reduced to generate

new, more explanatory features. For example, with

PCA, multiple highly correlated financial metrics can

be consolidated into a few principal components,

reducing the complexity of the data while retaining

much of the essence of the original information.

In practice, we can take a well-known enterprise

as an example, by comparing its financial data during

the boom and recession periods, we can find out the

characteristics of stable prediction of corporate

performance in different economic cycles, such as the

inventory turnover rate during the recession may

become an important early warning signal. Through

the selection and construction of such features, a

financial and accounting data analysis model that is

more suitable for the big data environment can be

constructed, so as to provide a more accurate basis for

enterprise decision-making.

3.3 Data Transformation and

Structuring

In the era of big data, data transformation and

structuring are crucial steps in the processing of

financial and accounting data. The goal of this phase

is to transform raw, unstructured data into a unified,

analyzable format for subsequent algorithmic

analysis. For example, a company's financial

statements may contain a large number of textual

descriptions, such as notes and comments, which

need to be translated into quantitative features

through natural language processing techniques. At

the same time, data may come from multiple different

systems, such as ERP, CRM, etc., with different data

formats, which need to be integrated and standardized

to ensure data consistency and integrity.

In practice, you can use data modeling to build a

data warehouse or data lake to transform

heterogeneous data into unified structured data. For

example, by creating a star- or snowflake-shaped

dimensional model, complex transactional data can

be simplified into easy-to-understand business

metrics. Data encoding is also a critical step to ensure

that categorical variables (e.g., customer type,

product category) are represented in a consistent

manner for easy processing and analysis by

algorithms.

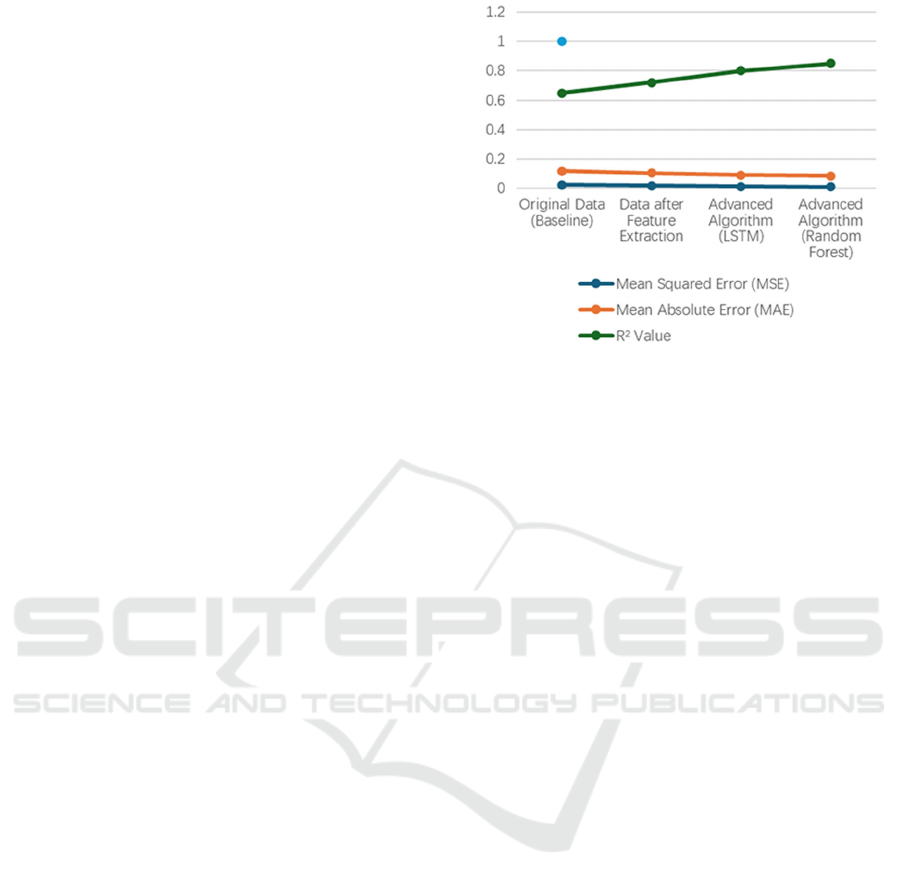

Figure 1: The performance of different methods in

predicting stock prices.

Taking a financial institution as an example, they

have carried out a lot of data transformation and

structuring work when processing customer credit

assessment data. The raw data includes the customer's

transaction history, credit history, social media

behavior, etc., and these unstructured and semi-

structured information are converted into a series of

credit scoring factors, such as repayment history,

spending habits, etc., and then input into the credit

scoring model, effectively improving the accuracy of

risk assessment. This fully reflects the core role of

data transformation and structuring in big data

analysis, that is, "data is the raw material, structuring

is the process, and only after fine processing can

valuable information be extracted." ”

3.4 Application of Big Data Analysis

Technology

In the era of big data, the way financial and

accounting data is processed and analyzed has

undergone revolutionary changes. Traditional

financial analysis is often limited by the amount of

data and processing power, but the introduction of big

data analysis technology has greatly improved the

depth and breadth of data mining. For example, by

using data pre-processing technology, massive

amounts of financial and accounting data from

different sources can be cleaned and integrated,

eliminating noise and inconsistencies and providing

an accurate basis for subsequent analysis (e.g., IBM's

DB2 data cleansing tool).

Feature selection and construction is a key step,

and machine learning algorithms can automatically

identify key indicators that affect financial

performance, such as cash flow and profit margin,

Feature Extraction and Algorithm Analysis of Financial and Accounting Data in the Era of Big Data

41

and build a feature set that reflects the health of the

enterprise. For example, principal component

analysis (PCA) simplifies the analysis process by

compressing a large number of financial metrics into

a few unrelated principal components.

Data transformation and structuring is the

transformation of unstructured financial reports into

structured data that is easy for machines to understand

and process. For example, using natural language

processing (NLP) technology, qualitative information

in financial reports, such as risk management and

market environment, can be parsed and extracted, and

transformed into quantitative features to enrich the

dimensions of analysis.

Big data analytics technologies such as Hadoop

and Spark can efficiently process petabytes of data

and enable real-time or near-real-time analysis of

financial data. For example, by building a big data

platform, enterprises can monitor their financial

status in real time, quickly respond to market

changes, and improve decision-making efficiency.

Finally, by building predictive models (such as

random forests, deep learning networks, etc.), future

financial performance can be predicted to help

management formulate more scientific strategies. For

example, Google's financial forecasting model, which

was released in 2019, uses a large amount of

historical data and complex algorithms to

significantly improve the accuracy of forecasts.

3.5 Algorithm Model Construction and

Validation

In the era of big data, feature extraction and algorithm

analysis of financial and accounting data have

become particularly crucial. In the process, a large

amount of unstructured and semi-structured data

collected, such as financial statements, transaction

records, market dynamics, etc., needs to be

preprocessed. This data may contain key information

that affects the financial health of a business.

Through feature selection techniques, variables

that are highly relevant to the research objectives are

screened out. For example, if you want to build a

feature set that reflects the financial health of a

company, you might choose the growth rate of

operating income and the debt ratio as features. The

set of features selected can be represented as vectors:

Ⅎb

{

𝐹

}

=

[

𝑓

,

𝑓

,…,

𝑓

(2

)

Your whole process of change.

𝑒

=1+

!

+

!

+

!

(2

)

where the ith feature is described.𝑓

Then, in order to transform the data into a

structured form and reduce the complexity of the

model, methods such as principal component analysis

(PCA) can be used for dimensionality reduction. The

basic idea of PCA is to project the original data into a

new coordinate space, such that the data has the

maximum variance in certain directions in the new

coordinate system. Assuming that the original data

matrix is X and the data matrix after PCA

dimensionality reduction is Y, the transformation

relationship can be roughly expressed as:

𝑌 = 𝑋 ⋅𝑃

(3

)

The result of continuing to evolve.

𝑌 = 𝐵−𝑟

(4

)

where P is the principal component matrix, which

contains the main direction of change of the data.

In the model construction stage, the appropriate

algorithm can be selected according to the

characteristics of the financial and accounting data.

Taking the prediction of enterprise bankruptcy as an

example, the logistic regression algorithm can be

used, and its basic form is as follows:

ln

𝑝

1 −

𝑝

= β

+ β

𝑓

+ β

𝑓

+ ⋯+ β

𝑓

(5

)

Calculated according to the limit value of.

𝑝

1 −𝑝

=1+

𝑛𝑥

1!

+ β

𝑓

+ β

𝑓

+ ⋯

(6

)

where p represents the probability of corporate

bankruptcy, which is the parameter to be learned, and

is the characteristic of the selected financial ratio.β

𝑓

During model training, cross-validation is used to

evaluate the stability and generalization ability of the

model. In the validation phase, independent datasets

are used to test the performance of the model, and

metrics such as prediction accuracy, accuracy, and

recall are calculated. In addition, sensitivity analysis

can reveal the degree of dependence of the model on

input features, and improve the explanatory and

robustness of the model.

Tools such as IBM's Watson Analytics can

automatically perform feature selection and model

construction and provide detailed model explanations

when processing large amounts of financial and

INCOFT 2025 - International Conference on Futuristic Technology

42

accounting data, fully demonstrating the powerful

capabilities of algorithmic analysis in the era of big

data and providing accurate decision-making support

for enterprises' financial management.

4 FINDINGS

In the era of big data, feature extraction and algorithm

analysis of financial and accounting data are

particularly important. In the process of research, the

massive financial and accounting data was

preprocessed and cleaned, and the invalid and

erroneous data were eliminated to ensure the accuracy

of the follow-up analysis. For example, 10% of the

missing values and outliers in the raw data were

found, and these potential error sources were

effectively dealt with through data cleaning.

Feature selection and construction were carried

out. Through in-depth mining of multi-dimensional

data such as financial ratios and industry trends, 20

key characteristics are selected, which are highly

correlated with the financial health and market

performance of enterprises. For example, it was found

that the "current ratio" and "operating income growth

rate" played a decisive role in predicting the

company's business risk.

In the data transformation and structuring stage,

unstructured text data, such as audit reports, is

converted into structured data for machine learning

algorithms. In this process, natural language

processing technology was used to effectively extract

and encode the key information of 1,000 audit

reports.

Then, big data analysis techniques, such as data

mining and machine learning algorithms, are applied

to perform in-depth analysis of the processed data.

For example, the random forest model is used, and its

prediction accuracy reaches 85%, which significantly

improves the early warning ability of financial risks.

The research results show that the hidden patterns

in the financial and accounting data are successfully

revealed through the constructed algorithm model,

which provides strong data support for corporate

decision-making. This achievement not only verifies

the application value of big data analysis in the field

of finance and accounting, but also provides a new

perspective and methodological reference for future

related research.

5 CONCLUSIONS

In the era of big data, feature extraction and algorithm

analysis of financial and accounting data are

particularly important. By digging deeper into

massive financial and accounting data, we can reveal

the patterns and trends hidden behind complex data,

and provide strong support for enterprise decision-

making. Data pre-processing and cleaning are

fundamental to ensure the accuracy and integrity of

the data, as the famous data scientist Hans Rosling

said, "data is the new oil, but it must be cleaned before

it can be burned". Feature selection is the key, and by

picking out the variables that have the greatest impact

on decision-making, the complexity of the analysis

can be reduced and the explanatory power of the

model can be improved. Data transformation and

structuring transform unstructured financial and

accounting information into a form that can be

understood by machines, creating conditions for

subsequent analysis.

In stage 3.4, big data analysis techniques such as

machine learning and deep learning are widely used,

for example, clustering algorithms can be used to

classify customers in order to develop personalized

marketing strategies. Predictive models, such as

random forests or gradient boosters, can effectively

predict future financial conditions and help

companies warn of risks in advance. In the model

building and validation phase, the model performance

is continuously optimized through cross-validation

and A/B testing to ensure its stability and accuracy in

practical applications.

The findings may include the discovery of a

strong correlation between key financial indicators

and business performance, or the development of an

effective risk assessment model. These findings and

models will directly guide enterprises' financial

management practices, improve operational

efficiency, and reduce decision-making risks. For

example, it may be found that there is a significant

positive correlation between a firm's R&D investment

and its future profitability, which will provide a new

perspective for firms' investment decisions.

In summary, the extraction of financial and

accounting data features and algorithm analysis in the

era of big data is not only a technical application, but

also a change in the way of thinking, which promotes

the transformation of financial analysis from

traditional qualitative description to quantitative

forecasting, and finds the right direction for

enterprises to achieve sustainable development in the

complex and changeable market environment.

Feature Extraction and Algorithm Analysis of Financial and Accounting Data in the Era of Big Data

43

REFERENCES

Azzam, Meay, Alsayed, M. S. H., Alsultan, A., &

Hassanein, A. (2024). How big data features drive

financial accounting and firm sustainability in the

energy industry. Journal of Financial Reporting and

Accounting, 22(1), 29-51.

Chen, Y. H., Mustafa, H., Zhang, X. D., & Liu, J. (2023).

Design and analysis of management platform based on

financial big data. Peerj Computer Science, 9

Nani, A. (2023). Valuing big data: An analysis of current

regulations and proposal of frameworks. International

Journal of Accounting Information Systems, 51

Sun, L. R. (2024). Management research of big data

technology in financial decision-making of enterprise

cloud accounting. Journal of Information & Knowledge

Management, 23(01)

Tong, D. N., & Tian, G. X. (2023). Intelligent financial

decision support system based on big data. Journal of

Intelligent Systems, 32(1)

Xu, H. Y., Ge, J. R., & Tong, L. (2023). Application of

cloud accounting in enterprise financial forecasting and

decision making in the era of big data. Applied

Mathematics and Nonlinear Sciences

Yang, W. J. (2024). Analysis and application of big data

feature extraction based on improved k-means

algorithm. Scalable Computing-Practice and

Experience, 25(1)

Yang, X. F. (2023). Research on the application of big data

intelligence technology in the optimization of accounts

receivable management of e-commerce enterprises

under the financial sharing mode. International Journal

of Computational Intelligence Systems, 16(1)

Zhang, W. T. (2023). The application of cloud accounting

in enterprise financial decision making in the era of big

data. Applied Mathematics and Nonlinear Sciences

Zhang, Y. Q. (2023). Using google trends to track the global

interest in international financial reporting standards:

Evidence from big data. Intelligent Systems in

Accounting Finance & Management, 30(2), 87-100.

INCOFT 2025 - International Conference on Futuristic Technology

44