Development the Novel FCF-SIWEC-RBNAR Hybrid Method for

Financial Performance Evaluation

Hamide Özyürek

1a

, Galip Cihan Yalçın

1b

and Karahan Kara

2c

1

Department of Business, Faculty of Economics and Administrative Sciences, OSTIM Technical University, Ankara, Turkey

2

Department of Business, Faculty of Economics and Administrative Sciences, OSTIM Technical University, İzmir, Turkey

Keywords: Financial Performance Analysis, Fermatean Cubic Fuzzy Sets, Simple Weight Calculation, Reference-Based

Normalization Alternative Ranking.

Abstract: Financial performance analyses are fundamental tools that provide insights into companies' financial

conditions. The primary aim of this study is to develop a financial performance analysis method as a decision

support system. In this context, the FCF-SIWEC-RBNAR (Fermatean Cubic Fuzzy- Simple Weight

Calculation- Reference-Based Normalization Alternative Ranking) hybrid method was developed. In this

method, expert weights are determined using FCF sets, while the weights of criteria are calculated using the

FCF-SIWEC approach based on expert evaluations. Companies are then ranked according to their financial

performance using the RBNAR method. To demonstrate the applicability of the proposed hybrid method, four

case studies were conducted using data from 50 companies operating on Borsa Istanbul for the years 2020,

2021, 2022, and 2023. As a result of the research, the "Debt-to-Equity Ratio" was identified as the most

significant financial criterion. Additionally, the financial performance rankings of companies were

determined for each year. These findings support that the FCF-SIWEC-RBNAR hybrid method is a robust

and applicable approach for financial performance evaluation.

1 INTRODUCTION

The most important activities of managers are

planning (Snyder & Glueck, 2019), implementation,

and control (Alipour et al., 2013; Wu et al., 2005). In

carrying out these activities, managers rely on

performance reports generated by management

accountants. Management accountants, in turn,

analyse the financial statements produced by the

accounting information system and provide

information to users by making these reports

applicable to management activities (Hadid & Al-

Sayed, 2021; Zhao & Yu, 2025). The standard

preparation of the generated information allows for

internal comparisons within firms over time and

external comparisons with other firms. According to

IFRS, which ensures this standard, financial

statements include the balance sheet, income

statement, and cash flow statement (Lopes & Penela,

2025). These financial statements enable the

a

https://orcid.org/0000-0002-2574-954X

b

https://orcid.org/0000-0001-9348-0709

c

https://orcid.org/0000-0002-1359-0244

measurement of a company's liquidity, profitability,

debt repayment capacity, and asset efficiency.

The financial statements produced by the

accounting information system are used by both

internal and external stakeholders in the decision-

making process (Tran Thanh Thuy, 2025). The

accuracy of decisions relies on making plans with

forecasts that ensure the sustainability of firms and on

company comparisons (Farshadfar et al., 2025), which

are facilitated by reports that are accurate, timely, and

tailored to needs. However, simply preparing reports

does not help in making accurate decisions; it is also

essential to analyse the reports with the correct

indicators. Financial ratios are the most important

tools in firm performance analysis.

Financial ratios are essential tools used to measure

key performance indicators such as liquidity,

profitability, debt levels, and operational efficiency of

companies. These ratios provide investors, creditors,

and company managers with insights into a company's

Özyürek, H., Yalçın, G. C., Kara and K.

Development the Novel FCF-SIWEC-RBNAR Hybrid Method for Financial Performance Evaluation.

DOI: 10.5220/0013462100003967

In Proceedings of the 14th International Conference on Data Science, Technology and Applications (DATA 2025), pages 53-63

ISBN: 978-989-758-758-0; ISSN: 2184-285X

Copyright © 2025 by Paper published under CC license (CC BY-NC-ND 4.0)

53

financial health while also revealing potential risks

and opportunities (Llorent-Jurado et al., 2024).

Liquidity ratios assess a company's ability to meet

short-term debt obligations, while profitability ratios

indicate the efficiency with which a company

generates income. Ratios that evaluate debt repayment

capacity help in understanding the extent to which a

company can sustainably meet its debt obligations.

The accurate calculation and interpretation of

financial ratios are crucial for reflecting the true

financial condition of a company. However,

misinterpretation or manipulation of these ratios can

lead to misleading results and conceal the company's

actual financial situation. Therefore, financial

analyses must be conducted meticulously, and all

ratios should be evaluated within their proper context.

Financial ratios play a critical role in evaluating

financial performance. In this context, the ratios

selected in this study, which are commonly used in the

literature, serve as significant indicators for assessing

a firm's financial performance. The financial

indicators added to the decision-making model in this

study include widely used ratios such as Return on

Equity (ROE) (Alsanousi et al., 2024; Qureshi et al.,

2021; Gutiérrez-Ponce & Wibowo, 2023; Rocha et al.,

2024), Return on Assets (ROA) (Loan et al., 2024;

Deb et al., 2024; Veeravel et al., 2024), Leverage

(Giannopoulos et al., 2022), Debt-to-Equity (Kara et

al., 2024; Lam et al., 2023; Abdel-Basset et al., 2020),

Operating Profit Margin (Mao, 2024), Pre-tax Profit

Margin (Kaya et al., 2024), and Net Profit Margin

(Çetin et al., 2024), all of which are instrumental in

evaluating a company's profitability, efficiency, and

debt repayment capacity.

These indicators enable a comprehensive

evaluation in financial analysis, helping us better

understand the performance of companies.

Accurately analyzing a company's financial

performance is not only crucial for understanding its

current financial position but also plays a significant

role in evaluating its future growth potential. Financial

performance reflects a company's efficiency in

obtaining, managing, and utilizing capital, which is

one of the key indicators of its financial health during

a specific period (Chrysafis, 2024). Regardless of the

sector, size, or geographical location, companies must

develop strategies based on effective financial

performance analysis to sustain long-term success and

maintain competitive advantages. In this context,

financial analyses are indispensable tools for

examining a company's financial condition in-depth

and formulating sound strategies for the future. It is

also important to remember that financial performance

is not limited to profitability; it is deeply intertwined

with organizational structures, strategic objectives,

and external environmental factors (Khizar et al.,

2024). Properly analysing financial performance

enables companies to establish a solid foundation

when making strategic decisions and contributes to

their success in competitive markets. Financial

performance analysis is of great importance not only

for internal management but also for investors,

creditors, and other external stakeholders (Akisik &

Gal, 2017).

Financial performance analysis is not only

essential for understanding a company’s current

position but also holds significant value in facilitating

the formulation of strategic decisions for the future. In

this regard, multi-criteria decision-making (MCDM)

methods, employed to assess the financial

performance of companies across diverse sectors,

enable a comprehensive and detailed analysis of

financial data. Tan et al. (2025) employed the SOCP-

MCDM method to assess the financial performance of

companies, utilizing a robust multi-criteria decision-

making framework that accounts for various

performance indicators. In a similar vein, Işık et al.

(2025) utilized the F-LBWAF-LMAW-MARCOS

method, integrating fuzzy logic with multiple

decision-making approaches to provide a nuanced

analysis of financial health across different firms.

These methodologies demonstrate the growing

application of advanced techniques in evaluating

financial performance, highlighting the need for

comprehensive approaches in contemporary business

analysis.Özekenci (2024) conducted financial

performance analyses using LBWA, MEREC, and

CRADIS methods on the BIST Sustainability 25

Index. Alsanousi et al. (2024) performed a financial

performance evaluation using BWM and TOPSIS in

the Saudi Stock Market. Kaya et al. (2024) ranked the

performance of companies in the Borsa Istanbul

Sustainability Index by applying FUCOM and

Copeland methods. Barutbas et al. (2024) examined

the financial performance of companies in the retail

sector using DF TOPSIS and fuzzy clustering

methods. Ghaemi-Zadeh et al. (2024) utilized D-

CRITIC, TOPSIS, and VIKOR methods for financial

performance analysis in the Tehran Stock Exchange.

Isık et al. (2024) performed financial performance

assessments in the insurance sector using PFAHP and

MAIRCA methods. Sharma & Kumar (2024)

conducted financial performance analysis in the

banking sector by employing entropy, TOPSIS, and

VIKOR methods. Liou et al. (2024) investigated the

effects of COVID-19 in the aviation sector using

DEMATEL. Ergülen & Çalik (2024) evaluated

financial performance changes during and before the

DATA 2025 - 14th International Conference on Data Science, Technology and Applications

54

pandemic in the Turkish industrial sector using F-

BWM and MARCOS methods. Kara et al. (2024)

applied SVN-CIMAS-CRITIC-RBNAR methods for

financial performance evaluations in the Borsa

Istanbul Technology sector.

The main motivation of this study is to develop a

decision support system for financial performance

evaluation and to demonstrate its applicability. In this

context, the FCF-SIWEC-RBNAR (Fermatean Cubic

Fuzzy- Simple Weight Calculation- Reference-Based

Normalization Alternative Ranking) hybrid method

has been developed. This hybrid method facilitates the

identification of experts' influence levels in the

decision-making process using FCF (Wang et al.,

2024).). It also enables the determination of the

weights of criteria (financial ratios) through the FCF-

SIWEC method (Puška et al., 2024). Furthermore, it

allows for the ranking of companies based on their

financial performance using the RBNAR method

(Kara et al., 2024). In this study, the financial

performance levels of 50 companies operating on

Borsa Istanbul for the years 2020, 2021, 2022, and

2023 were determined using the FCF-SIWEC-

RBNAR hybrid method.

2 METHODOLOGY

In this study, a hybrid method combining the FCF-

SIWEW-RBNAR approach has been developed to

evaluate the financial performance of companies.

This hybrid method is implemented in three stages. In

Stage 1, the weights of the experts determining the

importance levels of the criteria are calculated. In

Stage 2, the weights of the criteria are determined.

Finally, in Stage 3, the companies are ranked based

on their financial performance. In the methodology

section, the fundamental definitions of FCF are first

presented. Subsequently, the steps of the FCF-

SIWEC-RBNAR hybrid method are outlined.

2.1 Preliminaries of Fermatean Cubic

Fuzzy (FCF) Sets

Definition 1: In the context of the discourse denoted

as 𝔇 , 𝔅

is defined as the set

𝔅

=

〈

𝔡,𝛾

𝔅

(

𝔡

)

,𝛾

𝔅

(

𝔡

)

,𝛿

𝔅

(

𝔡

)

,𝛿

𝔅

(

𝔡

)

,𝛾

𝔅

(

𝔡

)

,𝛿

𝔅

(

𝔡

)

| 𝔡∈

𝔇

〉

. This formulation represents a systematically

structured collection of FCF sets associated with each

element 𝔡 within the set 𝔇. It is crucial to highlight

that this function definition is governed by the

following constraints:

0≤𝛾

𝔅

(

𝔡

)

+𝛾

𝔅

(

𝔡

)

≤1

and 0≤

𝛿

𝔅

(

𝔡

)

+𝛿

𝔅

(

𝔡

)

≤1 and 0≤𝛾

𝔅

(

𝔡

)

,𝛿

𝔅

(

𝔡

)

≤1 and 0≤

𝛾

𝔅

(

𝔡

)

+

𝛿

𝔅

(

𝔡

)

≤1 and 0≤

𝛾

𝔅

(

𝔡

)

+

𝛿

𝔅

(

𝔡

)

≤1 and for each element 𝓆 in the set 𝒬

(Wang et al., 2024).

Definition 2: Consider

𝔅

=

〈

𝔡,𝛾

𝔅

(

𝔡

)

,𝛾

𝔅

(

𝔡

)

,𝛿

𝔅

(

𝔡

)

,𝛿

𝔅

(

𝔡

)

,𝛾

𝔅

(

𝔡

)

,𝛿

𝔅

(

𝔡

)

| 𝔡∈𝔇

〉

is FCF set related to each element 𝔡 within set 𝔇. The

score function 𝑆𝑐𝔅

can be calculated by

employing Eq. (1) (Wang et al., 2024).

𝑆

𝑐𝔅

=

𝛾

𝔅

(

𝔡

)

+

𝛾

𝔅

(

𝔡

)

−

𝛿

𝔅

(

𝔡

)

−

𝛿

𝔅

(

𝔡

)

+

𝛾

𝔅

(

𝔡

)

−

𝛿

𝔅

(

𝔡

)

+1.

(1

)

2.2 The FCF-SIWEC-RBNAR Hybrid

Method

The FCF-SIWEC-RBNAR hybrid method is

developed to evaluate the financial performance of

companies. Let

∃=

∃

,∃

,…,∃

,…,∃

(𝑘=

1,2,…,𝐾)

shows the experts, ℘=

℘

,℘

,…,℘

,…,℘

(𝑗=1,2,…,𝐽) shows the criteria

and

Å=Å

,Å

,…,Å

,…,Å

(𝑖=1,2,…,𝐼) shows the

alternatives (companies). The FCF-SIWEC-RBNAR

hybrid method consists of three stages, with the steps

of the method detailed as follows:

Stage 1: Establishing the expert weighting matrix

using FCF sets:

Step 1-1: The expertise levels of the experts are

determined using linguistics variables (LVs) shown

in Table 1. Subsequently, LVs are converted to FCF

numbers. Therefore, the experts assessment matrix

𝒮

=𝒮

can be determined.

Table 1: The LVs for expertise level (Wang et al., 2024).

L

Vs FC

F

N

umbers

Very High (VH)

0.80,0.85

,

0.20,0.25

,

0.75,0.25

Hi

g

h

(

H

)

0.70,0.75

,

0.30,0.35

,

0.65,0.35

Medium

(

M

)

0.50,0.55

,

0.40,0.45

,

0.50,0.45

Low

(

L

)

0.30,0.35

,

0.70,0.75

,

0.35,0.65

Very Low (VH)

0.20,0.25

,

0.80,0.85

,

0.25,0.75

Step 1-2: FCF numbers are transformed to crisp

values using the score function shown in Eq. (2).

Therefore, the score function matrix

(

𝒮=

𝒮

)

can

be calculated.

𝒮

=𝑆𝑐𝒮

=

𝛾

𝒮

(

𝔡

)

+

𝛾

𝒮

(

𝔡

)

−

𝛿

𝒮

(

𝔡

)

−

𝛿

𝒮

(

𝔡

)

+

𝛾

𝒮

(

𝔡

)

−

𝛿

𝒮

(

𝔡

)

+1.

(2

)

Development the Novel FCF-SIWEC-RBNAR Hybrid Method for Financial Performance Evaluation

55

Step 1-3: The weighting of the experts is

computed using Eq. (3). Therefore, the experts

weighting matrix

(

𝑤=

𝑤

)

can be determined.

𝑤

=

𝒮

∑

𝒮

;

(

𝑘=1,2, …,𝐾

)

.

(3)

herein,

𝑤

∈

0,1

and

∑

𝑤

=1.

Stage 2: Establishing the criteria weighting

matrix using the FCF-SIWEC method (Puška et al.,

2024):

Step 2-1: Each expert assesses each criterion using

the LVs provided in Table 2. Subsequently, LVs are

converted to FCF numbers. Therefore, the criteria

assessment matrix

𝒬

=𝒬

can be determined.

Herein,

𝒬

=

〈

𝔡,𝛾

𝒬

(

𝔡

)

,𝛾

𝒬

(

𝔡

)

,

𝛿

𝒬

(

𝔡

)

,𝛿

𝒬

(

𝔡

)

,𝛾

𝒬

(

𝔡

)

,𝛿

𝒬

(

𝔡

)

| 𝔡∈𝔇

〉

.

Table 2: The LVs for criteria evaluation (Wang et al., 2024).

L

Vs FC

F

N

umbers

Extremely High (EH)

0.90,0.95

,

0.10,0.15

,

0.85,0.15

Very High (VH)

0.80,0.85

,

0.20,0.25

,

0.75,0.25

High (H)

0.70,0.75

,

0.30,0.35

,

0.65,0.35

Medium (M)

0.50,0.55

,

0.40,0.45

,

0.50,0.45

Low (L)

0.30,0.35

,

0.70,0.75

,

0.35,0.65

Very Low (VH)

0.20,0.25

,

0.80,0.85

,

0.25,0.75

Extremely Low (EL)

0.10,0.15

,

0.90,0.95

,

0.15,0.85

Step 2-2: The criteria assessment matrix is

multiplied by the experts' weights using Eq. (4).

Therefore, the weighted criteria assessment matrix

𝒫

=𝒫

can be determined.

𝒫

=𝑤

𝒬

=

⎩

⎪

⎪

⎪

⎪

⎪

⎪

⎪

⎨

⎪

⎪

⎪

⎪

⎪

⎪

⎪

⎧

〈

⎣

⎢

⎢

⎢

⎢

⎢

⎢

⎡

1−

1 −

𝛾

𝒬

(

𝔡

)

,

1−

1 −

𝛾

𝒬

(

𝔡

)

⎦

⎥

⎥

⎥

⎥

⎥

⎥

⎤

,

𝛿

𝒬

(

𝔡

)

,

𝛿

𝒬

(

𝔡

)

,

⎣

⎢

⎢

⎢

⎡

𝛾

𝒬

(

𝔡

)

,

1−

1−

𝛿

𝒬

(

𝔡

)

⎦

⎥

⎥

⎥

⎤

〉

⎭

⎪

⎪

⎪

⎪

⎪

⎪

⎪

⎬

⎪

⎪

⎪

⎪

⎪

⎪

⎪

⎫

.

(4)

Step 2-3: FCF numbers are transformed to crisp

values using score function shown in Eq. (2).

Therefore, the crisp criteria assessment matrix

𝒫=𝒫

can be calculated.

Step 2-4: The normalized criteria - matrix

𝒪=𝒪

can be calculated using Eq. (5).

𝒪

=

𝒫

𝒫

;

(

𝑗

=1,…,𝐽; 𝑘=1,…,𝐾

)

.

(5)

Step 2-5: The standardized criteria assessment

matrix

𝒩=𝒩

can be calculated using Eq.

(6).

𝒩

=𝒪

𝜎

;

(

𝑗

=1,…,𝐽; 𝑘=1,…,𝐾

)

.

(6

)

herein, 𝜎

refers the standard deviation of each

criterion.

Step 2-6: The sum of the weighting matrix

ℳ=ℳ

can be calculated using Eq. (7).

ℳ

=

∑

𝒩

;

(

𝑗

=1,…,𝐽;𝑘=1,…,𝐾

)

.

(7

)

Step 2-7: The criteria weighting matrix

𝕨=

𝕨

can be computed using Eq. (8).

𝕨

=

ℳ

∑

ℳ

;

(

𝑗

=1,…,𝐽

)

.

(8

)

herein, 𝕨=𝕨

,𝕨

,…,𝕨

,…,𝕨

for 𝕨

ϵ

0,1

with the

∑

𝕨

=1.

Stage 3: Evaluating the financial performance of

companies using the RBNAR method:

Step 3-1: The RBNAR method consist of two

distinct normalization processes (Kara et al., 2024).

These are the Z-score normalization technique (Shih

et al., 2007) and Aytekin’s reference-based

normalization technique (Aytekin, 2020). Then, these

two normalization can be aggregated with Heron

Mean (Zhu, 2022). Initially, the initial decision

matrix

ℒ=𝐿

is constructed. In this step, there

are three sub-steps:

Step 3-1a: The first normalized matrix

𝒦=

𝒦

is computed using Eq. (9).

𝒦

=𝑒

;

(

𝑖=1,…,𝐼;

𝑗

=1,…,𝐽

)

.

(9

)

herein, 𝑅

indicates reference value matrix and 𝜎

refers the standard deviation of each criterion.

Step 3-1b: The second normalized matrix

ℋ=

ℋ

is computed using Eq. (10).

𝒦

=1−

;

(

𝑖=1,…,𝐼;

𝑗

=1,…,𝐽

)

.

(10

)

herein, 𝑅

indicates reference value matrix and 𝛼

refers a positive value.

Step 3-1c: The aggregated normalized matrix

𝒢=𝒢

is computed using Eq. (11).

𝒢

=𝜉

𝒦

𝒢

+

(

1−𝜉

)

𝒦

𝒢

;

(

𝑖=1,…,𝐼;

𝑗

=

1,…,𝐽

)

.

(11

)

herein, 𝜉 indicates trade-off parameter for

determining weighting of first normalization

technique.

Step 3-2: The weighted normalized matrix

ℱ=ℱ

is computed using Eq. (11).

ℱ

=𝕨

𝒢

;

(

𝑖=1,…,𝐼;

𝑗

=1,…,𝐽

)

.

(11

)

DATA 2025 - 14th International Conference on Data Science, Technology and Applications

56

Step 3-3: The alternative ranking matrix

(

ℛ=

ℛ

)

is computed using Eq. (12).

ℛ

=

∑

ℱ

;

(

𝑖=1,…,𝐼;

𝑗

=1,…,𝐽

)

.

(12)

3 APPLICATIONS

In this study, the financial performance of 50

companies was evaluated for the years 2020, 2021,

2022, and 2023 using the FCF-SIWEC-RBNAR

hybrid method. In the application section,

information about the experts is first presented, and

the criteria are explained. Subsequently, the

applications of the FCF-SIWEC-RBNAR hybrid

method for each year are demonstrated.

3.1 Experts and Criteria

3.1.1 Experts

To determine the importance levels of the criteria, the

opinions of 8 experts were sought. These experts

consist of financial managers from companies and

academics conducting research in the field of finance.

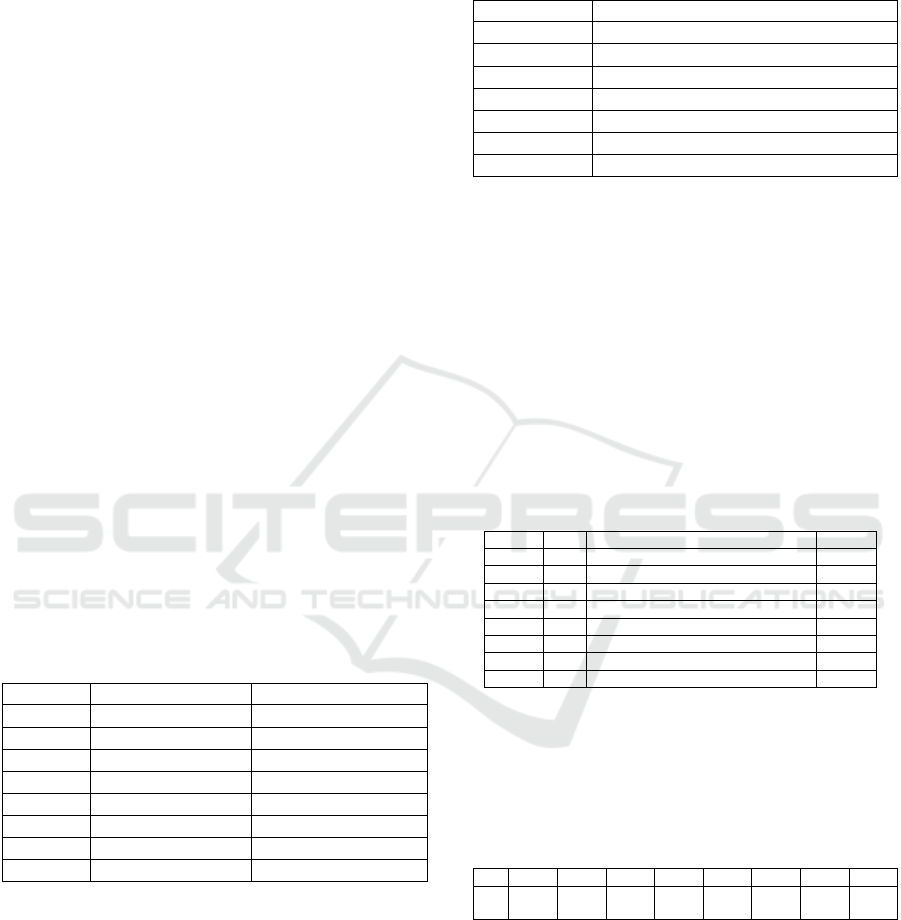

Information about the experts is provided in Table 3.

Face-to-face interviews were conducted to gather

expert evaluations. During this process, the expert

evaluation matrix, which reflects the expertise levels

of the experts, and the criteria evaluation matrix,

which indicates the importance levels of the criteria,

were obtained.

Table 3: Experts Group.

Ex

p

erts Ex

p

ertise

L

evel Pro

f

essions

∃

High (H)

Financial Manager

∃

High (H)

Financial Manager

∃

Very High (VH)

Financial Manager

∃

High (H)

Financial Manager

∃

Medium (M)

Professor of Finance

∃

Very High (VH)

Professor of Finance

∃

Very High (VH)

Professor of Finance

∃

Medium (M)

Professor of Finance

3.1.2 Criteria

Seven criteria were identified to evaluate the financial

performance of companies. These criteria consist of

financial ratios, which serve as key indicators of a

company's financial condition. The financial ratios

used in the study are presented in Table 4. The

financial ratio values of the companies were

calculated based on data obtained from financial

reports. Consequently, the initial decision matrices

for financial performance evaluation were established

for each year.

Table 4: Financial Ratios as Criteria.

Criteria Identification

℘

Equity Profitability Ratio

℘

Return on Assets (ROA) Ratio

℘

Leverage Ratio

℘

Debt-to-Equity Ratio

℘

Operating Profit Margin

℘

Pre-tax Profit Margin

℘

Net Profit Margin

3.2 Application-1: Assessment of

Financial Performance for 2020

The steps of the FCF-SIWEC-RBNAR hybrid

method for calculating the financial performance of

the selected companies were applied in the following

sequence:

Application-1 Stage 1: Establishing the expert

weighting matrix using FCF sets:

Step 1-1: The experts assessment matrix

𝒮

=

𝒮

were determined. It is shown in Table 5.

Table 5: The experts assessment matrix.

Expert LVs FCF Numbers

𝒮

∃

H

0.70,0.75

,

0.30,0.35

,

0.65,0.35

0.6448

∃

H

0.70,0.75

,

0.30,0.35

,

0.65,0.35

0.6448

∃

VH

0.80,0.85

,

0.20,0.25

,

0.75,0.25

0.7394

∃

H

0.70,0.75

,

0.30,0.35

,

0.65,0.35

0.6448

∃

M

0.50,0.55

,

0.40,0.45

,

0.50,0.45

0.5255

∃

VH

0.80,0.85

,

0.20,0.25

,

0.75,0.25

0.7394

∃

VH

0.80,0.85

,

0.20,0.25

,

0.75,0.25

0.7394

∃

M

0.50,0.55

,

0.40,0.45

,

0.50,0.45

0.5255

Step 1-2: The score function matrix

(

𝒮=

𝒮

)

were calculated using Eq. (2). It is shown in Table 5.

Step 1-3: The experts weighting matrix

(

𝑤=

𝑤

)

were calculated using Eq. (3). It is shown in

Table 6.

Table 6: The experts weighting matrix.

∃

∃

∃

∃

∃

∃

∃

∃

𝑤

0.123

9

0.123

9

0.142

1

0.123

9

0.101

0

0.142

1

0.142

1

0.101

0

Application-1 Stage 2: Establishing the criteria

weighting matrix using the FCF-SIWEC method:

Step 2-1: The criteria assessment matrix

𝒬

=

𝒬

were determined. It is shown in Table 7.

Step 2-2: The weighted criteria assessment matrix

𝒫

=𝒫

were determined using Eq. (4).

Step 2-3: The crisp criteria assessment matrix

𝒫=𝒫

can be computed by employing Eq. (2).

Development the Novel FCF-SIWEC-RBNAR Hybrid Method for Financial Performance Evaluation

57

Table 7: The criteria assessment matrix.

℘

℘

℘

℘

℘

℘

℘

∃

M L M H M H M

∃

H H M H M EH H

∃

M M L H M VH H

∃

H VH H VH H H M

∃

M M L M M M L

∃

EH VH EH EH VH EH H

∃

M H M H VH VH H

∃

VH H VH M VH VH H

Step 2-4: The normalized criteria assessment

matrix

𝒪=𝒪

were computed using Eq. (5).

Step 2-5: The standardized criteria assessment

matrix

𝒩=𝒩

were computed using Eq. (6).

Step 2-6: The sum of the weighting matrix

ℳ=ℳ

were computed using Eq. (7).

Step 2-7: The criteria weighting matrix

𝕨=

𝕨

were computed using Eq. (8). It is shown in

Table 8.

Table 8: The criteria weighting matrix.

℘

℘

℘

℘

℘

℘

℘

𝕨

0.1426 0.1362 0.1453 0.1464 0.1429 0.1428 0.1438

Application-1 Stage 3: Evaluating the financial

performance of companies using the RBNAR method:

Step 3-1: The initial decision matrix

ℒ=𝐿

was constructed.

Step 3-1a: The first normalized matrix

𝒦=

𝒦

were computed using Eq. (9).

Step 3-1b: The second normalized matrix

ℋ=

ℋ

were computed using Eq. (10). Herein,

references values for each criterion 𝑅

were

determined depending on sectoral avarage. It is

shown in Table 9. 𝛼 was also determined as 6.

Table 9: The references values for 2020.

℘

℘

℘

℘

℘

℘

℘

𝑅

-0.07 0.07 0.58 11.65 24.37 20.37 17.52

Step 3-1c: The aggregated normalized matrix

𝒢=𝒢

were computed using Eq.(11)

(

𝜉=0.5

)

Step 3-2: The weighted normalized matrix

ℱ=ℱ

were computed by employing Eq. (11).

Step 3-3: The alternative ranking matrix

(

ℛ=

ℛ

)

were computed using Eq. (12). It is shown in

Table 10.

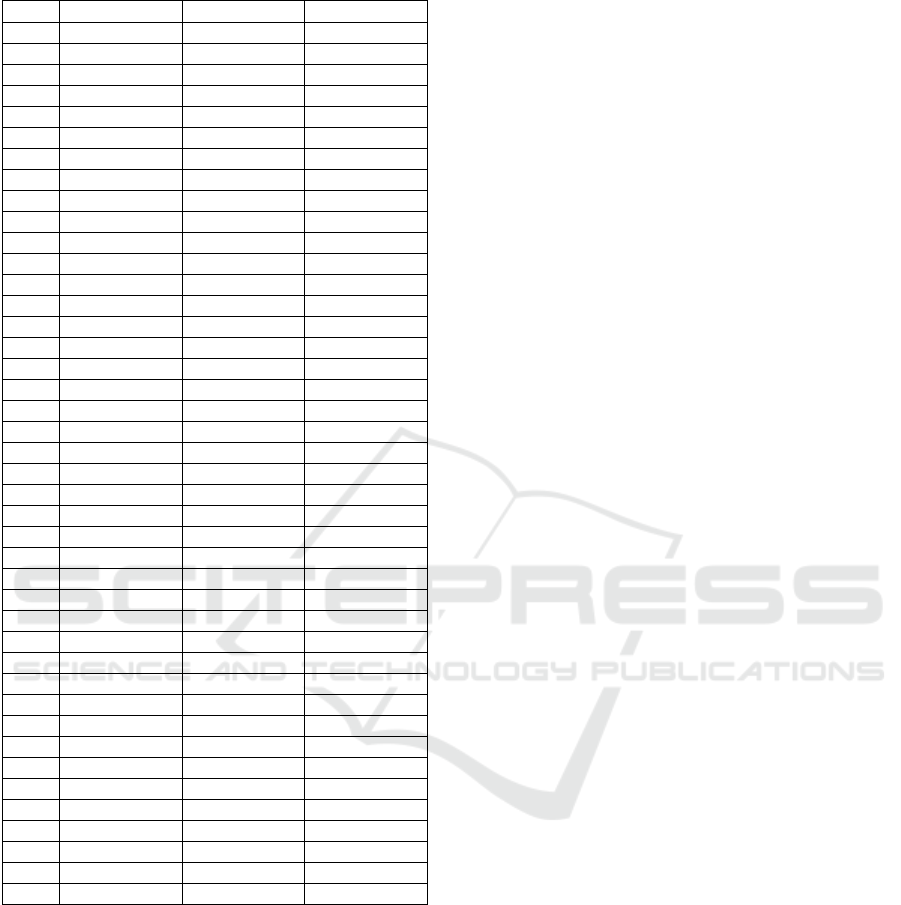

Table 10: The alternative ranking matrix (2020).

A

lt. Company

ℛ

Ran

k

Å

AEFES 0.962562 19

Å

AKCNS 0.984732 10

Å

AKSA 0.992541 3

Å

AKSEN 0.986193 8

Å

ARCLK 0.979713 14

Å

ASELS 0.962279 20

Å

BFREN 0.932081 31

Å

BIMAS 0.970206 17

Å

BRSAN 0.948489 25

Å

BRYAT 0.588302 50

Å

BTCIM 0.814295 46

Å

CCOLA 0.985611 9

Å

CIMSA 0.988697 5

Å

DOAS 0.942514 28

Å

ECILC 0.907017 39

Å

EGEEN 0.829042 44

Å

ENJSA 0.982585 12

Å

ENKAI 0.927217 32

Å

EREGL 0.950851 23

Å

FROTO 0.918203 37

Å

GUBRF 0.991015 4

Å

HEKTS 0.979841 13

Å

IPEKE 0.827259 45

Å

ISMEN 0.925188 33

Å

KONTR 0.997134 1

Å

KONYA 0.923407 34

Å

KOZAA 0.829462 43

Å

KOZAL 0.735799 48

Å

KRDMD 0.963375 18

Å

MGROS 0.666527 49

Å

ODAS 0.867859 42

Å

OTKAR 0.918612 36

Å

OYAKC 0.976441 15

Å

PETKM 0.988252 6

Å

PGSUS 0.759200 47

Å

SASA 0.970442 16

Å

SAYAS 0.954227 22

Å

SISE 0.933951 30

Å

SOKM 0.909599 38

Å

TCELL 0.943898 27

Å

THYAO 0.887813 40

Å

TOASO 0.958634 21

Å

TTKOM 0.946221 26

Å

TTRAK 0.937094 29

Å

TUKAS 0.986323 7

Å

TUPRS 0.874764 41

Å

ULKER 0.994155 2

Å

VESBE 0.948991 24

Å

VESTL 0.982698 11

Å

ZOREN 0.921379 35

DATA 2025 - 14th International Conference on Data Science, Technology and Applications

58

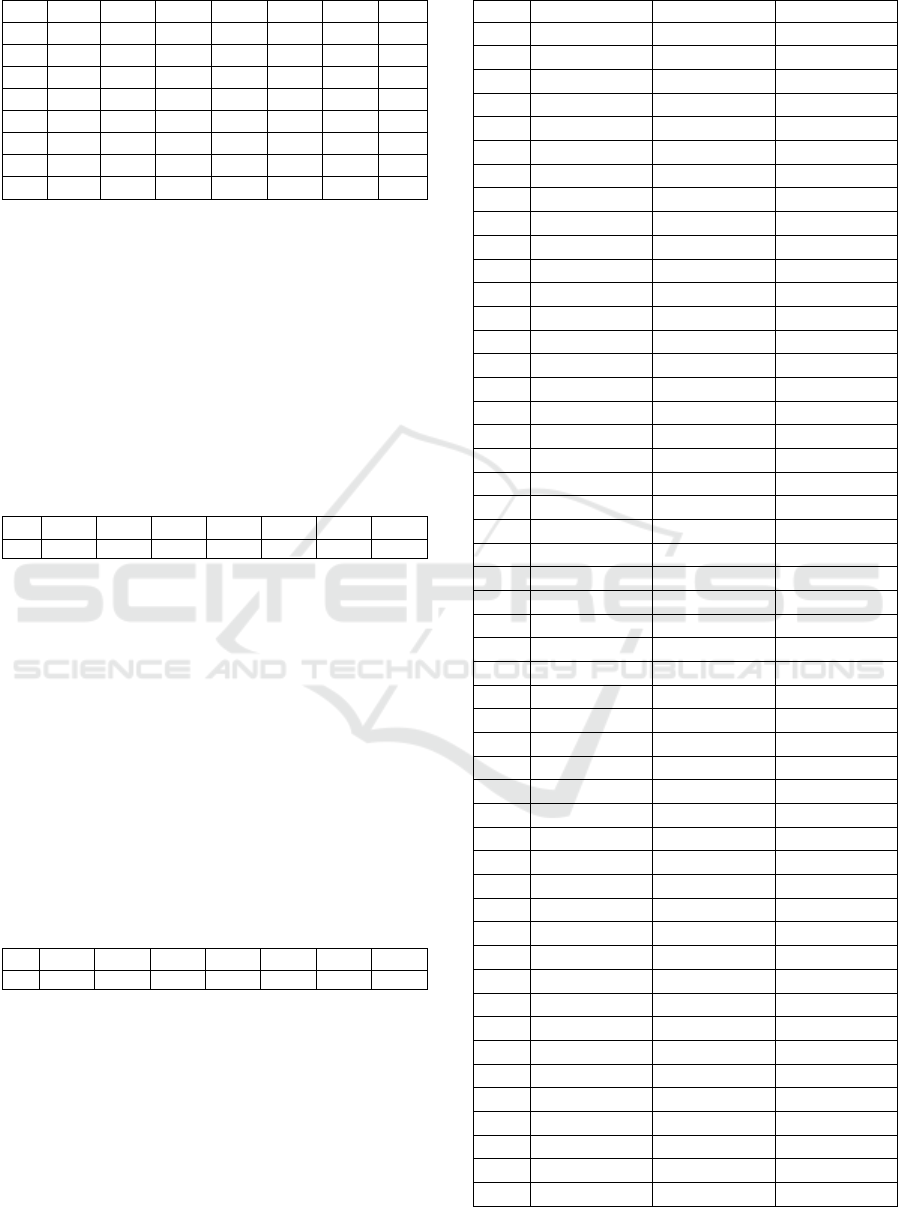

3.3 Application-2: Assessment of

Financial Performance for 2021

In Application 1, the expert weights and criteria

weights calculated are used in the same manner to

determine the financial performance of the selected

companies for the year 2021. Therefore, starting from

Stage 3, this application was completed as

Application 2:

Application-2 Stage 3: Evaluating the financial

performance of companies using the RBNAR method:

Step 3-1: The initial decision matrix

ℒ=𝐿

was constructed.

Step 3-1a: The first normalized matrix

𝒦=

𝒦

were computed using Eq. (9).

Step 3-1b: The second normalized matrix

ℋ=

ℋ

were computed using Eq. (10). Herein,

references values for each criterion 𝑅

were

determined depending on sectoral avarage. It is

shown in Table 11. 𝛼 was also determined as 6.

Table 11: The references values for 2021.

℘

℘

℘

℘

℘

℘

℘

𝑅

0.26 0.10 0.58 2.90 26.16 27.85 25.18

Step 3-1c: The aggregated normalized matrix

𝒢=𝒢

were computed using Eq.(11)

(

𝜉=0.5

)

Step 3-2: The weighted normalized matrix

ℱ=ℱ

were computed by employing Eq. (11).

Step 3-3: The alternative ranking matrix

(

ℛ=

ℛ

)

were computed using Eq. (12). It is shown in

Table 12.

3.4 Application-3: Assessment of

Financial Performance for 2022

In Application 1, the expert weights and criteria

weights calculated are used in the same manner to

determine the financial performance of the selected

companies for the year 2022. Therefore, starting from

Stage 3, this application was completed as

Application 2:

Application-3 Stage 3: Evaluating the financial

performance of companies using the RBNAR method:

Step 3-1: The initial decision matrix (

ℒ=𝐿

𝑖𝑗

𝐼𝑥𝐽

)

was constructed.

Step 3-1a: The first normalized matrix

𝒦=

𝒦

were computed using Eq. (9).

le 12: The alternative ranking matrix (2021).

A

lt. Company

ℛ

Ran

k

Å

AEFES 0.932210 23

Å

AKCNS 0.976393 5

Å

AKSA 0.972999 7

Å

AKSEN 0.967961 8

Å

ARCL

K

0.955702 17

Å

ASELS 0.965635 12

Å

BFREN 0.904064 33

Å

BIMAS 0.965993 11

Å

BRSAN 0.906092 32

Å

BRYAT 0.549874 50

Å

BTCIM 0.745476 47

Å

CCOLA 0.975334 6

Å

CIMSA 0.947578 18

Å

DOAS 0.896664 34

Å

ECILC 0.871806 38

Å

EGEEN 0.761759 44

Å

ENJSA 0.984248 2

Å

ENKAI 0.910959 29

Å

EREGL 0.939049 22

Å

FROTO 0.846560 41

Å

GUBRF 0.966433 10

Å

HEKTS 0.977750 4

Å

IPEKE 0.795278 43

Å

ISMEN 0.909414 30

Å

KONTR 0.966620 9

Å

KONYA 0.918015 26

Å

KOZAA 0.811229 42

Å

KOZAL 0.747146 46

Å

KRDMD 0.963214 13

Å

MGROS 0.739880 48

Å

ODAS 0.923764 25

Å

OTKAR 0.885828 36

Å

OYAKC 0.961425 15

Å

PETKM 0.960577 16

Å

PGSUS 0.739281 49

Å

SASA 0.939096 21

Å

SAYAS 0.849308 40

Å

SISE 0.908288 31

Å

SOKM 0.759649 45

Å

TCELL 0.915811 27

Å

THYAO 0.946889 19

Å

TOASO 0.927396 24

Å

TTKOM 0.940303 20

Å

TTRA

K

0.893256 35

Å

TUKAS 0.990163 1

Å

TUPRS 0.912764 28

Å

ULKER 0.861023 39

Å

VESBE 0.978342 3

Å

VESTL 0.962218 14

Å

ZOREN 0.880782 37

Step 3-1b: The second normalized matrix

ℋ=

ℋ

were computed using Eq. (10). Herein,

references values for each criterion 𝑅

were

determined depending on sectoral avarage. It is

shown in Table 13. 𝛼 was also determined as 6.

Development the Novel FCF-SIWEC-RBNAR Hybrid Method for Financial Performance Evaluation

59

Table 13: The references values for 2022.

℘

℘

℘

℘

℘

℘

℘

𝑅

0.20 0.09 0.51 1.38 22.57 18.68 19.23

Step 3-1c: The aggregated normalized matrix

𝒢=𝒢

were computed using Eq.(11)

(

𝜉=0.5

)

Step 3-2: The weighted normalized matrix

ℱ=ℱ

were computed by employing Eq. (11).

Step 3-3: The alternative ranking matrix

(

ℛ=

ℛ

)

were computed using Eq. (12). It is shown in

Table 14.

Table 14: The alternative ranking matrix (2022).

A

lt. Company

ℛ

Ran

k

Å

AEFES 0.964933 6

Å

AKCNS 0.942071 12

Å

AKSA 0.913490 25

Å

AKSEN 0.958796 8

Å

ARCL

K

0.860952 35

Å

ASELS 0.917481 23

Å

BFREN 0.913014 26

Å

BIMAS 0.970948 2

Å

BRSAN 0.970224 3

Å

BRYAT 0.525771 50

Å

BTCIM 0.945333 11

Å

CCOLA 0.971074 1

Å

CIMSA 0.966093 5

Å

DOAS 0.804489 44

Å

ECILC 0.805849 43

Å

EGEEN 0.954799 9

Å

ENJSA 0.938734 14

Å

ENKAI 0.853206 36

Å

EREGL 0.938701 15

Å

FROTO 0.821838 42

Å

GUBRF 0.920006 22

Å

HEKTS 0.959673 7

Å

IPEKE 0.690894 47

Å

ISMEN 0.786546 46

Å

KONTR 0.936900 16

Å

KONYA 0.931840 18

Å

KOZAA 0.662415 48

Å

KOZAL 0.607810 49

Å

KRDMD 0.906280 28

Å

MGROS 0.941262 13

Å

ODAS 0.913916 24

Å

OTKAR 0.873978 32

Å

OYAKC 0.861374 33

Å

PETKM 0.861179 34

Å

PGSUS 0.800734 45

Å

SASA 0.850716 38

Å

SAYAS 0.890156 30

Å

SISE 0.910982 27

Å

SOKM 0.932444 17

Å

TCELL 0.899292 29

Å

THYAO 0.946571 10

Å

TOASO 0.925703 19

Å

TTKOM 0.968590 4

Å

TTRA

K

0.887566 31

Å

TUKAS 0.849450 39

Å

TUPRS 0.925084 20

Å

ULKER 0.832743 41

Å

VESBE 0.852768 37

Å

VESTL 0.833815 40

Å

ZOREN 0.920313 21

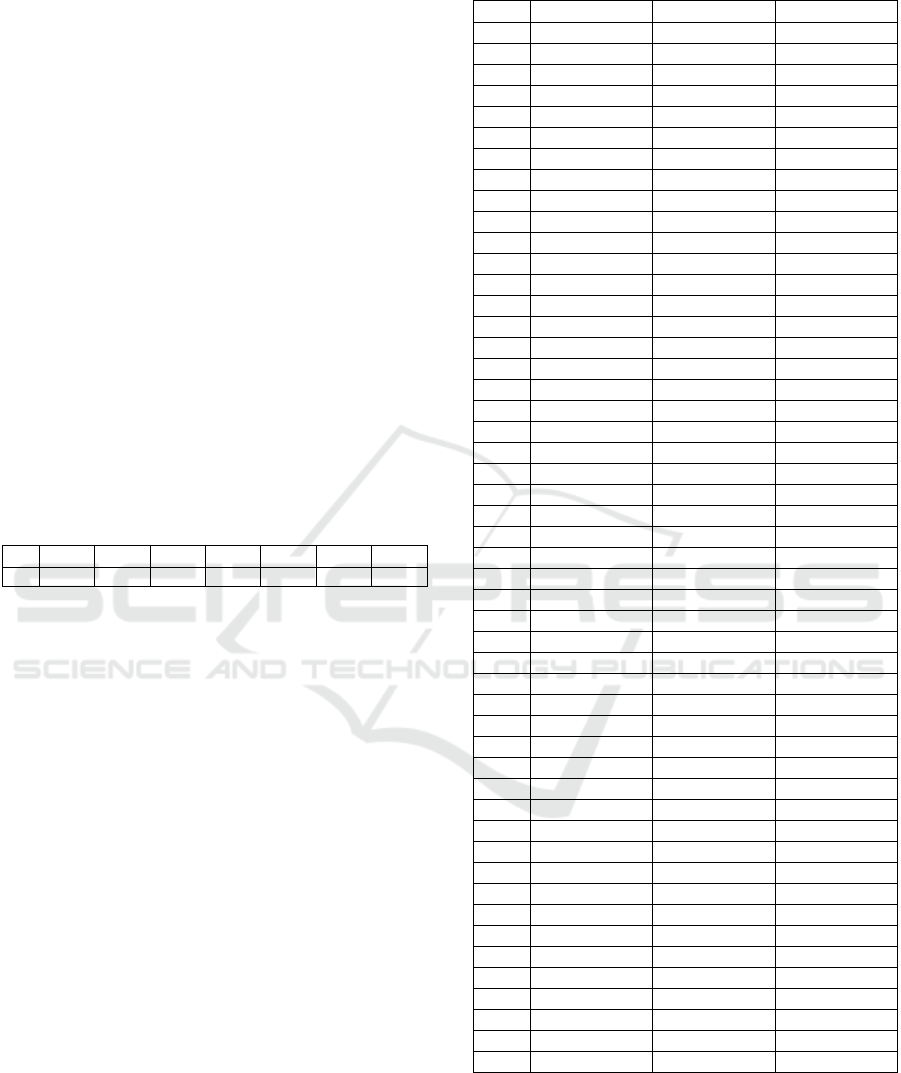

3.5 Application-4: Assessment of

Financial Performance for 2023

In Application 1, the expert weights and criteria

weights calculated are used in the same manner to

determine the financial performance of the selected

companies for the year 2023. Therefore, starting from

Stage 3, this application was completed as

Application 2:

Application-3 Stage 3: Evaluating the financial

performance of companies using the RBNAR method:

Step 3-1: The initial decision matrix

ℒ=𝐿

was constructed.

Step 3-1a: The first normalized matrix

𝒦=

𝒦

were computed using Eq. (9).

Step 3-1b: The second normalized matrix

ℋ=

ℋ

were computed using Eq. (10). Herein,

references values for each criterion 𝑅

were

determined depending on sectoral avarage. It is

shown in Table 15. 𝛼 was also determined as 6.

Table 15: The references values for 2023.

℘

℘

℘

℘

℘

℘

℘

𝑅

0.18 0.09 0.46 1.14 21.62 37.77 39.88

Step 3-1c: The aggregated normalized matrix

𝒢=𝒢

were computed using Eq.(11)

(

𝜉=0.5

)

.

Step 3-2: The weighted normalized matrix

ℱ=ℱ

were computed by employing Eq. (11).

Step 3-3: The alternative ranking matrix (

ℛ=

ℛ

𝑖

𝐼

) were computed using Eq. (12). It is shown in

Table 16.

Table 16: The alternative ranking matrix (2023).

A

lt. Company

ℛ

Ran

k

Å

AEFES 0.965852 10

Å

AKCNS 0.951164 17

Å

AKSA 0.952919 15

Å

AKSEN 0.981123 4

Å

ARCL

K

0.814969 43

Å

ASELS 0.964276 13

Å

BFREN 0.590641 49

Å

BIMAS 0.984929 2

DATA 2025 - 14th International Conference on Data Science, Technology and Applications

60

Table 16: The alternative ranking matrix (2023) (cont.).

A

lt. Company

ℛ

Ran

k

Å

BRSAN 0.983916 3

Å

BRYAT 0.545945 50

Å

BTCIM 0.974750 7

Å

CCOLA 0.864660 37

Å

CIMSA 0.974084 8

Å

DOAS 0.834484 41

Å

ECILC 0.887644 35

Å

EGEEN 0.961861 14

Å

ENJSA 0.952794 16

Å

ENKAI 0.910901 27

Å

EREGL 0.908386 29

Å

FROTO 0.770342 48

Å

GUBRF 0.896613 32

Å

HEKTS 0.771871 47

Å

IPEKE 0.792363 45

Å

ISMEN 0.910019 28

Å

KONTR 0.892299 34

Å

KONYA 0.912007 25

Å

KOZAA 0.798384 44

Å

KOZAL 0.792109 46

Å

KRDMD 0.905363 30

Å

MGROS 0.965707 11

Å

ODAS 0.895092 33

Å

OTKAR 0.858115 38

Å

OYAKC 0.846160 39

Å

PETKM 0.930501 21

Å

PGSUS 0.845413 40

Å

SASA 0.970854 9

Å

SAYAS 0.936964 20

Å

SISE 0.926524 22

Å

SOKM 0.975280 6

Å

TCELL 0.926093 23

Å

THYAO 0.937109 19

Å

TOASO 0.903715 31

Å

TTKOM 0.995678 1

Å

TTRA

K

0.815780 42

Å

TUKAS 0.921587 24

Å

TUPRS 0.964924 12

Å

ULKER 0.911346 26

Å

VESBE 0.977404 5

Å

VESTL 0.879879 36

Å

ZOREN 0.949470 18

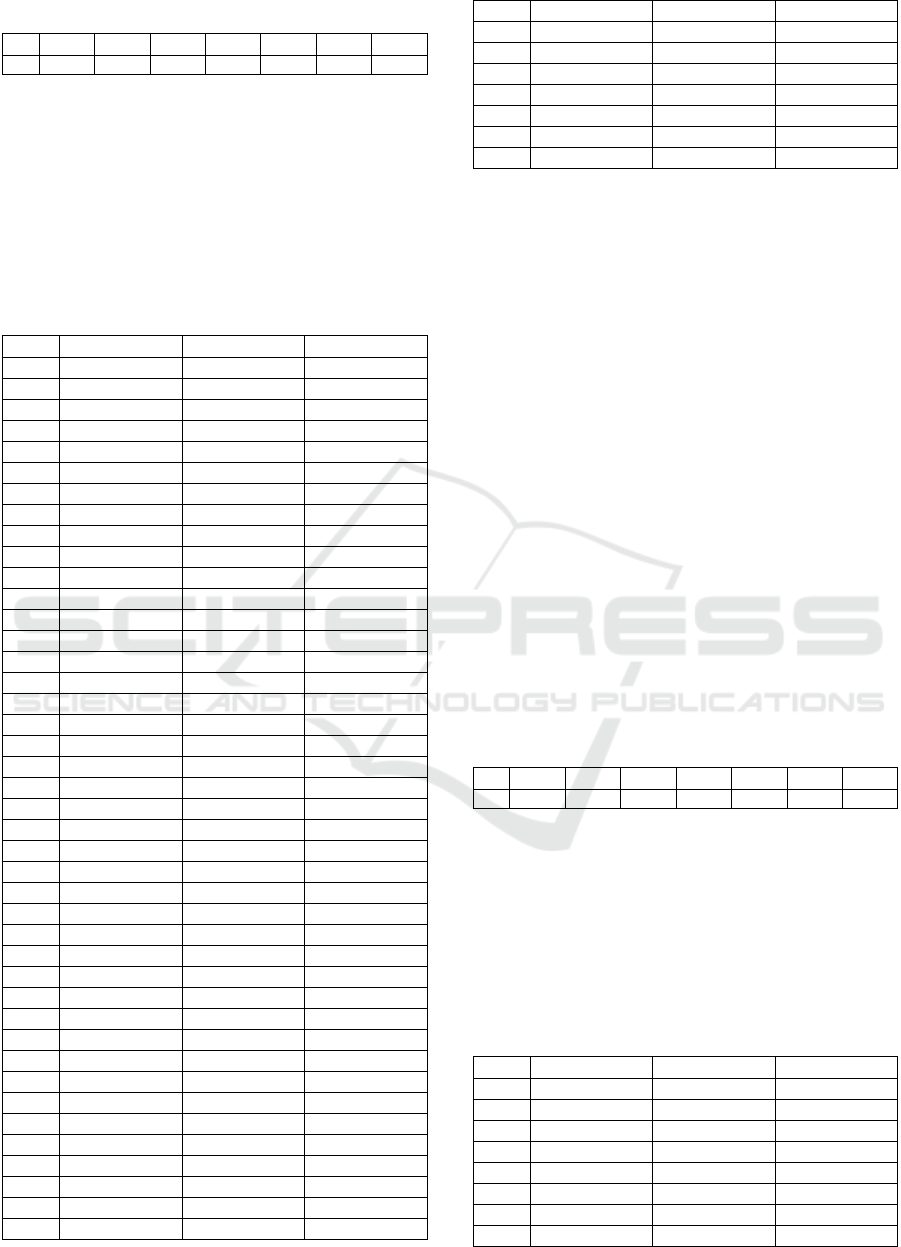

4 FINDINGS

In the results of the FCF-SIWEC-RBNAR hybrid

method application, three key findings were

identified. The first finding is the impact levels of the

experts in the decision-making process. The second

finding is the importance levels of the criteria in the

decision-making process. The third finding is the

financial performance rankings of the selected

companies for the years 2020, 2021, 2022, and 2023.

The findings obtained are as follows:

First finding: In the research, the impact levels of

the experts involved in determining the financial

performance of the companies are as follows: "

∃

=∃

=∃

>∃

=∃

=∃

>∃

=∃

." In this case,

the third, sixth, and seventh experts were identified as

the most influential experts in the decision-making

process.

Second finding: The importance ranking of the

financial ratio criteria used in the financial

performance calculation is as follows: "

𝐷𝑒𝑏𝑡 − 𝑡𝑜− 𝐸𝑞𝑢𝑖𝑡𝑦 𝑅𝑎𝑡𝑖𝑜

(

℘

=0.1464

)

>

𝐿𝑒𝑣𝑒𝑟𝑎𝑔𝑒 𝑅𝑎𝑡𝑖𝑜

(

℘

=0.1453

)

>

𝑁𝑒𝑡 𝑃𝑟𝑜𝑓𝑖𝑡 𝑀𝑎𝑟𝑔𝑖𝑛

(

℘

=0.1438

)

>

𝑂𝑝𝑒𝑟𝑎𝑡𝑖𝑛𝑔 𝑃𝑟𝑜𝑓𝑖𝑡 𝑀𝑎𝑟𝑔𝑖𝑛

(

℘

=0.1429

)

>

𝑃𝑟𝑒 − 𝑡𝑎𝑥 𝑃𝑟𝑜𝑓𝑖𝑡 𝑀𝑎𝑟𝑔𝑖𝑛

(

℘

=0.1428

)

>

𝐸𝑞𝑢𝑖𝑡𝑦 𝑃𝑟𝑜𝑓𝑖𝑡𝑎𝑏𝑖𝑙𝑖𝑡𝑦 𝑅𝑎𝑡𝑖𝑜

(

℘

=0.1426

)

>

𝑅𝑒𝑡𝑢𝑟𝑛 𝑜𝑛 𝐴𝑠𝑠𝑒𝑡𝑠 (𝑅𝑂𝐴) 𝑅𝑎𝑡𝑖𝑜

(

℘

=

0.1362

)

>." According to this ranking, the fourth

criterion, which has very similar importance levels to

the others, is determined to play the most significant

role in the decision-making process.

Third finding: The top three companies with the

highest financial performance for the year 2020 are

ranked as "KONTR, ULKER, AKSA." For the year

2021, the top three companies with the highest

financial performance are ranked as "TUKAS,

ENJSA, VESBE." For the year 2022, the top three

companies with the highest financial performance are

ranked as "CCOLA, BIMAS, BRSAN." Finally, for

the year 2023, the top three companies with the

highest financial performance are ranked as

"“TTKOM, BIMAS, BRSAN”.

5 CONCLUSIONS

This study aimed to develop a novel hybrid method for

financial performance analysis, designed as a decision

support system, and referred to as the FCF-SIWEC-

RBNAR method. The proposed method integrates

FCF sets to calculate expert weights, the FCF-SIWEC

approach to determine criteria weights, and the

RBNAR technique to evaluate and rank companies

based on their financial performance. The

methodology was systematically outlined and applied

to 50 companies listed on Borsa Istanbul across four

different case studies. The findings demonstrate that

the FCF-SIWEC-RBNAR hybrid method effectively

assessed and ranked companies' financial

performance, identifying the Debt-to-Equity Ratio as

the most significant financial criterion. Moreover, the

financial performance of the companies was

calculated for each year, and the top-performing

companies were determined. This research contributes

Development the Novel FCF-SIWEC-RBNAR Hybrid Method for Financial Performance Evaluation

61

to the literature by introducing a new hybrid approach

for financial performance evaluation and

demonstrating its practical applicability. The proposed

method holds potential for application in both

academic research and the financial industry, offering

a reliable tool for decision-making in financial

performance analysis.

The FCF-SIWEC-RBNAR hybrid method has

limitations that warrant consideration. The study's

findings are based on data from 50 companies listed

on Borsa Istanbul, which may limit generalizability to

other markets or industries. The accuracy of the

method depends on the quality of financial data and

the subjective nature of expert evaluations, which may

introduce bias. Additionally, the selected financial

ratios may not be universally applicable across all

sectors. Further research with broader datasets and

diverse economic contexts is needed to validate and

enhance the scalability of the method.

ACKNOWLEDGEMENT

The author gratefully acknowledges the support

provided by the Scientific and Technological

Research Council of Türkiye (TUBITAK), through

the Scientist Support Programs Presidency (BIDEB),

under the 2224-A Grant Program for Participation in

Scientific Meetings Abroad (Application No:

1919B022502253), for the presentation of this study.

REFERENCES

Abdel-Basset, M., Ding, W., Mohamed, R., & Metawa, N.

(2020). An integrated plithogenic MCDM approach for

financial performance evaluation of manufacturing

industries. Risk management, 22, 192-218. https://doi.

org/10.1057/s41283-020-00061-4.

Akisik, O., & Gal, G. (2017). The impact of corporate social

responsibility and internal controls on stakeholders’

view of the firm and financial performance.

Sustainability Accounting, Management and Policy

Journal, 8(3), 246-280. https://doi.org/10.1108/

SAMPJ-06-2015-0044

Alipour, S., Arabani, S. G., Asad, M. T., & Zareii, R.

(2013). Importance of planning and control of

managers. Arabian Journal of Business and

Management Review (Kuwait Chapter), 2(9), 36-38.

https://j.arabianjbmr.com/index.php/kcajbmr/article/vi

ew/401. (access date: 17.01.2025).

Alsanousi, A. T., Alqahtani, A. Y., Makki, A. A., &

Baghdadi, M. A. (2024). A Hybrid MCDM Approach

Using the BWM and the TOPSIS for a Financial

Performance-Based Evaluation of Saudi Stocks.

Information, 15(5), 258. https://doi.org/10.3390/info

15050258.

Aytekin, A. (2020). Çok kriterli karar problemine uzaklık

ve referans temelli çözüm yaklaşımı. Unpublished

Doctoral Thesis, Anadolu University, Eskisehir,

Turkiye. https://openaccess.artvin.edu.tr/xmlui/

handle/11494/2558. (access date: 17.01.2025)

Barutbaş, K., Bulut, B., & Otay, I. (2024). Financial

Performance Evaluation of Leading Retail Companies

in BIST Utilizing Decomposed Fuzzy TOPSIS. In

International Conf. on Intelligent and Fuzzy Systems

(pp. 123-132). Cham: Springer Nature Switzerland.

http://dx.doi.org/10.1007/978-3-031-67195-1_16.

Chrysafis, K. A., Papadopoulou, G. C., & Theotokas, I. N.

(2024). Measuring financial performance through

operating business efficiency in the global cruise

industry: A fuzzy benchmarking study on the “big

three”. Tourism Management, 100, 104830. https://doi.

org/10.1016/j.tourman.2023.104830.

Çetin, F. A., Öztürk, S., & Akarsu, O. N. (2024). The Effect

of ESG Data of Companies on Financial Performance:

A Panel Data Analysis on The BIST Sustainability

Index. Sosyoekonomi, 32(61), 125-146. http://dx.doi.

org/10.17233/sosyoekonomi.2024.03.07.

Deb, R., Behra, A., & Karkaria, D. (2024). ESG Scores and

Its Impact on Firm Performance: Study from Nifty100

Firms. IIM Kozhikode Society & Management Review,

22779752241287600. https://doi.org/10.1177/22779

7522412876.

Ergülen, A., & Çalık, A. (2024). F-BWM-MARCOS

approach for performance evaluation of Türkiye's top

500 industrial enterprises in the pre-pandemic and

pandemic era. Benchmarking: An International

Journal. http://dx.doi.org/10.1108/BIJ-05-2023-0336.

Farshadfar, S., Samarbakhsh, L., & Jahan, I. (2025).

Executive age, executive gender and financial

statement comparability. Advances in Accounting, 68,

100805. https://doi.org/10.1016/j.adiac.2024.100805.

Ghaemi-Zadeh, N., & Eghbali-Zarch, M. (2024).

Evaluation of business strategies based on the financial

performance of the corporation and investors' behavior

using D-CRITIC and fuzzy MULTI-MOORA

techniques: A real case study. Expert Systems with

Applications, 247, 123183. https://doi.org/10.1016/j.

eswa.2024.123183.

Giannopoulos, G., Kihle Fagernes, R. V., Elmarzouky, M.,

& Afzal Hossain, K. A. B. M. (2022). The ESG

disclosure and the financial performance of Norwegian

listed firms. Journal of Risk and Financial

Management, 15(6), 237. http://dx.doi.org/10.3390/j

rfm15060237.

Gutiérrez-Ponce, H., & Wibowo, S. A. (2023). Do

sustainability activities affect the financial performance

of banks? The case of Indonesian Banks. Sustainability,

15(8), 6892. https://doi.org/10.3390/su15086892.

Hadid, W., & Al-Sayed, M. (2021). Management

accountants and strategic management accounting: The

role of organizational culture and information systems.

Management accounting research, 50, 100725.

https://doi.org/10.1016/j.mar.2020.100725.

Işık, C., Türkkan, M., Marbou, S., & Gül, S. (2024). Stock

Market Performance Evaluation of Listed Food and

Beverage Companies in Istanbul Stock Exchange with

MCDM Methods. Decision Making: Applications in

DATA 2025 - 14th International Conference on Data Science, Technology and Applications

62

Management and Engineering, 7(2), 35-64.

https://doi.org/10.31181/dmame722024692.

Işık, Ö., Shabir, M., Demir, G., Puska, A., & Pamucar, D.

(2025). A hybrid framework for assessing Pakistani

commercial bank performance using multi-criteria

decision-making. https://doi.org/10.1186/s40854-024-

00728-x.

Kara, K., Yalçın, G. C., Çetinkaya, A., Simic, V., &

Pamucar, D. (2024). A single-valued neutrosophic

CIMAS-CRITIC-RBNAR decision support model for

the financial performance analysis: A study of

technology companies. Socio-Economic Planning

Sciences, 101851. https://doi.org/10.1016/j.seps.20

24.101851.

Kaya, A., Pamucar, D., Gürler, H. E., & Ozcalici, M. (2024).

Determining the financial performance of the firms in the

Borsa Istanbul sustainability index: integrating multi

criteria decision making methods with simulation.

Financial Innovation, 10(1), 21. https://doi.org/

10.1186/s40854-023-00512-3.

Khizar, H. M. U., Iqbal, M. J., Murshed, F., & Ahsan, M.

(2024). Sustainability outcomes in SMEs: a

configurational view of the interplay of strategic

orientations and environmental conditions. Journal of

Macromarketing, 44(2), 534-552. https://doi.org/10.11

77/02761467231203311.

Lam, W. H., Lam, W. S., Liew, K. F., & Lee, P. F. (2023).

Decision analysis on the financial performance of

companies using integrated entropy-fuzzy topsis

model. Mathematics, 11(2), 397. http://dx.doi.

org/10.3390/math11020397.

Liou, J. J., Chien, C. W., Gudiel Pineda, P. J., Li, C. S. J.,

& Hsu, C. C. (2024). Exploring the Impact of Pandemic

Measures on Airport Performance. Aerospace, 11(5),

373. http://dx.doi.org/10.3390/aerospace11050373.

Llorent-Jurado, J., Contreras, I., & Guerrero-Casas, F. M.

(2024). A proposal for a composite indicator based on

ratios (CIBOR) to compare the evolution of Spanish

financial institutions. Central Bank Review, 24(3),

100160. https://doi.org/10.1016/j.cbrev.2024.100160.

Loan, B. T. T., Anh, T. T. L., & Hoang, T. (2024). ESG

disclosure and financial performance: Empirical study

of Vietnamese commercial banks. Banks and Bank

Systems, 19(1), 208-220. http://dx.doi.org/10.21511

/bbs.19(1).2024.18.

Lopes, A. I., & Penela, D. (2025). The impact of IFRS 16

on lessees' financial information: A single-industry

study. Advances in Accounting, 68, 100803. https://doi.

org/10.1016/j.adiac.2024.100803.

Mao, Y. (2024). Tax Incentives, R&D Investment, and

Employment Absorption: Evidence from Chinese

Technology-Based SMEs. SAGE Open, 14(2),

21582440241251809.

https://doi.org/10.1177/21582440241251809.

Özekenci, S. Y. (2024). Financial Performance Measurement

of Companies in the BIST Sustainability 25 Index with

LBWA and MEREC-based CRADIS Methods. Journal

of Mehmet Akif Ersoy University Economics and

Administrative Sciences, 11(3), 1184-1211.

https://doi.org/10.30798/makuiibf.1465069.

Puška, A., Nedeljković, M., Pamučar, D., Božanić, D., &

Simić, V. (2024). Application of the new simple weight

calculation (SIWEC) method in the case study in the

sales channels of agricultural products. MethodsX, 13,

102930. https://doi.org/10.1016/j.mex.2024.102930.

Qureshi, M. A., Akbar, M., Akbar, A., & Poulova, P. (2021).

Do ESG endeavors assist firms in achieving superior

financial performance? A case of 100 best corporate

citizens. Sage Open, 11(2), 21582440211021598.

http://dx.doi.org/10.1177/21582 440211021598.

Rocha, R., Bandeira, A., & Ramos, P. (2024). The Impact

of Social Responsibility on the Performance of

European Listed Companies. Sustainability, 16(17),

7658. https://doi.org/10.3390/su16177658.

Sharma, D., & Kumar, P. (2024). Prioritizing the attributes

of sustainable banking performance. International

Journal of Productivity and Performance Management,

73(6), 1797 1825. http://dx.doi.org/10.1108/IJPPM-11-

2022-0600.

Shih, H. S., Shyur, H. J., & Lee, E. S. (2007). An extension

of TOPSIS for group decision making. Mathematical

and Computer modelling, 45(7-8), 801-813. https://

doi.org/10.1016/j.mcm.2006.03.023.

Snyder, N., & Glueck, W. F. (2019). How managers plan—

the analysis of managers’ activities. In Managerial

Work (pp. 227-233). Routledge.

Tan, Y., Park, S., de Medeiros, A. M. A., & Wanke, P.

(2025). Cost-benefit analysis in UK hotels: A hybrid

SOCP-MCDM approach. Tourism Management, 106,

105034. https://doi.org/10.1016/j.tourman.2024.105034.

Tran Thanh Thuy, N. (2025). Effect of accounting

information system quality on decision-making success

and non-financial performance: does non-financial

information quality matter?. Cogent Business &

Management, 12(1), 2447913. https://doi.org/10.1080/

23311975.2024.2447913.

Veeravel, V., Murugesan, V. P., & Narayanamurthy, V.

(2024). Does ESG disclosure really influence the firm

performance? Evidence from India. The Quarterly

Review of Economics and Finance, 95, 193-202.

https://doi.org/10.1016/j.qref.2024.03.008.

Wang, W., Chen, Y., Wang, Y., Deveci, M., Moslem, S., &

Coffman, D. M. (2024). Unveiling the implementation

barriers to the digital transformation in the energy

sector using the Fermatean cubic fuzzy method.

Applied Energy, 360, 122756. https://doi.org/

10.1016/j.apenergy.2024.122756.

Wu, J. H., Chen, Y. C., & Chang, J. (2005, January). The

IS manager: A study of critical professional activities

and Skills/Knowledge. In Proceedings of the 38th

Annual Hawaii International Conf. on System Sciences

(pp. 266c-266c). IEEE. https://doi.org/10.1109/H

ICSS.2005.601.

Zhao, R., Mou, Y., & Yu, X. (2025). Analysis of the

moderating effects of environmental regulations on

green accounting information disclosure and financial

performance of heavily polluting enterprises. Finance

Research Letters, 72, 106493. https://doi.org/10.

1016/j.frl.2024.106493.

Zhu, L. (2022). Sharp Bounds for a Generalized

Logarithmic Operator Mean and Heinz Operator Mean

by Weighted Ones of Classical Operator Ones.

Mathematics, 10(10), 1617. https://doi.org/10.3390/

math10101617.

Development the Novel FCF-SIWEC-RBNAR Hybrid Method for Financial Performance Evaluation

63