Using Adaptive Neuro-Fuzzy Inference System and Deep Learning to

Predict and Estimate the Current Stock Prices

Ying Bai

1

and Dali Wang

2

1

Johnson C. Smith University, 100 Beatties Ford Rd., Charlotte, U.S.A.

2

Christopher Newport University, One Avenue of the Arts, Newport News, U.S.A.

Keywords: ANFIS Algorithm, Deep Learning Model, Estimate and Predict Current Stock Prices, AI Applications in

Financial Implementations.

Abstract: To correctly and accurately predict and estimate the stock prices to get the maximum profit is a challenging

task, and it is critical important to all financial institutions under the current fluctuation situation. In this study,

we try to use different AI methods and algorithms, such as Adaptive Neuro Fuzzy Inference System (ANFIS)

and Deep Learning (DL), to easily and correctly predict and estimate the current and future possible stock

prices. Combining with some appropriate pre-data-processing techniques, the current stock prices could be

accurately and quickly estimated via those models. In this research, both algorithms are designed and built to

help decision makers working in the financial institutions to easily and conveniently predict the current stock

prices. The minimum training and checking RMSE values for ANFIS model can be 0.0009828 and 0.001713.

The minimum MSE value for DL model is 0.0000047 with a regression value of 0.9958.

1 INTRODUCTION

As the fast development of AI technologies, such as

fuzzy inference systems, machine learning and deep

learning, today various AI related algorithms have

been widely implemented in financial fields to

estimate and predict the stock values, currency

exchanging rates, bonus analyses and all other related

applications (Chen et al, 2019).

Most of research are concentrated on stock

predictions or estimations based on neural networks,

machine learning, and deep learning studies.

Different and various machine learning algorithms

accompanied with some sophisticated additions are

applied on stock analyses and predications to improve

the accuracy of prediction on stock markets. Chong et

al. reported to use Ensemble of Deep Neural

Networks to performance prediction for stock

markets (Chong et al, 2020). L. Yu developed an

algorithm based on deep learning and neural networks

to improve the analyses for economic and financial

data (Yu, 2022). Polepally et al. and Pardeshi and

Kale reported to use machine learning and deep

learning algorithms to improve the prediction

accuracy for current stock prices (Pardeshi and Kale,

2021). H. J. Singh, et al. (Singh, et al., 2022) and Y.

Lin et al. (Lin et al., 2021) developed a novel

multivariate recurrent neural network and a new

convolutional neural network with long short term

memory combined model to estimate the current

stock prices and their tendency (Lin et al, 2021).

Singh et al. performed a comparative studies and

analysis for different stock price prediction

techniques developed in recent years (Singh et al,

2022). S. Roy and S. Tanveer, 2023 (Roy and

Tanveer, 2023) developed an algorithm to forecast

stock price by using DeepNet method. Instead of

using any traditional machine learning model, Tarsi

et al. (Tarsi et al., 2023) utilized a Long Short Term

Memory (LSTM), which is a variation of machine

learning model, to predict the stock price. (Mandee,

A. et al. (Mandee et al., 2022) utilized an explainable

artificial intelligence XAI to predict stock market

trends.

Chinprasatsak et al. (Chinprasatsak et al., 2020)

reported to use neural network for forecasting high

and low price on foreign exchange market. A.

Alamsyah and W. H. Aprillia and P. Aggarwal and A.

K. Sahani (Alamsyah et al., 2020) performed some

studies in comparisons of the foreign currency

prediction performance with neural network

algorithms. T. A. Bui et al (Bui et al., 2022) reported

to use neural networks and CNN-RNN based hybrid

Bai, Y. and Wang, D.

Using Adaptive Neuro-Fuzzy Inference System and Deep Learning to Predict and Estimate the Current Stock Prices.

DOI: 10.5220/0013335100003956

In Proceedings of the 7th International Conference on Finance, Economics, Management and IT Business (FEMIB 2025), pages 183-188

ISBN: 978-989-758-748-1; ISSN: 2184-5891

Copyright © 2025 by Paper published under CC license (CC BY-NC-ND 4.0)

183

machine learning model to predict the currency

exchange rate. E. Sarmas et al (Sarmas et al., 2022)

performed a comparison study among different

machine learning classification methods used for

currency exchange rate trends. A. L. C. Tak and R.

Logeswaran (Tak and Logeswaran, 2022) also

developed a foreign currency prediction method

based on machine learning techniques.

To correctly and accurately predict and estimate

the current stock prices to get the maximum profit via

different AI methods, some correct AI models are

necessary with popular algorithms, such as Adaptive

Neuro Fuzzy Inference System (ANFIS) and Deep

Learning (DL). Combining with some appropriate

pre-data-processing techniques, the current stock

prices could be accurately and quickly estimated via

those models. In this research, both algorithms are

designed and built to help decision makers working

in the financial institutions to easily and conveniently

predict the current stock prices.

Stock prices are changed at any moment, and they

may be varied significantly day by day, month by

month and year by year. Due to the heavy complicity

and unforeseen variations on the current market, to

correctly and accurately predict the stock prices needs

the following factors and operational steps to be

taken:

1) The changing or variation of the stock prices

can be considered as a periodic function, and

this period could be 3 months, 6 months or

longer, which depends on the target period on

each research. In our case, we used 3 months

as a period.

2) Based on assumptions above, we utilized the

Google Stock dataset to train and check our

target ANFIS and DL models.

This study is divided into 6 sections; after this

Introduction, an introduction to two Google Stock

datasets used to train and check AI models is given in

section 2. The ANFIS and its implementations is

discussed in section 3. A discussion about DL is given

in section 4. The experiment studies and results are

given in section 5. The conclusion and future works

are provided in section 6.

2 GOOGLE STOCK DATASET

Two Google Stock datasets (Kaggle, 2012), one

contained 5-year stock transaction records from Jan.

3, 2012 to December 30, 2016, and the other

included1-month stock transaction records from

January 3, 2017 to January 31, 2017, are utilized in

this study. The first one is used as the training and

checking data for ANFIS and DL models, and the

second works as the testing and validation purpose for

those models.

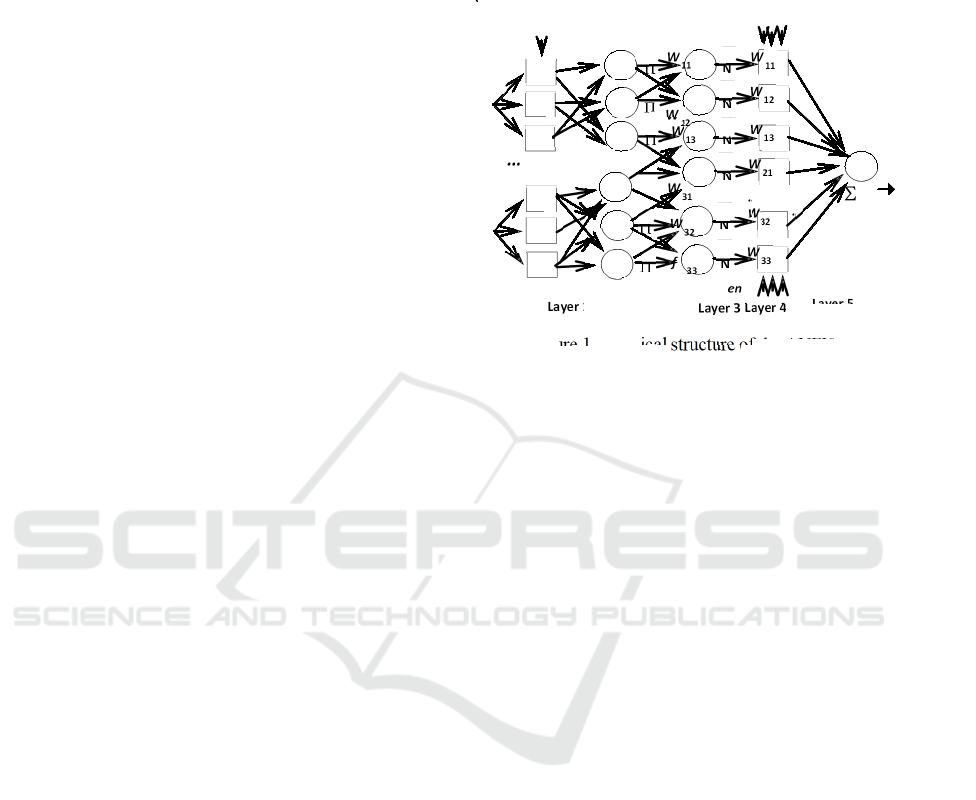

Figure 1: A typical structure of the ANFIS.

Each dataset contained six columns, Date, Open,

High, Low, Volume and Close, with both 5-year and

1-month stock price records. Each related column can

be mapped to the Opening price, Highest price,

Lowest price, transaction Volume and Closing price.

For our study, we only need four of them; Open,

High, Low and Close. In fact, we use the first three

columns, Open, High, Low as inputs and the Close

column as the output.

A critical key issue in using those data to train,

check and test our ANFIS or DL models is the data

preprocessing. As everybody knows, the stock prices

are changed or varied in every moment at a time, not

each day, and the amounts they changed are

significant with a relatively wider range, or even

dynamically, for a period of time. This provided a

challenging issue when using ANFIS, especially

using the fuzzy rules, to estimate the output or the

closing price due to the significant variations in the

price values. In the worst case, the ANFIS could not

perform its normal or correct FIS function due to the

out-of-bound of the input values with significant large

or big different price values for different time period.

To effectively correct or solve this important and

key issue, we need to preprocess those data, exactly

to perform a normalization job for those data to

enable them to be used in our model training and

checking processes. In summary or in a short word,

we only take care of those relative changing values on

the prices, but not for the absolute changing values,

which is good enough for us since we only pay our

attention to the changing values in trends or tendency

on the stock prices.

H

M

Π

Π

Π

Π

N

N

N

N

W

11

W

12

Σ

Close

W

13

W

31

W

11

W

12

W

13

W

21

Layer 1

Layer 2

Layer 3

Layer 4

Layer 5

L

H

L

Π

N

N

W

32

W

33

…

…

W

32

f

33

M

……

Open

High

Lo

w

Open

L

High Low

MFs

FEMIB 2025 - 7th International Conference on Finance, Economics, Management and IT Business

184

3 INTRODUCTION TO ANFIS

The so-called ANFIS is exactly a combination of two

soft-computing techniques: Artificial Neural

Network (ANN) and Fuzzy Inference System (FIS),

which was first introduced by (Jyh-Shing Roger Jang,

1992). The FIS used a Sugeno fuzzy inference system

and its structure is similar to a multilayer feed

forward neural network structure, but the difference

is that the links between nodes in ANFIS define the

signals’ flow direction and there are no associated

weight factors with the links. It consists of a network

of neurons that communicate between the input and

hidden layers, as well as the hidden and output layers.

Each layer consists of neurons constructed

according to the principles of fuzzy control. Figure 1

shows a Sugeno fuzzy model with 27 rules along with

a corresponding ANFIS architecture. In our case,

total 27 rules in the method of “If-Then” for the

Sugeno model are considered with x and y as inputs

and f as output (Imran et al., 2019). 27 rules are

defined as below (three input columns – Open, High,

Low, L: value low, M: value mid, H: value high):

R

1

: If Open is L and High is L, and Low is L,

then f

111

= p

111

Open + q

111

High + r

111

Low + c

111

R

2

: If Open is L and High is L, and Low is M,

then f

112

= p

112

Open+ q

112

High + r

112

Low + c

112

R

3

: If Open is L and High is M, and Low is L,

then f

21

= p

113

Open + q

113

High + r

113

Low + c

113

R

4

: If Open is L and High is M, and Low is M,

then f

22

= p

211

Open + q

211

High + r

211

Low + c

211

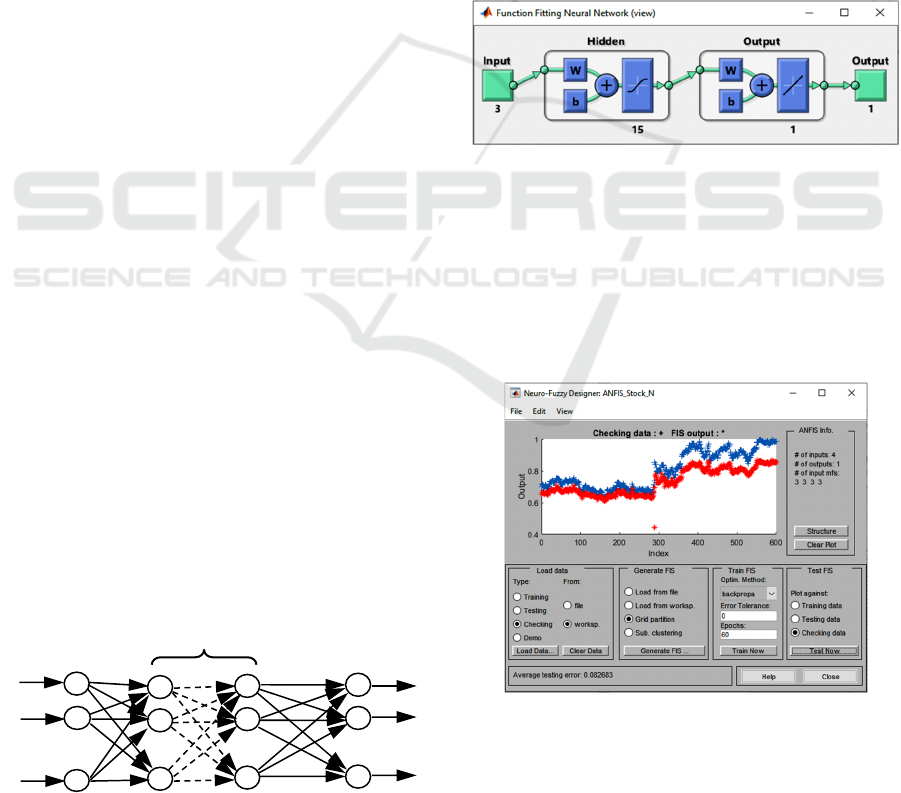

4 ANN AND DEEP LEARNING

An artificial neural network (ANN) has multiple

nodes with multiple layers, including input layer,

output layer and hidden layers. Figure 2 shows a

model of multiple layers feed forward ANN or DL.

The dash lines means that multilayer are included in

this ANN and these layers cannot be observable. In

Figure 2, on each feed forward arrow branch from

one node to another, a weight factor w

ij

should be

multiplied to obtain a complete transfer signal.

Figure 2: A multilayer feed-forward ANN or DL model.

A neural network can be adjusted or trained, so

that a particular input leads to a corresponding target

output. The network is adjusted, based on a

comparison between the output and the target, until

the network output matches the target. Typically,

many such input-target pairs are needed to train a

network, which is called a supervised learning model.

As we did for the ANFIS, the Google Stock

dataset is utilized to train, check and test this DL

model. Three columns, Open, High and Low, work

asinputs and the Close as the output. Totally 1200 sets

of data are used with 70% as training data, 15%

as

checking data and 15% as testing data. The

Levenberg-Marquard training

algorithm and

MATLAB Deeping Learning Toolbox are used to

perform these tasks to generate our desired ANN/DL

model with 15 hidden layers. The ANN/DL structure

is shown in Figure 3.

Figure 3: The structure used in our ANN/DL model.

5 EXPERIMENTAL RESULTS

By using the Google Stock 5-year dataset as the

training and checking data to train and check our

ANFIS model, the model structure and the training

result is shown in Figure 4.

Figure 4: The ANFIS model training results.

The testing and performance results for the

ANN/DL model are shown in Figure 5.

.

.

.

Inputs

Outputs

Hidden Layers

Using Adaptive Neuro-Fuzzy Inference System and Deep Learning to Predict and Estimate the Current Stock Prices

185

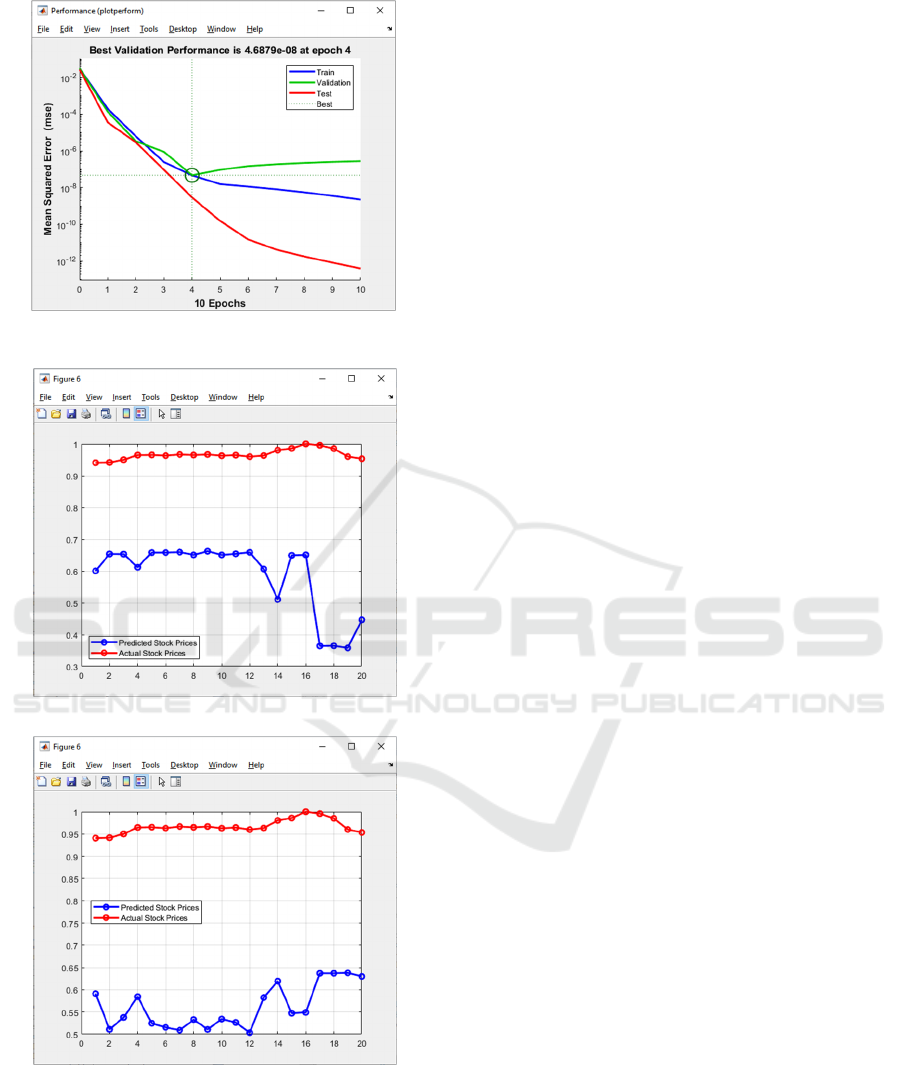

Figure 5: The validation and performance results.

(a)

(b)

Figure 6: Comparison ANFIS and ANN/DL algorithms.

A comparison study is performed for the validation

errors between the ANFIS and ANN/DL model, and

this comparison result is shown in Figure 6. Both

validation errors are RMS values by comparing the

actual output and the checking data inputs for ANFIS

and ANN/DL systems used in this study.

It can be found that the RMSE value for the

ANFIS method is about 0.0016, and the RMSE value

for ANN/DL model is 0.0044 with a regression value

of 0.9954. The ANFIS algorithm result is better

compared with the ANN/DL algorithm for our study,

exactly the ANFIS algorithm is about 64% better than

that of ANN/DL algorithm by checking the validation

RMSE error values in Figure 6 for our study.

6 CONCLUSIONS

With the help of MATLAB Fuzzy Logic and Deep

Learning Toolboxes as well as Google Stock dataset,

we develop two AI models with two related

algorithms, ANFIS and ANN/DL, to perform

prediction for stock prices. First we utilized Google

Stock 5-year dataset to train ANFIS and ANN

models. To confirm and check the effectiveness and

accuracy, we utilized another Google Stock 1-month

dataset to validate both models. A comparison result

shows that the ANFIS model overtakes the ANN/DL

model for our study.

REFERENCES

Aggarwal P. and Sahani A. K., (2020), "Comparison of

Neural Networks for Foreign Exchange Rate

Prediction," IEEE 15th International Conference on

Industrial and Information Systems (ICIIS),

RUPNAGAR, India, pp. 415-419, doi:

10.1109/ICIIS51140.2020.9342733.

Alamsyah and Aprillia W. H., (2022), "Comparison of

Predictions Foreign Currency Exchange Rates (USD,

JPY, EUR, GBP, CHF, CAD) to Rupiah (IDR) using

Artificial Neural Network and Long Short-Term

Memory," 6th International Conference on Information

Technology, Information Systems and Electrical

Engineering (ICITISEE), Yogyakarta, Indonesia, pp.

585-590, doi: 10.1109/ICITISEE57756.2022.

10057683.

Biswal A., (2023), Stock Price Prediction Using Machine

Learning: An Easy Guide, lesson 21 of 34, Simplilearn.

Bui T. A., Pashchenko F. F., Pashchenko A. F. and Kudinov

Y. I., (2020), "Using Neural Networks To Predict

Exchange Rates," 13th International Conference

"Management of large-scale system development"

(MLSD), Moscow, Russia, pp. 1-5, doi:

10.1109/MLSD49919.2020.9247748.

Chen C. T., Chiang L. K., Huang Y. C. and Huang S. H.,

(2019), "Forecasting Interaction of Exchange Rates

Between Fiat Currencies and Cryptocurrencies Based

on Deep Relation Networks," IEEE International

FEMIB 2025 - 7th International Conference on Finance, Economics, Management and IT Business

186

Conference on Agents (ICA), Jinan, China, 2019, pp.

69-72, doi: 10.1109/AGENTS.2019.8929155.

Chinprasatsak K., Niparnan N. and Sudsang A., (2020),

"Neural Network for Forecasting High Price and Low

Price on Foreign Exchange Market," 17th International

Conference on Electrical Engineering/Electronics,

Computer, Telecommunications and Information

Technology (ECTI-CON), Phuket, Thailand, pp. 461-

465, doi: 10.1109/ECTI-CON49241.2020.9158133.

Chong L. S., Lim K. M. and Lee C. P., (2020), "Stock

Market Prediction using Ensemble of Deep Neural

Networks," 2020 IEEE 2nd International Conference

on Artificial Intelligence in Engineering and

Technology (IICAIET), Kota Kinabalu, Malaysia, pp.

1-5, doi: 10.1109/IICAIET49801.2020.9257864.

Guo Y., (2020), "Stock Price Prediction Based on LSTM

Neural Network: the Effectiveness of News Sentiment

Analysis," 2nd International Conference on Economic

Management and Model Engineering (ICEMME),

Chongqing, China, pp. 1018-1024, doi:

10.1109/ICEMME51517.2020.00206.

https://www.kaggle.com/datasets/vaibhavsxn/google-

stock-prices-training-and-test-data (2012).

Imran M., Alsuhaibani Sarah A., (2019), Chapter 7 - A

Neuro-Fuzzy Inference Model for Diabetic Retinopathy

Classification, Editor(s): D. Jude Hemanth, Deepak

Gupta, Valentina Emilia Balas, In Intelligent Data-

Centric Systems, Intelligent Data Analysis for

Biomedical Applications, Academic Press, Pages 147-

172, ISBN 9780128155530.

Jang J. R., "Self-learning fuzzy controllers based on

temporal back propagation," (1992), in IEEE

Transactions on Neural Networks, Vol. 3, No. 5,

pp.714-723, doi: 10.1109/72.159060.

Lamba V., Hooda S., Solanki V., Ahuja R., Ahuja S. and

Kaur A., (2021), "Comparative Analysis of Artificial

Neural Networks for Predicting Nifty 50 value in The

Indian Stock Market," 5th International Conference on

Information Systems and Computer Networks

(ISCON), Mathura, India, pp. 1-5, doi:

10.1109/ISCON52037.2021.9702400.

Lin Y., Zhong Q., Huang Q., Li M. and Ma F., (2021), "A

new convolutional neural network and long short term

memory combined model for stock index prediction,"

14th International Congress on Image and Signal

Processing, BioMedical Engineering and Informatics

(CISP-BMEI), Shanghai, China, pp. 1-6, doi:

10.1109/CISP-BMEI53629.2021.9624337.

Mandee, Agarwal A., Bhatia A., Malhi A., Kaler P. and

Pannu H. S., (2022), "Machine Learning Based

Explainable Financial Forecasting," 4th International

Conference on Computer Communication and the

Internet (ICCCI), Chiba, Japan, pp. 34-38, doi:

10.1109/ICCCI55554.2022.9850272.

Moghaddam H., Moghaddam M. H., Esfandyari M.,

(2016), “Stock market index prediction using artificial

neural network”, Journal of Economics, Finance and

Administrative Science, pp.1-12.

Pardeshi Y. K. and Kale P. P., (2021), "Technical Analysis

Indicators in Stock Market Using Machine Learning: A

Comparative Analysis," 12th International Conference

on Computing Communication and Networking

Technologies (ICCCNT), Kharagpur, India, pp. 1-6,

doi: 10.1109/ICCCNT51525.2021.9580172.

Polepally V., Nandini Reddy N. S., Sindhuja M., Anjali and

Reddy, (2021), "A Deep Learning Approach for

Prediction of Stock Price Based on Neural Network

Models: LSTM and GRU," 12th International

Conference on Computing Communication and

Networking Technologies (ICCCNT), Kharagpur,

India, pp. 1-4, doi: 10.1109/ICCCNT51525.

2021.9579782.

Roy and Tanveer, (2023), "Stock Price Forcasting using

DeepNet," International Conference on Computational

Intelligence, Communication Technology and

Networking (CICTN), Ghaziabad, India, pp. 418-420,

doi: 10.1109/CICTN57981.2023.10141100.

Sarmas E. et al., (2022), "Comparison of Machine Learning

Classifiers for Exchange Rate Trend Forecasting," 13th

International Conference on Information, Intelligence,

Systems & Applications (IISA), Corfu, Greece, pp. 1-

7, doi: 10.1109/IISA56318.2022.9904380.

Singh A., Bhardwaj G., Srivastava A. P., Bindra A.,

Chaudhary and Ritika, (2022), "Application of Neural

Network to Technical Analysis of Stock Market

Prediction," 3rd International Conference on Intelligent

Engineering and Management (ICIEM), London,

United Kingdom, pp. 302-306, doi:

10.1109/ICIEM54221.2022.9853162.

Singh G. et al., (2022), "CNN-RNN based Hybrid Machine

Learning Model to Predict the Currency Exchange

Rate: USD to INR," 2nd International Conference on

Advance Computing and Innovative Technologies in

Engineering (ICACITE), Greater Noida, India, pp.

1668-1672, doi: 10.1109/ICACITE53722.

2022.9823844.

Singh H. J., Ghosh K. and Sharma S., (2022), "A Novel

Multivariate Recurrent Neural Network based Analysis

Model for Predicting Stock Prices," 2nd International

Conference on Innovative Sustainable Computational

Technologies (CISCT), Dehradun, India, pp. 1-6, doi:

10.1109/CISCT55310.2022.10046540.

Singh K., Thapliyal and Barthwal, (2022), "A comparative

analysis of stock price prediction techniques," 2022 7th

International Conference on Computing,

Communication and Security (ICCCS), Seoul, Korea,

Republic of, pp.1-4, doi: 10.1109/ICCCS55188.

2022.10079696.

Tak A. L. C. and Logeswaran R., (2022), "Foreign

Currency Exchange Market Prediction using Machine

Learning Techniques," IEEE International Conference

on Distributed Computing and Electrical Circuits and

Electronics (ICDCECE), Ballari, India, pp. 1-5, doi:

10.1109/ICDCECE53908.2022.9792832.

Tarsi M., Douzi S. and Marzak A., (2023), "Predicting

stock price using LSTM and Social Media dataset," 3rd

International Conference on Innovative Research in

Applied Science, Engineering and Technology

(IRASET), Mohammedia, Morocco, pp. 1-4, doi:

10.1109/IRASET57153.2023.10152930.

Using Adaptive Neuro-Fuzzy Inference System and Deep Learning to Predict and Estimate the Current Stock Prices

187

Thu H. G. T., Thanh T. N. and Quy T. L., (2021), "A

Neighborhood Deep Neural Network Model using

Sliding Window for Stock Price Prediction," IEEE

International Conference on Big Data and Smart

Computing (BigComp), Jeju Island, Korea (South), pp.

69-74, doi: 10.1109/BigComp51126.2021.00022.

Yu L., 2022, "Economic and Financial Data Analysis

System Based on Deep Learning and Neural Network

Algorithm," (2022), International Conference on

Knowledge Engineering and Communication Systems

(ICKES), Chickballapur, India, pp. 1-5, doi:

10.1109/ICKECS56523.2022.10060240.

FEMIB 2025 - 7th International Conference on Finance, Economics, Management and IT Business

188