Main Areas of Improvement of the Investment Environment Based

on Innovative Approaches

Hudayberganov Dilshod

1a

, Khasanova Raykhon

2b

, Umarova Gulchekhra

3c

,

Saatmurotov Shoxrux

4d

and Sapaeva Nilufar

1e

1

Urganch State University, 14, H.Olimjon Street, Urganch City, 220100, Uzbekistan

2

Institute of Counter Irrigation and Agro-Technology under the National Research University "TIIMSH",

19, Pakhtazor Dahasi, Karshi Shahar Khanabad St., 180100, Uzbekistan

3

Namangan Engineering-Construction Institute, 12 Islam Karimov St., Namangan city, 160100, Uzbekistan

4

Termiz State University, Barkamol Avlod Street, 43, Termiz, 732100, Uzbekistan

Keywords: Investment Environment, Regional Development, Innovative Approaches.

Abstract: In this article, the role of the investment environment in the economy of the region, its specific features,

existing opportunities, the implementation of an effective investment policy based on innovative approaches,

the formation of the investment environment and the main directions for its improvement are highlighted.

Also, based on innovative approaches, conclusions and proposals regarding the implementation of the priority

areas of improvement of the investment environment in the region are presente.

1 INTRODUCTION

Today, measures are being taken to further improve

industrial relations in the regions of our country. In

this regard, well-targeted and large-scale reforms are

being implemented in the direction of creating a

favorable investment environment in the new

Uzbekistan. In this regard, according to the 26th goal

of the Development Strategy put forward by the

President of the Republic of Uzbekistan, the

establishment of a new system based on the "bottom-

up" principle of effective use of investments and

increasing export volumes in order to create favorable

investment in the regions of our country were

mentioned and it is necessary to implement the

strategy of attracting foreign and local investments

(Mukhamadjanov, 2022). Therefore, improving the

investment environment in our country is a priority.

In order to improve the investment environment, it is

necessary to develop this field based on innovative

approaches. This requires an in-depth analysis of

a

https://orcid.org/0000-0003-2725-5831

b

https://orcid.org/0000-0003-7521-4526

c

https://orcid.org/0000-0002-9187-5149

d

https://orcid.org/0000-0009-2578-0786

e

https://orcid.org0009-0001-0195-256X

investment projects and the effective use of financial

incentives and tools to further increase investment

attractiveness in the conditions of a favorable

investment environment in the business sector of

Uzbekistan.

2 MATERIALS AND METHODS

This article uses methods of research such as analysis,

synthesis, economic method, logical analysis,

inductive, deductive and abstract thinking.

A number of scientific studies have been

conducted in the world and in our country in

connection with the development of the investment

environment and the improvement of its activities.

The most important issue is the creation of a

favorable investment environment for investors. In

some studies, the economic potential of the regions of

Uzbekistan, the further improvement of the attraction

of foreign direct investment in the economy, the

Dilshod, H., Raykhon, K., Gulchekhra, U., Shoxrux, S. and Nilufar, S.

Main Areas of Improvement of the Investment Environment Based on Innovative Approaches.

DOI: 10.5220/0014067200004738

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 4th International Conference on Research of Agricultural and Food Technologies (I-CRAFT 2024), pages 89-93

ISBN: 978-989-758-773-3; ISSN: 3051-7710

Proceedings Copyright © 2025 by SCITEPRESS – Science and Technology Publications, Lda.

89

creation of a favorable investment environment for

investors, the provision and development of its

attractiveness, the further liberalization of the

economy, it was emphasized that it is necessary to

create and modernize the existing infrastructure in

order to organize and improve the free use of goods,

as well as to develop the necessary production in the

regions (Mukhamadjanov, 2022).

In order to conduct an active investment policy in

the country, it is necessary to implement consistent

measures aimed at improving the investment

environment. It was noted that it is necessary to

evaluate the measures aimed at improving the

investment environment and formulate

recommendations for the development of favorable

conditions for investment activity (Kovalev, 2023).

When creating an investment environment, it is

necessary to ensure mutual harmony of investment

attractiveness and investment activity. In practice, it

is explained that the complexity of assessing the

investment environment as a combination of

investment attractiveness and investment activity and

its investment activity is the result of investment

attractiveness (Litvinova, 2013).

Creating an investment environment should be

considered an important goal of a sustainable

investment policy. In other studies, after defining the

objective of sustainable investment policy, more

information is needed about its practical

implementation Kovalev.

Improvement of the investment environment

should directly depend on the activity of investment

management. Investment management is a

specialized field of finance that deals with the

management of individual or institutional funds.

Other concepts used to describe this area of finance

are asset management, portfolio management, money

management and wealth management (Wang et al.,

2022).

Creating an investment environment in the

regions should depend on the effectiveness of

regional investments. In this regard, preference for

regional investments directly means the desire and

interest of the region for investments. This means the

percentage of the income that investors in the region

are willing to invest. It is calculated as the ratio of the

annual investment per capita of the region to the per

capita income of the region for that year (Fabozzi and

Drake, 2009).

Investment flows, measured as foreign direct

investment, are considered the main output of

investors, entrepreneurs and venture enterprises in the

economy. In this regard, the investments that can be

attracted will have their limits, and the interest rate

environment will affect the flow of investments. In

this case, it is necessary to evaluate the role of

macroeconomic indicators in attracting investments.

A developing economy can be modeled after an

economy with a low interest rate progressive policy

that supports foreign investment and business by

eliminating uncertainty in investment movements

(Adediran et al., 2022).

To stabilize and improve the investment

environment, it is necessary to create an effective

business environment. There are differences in the

degree of marketization of the business environment

in China's regions in terms of promoting

technological innovation and building an innovative

country (Zhang et al., 2023). In this way, it is

appropriate to create technological innovations to

stabilize the investment environment.

Thus, in order to improve the investment

environment, it is necessary to take into account the

possibilities of changing its composition. For this, it

is necessary to create incentives and opportunities for

attracting investments by state and regional

authorities, to reduce the unnecessary costs of

business, to reduce systemic risks, and to eliminate

existing obstacles to creating a social environment

(Saidova et al., 2024, Saidova et al., 2024).

3 RESULTS AND DISCUSSION

The main purpose of the existence of a commercial

structure in the formation of any investment

environment is to make a profit. One way to achieve

this goal is to actively invest. However, the investment

should be made only after conducting an investment

analysis. This allows you to determine the

appropriateness of the chosen investment method. In

this regard, an in-depth investment analysis should be

carried out in order to create an effective investment

environment in the regions of the country. Investment

analysis is a set of measures necessary for the

formation of an effective business plan aimed at the

implementation of an investment project and the

determination of the appropriateness of investments.

This makes it possible to justify the chosen investment

method.

The process of analyzing the investment

environment begins with the study of the state of the

national economy. In order to implement investment

projects supported by these institutions, analysis of the

economy of countries should be carried out between

international investment and financial institutions. It is

appropriate to assess the investment environment

through this. The assessment of the direct investment

I-CRAFT 2024 - 4th International Conference on Research of Agricultural and Food Technologies

90

environment is based on the analysis of the following

factors that describe the country's investment potential

and the risk of their implementation:

- natural and climatic resources;

- environmental condition;

- the level of infrastructure development and the

condition of its objects;

- political stability, force majeure situations and

the possibility of forecasting them;

- socio-economic situation (availability and

quality of labor resources, availability and

quality of the educational system, rate of economic

development in spheres of activity, investment

activity of business, budget situation and balance of

payments);

- quality of public administration (state of

economic regulation and legal system, policy of

state and local authorities, protection of property

rights, level of freedom, level of crime and

corruption);

- openness of the economy and trade rules with

foreign partners;

- the level of the tax burden and the quality of

the tax system;

- banking sector system, quality of other

financial institutions and credit availability;

- barriers to entering the market (informational,

technical and administrative barriers) and the degree

of monopolization of the economy.

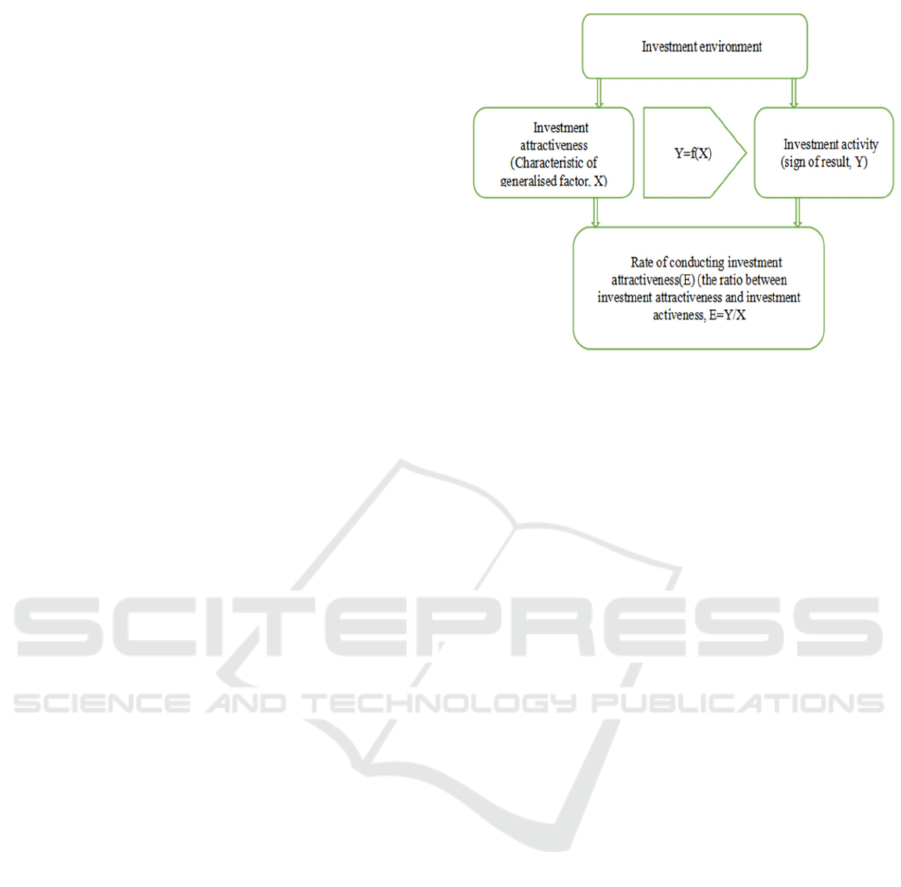

Today, on the basis of innovative approaches,

special attention is paid to its elements in the

improvement of the investment environment. This

makes it possible to create an effective investment

environment by increasing investment attractiveness

and carrying out investment activities, allowing to

determine the interrelationship between them, and

thus it will be possible to determine the level of

implementation of investment attractiveness (Fig. 1).

According to Figure 1, the investment

environment, investment attractiveness should be

considered as a generalized factor characteristic, and

investment activity as a result indicator. And the level

of realization of investment attractiveness is

determined by the ratio of investment activity to

investment attractiveness.

In addition, the following factors should be taken

into account for the formation and improvement of the

investment environment:

- formation of a favorable investment

environment under the influence of a comprehensive

set of objective factors;

- improvement of the investment environment in

the national economy in the form of the investment

environment of industries and regions;

Figure 1: The relationship between the concepts of

investment attractiveness, investment activity and

investment environment [Authors' development.]

- extensive development of the investment

environment in the form of an institutional system;

- differentiation of the investment environment

at levels and stages of the economy;

- prevention of various risks as a result of

suitable conditions.

Innovative approaches are based on innovation.

Considering this, investment programs are an

important direction for improving the investment

environment in Khorezm region. The number of

projects launched under these programs is increasing,

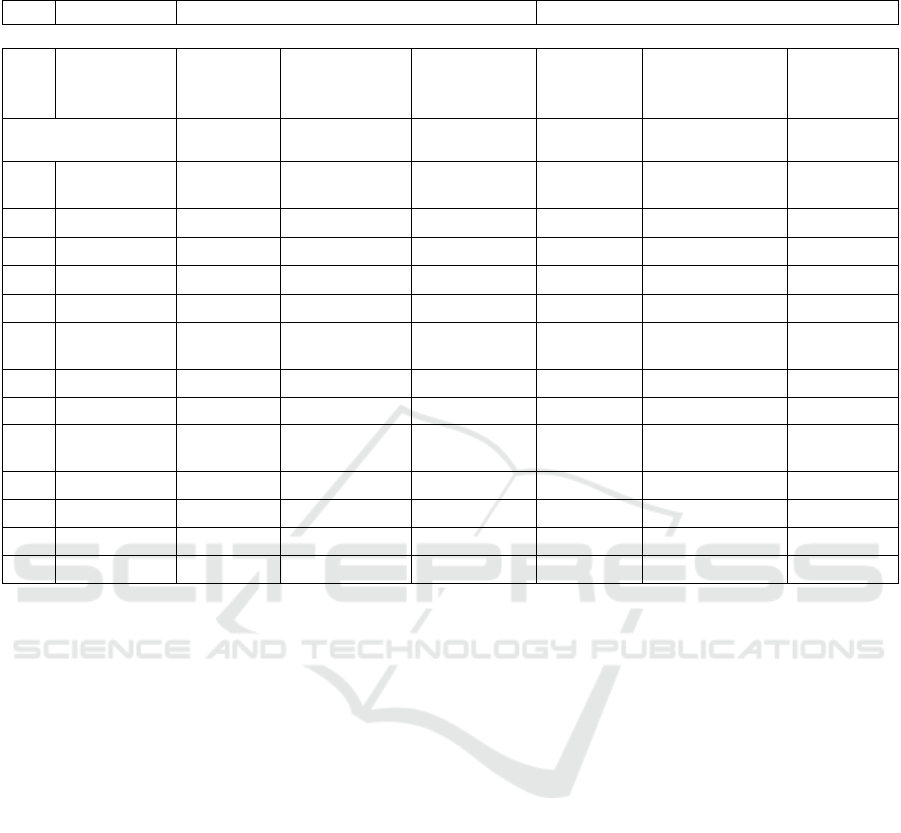

and their use cases are improving day by day (Table

1) (Kovalev, 2023).

Based on this table 1, the total volume of

investment projects in the region in 2022, 726

projects worth 1831912.4 million soums were

implemented and 15877 new jobs were created. In

2023, 1,091 projects worth 5,238,080.3 million

soums were implemented and 17,702 new jobs were

created. In 2023, the most investment projects were

implemented in Khanka district (119), Hazorasp

district (116) and Khiva city (115). The highest value

of the investment project was allocated to Shavat

district (733,795.8 million soums), Koshkopir district

(623,759.1 million soums) and Khiva city (604,828.9

million soums). came. The largest number of jobs

were created in Shavat district (2642), Khanka district

(1841) and Koshkopir district (1538). This

investment analysis allows you to create a basis for

all stages of the investment project.

It is known that the main goal of the analysis aimed

at the implementation of the investment environment

is to determine the feasibility and effectiveness of the

project.

For this, the result of its implementation and

Main Areas of Improvement of the Investment Environment Based on Innovative Approaches

91

Table 1: Information about the projects launched in the framework of the investment program in Khorezm region in 2022-

2023.

№ Area 2022 y. 2023 y.

Number

of

projects

Value (in

million

UZS)

Vacancies Number

of

projects

Value (in

million UZS)

Vacancies

Total 726 1831912,4 15877 1091 5238080,3 17702

1 Urgench

cit

y

37 142812.7 736 58 37335.6 1439

2 Khiva city

57 120976.6 784 115 604828.9 1263

3 Bogot

86 204671.8 1544 101 480001.3 1279

4 Gurlan

74 209837.2 1483 111 344530.3 1497

5 Koshkopir

69 101235.7 880 64 623759.1 1538

6 Urgench

re

g

ion

40 324984.8 1150 71 405665.8 1135

7 Hazorasp

64 94481.8 594 116 312022.8 1182

8 Xonqa

79 154394.1 2253 119 363894.0 1841

9 Khiva

re

g

ion

67 82930.5 4047 71 232023.6 1414

10 Shavat

65 139311.4 1002 94 733795.8 2642

11 Yangiariq

37 119770.9 656 58 104083.0 650

12 Yangibozor

38 120366.3 600 67 301342.6 528

13 Tuprakkala

13 16138.8 148 46 358777.6 1294

the benefits of the project are calculated. For this, the

amount of profit from investments should be

sufficient.

Effective legislation, economic and political

stability, stable financial and credit system ensure the

level of development and effective functioning of

economic systems. In this case, an important factor of

the economic situation in our country is the

investment environment. This concept is specific to

the economic system (economy of the enterprise,

region and country), and it describes a set of

economic, legal, political, social, organizational and

socio-cultural conditions that determine the

feasibility and attractiveness of investment.

Therefore, effective investment activities will

contribute to economic growth.

Social stability has a significant impact on the

investment environment and acts as a prerequisite for

various economic changes. However, the inflow and

outflow of investment is hindered by the existing

problems in communication, telecommunication

system, transport and hotel business. By analyzing the

network structure of foreign investments in the

country, aspects such as high political and economic

risks, as well as distance from competition in the

domestic market, affect the flow of foreign

investments. In this regard, the investment

environment at the level of an economic entity is the

main macroeconomic factor that predetermines its

investment activity.

The investment climate as a complex and relevant

concept is implemented on several levels. The

investment environment is formed as a result of a set

of political, economic, social and other factors that

create the basic conditions for investment activity in

a country or region. This shows its complexity. The

ability to differentiate the investment environment by

region or sector shows its multi-level.As the main

category of the country's investment environment, the

investment environment of economic sectors, regions

and regions will have a number of characteristics.

This means that they are highly dependent on

investment conditions and must be provided at the

government level. Based on the interdependence of

the concepts of the system of institutions in the

economy and the investment environment, the

investment environment will have its own structural

structure.

I-CRAFT 2024 - 4th International Conference on Research of Agricultural and Food Technologies

92

4 CONCLUSIONS

According to the results of the experiment, the

following Improving the investment environment

means creating the most favorable conditions for

business activity. For this, it is necessary to assess the

investment environment, which allows determining

the rating of doing business based on specific criteria.

Also, the investment environment is formed by the

policies and actions of state bodies. It directly affects

the factors determining the quality of infrastructure

creation, taxation and regulation, labor and financial

markets, security of property rights and public

administration.

Based on the above, it is necessary to implement

measures in the following directions to improve the

investment environment:

- to determine the size and structures of the

necessary investments, thereby implementing

measures to determine the technology,

industry, re-production, territorial location and

forms of ownership;

- increase the volume of investments directed to

the development of various fields, including

education, medicine, science and other fields;

- to determine the most effective and targeted

ways of economic development of the country.

REFERENCES

Decree No. PF-60 of the President of the Republic of

Uzbekistan dated January 28, 2022 "On the

development strategy of New Uzbekistan for 2022-

2026". Source: https://lex.uz/docs/5841063

Frank J. Fabozzi, Pamela Peterson Drake. Finance. Capital

Markets, Financial Management and Investment

Management. by John Wiley & Sons, 2009. - p. 7.

Handbook on sustainable investments. Background

Information and Practical Examples for Institutional

Asset Owners. - Swiss Sustainable Finance, 2017. - p.

155.

Idris A. Adediran, Solomon O. Okunade, Raymond L. Aor.

Diaspora investments in low & high interest rate

environments. // Research in Globalization, 5 (2022). -

pp. 1-10. 100094

Information of Khorezm Region Statistics Department

Kovalev R.V. Teoreticheskie basic investment climate:

economic factors and methods otsenki. // Economics:

Yesterday, Today and Tomorrow (Finance), 2023, Vol.

13, Is. 5A. - c. 332.

Litvinova V.V. Investment attractiveness and investment

climate in the region. Monograph. - M.: Financial

University, 2013. - 13 p. ISBN 978-5-7942-1035-4.

Mukhamadjanov Sh.S. Direction of investment

environment and regional investment in Uzbekistan. //

Economics and society: development of modern

models. – 2022. – Volume 12. – No. 4. – S. 271-282. –

DOI: 10.18334/ecsoc.12.4.117307

Saidova, M., Alimova, F., Tursunbaev, S., Kulmuradov, D.,

& Boltaeva, M. (2023). Influence of the shape of the

disc slots of the seeder on the suction force of the

vacuum for precise sowing of seeds. IOP Conference

Series: Earth and Environmental Science, 1284(1).

https://doi.org/10.1088/1755-1315/1284/1/012014

Saidova, M., Tursunbaev, S., Boltaeva, M., & Isakulova, N.

(2024). Comparison of pneumatic sowing machines by

the number of seeds in the slots of the discs and the

distance between the slots. BIO Web of Conferences,

105. https://doi.org/10.1051/bioconf/202410501004

Wang J., Qi B., Nie Y., Hussain M.J. Will the investment

environment in the region where the company is located

affect its financial risk? Evidence from Chinese listed

companies. // Finance Research Letters, Volume 57,

November 2023, 104218.

https://www.sciencedirect.com/science/article/abs/pii/

S1544612323005901

Zhang J., Chen X., Zhao X. A perspective of government

investment and enterprise innovation: Marketization of

business environment. // Journal of Business Research,

Volume 164, September 2023, 113925.

https://www.sciencedirect.com/science/article/abs/pii/

S0148296323002837

Main Areas of Improvement of the Investment Environment Based on Innovative Approaches

93