Improvement of Forming Promising Investment Environment in the

Region

Hudayberganov Dilshod

1a

, Qosimov Azimjon

2b

, Salimov Baxodir

3c

, Nurmetova Muyassar

4d

and Matyakubova Dilfuza

1e

1

Urganch State University, 14 Hamid Olimjon Street, Urgеnch City, 220100, Uzbekistan

2

Jizzakh State Pedagogical University, 4th house, Sharof Rashidov Street, Jizzakh city, 130100, Uzbekistan

3

Tashkent State Transport University, Temiryolchilar Street 1, Tashkent State Transport University, Mirabad District,

Tashkent City, 100167, Uzbekistan

4

Urganch Ranch-Technology University, Urgеnch City, Khanka St., 26, 220100, Uzbekistan

Keywords: Investment Environment, Regional Development, Economic Sustainability.

Abstract: In this article, the content, necessity, specific features, existing opportunities and the issues of improving its

effective implementation through the influence and directions of the investment policy actively conducted in

the region are highlighted. Also, conclusions, proposals and recommendations regarding the process of

forming a favorable investment environment in the region of Khorezm region, identifying and revealing the

aspects of their improvement are highlighted.

1 INTRODUCTION

The contemporary imperative for effective economic

sector development within our nation necessitates a

comprehensive focus on the cultivation of investment

sources. This pursuit demands the establishment of

conducive conditions and a propitious investment

climate. Central to this endeavor is the construction

of a conducive investment milieu, encompassing a

spectrum of economic relations aimed at fostering the

expanded reproduction of national and regional

economic domains. Fundamentally, the material

substratum of this milieu comprises diverse

investment resources, instrumental in financing

various economic sectors and augmenting their

material and technical infrastructures. These

resources span natural endowments, technological

assets, financial capital, labor reservoirs, and other

pertinent factors. Crucially, the investment climate

operates synergistically within the broader

framework of regional economic systems,

a

https://orcid.org/0000-0003-2725-5831

b

https://orcid.org/0000-0001-9417-6100

c

https://orcid.org/0000-0001-5212-2307

d

https://orcid.org/0009-0000-6115-6699

e

https://orcid.org0009-0008-1982-3652

constituting an integral facet thereof. Functioning

cohesively, the investment milieu facilitates the

processes of simple reproduction through direct

depreciation, alongside requisite increments in fixed

assets and their concomitant modernization.

Indeed, the formation and enhancement of the

investment milieu are pivotal for the socio-economic

advancement of regional economic sectors. Within

this purview, Article 26 of legislation recently enacted

within our nation underscores the imperative task

vested in competent state entities responsible for

regulating investments and investment activities.

Specifically, this mandate entails the continuous

refinement of regulatory frameworks governing

investment attraction, the cultivation of the

investment milieu, and the optimization of investment

endeavors within the territorial confines of the

Republic of Uzbekistan. Moreover, to foster a

salubrious investment climate, concerted efforts are

imperative to engender investment inflows and to

cultivate this environment effectively.

Dilshod, H., Azimjon, Q., Baxodir, S., Muyassar, N. and Dilfuza, M.

Improvement of Forming Promising Investment Environment in the Region.

DOI: 10.5220/0014045600004738

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 4th International Conference on Research of Agricultural and Food Technologies (I-CRAFT 2024), pages 83-88

ISBN: 978-989-758-773-3; ISSN: 3051-7710

Proceedings Copyright © 2025 by SCITEPRESS – Science and Technology Publications, Lda.

83

2 MATERIALS AND METHODS

This article uses methods of research such as analysis,

synthesis, economic method, logical analysis,

inductive, deductive and abstract thinking. In the

studies conducted based on these methods, the

formation of a favorable investment environment and

the improvement of its processes have been studied as

an important issue.

The concept of investment climate as an economic

category attracts the constant attention of scientists,

analysts and experts, as well as accounting subjects,

politicians and entrepreneurs.

Investment environment should be related to its

attractiveness. In this regard, in some studies, it was

noted that the health and attractiveness of the

investment environment can be assessed through

macroeconomic indicators that reflect the state's

socio-economic status (Zayniddinov, 2020).

In our country, the state is paying special attention

to the issues of creating sufficient conditions for the

formation of the investment environment, accelerating

and stimulating its operation, as well as improving it.

In other studies, conducted in this regard, it is noted

that foreign investments are attracted to the regions

with the richest natural resources, relatively favorable

economic conditions and investment environment,

employment of the population and other social

problems (Ziyayev et al., 2019).

Various conditions must be sufficient for the

formation of the investment environment. The

particularity of the investment environment is

determined by generalizing features of economic,

social, organizational, legal, political and other

conditions that determine the appropriateness and

attractiveness of the activity in this regard (Bakiyeva,

2019). In this case, the interrelated set of these factors

influencing the investment activity is the investment

environment, which is a decisive link in the economy

of this or that country.

In many countries, the investment climate is

focused on the economic development of the country's

regions. The investment environment in the Russian

economy seems to be favorable in terms of wide

opportunities for regional economic development

(Okolyshev and Okolysheva, 2017).

The investment environment affects the natural

conditions of some areas, including the city. Some

studies argue that the investment preference is

changed by the urban natural environment (Zhao et al.,

2023).

As an external source, it is necessary to evaluate

the environment of foreign direct investments. In this

regard, the country's outward foreign direct

investment environment was evaluated by applying

the principal components and data analysis

methodology for the Chinese economy (Xue et al.,

2021).

Whether the investment environment is effective

depends on the investor. It has been studied that

investor preferences and expectations depend on the

macroeconomic environment in which they are

formed, and that this includes periods of high or low

market returns or increased economic uncertainty

(Bachmann et al., 2024).

The existence of financial environment as a form

of investment environment should depend on theories.

That is, in other studies, the theory is based on the fact

that the financial environment, including investments

and organizations' access to funds, is directly

incidental to the effective functioning of the financial

system (Agyapong and Tweneboah, 2023).

Directly the above studies justify the necessity of

formation and improvement of the investment

environment for the regions.

3 RESULTS AND DISCUSSION

The socio-economic development of the country's

regions, the increase in the income of the population

and the improvement of the living conditions depend

on the amount and composition of the investment

funds attracted to the sectors and sectors of the

national economy. Therefore, special attention is paid

to creating an attractive environment for attracting

investment funds in the regions. In this regard, the

state implements strict measures to make the country

more attractive for foreign investors. In this regard,

privatization is considered an important direction as a

means of ensuring the flow of direct foreign

investments to our country.

A favorable investment environment for foreign

investors has been created in our country. That is,

Uzbekistan has the following conditions for attracting

foreign investors (Mahmudov et al., 2020):

- political stability;

- the formation of a legal framework protecting

private property and competition;

- establishment of infrastructure supporting the

investment process;

- convenient geographical location of the

country;

- the high development potential of the agro-

industrial sector and the country's wealth of mineral

and raw material resources;

- high to qualification had work of resources

availability;

I-CRAFT 2024 - 4th International Conference on Research of Agricultural and Food Technologies

84

- trade for internal market of size enough level

width.

Also, it is necessary to assess the effectiveness of

investment projects for the implementation of

strategic programs to improve the investment

environment of the regions. Through this strategic for

programs investment projects efficiency evaluation

mechanism will be improved. Taking this into

account, scientific research in our country approach

based on economic sectors investment will be done.

The results of the activity of economic sectors or

certain inactive management institutions in the

conditions of the market economy also exert their

influence on the formation of the investment

environment, and this situation is directly reflected in

the level of well-being of the regions. In this regard,

the active participation of these institutions in the

public discussion of investment projects from the

point of view of partnership is considered important

in improving the direct investment environment.

It is important to note that the current composition

and condition of the investment environment in the

regions can be clearly observed based on the price

movements in the market. Because today there are

many other sources of investment environment

besides other markets, which in turn should

contribute to the formation of an effective and

favorable investment environment. These include

venture funds, mutual funds, trust funds and other

businesses. Here there are various markets related to

them, which objectively occupy a large share in the

conditions of the investment environment, thereby

gaining significant importance in the formation and

improvement of a favorable investment environment.

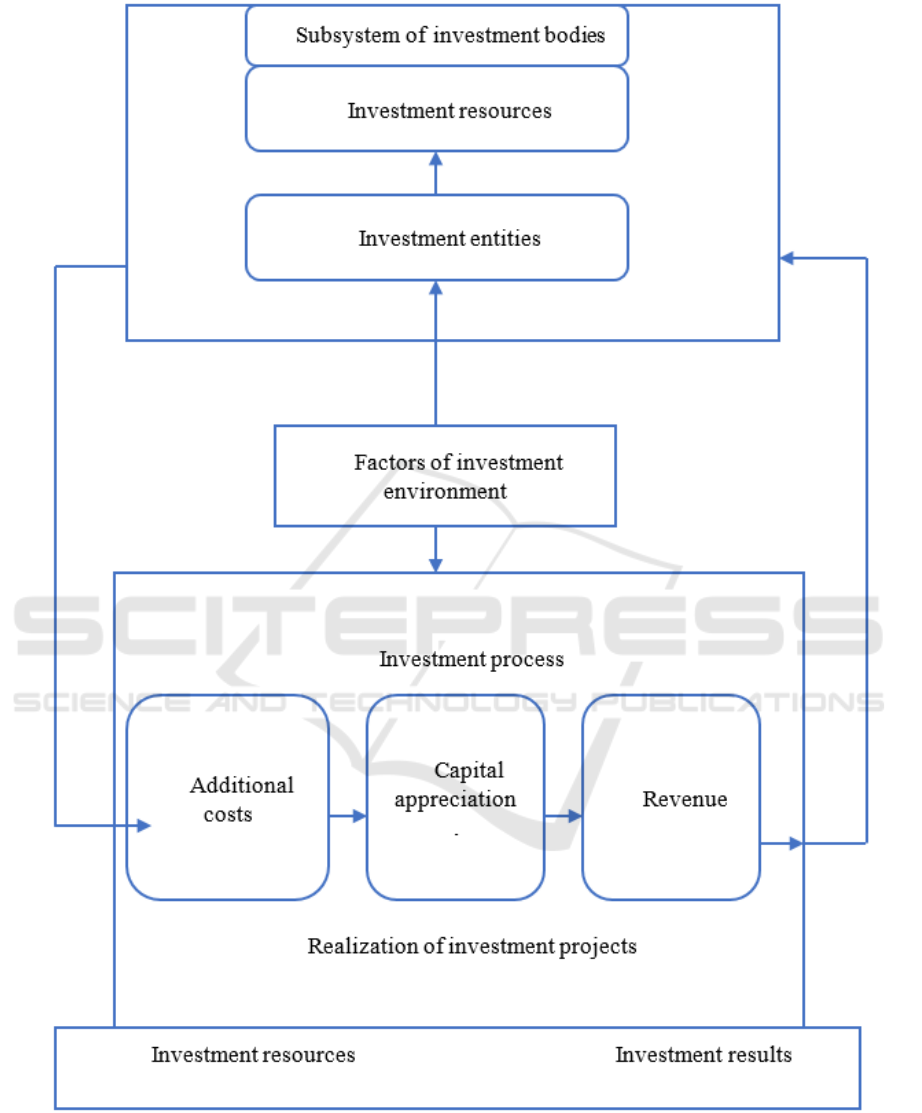

These circumstances are considered to be the process

of forming a favorable investment environment in the

region (Fig. 1).

Based on this figure, it will be possible to create

and improve the investment environment in the

region.

It is known that investments appear as a sum of

expenditures made in the form of long-term capital

investments in industry, transport, etc. Effective

attraction of investments should directly depend on a

favorable investment environment. In these

processes, the investment environment consists of the

structure in which investors operate, and includes the

conditions for buying and selling their various forms

of funds in the financial market. Based on gross

investment and depreciation in the region under the

conditions of the investment climate, net investment

in fixed capital is expressed as the value of the net

increase in fixed capital per year.

In our opinion, the investment environment is a

system of economic relations between its subjects in

the process of making investments. Based on these,

investment activity entities operate effectively in their

respective investment field.

In the conditions of the investment environment,

permanent investments in the regions are not capital,

that is, they lead to changes in capital. In this case, the

time aspect of the investment is based on its flow.

Based on this, the main goal of the investment

environment is to create favorable conditions for the

development and improvement of the investment

process.

The investment environment as the most

important feature of the enterprises in the regions

directly affects the future development prospects,

competitiveness and financial stability of the

enterprise. Based on it, the investment environment

of the enterprise is a set of characteristics of its

production, commercial, financial and management

activities and the characteristics of the investment

environment. Its results show the feasibility and

necessity of investment.

The investment environment as the most

important feature of the enterprises in the regions

directly affects the future development prospects,

competitiveness and financial stability of the

enterprise. Based on it, the investment environment

of the enterprise is a set of characteristics of its

production, commercial, financial and management

activities and the characteristics of the investment

environment. Its results show the feasibility and

necessity of investment.

In order for the investment climate in the regions

to be effective, investment attractiveness should be

ensured. Based on it, the investment attractiveness of

the region depends on the following factors:

- level of socio-economic development of the

object;

- investment activity;

- tourism level, dynamics, flows and provision

of infrastructure;

- availability of investment resources, etc.

The main problem of attracting investors,

including foreign investors, in creating a favorable

investment environment is the lack of improvement

of investment legislation and the complexity of the

tax system. To overcome these problems, it is

necessary to ensure consistency and complexity of

investment legislation. The procedure for improving

legislation, in turn, should ensure the development of

directly applicable laws that meet the expectations

and interests of businessmen.

Improvement of Forming Promising Investment Environment in the Region

85

Figure 1: The process of forming a promising investment environment in the region.

With the effective provision of this legal

environment, the investor will be able to invest in the

region, and his rights will consist of the following

directions:

I-CRAFT 2024 - 4th International Conference on Research of Agricultural and Food Technologies

86

- implementation of effective investment

activity;

- independent determination of investment

volume and target directions;

- ownership, use and disposal of investment

objects and results;

- transfer of their rights under the contract to the

implementation of investments and their results;

- control over the targeted spending of funds

allocated for investments;

- combining own and loan funds with funds of

other investors for joint funds;

- implementation of other rights stipulated in the

contract within the framework of legislation.

Also, organizational decisions necessary to fulfill

the specified parameters of investment activities are

made at the expense of regional resources. In this

case, the growth rates of the investment volume, the

volume of investments, investment lending and the

list of investment projects are approved.

Therefore, the investment environment is

determined by a number of conditions that describe

the attractiveness of investments, risk and

profitability ratios for different investors. In this case,

special attention is paid to the investment

environment from the point of view of foreign

investments. Because this situation is related to the

growth of capital, entrepreneurship and the activity of

local enterprises.

The main factors in the formation of the

investment environment of the region will be the

following areas:

- territorial balance, inflation and its regulation

measures;

- natural resources existence and monopolies;

- by region distribution and infrastructure of

objects availability;

- worker power quality and territorial

distribution;

- to the market enter administrative, information

and another obstacles, competition level;

- of the population political stability, social

safety, security standards;

- regional and local government quality;

- tax load and its stability;

- finance market quality and credit get

opportunity;

- of currency conversion and its influence;

- economy openness (trade, capital movement

and worker power).

Based on the above, the research of the investment

environment is the basis of the study of the

investment environment. Accordingly, socio-

economic relations formed as a result of assessment

of investment attractiveness are studied

4 CONCLUSIONS

The investment environment, a complex

amalgamation of various investment instruments and

stages, warrants meticulous analysis and evaluation to

ascertain the sources of expendable investments. It

encompasses both the beneficiaries and beneficiaries

of investment, necessitating a comprehensive

assessment of investment efficacy. Modern

methodologies for such assessments encompass a

spectrum of indicators, spanning economic,

budgetary, and social efficiency metrics. Central to

our contention is the pivotal role of creating a

favourable investment milieu in the region to bolster

its investment attractiveness and ensure economic

equilibrium and stability. We contend that the

establishment of such an environment is intrinsic to

the state's investment policy. Consequently, fostering

a propitious investment milieu serves as a linchpin for

addressing key imperatives, including regional socio-

economic development, production modernization

and diversification, and enhancing regional economic

competitiveness. Furthermore, to ameliorate the

investment environment in the region, the

formulation of comprehensive programs geared

towards attracting foreign investments is imperative.

These programs must be intricately aligned with the

overarching goals of the region's socio-economic

development strategy. They ought to delineate

sectoral and regional priorities and proffer lucid

measures aimed at enhancing the investment climate.

In essence, the creation of a conducive investment

environment emerges as a prerequisite for sustainable

development and economic prosperity in the region.

Through strategic planning and concerted efforts, the

region can position itself as an attractive destination

for both domestic and foreign investments, thereby

fostering growth, innovation, and resilience in its

economic landscape.

REFERENCES

Law of the Republic of Uzbekistan dated December 25,

2019, "On Investments and Investment Activities",

No598. Source: https://lex.uz/docs/4664142

Zayniddinov R.X. Ways of using advanced foreign

experiences to increase the attractiveness of the

investment environment in Uzbekistan. // "Economics

and innovative technologies" scientific-electronic

Improvement of Forming Promising Investment Environment in the Region

87

journal, No5, September-October, 2020 (No00049). -

96 p. http://iqtisodiyot.tsue.uz

Ziyayev T.M., Qobilov A.O'., Yoqub D.T., Zufarova M.Q.

Favourable investment environment and active

investment politics are stable economic growth factors.

// Economics and finance (economics and finance),

2019, 10 (130). - 56 p.

Bakiyeva I.A. The importance of creating a favorable

investment environment and factors affecting it. //

Scientific electronic journal "International Finance and

Accounting", No4, August, 2019. - 5 p.

Okolyshev D.A., Okolysheva I.A. Development of

proposals for improving the investment environment

based on trilateral relations. // Scientific almanac, 2017,

No9-1 (35) . - p. 70.

Zhao S., Shao Q., Zhou X. Greenbelt investment with

temporal preference in uncertain environments. //

Sustainable Cities and Society, Volume96, September

2023, 104675.

https://www.sciencedirect.com/science/article/abs/pii/

S221067072 300286X

Xue R., Liu H., Bruyne K.De, Hynes K., Shi Y. Evaluation

of outward foreign direct investment environment in

China. // Review of transnational corporations, 2021. -

pp. 44-60.

https://doi.org/10.1080/19186444.2022.2053425.

Bachmann K., Meer J., Krauss A. Investment motives and

performance expectations of impact investors. //

Journal of Behavioral and Experimental Finance, 42

(2024), 100911. - pp.1-9.

Agyapong D., Tweneboah G. The antecedents of circular

economy financing and investment supply: The role of

financial environment. // Cleaner Environmental

Systems, 8 (2023), 100103. - pp.1-2.

Mahmudov S.B. Improvement of investment environment

in financing investments. // "Economy and innovative

technologies" scientific-electronic journal, №4, July-

August, 2020, No00048. - 100 p.

http://iqtisodiyot.tsue.uz

I-CRAFT 2024 - 4th International Conference on Research of Agricultural and Food Technologies

88