Train Recurrent Neural Network to Predict Stock Prices Using Daily

Return Rate

Kangrong Shi

School of Information Science and Technology, Beijing University of Technology, Beijing, China

Keywords: Stock Price Prediction, Daily Return, Recurrent Neural Network (RNN), Long Short-Term Memory Network

(LSTM), Gated Recurrent Unit (GRU).

Abstract: In financial markets, where stock prices are extremely volatile, predicting their future movements has always

been a major challenge for the financial and academic communities. This study aims to explore a novel

method of stock market price prediction, that is, using daily returns as training data, to replace the traditional

forecasting models that rely on closing prices. Traditional forecasting models often fail to fully capture the

complex patterns and nonlinear relationships of stock price dynamics, resulting in limited forecasting

accuracy. In order to overcome these limitations, this study uses three advanced models in deep learning:

Recurrent Neural Network (RNN), Long Short-Term Memory Network (LSTM), and Gated Recurrent Unit

(GRU) to improve the accuracy of prediction through daily return data. Three key metrics were used in this

experiment: Root Mean Square Error (RMSE), Mean Absolute Error (MAE), and Mean Square Error (MSE)

to evaluate the performance of the model. These indicators can comprehensively measure the deviation

between the predicted value of the model and the actual stock price, thus providing an important reference for

the optimization and selection of the model. Through rigorous testing and comparison of these models, it can

be found that models that use daily returns as input data have significant advantages in terms of forecast

accuracy. This finding suggests that daily returns can provide more granular time-series information, which

can help models capture short-term fluctuations in stock prices and market dynamics, thereby improving the

accuracy of forecasts.

1 INTRODUCTION

The stock market is unpredictable in nature (Pawar,

Jalem, and Tiwari, 2019). Market trends, supply-

demand ratios, the global economy, public sentiment,

sensitive financial information, earnings declarations,

historical prices, and other factors may determine

market prices (Moghar and Hamiche, 2020).

Accurate forecasts can help investors grasp market

trends and make more informed investment choices.

It involves the investigation of historical data, the

assessment of market sentiment, and the

consideration of macroeconomic factors. The

accuracy of the forecast will have a direct impact on

the return of investment. Therefore, many models

have been developed for time series prediction, such

as the Gated Recurrent Unit (GRU) model (Gao,

Wang and Zhou, 2021), the Recurrent Neural

Network (RNN) model and the special RNN model

with long short-term memory (LSTM) model (Lase,

Yenny, Owen, Turnip and Indra, 2022). In this paper,

author will compare the LSTM model, GRU model

and RNN model for the NFLX stock price forecasting.

However, few studies have focused on

forecasting daily stock market returns (Zhong and

Enke, 2019). With the development of finance,

people's prediction of stock prices is not limited to

predicting general trends. People want to be able to

predict the profit and loss of each day. Therefore, in

this paper, the daily rate of return is used as the

training data. This allows for a more accurate fit of

the daily reporting data and zooms in on the details of

stock trends.

2 LITERATURE REVIEW

The method of stock price forecasting has evolved

with the development of technology. Early models

relied heavily on traditional time series analysis

methods, such as the Autoregressive Moving Average

Model (ARMA) and the Autoregressive Integral

488

Shi and K.

Train Recurrent Neural Network to Predict Stock Prices Using Daily Return Rate.

DOI: 10.5220/0013526600004619

In Proceedings of the 2nd International Conference on Data Analysis and Machine Learning (DAML 2024), pages 488-493

ISBN: 978-989-758-754-2

Copyright © 2025 by Paper published under CC license (CC BY-NC-ND 4.0)

Moving Average Model (ARIMA) (Selvin,

Vinayakumar, Gopalakrishnan, Menon and Soman,

2017, September), which excelled at handling linear

time series data. However, because stock market data

is characterized by nonlinearity and complexity, these

traditional methods have limitations in capturing data

dynamics.

Due to the development of machine learning

technology and computer hardware, especially deep

learning, stock price forecasting methods have begun

to shift to more complex models. LSTM has attracted

a lot of attention due to its success in stock price

forecasting. Sen et al. (2021) introduce a hybrid

modeling method for this purpose, employing both

machine learning and deep learning techniques,

notably LSTM networks, validated through walk-

forward validation. This scheme is a univariate model

scheme based on LSTM. The success of their model

in predicting NIFTY 50 opening values (Zhou, 2024).

In addition to RNN and their variants, other

machine learning algorithms, such as XGBoost, Deep

Neural Network (DNN)

0

(Srivastava and Mishra,

2021, October) (Singh and Srivastava, 2017) and

Support Vector Machines (SVM) (Zhou, 2024), are

also used in stock price forecasting. XGBoost as an

efficient ensemble learning method, improves the

accuracy of forecasting by building multiple decision

trees, while SVM distinguishes different stock price

movements by finding the optimal hyperplane.

3 METHODOLOGY

3.1 Preprocessing

One step in data preprocessing is to normalize the

data. This step guarantees that the data range is from

0 to 1.Scholars generally use the following formula

for data normalization: (𝑑𝑎𝑡𝑎′ represents the data has

been normalized, data represents the original data,

𝑑𝑎𝑡𝑎

and 𝑑𝑎𝑡𝑎

represents the maximum and

minimum value of the dataset)

data′=

data − data

data

−data

(1)

There is a limited amount of storage space

allocated to each piece of data when running the code.

In the formula, when the denominator

is too much, the

last bits of the data are discarded for normalization.

In stocks, there is a concept called daily return. This

is a measure of the earnings of each day compared to

the day before: ( 𝑝𝑟𝑖𝑐𝑒

is the closing stock

price of current day, 𝑝𝑟𝑖𝑐𝑒

is the closing stock

price of previous day)

dail

y

return=

price

−price

price

× 100%.

(2

)

At this time, when normalizing using Equation 1,

the denominator will become smaller and the

prediction in the neural network model is more exact.

If the daily return is used as training data, the

loss function should be adjusted accordingly. If use

RMSE as the evaluation metric, it may happen that

model A fits the daily return well but fits the raw

stock price data poorly. For example:

Table 1: Examples of the relationship between daily return

and closing price.

day1 day2 day3

model

loss

(RMSE)

raw price 100 150 225

dail

y

return 0 0.5 0.5

model A

(dail

y

return)

0 0.5 0.2 0.212

model A

(price)

100 150 180 31.8

model B

(dail

y

return)

100 0.3 0.7 0.200

model B

(price)

100 130 221 14.4

This is an exaggerated example, but it is not hard

to see that there are models that perform well on daily

returns but not on raw price forecasts. This is because

the daily returns on the second and third days are the

same, with model A predicting the second day more

accurate, but predicting the third day not, and model

B predicting the third day more accurately. Since the

price is higher on the third day, the loss between B

and the original price is smaller. So, this study

choses to calculate the predicted price data based on

the fitting curve and compare it with the raw price as

the loss function.

3.2 RNN

RNN is the simplest recurrent neural network. Figure

1 is a schematic diagram of the structure of the RNN

model.

Figure 1: RNN model structure.

𝑋

: Input data at moment t.

Train Recurrent Neural Network to Predict Stock Prices Using Daily Return Rate

489

𝐴

: The state of memory cells at moment t.

𝐴

=𝑡𝑎𝑛ℎ(𝑊

𝑋

+𝑊

𝐴

+𝑏

)

(3

)

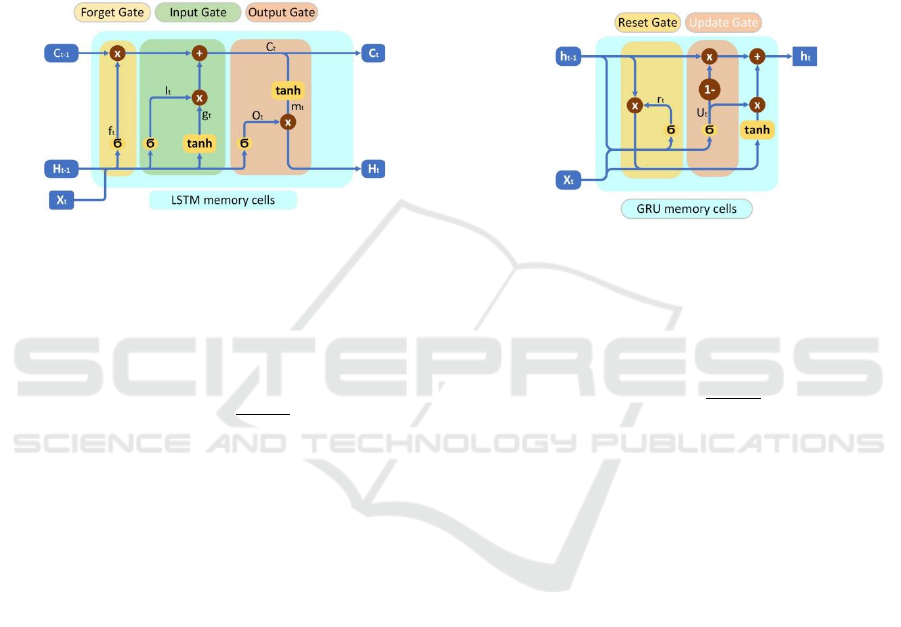

3.3 LSTM

The LSTM modifies the RNN model by designing a

memory cell with selective memory function. It can

memorize valuable information, filter out noise, and

reduce the burden on memory. Figure 2 is a schematic

diagram of the structure of the LSTM model.

Figure 2: LSTM model structure.

𝑐

: The state of memory cells at moment t.

ℎ

: The hidden state at moment t. In many cases, the

hidden state is output directly.

𝑥

: Input data at moment t.

σ: It represents an activation function. In this

experiment it is σ(x)=

(

)

tanh: It represents tanh(x) which can limit the data

to (-1,1).

⊙: It represents the multiplication of two vectors

element by element.

𝑓

: The forget gate at moment t. Decide what

information to forget.

f

=σ(W

x

+W

h

+b

) (4)

𝐼

: Input gate at moment t. Decide which new

memories to generate.

𝑔

: The candidate cell state. New memories are

generated based on the input, but not all of them

are useful and need to be multiplied by 𝐼

.

𝐼

=𝜎(W

x

+W

h

+b

)

(5)

𝑔

=𝑡𝑎𝑛ℎ(W

x

+W

h

+b

)

(6)

𝑂

: Output gate at moment t. Decide what

information to output.

𝑚

: All memories are output according to the state of

the memory cells. After being multiplied with

OT, it can output a useful part.

𝐶

=𝐶

⊙

𝑓

+𝑔

⨀𝐼

(7)

𝑂

=𝜎(W

x

+W

h

+b

)

(8)

𝑚

=𝑡𝑎𝑛ℎ(𝐶

)

(9)

ℎ

=𝑂

⊙𝑚

(10)

3.4 GRU

Compared with LSTM, the GRU model has a simpler

structure. Different from LSTM, an update gate and a

reset gate make up the GRU model. Because it has

fewer parameters, it is not easy to overfit. Figure 3 is

a schematic diagram of the structure of the GRU

model.

Figure 3: GRU model structure.

ℎ

: The hidden state at moment t. In many cases, the

hidden state is output directly.

𝑥

: Input data at moment t.

σ: It represents an activation function. In this

experiment it is σ(x)=

(

)

tanh: It represents tanh(x) which can limit the data

to (-1,1).

⊙: It represents the multiplication of two vectors

element by element.

𝑟

: The reset gate of moment t. It combines the new

input information with previous memories.

𝑟

=𝜎(W

x

+W

h

+b

)

(11)

𝑢

: The update gate of moment t. It removes useless,

repeatable memories and retains useful

memories.

𝑢

=𝜎(W

x

+W

h

+b

)

(12)

ℎ

=𝑡𝑎𝑛ℎ(W

x

+W

(h

⨀r

)

+b

)

(13)

ℎ

=(1−𝑢

)⨀ℎ

+𝑢

⨀ℎ

(14)

4 EXPERIMENT

4.1 Dataset

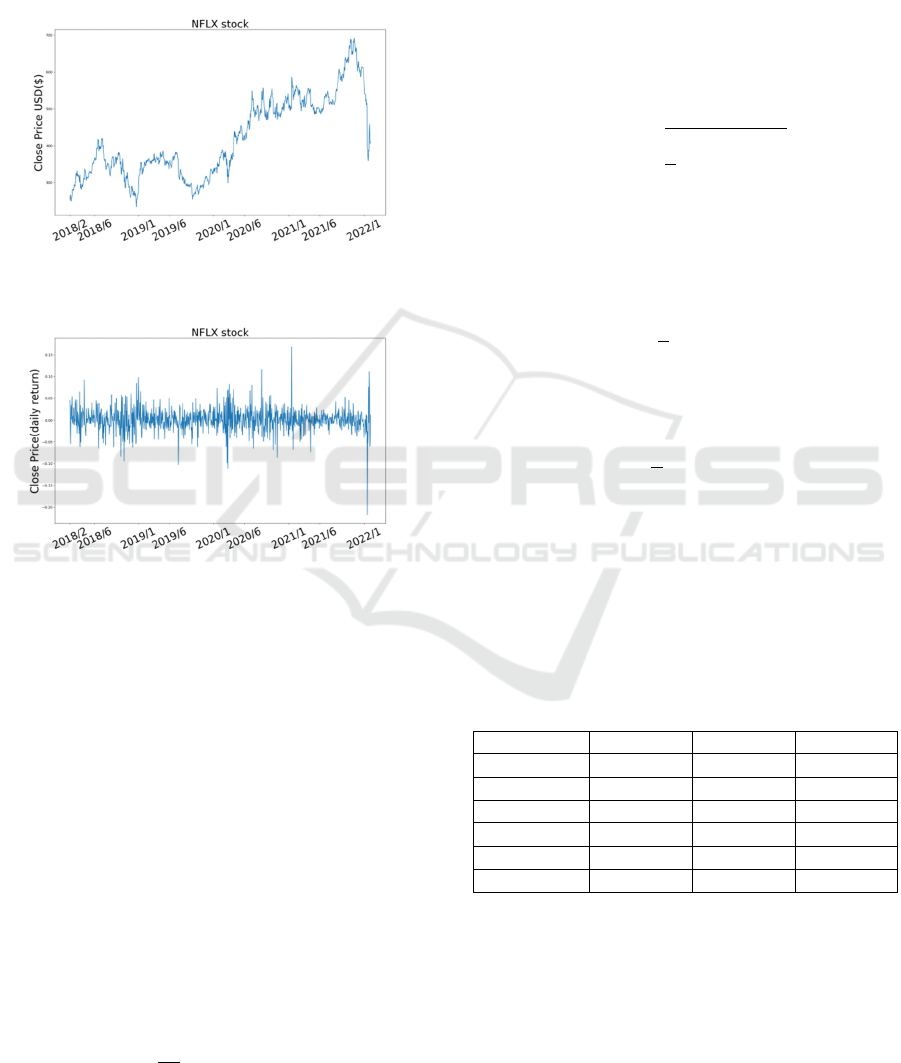

This experiment uses Netflix (NFLX) stock prices

from 2018.2 to 2022.2 as a data set (Verma, and Arti).

The dataset contains the date, closing price, opening

DAML 2024 - International Conference on Data Analysis and Machine Learning

490

price, volume, and other indicators of the NFLX stock.

In this experiment, the date and closing price are

worth paying attention to. Figure 4 shows the closing

price of NFLX.

Figure 5 shows the daily returns of NFLX .

Figure 4: Closing price of NFLX.

Figure 5: Daily return of NFLX.

In this experiment, 15% of the data was

segmented for detection, and the rest was used for

training.

4.2 Data preprocessing

This experiment uses minmax-scaler as the

normalization method (formula (1))

The control group (CG): directly normalize

the closing price and put it into the RNN, LSTM, and

GRU models as training data.

The experimental group (EG): firstly, convert

the closing price into the form of daily return

(Equation (2))

The second step is to average the daily return in

groups of ten as the data for that day: (𝑑𝑎𝑡𝑎

′ is the

average data of daily return)

data

′=

1

10

dail

y

return

(15)

Then put the average data of daily return into the

RNN, LSTM and GRU models as training data.

4.3 Evaluation metric

In this experiment, RMSE, MAE and MSE were used

as evaluation indicators. In the formula, y represents

the original value, 𝑦 represents the value of

prediction, and n represents how much data there is.

Root Mean Square Error (RMSE) is often used

to evaluate models that predict accurately. Because it

has a square term, it is sensitive to outliers.

RMSE(

y

,

y

)=

1

n

(

y

−

y

)

(16)

Mean Absolute Error (EAS) is a commonly used

loss function that is simple, intuitive, and easy to

calculate. It is suitable for comparison when the error

is obvious, but it is not conducive to the calculation

of gradients。

MAE(

y

,

y

)=

1

n

|

y

−

y

|

(17)

Mean Squared Error (MSE) is a derivable

formula which fit gradient descent algorithm. Also, it

has a square term, so it is sensitive to outliers.

MSE(

y

,

y

)=

1

n

(

y

−

y

)

(18)

4.4 Result

In this experiment, the final data was converted into a

daily return to calculate the RMSE, MAE, MSE.

Table 2 shows a comparison of the prediction

accuracy of the experimental and control groups in

different models.

Table 2: Comparison of CG and EG in different models.

Model RMSE MAE MSE

LSTM(CG)

3.03 × 10

1.82 × 10

9.19 × 10

LSTM(EG)

4.96 × 10

4.96 × 10

2.46 × 10

GRU(CG)

3.17 × 10

1.94 × 10

1.01 × 10

GRU(EG)

3.89 × 10

3.89 × 10

1.51 × 10

RNN(CG)

5.28 × 10

3.65 × 10

2.79 × 10

RNN(EG)

8.99 × 10

7.84 × 10

8.09 × 10

In the experiment, the effects of CG and EG

predictions in different models are also plotted.

Figure 6 is a comparison of stock prices predicted

using LSTM for the experimental and control groups.

Figure 7 is a comparison of stock prices predicted

using GRU for the experimental and control groups.

Figure 8 is a comparison of stock prices predicted

using RNN for the experimental and control groups

Train Recurrent Neural Network to Predict Stock Prices Using Daily Return Rate

491

Figure 6: CG and EG predict results in LSTM.

Figure 7: CG and EG predict results in GRU.

Figure 8: CG and EG predict results in RNN.

5 CONCLUSIONS

An in-depth analysis of the experimental data in

Table 2 shows a significant conclusion: the use of

daily returns as an input to the forecasting model

significantly improves the accuracy of forecasting

compared to the traditional method of using closing

prices. This finding was validated in three different

recurrent neural network models: LSTM, GRU, and

RNN. Specifically, the use of daily return showed an

increase in predictive power across all models, but

this improvement was particularly significant in the

GRU model, while the improvement effect was

relatively small in the RNN model.

This difference may be due to the unique

structural characteristics of the GRU model, which

effectively controls the flow of information through

update gates and reset gates, allowing the model to

better capture short-term dynamic changes in time

series data, which is especially important for data

with high frequency changes such as daily returns. In

contrast, RNN models may not be as effective as

GRU and LSTM models in dealing with such

complex data due to their simple structure, especially

in capturing long-term dependencies. Although the

LSTM model also shows a good performance

improvement, it may not have a significant

improvement effect when processing the daily return

data as well as the GRU model due to its more

complex gating mechanism.

These results further confirm the potential of

daily returns as an input to predictive models,

especially when using models such as GRU that can

efficiently handle short-term dynamic changes. This

finding has important practical implications for

financial analysts and investors, as it provides a new

perspective to improve stock market forecasting

models, which may lead to better investment

decisions and risk management strategies.

REFERENCES

Gao, Y., Wang, R., & Zhou, E. (2021). Stock prediction

based on optimized LSTM and GRU

models. Scientific Programming, 2021(1), 4055281.

Ghosh, A., Bose, S., Maji, G., Debnath, N., & Sen, S. (2019,

September). Stock price prediction using LSTM on

Indian share market. In Proceedings of 32nd

international conference on (Vol. 63, pp. 101-110).

Jahan, I., & Sajal, S. (2018). Stock price prediction using

recurrent neural network (RNN) algorithm on time-

series data. In 2018 Midwest instruction and

computing symposium. Duluth, Minnesota, USA:

MSRP.

Lase, S. N., Yenny, Y., Owen, O., Turnip, M., & Indra, E.

(2022). Application of Data Mining To Predicate

Stock Price Using Long Short Term Memory

Method. INFOKUM, 10(02), 1001-1005.

Moghar, A., & Hamiche, M. (2020). Stock market

prediction using LSTM recurrent neural

network. Procedia computer science, 170, 1168-1173.

Patel, J., Patel, M., & Darji, M. (2018). Stock price

prediction using RNN and LSTM. Journal of

Emerging Technologies and Innovative

Research, 5(11), 1069-1079.

Pawar, K., Jalem, R. S., & Tiwari, V. (2019). Stock market

price prediction using LSTM RNN. In Emerging

DAML 2024 - International Conference on Data Analysis and Machine Learning

492

Trends in Expert Applications and Security:

Proceedings of ICETEAS 2018 (pp. 493-503).

Springer Singapore.

Pramod, B. S., & Pm, M. S. (2020). Stock price prediction

using LSTM. Test Engineering and Management, 83,

5246-5251.

Rekha, G., D Sravanthi, B., Ramasubbareddy, S., &

Govinda, K. (2019). Prediction of stock market using

neural network strategies. Journal of Computational

and Theoretical Nanoscience, 16(5-6), 2333-2336.

Selvin, S., Vinayakumar, R., Gopalakrishnan, E. A., Menon,

V. K., & Soman, K. P. (2017, September). Stock price

prediction using LSTM, RNN and CNN-sliding

window model. In 2017 international conference on

advances in computing, communications and

informatics (icacci) (pp. 1643-1647). IEEE.

Singh, R., & Srivastava, S. (2017). Stock prediction using

deep learning. Multimedia Tools and Applications, 76,

18569-18584.

Srivastava, P., & Mishra, P. K. (2021, October). Stock

market prediction using RNN LSTM. In 2021 2nd

Global Conference for Advancement in Technology

(GCAT) (pp. 1-5). IEEE.

Verma, S., & Arti, S. Prediction of Netflix Stock Prices

using Machine Learning. Learning, 1(2), 9-14.

Zhong, X., & Enke, D. (2019). Predicting the daily return

direction of the stock market using hybrid machine

learning algorithms. Financial innovation, 5(1), 1-20.

Zhou, J. (2024). Predicting Stock Price by Using Attention-

Based Hybrid LSTM Model. Asian Journal of Basic

Science & Research, 6(2), 145-158.

Train Recurrent Neural Network to Predict Stock Prices Using Daily Return Rate

493