Analyzing Blockchain Consensus Mechanisms for Double-Spending

Attack Prevention

Jiasong Ye

a

Engineering Department, Shenzhen MSU-BIT University, Shenzhen, China

Keywords: Blockchain, Consensus Mechanisms, Double-Spending Attacks, Cryptocurrency.

Abstract: With the rapid development of blockchain technology, cryptocurrency transactions face increasing security

risks, particularly from double-spending attacks. This paper explores the effectiveness of various blockchain

consensus mechanisms in preventing these attacks. It examines the principles and applications of Proof of

Work (PoW), Proof of Stake (PoS), and Delegated Proof of Stake (DPoS) mechanisms, evaluating their

advantages and limitations. The paper provides a comprehensive classification and comparison of these

consensus methods, focusing on their strategies for countering double-spending threats. Through a blend of

theoretical analysis and methodological research, the study identifies the strengths and weaknesses of existing

mechanisms. Experimental results show that while PoW offers strong security, it is hindered by high energy

consumption and mining power centralization. In contrast, PoS and DPoS reduce energy consumption and

improve network flexibility but grapple with issues like power centralization and governance efficiency. This

research provides valuable insights for future improvements in blockchain consensus mechanisms and

enhances the security of cryptocurrency systems.

1 INTRODUCTION

In the Internet era, electronic payments have become

the mainstream method for daily transactions.

However, this reliance brings potential privacy risks

and data security issues, leading to public scepticism

about the ability of third-party institutions to protect

data. In the absence of a trust mechanism, there is an

urgent need for a new way for parties to conduct

transactions to ensure security and privacy (Kim et.al,

2008). Blockchain technology emerges as a solution

to these problems. Many institutions regard

blockchain as a key breakthrough for future

technological development, believing it has the

potential to fundamentally transform existing

business models. In 2008, a researcher under the

pseudonym “Satoshi Nakamoto” first proposed the

concept of digital cryptocurrency (Nakamoto, 2008).

He then introduced the concept of Bitcoin (Guth and

Leymann, 2018), marking the birth of blockchain

technology. Unlike the traditional monetary system,

where a central bank holds centralized control, the

Bitcoin system distributes the responsibility of

maintaining the ledger and issuing currency among

a

https://orcid.org/0009-0008-1157-3396

all participants. The primary issue that consensus

mechanisms in cryptocurrency systems address is

determining ownership as the currency circulates

(Pass and Shi, 2016).

Cryptocurrency consensus mechanisms can be

divided into permissionless and permissioned types

(Cryptape, 2016). In permissionless mechanisms,

Proof of Work (PoW) is the most representative

protocol, where all nodes have equal rights.

Permissioned protocols include Proof of Stake (PoS)

and Delegated Proof of Stake (DPoS), which are

applied in different scenarios based on the

authorization levels of nodes. The success of Bitcoin

is not only attributed to these consensus mechanisms

but also built on the foundation of early decentralized

digital currency systems such as b-money (Fujuan

et.al, 2024) and hashcash (Back, 2002), which first

realized a fully decentralized electronic cash system.

However, due to the network's decentralized nature,

the system is also vulnerable to malicious attacks,

such as double-spending and denial-of-service

attacks, which could disrupt its normal operation

(Mehar et.al, 2019). Studying Bitcoin's PoW

mechanism has played a crucial role in addressing the

432

Ye and J.

Analyzing Blockchain Consensus Mechanisms for Double-Spending Attack Prevention.

DOI: 10.5220/0013525500004619

In Proceedings of the 2nd International Conference on Data Analysis and Machine Lear ning (DAML 2024), pages 432-437

ISBN: 978-989-758-754-2

Copyright © 2025 by Paper published under CC license (CC BY-NC-ND 4.0)

issue of double-spending (Miller et.al, 2015). Before

the advent of blockchain technology, double-

spending could only be prevented through centralized

means. Bitcoin, through its decentralized PoW

mechanism, provided a novel solution, effectively

preventing this issue.

As blockchain technology advances and the value

of cryptocurrencies increases, attacks on these

systems have become more prevalent. In August

2010, a hacker exploited a vulnerability in Bitcoin's

code, creating over 18 billion Bitcoins, leading to

Bitcoin’s first hard fork. This marked the first major

attack on a PoW-based cryptocurrency. Since then,

attackers have increasingly targeted blockchain

mechanisms and ecosystems. For example, in 2012,

the Bitcoinica exchange was hacked, leading to the

theft of customers' Bitcoin keys, and in 2016, a smart

contract vulnerability on Ethereum caused the failure

of The DAO project, prompting another blockchain

fork. In 2018, Bitcoin Gold suffered a 51% attack,

and other cryptocurrencies like Beauty Chain and

Monacoin faced losses due to smart contract

vulnerabilities and selfish mining attacks. These

incidents underscore the risks in blockchain

applications. Researchers, including Satoshi

Nakamoto, have long warned of threats like the 51%

attack (Karame et.al, 2012). As computational power

centralizes, the risk of such attacks grows. To address

these vulnerabilities, this paper explores consensus

mechanisms in cryptocurrencies, particularly their

role in preventing double-spending attacks. By

categorizing different consensus models, the study

provides theoretical and practical insights to improve

cryptocurrency security.

2 METHODOLOGY

In the comprehensive examination of the

cryptocurrency landscape, addressing security

threats, particularly double-spending attacks, is

paramount. This paper focuses on analyzing the

consensus mechanisms used in cryptocurrencies and

explores their vital role in preventing such attacks. To

achieve this, an extensive literature review and

detailed case studies are conducted to classify and

evaluate different consensus mechanisms, such as

PoW, PoS, and DPoS. Each mechanism's strengths

and vulnerabilities are analyzed in relation to

security, revealing how they either mitigate or expose

systems to double-spending risks. Lastly, the study

compiles a set of targeted preventive strategies and

practical recommendations that enhance the

resilience of cryptocurrencies against various security

threats. These measures aim to safeguard users' assets

and maintain trust in digital transactions. The

research process, outlined in Figure 1, follows a

structured approach that includes reviewing current

practices, analyzing vulnerabilities, and proposing

actionable solutions.

Figure 1: The pipeline of this study (Picture credit:

Original).

2.1 Blockchain Technology and

Related Background

Blockchain technology originated in the late 1970s

when a computer scientist named Ralph Merkle filed

a patent for hash trees, also known as Merkle trees

(Merkle, 1987). These trees are a computer science

structure that links blocks through cryptography.

Blockchain is a distributed ledger technology that

records transaction information in a decentralized

manner, thereby eliminating the reliance on

centralized authorities. It forms an immutable data

chain by linking blocks in chronological order, where

each block contains a series of transactions,

timestamps, and the cryptographic hash of the

previous block. Each block includes several

transaction data and a hash value pointing to the

previous block to ensure the integrity and security of

the data (Lei and Gang, 2016). The data on the

blockchain is consistent over time because it cannot

be deleted or modified without network consensus.

Thus, blockchain technology can create immutable

ledgers to track orders, payments, accounts, and other

transactions. The system's built-in mechanisms

prevent unauthorized transaction entries and create

consistency in the shared view of these transactions

(Yidong and Xiaotong, 2012). Other characteristics

of blockchain technology include open consensus,

where anyone can participate in the blockchain

network, and each node has a complete copy of the

database, making the network open and transparent.

It is thrustless, requiring no reliance on a trusted third

party, as nodes collaborate according to rules, making

the system public and transparent, and difficult to

deceive other nodes. Anonymity links users' identities

to their public key addresses rather than their real

identities, enabling users to trade and use blockchain

anonymously. Traceability means that transaction

data carries timestamps, allowing each transaction to

be traced back to its origin, ensuring data integrity

and transparency.

Analyzing Blockchain Consensus Mechanisms for Double-Spending Attack Prevention

433

2.2 Consensus Mechanisms and

Double-Spending Attacks

2.2.1 PoW Module

This is the most widely used consensus mechanism,

initially implemented in Bitcoin. It relies on

computational power to solve complex cryptographic

puzzles. The first node to solve the puzzle gains the

right to add a new block and receives a corresponding

reward. This mechanism ensures network security by

requiring significant computational resources,

making it extremely costly for malicious actors to

control the network. The PoW mechanism is based on

competition among miners to solve cryptographic

puzzles that require substantial computational power.

The solution to this puzzle, known as the "proof,"

needs to be verified by the network before the block

can be added to the chain. The security of PoW is

reflected in its high computational cost and economic

penalties for double-spending attempts. An attacker

would need to control more than 51% of the network's

computing power to alter the blockchain, which is

nearly impossible for a large network like Bitcoin.

2.2.2 PoS Module

Unlike PoW, PoS selects validators based on the

number of tokens they hold and are willing to stake

as collateral. Validators are chosen to propose and

verify new blocks based on their staked assets,

reducing the need for extensive computational

resources. PoS aims to address the energy efficiency

issues of PoW and mitigate the "nothing-at-stake"

risk through penalty mechanisms. The PoS

mechanism allocates block validation rights based on

the amount of tokens held by validators. The selection

of validators follows a pseudo-random process,

considering factors such as the age of the staked

tokens and randomness. PoS reduces the

computational burden associated with PoW and

ensures network security through economic

incentives. Validators' staked assets are at risk, and if

they are found to behave maliciously, such as

attempting a double-spending attack, their staked

assets will be forfeited.

2.2.3 DPoS Module

DPoS introduces a voting system where token holders

elect a small number of representative nodes to verify

transactions and generate new blocks. This

mechanism maintains decentralization while

improving efficiency and transaction speed.

However, DPoS poses a centralization risk when

voting power is concentrated among a few large

stakeholders. DPoS builds on PoS by introducing an

election mechanism, where token holders vote to

elect a small number of witnesses to verify

transactions. This reduces the number of nodes

involved in the consensus, improving transaction

throughput and reducing latency. However, this

mechanism also introduces the risk of centralization,

as a few large stakeholders may dominate the network

through the voting process.

2.3 Double-Spending Attacks

Double-spending is one of the most threatening attack

forms in blockchain, referring to the situation in

digital currency systems where the same digital asset

is improperly used multiple times due to the

duplicability of data. In simple terms, it means the

same amount of digital currency is spent twice or

more.

Reasons for double-spending attacks include: 1.

Rapid Successive Transactions: Attackers may

quickly submit multiple new transactions before the

initial transaction is confirmed, attempting to double-

spend and make it difficult for the system to detect

and prevent this behavior in time;2. Use of Multiple

Identities: Attackers may use multiple identities to

submit transactions, increasing the chances of a

successful double-spending attack;3. Control of

Multiple Nodes: Attackers may try to control multiple

nodes or participate in multiple mining pools to

increase the probability of a successful double-

spending attack. For example, conducting a 51%

attack to control the entire blockchain network,

enabling the attacker to publish fraudulent

transactions and thus perform a double-spending

attack. Types of double-spending attacks include:1.

Finney Attack: The attacker privately mines a block

containing another transaction. Once the initial

transaction is confirmed, the attacker publishes this

privately mined block, effectively performing a

double-spend and successfully stealing funds;2. Race

Attack: The attacker broadcasts another transaction to

part of the network while simultaneously mining a

block that does not include that transaction. If the

alternative transaction is confirmed before the

legitimate one, the attacker can successfully double-

spend;3. Vector76 Attack: This attack targets

cryptocurrencies that rely on the BIP16 payment

protocol variant. By exploiting vulnerabilities in the

payment protocol, the attacker can execute a double-

spending attack.

DAML 2024 - International Conference on Data Analysis and Machine Learning

434

2.4 Prevention of Double-Spending

from the Perspective of Consensus

Mechanisms

In PoW, nodes compete to solve complex

mathematical problems, granting them the right to

add blocks to the blockchain. Bitcoin’s

decentralization ensures that transaction legitimacy is

collectively verified, and only when the majority

agrees is a transaction confirmed. To counter double-

spending, PoW relies on dispersing computational

power across the network. By making it economically

unfeasible for attackers to control over 51% of the

network’s computing power, PoW deters such

attacks. Additional security is achieved by increasing

transaction confirmation requirements and total hash

rates, which raise the cost of reorganizing the chain.

Moreover, random block production mechanisms,

such as Bitcoin-NG and Greedy Heaviest Observed

Subtree (GHOST), add unpredictability to block

creation, making it harder for attackers to exploit the

system. PoS introduces stake locking and penalties

for malicious behavior, such as attempting double-

spending attacks. Validators must lock tokens as

collateral, and if caught acting maliciously, they lose

their stake, significantly raising the cost of attacks.

Validators are also selected randomly, preventing

attackers from predicting or controlling the block

production order. Additionally, PoS utilizes a

committee of validators to approve blocks, further

decentralizing control and making it difficult for an

attacker to succeed with double-spending. DPoS

focuses on node management and supervision. Token

holders elect supernodes to verify transactions, and

malicious nodes can be replaced via voting if

necessary. Real-time monitoring and dynamic

penalties ensure that nodes exhibiting harmful

behavior are immediately penalized. Observer nodes

provide an additional layer of oversight, reporting any

abnormal actions to the community, ensuring a fair

and secure blockchain system through collective

governance.

3 RESULT AND DISCUSSION

3.1 Comparative Analysis of Consensus

Mechanisms

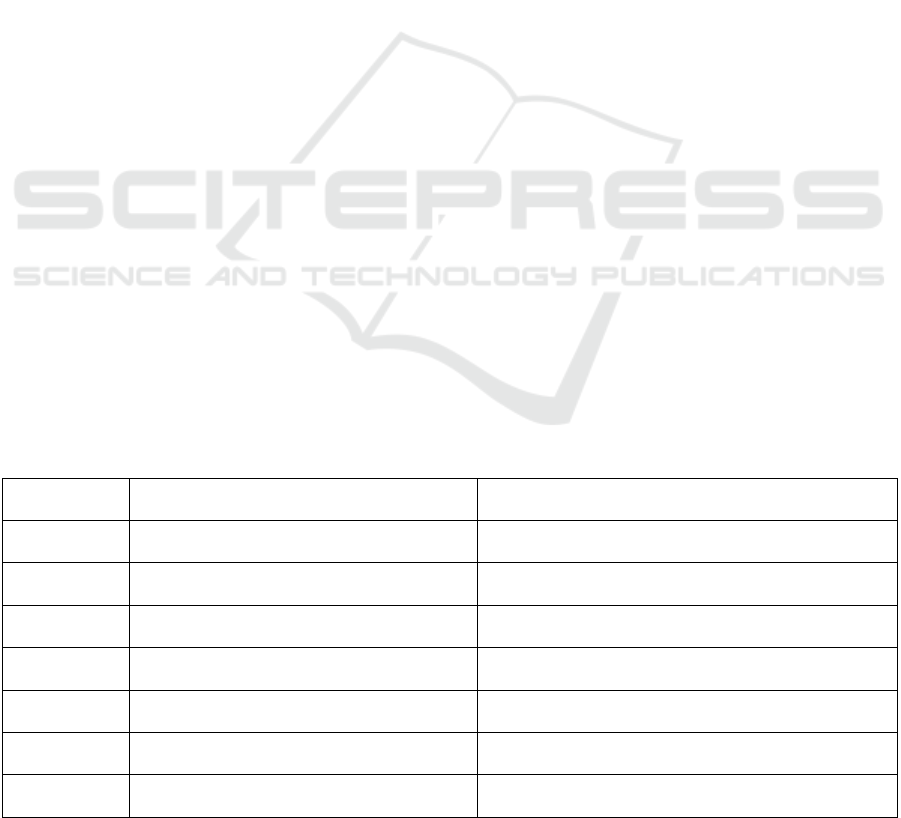

Table 1 summarizes the double-spending prevention

measures in permissionless and permissioned

consensus mechanisms. In permissionless systems

like PoW, security is achieved through

decentralization and the distribution of computational

power. By making it costly for an attacker to control

over 51% of the network, PoW reduces the risk of

double-spending. Additional measures include

multiple block confirmations, increasing the network

hash rate, and randomizing block generation through

mechanisms like Bitcoin-NG and GHOST. Despite

its strengths, PoW faces challenges such as high

energy consumption, long confirmation times, and

the risk of mining pool centralization, which could

increase vulnerability to attacks. Permissioned

mechanisms like PoS and DPoS take a different

approach. PoS raises the economic cost of attacks by

requiring validators to lock tokens as collateral and

randomly selecting validators to prevent attack

planning. However, PoS risks centralization due to

wealth accumulation. DPoS enhances security

through elected supernodes and real-time node

monitoring, but faces potential issues with vote

manipulation and centralization.

Table 1: The double-spending prevention measures.

Mechanism

Type

Preventive Measures Specific Characteristics

PoW 1. Increase transaction confirmation count Increase the difficulty of reorganizing the chain within

a short

p

eriod of time for attackers

2. Increase network total computing power Raise the economic cost of controlling 51% of the

com

p

utin

g

p

ower

3. Encourage mining decentralization Avoid concentration of computing power in a few

mining pools, reducing single entity control risk

PoS 1. Staking lock-up and penalty mechanism Lock up tokens as collateral, punish malicious actors

b

y deducting part or all of the collateral

2. Random selection of validators Difficult to predict validators, enhance unpredictability

a

g

ainst attackers

DPoS 1. Node election and replacement

mechanis

m

Token holders vote to elect and replace malicious

nodes, strengthen network resilience

2. Node behavior monitoring and dynamic

p

enalty mechanism

Monitor node behavior, revoke eligibility and deduct

collateral from malicious actors

Analyzing Blockchain Consensus Mechanisms for Double-Spending Attack Prevention

435

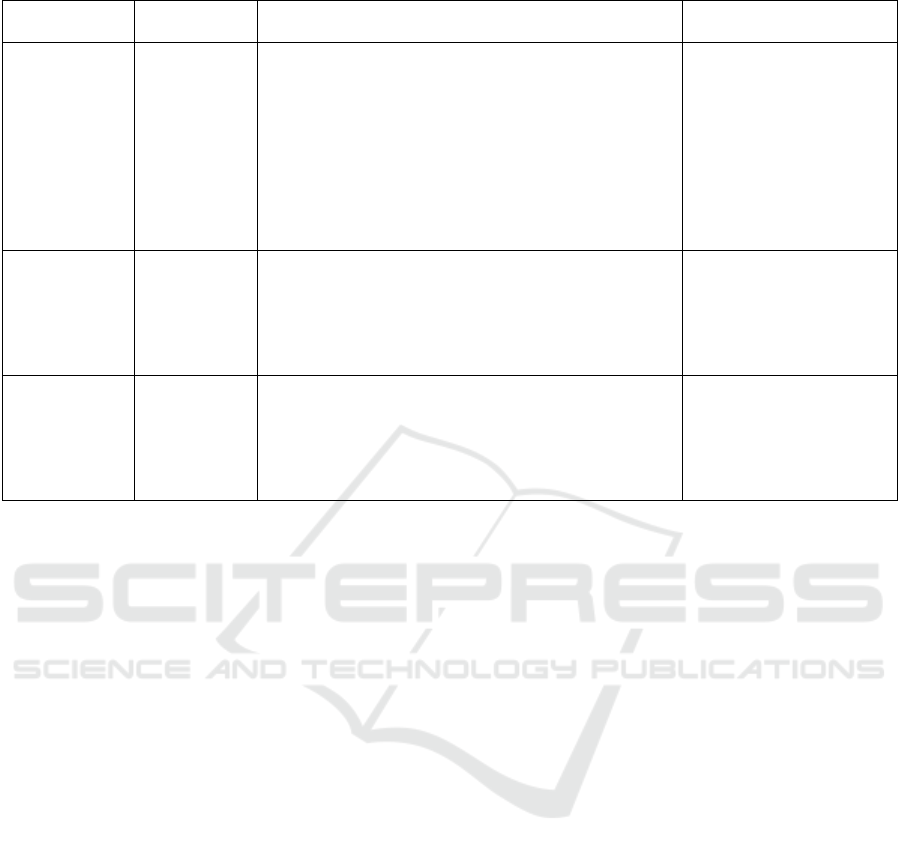

Table 2: Advantage and disadvantage of different methods.

Consensus

Mechanis

m

Type Advantage Disadvantage

PoW No

authorization

1. Decentralization, any node has the opportunity

to participate.

2. The cost of a 51% attack is high, reducing the

risk of double-spending attacks.

3. The number of transactions confirmed

improves security.

4. Increasing network computing power reduces

the risk of being attacked.

5.Randomized block mechanisms increase

un

p

redictabilit

y

.

1.High energy

consumption issues affect

sustainability.

2.Longer transaction

confirmation times affect

user experience.

3.Mining concentration

may lead to centralization

of computing power and

increased risks.

PoS Authorization 1. Staking currency as collateral increases the cost

of malicious behavior.

2. Randomly selecting validators reduces

predictability for attackers.

3. The validator committee mechanism enhances

securit

y

.

1.It may lead to a “rich get

richer” phenomenon,

increasing centralization

risks.

DPoS Authorization 1. Selecting super nodes increases flexibility.

2. Real-time monitoring of node behavior quickly

eliminates malicious nodes.

3.Improve network anti-attack capabilities.

1.Centralization risks,

voting manipulation

issues.

2.Weakening the

efficiency of community

governance.

Overall, the PoW mechanism provides robust

security against double-spending attacks, but its

drawbacks in terms of energy consumption and user

experience are evident. In contrast, PoS and DPoS

excel in terms of cost-effectiveness and flexibility,

but they also face challenges such as power

concentration and governance efficiency. Future

consensus mechanisms may combine these strengths

to form hybrid models that achieve higher security,

efficiency, and sustainability, further reducing the

risk of double-spending attacks. Table 2 summarizes

the strengths and weaknesses of PoW, PoS, and DPoS

in preventing double-spending attacks.

3.2 Future Development Directions

The future of blockchain consensus mechanisms may

evolve towards hybrid models that combine the

advantages of PoW, PoS, and DPoS to enhance the

security, efficiency, and sustainability of blockchain

networks. Initially, the decentralized computing

power of the PoW mechanism can be used to ensure

network security and resistance to attacks, preventing

double-spending in the early stages. Then, the PoS

staking mechanism can be adopted, allowing token

holders to lock their tokens as collateral to reduce

energy consumption and resource usage. Finally, by

introducing DPoS’s fast election and voting

mechanisms, the transaction validation speed and

network efficiency can be improved.

To mitigate the high energy consumption of PoW

and the centralization issues of PoS and DPoS, new

mechanisms may incorporate randomness in

validation and dynamic node adjustment strategies,

such as randomly selecting validators and using

multi-layer consensus structures to decentralize

validation power. These strategies aim to ensure

decentralization and flexibility, enhancing the

system's security and resistance to attacks. The

development of the blockchain ecosystem will be a

significant trend in the future. As blockchain

technology integrates with existing financial systems,

compliance and regulation will become key factors.

This will drive developers to consider legal and

regulatory requirements when designing consensus

mechanisms, thereby reducing the risk of double-

spending attacks and increasing user trust. Finally,

community participation and governance models will

gradually evolve. Future consensus mechanisms will

place greater emphasis on community governance by

designing fair and transparent election mechanisms

and governance structures to enhance user

engagement and trust in the network. This shift will

foster a more secure, efficient, and fair blockchain

network, making malicious behaviors such as double-

spending more difficult to execute. In conclusion, the

future development of blockchain will rely on

technological advancements, community

governance, and ecosystem refinement to achieve

higher levels of security and sustainability.

DAML 2024 - International Conference on Data Analysis and Machine Learning

436

4 CONCLUSIONS

This paper has analyzed the effectiveness of different

blockchain consensus mechanisms—PoW, PoS, and

DPoS—in preventing double-spending attacks.

Through detailed examination of their strategies and

application scenarios, it is evident that each

mechanism offers distinct advantages and drawbacks.

PoW provides robust security but suffers from high

energy consumption and risks related to the

concentration of computational power. PoS and

DPoS, while improving network efficiency and

reducing energy usage, face issues of centralization

and governance inefficiencies. Future research will

explore hybrid consensus mechanisms that blend the

strengths of PoW, PoS, and other emerging methods

to enhance blockchain security and scalability.

Further investigation will focus on optimizing these

mechanisms for specific applications, improving

transaction speed while minimizing risks of double-

spending. Additionally, enhancing governance

structures within the blockchain ecosystem will be

essential in creating a more secure, efficient, and

sustainable digital currency network. This approach

aims to strengthen the foundation for future

blockchain systems and their security protocols.

REFERENCES

Back, A., 2002. Hashcash-a denial of service counter-

measure.

Cryptape, 2016. Consensus calculation. The engine of

blockchain.

Fujuan, L., Zhuo, M., Qun, W., 2024. Overview of identity

management mechanism of blockchain system. Journal

of Computer Engineering & Applications, 60(1).

Guth, J., & Leymann, F., 2018. Towards pattern-based

rewrite and refinement of application architectures.

Advanced summer school on service-oriented

computing. IBM Research Division, 90-100.

Karame, G.O., Androulaki, E., & Capkun, S. 2012. Double-

spending fast payments in bitcoin. In Proceedings of the

ACM conference on Computer and communications

security, 906-917.

Kim, D.J., Ferrin, D.L., & Rao, H.R., 2008. A trust-based

consumer decision-making model in electronic

commerce: The role of trust, perceived risk, and their

antecedents. Decision support systems, 44(2), 544-564.

Lei, T., Gang, C., 2016. Blockchain 2.0. Chinese

informatization, 8.

Mehar, M.I., Shier, C.L., Giambattista, A., Gong, E.,

Fletcher, G., Sanayhie, R., & Laskowski, M. 2019.

Understanding a revolutionary and flawed grand

experiment in blockchain: the DAO attack. Journal of

Cases on Information Technology, 21(1), 19-32.

Merkle, R.C. 1987. A digital signature based on a

conventional encryption function. In Conference on the

theory and application of cryptographic techniques,

369-378.

Miller, A., Kosba, A., Katz, J., & Shi, E. 2015.

Nonoutsourceable scratch-off puzzles to discourage

bitcoin mining coalitions. In Proceedings of the acm

sigsac conference on computer and communications

security, 680-691.

Nakamoto, S., 2008. Bitcoin: A peer-to-peer electronic cash

system. Satoshi Nakamoto.

Pass, R., & Shi, E., 2016. Hybrid consensus: Scalable

permissionless consensus.

Yidong, C., Xiaotong, Z., 2012. An economic analysis of

the new currency Bitcoin. Modern economic

information, 16, 8-8.

Analyzing Blockchain Consensus Mechanisms for Double-Spending Attack Prevention

437