Hybrid Consensus Model for Blockchain Networks: Integrating Raft

and PBFT for Enhanced Scalability and Performance

Zeqi Wang

a

Faculty of Information Technology, Monash University, Clayton, Australia

Keywords: Hybrid Consensus Model; Raft Algorithm; PBFT; Blockchain Networks.

Abstract: This research investigates the integration of Reliable, Replicated, Redundant, And Fault-Tolerant (Raft)

algorithm and Practical Byzantine Fault Tolerance (PBFT) consensus mechanisms to address scalability and

performance limitations in blockchain networks, with a focus on financial applications. The objective is to

develop a hybrid consensus model that combines Raft’s efficient and rapid consensus process with PBFT’s

robust fault tolerance. The proposed model leverages Raft's decentralized voting procedure to improve system

responsiveness while utilizing PBFT to ensure secure and accurate data consensus in environments prone to

Byzantine faults. Extensive simulations were conducted to evaluate the hybrid model's performance. The

results demonstrate that integrating Raft and PBFT not only preserves high throughput and reliability but also

significantly enhances scalability, making the model particularly suitable for complex and security-sensitive

applications, such as payment systems and digital currencies. This research highlights the practical benefits

of hybrid consensus models in overcoming the inherent challenges of deploying blockchain technology in

critical financial services. It suggests future research directions for broader applications across various sectors

that require robust, scalable, and secure blockchain solutions.

1 INTRODUCTION

Blockchain technology's most well-known

application in the financial sector is Bitcoin, first

introduced by Satoshi Nakamoto in 2008 (Nakamoto,

2008). As this technology continues to evolve, it has

spurred numerous innovations that are bringing

profound changes to key financial areas such as

payment systems and securities trading (Javaid et.al,

2022). While Bitcoin and Ethereum pioneered

decentralized digital currencies, later technologies

like Ripple and Stellar were specifically designed to

address cross-border payments. As Pahlajani et al.

suggest, these newer platforms adopt different

consensus algorithms to enhance transaction

efficiency and security, marking a significant

advancement in blockchain's application to global

finance (Pahlajani et.al, 2019). This evolution

demonstrates how blockchain technology is being

tailored to meet specific financial sector needs

beyond its original cryptocurrency use case.

Blockchain platforms such as Ripple and

CoinExpress illustrate the potential to streamline

a

https://orcid.org/0009-0007-7989-5642

financial transactions by reducing intermediaries,

lowering costs, and enhancing security through

decentralized ledgers and efficient payment routing

mechanisms. These improvements address the

limitations of traditional systems like Society for

Worldwide Interbank Financial Telecommunications

(SWIFT), which, while highly secure and

standardized, face challenges in terms of transaction

speed, transparency, and costs due to their reliance on

multiple intermediaries (Pahlajani et.al, 2019; Qiu

et.al, 2019; Yu et.al, 2018). The contrast between

blockchain-based solutions and traditional financial

systems highlights the transformative potential of this

technology in reshaping global financial

infrastructure.

Despite advancements in blockchain technology

that ensure transaction integrity and non-repudiation

through decentralized architecture and digital

signatures, its broader application in payment systems

is hindered by challenges related to efficiency,

security, scalability, and limited transaction speed.

These issues are especially pronounced in high-

throughput environments, where processing large

Wang and Z.

Hybrid Consensus Model for Blockchain Networks: Integrating Raft and PBFT for Enhanced Scalability and Performance.

DOI: 10.5220/0013517800004619

In Proceedings of the 2nd International Conference on Data Analysis and Machine Learning (DAML 2024), pages 365-368

ISBN: 978-989-758-754-2

Copyright © 2025 by Paper published under CC license (CC BY-NC-ND 4.0)

365

volumes of real-time transactions requires efficient

consensus mechanisms that are difficult to implement

without compromising decentralization, as noted by

Kim and Kim (Kim et.al, 2020). However, consensus

algorithms like Reliable, Replicated, Redundant, And

Fault-Tolerant (Raft) and Practical Byzantine Fault

Tolerance (PBFT) offer specific strengths that can

help address these scalability and performance

challenges (Yang et.al, 2022).

The Raft algorithm is characterized by its

simplicity, efficiency, and low latency, making it

commonly used in real-time transaction processing

within private blockchains. As for PBFT, Yang et al.

argue that its robust fault tolerance ensures data

consistency even in the presence of malicious nodes,

a feature that is crucial for maintaining the security

and reliability of consortium blockchains (Yang et.al,

2022). Despite their individual merits, both Raft and

PBFT face inherent limitations. Raft's simplicity may

lead to insufficient fault tolerance, while PBFT, due

to its high communication overhead and scalability

issues, may perform less efficiently in larger

networks.

This study proposes a hybrid consensus model

that combines the advantages of both the Raft

algorithm and PBFT to address the limitations of

existing consensus mechanisms. Wang et al.

demonstrated the feasibility of integrating multiple

algorithms for robust and scalable digital payment

solutions, this research takes a step further (Wang

et.al, 2023). The proposed hybrid model leverages the

efficiency of Raft and the fault tolerance of PBFT to

enhance the performance, scalability, and security of

blockchain-based payment systems.

As a new consensus mechanism, the integration of

Raft and PBFT not only accelerates transaction

processing and reduces latency but also ensures

secure financial transactions. By addressing the

limitations of current blockchain applications in the

financial sector, this research contributes to the

development of more efficient, secure, and scalable

blockchain technologies. The resulting model is

expected to significantly improve the practical

implementation of blockchain systems in real-world

financial scenarios.

2 METHODOLOGIES

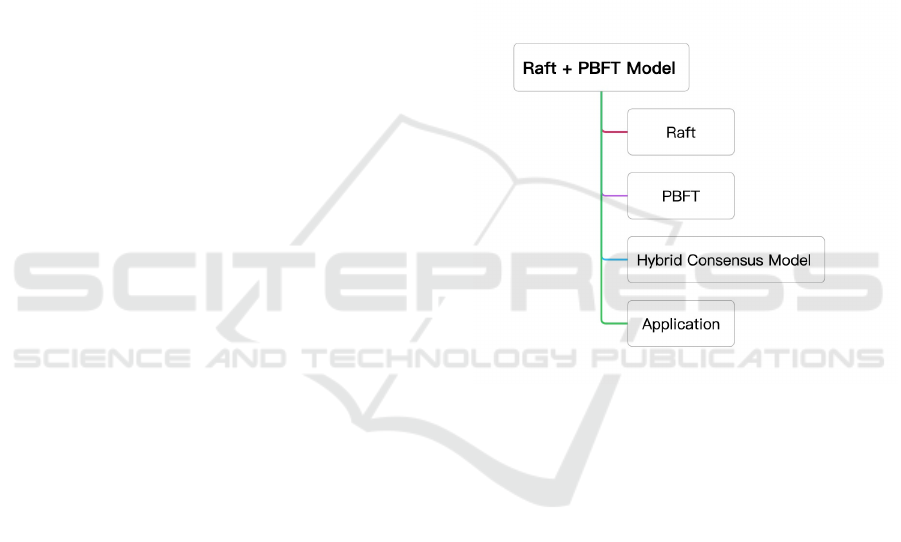

This study focuses on developing a resilient system

for high-volume payment processing by integrating

the Raft and PBFT algorithms into a hybrid consensus

model. Figure 1 illustrates a structured diagram of the

hybrid model, showcasing the integration of Raft and

PBFT for blockchain applications. The model

combines Raft’s efficiency and simplicity in leader

election and log replication with PBFT’s robustness

in ensuring data consistency and fault tolerance under

malicious conditions. This hybrid approach seeks to

address the limitations and strengths of each

algorithm—specifically, Raft’s lack of BFT and

PBFT’s challenges with scalability and

communication overhead. By merging these

characteristics, the model aims to achieve a balanced

solution that enhances both performance and security.

The ultimate goal is to implement this hybrid

consensus model in high-volume, security-critical

payment systems to ensure optimal performance and

robust security.

Figure 1: The structure of this model (Picture credit:

Original).

2.1 Raft

The Raft consensus algorithm is recognized for its

simplicity, high throughput, and low latency, making

it particularly suitable for private blockchains.

According to Huang et al., Raft's leader-based

approach ensures efficient log replication, reliable

leader election, and robust safety features,

contributing to its reliable consensus and optimal

resource utilization. Similarly, Macpherson and

Goodell highlight Raft’s effectiveness in blockchain

redesigns, using it to enhance efficiency and focus

functionality based on its proven performance

(Macpherson et.al, 2024). However, Raft is not

designed to handle BFT scenarios, as it assumes that

failures are non-malicious (i.e., crash failures),

meaning nodes may stop but will not behave

maliciously. This limitation affects Raft ’ s

applicability in environments where nodes might act

DAML 2024 - International Conference on Data Analysis and Machine Learning

366

arbitrarily or maliciously, such as those prone to

Byzantine faults (Ongaro and Ousterhout, 2014).

2.2 PBFT

PBFT is a consensus algorithm widely used in

blockchain alliance chains, introduced by Castroin

1999 as an improvement over the original BFT

algorithm (Castro and Liskov, 1999). Yang et al.

consider PBFT to be the most prevalent consensus

algorithm for blockchain alliance chains but highlight

significant limitations in terms of scalability,

communication complexity, and fault tolerance

(Yang et.al, 2022). These issues, they argue, confine

PBFT’s effectiveness to smaller networks, making it

less suitable for larger and more demanding

applications, such as financial services. Similarly,

Zhang and Li recognize that PBFT's three-phase

commit protocol leads to substantial communication

overhead, especially in large-scale systems with

numerous nodes, which ultimately limits its overall

efficiency (Zhang and Li, 2018).

2.3 Hybrid Consensus Model

Before delving into the hybrid consensus model

integrating Raft and PBFT, it is essential to explore

other notable hybrid models that have been

implemented in blockchain technology. These

models demonstrate how different consensus

algorithms can be combined to enhance performance,

scalability, and security. Kwon outlines a hybrid

model that integrates Tendermint's BFT consensus

with Proof of Stake (PoS) to eliminate the need for

energy-intensive mining, as seen in Proof of Work

(PoW) systems like Bitcoin (Kwon, 2014). This

model leverages BFT for fast and secure consensus

finality, while PoS ensures that validators with a stake

in the network maintain its security and stability by

locking up their coins, aligning their interests with the

network’s well-being. Zhang et al. propose a hybrid

model for Central Bank Digital Currency (CBDC)

that integrates Delegated Proof of Stake (DPOS) and

PBFT to enhance transaction throughput and

scalability (Zhang et.al, 2021). The model combines

an account-based system for handling frequent, small

transactions with an unspent transaction output

(UTXO) model for managing larger, less liquid

assets, while employing a modular architecture that

optimizes node functionality.

Following the exploration of these hybrid models,

this research focuses on a new hybrid consensus

model that integrates Raft and PBFT to address the

efficiency and scalability challenges common in

payment systems. By combining Raft’s low-latency

consensus mechanism with PBFT’s ability to BFT,

the model ensures both performance and security in

high-throughput environments.

3 RESULT AND DISCUSSION

The discussion section will evaluate the advantages

and drawbacks of both the Raft and PBFT models,

while also exploring future research directions.

Focusing initially on Raft, its unique qualities such as

simplicity, high throughput, and low latency make it

particularly well-suited for private blockchain

networks like those developed by Macpherson and

Goodell (Macpherson et.al, 2024). They have utilized

Raft to redesign an innovative digital payment

infrastructure that manages retail CBDCs, which

enhances user privacy and enables direct asset

custody. This system processes transactions in real-

time without sacrificing reliability and data integrity,

even under conditions where up to half of the network

nodes fail. This resilience, praised by Huang et al.

(Huang et.al, 2020), confirms Raft's suitability for

environments requiring predictable and robust

operations, particularly where nodes are non-

malicious and extensive transaction verification is

unnecessary.

Transitioning to PBFT, this algorithm ensures

accurate data consensus within a distributed network,

even amidst Byzantine nodes engaging in malicious

activities, making it one of the most widely adopted

consensus mechanisms. Building on PBFT's

foundation, Yang et al. have developed Nested

Byzantine Fault Tolerance (NBFT), which integrates

a consistent hashing algorithm to improve node

selection and grouping, thereby enhancing fault

tolerance and scalability (Yang et.al, 2022).

Similarly, Zhang and Li have proposed the Group-

Hierarchy (GH) model based on PBFT, employing a

layered approach to achieve both local and global

consensus across divided groups within a system

(Zhang and Li, 2018). This architecture streamlines

the consensus process and exemplifies PBFT’s

flexibility and effectiveness when integrated with

other models. Such adaptability is crucial for

enhancing the overall effectiveness of consensus

mechanisms in distributed systems, including

potential synergies between Raft and PBFT.

Zhang et al. proposed a hybrid model known as

Proof of Authority-Practical Byzantine Fault

Tolerance (POA-PBFT), which is a fusion of Proof of

Authority and PBFT (Zhang et.al, 2021). This model

enhances the traditional DPOS-BFT by specifically

Hybrid Consensus Model for Blockchain Networks: Integrating Raft and PBFT for Enhanced Scalability and Performance

367

tailoring the block production sequence and

consensus mechanisms for CBDCs. This design

significantly bolsters the security and efficiency of

the blockchain network. Unlike Raft’s decentralized

voting process where nodes democratically elect a

leader, POA-PBFT uses a central authority to appoint

bookkeeping nodes, simplifying the election process

and ensuring stable node operations. This centralized

appointment mechanism is particularly suited to the

unique requirements of CBDCs, ensuring controlled

and stable operations within the blockchain

environment tailored for digital currencies managed

by central banks. The Raft-PBFT hybrid model

presents a more suitable option for blockchain

applications by combining Raft’s decentralized

voting process with PBFT's stringent control

mechanisms. This synergy allows the model to

benefit from Raft’s streamlined leader election

process, enhancing system responsiveness and

robustness, while also incorporating PBFT’s capacity

to ensure accurate data consensus in the presence of

Byzantine faults. Consequently, this hybrid model

capitalizes on the strengths of both consensus

mechanisms, enhancing the overall reliability and

efficiency of the system. This makes it a particularly

effective solution for complex blockchain

environments, especially within payment system.

4 CONCLUSIONS

This study investigated the integration of Raft and

PBFT consensus algorithms to address scalability and

performance issues in blockchain networks,

particularly within the financial sector. The proposed

hybrid consensus model combines Raft’s efficiency

with PBFT’s robust fault tolerance, aiming to

optimize blockchain-based payment systems. By

thoroughly analyzing the advantages and limitations

of each algorithm, the research introduces a

synergistic solution that overcomes existing

limitations and enhances transaction processing

speed, system reliability, and scalability.

Future research will focus on designing and

implementing this hybrid consensus model to validate

its applicability in real-world payment systems. This

will include conducting detailed simulations and

experimental tests to assess the model’s performance

in managing the complexities of actual financial

transactions. Additionally, subsequent studies will

address potential challenges during the

implementation and operational phases, such as

integrating the distinct consensus mechanisms of Raft

and PBFT and ensuring their cohesive operation

within a unified system.

REFERENCES

Castro, M., Liskov, B., 1999. Practical byzantine fault

tolerance. OsDI. 99(1999), 173-186.

Huang, D., Ma, X., Zhang, S., 2020. Performance analysis

of the raft consensus algorithm for private blockchains.

IEEE Transactions on Systems, Man, and Cybernetics:

Systems, 50(1), 172-181.

Javaid, M., Haleem, A., Singh, R.P., et al. 2022. A review

of Blockchain Technology applications for financial

services. BenchCouncil Transactions on Benchmarks,

Standards and Evaluations, 2(3), 100073.

Kim, S.I., Kim, S.H., 2020. E-commerce payment model

using blockchain. Journal of Ambient Intelligence and

Humanized Computing, 13(3), 1673-1685.

Kwon, J., 2014. Tendermint: Consensus without mining.

Draft v. 0.6, fall, 1(11), 1-11.

Macpherson, W., Goodell, G., 2024. Benchmarking the

performance of a self-custody, non-ledger-based,

obliviously managed digital payment system. arXiv

preprint: 2404.12821.

Nakamoto, S., 2008. Bitcoin: A peer-to-peer electronic cash

system. Satoshi Nakamoto.

Ongaro, D., Ousterhout, J., 2014. In search of an

understandable consensus algorithm. USENIX annual

technical conference, 305-319.

Pahlajani, S., Kshirsagar, A., Pachghare, V., 2019. Survey

on private blockchain consensus algorithms.

International Conference on Innovations in Information

and Communication Technology, 1-6.

Qiu, T., Zhang, R., Gao, Y., 2019. Ripple vs. SWIFT:

Transforming cross border remittance using blockchain

technology. Procedia computer science, 147, 428-434.

Wang, Z.F., Liu, S.Q., Wang, P., et al. 2023. BW-PBFT:

Practical byzantine fault tolerance consensus algorithm

based on credit bidirectionally waning. Peer-to-Peer

Networking and Applications, 16(6), 2915-2928.

Yang. J., Jia. Z., Su. R., et al. 2022. Improved fault-tolerant

consensus based on the PBFT algorithm. Ieee Access,

10, 30274-30283.

Yu, R., Xue, G., Kilari, V.T., et al. 2018. CoinExpress: A

fast payment routing mechanism in blockchain-based

payment channel networks. International conference on

computer communication and networks, 1-9.

Zhang, J., Tian, R., Cao, Y., et al. 2021. A hybrid model for

central bank digital currency based on blockchain.

IEEE Access, 9, 53589-53601.

Zhang, L., Li, Q., 2018. Research on consensus efficiency

based on practical byzantine fault tolerance.

International conference on modelling, identification

and control, 1-6.

DAML 2024 - International Conference on Data Analysis and Machine Learning

368