Advances in Artificial Intelligence for Stock Price Prediction: A

Comprehensive Investigation of Models and Applications

Tianai Chen

a

The Middle School Attached to Hebei Normal University, Shijiazhuang, Hebei, China

Keywords: Stock Price Prediction, Machine Learning, Artificial Intelligence.

Abstract: Traditional prediction models in stock price prediction are inefficient due to market changes. Artificial

Intelligence (AI) technologies have improved stock price forecast precision and adaptability. The steps in the

machine learning process are gathering and preparing data, training and testing sets, random forest machine

learning approaches, and deploying models for real-world applications. Regression and classification issues

are handled by employing strategies such as multivariate linear regression, decision trees, and random forests

to predict continuous target variables. Decision trees capture non-linear connections and are resistant to

outliers. In order to solve the vanishing gradient issue and beat conventional Recurrent Neural Networks

(RNNs) including audio recognition, time series forecasting, and handwriting identification, recurrent neural

networks with Long Short-Term Memory (LSTM) are employed. Deep learning algorithms are increasingly

replacing linear regression in AI stock price prediction due to complex nonlinear relationships in the market.

These models can process large amounts of data for pattern recognition and feature extraction, increasing

prediction accuracy. However, AI models face limitations such as not providing detailed explanations for

patterns, not being efficient for different stocks, and not considering external effects. Some advanced methods

such as expert systems and transfer learning could be considered to solve these limitations.

1 INTRODUCTION

Stocks are the main instrument used by investors in

the capital market; they are securities that symbolize

ownership in a corporation. Stock forecasting is

essential for investors looking for returns since price

changes in stocks are a reflection of market

expectations regarding a company's future prospects.

However, conventional stock prediction models have

limited accuracy because they are unable to quickly

adjust to changes in the market, even though they are

frequently based on financial theory. Recently, the

use of computer algorithms for stock price prediction

has advanced with the development of artificial

intelligence technologies. Artificial Intelligence (AI)

models can better capture the complex driving

reasons behind stock price volatility by extracting

characteristics and identifying patterns from massive

volumes of historical data. This improves prediction

accuracy and flexibility and gives investors more

useful decision assistance. Artificial intelligence is

anticipated to become increasingly integrated with

conventional financial models in the future, hence

a

https://orcid.org/0009-0001-1979-0087

enhancing its capacity to predict stocks and

expanding the opportunities available to investors.

Many distinct kinds of algorithms have evolved

over the course of artificial intelligence development.

Notable examples of these algorithms include

decision trees, neural networks, logistic regression

and linear regression. Numerous unique applications,

such as Generative Pre-Trained Transformers (GPT)-

3, Microsoft's You Only Look Once (YOLO),

Google's Image Classification, and OpenAI's Dota 2

Bot, have been built through the use of these well-

known techniques. A number of examples

demonstrate the ways in which advances in AI have

affected several facets of human civilization, from

biology and chemistry to medicine, with a great deal

of work being done especially in the financial sector.

For instance, Duan et al. examine pertinent papers to

pinpoint problems and obstacles related to AI for

decision-making in the big data era, suggesting

theoretical advancement and AI application (John,

2019). Tkáč et al. reviewed twenty years of research

on the use of artificial neural networks in business,

and they discovered that the majority of the papers

Chen and T.

Advances in Artificial Intelligence for Stock Price Prediction: A Comprehensive Investigation of Models and Applications.

DOI: 10.5220/0013487200004619

In Proceedings of the 2nd International Conference on Data Analysis and Machine Learning (DAML 2024), pages 51-55

ISBN: 978-989-758-754-2

Copyright © 2025 by Paper published under CC license (CC BY-NC-ND 4.0)

51

they looked at discussed expert systems in practical

settings (Michal, 2016). A review of the literature

from 2002 to 2013 by Côrte-Real et al. concentrated

on business intelligence in banking (Moro, 2015),

which employs certain AI algorithms for predictive

analysis. Last but not least, Business Intelligence and

Analytics (BI&A) implementation diffusion phases

are systematically mapped out by Côrte-Real, Ruivo

and Oliveira, who also suggest further study in the

then-largely ignored post-adoption stages (Tiago,

2014). Given the wide range of applications and rapid

expansion of artificial intelligence in this sector, a

comprehensive overview of this unique topic is

essential.

An extensive review of artificial intelligence

specifically applied to stock price prediction will be

given in this paper. First, popular techniques to stock

price prediction and pertinent findings from previous

research will be outlined by the author in the

methodologies section. The discussion part that

follows will provide a thorough analysis of the

benefits and drawbacks of the previously mentioned

techniques. In the concluding section, the author will

comprehensively summarize the study and discuss

the obstacles, limitations, and potential developments

in the particular domain of artificial intelligence for

stock price prediction.

2 METHOD

2.1 Introduction of the Machine

Learning Workflow

To get the desired outcome in the machine learning

process, a multitude of stages must be completed.

Typically, gathering data is the first of these phases.

Web scraping and the use of public databases are

common techniques for gathering related data. Web

scraping is the most popular technique, mostly used

to obtain data efficiently from large financial and

stock market websites. Data preparation, which may

entail controlling outliers, managing missing values,

and splitting the data into training and testing groups,

is probably going to happen once data collection is

finished. The next stage is using machine learning or

deep learning methods like random forest, to create

an appropriate model. The training and testing sets

created during data preprocessing will next be utilized

for training and testing the model. At last, if the error

value in the testing dataset is less than the threshold

established, deploying the model for real-world

application might be considered.

2.2 Multiple Linear Regression

A machine learning method called multiple linear

regression makes predictions about a continuous

target variable by taking into account a number of

independent factors. It is an expansion of the single-

independent-variable basic linear regression model.

The link between the target variable and the

independent variables is modeled by means of a linear

equation in the model. The objective is to use

techniques such as ordinary least squares to determine

the optimal regression coefficients. This method is

commonly used in engineering, social sciences,

economics, and finance to comprehend many

variables and create predictions.

In terms of the application of multiple linear

regression, it was used by Shakhla et al. to forecast

the price of APPLE INC.'s shares (Shakhla, 2018).

With the use of historical data from the Yahoo

Finance Developer Application Programming

Interface (API), a prediction model based on

NASDAQ (NDAQ) and Apple stock prices was

trained. For both equities, the data contained the day-

open price and day-high price of the stock. Panda's

Data-frame was used to preprocess the data,

eliminating Not A Number (NAN) values that would

have caused the data-frame to become inconsistent.

To get rid of duplicates and inconsistencies, the

values were forward-filled and backward-filled using

function related to filling null values.

2.3 Decision Tree

Regression and classification challenges can be

addressed by supervised learning algorithms called

decision trees. Representing characteristics or traits,

they are made up of a root node, internal nodes, and

leaf nodes. Recursive splitting of the dataset

according to the feature delivering the maximum

information gain or the lowest impurity is the method

used. Decision trees have several benefits, including

their ability to handle numerical and categorical

variables with ease, their resilience to outliers and

missing values, their ability to capture non-linear

correlations, and their attribute significance. Pruning,

regularization, and ensemble approaches are

frequently employed to enhance generalization

performance since they might be susceptible to

overfitting.

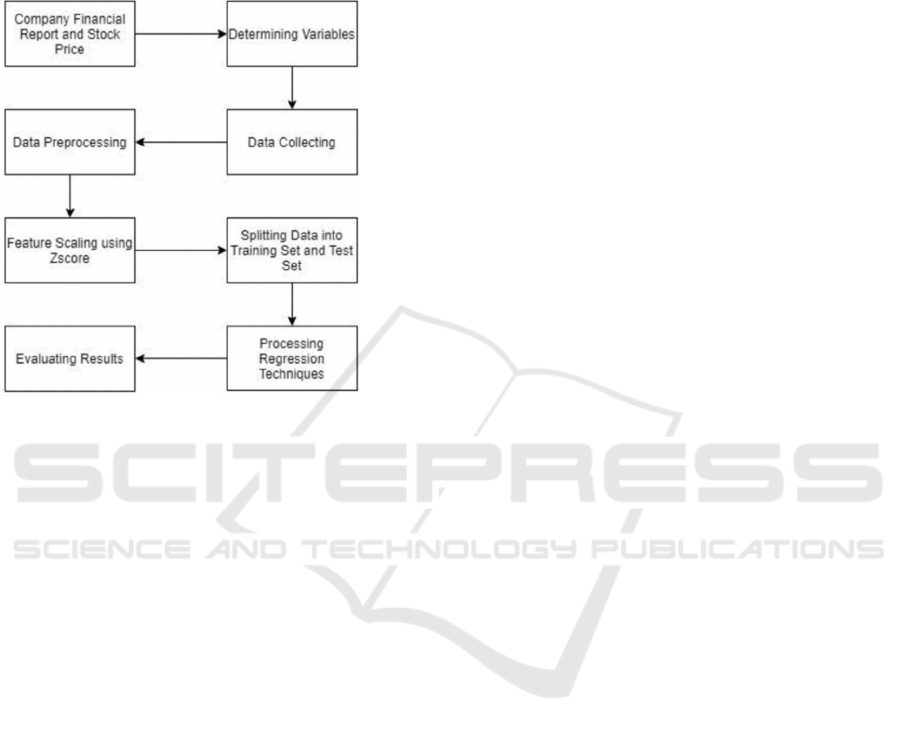

In order to forecast Indonesian stock prices during

the Covid-19 pandemic, Hindrayani et al. employed a

decision tree model (Hindrayani, 2020). Getting stock

prices, computing variables including net income,

liabilities, and total current assets, and figuring out

the closing daily stock price were all part of the

research process, presenting in Figure 1. A training

DAML 2024 - International Conference on Data Analysis and Machine Learning

52

and test set of data were divided for regression

analysis, and the data was preprocessed and feature

scaled using Zscore. Multiple Linear Regression,

Support Vector Regression, Decision Tree

Regression, and K-Nearest Regression were used to

evaluate the robustness of the model.

Figure 1:

The framework of machine learning

(Hindrayani, 2020).

2.4 Random Forest

Random Forest is a potent ensemble learning method

for classification and regression. Bootstrapping,

feature subsampling, and ensemble prediction are

used to merge numerous decision trees. Enhancing

generalization performance, this produces a

heterogeneous ensemble of models. Prominent

benefits include elevated precision, resilience against

anomalies and interference, capacity to manage dual

duties, automated feature identification and

significance approximation, expandability to

substantial datasets, and effortless parallelization.

Owing to its robustness and adaptability, Random

Forest is extensively employed in a number of fields,

including as finance, healthcare, image identification,

and natural language processing.

Random forest was utilized by Khaidem et al. in

the past to forecast the direction of stock market

prices (Khaidem, 2016). The procedure entails

smoothing historical stock data exponentially to

eliminate noise or random variation, allowing the

model to detect long-term price patterns. These data

are compiled into feature matrices, from which

technical indications are generated. The two data

classes are examined for linear separability by

locating their convex hulls before to provide the

training data to the Random Forest Classifier. A

property of two sets of data points is called linear

separability, in which every point in one set is on one

side of a hyperplane and every point in the other set

lies on the other.

2.5 Long Short-Term Memory

A recurrent neural network design called Long Short-

Term Memory (LSTM) is used in deep learning to

overcome vanishing gradients in conventional

Recurrent Neural Networks (RNNs). Long-term

information retention memory cells, a gate structure

governing information flow, and gradient flow are

some of its primary characteristics. For applications

requiring sequential data, such handwriting

identification, natural language processing, time

series forecasting, and audio recognition, LSTM

networks are very helpful. They have proven to

perform better than conventional RNNs in a variety

of applications, which has led to their widespread

adoption as a prominent deep learning architecture.

LSTM was utilized by Lanbouri et al. to forecast

high frequency data (Lanbouri, 2020). Three phases

comprise the preprocessing approach: feature

development, feature scaling and normalization, and

data cleaning. Finding erroneous and absent values,

such as Missing Completely at Random (MCAR)

data, is the process of data cleansing. Value

imputation and instances discarding are two of the

techniques employed. Technical analysis, which

takes stock market history and indicators like Moving

Average and Moving Average Convergence

Divergence (MACD) into account, is a step in the

feature building process. Technical analysis uses

Bollinger bands, the MACD, and the Exponential

Moving Average (EMA) to determine when stock

values are turning. Adjusting overbought/oversold

asset signals takes directional movement shifts into

account.

3 DISCUSSION

In AI models that predict stock price fluctuations, the

deep learning algorithms are gradually taking the

place of some simple techniques such as linear

regression. This shift is the result of several different

factors. Among them, the most important of which is

the complex nonlinear relationships seen in the stock

market. Improved prediction accuracy can be

achieved by modeling these complicated dynamics

using deep learning models that include multi-layered

nonlinear transformations. Advances in computing

power and data collection capabilities also enable the

collection of extensive stock trading data. The deep

Advances in Artificial Intelligence for Stock Price Prediction: A Comprehensive Investigation of Models and Applications

53

learning models are more adepted at processing

massive amounts of data for pattern recognition and

feature extraction compared to the linear regression

model, which increases the accuracy of the

prediction, whereas the model of linear regression is

more susceptible to sample size limitations (Bao,

2017).

There are currently several distinct limitations

and challenges that are associated with using AI to

predict the value of a stock. One of those is that they

are not very adept at providing a detailed explanation

of why patterns occur. AI models are capable of

predicting prices that are similar. In addition, due to

the widespread use of relevant models, a trained

model for one stock may not be able to forecast

another efficiently; various stocks with different

related distributions may provide different results. A

further difficulty for stock prediction is that AI

models typically fail to take external effects into

account, despite the fact that these variables are often

the main cause of changes in market movements.

To address the aforementioned issues, several

methods can be applied. First, using expert systems,

Shapley Additive Explanations (SHAP), and Local

Interpretable Model-agnostic explanations (LIME)

can help enhance the interpretability of models. An

expert system is a knowledge-based AI system that

simulates expert decision-making, employing a

knowledge base, inference engine, and user interface

to provide clear reasoning and explainable results. A

technique based on game theory called SHAP

determines the relevance of a feature and provides

comprehensible feature contributions to the outcomes

of each prediction (Tsiotsios, 2014). By creating

simulated data and using it to train a basic model to

mimic local behavior, LIME is a local interpretable

model that clarifies black-box model predictions

(Ribeiro, 2016). To improve model interpretability

and increase the transparency and understandability

of prediction outputs, choose interpretable models,

add interpretability components to black-box models,

optimize the training process, and employ

visualization approaches. To overcome the problem

of trained models' limited applicability, the second

suggestion is to apply transfer learning. The process

entails integrating macroeconomic data into the stock

price prediction model or transferring an effective

prediction model created in related financial sectors

to improve the model's capacity for generalization

(Lundberg, 2017). The third point is to introduce

ongoing characteristics as part of the predictive data,

which can help enhance the timeliness of forecasts.

4 CONCLUSIONS

An extensive review of AI models used to forecast

stock prices has been established in this article,

including various algorithm and their differences.

Four distinct models are examined by the author:

decision trees model, random forests model, long

short-term memory model, and multiple linear

regression model. For individuals who are intrigued

by the topic of AI-driven stock price projections, it

provides pertinent resources and presents concepts

and models that can help with the understanding and

using of the models. The piece highlights the

developments in AI stock price prediction, addresses

problems that result from these forecasts, and

suggests possible fixes. The paper points out several

inadequacies in this field, despite the fact that AI

models supporting the growth of the financial

industry have seen substantial advancements. These

include the models' insufficient consideration of

external factors that can easily influence the prices of

the stock, poor interpretability, and low general

applicability of the models.

REFERENCES

Bao, W. J., & Rao, Y. Yue. 2017. A deep learning

framework for financial time series using stacked

autoencoders and long-short term memory. PLOS ONE.

https://doi.org/10.1371/journal.pone.0180944

Hindrayani, K. M., Fahrudin, M., Aji, R. P., & Tresna, E.

M. S. 2020. Indonesian stock price prediction including

COVID-19 era using decision tree regression.

International Seminar on Research of Information

Technology and Intelligent Systems (ISRITI), 344-347.

Hindrayani, K. M., Fahrudin, M., Aji, R. P., & Tresna, E.

M. S. 2020. Research methodology. Indonesia.

John, S., Duan, Y., & Yogesh, K. 2019. Artificial

intelligence for decision making in the era of Big Data

– evolution, challenges and research agenda.

International Journal of Information Management, 48,

63-71.

Khaidem, L., Saha, S. R., & Dey, S. 2016. Predicting the

direction of stock market prices. Applied Mathematical

Finance, 00(00), 1-20.

Lanbouri, Z., & S. A. 2020. Stock market prediction on high

frequency data using long-short. International

Workshop on Artificial Intelligence & Internet of

Things (A2IoT), 603-608.

Lundberg, S. M., & Lee, S.-I. 2017. A unified approach to

interpreting model predictions. Advances in Neural

Information Processing Systems 30.

Michal, T., & Robert, V. 2016 Jan. Artificial neural

networks in business: Two decades of research. Applied

Soft Computing, 38, 788-804.

DAML 2024 - International Conference on Data Analysis and Machine Learning

54

Moro, S., Rita, P., & Cortez, P. 2015. Business intelligence

in banking: A literature analysis from 2002 to 2013

using text mining and latent Dirichlet allocation. Expert

Systems with Applications, 42(3), 1314-1324.

Ribeiro, M. T., Singh, S., & Guestrin, C. 2016. Why should

I trust you? Explaining the predictions of any classifier.

Proceedings of the 22nd ACM SIGKDD International

Conference on Knowledge Discovery and Data Mining.

New York, NY: Association for Computing Machinery.

Shakhla, S., & B. S. 2018. Stock price trend prediction

using multiple linear regression. International Journal

of Engineering Science Invention (IJESI), 7(10), 29-33.

Tiago, O., Pedro, R., & Nadine, C.-R. 2014. The diffusion

stages of business intelligence & analytics (BI&A): A

systematic mapping study. Procedia Technology, 16,

172-179.

Tsiotsios, M., Angelopoulou, M. E., Kim, T.-K., Davison,

A. J., & Chourmouzios, A. 2014. Backscatter

compensated photometric stereo with 3 sources. 2014

IEEE Conference on Computer Vision and Pattern

Recognition, 2259-2266.

Advances in Artificial Intelligence for Stock Price Prediction: A Comprehensive Investigation of Models and Applications

55