Statistics and Analysis of Netflix Stock Price in the Post-Pandemic

Era Based on Machine Learning Algorithms

Zimo Tang

a

The Department of Financial and Actuarial Mathematics, Xi 'an Jiaotong-Liverpool University, Suzhou, China

Keywords: Machine Learning, Stock Prediction, Netflix.

Abstract: This paper will focus on the analysis and prediction of Netflix's stock performance during and after the

pandemic. In the era following the influenza pandemic, there has been a significant change in consumer

entertainment consumption habits. As a leading player in the streaming industry, Netflix’s stock data is highly

representative and serves as a critical point for analyzing trends in the streaming sector. This study will select

various machine learning models, including deep learning algorithms and supervised learning algorithms, to

analyze Netflix’s stock. The main objective is to observe the predictive capabilities of these models under

abnormal conditions. The methodology involves several key steps: first, data preprocessing, including

cleaning and visualization; second, modeling analysis and parameter tuning; and finally, comparing the

predicted trend charts to assess the effectiveness of the models. The final conclusion will rank the models’

performance, with XGBoost performing the best, followed by Random Forest, and Long Short-Term Memory

(LSTM) showing relatively lower performance. By examining various algorithms, it sheds new light on the

application of advanced predictive models for financial forecasting, particularly during significant market

disruptions.

1 INTRODUCTION

Stocks are securities issued by companies, and the

stock market is the venue for trading these stocks.

Through buying and selling stocks, investors can

achieve capital appreciation or secure stable returns.

Brown and Smith highlighted the importance of stock

market forecasting in formulating investment

strategies and economic policies (Brown, 2019).

Accurate forecasts can assist investors in developing

strategies, optimizing portfolios, and maximizing

returns. Furthermore, policymakers and economists

can use market trend predictions to understand

economic health. Therefore, the prediction for stock

markets deserves more attention.

In recent years, the integration of artificial

intelligence and algorithms in the stock markets has

become increasingly widespread. Advances in

machine learning technology have provided new

possibilities for stock forecasting. In the context of

time series analysis, methods from deep learning

have proven highly effective. These approaches are

well-suited for modeling and analyzing data with

intricate and changing patterns, leading to improved

a

https://orcid.org/0009-0006-0168-9729

performance in handling complex dynamic features.

These technologies can process large amounts of

historical data and real-time information, identifying

potential patterns and relationships, thereby enabling

more precise predictions in a dynamically changing

market environment. Major applications include

predictive analytics, risk management, portfolio

optimization, and market sentiment analysis. For

instance, Patel and Sharma utilized machine learning

techniques for fraud detection and anomaly detection

in financial transactions (Patel, 2020). Related

research has also explored how sentiment analysis

and machine learning technologies can be utilized for

forecasting market sentiment and supporting

investment decisions (Silva, 2023).

However, the influence of external factors such as

economic policy changes and market sentiment has

made stock market trends more complex. Therefore,

improving prediction accuracy often requires

integrating advanced machine learning algorithms

and big data analytics. At the onset of the coronavirus

outbreak, the international economic landscape faced

severe challenges, with most industries encountering

unprecedented difficulties. However, for streaming

606

Tang, Z.

Statistics and Analysis of Netflix Stock Price in the Post-Pandemic Era Based on Machine Learning Algorithms.

DOI: 10.5220/0013277500004568

In Proceedings of the 1st International Conference on E-commerce and Artificial Intelligence (ECAI 2024), pages 606-610

ISBN: 978-989-758-726-9

Copyright © 2025 by Paper published under CC license (CC BY-NC-ND 4.0)

platforms like Netflix (Singh, 2020), the pandemic

unexpectedly acted as an accelerator. First, the

pandemic restricted travel and offline entertainment

activities, leading a significant number of consumers

to turn to online streaming services to meet their

entertainment needs. Netflix, with its extensive

content library and convenient viewing experience,

successfully attracted a large number of new users

and increased the stickiness of existing users.

Secondly, During the pandemic, the competitive

dynamics of the international streaming market

experienced significant changes. Netflix, by utilizing

its established brand reputation and strategic market

advantages, further reinforced its leading position,

outperforming rivals in viewership and subscriber

growth.

As of now, Exploration on Netflix's stock has

largely focused on normal periods. For example,

Singh and Kumar applied various machine learning

techniques to predict Netflix's stock prices and

evaluated the effectiveness of different techniques.

Alternatively, research has focused on improving

prediction accuracy. For instance, research proposed

a hybrid forecasting method combining ARIMA

models with neural networks to increase the

reliability of predictions for Netflix's stock price by

incorporating more precise data and advanced

analytical techniques (Garcia, 2021).

Considering the gap, this paper plans to focus on

the impact of the coronavirus pandemic as an external

factor on Netflix's stock market prices and explore the

development of the streaming industry in the post-

pandemic era through stock price predictions. By

comparing the accuracy of different machine learning

algorithms, aims to identify the most effective model

for abnormal stock fluctuations. The best model will

be used to forecast Netflix's stock prices, providing

valuable insights for investors and analyzing the

development of the media industry in the post-

pandemic era through the stock trends of Netflix, a

representative streaming enterprise.

2 METHOD

2.1 Preparation

The Netflix stock price dataset on Kaggle used in this

study provides historical data related to Netflix's

stock prices (Kaggle, 2024), often used for financial

analysis, time series forecasting, and data

visualization. This dataset comprises 6,750 data

points over six years, from December 2, 2019, to May

24, 2024. Typically, the data is available in CSV

format, easily imported into data analysis tools.

This study uses a dataset without missing values,

eliminating the need for imputation of missing

closing prices. Outliers, which may indicate

extremely high or low prices, are detected and

addressed using statistical methods such as Z-score or

IQR. To stabilize data variance and mitigate the

impact of extreme values, a moving window

approach smooths the stock price data, replacing the

original closing prices with the 30-day moving

average. The dataset is split into an 80% training set

and a 20% test set, ensuring adequate data for model

training and sufficient data for testing model

generalization. To realistically simulate the model's

performance in practical scenarios, the dataset is

divided into two segments: the training set, which

consists of the initial 80% of the data for model

training and development, and the test set, which

includes the remaining 20% for assessing the model's

accuracy and generalization.

Throughout the observation period, Netflix's

stock price demonstrated significant fluctuations and

growth. The average opening price was $432.54, with

a standard deviation of $528.40, reflecting

considerable uncertainty in opening prices. Similarly,

the highest price, lowest price, and closing price

exhibited comparable volatility, indicating a dynamic

valuation process by the stock market. During the

early pandemic, the global economy was severely

impacted, posing unprecedented challenges for most

industries. However, for streaming platforms like

Netflix, the pandemic acted as an unexpected

accelerator. Charts reveal a significant upward trend

in Netflix's stock price from 2020, with ongoing

fluctuations through 2024. Both opening and closing

prices rose substantially during this period, signalling

market optimism regarding Netflix's future growth

potential.

2.2 Machine Learning-Based Models

This study employs three models—Random Forest,

XGBoost, and LSTM—for comparative analysis,

utilizing historical stock price data to train and

validate the models' predictive performance. The

input data for the task includes historical stock prices,

the output of the task is the predicted stock price value

for a specific future period . To evaluate the

performance of the proposed models, this study used

Mean Absolute Error (MAE), Mean Squared Error

(MSE), and R2 metrics.

2.2.1 LSTM

The architecture of an LSTM includes four essential

components: the input gate, which controls the

integration of new information into the cell state; the

Statistics and Analysis of Netflix Stock Price in the Post-Pandemic Era Based on Machine Learning Algorithms

607

forget gate, which manages the retention or removal

of existing information from the cell state; the output

gate, which governs the flow of information to the

final output; and the cell state, which serves as a long-

term memory carrying information through time steps

(Hochreiter, 1997; Yang, 2020). In this research, the

LSTM model is configured with 50 hidden units

across three layers, enhancing its ability to detect

complex patterns in time series data. The output layer

is set to a dimension of 1, which aligns with the

single-variable nature of the data. A learning rate of

0.0005 is utilized to maintain optimization stability,

and the model undergoes training for 1,500 epochs.

To facilitate effective learning, the Adam optimizer,

known for its adaptive adjustment of learning rates, is

paired with the mean squared error loss function."

2.2.2 Random Forest

Random Forest is a method that utilizes an ensemble

of decision trees to make predictions (Breiman,

2001). By aggregating the outcomes of these trees

through averaging or voting, it delivers dependable

results for both classification and regression tasks. Its

exceptional performance and robustness have led to

its widespread use in time series forecasting recently.

In this study, the Random Forest model is specifically

configured with 100 decision trees, each limited to a

maximum depth of 3 to prevent overfitting, and a

learning rate of 0.1 to control the contribution of each

tree during training. This setup aims to enhance the

model’s accuracy and efficiency in predicting future

trends.

2.2.3 XGBoost

XGBoost is a highly efficient and scalable gradient

boosting framework that enhances model

performance by iteratively constructing a series of

ordered decision trees (Chen, 2016). Each tree

corrects the errors of its predecessor, improving

predictive accuracy and robustness. This iterative

approach makes XGBoost a favored choice for

various machine learning tasks. It supports parallel

computation and regularization to achieve rapid

training and reduce overfitting. XGBoost is widely

used across various fields, including machine

learning tasks such as classification, regression, and

ranking. Due to its outstanding performance and

versatility, XGBoost has become a crucial tool in data

science and machine learning. In this study, the model

is configured with 200 decision trees, each having a

maximum depth of 20. This setup is designed to

effectively capture complex data patterns while

minimizing the potential for overfitting.

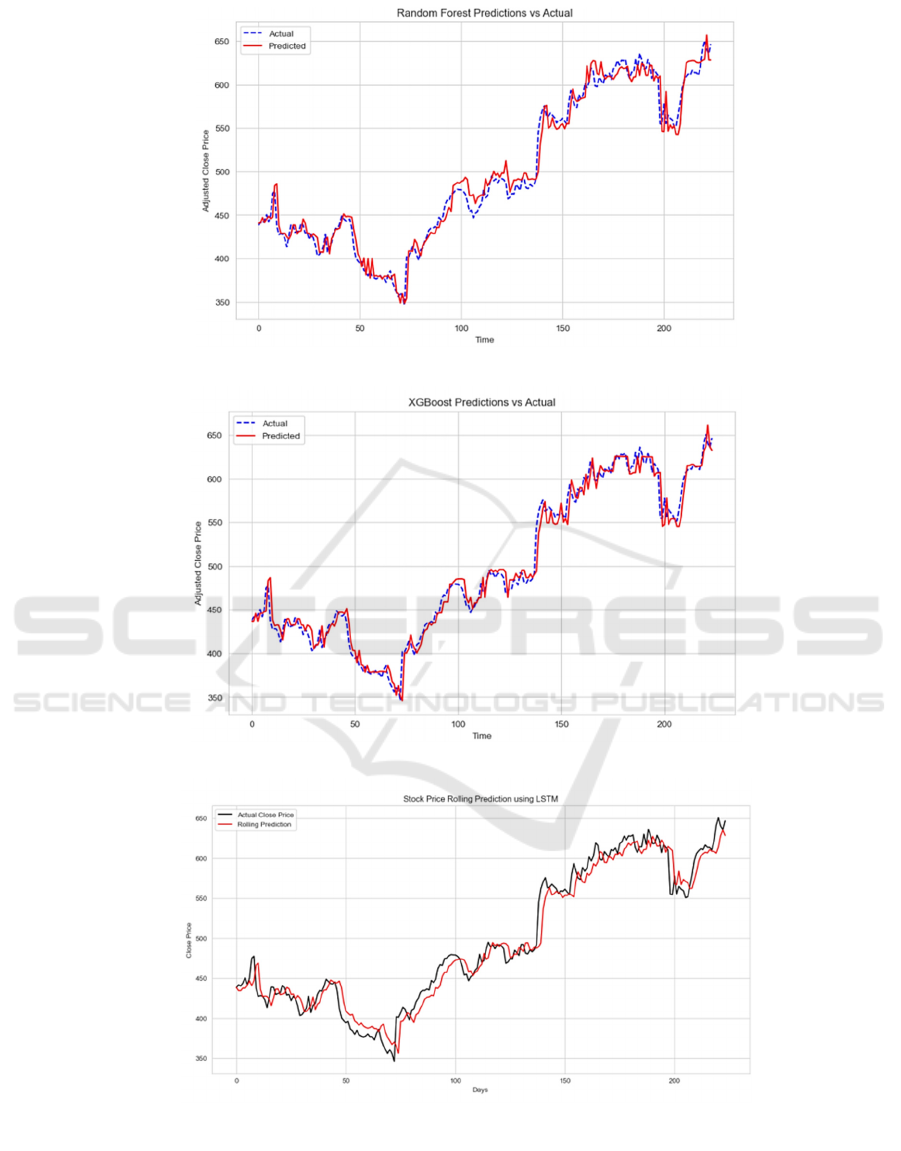

3 RESULTS AND DISCUSSION

In predicting Netflix’s stock price, various models

were evaluated based on their performance in trend

prediction and metrics. Specifically, XGBoost

outperformed all other models in these metrics shown

in Table 1, Figure 1, Figure 2 and Figure 3, showing

the smallest deviation between predicted and actual

values and the highest correlation. In contrast,

Random Forest and Long Short-Term Memory

(LSTM) networks, while having their strengths, did

not match XGBoost’s consistency.

XGBoost demonstrated the best predictive

performance. This performance is attributed to

XGBoost’s advanced boosting technique, which

constructs a series of decision trees where each tree

corrects the errors of its predecessor. This iterative

correction, along with support for parallel computing

and regularization, enables XGBoost to handle

complex datasets effectively and capture intricate

stock price patterns. XGBoost’s ability to reduce

overfitting and maintain robustness across different

data subsets results in the lowest MSE and MAE and

the highest R².

An analysis of the performance data shows that

XGBoost outperforms other models across various

metrics. Specifically, its Mean Squared Error (MSE)

is 153.5109, which is notably lower than LSTM’s

MSE of 273.821, reflecting a reduction of about

120.31. This suggests that XGBoost has a smaller

discrepancy between its predictions and actual values.

Similarly, XGBoost’s Mean Absolute Error (MAE)

of 8.8367 is also superior to LSTM’s MAE of

12.5629, with a decrease of approximately 3.7262,

further indicating its better predictive accuracy.

While Random Forest’s R² is somewhat close to

XGBoost’s, at 0.9752 compared to 0.979, XGBoost’s

better performance in terms of MSE and MAE

highlights its overall robustness. On the other hand,

LSTM shows the poorest performance, with an R² of

0.9626, which is significantly lower than XGBoost’s,

creating a difference of 0.0164. These findings

emphasize the superior performance of XGBoost

with the Netflix dataset.

Table 1: The Performance of Different Models in the

Netflix Dataset.

Model Performance

MSE MAE R2

Random Forest 180.9926 10.0717 0.9752

XGBoost 153.5109 8.8367 0.979

LSTM 273.821 12.5629 0.9626

ECAI 2024 - International Conference on E-commerce and Artificial Intelligence

608

The subpar performance of LSTM may be attributed

to several factors, including difficulties in capturing

long-term dependencies within the dataset,

limitations in the amount of training data, and

challenges associated with optimizing

hyperparameters. Despite its capacity to handle long-

term dependencies, LSTM networks are susceptible

to overfitting in volatile stock markets, face

Figure 1: Price Prediction using Random Forest (Photo/Picture credit: Original).

Figure 2: Price Prediction using XGBoost (Photo/Picture credit: Original).

Figure 3: Price Prediction using LSTM (Photo/Picture credit: Original).

Statistics and Analysis of Netflix Stock Price in the Post-Pandemic Era Based on Machine Learning Algorithms

609

challenges with hyperparameter tuning, and are

sensitive to network architecture (such as layer and

unit numbers). Additionally, LSTM ’s high model

complexity demands extensive training data and

computational resources for parameter optimization,

which can constrain its practical utility. This suggests

that LSTM, though promising, requires further tuning

and feature engineering to enhance its performance.

For future improvements, systematic techniques

should be used to optimize model parameters,

enabling a thorough exploration of the parameter

space to identify the optimal configuration for each

model and maximize predictive accuracy. The

experimental framework should also be expanded to

include other machine learning models, such as

transformer-based architectures, for a broader

comparison of methods. Evaluating the accuracy,

efficiency, and robustness of these models will help

identify the most suitable model or ensemble for

stock price prediction. Current models have several

limitations. First, they often fail to account for

external factors, such as policy changes, news reports,

and market sentiment, which significantly impact

stock prices but are difficult to capture from historical

data alone. Future models should integrate these

factors into their analysis. Second, model

interpretability is poor. While achieving high

accuracy, models provide little insight into the

reasoning behind their predictions. Future research

should emphasize more interpretable machine

learning methods to explain model decisions. Finally,

models lack generalizability. They are typically

trained on single stocks and may not perform well

when applied to others. Future work should improve

model generalization to enhance adaptability and

practical use across different stocks.

4 CONCLUSIONS

This study employs machine learning models to

forecast Netflix’s stock prices during the pandemic

and post-pandemic periods, aiming to compare the

performance of different models under non-natural

fluctuations. The analysis includes XGBoost,

Random Forest, and LSTM algorithms. Through data

multiprocessing, model building, and hyper

parameter tuning, the performance of these models

was evaluated. The results indicate that XGBoost

achieved the best performance under the influence of

uncontrollable external factors like diseases, while

LSTM performed the worst. Additionally, this study

addresses the gap in forecasting Netflix’s stock

during abnormal periods, providing valuable insights

for investors. Future work will involve incorporating

additional machine learning models into the

prediction framework to compare their accuracy,

efficiency, and robustness, thereby identifying the

most suitable model or ensemble for specific

forecasting tasks.

REFERENCES

Brown, P. J., & Smith, C. M. 2019. The Importance of

Stock Market Forecasting: Implications for Investment

Strategies and Economic Policy. Financial Analysts

Journal.

Breiman, L. 2001. Random Forests. Machine Learning,

45(1), 5-32. https://www.stat.berkeley.edu/~breiman/

randomforest2001.pdf

Chen, T., & Guestrin, C. 2016. XGBoost: A Scalable Tree

Boosting System. Proceedings of the 22nd ACM

SIGKDD International Conference on Knowledge

Discovery and Data Mining (KDD 2016), 785-794.

https://arxiv.org/abs/1603.02754

Garcia, A., & Davis, C. J. 2021. Hybrid Forecasting

Approach for Netflix Stock Prices Combining ARIMA

and Neural Networks. Applied Economics Letters.

Hochreiter, S., & Schmidhuber, J. 1997. Long Short-Term

Memory. Neural Computation, 9(8), 1735-1780.

https://www.bioinf.jku.at/publications/older/2604.pdf

Kaggle, Netflix stock price, 2024, https://www.kaggle.

com/datasets/henryshan/netflix-stock-price/data

Patel, J. K., & Sharma, M. B. 2020. Anomaly Detection in

Financial Transactions Using Machine Learning.

Proceedings of the International Conference on Data

Mining.

Silva, A. J., & Murphy, H. R. 2023. Sentiment Analysis and

Machine Learning in Financial Markets. Financial

Analysts Journal.

Singh, R., & Kumar, P. 2020. Stock Price Prediction Using

Machine Learning Techniques: A Focus on Netflix.

International Journal of Financial Engineering and Risk

Management.

Yang, Z., Liu, H., & Zhang, H. 2020. A comprehensive

review on the application of LSTM in financial

forecasting. Computational Economics, 55(4), 1025-

1057.

ECAI 2024 - International Conference on E-commerce and Artificial Intelligence

610