The Impact of Federal Reserve Policy Regulation (Interest Rate) on

the Google's Stock Price and the Company's Investment Policy

Zhenwei Wu

1,*

and Letao Xing

2

1

Harrow International School Shenzhen, Shenzhen, 518066, China

2

West Michigan College, Guizhou University of Finance and Economic, Shuangya Shan, 550025, China

*

Keywords: The Federal Reserve Adjusts the Interest Rate, Federal Funds Rate, US Stock Market, Google Stock Index.

Abstract: This paper mainly expands the central bank plays an important role in the national economy and is

responsible for formulating and implementing monetary policies to regulate the macroeconomy. The

Federal Reserve, as the central bank of the United States, controls the economy by adjusting the federal

funds rate. Since 2020, affected by force majeure factors, the Federal Reserve has cut interest rates many

times and then raised interest rates due to high inflation. The trend of stocks is related to the macroeconomy,

and the adjustment of the Federal Reserve's policies has an impact on the stock market. With the frequent

adjustment of its monetary policies, the impact on the national economy, the investment policies and stock

prices of enterprises is increasingly prominent. This paper takes Google as an example for research, aiming

to provide reference for similar technology companies and emphasizing the importance of optimizing the

investment structure of enterprises.

1 INTRODUCTION

The central bank plays an important role in the

national economy. It is the dominant financial center

institution and maintains the financial stability of a

country. It is mainly responsible for formulating and

implementing the national monetary policy to

achieve the purpose of regulating the macro

economy. Central banks mostly adopt expansionary

monetary policies to cope with the economic

depression, including interest rate reduction, deposit

reserve requirements and rediscount to increase the

money supply, reduce the financing costs of

economic entities, stimulate the increase of the social

aggregate demand, and promote economic growth

(Yin, 2022). The Federal Reserve fulfills the role of

the US central bank to control the country's economy

by adjusting the federal funds rate. Since 2020, a

number of force majeure factors have had a huge

impact on the US economy, leading the Fed to cut

interest rates repeatedly to boost market demand. In

2022, the US reached its highest inflation level in 40

years, and the Fed had to raise interest rates seven

times in a year, raising the federal funds rate to

4.25% to 4.5%, and the US inflation level began to

fall (Huang, 2023). Stocks are the barometer of the

economy and are often forward-looking. The quality

of the macro economy determines the trend of

stocks, and the macro economy is affected by the

policy regulation of the central bank, so the

adjustment of the Federal fund rate will have certain

impacts on the volatility of the stock market

(Christiano et al., 2010).

With the frequent adjustment of the monetary

policy by the Federal Reserve, the uncertainty is

increasingly increasing, which has an important

impact on the national economic development. The

impact on the investment policy of enterprises needs

to be strengthened, which is of great significance for

the optimization of the investment structure of

enterprises.

This paper reviews the impact of Federal

Reserve's interest rate hike and interest rate cut on

Google's stock price and investment policy, and

provides reference for technology companies similar

to Google in the future.

The Fed's interest rate adjustment affects stock

prices mainly through the following ways: The

federal funds rate affects stock prices by adjusting

dividends, real interest rates and excess returns

(Challe and Giannitsarou, 2014). The Fed adjusts

interest rates, which has the effect of stabilizing the

economy. When the inflation rate is low and the

stock market booms, the Federal Reserve can adjust

Wu, Z. and Xing, L.

The Impact of Federal Reserve Policy Regulation (Interest Rate) on the Google’s Stock Price and the Company’s Investment Policy.

DOI: 10.5220/0013271000004568

In Proceedings of the 1st International Conference on E-commerce and Artificial Intelligence (ECAI 2024), pages 585-589

ISBN: 978-989-758-726-9

Copyright © 2025 by Paper published under CC license (CC BY-NC-ND 4.0)

585

the instability of economic fluctuations by adjusting

the federal funds rate (Liu, 2022). The samples

selected in this paper are from the monthly data from

2020 to 2022, and the Google stock index and the

federal funds rate are mainly used to analyze the

relationship between the change of Google stock

price and the adjustment of the Federal Reserve

interest rate. The formulation and adjustment of

economic policies is the main way for the

government to intervene in the economy. Policy

formulation will cause uncertainty in the judgment

of enterprises on the future form, making enterprises

tend to hold cash instead of expanding investment

scale, and enterprises will actively postpone

investment plans until the uncertainty is alleviated

(Tan and Zhang, 2017).

2 DATA ANALYSIS

2.1 Data Source

In this paper, all data are selected from the monthly

data from January 1, 2020 to December 31, 2022, the

federal funds rate data from the official FOMC

website, Board of Governors of the Federal Reserve

System (US), and Google company data from the

official Google website.

2.2 Basic Analysis

The data discussed in this paper, Google company

stock price index and federal funds rate, are all time

series, and the covariance is used to discuss the

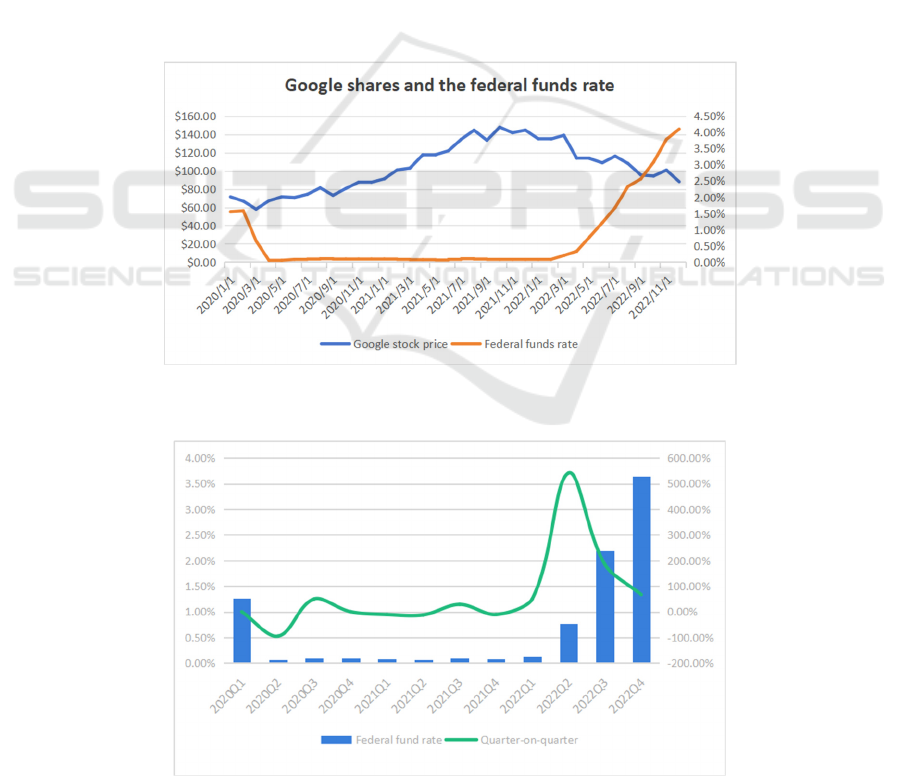

correlation of the two (see Figure 1).

The quarter-on-quarter data from 2020Q1 to

2022Q4 showed that Google's stock price fluctuated

between growth and decline, with a maximum

Figure 1: Google shares and the federal funds rate (Picture credit: Original).

Figure 2: Quarter-on-quarter analysis of Federal fund rate (Picture credit: Original).

ECAI 2024 - International Conference on E-commerce and Artificial Intelligence

586

Figure 3: Quarater-on-quarter analysis of Google stock price (Picture credit: Original).

increase of 21.02% and a maximum decline of

17.76% (see Figure 2).

Quarter-on-quarter data from 2020Q1 to 2022Q4

showed that the federal funds rate fluctuated

between growth and decline, with a maximum

increase of 541.67% and a maximum decrease of

95.24%. (See Figure 3)

3 CORRELATION ANALYSIS

Cov

X, Y

∑

(1)

In the course of the analysis, the company's stock

price is set as the variable X, and the average value

is, 𝑋

=average(X), Let the federal funds rate be the

variable Y, and the average is equal to 𝑌

=average(Y). And the correlation coefficient is

written as Corr=cov(X,Y).

n is the total number of months from 2020 to

2022, which is 36 months. So n-1 is 35 months.

Based on the collected data, Excel sheets were

utilized. The average of the respective Google stock

indexes is about 103.7788889.The average for the

federal funds rate is 0.007130556.The covariance

function in Excel is used to find it Cov(X, Y) =

0.05647.

Based on the covariance formula and the data

collected, the covariance between the federal funds

rate and Google's stock price is approximately

-0.05647, and the negative correlation between the

federal funds rate and Google's share price is

obtained.

4 IMPACT OF FEDERAL

RESERVE POLICIES ON

GOOGLE’S STOCK PRICE

4.1 Short-term Impact

The short-term fluctuations of Google’s stock price

are significant, and the changes in Federal Reserve

policy have the most severe impact especially when

after interest rate hikes or decreases. For example,

the Fed decided to raise their federal funds rate by 75

basis points, which has caused Google’s stock price

to drop rapidly (Adams, 2023). These factors were

worries for many investors. For instance, the rising

borrowing costs and the possibility of declining

consumer and company spending may hurt Google’s

revenue and its source of income.

However, this is not always the case, calm

reactions are usually generated by smaller increases

like the 25 basis point changes, this shows that the

size of the policy can be a crucial factor in

influencing the size of the stock price reaction, on

top of that the market processes the consequences of

the Fed’s decisions. At the same time, the stock price

will show frequent fluctuations followed by the

policy announcement.

The Impact of Federal Reserve Policy Regulation (Interest Rate) on the Google’s Stock Price and the Company’s Investment Policy

587

4.2 Long-term Impact

Whereas the long-term research shows that the

overall effect of the frequent policy change has

greatly impacted Google’s stock price trends. The

analysis identified a pattern where Google’s shares

were found to be linked with the extended period of

increasing interest rates (Stapleton, 2019). The

phenomenon can be explained by the increasing

tightening of financial circumstances, which reduces

the growth expectations for businesses like Google.

On the other hand, during the rate cut period, for

example, the Covid 19 epidemic, when the Federal

Reserve Bank cuts interest rates, the implications

ripple through the economy, influencing everything

from personal savings accounts to large-scale

investments (Fast Company, 2022). Google’s stock

price experienced a sharp increase. While interest

rates dropped there was a boost of investor’s

confidence which may pull up the stock price. This

shows how sensitive Google’s stock price is to the

macroeconomic factors impacted by the Fed’s

monetary policy.

5 IMPACT ON GOOGLE’S

INVESTMENT STRATEGY

5.1 Investment Scale and Risk

Management

Another approach that can be shown is the

investment strategy that Google has adopted. They

are often more careful when investing during high

interest rates, whereas they will focus more on lower

risk and more stable return projects (Dzama, 2024).

5.2 Response to Policy Easing

In contrast during the period of policy easing Google

showed some very aggressive moves in investment

approaches. During the relaxation period where

people don’t tend to go out during Covid 19 in 2020,

the business increased its investments in the field of

artificial intelligence. There were higher capital

expenditures and these ambitions were encouraged

by lower borrowing costs and a more promising

economic future.

5.3 Comparative Analysis with Other

Tech Companies

Comparing different firms is also essential,

especially tech firms like Apple, Microsoft, and

Amazon. There was a comparison of the sensitivity

to the changes in federal reserve policy, and what

was surprising was Google is more diverse in terms

of digital advertising. While Apple puts more

emphasis on consumer electronic products, which is

a different pattern of price responses. technology

companies such as Apple, which managed to become

the leading brand by brand value while being named

the company with the highest stock market value

worldwide at the beginning of the year 2022

(Cachanosky, 2021).

6 CONCLUSIONS

6.1 Research Findings

The analysis shows that these changes in the Federal

Reserve policy have a significant impact on the

short-term interest rate. This caused Google’s stock

price to drop right away due to the rise of borrowing

costs and caused the investors to worry about the

decline in consumer spending.

In the long term, Google’s stock price increased

by a series of interest rate increases. This led to the

tightening of financial conditions. Moreover, during

times when interest rates are lowered like during the

COVID-19 pandemic, market confidence and

cheaper borrowing caused Google’s stock price to

rocket.

Google’s strategy for this is to adjust their focus

to other things. Firstly, they’ve changed their focus

to a lower-risk project. Where there may be a lower

possibility of risk in line with shorter paybacks. On

the other hand, Google has put more focus and more

investments during times when interest rates are

down and takes advantage of it to pursue more

ambitious projects.

When comparing these companies to other big

companies like Apple and Microsoft although they

are all sensitive to the change of the Federal Reserve

policy however they have different responses to their

business structure and business strategy.

6.2 Research Limitations

There are also some limitations to this. Firstly these

data are from the past so this might not predict

accurate sense to the forthcoming patterns of the

changing technology industry. In addition, other than

the federal reserve policy, there may also be some

other factors that may influence Google’s stock price

and investment choices. Moreover, this study only

ECAI 2024 - International Conference on E-commerce and Artificial Intelligence

588

focuses on monetary policy. There may also be a

non-monetary policy that may also have some effect

on Google’s financial success.

6.3 Practical Recommendations

Comprehending the effect of Federal Reserve policy

is very essential for Google and other companies to

consider. By managing the financial risks and can

make well-informed investment decisions.

Businesses may also want to make investment plans

in order to prevent major changes in the market from

causing disruptions to companies.

Overall, this research summarizes the

information about the connection between Google’s

financial strategy and changes in Federal Reserve

policy by assisting policymakers and business to

navigate this complex field.

AUTHORS CONTRIBUTION

All the authors contributed equally and their names

were listed in alphabetical order.

REFERENCES

Adams, Michael. Federal Funds Rate History 1990 to 2022.

Forbes Advisor, 17 Oct. 2023》

Cachanosky, Nicolás, et al. 2021. The Federal Reserve’s

Response to The COVID‐19 Contraction: An Initial

Appraisal. Southern Economic Journal, 87(4): 1152–

1174.

Challe, E., Giannitsarou, C., 2014. Stock Prices and

Monetary Policy Shocks: A General Equilibrium

Approach. Journal of Economic Dynamics and

Control, 40:46-66

Christiano, L., llut, C. L., Motto, R., et al., 2010. Monetary

Policy and Stock Maret Booms. National Bureau of

Economic Research.

Dzama, C., 2024. What happens when the Fed cuts interest

rates? | FedSmith.com. FedSmith.com., September 18.

Fast Company. 2022. Why are Apple, Microsoft, Google,

and Amazon still the largest companies in the world -

and why does Daxsen want to replicate their model?

June 2.

Huang W., 2023. The Impact of the Fed Funds Rate

Adjustment on the US Stock Market - Based on the

Evidence of the Fed and the US Stock Market from

2012 to 2022. Journal of Engineering Economics, (05).

Liu X., 2022. Spillover effects of Fed's monetary Policy

Uncertainty on China's Corporate Investment. Zhejiang

Finance, (12).

Stapleton, Chip. Is Google a Good Investment?

Investopedia, 2019.

Tan, X., Zhang, W., 2017. The Channel analysis of

Economic policy Uncertainty affecting Enterprise

Investment. World Economy, (12).

Yin J., 2022. Federal Reserve's Monetary Policy in

response to Financial Crisis: Effects, Characteristics

and Problems. Zhejiang Finance, (09).

The Impact of Federal Reserve Policy Regulation (Interest Rate) on the Google’s Stock Price and the Company’s Investment Policy

589