Preparation of Camera-Ready Contributions Analysis of the

Application and Effectiveness of Artificial Intelligence in Modern

Taxation Work

Xinyue Hu

School of Public Finance & Taxation, Shandong University of Finance and Economics, Liaocheng, China

Keywords: Artificial Intelligence, Digital Government, Finance and Taxation, Technological Security.

Abstract: With the continuous improvement and development of artificial intelligence, big data and other emerging tec

hnologies, the efficiency of government finance and taxation work is constantly improving. Using the metho

d of case study, this paper starts from the different status quo of governments' current use of AI to assist gov

ernment tax work, and selects a number of cases to be analysed with the aim of exploring the impact of AI o

n the modern financial and tax work, and finally concludes that AI has already brought great convenience to

the tax work of governments. It is found that AI fuelling the high-quality development of the sports industry

has ushered in development opportunities in terms of technology, data, policy and market, but it also faces r

ealistic challenges in terms of technology, security, talent and ethics. Finally, this paper attempts to propose

a partial solution to the risks of AI as an emerging technology, establishing a multi-party collaborative co-m

anagement system and resolving ethical conflicts.

1 INTRODUCTION

In recent years, there have been impressive breakthro

ughs in the application of artificial intelligence. 2023,

OpenAI, a U.S. artificial intelligence research labora

tory, released version 4.0 of ChatG-PT; in the same y

ear, Baidu released version 4.0 of the Wenshin Big

Model. Artificial Intelligence is based on a data + ari

thmetic-driven approach to build a large number of A

I models through multiple calculations and simulatio

ns with existing data, capable of generating highly re

alistic and valuable content in multiple fields and sce

narios, and bringing about a profound change to curr

ent business models and productivity growth.

At present, with the rapid development of artifici

al intelligence, artificial intelligence models and thei

r deep learning functions have been widely used in fi

nance, education, healthcare and other fields, and go

vernment departments in many countries have also in

troduced artificial intelligence technology to assist in

their daily work, which not only streamlines the wor

k process and improves work efficiency, but also use

s the advantages of the Internet to monitor the tax ris

ks and safeguard the safety and stability of governme

nt finance.

Countries have different national conditions, diff

erent technological levels, and different methods of o

riginal government tax management. This paper aim

s to use the method of case analysis to select more ty

pical cases in each country, analyse the similarities i

n the successful experiences of each country, explore

the positive impact of AI technology on the govern

ment's fiscal and tax work, and try to put forward de

velopment proposals with general applicability.

2 CHARACTERISTICS AND

ROLE OF ARTIFICIAL

INTELLIGENCE

Traditional artificial intelligence is mainly through a

fixed programming language to make feedback on th

e user's needs, providing convenient browsing and st

atistical functions, but due to its lack of imitation, lea

rning, and creativity, it can only respond based on ex

isting data, and has certain limitations in its use.

With the development of technology, ChatGPT, a

dialogue-based chatbot based on AIGC technology a

nd presenting the characteristics of generative substit

Hu, X.

Preparation of Camera-Ready Contributions Analysis of the Application and Effectiveness of Artificial Intelligence in Modern Taxation Work.

DOI: 10.5220/0013270900004568

In Proceedings of the 1st International Conference on E-commerce and Artificial Intelligence (ECAI 2024), pages 579-584

ISBN: 978-989-758-726-9

Copyright © 2025 by Paper published under CC license (CC BY-NC-ND 4.0)

579

utability and high efficiency and convenience, has at

tracted wide attention from the society.

This new type of AI is able to capture user needs

through dialogue, synthesize database content and va

rious algorithmic models, and output innovative and

constructive content. In addition, the new AI is also a

ble to take full advantage of the Internet to capture d

ata fluctuations and provide effective data monitorin

g for users. More interactive, flexible and intelligent,

it is a strong learning application paradigm based on

human feedback content with both digital twinning,

editing and authoring capabilities (Li Eveningxia, Li

u Xingxin, 2024).

3 DEZHOU WUCHENG COUNTY

TAXATION BUREAU CASE

In the past, during the office process of traditional ta

x departments, it often happened that taxpayers had t

o go back and forth several times to make up for the

materials because they did not understand the tax pro

cess. With the development of artificial intelligence t

echnology, more online channels are being fully utili

sed.

Wucheng County Taxation Bureau of Dezhou Cit

y, in response to the taxpayers' demand for business,

comprehensively integrates network tax resources, a

nd gradually builds and improves a new "five-in-one

" diversified taxation pattern with online taxation as t

he main focus, self-service taxation as a supplement,

third-party agency as a supplement, mobile taxation

assistance, and window taxation as the bottom of the

pocket (Shandong Provincial Taxation Bureau of the

State Administration of Taxation, 2020). For examp

le, upgrading the electronic numbering system, comb

ining mobile phone reservation queuing with offline

numbering to reduce the waiting time of taxpayers; a

nd establishing an online community for taxpayers w

ho were not clear about the tax process in the past, so

that the business staff can solve taxpayers' questions

online in shifts. This way of handling greatly saves t

he waiting time of taxpayers, so that the masses can

actually experience the intelligent tax handling, so th

at "one trip for nothing" becomes "only one trip". In

addition to the convenience brought by the online ap

plet, the business hall has also introduced a self-servi

ce robot, which can help taxpayers obtain the service

s they need more quickly through voice operation, ro

ute guidance and other functions for those who have

difficulties in handling business offline.

In addition, the Tax Office of the Wucheng Coun

ty Taxation Bureau in Dezhou City has actively expl

ored new ways of serving the masses with artificial i

ntelligence, based on the construction of an online ta

x platform, one-on-one counselling for enterprises, a

nd encouragement of taxpayers to handle registratio

n, approval of invoices, filing of financial accounting

systems and other businesses through the Internet, tr

ansferring more than 60 per cent of the business volu

me of the window. At present, about 90 per cent of ta

xpayers receiving invoices have applied online and r

eceived them at self-service equipment terminals, bu

t the traditional tax window is still retained to undert

ake the remaining 10 per cent of business in special c

ircumstances, effectively realizing that the tax busine

ss can be done in the vicinity of the taxpayer's home,

that it can be done at multiple points, and that it can

be done less frequently and more quickly.

Nowadays, the construction of digital governmen

t is a key hand in promoting Chinese-style modernisa

tion and the modernisation of the national governanc

e system. With the reform of China's market econom

ic system and the continuous innovation and develop

ment of artificial intelligence technology, the constru

ction of China's digital government has achieved rem

arkable results. According to statistics, China's e-gov

ernment ranking has risen from 78th in 2012 to 43rd

in 2022, one of the highest increases in the world. A

mong them, China's online service ranking in 2022 w

ill be 13th in the international rankings, and its teleco

mmunication facilities ranking will reach 47th. This

series of achievements demonstrates that China is co

nstantly changing its role in building digital governm

ent, gradually transforming itself from a "participant

" to a "leader", and opening up a path of digitalisatio

n with Chinese characteristics.

4 GOVERNMENT AND BUSINESS

CO-OPERATION IN BUILDING

"SMART TAX"

In 2017, Beijing Municipal Bureau of National Taxa

tion signed a strategic cooperation agreement with A

li Cloud Computing Co. The two sides will promote

the application of cloud computing, big data and artif

icial intelligence technologies in the field of taxation

through complementary advantages and resource int

egration, and jointly promote the construction of "int

elligent taxation". This is an opening for the governm

ent and enterprises to explore a new path of cooperat

ion, which will jointly promote the deep integration

of Internet innovations and tax work, and carry out in

-depth cooperation in the areas of infrastructure, busi

ness centre, data centre, intelligent customer service,

ECAI 2024 - International Conference on E-commerce and Artificial Intelligence

580

data innovation and intelligent office. It will also set

up a joint research centre for intelligent tax manage

ment, explore the application of algorithms for intelli

gent case selection in auditing, dynamic credit score

management, and tax risk management for large ente

rprises, and jointly build a "smart tax information pla

tform" for Beijing State Tax.

Beijing State Taxation will focus on the introduct

ion of an enterprise-level Internet architecture and th

e construction of a hybrid cloud-mode business centr

e and data centre to realise the "storage, communicat

ion and use" of data. It will also innovatively introdu

ce ET intelligent customer service to provide taxpaye

rs with the convenience of consulting and handling b

usiness without leaving their homes.

Nowadays, Beijing State Tax has cumulatively la

unched 31 optimisation projects in 11 categories, wh

ich have reduced the burden of the physical tax servi

ce hall by 51%, reduced the hall's human flow by mo

re than 30%, and reduced the average waiting time o

f taxpayers by more than 40%, and gained the praise

s of the majority of taxpayers. By joining hands with

Aliyun, the two sides will further give full play to th

eir respective advantages, cooperate in good faith, an

d achieve mutual benefits and win-win results, so as

to jointly accelerate the construction of tax modernis

ation, enable taxpayers to experience a more efficien

t and effective tax service, and create a more stable, f

air, and transparent business environment of high qu

ality.

5 BIG DATA ANALYSIS HELPS

HENAN INCREASE FISCAL

REVENUE

In 2017, Beijing Municipal Bureau of National Taxa

tion signed a strategic cooperation agreement with A

li Cloud Computing Co. The two sides will promote

the application of

As an important part of the tertiary industry, the s

ervice sector plays an important role in expanding th

e Government's fiscal revenue; in terms of tax contri

bution, the proportion of tax revenue from the servic

e sector in the total tax revenue has exceeded 50 per

cent for many years in a row, making it the most imp

ortant source of tax revenue.

Henan tax department analyses the tax big data a

nd provides targeted reminders and guidance assistan

ce on tax-related matters matching the business deve

lopment for the cultural and tourism sector. As early

as 2022, relying on tax big data, Henan tax departme

nt carried out tourism data analysis, put forward sugg

estions on various aspects such as developing touris

m cultural and creative products and creating immers

ive performing arts projects, and formed a special re

port. Giving cultural relics, documents, oracle bone r

ecords and other new expressions of the times, and in

novating communication methods through artificial i

ntelligence, multimedia and other digital technologie

s (State Administration of Taxation, 2024).

Artificial intelligence plays an important role in t

he current period for the government to develop the t

ertiary industry, especially the service industry. Thro

ugh data collection, only the indicator of tax cost rate

is used as a reference [Taxation cost rate = Taxation

cost in a certain period ÷ Taxation revenue in a certa

in period × 100% According to this indicator, the col

lection cost rate of a certain region or a collection un

it, a certain tax system or a certain tax type can be ca

lculated specifically]. After 2004, the cost of tax coll

ection in China has remained above 6 per cent, whic

h shows that "high cost and low efficiency" in tax co

llection and management has become a difficult prob

lem in the field of tax collection and management in

China.

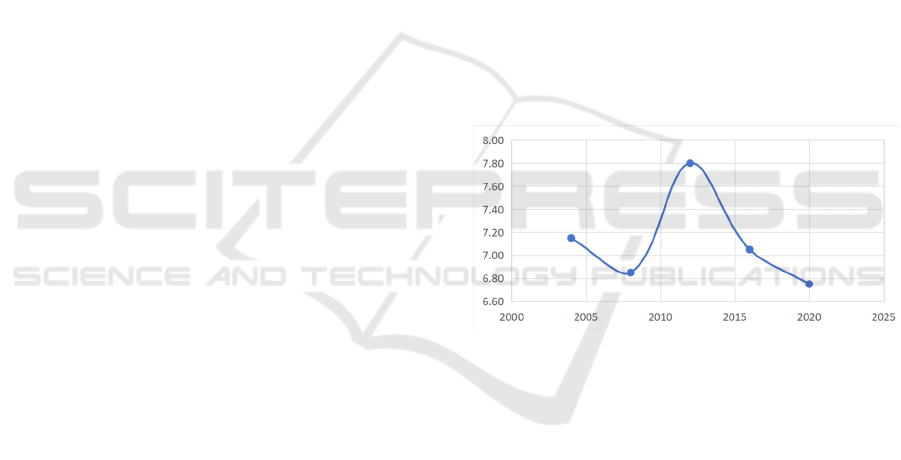

Data source: Zhi.com - "Wang Di, Shao Xuefeng.

Institutional Efficiency with the Addition of Digital

Technology.

Figure1: Tax cost ratio.

Based on the tax cost rate, this paper draws on the tre

atment method and some data of existing literature, a

nd refers to the tax collection and administration effi

ciency model (TCAE) of its service industry (Figure

1), and makes preliminary calculations on the data of

the tax collection and administration efficiency of th

e east, west and central China between 2004 and 202

0(Figure 2) (Di Wang, Xuefeng Shao, 2023).

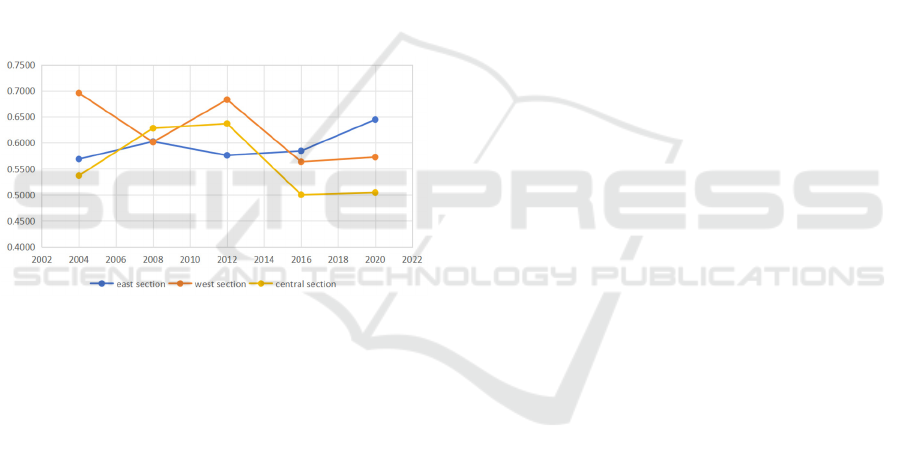

On the whole, China's service industry tax collect

ion and management costs show a decreasing trend,

but the tax costs are still high, and there is still a grea

ter space for service industry tax collection and mana

gement efficiency to rise. Secondly, the service indu

stry tax collection and management efficiency in the

eastern and central regions both show certain fluctua

tion changes, while the eastern region shows a rising

Preparation of Camera-Ready Contributions Analysis of the Application and Effectiveness of Artificial Intelligence in Modern Taxation

Work

581

trend in general, and there is no obvious increasing t

rend in the central region; and the service industry ta

x collection and management efficiency in the weste

rn region shows a certain decreasing trend in general

(Li Jianjun, 2011). It can be surmised that since the

21st century, the eastern region, as the main port of f

oreign exchange, can have access to more new techn

ologies from different countries, and thus take the lea

d in launching technology pilots and gradually expan

ding them to the whole country. In addition the impa

ct of digital transformation and the application of AI

technology is significant. in September 2015, the Sta

te Administration of Taxation (SAT) implemented th

e "Internet+Tax" action plan, which greatly accelerat

ed the application of digitalisation in the field of taxa

tion, and AI technology and intelligent big data have

been more and more widely used in tax collection an

d management of the service sector. after 2016 , the i

ncrease in tax revenues and the decrease in cost rate

of the service industry have shown large changes.

Data source: Knowledge Network - "Li Jianjun.

Assessment and Analysis of Tax Administration

Efficiency.

Figure 2: Descriptive statistics of tax administration

efficiency in the East, West and Central regions.

6 EXAMPLES OF ARTIFICIAL

INTELLIGENCE IN

INTERNATIONAL

GOVERNMENT

The development of artificial intelligence technology

has accelerated the process of building a digital gov

ernment in China, which has led to a qualitative impr

ovement in the efficiency of modern financial and ta

x work. And in the international community, AI tech

nology has also gained the eye of many governments.

In Southeast Asia, on 5 February 2024, the Indian

Ministry of Finance reported to Parliament that the c

ountry's tax department had achieved great results in

monitoring and identifying high-risk taxpayers suspe

cted of inflating input tax credits using advanced dat

a analytics and artificial intelligence models. An aud

it of data for the period April-December 2023 alone i

dentified 14, 597 cases of tax evasion, with a suspect

ed inflated input tax credit of Rs 1, 800 crore, and 98

arrests were made in connection with the cases (Nati

onal Board of Revenue, 2024). The Indian tax depart

ment says it will continue to upgrade these tools, usi

ng big data analysis to improve efficiency and build

a better system of intelligent tax risk monitoring to e

nsure government revenue.

In Europe, Austria, as an important member of th

e European Union, attracts many foreign enterprises

to invest. Austria also has a sound tax system and a s

trict tax supervision mechanism, and a major feature

of its government finance work is the establishment

of a relatively perfect tax big data supervision syste

m, in which the Predictive Analytics Competence Ce

ntre of the Austrian Federal Ministry of Finance mak

es use of big data and artificial intelligence to identif

y tax risks and carry out real-time assessment and ris

k push. In terms of coverage, Austria's tax big data s

upervision basically covers all groups of the employe

d population, and more than 6 million people can be

assessed for tax risks in a year, which can greatly red

uce the risk of fiscal revenues and expenditures and

maintain the smooth operation of government work.

The Austrian Federal Ministry of Finance's Compete

nce Centre for Predictive Analytics The Competence

Centre for Predictive Analytics of the Austrian Fede

ral Ministry of Finance is responsible for identifying

tax risks using, among other things, big data and artif

icial intelligence, as well as tax risk pushing through

the assessment of tax-related data in real time. Accor

ding to statistics, only for payroll tax, Austria can ac

hieve tax risk assessment for more than 6 million peo

ple in a year through tax big data regulation, account

ing for about 67 per cent of the total Austrian popula

tion, basically achieving full coverage of the employ

ment group.2022 Since 2022, Austria has recovered

as much as 540 million euros of tax through big data

risk assessment (National Tax Administration, 2024).

Austrian tax inspections are more varied and hav

e a relatively strong big data regulatory capacity, and

they use big data, both internal and external data sou

rces. In particular, internal data sources consist mainl

y of basic data stored in the Ministry of Finance, suc

h as taxpayer registration data, tax assessments, decl

arations, customs declarations or vehicle data; extern

al data sources consist mainly of data from business

registers, land registers or trade registers.

At the same time, the Austrian tax authority detec

ts tax data anomalies through its self-developed math

ECAI 2024 - International Conference on E-commerce and Artificial Intelligence

582

ematical model, thus laying the foundation for tax ris

k assessment. The author suggests that Chinese enter

prises investing in Austria should keep abreast of the

requirements of the relevant Austrian tax laws and r

egulations and the latest developments, strengthen th

e importance of tax management, and do a good job i

n tax compliance management, so as to avoid abnor

mal reduction of sales data, abnormal increase of exp

enses, and significant reduction of tax burden, etc., w

hich are easy to be judged as abnormal by the system,

and thus to reduce the risk of being inspected by the

tax authorities.

Elsewhere in the EU, the Danish Tax Administrat

ion automates the valuation of real estate with the he

lp of robots, i.e. machine algorithms that automatical

ly calculate or validate the pricing of real estate with

out any manual inputs from tax officers; the valuatio

n model includes a total of 19 variables, such as prox

imity to amenities, such as schools and parks, and th

e level of pollution in the area (Kim Willsher, 2024).

The Italian tax authority developed the VeRa algorit

hm to cross-reference financial data with tax returns,

income, property records, bank accounts, and other

electronic payment information to monitor taxpayers

at higher risk of nonpayment; 1 million high-risk fra

ud cases were identified in 2022 alone. The Spanish

Tax Administration has been using an automated deb

tor analysis program since 2015, which mines and an

alyses the amount of tax owed and the complexity of

the case to classify debtors into five categories, whic

h it uses to determine which collection methods to us

e (Joyce Beebe, 2024). Other EU member states use

AI and big data to analyse granular features of taxpa

yer behaviour and carry out predictive analytics, ena

bling regulators to develop more precise regulations

and policies based on taxpayer profiles (Jie Chen, 20

24).

7 RISKS AND CHALLENGES

The development of artificial intelligence technology

has accelerated the process of building a digital gov

ernment in China, which has led.

The combination of artificial intelligence and gov

ernment financial management is both an inevitable t

rend of the booming development of science and tec

hnology and an important element of the constructio

n of the current social governance system.

As an emerging technology, artificial intelligence

has two sides, on the one hand, in the current society

to improve the efficiency of the government's tax co

llection work of the general demand for increased, e

merging industries continue to increase, the tax work

has become more complex and diverse, artificial int

elligence technology with the help of data sharing, in

telligent analysis of the tax work of the string togethe

r, can improve the government's ability to understand

the public opinion, decision-making assistance and s

ervice supply capacity.

On the other hand, with the increasing level of ne

twork information sharing, the current network infor

mation is also facing more serious security problems,

and the openness, complexity and high-speed iterati

ve nature of artificial intelligence will also bring the

administrative supervision of the object is difficult to

identify, the main body of the lack of capacity, and t

he process of the governance of the more closed prob

lems. As an emerging product, the current law on the

regulation of artificial intelligence is not yet perfect,

and the lack of legal regulation and the omission of

regulatory procedures also pose a greater risk.

In addition, the development of AI will inevitably

bring about changes in the structure of the workforc

e, according to a press conference of the Ministry of

Human Resources and Social Security, by the beginn

ing of 2017 China's unemployment rate reached 4.0

5%; by the end of 2023, the recruitment ratio of fina

ncial and tax positions at all levels of government ac

ross the country has reached 39:1, with the developm

ent of AI, more basic and repetitive work will inevita

bly be replaced, and the government and even societ

y as a whole will further expand the competitive pres

sure on employment.

8 CONCLUSIONS

China's development of AI technology has a unique

advantage, the implementation of the strategy of scie

nce and education, the strategy of strengthening the c

ountry with talents, and the strategy of innovation-dr

iven development has provided a favourable policy e

nvironment for the development of AI technology, a

nd China, as the world's largest country in terms of p

opulation, has created the necessary conditions for th

e combination of AI and the government's fiscal wor

k with its diversified social needs. It can be learnt thr

ough the case study that AI has a positive contributio

n to maintaining government revenue and improving

the efficiency of tax collection, and can be realised b

y reducing the cost of tax collection and managemen

t.

Based on the above analyses, this paper makes th

e following recommendations:

First,Continuing to improve the breadth and de

pth of the application of artificial intelligence in the a

rea of modern finance and taxation work, following t

Preparation of Camera-Ready Contributions Analysis of the Application and Effectiveness of Artificial Intelligence in Modern Taxation

Work

583

he development step of "from point to point", focusi

ng on the balance of technological development in v

arious regions, narrowing the technological gap, and

sharing the experience and effectiveness among loca

l governments. The vertical and deep development of

digital technology is being actively promoted, espec

ially in the relatively backward regions of central and

western China, where new-generation digital infrast

ructures, such as big data, artificial intelligence and t

he Internet of Things, are being actively developed, a

nd the application of digital technology in the field o

f tax collection and administration and the integratio

n of digital technology with the tax system are being

actively promoted.

Second, Doing a good job of the aftermath of tec

hnological innovation and paying attention to change

s in the structure of the labour force. In improving w

ork efficiency and exploring new ways of cutting cos

ts in government finance, we should do a good job of

bridging the gap between old and new ways of work

ing, pay attention to changes in the relationship betw

een AI and employment, adhere to the people-centre

d work ideology, change the structure of employmen

t, and reshape career planning, so that AI can actuall

y be used for people rather than replacing them.

Third, Innovate government management concep

ts and build a perfect working system. The governme

nt should do a good job of top-level design and guida

nce, formulate corresponding tax collection and man

agement processes for emerging industries, strengthe

n theoretical training for business personnel, realize t

he online business process and intelligent data applic

ation, use the advantages of digital platforms, throug

h the collection of tax information for data analysis, t

o understand the situation of the tax source and the r

elevant regulatory deficiencies, to reduce the loss of

the tax source, and to effectively solve the problem o

f asymmetry of information.

Fourth, between the government and enterprises.

The problem of information asymmetry between the

government and enterprises is effectively solved.

Fifth, Strictly formulate rules and crack down on

violations. The people's congresses at all levels have

improved and revised local laws and regulations suc

h as the Tax Administration Law as soon as possible,

clarified the rights of tax authorities to collect tax-re

lated information at the legal level, strengthened the

management of the quality of tax-related data, and co

nstructed risk management platforms; technologicall

y, they have ensured that the digital means are "usabl

e, controllable, and knowable", and that digital techn

ologies used in the process of tax administration are

safe and sound, and that technological security is ma

intained throughout. Technically, it ensures that digit

al means are "available, controllable and knowable"

and that the digital technology used in the process of

tax collection and management is safe and sound, an

d that technical security is maintained throughout.

REFERENCES

Chen J, 2024. Comparative analysis of the application of a

rtificial intelligence in the field of tax collection and ad

ministration in EU member states[J]. International Tax

ation

Inspections and Anti-Avoidance Investigations, 2024. Joyc

e Beebe. AI and Taxes-A Work in Progress:Part 1[EB/

OL].

Kim Willsher, 2022. French Tax Officials Use AI to Spot

20, 000 Undeclared Pools[EB/OL].

Li Jianjun. Assessment and analysis of tax administration

efficiency:1997-2007.

Li Xiangxia, Liu Xingxin, 2024. Digital application empo

wers tax administration to improve efficiency.

SAT, 2024. India identifies lakhs of GST evasion cases wit

h big data and AI technology, 2024

State Administration of Taxation, 2024. Henan: Tax benefi

ts empower cultural and tourism market to flourish

State Administration of Taxation, 2022. nvesting in Austri

a: Guidelines for Responding to Tax

State Administration of Taxation Shandong Province Taxa

tion Bureau, 2020. [Dezhou Daily] Wucheng County T

axation Bureau Applies Information Technology and A

rtificial Intelligence to Tax Handling - Improving Effic

iency and Enhancing Taxpayer Satisfaction

Wang Di, Shao Xuefeng, 2023. Institutional Efficiency un

der the Addition of Digital Technology--Analysis Base

d on Tax Administration of Service Industry.

ECAI 2024 - International Conference on E-commerce and Artificial Intelligence

584