Principe and Applications of Hybrid Prediction Models for Stock

Price Forecasting

Yikun Liu

Department of Information Science and Technology, Beijing University of Technology, Beijing, China

Keywords: Stock Prediction, Hybrid Models, Machine Learning.

Abstract: The stock market, one of the key elements of the financial industry, is a risky and lucrative arena that draws

in a large number of traders. Contemporarily, there has been a surge in interest in research concerning stock

price prediction. This research focuses on the concept and utilization of hybrid prediction models in predicting

stock prices. This study first introduces some traditional and deep learning-based single models and the

relevant background of stock forecasting, and then introduces some cutting-edge hybrid model configurations.

The prediction results of these models were compared. By analysing mean average error (MAE), root mean

square error (RMSE) and other performance metrics, it can be found that these hybrid models have a great

improvement compared with the single model, and different models have different advantages. The research

on hybrid model stock forecasting is helpful to understand its application in the stock market, better forecast

stocks, and lay the foundation for the establishment of more diversified and effective models in the future.

1 INTRODUCTION

The stock market, one of the key elements of the

financial industry, is a risky and lucrative arena that

draws in a large number of traders. The correct

prediction of stock prices can enable investors to

reduce risks and improve returns when making

decisions. Research on stock price prediction has

become very popular in recent years. According to

different theories of model construction, there are two

primary groups for stock price single prediction

models (Zhang, 2020). Classic statistical models, like

the time sequence and hidden Markov model, are

founded on statistical theory. Neural networks,

support vector machines, decision trees, and other

cutting-edge stock prediction techniques are

examples of machine learning models. Each of these

approaches has advantages and disadvantages, and

several typical models are described below.

In time series analysis, the Auto-Regressive

Integrated Moving Average Model (ARIMA) and the

Auto-Regressive Moving Average Model (ARMA)

are frequently used to forecast and evaluate data with

time changes, and ARIMA is an extension of ARMA

(Zhao, 2021). Compared with ARMA, ARIMA has

one more difference step in data processing and

performs better in processing non-stationary time

series data. However, this model is not suitable for

long-term prediction (Huang, 2023).

It was during the latter part of the 1960s that the

Hidden Markov Model (HMM) was developed, and

Baum et al. gave the original prototype of the model

in a series of statistical papers. It also has its

application in the financial field. In 2005, Hassan and

Nath introduced a new technique for predicting stock

prices by using HMM to the task. The method takes

the opening price, closing price, highest price and

lowest price as the model input, and predicts the stock

price by parameter estimation and state decoding

(Hassan, 2005). HMM has a good effect on process

state prediction, and can be used in state prediction

where state classification is more obvious. HMM has

a good effect on global (the whole) prediction, but it

also has the disadvantages of not suitable for local

prediction and poor prediction accuracy in the

medium and long term.

The vast amount of data in the stock market has

drawn the interest of numerous academics since the

big data era began. The subject of stock prediction

makes extensive use of machine learning techniques

including support vector machines, neural networks,

decision trees, etc. Many of the drawbacks of

conventional approaches are offset by their benefits

in processing complex and massive amounts of data.

After combining machine learning algorithms with a

Liu, Y.

Principe and Applications of Hybrid Prediction Models for Stock Price Forecasting.

DOI: 10.5220/0013270600004568

In Proceedings of the 1st International Conference on E-commerce and Artificial Intelligence (ECAI 2024), pages 561-567

ISBN: 978-989-758-726-9

Copyright © 2025 by Paper published under CC license (CC BY-NC-ND 4.0)

561

vast amount of historical stock market data,

researchers are able to develop and train their model,

which then helps them forecast future stock market

trends. When compared to conventional methods,

machine learning techniques greatly improve

precision in forecasting and have significant

implications in both theory and practice.

Regardless of the forecasting technique employed,

stock forecasting has specific forecasting constraints

and uses a finite amount of data and information.

Consequently, Bates and Granger combined

forecasting method highlights the benefits of various

forecasting techniques while avoiding drawbacks,

making full use of the data in various forecasting

models to forecast. The stock market prediction is

progressively made using the integrated approach

(Bates, 1969). In order to forecast the closing price of

the stocks for the following day, Lu proposed the

convolutional neural networks-bidirectional long

short-term Memory-attention Mechanism(CNN-

BiLSTM-AM) approach. The attention mechanism

(AM), bi-directional long short-term memory

(BiLSTM), and convolutional neural networks (CNN)

make up this technique. Its performance is superior to

that of the other models (Lu, 2020). By combining

deep neural network (DNN) and predictive rule

integration (PRE) technology, a hybrid stock

prediction model was proposed by Srivinay. RMSE

of this model was improved about 6% compared to

the sinlge prediction model (Srivinay, 2022). A novel

method of prediction based on generative adversarial

networks (GANs) is called the Hybrid Prediction

Algorithm (HPA). Multi-Model based Hybrid

Prediction Algorithm (MM-HPA) and GAN-HPA

were coupled by Nagagopiraju to create a new hybrid

model called MMGAN-HPA (Nagagopiraju, 2023).

This paper mainly focuses on the research history

and research development of stock forecasting, and

introduces some current cutting-edge stock

forecasting methods based on mixed models, aiming

to provide theoretical basis for further research of

stock forecasting, hoping to find more accurate and

efficient forecasting methods. In the second section,

the factors and some common models often used in

stock forecasting are introduced; in the third section,

the structure of mixed models used in stock

forecasting is introduced; in the fourth section, the

performance of mixed models in stock forecasting is

introduced; in the fifth chapter, the limitations of

these models in application and the future outlook of

stock forecasting based on mixed models are

introduced.

2 DESCRIPTIONS OF STOCK

PRICE PREDICTION

The fundamental concept behind stock prediction is

to develop a model that, using historical data from the

past, projects future stock prices. At first technical

analysis were mostly used for subjective projections

for shares.. The closing values of stocks were later

enumerated in chronological sequence to create a new

model. Based on the stock's past price movement,

forecast the short-term change trend for the future. At

present, people use the large amount of historical data

generated by the stock market, combined with

machine learning algorithms for modeling and

training. They trained their models to predict future

movements of stocks.

There are some basic data types in stock

prediction (Lu, 2021). The initial transaction price per

share of a particular securities following the stock

exchange's opening each trading day is referred to as

the opening price. One minute before a stock deals for

its final session of the day, its volume-weighted

average price equals its closing price. The total

number of equities exchanged during the day is

referred to as volume. The highest price equals the

maximum price a stock can produce during the course

of trading everyday. The lowest price is the minimum

price a stock can produce during the course of trading

everyday. Turnover quantity is the total number of

shares of all stocks that were traded in that particular

day. Some technical indicators are also used in stock

prediction.Technical indicators refer to the collection

of raw trading data calculated by different

mathematical formulas. The internal information of

different aspects of the stock market can be directly

reflected by making the calculation results of these

indicators into charts. Assessing and forecasting the

stock market's movement and behavior is

advantageous. Stochastic Indicator (KDJ-K, KDJD,

KDJ-J), Relative Strength Index (RSI-6, RSI-10),

Boll, Boll upper bound, Boll lower bound,Moving

Average Convergence Divergence (MACD), MACD

signal line, MACD histogram (Shao, 2022). In

addition to technical indicators, some

macroeconomic factors are also commonly used in

stock forecasting, such as China's 2-year treasury

yields, US 10-year debt (Liu, 2022).

ECAI 2024 - International Conference on E-commerce and Artificial Intelligence

562

3 CONFIGURATIONS FOR

HYBRID MODEL

CNN is a frequently utilized model. The fundamental

building blocks of the CNN model, the convolution

layer and pooling layer, are capable of automatically

extracting and reducing the dimension of the input

features. This reduces the adverse impact of the

traditional model and works better for extracting

characteristics of stock information. The convolution

layer extracts some local features of the input stock

price sequence through the convolution kernel, which

is equivalent to the feature extractor. The stock price

series is reduced and the secondary features are

extracted during the pooling layer, so as to further

enhance the model's capacity for generalization. Long

Short-Term Memory(LSTM) is generally limited to

transmitting data in a single direction and only

accepting input from the past; it cannot process input

from the future. Data from the past and the future can

be taken into account by BiLSTM simultaneously. Its

principle is: Compute LSTM's path starting from both

ends respectively, and then merge the LSTMs of the

two directions(Althelaya, 2018). Past data

information of the input sequence is stored in the

forward LSTM. Information regarding the input

sequence's future is contained in the backward LSTM.

The human brain's capacity to focus on items is

simulated in the Attention Mechanism (AM). Giving

more weight to relevant information and less weight

to unimportant information is the fundamental tenet

of AM. The main structure of CNN-BiLSTM-AM

model is CNN, BiLSTM, and AM, including input

layer, CNN layer, BiLSTM layer, AM layer, and

output layer(Lu, 2021).In the training process, the

standardization process is applied to reduce the

difference between the data and better adapt to the

model training.Separately, every network layer

extracts and processes characteristics of data. Lastly,

the output layer stores the model's forecasting

findings. To continually improve the model's

predictive power, every discrepancy between the

actual value and the anticipated results is computed,

and backpropagation is used to update the model's

weight and deviation. The training process continues

until a set termination condition is met (completion of

a predetermined number of cycles or an error

threshold is reached). After the training process, the

model can be used for prediction. First, the input data

is standardized, and then the trained CNN-BiLSTM-

AM model is used to generate prediction results. And

then restore the output results to the original data

format, and finally output them.

An enhanced neural network model built on the

foundation of a recurrent neural network(RNN) is the

LSTM model, which resolves the gradient explosion

and disappearance issues with RNNs and offers a

greater capacity for generalization. The input, output,

and forgetting gates are added to the LSTM model in

comparison to the RNN. These gate units remove or

add data information, so that it can retain important

information as much as possible and remove

interference information. In these door units, first of

all, the forgetting door is responsible for forgetting

the useless historical stock information, then, based

on input stock data and historical information, the

input door modifies the unit status. The current stock

information is finally output by the output door based

on the status of the unit. Bidirectional Encoder

Representations from Transformers(BERT)'s design

is inspired by bidirectional and Transformer, which,

unlike traditional one-way language models, takes

into account both left and right contexts to more fully

capture the context of text. BERT model uses self-

attention mechanism to construct deep neural

network, and Transformer is the core to implement

bidirectional text coding (Zhang, 2024). BERT model

and BiLSTM model are used to extract the emotional

features of some financial news, and BERT self-

supervision function is used to predict the emotional

polarity of the remaining financial news. The

forecasting step utilizing LSTM can be continued

After integrating the obtained emotional features with

stock information.

4 IMPLEMENTATION RESULTS

The Shanghai Composite Index (000,001) stock is

chosen as the experimental data in an experiment (Lu,

2021). Models are trained using the training data set

that has been analyzed. MAE, RMSE, and R-square

(R

2

) are employed as the methodologies' evaluation

criteria to assess each model's ability to predict

outcomes. Higher prediction effect is associated with

lesser MAE and RMSE. The model's predictive

power increases with the proximity of its R

2

value to

zero, which runs from zero to one. Of the nine

methods in the Table 1, CNN-BiLSTM-AM performs

the best since its MAE and RMSE are the lowest and

its R

2

is closest to 1. Comparing BiLSTM with LSTM,

MAE decreased 4%, RMSE decreased 2%, indicating

that BiLSTM has better effect. BiLSTM and LSTM

are combined with CNN to form BiLSTM-CNN and

LSTM-CNN, respectively. The results show that

CNN-bilSTM has a higher R

2

and smaller MAE and

RMSE than CNN-LSTM. It shows that CNN-

Principe and Applications of Hybrid Prediction Models for Stock Price Forecasting

563

BiLSTM performs better than CNN-LSTM. The

combination of BiLSTM and CNN is changed to

BiLSTM and AM to form BiLSTM-AM, MAE and

RSME further decrease, and R2 improves slightly,

which indicates that bilSTM-AM performs better

than CNN-BiLSTM.

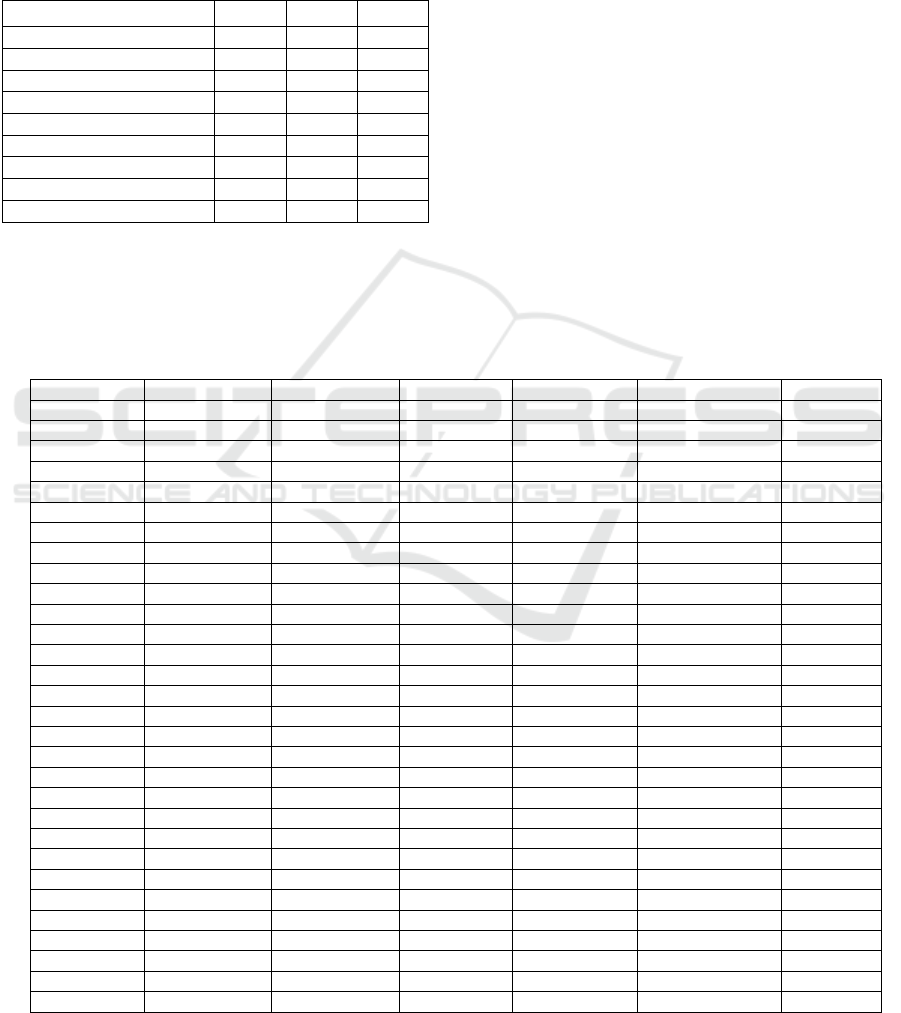

Table 1: Comparison of evaluation error indexes of the five

methods.

Method MAE RMSE R²

MLP 31.496 39.260 0.9699

CNN 25.665 36.878 0.9735

RNN 26.822 35.801 0.9751

LSTM 24.361 34.331 0.9770

BiLSTM 23.409 33.579 0.9780

CNN-LSTM 23.195 32.640 0.9792

CNN-BiLSTM 22.715 32.065 0.9800

BiLSTM-AM 22.337 31.955 0.9801

CNN-BiLSTM-AM 21.952 31.694 0.9804

A study uses the DJIA stock dataset from 2018 to

2023 to examine a number of algorithms, including

ANN, LSTM-GA, LSTM1D, LSTM2D, LSTM3D,

and optimized LSTM with ARO (LSTM-ARO)

(Gülmez, 2023). An indicator used to assess the

precision of forecasting models is MAE. As can be

seen from the summary of the table, for most of the

stocks used in the experiment, the MAE of LSTM-

ARO is the lowest among the several methods,

indicating that LSTM-ARO performs most

effectively out of all the experiment's approaches.

However, another crucial point to remember is that

different stocks have varying degree of precision

of prediction using LSTM-ARO. The precision of a

model's predictions is also assessed by its R

2

value.

The model's predictive power increases with the

proximity of its R

2

value to zero, which runs from

zero to one. As can be seen from the summary of the

Table 2 and Table 3, for most of the stocks used in the

experiment, the R

2

of LSTM-ARO is the lowest

among the several methods, indicating that LSTM-

ARO performs most effectively out of all the

experiment's approaches. A further point to consider

is that certain models, like LSTM1D and LSTM2D,

perform worse than a straightforward data average

when it comes to specific indicators, as shown by

their negative R

2

ratings.

Table 2: Comparison of the models for MAE criteria.

MAE Ticke

r

LSTM-ARO LSTM-GA LSTM1D LSTM2D LSTM3D ANN

AXP 3.804 3.848 5.159 5.415 5.082 4.704

AMGN 3.318 3.425 9.614 7.867 11.513 6.193

AAPL 3.846 3.955 5.851 4.878 6.632 7.673

BA 4.425 4.805 15.994 14.042 15.369 13.813

CAT 4.947 4.748 8.875 10.310 8.661 9.235

CSC0 0.744 0.813 0.828 1.176 1.430 0.988

CVX 3.830 3.531 12.940 5.969 16.006 10.518

GS 7.060 7.272 9.653 10.129 8.844 12.525

HD 6.206 6.026 6.046 14.317 7.487 10.753

HON 2.876 3.068 5.851 5.413 3.854 5.769

IBM 2.113 2.096 2.652 3.117 3.755 2.836

INTC 1.092 1.072 4.107 4.486 5.064 3.059

JNJ 1.912 1.795 3.436 3.860 4.525 2.139

KO 0.738 0.751 2.584 2.624 3.217 1.439

JPM 2.523 2.894 4.570 3.415 3.380 4.569

MCD 3.630 3.646 5.864 10.878 8.596 8.233

MMM 2.602 2.532 6.410 5.845 6.210 5.538

MR

K

1.551 1.212 3.810 5.563 5.906 3.165

MSFT 6.584 7.583 8.889 8.659 8.784 9.363

NKE 2.907 3.050 3.371 4.501 3.939 4.563

PG 2.180 2.105 5.392 5.186 5.357 5.968

TRV 2.853 2.808 2.796 7.112 7.962 7.323

UNH 9.016 7.852 40.169 45.718 29.796 13.116

CRM 5.024 5.879 7.527 6.616 6.419 6.931

VZ 0.618 0.609 1.274 1.274 1.258 1.303

V 3.724 3.849 5.347 4.752 5.583 6.540

WBA 0.667 0.693 1.124 1.270 1.313 1.153

WMT 2.291 2.309 3.314 3.464 3.648 4.770

DIS 2.923 2.935 4.472 5.300 5.338 3.431

DOW 1.059 1.114 1.178 1.203 1.489 2.337

ECAI 2024 - International Conference on E-commerce and Artificial Intelligence

564

Table 3: Comparison of the models for R

2

criteria.

R

2

Ticke

r

LSTM-ARO LSTM-GA LSTM1D LSTM2D LSTM3D ANN

AXP 0.907 0.900 0.836 0.815 0.836 0.862

AMGN 0.943 0.942 0.606 0.696 0.354 0.834

AAPL 0.857 0.848 0.675 0.764 0.602 0.458

BA 0.954 0.945 0.527 0.625 0.540 0.661

CAT 0.909 0.914 0.724 0.649 0.732 0.705

CSC0

0.961 0.954 0.952 0.913 0.870 0.933

CVX 0.911 0.919 0.227 0.802 -0.214 0.467

GS 0.886 0.885 0.806 0.781 0.826 0.651

HD 0.902 0.906 0.909 0.587 0.868 0.708

HON

0.928 0.921 0.725 0.766 0.880 0.728

IBM 0.884 0.885 0.826 0.772 0.650 0.798

INTC 0.972 0.970 0.593 0.498 0.338 0.803

JNJ 0.834 0.854 0.515 0.407 0.192 0.786

KO 0.841 0.845 —0.246 -0.339 —0.943 0.537

JPM 0.940 0.924 0.821 0.890 0.892 0.807

MCD

0.875 0.869 0.689 0.133 0.401 0.442

MMM 0.947 0.952 0.700 0.728 0.698 0.789

MRK 0.962 0.976 0.756 0.520 0.446 0.858

MSFT 0.892 0.865 0.797 0.820 0.820 0.773

NKE 0.949 0.946 0.935 0.887 0.908 0.874

PG 0.900 0.903 0.568 0.589 0.574 0.424

TRV 0.866 0.866 0.869 0.359 0.121 0.314

UNH 0.823 0.865 -1.517 -2.239 -0.512 0.664

CRM 0.947 0.930 0.892 0.913 0.917 0.902

VZ 0.975 0.975 0.917 0.910 0.922 0.918

V 0.814 0.805 0.652 0.708 0.611 0.465

WBA 0.967 0.965 0.913 0.890 0.879 0.910

WMT 0.888 0.885 0.808 0.760 0.762 0.612

DIS 0.965 0.963 0.924 0.899 0.895 0.954

DOW 0.956 0.953 0.944 0.937 0.917 0.806

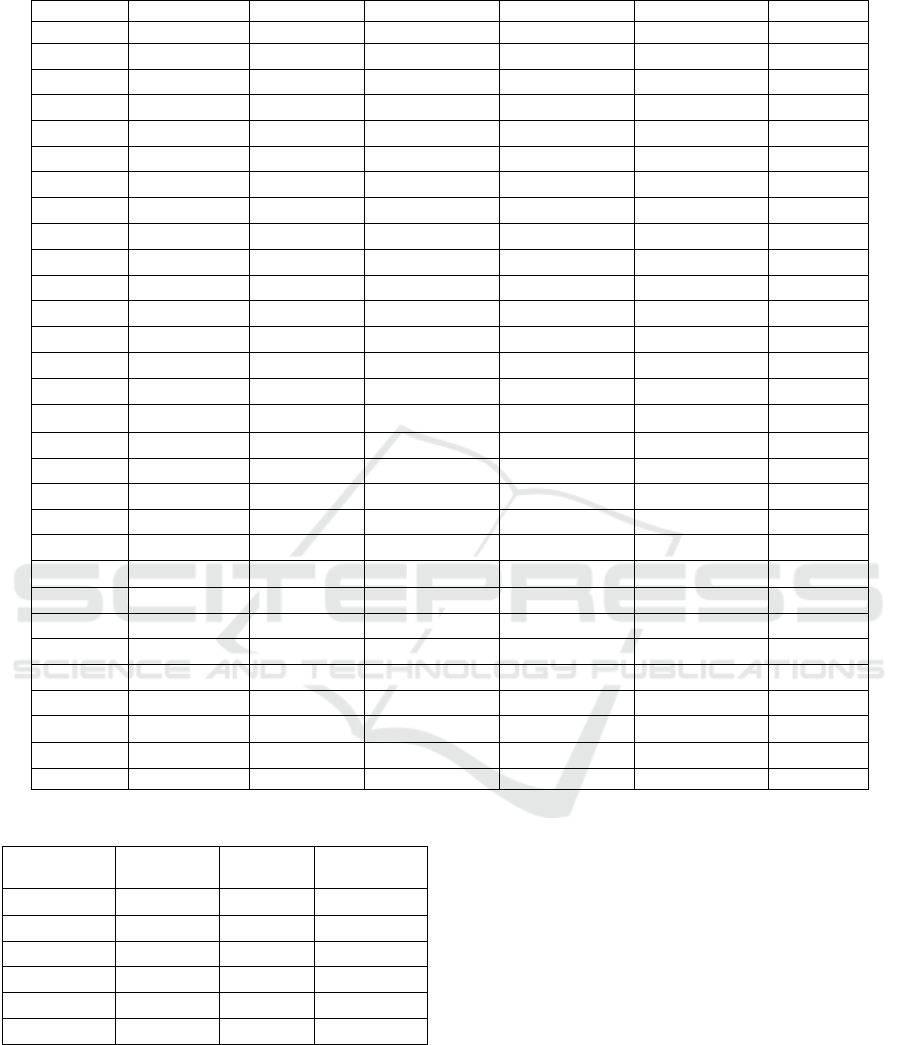

Table 4: Performance of MMGAN-HPA.

Stock ticker

MAE MSE

CORRELATI

ON

TCS 0.00263397 0.00003490 0.99586647

BHEL 0.00267097 0.00002290 0.99686559

WIPRO 0.00239697 0.00002400 0.99716163

AXISBANK 0.00280396 0.00003020 0.99837178

MARUTI 0.00221797 0.00002160 0.99721564

TATASTEEL 0.00463494 0.00006770 0.99736265

MMGAN-HPA is also an efficient hybrid model.

Seen from Table 4, MAE, MSE of stocks used

throughout the experiment are very low, the

correlation prediction performance is very high,

demonstrating the algorithm's effectiveness.

A FASTRNN_CNN_BiLSTM model was

proposed in a recent study (Yadav, 2022). The RMSE

and calculation time are used to evaluate the models'

performance. Out of the 500 stocks in the trial, 86%

were used for training and 14% were used for testing.

The four businesses' stock values, i.e., Apple,

Facebook, Nike, and Uber, have been used to test the

models. Nine additional cutting-edge models are

contrasted with these suggested models. It is evident

that the suggested models outperform other models in

terms of computing time and RMSE. Though the

computation time of FBProphet, it has a higher

RMSE. The suggested models perform optimally

across a variety of stocks overall. A typical results for

Apple is given in Table 5.

Principe and Applications of Hybrid Prediction Models for Stock Price Forecasting

565

Table 5: RMSE and computation time calculated for the state-of-the-art and the proposed models for Apple Inc. stock values.

Model name RMSE Time (in s)

ARIMA 0.796109 1.63

BiLSTM_Attention_CNN_BiLSTM 0.234644 25.72292113

CNN_LSTM_Attention_LSTM 0.214821 16.00164294

FBProphet 0.935556 0.659962893

LSTM 0.228731 13.28157353

LSTM_Attention_CNN_BiLSTM 0.263613 19.96186757

LSTM_Attention_CNN_LSTM 0.27994 17.32732081

LSTM_Attention_LSTM 0.299334 19.28274226

LSTM_CNN_BiLSTM 0.23489 16.76800251

FastRNN (proposed) 0.202456 3.337492943

FASTRNN_CNN_BiLSTM(proposed) 0.205647 13.49208355

Abbreviations: ARIMA, auto regressive integrated moving average; RMSE,root mean squared error

5 LIMITATIONS AND

PROSPETCS

The stock data from the Chinese stock market is used

to train certain mixed models. When utilizing the

model on foreign stock markets, there will be an

obvious lag, which might be connected to how

Chinese and international stock markets trade. Such

difference can lead to situations where the trained

model cannot be applied to multiple different stock

markets. The data in the real stock market is noisy,

which may lead to poor results if used directly for

training. Additionally, overfitting phenomena might

exist while training. To some model, the result is good

while training, however, they perform poorly when

using other data.

Numerous causes, including abrupt political

events, changes in economic policy, and major global

events, frequently have an impact on the stock market.

These factors are often unpredictable and can lead to

errors in model predictions. In the subsequent

development of stock prediction, more consideration

can be given to how market sentiment, financial news

and economic policies affect the fluctuating pattern of

shares, so that the forecasting model will not only rely

on stock historical data, but become more

comprehensive.

6 CONCLUSIONS

To sum up, this research focuses on the concept and

utilization of hybrid prediction models in predicting

stock prices. This article first introduces some

traditional and deep learning-based single models and

the relevant background of stock forecasting, and

then introduces some cutting-edge hybrid model

configurations. The prediction results of these models

were compared. By analysing MAE, RMSE and other

performance analysis indicators, it can be found that

these hybrid models have a great improvement

compared with the single model, and different models

have different advantages. In the subsequent

development of stock prediction, more consideration

can be given to how market sentiment, financial news

and economic policies affect the fluctuating pattern of

shares, so that the forecasting model will not only rely

on stock historical data, but become more

comprehensive. The research on hybrid model stock

forecasting is helpful to understand its application in

the stock market, better forecast stocks, and lay the

foundation for the establishment of more diversified

and effective models in the future.

REFERENCES

Althelaya, K. A., El-Alfy, E. S. M., Mohammed, S., 2018.

Evaluation of bidirectional LSTM for short-and long-

term stock market prediction. 2018 9th international

conference on information and communication systems

(ICICS), l51-156.

Bates, J. M., Granger, C. W., 1969. The combination of

forecasts. Journal of the operational research society,

20(4), 451-468.

Gülmez, B., 2023. Stock price prediction with optimized

deep LSTM network with artificial rabbits optimization

ECAI 2024 - International Conference on E-commerce and Artificial Intelligence

566

algorithm. Expert Systems with Applications, 227,

120346.

Hassan, M. R., Nath, B., 2005. Stock market forecasting

using hidden Markov model: a new approach. 5th

international conference on intelligent systems design

and applications (ISDA'05), 192-196.

Huang M., 2023. Empirical research on stock price

prediction based on ARIMA model. Neijiang Science

and Technology, 3, 61-62.

Liu, X., 2022. Research on Multi-factor Stock prediction

combined with quantitative trading. Master's Thesis of

Soochow University.

Lu, W., Li, J., Wang, J., Qin, L., 2021. A CNN-BiLSTM-AM

method for stock price prediction. Neural Computing

and Applications, 33(10), 4741-4753.

Shao, G., 2022. Stock price prediction based on

multifactorial linear models and machine learning

approaches. 2022 IEEE Conference on

Telecommunications, Optics and Computer Science

(TOCS), 319-324.

Srivinay, Manujakshi, B. C., Kabadi, M. G., Naik, N., 2022.

A hybrid stock price prediction model based on PRE

and deep neural network. Data, 7(5), 51.

Vullam, N., Yakubreddy, K., Vellela, S. S., Sk, K. B.,

Reddy, V., Priya, S. S., 2023. Prediction And Analysis

Using A Hybrid Model For Stock Market. 2023 3rd

International Conference on Intelligent Technologies

(CONIT) (pp. 1-5. IEEE.

Yadav, K., Yadav, M., Saini, S.: Stock values predictions

using deep learning based hybrid models. CAAI Trans.

Intell. Technol. 7(1), 107–116.

Zhang, Q., Lin, T., Qi, X., Zhao, X., 2020. Overview of

stock prediction based on Machine learning. Journal of

hebei academy of sciences, 4), 15-21.

Zhang, S., Su, C., 2017. Research on stock index prediction

based on sentiment dictionary and BERT-BiLSTM.

Computer Engineering and Applications 1-16.

Zhao, T., Han, Y., Yang, M., et al., 2021. A review of time

series data prediction methods based on machine

learning. Journal of Tianjin university of science and

technology, 5, 1-9.

Principe and Applications of Hybrid Prediction Models for Stock Price Forecasting

567