Car Price Prediction Using Machine Learning

Rui Chen

a

Department of Statistics and Applied Probability, University of California, Santa Barbara, California, U.S.A.

Keywords: Machine Learning, Price Prediction.

Abstract: Car price prediction is always a critical issue for the car industry, with significant implications for consumers,

dealers, and manufacturers. This study aims to compare the performance of three machine learning models -

Linear Regression (LR), Decision Tree (DT), and K-nearest neighbors (KNN) - to predict car prices using a

comprehensive dataset of vehicle characteristics. The research integrates diverse methodologies, evaluates

model performance using the R-squared (R

ଶ

) metric, and discusses the implications for practical applications.

The DT model, enhanced by feature importance analysis, achieved the highest R

ଶ

on the test set, indicating

its strong ability to capture complex patterns within the data. These findings underscore the potential of

advanced machine learning techniques to provide more accurate and reliable pricing models. By improving

price predictions, this research can support stakeholders in developing more effective pricing strategies,

ultimately benefiting consumers with fairer prices and helping dealers and manufacturers optimize their

revenue and inventory management.

1 INTRODUCTION

In the rapidly evolving automotive market, the

precise prediction of car prices remains a critical

challenge with significant implications for

consumers, dealers, and manufacturers alike. As

consumers seek the best value for their purchases, and

dealers aim to optimize inventory and pricing

strategies, the need for precise valuation models

becomes increasingly evident. This research is

motivated by the impact that accurate pricing can

have on consumer satisfaction and business

profitability.

The automotive industry relies heavily on

accurate pricing strategies to ensure fair market value

for vehicles, optimize inventory management, and

enhance consumer trust. Traditional pricing models

often fail to account for the intricate dependencies

among variables like vehicle age, mileage, brand, and

condition, leading to suboptimal pricing strategies.

However, Machine learning has opened up new

avenues for increasing the precision of auto price

forecasts. Based on a reliable dataset of diverse

vehicle characteristics, this study aims to examine

and contrast the accuracy of Linear Regression (LR),

Decision Tree (DT), and K-nearest neighbors (KNN)

a

https://orcid.org/0009-0008-2487-2862

models in forecasting automobile pricing. By

analyzing a robust dataset, this research contributes to

demonstrating the strengths and limitations of these

models in real-world scenarios, providing a

comparative analysis that will serve as a valuable

reference for consumers, dealers and industry

manufacturers.

2 LITERATURE REVIEW

Making use of machine learning to anticipate vehicle

prices has been the focus of numerous studies, each

adding unique methodologies and reasoning about the

variables influencing automobile pricing and the

precision of various machine learning models used to

make predictions. In the automotive industry,

machine learning has become a useful tool that assists

dealers and consumers in making informed decisions.

The car industry is a major pillar of global

economies, significantly contributing to the gross

domestic product (GDP) of many nations. Several

studies have explored the relationship between

automotive production and economic stability. One

such study examined the evolution of motor vehicle

production across various continents from 2018 to

536

Chen, R.

Car Price Prediction Using Machine Learning.

DOI: 10.5220/0013270100004568

In Proceedings of the 1st International Conference on E-commerce and Artificial Intelligence (ECAI 2024), pages 536-541

ISBN: 978-989-758-726-9

Copyright © 2025 by Paper published under CC license (CC BY-NC-ND 4.0)

2022, highlighting how the industry is deeply

impacted by macroeconomic factors such as the

pandemic. The research demonstrated that the

automotive industry fared better in the pre-pandemic

period compared to the pandemic period (Toma,

2023).

As one of the largest sectors in terms of

employment and technological innovation, the

industry's impact extends far beyond the vehicles it

produces. The integration of modern supply chain

practices, such as modular procurement, has made the

automotive sector a driver of global economic

development. However, the COVID-19 pandemic

disrupted these supply chains, leading to shortages of

key components, such as semiconductors, which has

further impacted car prices (Radić. N & Radić. V,

2021). Another study emphasized the ripple effects of

supply chain disruptions in the automotive industry,

underscoring how these disruptions not only led to a

decline in production but also contributed to price

volatility in the market (Asghar et al., 2021). As the

global economy recovers from the effects of the

pandemic, the used car market has experienced rapid

growth. Many buyers, unable to afford new vehicles,

have turned to used cars as a more affordable option.

According to research, the surge in used car demand,

spurred by the shortage of new cars and a rise in

consumer purchasing power, has driven up the prices

of used cars (Das Adhikary et al., 2022). With the

rising demand, car sellers have taken advantage by

listing vehicles at inflated prices, further emphasizing

the need for accurate car price prediction models to

help buyers make informed decisions.

A number of machine learning algorithms, each

with specific advantages and disadvantages, have

been used to forecast automobile values, helping

buyers and sellers evaluate vehicles more accurately.

According to a study, LR models are useful for

estimating the cost of used automobiles and

emphasize the significance of a vehicle’s attributes

such as its make, model, condition, and mileage (Muti

& Yıldız, 2023). LR, while effective, often struggles

with non-linear data patterns, leading researchers to

explore more advanced models like Random Forests

(RF) and DT for better accuracy. Another study used

Random Forest models with more than 200 DTs to

predict used car prices, achieving high accuracy rates

(Ranjith, 2021). The study showed that because RF

can handle complicated interactions between

variables and many features, it performs better than

other regression models. Another study evaluates the

increasing complexity of China's used car market by

using machine learning models, including

LightGBM, to analyze key factors from five datasets,

ultimately constructing a predictive model that

enhances used car sales strategies. (Wang et al.,

2022). Additionally, a 2022 research introduces an

intelligent framework using artificial neural networks

to estimate used car prices, outperforming traditional

models like random forests in accuracy, as validated

with large datasets of U.S. vehicles. (Pillai, 2022).

Moreover, ensemble machine learning methods like

Random Forest, Support Vector Machine, and

Artificial Neural Network were used in a study on

Bosnia and Herzegovina's car price prediction. Using

this method produced a model with an accuracy of

87.38%. (Gegic et al., 2019).

However, the rise of electric vehicles (EVs) and

advancements in digitalization are reshaping the

automotive industry. The EU and Germany's focus on

the decarbonization of the automotive sector

highlights the impact of environmental regulations on

car prices. As consumers shift towards EVs, machine

learning models must adapt to include variables such

as battery life, charging infrastructure, and

government incentives (Nettekoven, 2023).

Although there are already various researches on

car price prediction, there isn’t a comprehensive

comparative analysis of different algorithms that can

predict car prices. Also, different prediction methods

may perform differently in certain situations in reality.

Therefore, this paper will use experiments to show

which algorithm has the best performance in general

and how those algorithms can perform better than

each other in different situations.

3 METHODOLOGYS

3.1 Data Description and Preparation

The dataset from Kaggle was used in this

investigation because it has a number of attributes,

including make, model, horsepower, mileage. The

brands and makes of cars might serve as a

representation of what consumers choose to purchase

in the present day. Because of its richness and

significance, it is a good fit for creating reliable

prediction models.

The first step in data preparation involved

cleaning the dataset, where missing values were

addressed through imputation. For continuous

variables, median values were used, while mode

values were applied to categorical variables. Feature

engineering was also performed to enhance model

performance by creating new features from existing

data, such as categorizing continuous variables like

mileage and age into bins.

Car Price Prediction Using Machine Learning

537

One-hot encoding was used to change categorical

information into a format that machine learning

algorithms could understand. To make sure that scale

discrepancies wouldn't allow one property to

dominate the others, numerical features were

standardized.

3.2 Model Development

Three machine learning models were selected for this

study. LR served as a baseline, offering simple

interpretations of data by modeling a linear

associations between car prices and vehicle attributes.

DT can manage non-linear association between car

features, so it was a perfect fit for capturing the

intricate dynamics involved in automotive pricing.

KNN was included for its effectiveness in cases

where similar historical data points can predict future

data points, leveraging feature similarity for price

prediction.

4 EXPERIMENT RESULTS AND

DISCUSSION

4.1 Experiment Evaluation

To understand how well the models used fit the data,

the R-squared ( R

ଶ

) was used to evaluate those

models. R

ଶ

stands for the proportion of dependent

features’ variance that is predictable from

independent features. Higher values in R

ଶ

indicate a

better fit between the model and the data.

Additionally, scatter plots were generated to visually

assess the alignment between the predicted and actual

values, offering a more intuitive understanding of the

model's performance. Furthermore, to gain deeper

insights into how the DT model arrived at its

predictions, a feature importance analysis was

conducted. This analysis identifies which features had

the most influence on predicting car prices. The tools

utilized were Python and modules like Pandas, Scikit-

learn, Matplotlib. Pandas were used to process data,

Scikit-learn was used to create and assess models, and

Matplotlib was used to visualize data.

4.2 Model Performance

The models' performance was evaluated based on the

R

ଶ

metric, with the DT model achieving the highest

R

ଶ

of 0.90. This suggests that the DT model was the

most effective at capturing the complex patterns

within the dataset, explaining 90% of the variance in

car prices. The LR model, with an R

ଶ

of 0.81, served

as a reliable baseline but struggled with the non-linear

aspects of the data. The KNN model, with an R

ଶ

of

0.72, was less effective than both the DT and LR

models in explaining the variance in car prices. Table

1 shows the results of LR, DT and KNN.

Table 1: R

ଶ

Values for LR, DT and KNN.

Model R

2

Linear Regression 0.81

Decision Tree 0.90

K-Nearest Neighbors 0.72

4.3 Visual Analysis

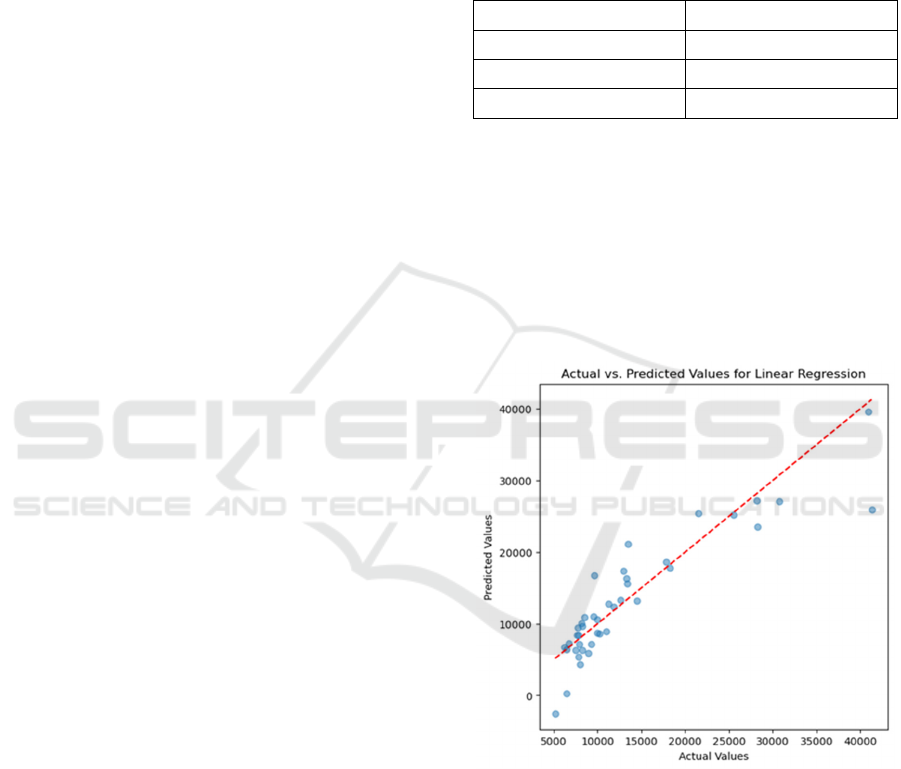

Scatter plots were created to compare the actual

values for each model versus the anticipated values in

order to better examine the models' performance. The

degree to which each model's forecasts matched the

actual automobile pricing is shown visually in these

plots. Figure 1, Figure 2 and Figure 3 shows the

scatter of LR, DT and KNN.

Figure 1: Scatter plots for LR (Photo/Picture credit:

Original).

ECAI 2024 - International Conference on E-commerce and Artificial Intelligence

538

Figure 2: Scatter plots for DT (Photo/Picture credit:

Original).

Figure 3: Scatter plots for KNN (Photo/Picture credit:

Original).

These plots indicate that the DT model provided

predictions that are closely aligned with the actual car

prices, as shown by the points clustering along the

diagonal line, which indicates a strong fit. The LR and

KNN models, while generally effective, exhibited

more variability, with predictions deviating more

from the actual values, particularly in the case of the

KNN model, which showed the greatest dispersion

from the diagonal.

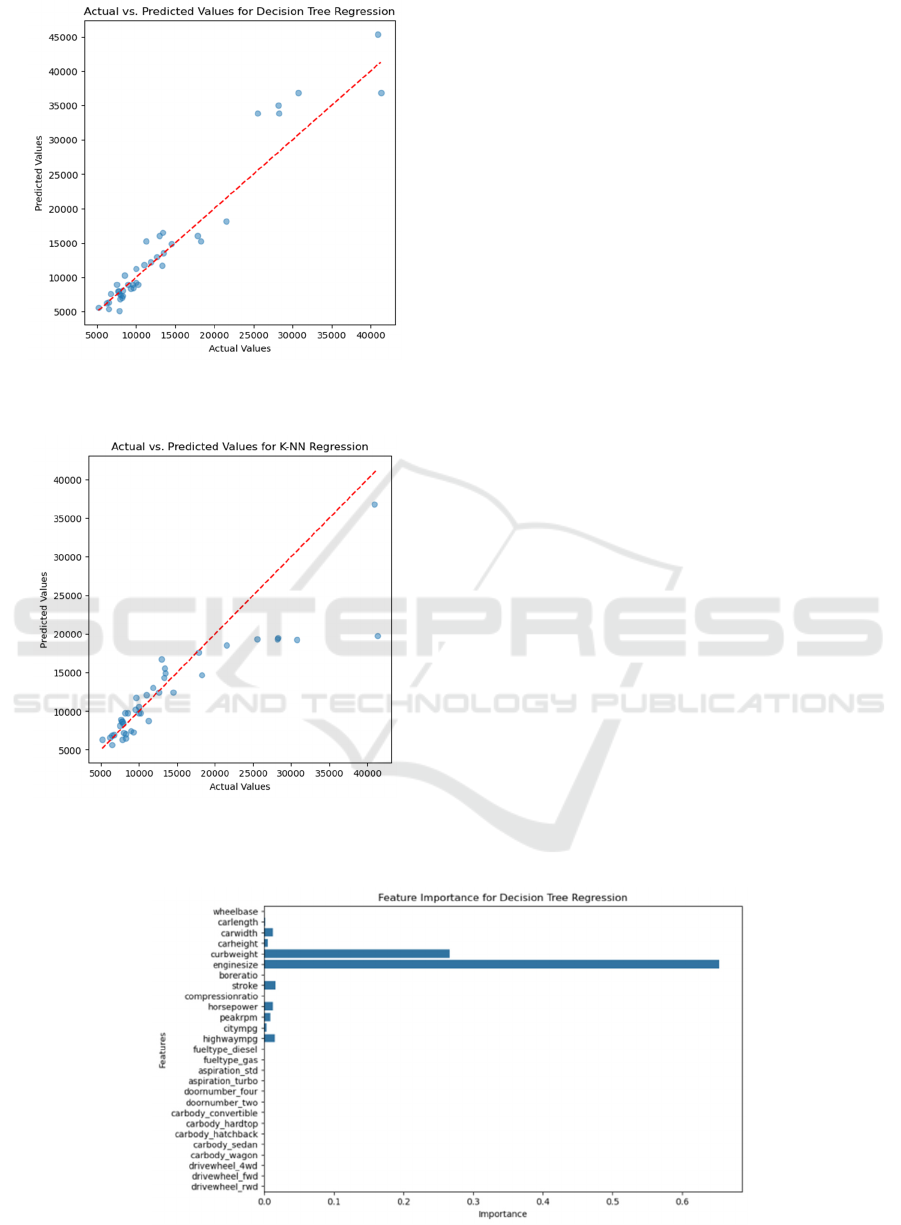

4.4 Feature Importance Analysis

In addition to the visual analysis for the three models,

a feature importance analysis was conducted for the

DT model. The importance of each feature was

calculated based on its contribution to the prediction

of car prices, as shown in Figure 4.

The results indicate that engine size was the most

significant feature, with a feature importance score of

approximately 0.65. This aligns with expectations, as

engine size typically plays a key role in determining

a car's performance and value. Larger engines

generally correlate with more powerful and expensive

vehicles. Curb weight was the second most important

feature, with a score of approximately 0.27. Heavier

cars are often associated with luxury models or robust

vehicles, contributing to a higher price point. Other

features, such as stroke and mileage on the highway,

had relatively low importance scores (around 0.02

each), suggesting that while they do contribute to the

pricing model, they are not as significant as

performance-related features like engine size and

curb weight. Several other features, such as car width,

car height, horsepower, car peak rpm, and mileage in

the city, exhibited negligible importance. This

suggests that these characteristics play a minor role in

price determination, at least within the context of the

dataset used in this study.

Figure 4: Feature Importance (Photo/Picture credit: Original).

Car Price Prediction Using Machine Learning

539

4.5 Practical Implications

The automotive sector can benefit from this study's

findings in practice. The DT model works well with

dynamic pricing technologies that need to analyze

several aspects in real time because of its capacity to

manage intricate, non-linear interactions. However,

care must be taken to avoid overfitting, especially

when using the model for higher car price predictions

where residual errors were noted. Additionally, the

feature importance analysis suggests that engine size

and curb weight should be primary considerations

when building pricing models for vehicles, as they

account for the majority of the predictive power.

In contrast, the LR model, though simpler, could

be beneficial in scenarios where interpretability and

processing speed are prioritized over precision. This

model may require additional tuning or regularization

to improve its generalizability, as it struggles with

non-linearity in the data.

The KNN model, while computationally intensive

and having a lower R

ଶ

score, offers a robust

alternative with better generalization capabilities.

KNN is useful in contexts where data consistency is

variable, as it leverages the similarity between data

points to make predictions. However, it is less

effective in capturing the broader trends in the data,

as seen in its lower performance relative to the DT

model.

5 LIMITATIONS AND FUTURE

OUTLOOK

This study's primary limitation is its reliance on a

static dataset, which does not account for temporal

fluctuations in the automotive market. Car prices are

influenced by various external factors, such as

economic conditions, changes in consumer

preferences, and technological advancements, all of

which can change over time. The models developed

here do not incorporate temporal dynamics, which

could lead to reduced accuracy in real-world

applications where these factors play a significant

role.

Another limitation is the geographical specificity

of the dataset, which may limit the application of the

models to other regions with different market

conditions. For instance, factors such as local

economic conditions, tax regulations, and consumer

preferences can vary significantly between regions or

countries, making price predictions less accurate.

When it comes to model complexity, the DT and

KNN models are prone to overfitting, especially

when dealing with small or noisy datasets. When a

model is overfitted, it may perform well on training

data but not on unknown data. This issue could be

mitigated by employing techniques such as pruning in

DTs or adjusting the number of neighbors in KNN.

Future research could address these limitations by

incorporating time-series analysis to capture temporal

changes in car prices. This would involve developing

models that can adapt to changes in economic

conditions, market trends, and other temporal factors.

Additionally, expanding the dataset to include data

from multiple regions would enhance the

generalizability of the models, allowing them to be

applied more broadly.

Moreover, future studies could explore the

integration of unstructured data, such as text from

online car listings or social media sentiment, into the

models. This could provide a more comprehensive

understanding of the factors influencing car prices

and lead to more accurate predictions.

Finally, investigating more sophisticated machine

learning algorithms, such as deep learning, may help

the models perform better. Because those more

complex algorithms are able to recognize more

interactions between variables, more robust

predictions can be made.

6 CONCLUSIONS

This paper offers a thorough examination of KNN,

DT, and LR in the prediction of vehicle pricing. The

DT model emerged as the most effective,

demonstrating its ability to capture complex patterns

and interactions within the dataset. The study also

highlights the practical applications of these models

in the automotive industry, particularly in dynamic

pricing tools and real-time valuation systems.

However, the study also acknowledges its limitations,

particularly the lack of temporal dynamics and

geographical diversity in the dataset. Future research

could address these issues by incorporating time-

series analysis and expanding the dataset to include

multiple regions. Additionally, integrating

unstructured data and applying more advanced

machine learning techniques to the data could further

enhance the accuracy of the models. The findings of

this study contribute to the ongoing development of

machine learning models for car price prediction,

providing valuable insights for both academic

researchers and industry practitioners. By improving

the accuracy and robustness of these models, it is

ECAI 2024 - International Conference on E-commerce and Artificial Intelligence

540

possible to develop more effective pricing strategies,

enhance consumer trust, and optimize inventory

management in the automotive industry.

REFERENCES

Asghar, M., Mehmood, K., Yasin, S., Khan, Z. M., 2021.

Used cars price prediction using machine learning with

optimal features. Pakistan Journal of Engineering and

Technology, 4(2), 113-119.

Das Adhikary, D. R., Sahu, R., Pragyna Panda, S., 2022.

Prediction of used car prices using machine learning. In

Biologically Inspired Techniques in Many Criteria

Decision Making: Proceedings of BITMDM 2021 (pp.

131-140). Singapore: Springer Nature Singapore.

Gegic, E., Isakovic, B., Keco, D., Masetic, Z., Kevric, J.,

2019. Car price prediction using machine learning

techniques. TEM Journal, 8(1), 113.

Muti, S., Yıldız, K., 2023. Using linear regression for used

car price prediction. International Journal of

Computational and Experimental Science and

Engineering, 9(1), 11-16.

Nettekoven, Z. M., 2023. Automotive industry

transformation and industrial policy in the EU and

Germany: A critical perspective (No. 208/2023).

Working Paper.

Pillai, A. S., 2022. A Deep Learning Approach for Used Car

Price Prediction. Journal of Science & Technology,

3(3), 31-50.

Radić, N., Radić, V., 2021. Macroeconomic Consequences

Caused by the COVID-19 Pandemic–Case Study of the

Automotive Industry. LIMEN 2021, 79.

RANJITH, V., 2021. Used Car Price Prediction Using

Machine Learning.

Toma, S. G., 202. The Evolution of the World Motor

Vehicle Production in the Period 2018-2022. Ovidius

University Annals, Economic Sciences Series, 23(2),

175-179.

Wang, A., Yu, Q., Li, X., Lu, Z., Yu, X., Wang, Z., 2022.

Research on Used Car Valuation Problem Based on

Machine Learning. In 2022 International Conference on

Computer Network, Electronic and Automation

(ICCNEA) (pp. 101-106). IEEE.

Car Price Prediction Using Machine Learning

541