Cryptocurrency Price Prediction Based on CNN-BiLSTM-AM Model

Meijun Gao

School of Electronics Engineering and Computer Science, Peking University, Beijing, China

Keywords: Cryptocurrency Price Prediction, CNN, BiLSTM, Attention Mechanism.

Abstract: Contemporarily, as the cryptocurrency market has experienced unprecedented rapid growth, its high price

volatility and complex nonlinear dynamic characteristics have made cryptocurrency price prediction a focus

of concern. Accurate price prediction is crucial for investors for it helps investors effectively manage

investment risks and significantly increase investment returns. This study innovatively proposes a hybrid

prediction model which integrates convolutional neural network (CNN), bidirectional long short-term

memory network (BiLSTM) and attention mechanism (AM), named as the CNN-BiLSTM-AM model, aiming

to accurately predict the price of three typical cryptocurrencies, BTC, ETH, and LTC. CNN is used in feature

extraction. BiLSTM is introduced to process time series data. AM tracks how feature states affect

cryptocurrency closing prices over history. With the aim of verifying the effectiveness of the hybrid model,

the next day's closing price of BTC, ETH, and LTC is selected as the test dataset for this model and three

other mainstream prediction models. Experimental results indicate that this hybrid model ranks first in terms

of prediction accuracy, specifically manifested in the smallest Mean Absolute Error (MAE) and Root Mean

Squard Error (RMSE), along with the highest R-Square (R²). These results indicate that the hybrid CNN-

BiLSTM-AM model can be adopted as a powerful tool for investors to formulate investment strategies and

make actual investment decisions.

1 INTRODUCTION

Since the launch of Bitcoin in 2009, the

cryptocurrency market has profoundly reshaped the

financial ecology and created a new paradigm of

decentralized and highly secure value transfer and

storage. Unlike typical financial assets, which are

mainly supported by the government or central banks,

cryptocurrencies rely on advanced peer-to-peer

network architecture and blockchain technology to

operate independently. The rapid development of

representative cryptocurrencies such as BTC, ETH,

and LTC has not only established their solid position

in the trading field, but also stimulated widespread

investment and speculation enthusiasm. With the

continuous expansion and increasing influence of the

cryptocurrency market, accurate prediction of its

price fluctuations has become a cutting-edge research

topic across multiple disciplines such as economics,

finance and computer science, attracting attention

from many scholars and professionals. Financial

market forecasting, a traditional problem in

economics and finance, is even more difficult in the

rapidly evolving cryptocurrency market environment.

Among traditional methods, econometric models

such as ARIMA are widely used in financial markets,

but their forecasting effectiveness is severely

challenged in the emerging field of cryptocurrency,

because this market is highly dynamic and complex,

far beyond the traditional scope (Zhang, 2003). In the

face of the unique decentralized characteristics of

cryptocurrency and its extreme sensitivity to external

factors such as regulatory policy adjustments, market

sentiment fluctuations and technological innovation,

its price trends show significant non-linear and highly

volatile characteristics. These features limit the

availability of traditional linear models in accurately

capturing the dynamic price patterns of

cryptocurrencies, prompting the research community

to continuously explore forecasting methods that are

more suitable for this emerging market.

Faced with high complexity and dynamic changes

of the cryptocurrency market, traditional prediction

methods seem to be unable to cope with it. However,

the latest achievements in machine learning field,

especially models such as SVM, random forests, and

various neural networks are playing an increasingly

important role in cryptocurrency price prediction with

516

Gao, M.

Cryptocurrency Price Prediction Based on CNN-BiLSTM-AM Model.

DOI: 10.5220/0013269800004568

In Proceedings of the 1st International Conference on E-commerce and Artificial Intelligence (ECAI 2024), pages 516-523

ISBN: 978-989-758-726-9

Copyright © 2025 by Paper published under CC license (CC BY-NC-ND 4.0)

their outstanding ability to analyse complex nonlinear

relationships. The application of these new methods

has opened up new ways to improve forecast

accuracy. In particular, deep learning technology,

with its advantage in processing massive sequence

data, has shown extraordinary potential in

cryptocurrency price prediction. Scholars have

actively tried plenty of deep learning architectures,

such as LSTM, CNNs, and their fusion models,

aiming to more accurately grasp market dynamics.

During the past decade, the advancement of deep

learning technologies has significantly impacted time

series forecasting. In this context, the LSTM network

has performed well in capturing complex long-term

correlations in sequence data with its outstanding

capability. Therefore, it has gradually become a

popular tool in cryptocurrency price forecasting field.

The research of Shah and Zhang strongly proved that

the LSTM network can precisely grasp the time series

traits of Bitcoin price data. Meanwhile, its prediction

precision is significantly improved compared with

traditional models (Shah & Zhang, 2014). In a 2018

study, McNally pioneered a new hybrid model by

combining the advantages of LSTM and Gated

Recurrent Unit (GRU). Experimental data clearly

showed that this hybrid model surpassed the single

LSTM model in prediction accuracy (McNally, 2016).

Another significant breakthrough is the

application of CNN to time series data to extract

characteristic patterns of price fluctuations.

Researchers pointed out that CNN is good at

capturing local characteristics in cryptocurrency price

trends. These characteristics are then input into

LSTM to deeply mine the long-term dependence of

the price sequence. Recent studies have shown that

mixed models integrating CNN and LSTM have

better performance than single models when dealing

with the high volatility and uncertainty of

cryptocurrency prices (Zhang et al, 2021). In addition,

the introduction of attention mechanisms (AMs) has

added new vitality to these models. AM gives

different importance weights to different parts of the

input data, allowing the model to concentrate on the

historical information that is most crucial to the

prediction results (Chen et al., 2020). This not only

makes the prediction result more accurate, but also

enhances the interpretability of the model. At present,

the application of CNNs, BiLSTMs and AMs has

become effective frameworks for parsing the

complex market dynamics of cryptocurrencies (Seabe

et al, 2023).

Cryptocurrency price prediction remains a

challenging field because of its high volatility and

reliance on external factors like news, regulations,

and technology. This research introduces a novel

model that incorporates CNN, BiLSTM, and AM to

address these challenges. By integrating the three

different models, a more precise and robust prediction

can be made for financial investors and analysts.

2 DATA AND METHOD

This research selected three typical cryptocurrencies,

BTC, ETH and LTC. The detailed historical price

data for BTC and LTC is from January 2014 to

January 2024. Since ETH was first issued in July

2014, the historical price data for ETH is from

January 2019 to January 2024. They are all

downloaded from Yahoo Finance. These data cover

key information such as daily opening and closing

prices, as well as price percentage changes and

trading volume. During the experiment, the whole

dataset was separated into two sections: the first 80%

were used for model training, and the remaining 20%

were utilized as a test set to check the model's

prediction accuracy.

Following part details the specific principles of

CNN, LSTM, AM, as well as the hybrid CNN-

BiLSTM-AM model. Lecun first introduced CNN to

the public in 1998 (Lecun et al, 1998). CNNs are used

to capture spatial information from time series data

and identify short-term trends in cryptocurrency price

changes. The mathematical representation of the

convolutional layer is as follows:

𝑧

= 𝑡𝑎𝑛ℎ(𝑊

∙𝑥

+ 𝑏

) (1)

Here, 𝑧

is the output of the convolution

layer, 𝑊

represents the convolution filter

weights, 𝑥

refers to the input vector (such as price

features), and 𝑏

is the bias term. A pooling layer is

adopted after the CNN layer to lower dimensionality

of the output, ensuring computational efficiency

while retaining the most critical features.

Schmidhuber first introduced the concept of

LSTM model in 1997 (Hochreiter & Schmidhuber,

1997). It was invented to address the persistent

problems with gradient disappearance and gradient

explosion in RNNs (Ta et al, 2020). LSTM networks

are ideal for cryptocurrency price prediction beacause

of their powerful capability of extracting long-term

dependencies in sequential data. Each LSTM memory

cell consists of Forget Gate, Input Gate, and Output

Gate. The function of Forget Gate is to determine

what information should be removed from the

memory cell. It takes in the current input and output

value from the previous moment and returns a value

Cryptocurrency Price Prediction Based on CNN-BiLSTM-AM Model

517

between 0 and 1, indicating how much information

should be forgotten. The calculation formula is as

follows:

𝑓

= 𝜎𝑊

ℎ

1

, 𝑥

+ 𝑏

(2)

Here, 𝑊

is a weight matrix which connects the prior

hidden state and the current input. 𝑏

is the bias term.

The function of Input Gate is to decide which new

information should be appended to the memory cell.

The Input Gate receives two input values: the current

input value and the previous output value. It works in

two steps: Generating the Candidate Memory Value,

𝐶

= 𝑡𝑎𝑛ℎ (𝑊

ℎ

1

, 𝑥

+ 𝑏

) (3)

where 𝑊

and 𝑏

refer to the weight and bias terms.

They are used to compute the candidate value and

calculating Output:

𝑖

= 𝜎(𝑊

ℎ

1

, 𝑥

+𝑏

) (4)

The Input Gate output 𝑖

decides which parts of the

candidate memory value will be added to the current

memory state. LSTM refreshes the cell state 𝐶

after

the two operations above. The update process is as

follows:

𝐶

= 𝑓

𝐶

1

+ 𝑖

𝐶

(5)

The former term represents the amount of previous

memory to retain based on the Forget Gate’s output.

The latter term represents the new information being

appended to the memory state, controlled by the Input

Gate. The function of Output Gate is to receive inputs

including the current input value and the previous

output value. The calculation formula is:

𝑂

= 𝜎(𝑊

ℎ

1

, 𝑥

+𝑏

) (6)

Here, 𝑂

is an output that determines how much of the

current memory to retain. The final output hidden

state ht is computed as:

ℎ

= 𝑜

𝑡𝑎𝑛ℎ (𝐶

) (7)

In 1980, Treisman et al. first proposed AM

(Treisman & Gelade, 1980). The important

information is chosen from a vast amount of

information by computing the probability distribution

of attention. AM is employed to focus on the most

relevant portions of the time series by learning which

features from the past are most important for

predicting the future. Then it assigns different

weights to different time steps due to their importance.

The attention score calculation is shown by this

formula:

𝛼

= 𝑒𝑥𝑝

(

𝑒

)

/𝛴

𝑒𝑥𝑝 (𝑒

) (8)

Here, 𝑒

represents the relevance between the current

and past hidden states. 𝛼

is the weight assigned to

each input time step. The hybrid model integrates

CNN, BiLSTM, and the attention mechanism to

discover both short-term trends and long-term

dependencies in the training data. The CNN layer

extracts spatial patterns, while the BiLSTM captures

both forward and backward dependencies from the

time series. The attention mechanism then refines the

predictions by emphasizing the most critical

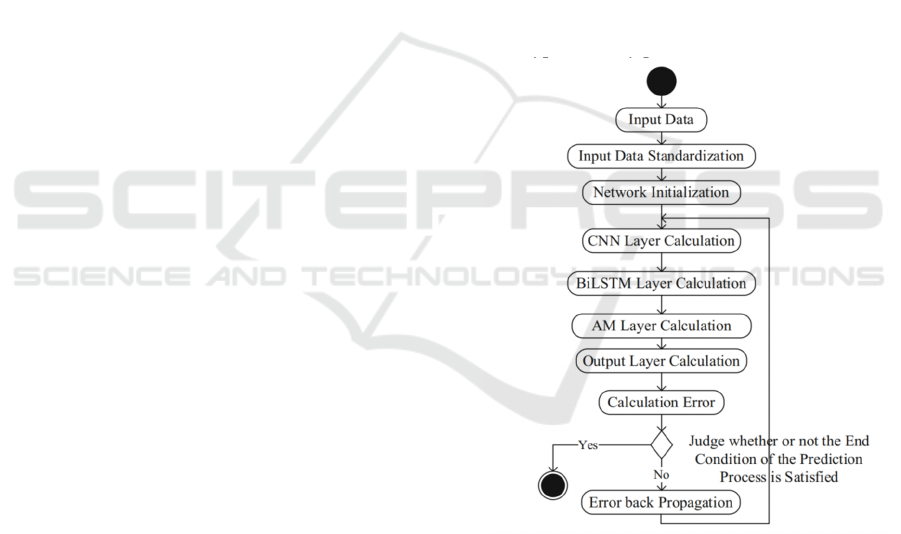

historical data points. Figure 1 visually outlines this

framework. The model framework consists of:

Input Layer. Receives the historical price data

of BTC, ETH, and LTC.

CNN Layer. Extracts short-term features.

BiLSTM Layer. Captures long-term

dependencies bi-directionally.

Attention Layer. Focuses on the most relevant

time steps.

Output Layer. Generates the predicted

cryptocurrency prices.

Figure 1: Model framework of CNN-BiLSTM-AM (Photo/

Picture credit: Original).

The parameters’ settings of the CNN-BiLSTM-

AM model are as follows. The convolution layer uses

64 filters and 3 kernels. The activation function for

both convolution layer and pooling layer is ReLU.

The pool size is 1. The number of BiLSTM hidden

units is 64. The training process consists of the

following parameters: batch size of 64, time step of 5,

learning rate of 0.001, epoch of 100, loss function of

ECAI 2024 - International Conference on E-commerce and Artificial Intelligence

518

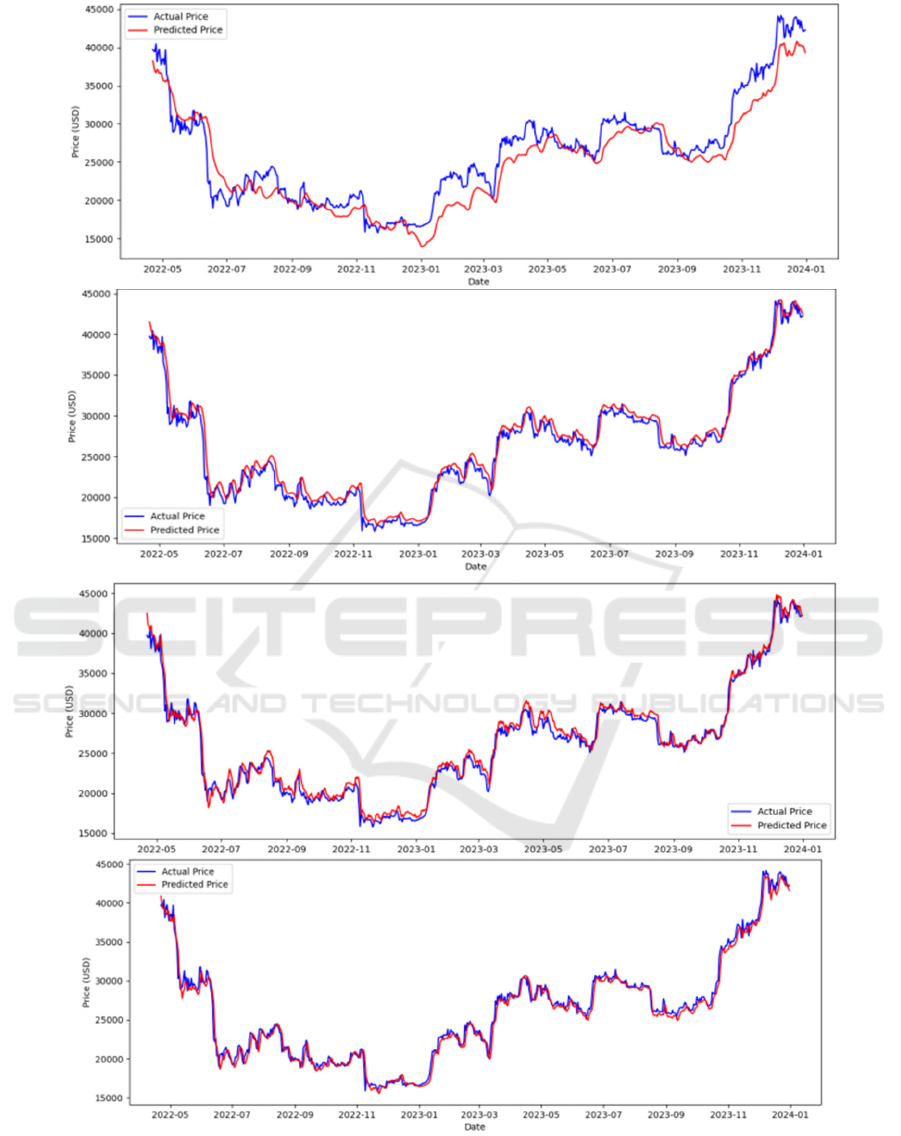

Figure 2: The CNN, LSTM, CNN-BiLSTM and CNN-BiLSTM-AM for BTC (left to right and then upper to lower) forecasted

and actual BTC prices (Photo/Picture credit: Original).

Cryptocurrency Price Prediction Based on CNN-BiLSTM-AM Model

519

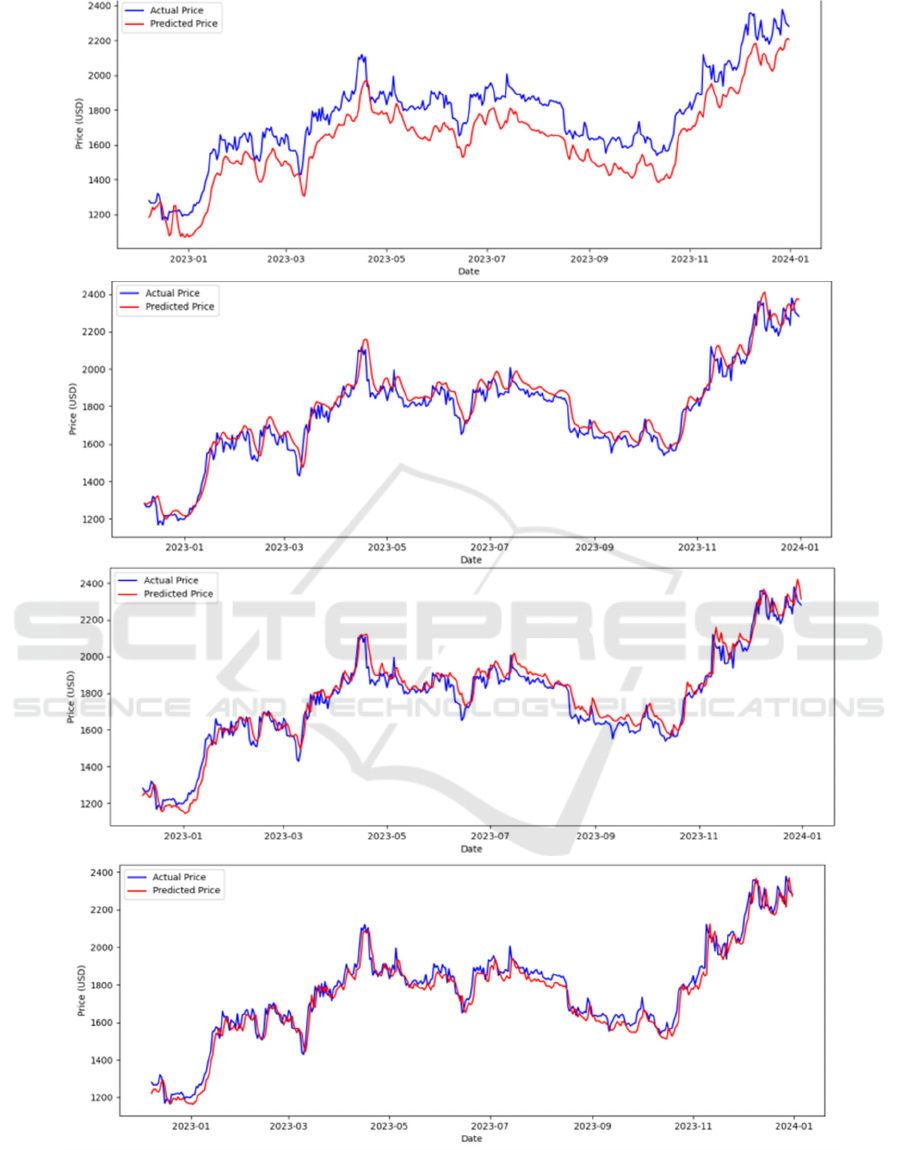

Figure 3: The CNN, LSTM, CNN-BiLSTM and CNN-BiLSTM-AM for ETH (left to right and then upper to lower) forecasted

and actual BTC prices (Photo/Picture credit: Original).

ECAI 2024 - International Conference on E-commerce and Artificial Intelligence

520

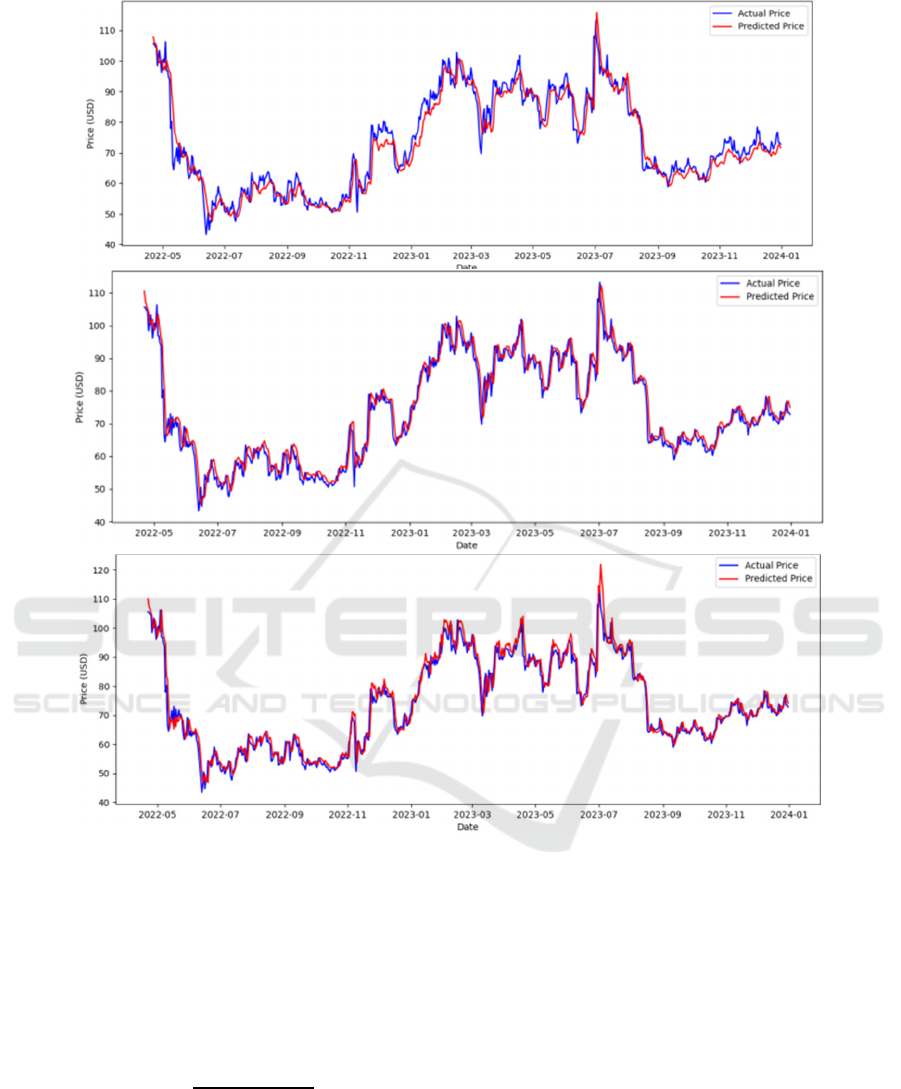

Figure 4: The CNN, LSTM, CNN-BiLSTM and CNN-BiLSTM-AM for LTC (left to right and then upper to lower) forecasted

and actual BTC prices (Photo/Picture credit: Original).

MAE, and optimizer selection of Adam. All of the

four models’ training parameters are the same.

The research uses MAE, RMSE and R

2

as the

evaluation indexes to assess the performance of

different models. They are calculated as follows:

𝑀𝐴𝐸 = 𝛴

|𝑦

𝑦

|/𝑛 (9)

𝑅𝑀𝑆𝐸 =

𝛴

(𝑦

𝑦

)

2

/𝑛 (10)

𝑅

2

= 1 (𝛴

(

𝑦

𝑦

)

2

)/(𝛴

(

𝑦

𝑦

)

2

) (11)

In these formulae, 𝑦

is the real price and 𝑦

is the

forecasted price. Lower values of MAE and RMSE,

along with an R

2

closer to 1, means the model has a

better performance.

3 RESULTS AND DISCUSSION

3.1 Model Performances

CNN, LSTM, CNN-BiLSTM and CNN-BiLSTM-

AM were applied in this experiment. The

performance of different models is evaluated by using

each of them to predict cryptocurrency prices for

BTC, ETH, and LTC. The prediction time range for

BTC and LTC is from May 2022 to January 2024.

Since ETH was first issued in July 2014, according to

the ratio of 8:2 for training and testing sets, the

prediction time range for ETH is from January 2023

Cryptocurrency Price Prediction Based on CNN-BiLSTM-AM Model

521

to January 2024. The results for BTC, ETH and LTC

are shown in Figure 2, Figure 3 and Figure 4.

As can be seen from the results, CNN-BiLSTM-

AM, CNN-BiLSTM, LSTM, and CNN rank highest

to lowest in terms of the degree of fitting for broken

lines of the forecasted prices to the true prices for all

three cryptocurrencies. CNN-BiLSTM-AM always

has the highest and nearly perfectly coincident degree

of fitting for broken lines of its predicted prices to real

prices, whereas CNN always has the lowest. Based on

each model's predicted prices and actual

cryptocurrency prices, the evaluation metrics of each

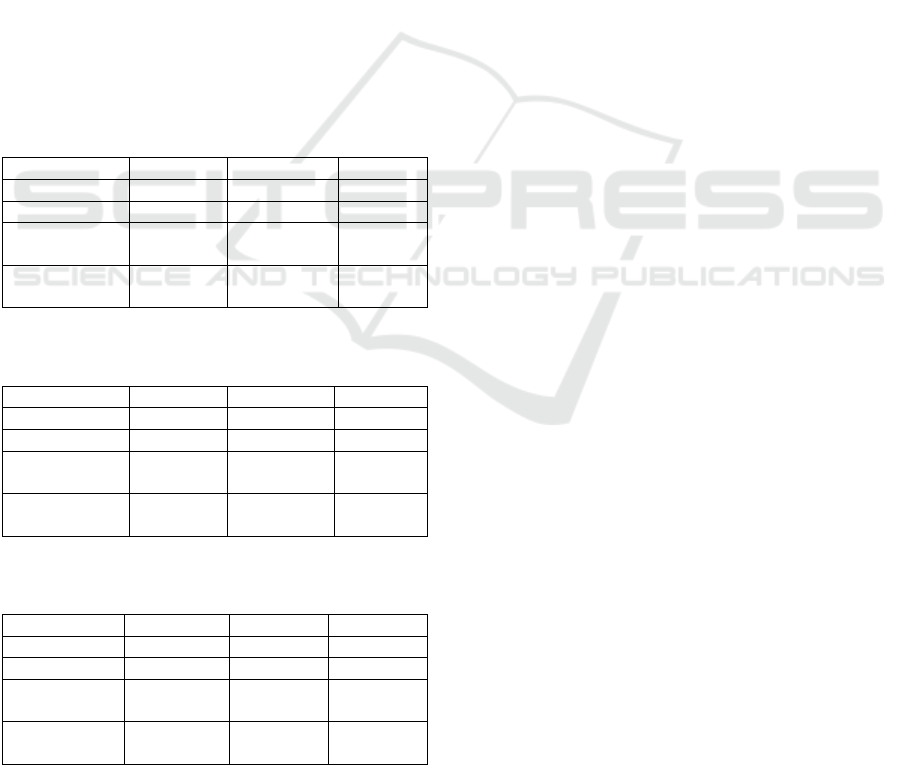

model can be calculated easily. Tables 1, 2, and 3

display the comparison results of the twelve studies

for BTC, ETH and LTC, respectively. For all three

cryptocurrencies, the CNN-BiLSTM-AM model

continuously beats CNN, LSTM, and CNN-BiLSTM

in terms of three evaluation metrics. These results

demonstrate that combining CNN with BiLSTM

networks and the Attention Mechanism improves

prediction accuracy, with lower RMSE , MAE values

and R

2

closer to 1.

Table 1: Comparison of evaluation error indices of different

models for BTC.

Model RMSE MAE R2

CNN 2375.992 1884.418 0.873

LSTM 1076.398 822.402 0.974

CNN-

BiLSTM

949.195 701.529 0.980

CNN-

BiLSTM-AM

844.350 593.538 0.984

Table 2: Comparison of evaluation error indices of different

models for ETH

Model RMSE MAE R2

CNN 151.266 140.014 0.641

LSTM 60.618 47.942 0.942

CNN-

BiLSTM

55.770 44.222 0.951

CNN-

BiLSTM-AM

52.909 40.977 0.956

Table 3: Comparison of evaluation error indices of different

models for LTC.

Model RMSE MAE R2

CNN 4.095 2.904 0.928

LSTM 3.488 2.418 0.948

CNN-

BiLSTM

3.805 2.684 0.937

CNN-

BiLSTM-AM

3.426 2.323 0.950

3.2 Comparison

By comparing the prediction accuracy of all the four

models on cryptocurrency price data, significant

model performance difference can be observed.

Specifically, the model's capability of capturing

temporal dependencies in time series data is much

improved with the addition of BiLSTM. In

comparison, the basic CNN model performed the

worst in the prediction of BTC, ETH and LTC, with

highest RMSE and MAE values, while the R² is

relatively low. This phenomenon shows that although

CNN performs well in extracting short-term spatial

features, it is insufficient for processing time series

data when long-term trends need to be captured. The

LSTM performs much better than CNN, especially in

the prediction of ETH and LTC. Furthermore, by

introducing BiLSTM, the model performance has

been further improved. The capacity of BiLSTM to

concurrently analyze data in both forward and

backward directions sets it apart from other models.

This trait significantly improves the model's

comprehension of long-term interdependence. The

CNN-BiLSTM-AM model performed best on all

evaluation indicators and cryptocurrencies. The

addition of AM enables the model to concentrate on

the most influential time nodes in the data, thereby

more accurately capturing key points and long-term

trends in price data. It is worth mentioning that this

model has achieved particularly outstanding results in

predicting BTC, with the RMSE value reduced to

844.350 and the R² value as high as 0.984, fully

verifying its excellent performance and applicability.

3.3 Explanation and Implications

The study's findings indicate that the CNN-BiLSTM-

AM model outperforms other models in applications

that predict cryptocurrencies’ prices. Its superiority is

mainly attributed to the model's strong capacity to

grab space and time dependence characteristics.

Specifically, with the effective extraction of

significant characteristics from the original input data,

CNN creates a well-prepared data base for the

ensuing analysis procedure. The introduction of the

BiLSTM layer gives the model the capacity to

simultaneously observe forward and backward event

sequences, significantly enhancing its understanding

of dynamic changes in time. The model may

intelligently concentrate on the time nodes that have

the greatest impact on future price fluctuations thanks

to the integration of AM. By integrating all the

advantages of the three methods, the accuracy of

ECAI 2024 - International Conference on E-commerce and Artificial Intelligence

522

cryptocurrency price prediction is significantly

improved.

3.4 Limitations and Prospects

Despite the CNN-BiLSTM-AM model shows

significant advantages in prediction accuracy of

cryptocurrency price, its limitations cannot be

ignored. On one hand, the model is prone to be

affected by the quantity and quality of input data.

Given the nature of the cryptocurrency market being

susceptible to multiple external factors, if the training

data fails to fully capture these dynamic factors, the

predictive robustness of the model will be greatly

compromised. On the other hand, a significant

limitation lies in the high computational complexity

of the model. Integrating CNN, BiLSTM layers and

AM results in a sharp increase in resource

consumption. This not only prolongs the training

cycle, especially when processing massive data, but

also places higher demands on computing resources.

Looking forward, future researchers can focus on the

introduction of diversified training data. For example,

the model's sensitivity and forecasting ability to

sudden market changes can be significantly improved

by taking into account the macroeconomic indicators

and market sentiment analysis. Additionally,

advanced technologies such as reinforcement

learning can be combined to enhance the model's

capability to adapt to market changes in real time.

Meanwhile, expanding the application field of this

hybrid model to other financial markets such as

stocks and commodities, through cross-market

verification, will not only further evaluate its

universality and effectiveness, but also bring more

innovation to other fields of financial market

prediction.

4 CONCLUSIONS

To sum up, asset price forecasting is crucial in

financial investment and decision activities. Given

that cryptocurrency is a kind of financial assets with

high volatility, accurate prediction is particularly

challenging in this field. This paper innovatively

raises a hybrid CNN-BiLSTM-AM model to forecast

the cryptocurrency price of the next day. The research

selects three widely known cryptocurrencies (BTC,

ETH and LTC) to test different models’ performance.

Results indicate that the CNN-BiLSTM-AM model

ranks first compared with CNN, LSTM, and CNN-

BiLSTM according to prediction accuracy. This

finding proves the superiority of this hybrid model in

processing cryptocurrency price data and provides

new ideas for subsequent research and practical

applications. In conclusion, this study not only

contributes new methods and insights to the

prediction technology of the cryptocurrency market,

but also provides valuable reference and inspiration

for researchers in other related fields.

REFERENCES

Chen, Q., Zhang, W., Lou, Y., 2020. Forecasting stock

prices using a hybrid deep learning model integrating

attention mechanism, multi-layer perceptron, and

bidirectional long-short term memory neural network.

IEEE Access, 8, 117365-117376.

Hochreiter, S., Schmidhuber, J., 1997. Long Short-Term

Memory. MIT Press, 9(8), 1735-1780

Lecun, Y., Botou, L., Bengio, Y., Haffner, P., 1998.

Gradient-based learning applied to document

recognition. Proc IEEE, 86(11), 2278–2324

McNally, S., 2016. Predicting the price of Bitcoin using

Machine Learning. Doctoral dissertation, Dublin,

National College of Ireland.

Seabe, P. L., Moutsinga, C. R. B., Pindza, E. (2023).

Forecasting cryptocurrency prices using LSTM, GRU,

and bi-directional LSTM: a deep learning approach.

Fractal and Fractional, 7(2), 203.

Shah, D., Zhang, K., 2014. Bayesian regression and Bitcoin.

52nd annual Allerton conference on communication,

control, and computing (Allerton), 409-414.

Ta, V., Liu, C., Tadesse, D., 2020. Portfolio optimization-

based stock prediction using long-short term memory

network in quantitative trading. Appl Sci, 10(2), 437–

456

Treisman, A., Gelade, G., 1980. A feature-integration

theory of attention. Cogn Psychol 12(1), 97–146

Zhang, G., 2003. Time series forecasting using a hybrid

ARIMA and neural network model. Neurocomputing 50,

159–175.

Zhang, Z., Dai, H. N., Zhou, J., Mondal, S. K., García, M.

M., Wang, H., 2021. Forecasting cryptocurrency price

using convolutional neural networks with weighted and

attentive memory channels. Expert Systems with

Applications, 183, 115378.

Cryptocurrency Price Prediction Based on CNN-BiLSTM-AM Model

523