Improvements of Time Series Prediction Models for ExxonMobil

Based on Moving Averages

Wenjie Deng

Finance Department, Shanghai Lixin University of Accounting and Finance, Shanghai, China

Keywords: Time Series Forecasting, Moving Averages, Stock Price Forecasting, Energy Sector.

Abstract: Time series forecasting plays a crucial role in financial analysis, especially in predicting stock prices and

guiding investment strategies. In this study, ExxonMobil will be used as the research object to test a price

prediction model based on moving averages. The data is derived from historical stock data provided by Yahoo

Finance, and metrics such as the 10-day Simple Moving Average (SMA), 20-Day Exponential Moving

Average (EMA), Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD)

from Python's stockstat library are added to the model as enhancements to the historical forecasting model.

The enhanced model fits well, with an R-square value of 0.8546, showing significant prediction accuracy.

While the model is effective in capturing the overall trend, it is less consistent with the actual performance of

the market during periods of high volatility. For petrochemical module companies, the impact of international

oil prices and geopolitical events cannot be ignored. These results suggest that adding industry-specific

dynamic-specific technical indicators to forecasting models can greatly improve stock price forecasts, thereby

providing valuable insights for financial analysts and investors who focus on the energy market.

1 INTRODUCTION

Since its creation, time series forecasting has been an

important tool in financial analysis, and price

prediction models built on it enable investors and

analysts to predict future stock movements based on

historical price data. Due to its accuracy, this type of

prediction is also considered one of the most

important model building methods. Moving averages

(MAs), including simple moving averages (SMAs)

and exponential moving averages (EMAs), have been

widely used to identify market trends, especially in

sectors with high stock price volatility such as

petrochemicals (Yadav et al., 2024). Looking back at

the earliest time series forecasting models, they were

simple models built on the basis of MAs, which

smoothed the fluctuation curve of stock prices by

averaging data points for a specific period (Tsay,

2019). Over the next few decades, time series

forecasting methods have evolved considerably, and

researchers have added more sophisticated statistical

and computational techniques to them. Early

innovations include models (e.g., the Autoregressive

Composite Moving Average, ARIMA), which were

developed to explain more complex data patterns,

using autoregressive and differential to deal with non-

stationary data, with remarkable results (Guresen et

al., 2011). Because the ARIMA model can model

time-dependent structures such as seasonality and

trend in stock prices, it has become a basic tool and

underlying logic for financial time series analysis in

subsequent use (Fischer & Krauss, 2018).

Recent research has further expanded the scope of

time series forecasting by incorporating machine

learning and deep learning models. Techniques such

as long short-term memory (LSTM) networks and

gated recursive units (GRUs) have emerged, and

these models are particularly adept at capturing long-

term dependencies and nonlinear relationships in data

(Althelaya et al., 2018). Through more complex

patterns learned from large datasets, these models far

outperform traditional models in highly volatile

markets (Guresen et al., 2011). Considering that the

target of this study is a company in the petrochemical

industry, ExxonMobil, which will face more market

dynamics and volatility caused by external factors,

the application of more advanced forecasting

techniques such as LSTM and GRU has the scope to

refines the effectiveness of forecasting (Bustos &

Pomares-Quimbaya, 2020).

For financial forecasting, mainstream research

tends to focus more and more on improving

510

Deng, W.

Improvements of Time Series Prediction Models for ExxonMobil Based on Moving Averages.

DOI: 10.5220/0013269700004568

In Proceedings of the 1st International Conference on E-commerce and Artificial Intelligence (ECAI 2024), pages 510-515

ISBN: 978-989-758-726-9

Copyright © 2025 by Paper published under CC license (CC BY-NC-ND 4.0)

forecasting accuracy by adding machine learning

techniques into traditional time series models. It's

easy to see that hybrid models that combine ARIMA

with deep learning methods such as LSTM do a great

job of capturing intricate price movements, so it's also

particularly useful for studying stocks with high

volatility (Zolfaghari & Gholami, 2021). Traditional

methods tend to ignore nonlinear relationships and

external factors, or cannot actively incorporate them

into the same model for study due to technical

limitations, but new models will actively take them

into account in order to achieve more accurate

prediction criteria.

In the energy sector, the impact of external factors

such as crude oil prices, geopolitical tensions, and

regulatory changes adds more complexity to

forecasting models (Lin et al., 2021). Traditional

models rely mainly on historical price data, which is

often difficult to account for these influencing factors,

so additional indicators and more advanced

modelling techniques are needed (Ding & Qin, 2020).

This study further advances the forecasting model by

adding technical indicators calculated by adding

Python libraries such as stockstats to the model to

make it more in line with real-world market

conditions. The advent of library application

indicators such as stockstats in the Python library has

further advanced the development of this field, and by

integrating these indicators, the predictive ability of

the model has been further enhanced, and the

automatic calculation of various technical indicators

has been possible (Su et al., 2022). By incorporating

these metrics, researchers are able to refine their

forecasting models to better align them with real-

world market conditions. In the energy sector, the

price of a stock can be affected by factors beyond the

control of a single company, and the above model can

be used to better simulate the stock price.

In addition, the integration of technical indicators

such as the Moving Average Convergence

Divergence Indicator (MACD), the Relative Strength

Index (RSI), and the Bollinger Bands can further

improve the ability to predict stock prices, taking into

account market momentum and overbought or

oversold conditions (Su et al., 2022). These indicators

provide additional context beyond historical price

action and are therefore particularly useful for large-

cap energy stocks such as ExxonMobil (Atsalakis &

Valavanis, 2009).

This study was designed to overcome the

restrictions of conventional prediction models when

applied to energy sector stocks. ExxonMobil is

affected by global commodity prices, regulatory

changes and geopolitical events, which compromise

the accuracy of traditional time series models. The

purpose of this study is to refine the moving average-

based model by incorporating technical indicators

from the integrated 'stockstats' library and to evaluate

its effectiveness in ExxonMobil's stock price

forecasts.

2 DATA AND METHOD

ExxonMobil, which is one of the world's largest

publicly traded oil and petrochemical companies.

Because of its significant impact on the global energy

market and is widely influenced by economic,

geopolitical, and industry-specific factors.

ExxonMobil operates in an industry that is much

more affected by external forces such as crude oil

prices, regulatory changes and geopolitical events

than technology companies such as Amazon, which

adds to the complexity of its share price movements.

These features make ExxonMobil an ideal target for

evaluating the effectiveness of enhanced time series

forecasting models that incorporate technical

indicators. The inherent volatility of the energy

industry presents unique challenges and opportunities

for predictive models. Stocks like ExxonMobil are

directly affected by commodity price volatility,

OPEC decisions, and environmental policies, and

their share prices are sensitive to both market and

non-market impacts. Based on ExxonMobil, this

study aims to evaluate how technical indicators can

be used to improve traditional moving average

models to better capture these dynamics and provide

highly relevant insights to analysts and investors in

the energy sector.

The data for this research is sourced from Yahoo

Finance and covers the daily share price data of

ExxonMobil (ticker: XOM) from August 1, 2015 to

July 31, 2024. Key variables include date, open, high,

low, closing, adjusted close, and volume, which

shows a comprehensive view of the stock's historical

performance. To ensure the integrity and accuracy of

the data, missing or erroneous entries were cleaned up

prior to the study to make sure the integrity of the

analysis. This dataset contains more than 2,500 daily

observations over the past decade, providing a solid

foundation for building time series models under a

variety of market conditions, from stable periods to

periods of high volatility. The technical indicators

used in the 'stockstats' library include SMA, EMA,

RSI and MACD, which add depth to the analysis by

capturing market momentum and trends, which is

more in line with the purpose of this article.

Improvements of Time Series Prediction Models for ExxonMobil Based on Moving Averages

511

The predictive model used in this study combines

the traditional MA with other technical indicators of

the 'stockstats' library in Python. The prediction

model adopts an MA-based approach, enhanced by

the integration of technical indicators. The specific

steps are as follows. For data preprocessing, technical

indicators such as SMA, EMA, and Bollinger Bands

are calculated and added to the dataset for subsequent

analysis. Besides, this study will use a correlation

matrix to analyze the correlation between variables to

identify the technical indicators that are most relevant

to stock price movements. The ADF test is used to

perform a static test on the time series to determine if

the data requires further differential processing. The

variance expansion factor (VIF) is calculated to check

for multicollinearity between variables to ensure that

covariance issues are not affected during model

fitting. For model building, this study combines

technical indicators to build a forecasting model

based on moving averages, and use weighted moving

averages (WMA) and exponential smoothing (ESM)

to capture short-term and long-term trends in prices.

When training the model, the linear regression

method is used to establish the prediction relationship,

and the closing price of the preceding period and

technical indicators are used as independent variables

to predict the future closing price. For model

evaluation, R ² (coefficient of determination) and

mean square error (MSE) were used as evaluation

indicators to measure the prediction performance of

the model. The robustness of the model is further

validated using a cross-validation method to ensure

the consistency of the model across different datasets.

Through the above steps, this study aims to

develop an accurate stock price forecasting model to

capture the market dynamics of ExxonMobil stock.

The forecasting model uses a moving average-based

approach, enhanced by integrating technical

indicators. Evaluation metrics include R-squared (R²)

and mean squared error (MSE) to evaluate model

performance. The analysis starts with a correlation

matrix to determine the relevant variables, followed

by an ADF test to check for staticity.

Multicollinearity between variables was tested using

variance expansion factor (VIF).

3 RESULTS AND DISCUSSION

3.1 Correlation Analysis

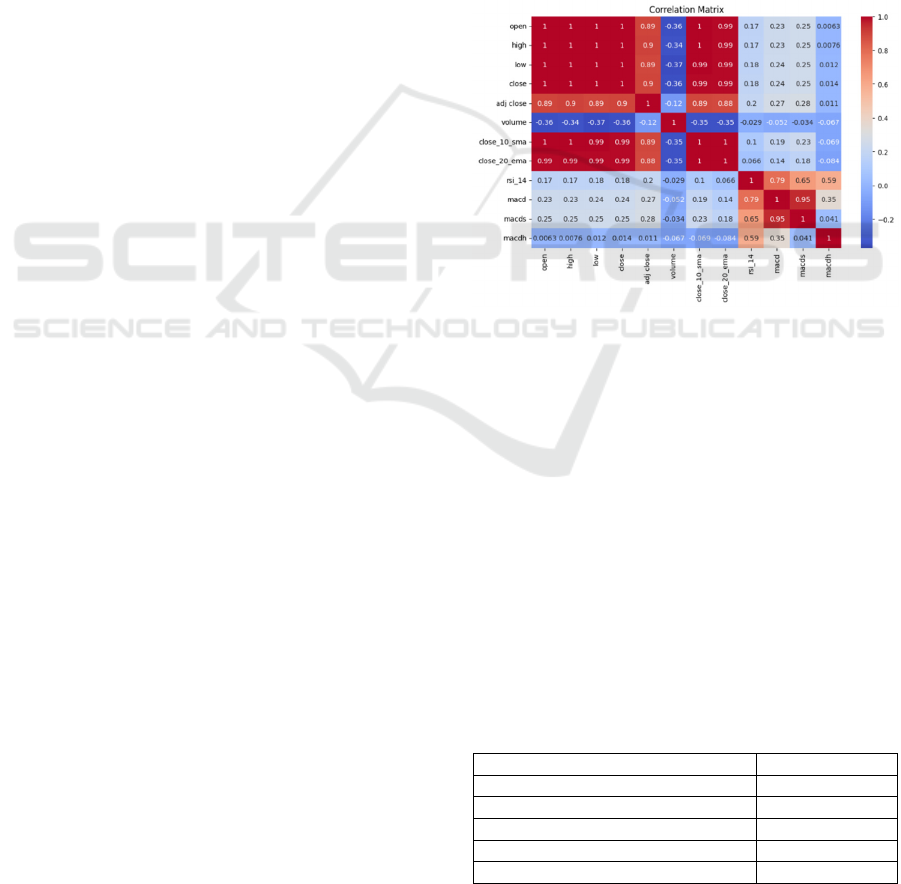

For the correction of the model, the following

technical indicators were selected: 10-day MA, 20-

day EMA, 14-day RSI and MACD and its signal lines

(MACDS). These indicators were chosen because

they are sensitive to capturing market trends and

correlated momentum, which will be necessary for

stocks like ExxonMobil, which are sensitive to

external economic factors. In this paper, a correlation

matrix is generated to study the relationship between

these variables (as depicted in Fig. 1). The results of

the analysis show that there is a strong correlation

between the SMA and EMA and the closing price,

which indicates that these indicators are effective in

capturing the trend of stocks. The MACD and RSI

also show a moderate correlation, suggesting that it’

s very useful that these indicators can be used to

recognise the overbought or oversold situations that

may signal a reversal.

Figure 1: Correlation Matrix of Technical Indicators

(Photo/Picture credit: Original).

This article also performs an ADF test on the

closing price data to check if it is static. The ADF

statistic was -1.207 and the P-value was 0.6708,

indicating non-stationarity. Since ExxonMobil has

trend and volatility as its inherent characteristics, this

outcome is to be expected. To evaluate

multicollinearity, the VIF values of the main

indicators are calculated. The calculated results show

that the VIF values of the 10-day SMA and 20-day

EMA are extremely high, suggesting that the model

has severe multicollinearity (seen from Table 1). This

suggests that while these metrics are valuable,

combining them in a model can lead to overfitting

because the information they provide overlaps.

Table 1: Variance Inflation Factor (VIF) for Key Indicators.

Metric VIF Value

10-da

y

SMA 40,556

20-da

y

EMA 40,615

RSI

(

14 da

y

s

)

4.912

MACD 5.267

MACD Signal (MACDS) 4.896

ECAI 2024 - International Conference on E-commerce and Artificial Intelligence

512

3.2 Model Performance

This prediction model was developed with a 10-day

SMA as a baseline. In this research, MSE and R²

metrics will be used to evaluate the performance of

the model. From the calculations, the MSE value of

the model is 7.0674 and the R² value is 0.8546,

indicating that the fit between the predicted stock

price and the actual stock price is very high. Higher R

² values suggest that about 85.5% of the variance in

ExxonMobil's stock price can be explained by the

model. However, when it comes to capturing price

volatility when it comes to capturing extreme market

volatility, the MSE value suggests that there is still

room for improvement.

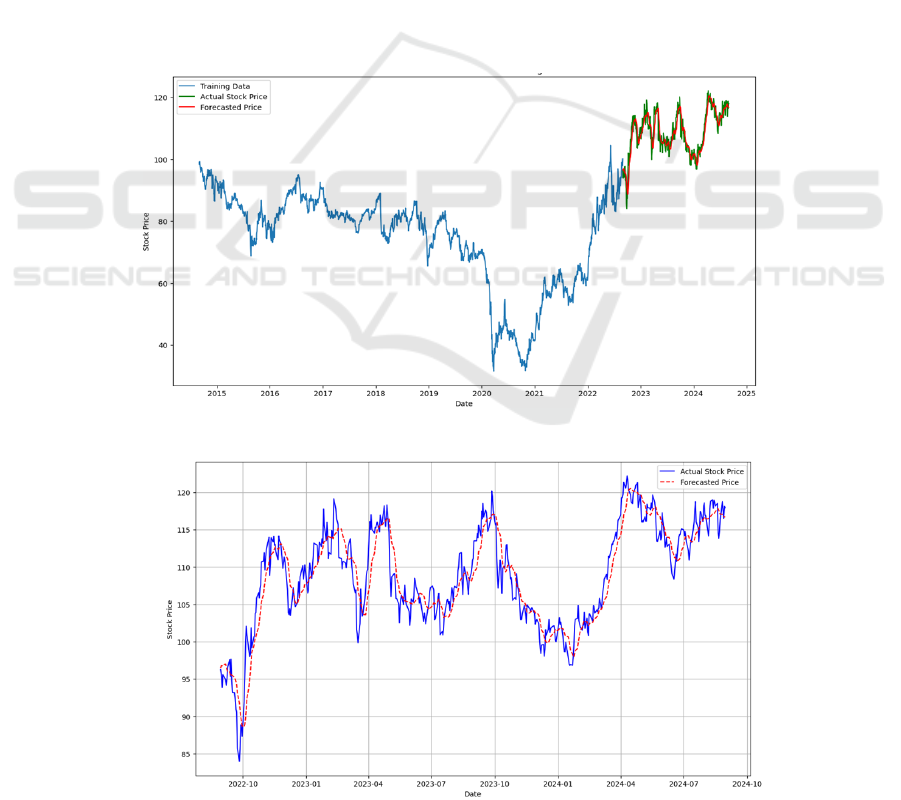

As shown in Fig. 2, during periods of market

stability, the model's predictions are closely related to

the actual stock price, suggesting that the model has

the ability to predict the overall trend. However,

during periods of high volatility, the difference

between the actual price and the predicted price

becomes more pronounced. These biases suggest that

while the model captures overall trends, it is not

adequately equipped to respond to rapid market

changes that can be influenced by external factors

such as oil price fluctuations or geopolitical events.

This visual evidence further highlights the strengths

and areas for improvement of the model, reinforcing

the importance of refining the model to better respond

to market mutations. Future improvements could

include the integration of more complex indicators or

external macroeconomic variables to improve

forecast accuracy during periods of volatility. As can

be seen from Fig. 3, the model's predictions are

closely related to the actual stock price, especially

during periods when the stock price is relatively

stable. However, during periods of high volatility, the

difference between the price predicted by the model

and the actual situation is apparent, reflecting the

challenge of accurately predicting high market

volatility.

Figure 2: ExxonMobil Stock Price Forecasting (Photo/Picture credit: Original).

Figure 3: Actual vs. Predicted Stock Prices (Photo/Picture credit: Original).

Improvements of Time Series Prediction Models for ExxonMobil Based on Moving Averages

513

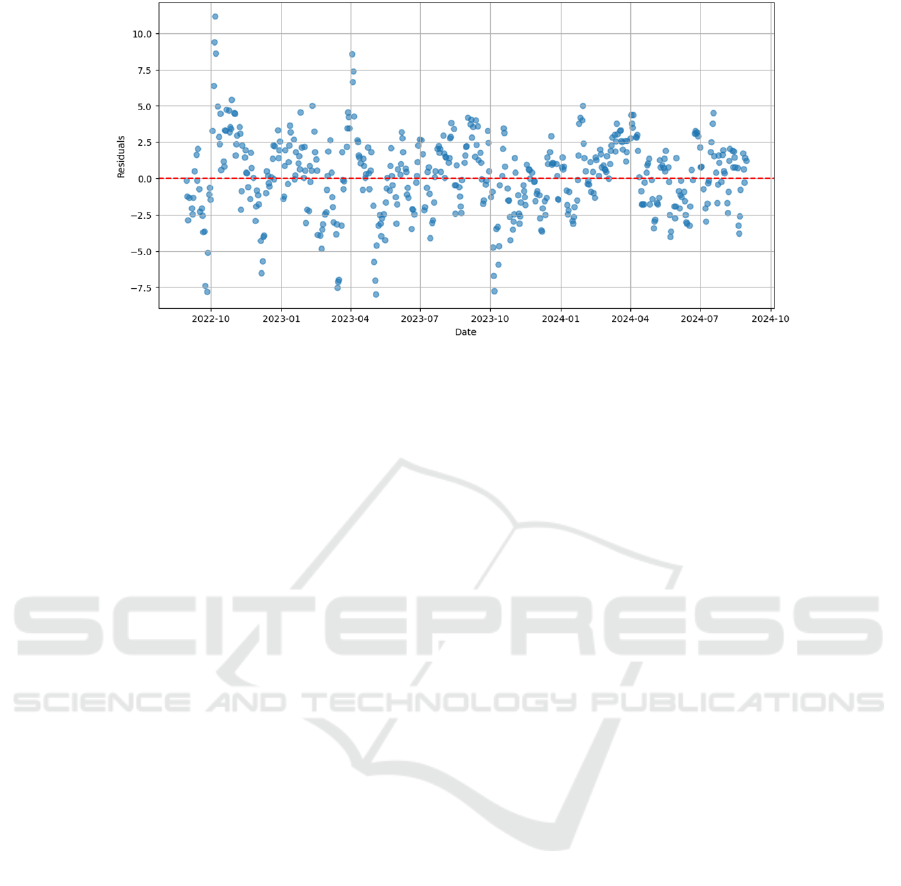

Figure 4: Residuals Plot (Cleaned Data) (Photo/Picture credit: Original).

Fig. 4 shows the residuals of the model, which

highlights the margin of error between current and

projected prices. As one can see from the results, the

residuals are concentrated around zero, but there is a

noticeable peak when there is a lot of market activity.

These spikes suggest that while the model is

performing well overall, it has limitations in adapting

to market abrupt changes influenced by external

factors.

3.3 Comparison and Implications

In this study, the developed enhanced forecasting

model was compared with the traditional moving

average model to evaluate the impact of integrating

other technical indicators such as EMA, RSI, and

MACD on the enhanced model. Traditional models

built on the likes of SMAs are often limited by their

inability to capture complex market dynamics,

especially when looking at energy sector stocks like

ExxonMobil. These stocks are heavily influenced by

external factors such as crude oil prices, geopolitical

risks, and regulatory changes. By incorporating a

wider range of metrics, the prediction accuracy of the

enhanced model is significantly improved, with an R-

square value of 0.8546 and a reduced MSE.

Compared to traditional moving averages, the

EMA indicator reacts more to market trends because

it gives more weight to recent price changes, allowing

the model to adjust more quickly based on new

information. The RSI serves as a momentum

oscillator by identifying overbought or oversold

conditions, which is essential for predicting reversals.

The MACD and its signal lines help to capture the

momentum and strength of price movements,

providing additional signals that complement the

moving averages.

These enhancements greatly improve the model's

ability to predict stock price movements under stable

market conditions. However, the performance of the

model still shows some differences during periods of

high volatility, especially when sudden external

shocks affect the market. This suggests that while the

model performs well at capturing general trends, it

still needs to be further refined to cope with the rapid

changes in the market. These findings are particularly

interesting for financial analysts and investors who

focus on the energy sector. The enhanced model

provides a more nuanced understanding of

ExxonMobil's stock price movements, which makes

it possible for the future to provide a valuable tool that

is practical in making informed investment decisions

and predicting future trends. By incorporating more

technical indicators, the model better aligns with the

unique dynamics of the energy market, allowing

analysts to identify potential trading opportunities

and manage risk more effectively.

In addition, the study highlights the importance of

adapting forecasting models to specific industries.

The volatility and sensitivity of energy markets to

external factors requires models that are able to

combine technical analysis with broader market

insights. Future studies can further improve these

models by incorporating external variables such as

crude oil prices or geopolitical risk indices, thereby

improving the accuracy and robustness of forecasts.

In conclusion, the enhanced approach demonstrated

in this study highlights the potential of technical

indicators to significantly improve traditional time

series forecasting models, providing valuable insights

for financial modelling and strategic investment in the

energy sector.

ECAI 2024 - International Conference on E-commerce and Artificial Intelligence

514

3.4 Limitations and Prospects

Although the performance of the enhanced prediction

model has been relatively improved, there are also

some noticeable limitations that require to be

accommodated in forthcoming researches. One major

limitation is that the model relies on historical stock

price data and technical indicators, which may not

fully capture the impact of unforeseen market shocks

or changes in investor sentiment. ExxonMobil's stock

belongs to the energy sector and is particularly

sensitive to external factors such as crude oil price

fluctuations, geopolitical events, regulatory changes,

and broader economic conditions. These factors can

also lead to sudden and large price fluctuations, which

are difficult to predict by technical indicators alone.

Another notable limitation is the multicollinearity

between the metrics used in the model. The VIF

analysis shows that some indicators, such as the 10-

day SMA and 20-day EMA, have extremely high

values, suggesting that the information provided by

these variables overlaps with each other and can lead

to overfitting. Multicollinearity reduces the predictive

power of the model, making it less robust when

applied to different market conditions. Solving this

problem through feature selection, dimensionality

reduction, or advanced regularization techniques can

help to enhance the stability and universality of the

model.

There are also differences in the model's

performance during periods of high market volatility,

highlighting the challenges of predicting rapid price

changes driven by external events. While the

consolidation of indicators such as the RSI and

MACD adds value by capturing momentum and trend

reversals, these enhancements are still not enough to

fully adapt to sudden changes. Incorporating external

macroeconomic variables, such as real-time oil prices,

global economic indicators, or sentiment analysis

from news sources, can further refine the model and

improve its ability to respond quickly to market

changes.

4 CONCLUSIONS

To sum up, this study aimed to improve time series

forecasting of ExxonMobil’s stock prices by

integrating moving averages with additional technical

indicators using the stockstats Python library. The

enhanced model demonstrated significant

improvements in predictive accuracy, with an R-

square value of 0.8546, highlighting its ability to

closely track actual stock prices. By incorporating

indicators like EMA, RSI, and MACD, the model

provided valuable insights into market trends and

momentum, making it a more effective tool for

financial analysts and investors. However, the study

also highlighted challenges such as multicollinearity

among indicators and the limitations of relying solely

on historical data. Future research should focus on

refining the model by incorporating additional

macroeconomic factors, employing advanced

machine learning techniques, and reducing

multicollinearity to further improve forecasting

accuracy. Overall, this research underscores the

importance of adapting time series models to the

unique characteristics of the energy sector, offering

valuable tools for financial analysis and investment

strategy development.

REFERENCES

Atsalakis, G. S., Valavanis, K. P., 2009. Forecasting stock

market short-term trends using a neuro-fuzzy based

methodology. Expert Systems with Applications, 36(7),

10696-10707.

Bao, Z., Wang, C., 2022. A multi-agent knowledge

integration process for enterprise management

innovation from the perspective of neural networks.

Information Processing & Management, 59(2), 102873.

Bustos, O., Pomares-Quimbaya, A., 2020. Stock market

movement forecast: A systematic review. Expert

Systems with Applications, 156, 113464.

Ding, G., Qin, L., 2020. Study on the prediction of stock

price based on the associated network model of LSTM.

International Journal of Machine Learning and

Cybernetics, 11(6), 1307-1317.

Fischer, T., Krauss, C., 2018. Deep learning with long

short-term memory networks for financial market

predictions. European Journal of Operational Research,

270(2), 654-669.

Guresen, E., Kayakutlu, G., Daim, T. U., 2011. Using

artificial neural network models in stock market index

prediction. Expert Systems with Applications, 38(8),

10389-10397.

Lin, G., Lin, A., Cao, J., 2021. Multidimensional KNN

algorithm based on EEMD and complexity measures in

financial time series forecasting. Expert Systems with

Applications, 168, 114443.

Su, Y., Cui, C., Qu, H., 2022. Self-Attentive Moving

Average for Time Series Prediction. Applied Sciences,

12(7), 3602.

Tsay, R. S., 2019. An introduction to time series analysis

and forecasting with applications to financial data.

Wiley Series in Probability and Statistics.

Yadav, D. K., S., Goswami, L., 2024. Autoregressive

Integrated Moving Average Model for Time Series

Analysis. 2024 International Conference on

Optimization Computing and Wireless Communication

(ICOCWC), Debre Tabor, Ethiopia, 1-6.

Improvements of Time Series Prediction Models for ExxonMobil Based on Moving Averages

515